Equity Metals Announces a Significant Increase to the Mineral Resource Estimate at the Silver Queen Project, BC

Highlights

- Increase in Indicated Category by 187% to 62.8Mozs AgEq or by 214% to 765Kozs AuEq: 21.0Mozs Ag (+297%), 237Kozs Au (+179%), 18Mlbs Cu (+288%), 48Mlbs Pb (+178%) and 267Mlbs Zn (+134%)

- Increase in Inferred Category by 30% to 22.5Mozs AgEq or by 41% to 273Kozs AuEq: 10.3Mozs Ag (+117%), 50Kozs Au (-21%), 10Mlbs Cu (+79%), 23Mlbs Pb (+45%) and 84Mlbs Zn (-9%)

Equity Metals Corporation (TSX-V: EQTY) reports that Kirkham Geosystems Ltd and P&E Mining Consultants Inc. have completed an updated Independent Mineral Resource Estimate for the Silver Queen Project, British Columbia, Canada. The MRE features lateral and down-dip extensions of the previously modelled No. 3 and NG-3 Veins, originally included in the 2019 MRE, and new, previously unmodelled mineralization from the Camp and Sveinson Targets. The MRE utilizes a Net Smelter Return cut-off at C$100/t with updated metal pricing.

President Joe Kizis comments, “At the time we assumed management of the Company in Q3 of 2019, we felt there were clear opportunities to quickly add significantly to the 2019 MRE at Silver Queen, and we are proud to report our success at a very low cost of $0.15/oz of added AgEq or $11/oz of added AuEq. The MRE remains open for additional delineation west of the Camp Target and within the Sveinson Target. In addition, there are several targets that have only been tested by a few drill holes and remain very attractive areas for new discoveries and MRE increase.”

Silver Queen Resource Model highlights:

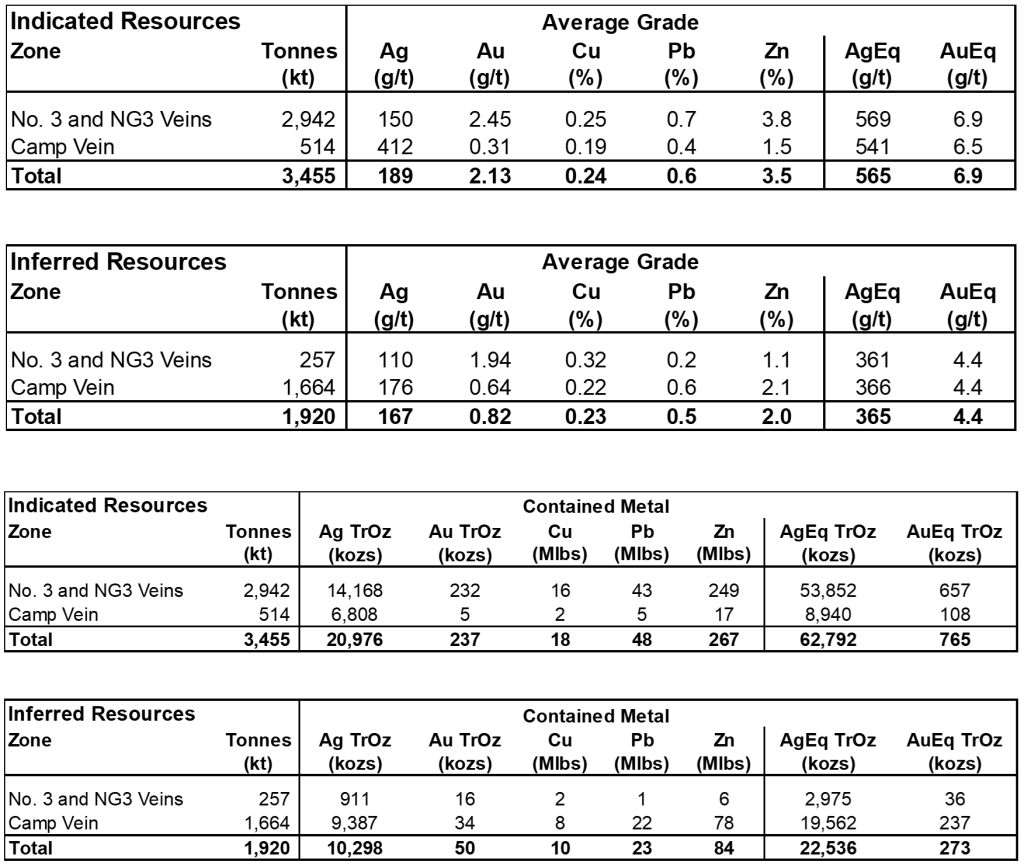

Compared to the 2019 Mineral Resource Estimate, the 2022 update, at a C$100/t NSR cut-off, features:

- A 2.6Mt increase in Indicated Mineral Resources to 3.46Mt averaging 189g/t Silver, 2.13g/t Gold, 0.24% Copper, 0.6% Lead and 3.5% Zinc (565g/t AgEq or 6.9g/t AuEq) containing:21.0 million ounces of silver; 237 thousand ounces of gold; 18 million pounds of copper; 48 million pounds of lead; and 267 million pounds of zinc.

This equates to 62.8 million ounces silver equivalent or 767 thousand ounces of gold equivalent; and

- A 1.1Mt increase in Inferred Mineral Resources to 1.92Mt averaging 162g/t Silver, 0.80g/t Gold, 0.23% Copper, 0.5% Lead and 2.0% Zinc (356g/t AgEq or 4.3g/t AuEq) containing:10.3 million ounces of silver; 50 thousand ounces of gold; 10 million pounds of copper; 23 million pounds of lead; and 84 million pounds of zinc.

This equates to 22.5 million ounces silver equivalent or 273 thousand ounces of gold equivalent.

The updated MRE incorporates an additional 25,659 metres of core drilling completed in 2020-22 and updated metal recoveries and pricing.

Silver Queen Project Highlights

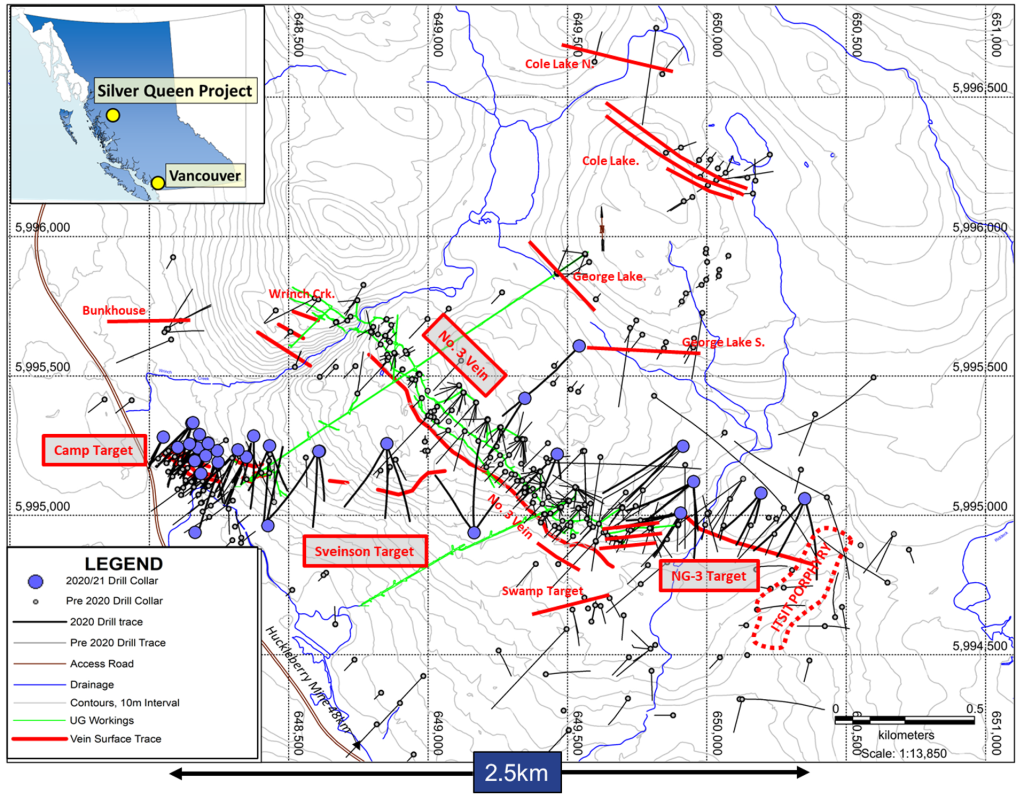

- A total of 78 drill holes for 25,659 metres was completed by the Company on the Silver Queen Project in six successive phases of exploration starting in late 2020. Five separate target areas have been tested in part and thick intervals of high-grade gold, silver and base-metal mineralization have been identified in each of the Camp Vein, the Svenson Target, No. 3 Vein, and NG-3 Vein systems.

Figure 1: Plan map of targets and deposits on the Silver Queen vein system, BC

- The updated NI 43-101 Mineral Resource Estimate increases the tonnage by approximately 240% with the increase being from the result of revised metal pricing, the extension to the NG-3 Deposit and the addition of mineralization from the Camp and Sveinson Veins.

- Approximately 64% of the Mineral Resources are classified as Indicated Resources on a per tonnage basis and 74% of the total on a AgEq basis reflecting the overall higher average grade (565g/t Ag Eq) of the MRE in the Indicated category.

- The Mineral Resource has a strong precious-metal bias with gold and silver accounting for approximately 64% of the total value.

- The Mineral Resource update features a significant increase in contained silver ounces in both the Indicated (+297%) and Inferred (+117%) categories, which is supported in large part by the addition of strongly silver enriched mineralization from the Camp Veins.

- The company has expended C$6.75 million on exploration of the Silver Queen project since 2019 resulting in a cash-discovery-cost of only C$0.15/oz per AgEq added or C$11/oz AuEq

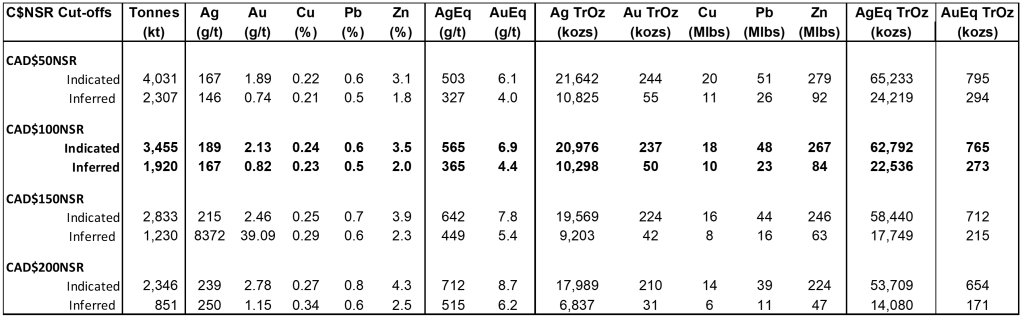

- Tabulation of grades and tonnages sensitivities (Table 2) demonstrate an excellent retention of higher-grade mineralization at increasing C$NSR cut-offs with 84% of the Base-case Mineral Resource when expressed on a AgEq basis remaining at a C$200 NSR cut-off.

Vein Target Specifics

- Drilling on the Camp Target identified a conjugate vein set comprising steep southwest-dipping, strongly silver-enriched veins and steep north-dipping, gold-enriched polymetallic veins. Individual veins demonstrate good lateral continuity over +150 metre strike-lengths within an overall cumulative strike-length of the target of approximately 300 metres. Drilling confirmed continuity of the vein sets to depths of up to 195 metres, with several veins extending laterally to the east and projecting into the Sveinson Target.

- The Sveinson Target includes the previously identified No. 5 and Switchback Veins and forms a broad, 150 metre wide, veined structural corridor that projects laterally eastward for over 1000 metres where it transitions into the No. 3 Vein system. Drilling successfully intersected multiple shallow veins at less than 100 metres below surface as well as several deeper vein intercepts at over 350 metres below surface. Numerous veins have been encountered across the full 150 metre width of the Sveinson Structural Zone, with several individual vein segments demonstrating good lateral continuity along 200 to 400 metre strike lengths.

- The No. 3 Vein system, strikes northwest to southeast and dips to the northeast at approximately 60 degrees. The average width of the veins is 0.9 to 1.2 metres with local increases up to about 4.6 metres. The No. 3 Vein can be traced on surface and in drilling for over a 1.2 kilometre strike length where it transitions across an oblique structure and into the NG-3 Vein system.

- The NG-3 Target forms the southeast extension of the No. 3 Vein and was tested with eight core holes which returned several intersections of high-grade gold and silver. Equity’s drilling has now confirmed the extension of the NG-3 Vein to over 300 metres of strike and to depths of up to 240 metres below surface. The drill holes have established internal continuity between widely spaced historical intercepts drilled by previous management and earlier drilling by Equity. Mineralization remains open along strike and down dip.

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Inferred Resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be classified as Mineral Reserves. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

A NI 43-101 Technical Report will be posted on SEDAR within 45 days.

Table 1: Base Case Mineral Resource Estimate for the Silver Queen Project Utilizing a C$100/t NSR cut-off value

- The current Mineral Resource Estimate was prepared by Garth Kirkham, P.Geo., of Kirkham Geosystems Ltd and Eugene Puritch, P. Eng., FEC, CET and Fred Brown, P, Geo. of P&E Mining Consultants Inc. Independent Qualified Persons, as defined by National instrument 43-101.

- All Mineral Resources have been estimated in accordance with Canadian Institute of Mining and Metallurgy and Petroleum definitions, as required under National Instrument 43-101.

- Mineral Resources were constrained using continuous mining units demonstrating reasonable prospects of eventual economic extraction.

- Silver and Gold Equivalents were calculated from the interpolated block values using relative process recoveries and prices between the component metals and silver to determine a final AgEq and AuEq values.

- Silver and Gold Equivalents and NSR$/t values were calculated using average long-term prices of $20/oz silver, $1,700/oz gold, $3.50/lb copper, $0.95/lb lead and $1.45/lb zinc. All metal prices are stated in $USD. The C$100/tonne NSR cut-off grade value for the underground Mineral Resource was derived from mining costs of C$70/t, with process costs of C$20/t and G&A of C$10/t. Process recoveries used were Au 70%, Ag 80%, Cu 80%, Pb 81% and Zn 90%.

- Grade capping was performed on 1m composites for the No. 3 and NG-3 veins and whole vein composites for the Camp and Sveinson veins. For the No. 3 and NG-3 veins Inverse distance cubed (I/d3) was utilized for grade interpolation for Au and Ag and inverse distance squared (I/d2) was utilized for Cu, Pb and Zn. Inverse distance squared (I/d2) was used for all metals in the Camp and Sveinson veins.

- A bulk density of 3.56t/m3was used for all tonnage calculations in the No. 3 and NG-3 veins. A variable density with a 3.15 average was used for the Camp and Sveinson veins.

- Mineral Resources are not Mineral Reserves until they have demonstrated economic viability. Mineral Resource Estimates do not account for a Mineral Resource’s mineability, selectivity, mining loss, or dilution.

- An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- All figures are rounded to reflect the relative accuracy of the estimate and therefore numbers may not appear to add precisely.

Table 2: Resource Model Sensitivities at Various C$NSR/t cut-offs

- Sensitivities were calculated at progressive C$NSR/t cut-off utilizing the same parameters and metal pricing as the Base Case scenario described in Table 1.

Silver, Gold Equivalencies and C$NSR Calculations

Silver and Gold Equivalents and NSR$/t values were calculated using approximate average long-term prices of $20/oz silver, $1,700/oz gold, $3.50/lb copper, $0.95/lb lead and $1.45/lb zinc. All metal prices are stated in $USD with a conversion to $CAD of 0.77. See below the equivalency and C$NSR calculations:

AgEq = (Ag g/t x 1) + (Au g/t x 81.41) + (Cu% x 116.35) + (Pb% x 28.77) + (Zn% x 44.80)

AuEq = (Ag g/t x 0.012) + (Au g/t x 1) + (Cu% x 1.43) + (Pb% x 0.35) + (Zn% x 0.55)

C$NSR = (Ag g/t x 0.57) + (Au g/t x 46.79) + (Cu% x 66.87) + (Pb% x 16.54) + (Zn% x 25.74)

Qualified Persons

The independent Qualified Persons for the Mineral Resource Estimate disclosure for the Project are Garth Kirkham, P.Geo., Principal, Kirkham Geosystems Ltd. and Eugene Puritch, P. Eng., FEC, CET and Fred Brown, P.Geo, of P&E Mining Consultants Inc. (“P&E”), Independent Qualified Persons (“QP”), as defined by National instrument 43-101 who have reviewed and approved the technical contents of this news release. In accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects, Robert Macdonald, P.Geo, Vice President Exploration, is the Qualified Person for the Company and has validated and approved the technical content of this news release.

Risk Factors

Equity Metals Corporation is aware that this Project is subject to the same types of risks that large precious metal projects experience at an early stage of development in British Columbia. The Company has engaged experienced management and specialized consultants to identify, manage and mitigate those risks. However, the types of risks will change as the project evolves and more information becomes available.

Further details regarding the foregoing Mineral Resource Estimate, including the estimation methods and procedures, will be detailed in the pending NI 43-101 Technical Report, which will be filed on SEDAR (www.sedar.com) under the Company’s profile within 45 days from the date of this news release.

About Silver Queen Project

The Silver Queen Project is a premier gold-silver property with over 100 years of historical exploration and development and is located adjacent to power, roads and rail with significant mining infrastructure that was developed under previous operators Bradina JV (Bralorne Mines) and Houston Metals Corp. (a Hunt Brothers company). The Property contains two historical declines into the No. 3 Vein, camp infrastructure, and a maintained Tailings Facility.

The Silver Queen Property consists of 45 mineral claims, 17 crown grants, and two surface crown grants totalling 18,852ha with no underlying royalties. Mineralization is hosted by a series of epithermal veins distributed over a 6 sq km area. The initial NI43-101 Mineral Resource Estimate was detailed in a News Release issued on July 16th, 2019 and is hosted by the No. 3 Vein, which is traced by drilling for approximately 1.2km and then to the southeast where it transitions into the NG-3 Vein close to the buried Itsit copper-molybdenum porphyry.

More than 20 different veins have been identified on the Property, forming an extensive network of zoned Cretaceous- to Tertiary-age epithermal veins. The Property remains largely under explored.

About Equity Metals Corporation

Equity Metals Corporation is a Manex Resource Group Company. Manex provides exploration, administration, and corporate development services for Equity Metals’ two major mineral properties, the Silver Queen Au-Ag-Zn-Cu project, located in central B.C., and the Monument Diamond project, located in Lac De Gras, NWT. The Company also has a 1% royalty (Greenwood Royalty) and a 100% working interest in the La Ronge Silica Project.

The Company owns 100% interest, with no underlying royalty, in the Silver Queen Project, located along the Skeena Arch in the Omineca Mining Division, British Columbia. The property hosts high-grade, precious- and base-metal veins related to a buried porphyry system, which has been only partially delineated. The Company also has a controlling JV interest in the Monument Diamond project, NWT, strategically located in the Lac De Gras district within 40 km of both the Ekati and Diavik Diamond Mines. The Project owners are Equity Metals Corporation (57.49%), Chris and Jeanne Jennings (22.11%); and Archon Minerals Ltd. (20.4%). Equity Metals is the operator of the Project.

The 100% controlled La Ronge Silica Project is an historical sand quarry located in central Saskatchewan, approximately 60 kilometers south-southeast of La Ronge, Saskatchewan and 210 kilometers west of Flin Flon, Manitoba. Preliminary studies indicate the silica deposit may be developed into a simple and profitable, low-cost mining and washing operation to produce high-purity silica (>98% SiO2), a specialty product for the EV battery industry.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE