Emperor Metals Expands Near-Surface Mineralization at Duquesne West Gold Deposit; Intersects 52.1 m of 0.8 g/t Au

Emperor Metals Inc. (CSE: AUOZ) (OTCQB: EMAUF) (FSE: 9NH) is pleased to announce the results from the first 3 holes in our 19 drillhole program, focused on the conceptual open-pit. This represents 1,452 meters – 18% of the completed 8,166 m drilling campaign for 2024.

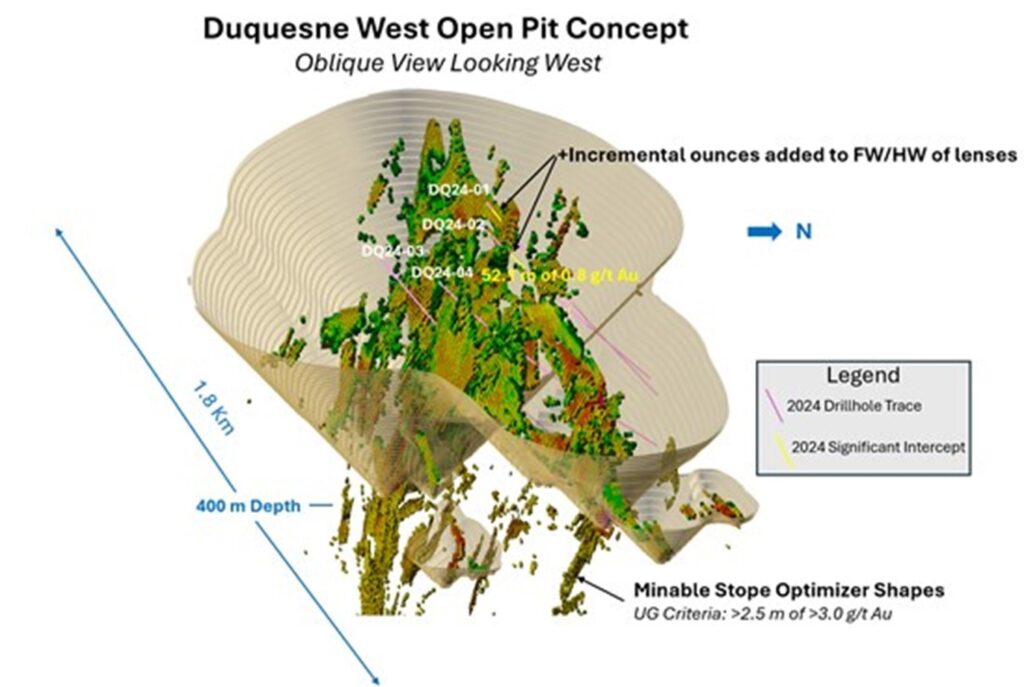

Full results for DQ24-01 to DQ24-03 have been released from SGS Laboratories (see Table 1 intercept highlights). These results indicate the potential for resource expansion within the open pit concept. Emperor is targeting a multi-million-ounce resource in a combination of conceptual open pit and underground mining scenarios. The Property hosts a historical inferred mineral resource estimate of 727,000 ounces of gold at a grade of 5.42 g/t Au.1,2

Highlights:

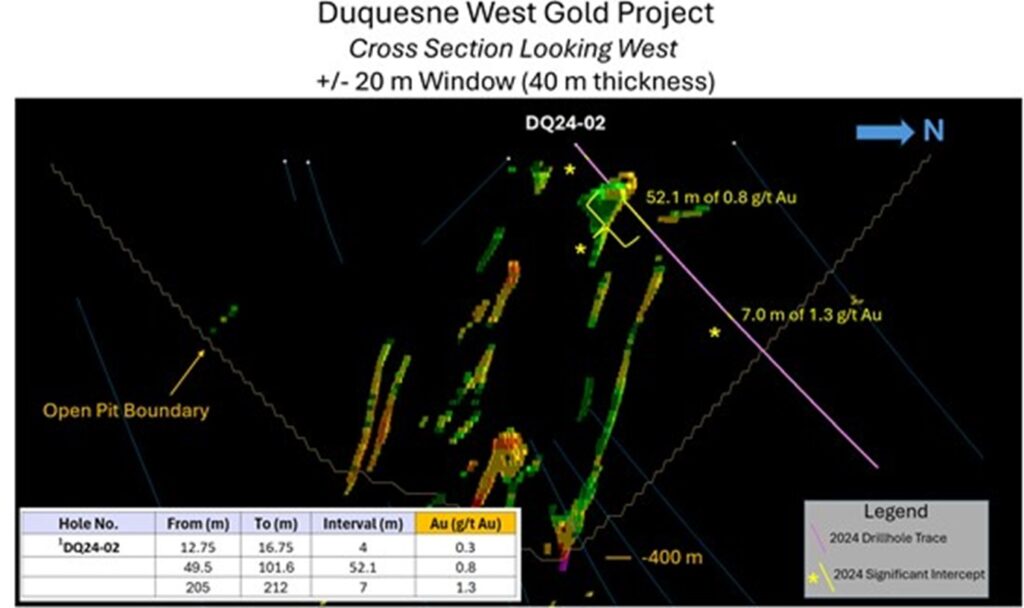

- DQ24-02 intersects 52.1 metres (m) of 0.8 grams per tonne (g/t) gold (Au) (including 7.0 m of 1.74 g/t Au) within the open pit concept (see Figure 1). The mineralization is both within Quartz Feldspar Porphyry (QFP) and adjacent Mafic Volcanics.

- DQ24-03 intersected 30.2 m of 0.4 g/t Au and DQ24-02 intersected 7.0 m of 1.30 g/t Au. Both these intercepts are adjacent to and within the QFP’s.

- Drilling adds incremental ounces outside of known high-grade areas in the open pit scenario. These intercepts are expected to reduce the stripping ratio due to gold endowment in areas that were overlooked and historically unsampled.

- Assay results for additional drill holes are expected to be provided in the next 2 weeks.

CEO John Florek commented: “We have been successful in demonstrating that additional ounces are contained within our conceptual open-pit model, and that the potential for low-grade bulk tonnage was indeed unaccounted for, which we expect will greatly enhance a new mineral resource estimate expected in Q1 of 2025.

As we advance towards the mineral resource estimate, lower-grade and bulk tonnage material will be key for assessing the economics of this deposit and developing an open-pit model.”

The 2024 drilling campaign at Emperor’s Duquesne West Gold Project in Quebec builds on the success of the 2023 program, which focused on adding inferred ounces within the Conceptual Ultimate Open Pit. The initial 1,452 meters of drilling concentrated on near-surface mineralization, allowing Emperor to add ounces more efficiently and at a lower grade compared to an underground mining scenario.

The 2024 season is a multifaceted program designed to test several scenarios to add ounces and/or expand the footprint:

- Explore Lower Grade Discoveries: Target additional discoveries within the host rock containing high-grade gold lenses, focusing on the conceptual open-pit model.

- Increase the Thickness of the High-Grade Lenses: Incorporate previously unaccounted lower-grade gold from the margins of high-grade lenses to enhance their overall thickness.

- Expand Mineralized Zones: Extend the lateral footprint of mineralized zones along strike and dip.

- Discover New Zones: Explore potential new zones not yet included in the Conceptual Open Pit Model, with a particular focus on eastward expansion.

With the overwhelming majority of drill holes hitting near-surface mineralization along this multi-kilometre trend, we have identified the clear potential for additional high-grade gold mineralization at depth. Emperor Metals plans to significantly expand its resource base with drill testing. A mineral resource update is scheduled for Q1 of 2025, reflecting the results of the ongoing exploration program.

Figure 1: Location of DQ24-01 to 03 DDH.

Drillhole Discussion:

DQ24-01 to 03

The common theme to the discussion of low-grade bulk tonnage mineralization at Duquesne West is that it is hosted adjacent and within the previously unsampled Quartz Feldspar Porphyries. More drilling is needed to define the full extent and breath of this mineralization (see Figure 2).

In general, this pervasive mineralization expands in thickness as well as continuity along strike and dip. Although this mineralization is lower grade, it is contained in the Conceptual Open-Pit Model and is expanding zones in the footwall of this deposit that will certainly add ounces to the upcoming mineral resource estimate. Additionally new zones are being discovered for follow-up.

By concentrating on drilling near-surface mineralization within an ultimate conceptual open pit, Emperor can add ounces more rapidly and mine at a significantly lower grade compared to an underground mining scenario. Deposits in the region at currently active open pits have been economic at grades equal 0.30 g/t Au (see Agnico Eagles press release dated Feb 15, 2024 – Detour Lake Deposit cut-off grade, pg. 52.)

Emperor plans on a mineral resource update scheduled for Q1 of 2025.

Figure 2: Image showing DQ24-02 intercept in relation to historical DDH (Blue). Notice paucity of drilling to define lenses.

Table 1 – Intercept Highlights- Host Structures are interpreted to be steeply dipping and true widths are generally estimated to 90%.

| Hole No. | From (m) | To (m) | Interval (m) | Au (g/t Au) |

| DQ24-011 | 12 | 13 | 1 | 0.18 |

| 13 | 14 | 1 | 0.19 | |

| 14 | 15 | 1 | 2.54 | |

| 15 | 16 | 1 | 0.09 | |

| 16 | 17 | 1 | 0.005 | |

| 17 | 18 | 1 | 0.07 | |

| 18 | 19 | 1 | 0.19 | |

| 19 | 20 | 1 | 0.1 | |

| 20 | 21 | 1 | 0.04 | |

| 21 | 22 | 1 | 0.25 | |

| 22 | 23 | 1 | 0.73 | |

| 23 | 24 | 1 | 0.05 | |

| 24 | 25 | 1 | 0.01 | |

| 25 | 26 | 1 | 0.005 | |

| 26 | 27 | 1 | 0.005 | |

| 27 | 28 | 1 | 0.005 | |

| 28 | 29 | 1 | 0.005 | |

| 29 | 30 | 1 | 0.005 | |

| 30 | 31 | 1 | 0.005 | |

| 31 | 32 | 1 | 0.005 | |

| 32 | 33 | 1 | 0.01 | |

| 33 | 34 | 1 | 1.58 | |

| 34 | 35 | 1 | 0.13 | |

| 35 | 36 | 1 | 0.31 | |

| 36 | 37 | 1 | 0.55 | |

| 37 | 38 | 1 | 1.26 | |

| 38 | 39 | 1 | 0.26 | |

| 39 | 40.35 | 1.35 | 0.41 | |

| 40.35 | 41.7 | 1.35 | 0.11 | |

| Wt. Avg. | 29.7 | 0.31 | ||

| Including: (12-23m) | 11 | 0.40 | ||

| Including:(33-41.7m) | 8.7 | 0.55 | ||

| 66 | 67 | 1 | 0.71 | |

| 67 | 68 | 1 | 0.33 | |

| 68 | 69 | 1 | 0.02 | |

| 69 | 70 | 1 | 0.02 | |

| 70 | 71 | 1 | 0.23 | |

| Wt. Avg. | 5 | 0.3 | ||

| 106 | 107 | 1 | 0.32 | |

| 107 | 108 | 1 | 0.25 | |

| 108 | 109 | 1 | 0.1 | |

| 109 | 110 | 1 | 0.02 | |

| 110 | 111 | 1 | 0.1 | |

| 111 | 112 | 1 | 0.06 | |

| 112 | 113 | 1 | 0.79 | |

| 113 | 114 | 1 | 0.25 | |

| 114 | 115 | 1 | 0.16 | |

| 115 | 116 | 1 | 0.27 | |

| 116 | 117 | 1 | 0.81 | |

| 117 | 118 | 1 | 0.41 | |

| 118 | 119 | 1 | 0.36 | |

| 119 | 120 | 1 | 0.11 | |

| 120 | 121 | 1 | 0.41 | |

| Wt. Avg. | 15 | 0.3 | ||

| 165 | 166 | 1 | 0.64 | |

| 166 | 167 | 1 | 0.79 | |

| 167 | 168 | 1 | 0.005 | |

| 168 | 169 | 1 | 0.03 | |

| 169 | 170 | 1 | 0.39 | |

| 170 | 171 | 1 | 0.19 | |

| 171 | 172 | 1 | 0.06 | |

| 172 | 173 | 1 | 0.01 | |

| 173 | 174 | 1 | 0.09 | |

| 174 | 175 | 1 | 0.58 | |

| Wt. Avg. | 10 | 0.3 | ||

| Hole No. | From (m) | To (m) | Interval (m) | Au (g/t Au) |

| DQ24-021 | 12.75 | 13.75 | 1 | 0.3 |

| 13.75 | 14.75 | 1 | 0.33 | |

| 14.75 | 15.75 | 1 | 0.05 | |

| 15.75 | 16.75 | 1 | 0.45 | |

| Wt. Avg. | 4 | 0.3 | ||

| 49.5 | 51 | 1.5 | 11.8 | |

| 51 | 53.5 | 2.5 | 0.005 | |

| 53.5 | 56 | 2.5 | 0.005 | |

| 56 | 58.5 | 2.5 | 0.02 | |

| 58.5 | 61 | 2.5 | 2.15 | |

| 61 | 63.5 | 2.5 | 0.85 | |

| 63.5 | 66 | 2.5 | 0.03 | |

| 66 | 68.5 | 2.5 | 0.005 | |

| 68.5 | 71 | 2.5 | 0.12 | |

| 71 | 73.5 | 2.5 | 0.005 | |

| 73.5 | 76 | 2.5 | 0.005 | |

| 76 | 78.5 | 2.5 | 0.005 | |

| 78.5 | 80.7 | 2.2 | 0.005 | |

| 80.7 | 82.3 | 1.6 | 0.15 | |

| 82.3 | 84.7 | 2.4 | 0.005 | |

| 84.7 | 85.7 | 1 | 0.04 | |

| 85.7 | 86.7 | 1 | 0.23 | |

| 86.7 | 87.7 | 1 | 0.25 | |

| 87.7 | 88.7 | 1 | 0.02 | |

| 88.7 | 90.25 | 1.55 | 0.25 | |

| 90.25 | 91.25 | 1 | 0.005 | |

| 91.25 | 92.25 | 1 | 0.95 | |

| 92.25 | 93.25 | 1 | 1.75 | |

| 93.25 | 94.25 | 1 | 3.83 | |

| 94.25 | 95.25 | 1 | 3.47 | |

| 95.25 | 96.25 | 1 | 0.66 | |

| 96.25 | 97.25 | 1 | 0.38 | |

| 97.25 | 98.25 | 1 | 1.12 | |

| 98.25 | 99.25 | 1 | 0.005 | |

| 99.25 | 100.25 | 1 | 0.28 | |

| 100.25 | 101.6 | 1.35 | 0.13 | |

| Wt. Avg. | 52.1 | 0.8 | ||

| Including: (85.7-101.6m) | 14.55 | 0.92 | ||

| Including: (91.25-98.25m) | 7 | 1.74 | ||

| 205 | 206 | 1 | 7.34 | |

| 206 | 207 | 1 | 0.16 | |

| 207 | 208 | 1 | 0.01 | |

| 208 | 209 | 1 | 0.16 | |

| 209 | 210 | 1 | 0.005 | |

| 210 | 211 | 1 | 0.26 | |

| 211 | 212 | 1 | 0.88 | |

| Wt. Avg. | 7 | 1.3 | ||

| Hole No. | From (m) | To (m) | Interval (m) | Au (g/t Au) |

| DQ24-031 | 114.6 | 115.6 | 1 | 1.09 |

| 115.6 | 116.6 | 1 | 1.11 | |

| 116.6 | 117.6 | 1 | 0.92 | |

| 117.6 | 118.85 | 1.25 | 0.45 | |

| Wt. Avg. | 4.25 | 0.87 | ||

| 142.2 | 143.2 | 1 | 1.4 | |

| 143.2 | 144.2 | 1 | 0.64 | |

| 144.2 | 145.2 | 1 | 0.48 | |

| Wt. Avg. | 3 | 0.84 | ||

| 178.5 | 179.5 | 1 | 2.23 | |

| 179.5 | 180.5 | 1 | 0.56 | |

| 180.5 | 181.5 | 1 | 0.19 | |

| 181.5 | 182.5 | 1 | 0.03 | |

| 182.5 | 183.5 | 1 | 0.01 | |

| 183.5 | 184.5 | 1 | 0.03 | |

| 184.5 | 185.5 | 1 | 0.19 | |

| 185.5 | 187.4 | 1.9 | 0.06 | |

| 187.4 | 188.65 | 1.25 | 0.07 | |

| 188.65 | 189.7 | 1.05 | 0.03 | |

| 189.7 | 190.7 | 1 | 0.68 | |

| 190.7 | 191.7 | 1 | 0.07 | |

| 191.7 | 192.7 | 1 | 0.01 | |

| 192.7 | 193.7 | 1 | 2.7 | |

| 193.7 | 194.7 | 1 | 0.12 | |

| 194.7 | 195.7 | 1 | 0.23 | |

| 195.7 | 196.7 | 1 | 0.11 | |

| 196.7 | 197.7 | 1 | 0.26 | |

| 197.7 | 198.7 | 1 | 0.16 | |

| 198.7 | 199.7 | 1 | 0.83 | |

| 199.7 | 200.7 | 1 | 0.24 | |

| 200.7 | 201.7 | 1 | 0.19 | |

| 201.7 | 202.7 | 1 | 0.27 | |

| 202.7 | 203.7 | 1 | 0.19 | |

| 203.7 | 204.7 | 1 | 0.09 | |

| 204.7 | 205.7 | 1 | 0.14 | |

| 205.7 | 206.7 | 1 | 0.07 | |

| 206.7 | 207.7 | 1 | 2.49 | |

| 207.7 | 208.7 | 1 | 0.29 | |

| Wt. Avg. | 30.2 | 0.4 | ||

| Including: (189.7-208.7m) | 19 | 0.5 | ||

| 330.1 | 331.1 | 1 | 0.42 | |

| 331.1 | 332.1 | 1 | 1.67 | |

| 332.1 | 333.1 | 1 | 0.44 | |

| 333.1 | 334.1 | 1 | 0.95 | |

| 334.1 | 335.1 | 1 | 0.35 | |

| 335.1 | 336.1 | 1 | 0.05 | |

| 336.1 | 337.1 | 1 | 0.06 | |

| 337.1 | 338.1 | 1 | 0.01 | |

| 338.1 | 339.1 | 1 | 0.005 | |

| 339.1 | 340.1 | 1 | 0.005 | |

| 340.1 | 341.1 | 1 | 0.66 | |

| 341.1 | 342.1 | 1 | 0.68 | |

| 342.1 | 343.1 | 1 | 0.12 | |

| 343.1 | 344.1 | 1 | 0.38 | |

| Wt. Avg. | 14 | 0.4 | ||

| Including:( 330.1-335.1m) | 5 | 0.766 | ||

| 400 | 401 | 1 | 0.41 | |

| 401 | 402 | 1 | 0.36 | |

| Wt. Avg. | 2 | 0.4 | ||

| 478.2 | 479.2 | 1 | 0.12 | |

| 479.2 | 480.2 | 1 | 0.36 | |

| 480.2 | 481.2 | 1 | 1.14 | |

| Wt. Avg. | 3 | 0.5 | ||

| 1Host Structures are interpreted to be steeply dipping and true widths are generally estimated to 90%. | ||||

Quality Assurance and Control

The Quality Assurance and Quality Control was conducted by Technominex, a geological contractor hired by Emperor Metals, which adheres to CIM Best Practices Guidelines for exploration related activities conducted at its facility in Rouyn Noranda, Quebec. The QA/QC procedures are overseen by a Qualified Person on site.

Emperor Metals QA/QC protocols are maintained through the insertion of certified reference material (standards), blanks and lab duplicates within the sample stream totaling approximately one QA/QC sample per 7 samples. Drill core is cut in-half with a diamond saw, with one-half placed in sealed bags with appropriate tags and shipped to the SGS Sudbury laboratory and the other half retained on site in the original core box. A dispatch list consists of 88 or 176 samples along with their corresponding QA/QC samples for a single batch. This allows complete batches (88 samples) for fire assay. A file for sample tracking records tags used and weights of sample bags shipped to the SGS Lakefield. Shipment is done by Manitoulin Transport and coordination by Technominex staff in Rouyn-Noranda.

The third-party laboratory, SGS prep laboratory in Sudbury Ontario, processes the shipment of samples using standard sample preparation (code PRP91) and produces pulps from the specified samples. The pulps are then sent off to SGS Burnaby for analysis. Chain of custody is maintained from the drill to the submittal into the laboratory preparation facility all the way to analysis at the SGS Burnaby B.C. laboratory.

Analytical testing is performed by SGS laboratories in Burnaby, British Columbia. The entire sample is crushed to 75% passing 2mm, with a split of 500g pulverized to 85% passing 75 microns. Samples are then analyzed using Au – ore grade 50g Fire Assay, ICP-AES with reporting limits of 0.01 -100 part per million (ppm). High grade gold analysis based on the presence of visible gold or a fire assay result exceeding 100 ppm, are analyzed by Au – metallic screening, 1kg screened to 106μm, 50g fire assay, gravimetric, AAS or ICP-AES of entire plus fraction and duplicate analysis of minus fraction. Reporting limit 0.01ppm.

About the Duquesne West Gold Project

The Duquesne West Gold Property is located 32 km northwest of the city of Rouyn-Noranda and 10 km east of the town of Duparquet, Quebec, Canada. The property lies within the historic Duparquet gold mining camp in the southern portion of the Abitibi Greenstone Belt in the Superior Province.

Under an Option Agreement, Emperor agreed to acquire a 100% interest in a mineral claim package comprising 38 claims covering approximately 1,389 ha, located in the Duparquet Township of Quebec (the “Duquesne West Property”) from Duparquet Assets Ltd., a 50% owned subsidiary of Globex Mining Enterprises Inc. (GMX-TSX). For further information on the Duquesne West Property and Option Agreement, see Emperor’s press release dated Oct. 12, 2022, available on SEDAR.

The Property hosts a historical inferred mineral resource estimate of 727,000 ounces of gold at a grade of 5.42 g/t Au.1,2 The mineral resource estimate predates modern Canadian Institute of Mining and Metallurgy (CIM) guidelines and a Qualified Person on behalf of Emperor has not reviewed or verified the mineral resource estimate, therefore it is considered historical in nature and is reported solely to provide an indication of the magnitude of mineralization that could be present on the property. The gold system remains open for resource identification and expansion.

A reinterpretation of the existing geological model was created using AI and Machine Learning. This model shows the opportunity for additional discovery of ounces by revealing gold trends unknown to previous workers and the potential to expand the resource along significant gold-endowed structural zones.

Multiple scenarios exist to expand additional resources which include:

- Underground High-Grade Gold.

- Open Pit Bulk Tonnage Gold.

- Underground Bulk Tonnage Gold.

1 Watts, Griffis, and McOuat Consulting Geologists and Engineers, Oct. 20, 2011, Technical Report and Mineral Resource Estimate Update for the Duquesne-Ottoman Property, Quebec, Canada, for XMet Inc.

2 Power-Fardy and Breede, 2011. The Mineral Resource Estimate (MRE) constructed in 2011 is considered historical in nature as it was constructed prior to the most recent CIM standards (2014) and guidelines (2019) for mineral resources. In addition, the economic factors used to demonstrate reasonable prospects of eventual economic extraction for the MRE have changed since 2011. A qualified person has not done sufficient work to consider the MRE as a current MRE. Emperor is not treating the historical MRE as a current mineral resource. The reader is cautioned not to treat it, or any part of it, as a current mineral resource.

QP Disclosure

The technical content for the Duquesne West Project in this news release has been reviewed and approved by John Florek, M.Sc., P.Geol., a Qualified Person pursuant to CIM guidelines.

About Emperor Metals Inc.

Emperor Metals Inc. is an innovative Canadian mineral exploration company focused on developing high-quality gold properties situated in the Canadian Shield.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE