Dolly Varden Silver Announces Agreement to Quadruple Tenure Area in the Golden Triangle by Acquiring Hecla Mining Company’s Adjacent Kinskuch Property

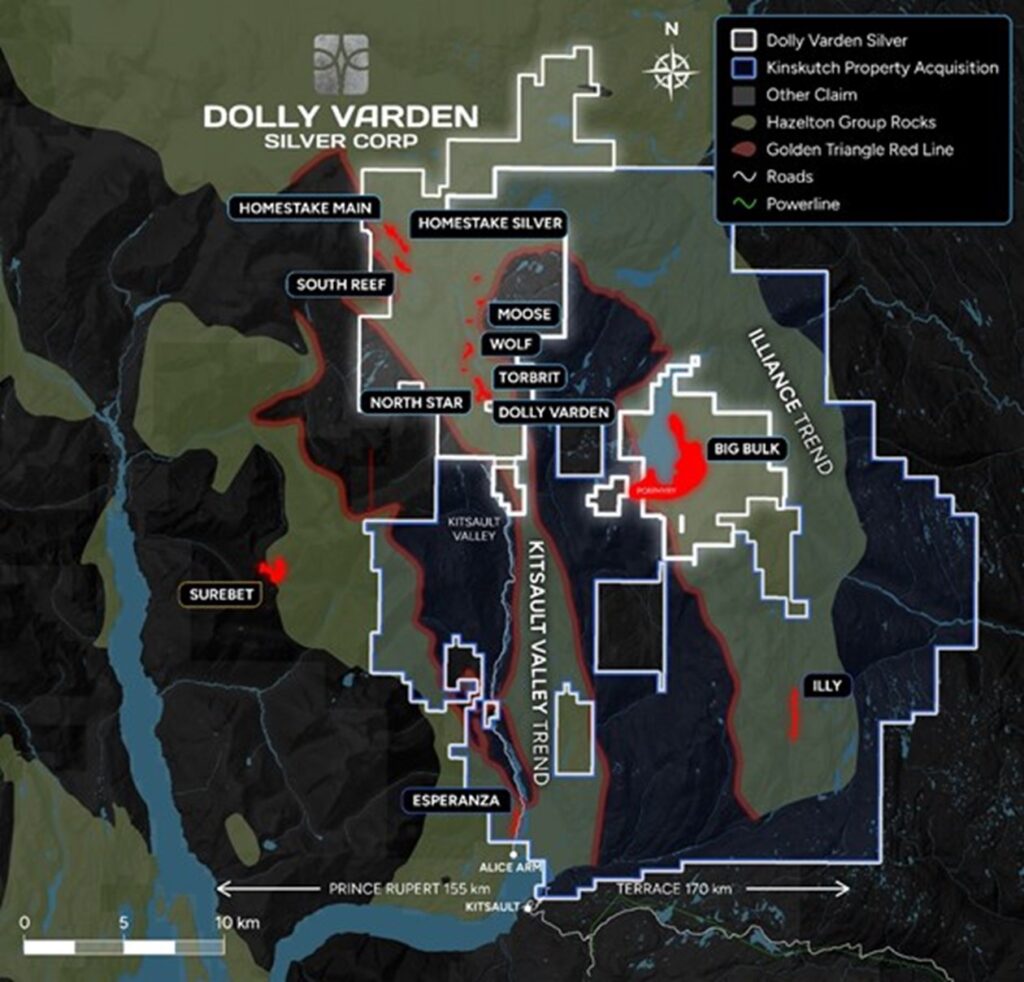

Dolly Varden Silver Corporation (TSX-V: DV) (NYSE American: DVS) (FSE: DVQ1) is pleased to announce that it has entered into a definitive agreement to acquire 100% of Hecla Mining Company’s Kinskuch property in northwest BC’s Golden Triangle. The Transaction will consolidate a district scale, contiguous claim package that includes the Kitsault Valley, Big Bulk and Kinskuch projects. This consolidation of Hecla and Dolly Varden’s project areas dramatically increases the Kitsault Valley Project size to approximately 77,000 hectares, covering some of the most underexplored and prospective rocks for silver, gold and copper mineralization in the Golden Triangle.

“Consolidating Dolly Varden’s Kitsault Valley Project with our major shareholder Hecla’s large and underexplored claims covering prospective Hazelton Group rocks will allow for more efficient exploration and enable us to unlock value on our path to be a premier precious metals company. Additionally, we welcome Hecla’s increased share ownership in our Company,” stated Shawn Khunkhun, President and CEO of Dolly Varden.

Dolly Varden has agreed to purchase the Kinskuch property from Hecla for consideration of $5 million, which shall be satisfied by Dolly Varden issuing 1,351,963 common shares of the Company to Hecla. Hecla will also retain a 2% net smelter return royalty on the Kinskuch property area. The NSR will include a 50% buyback right, for $5 million, that will allow Dolly Varden to reduce the royalty to 1% at any time. As per an existing agreement between Dolly Varden and Hecla, Hecla will maintain a designated position on Dolly Varden’s Technical Committee, working together to unlock the potential of the underexplored areas.

The issuance of the Common Shares and completion of the Transaction remains subject to TSX Venture Exchange and NYSE America approval and other customary conditions and is currently expected to complete in mid May. The Transaction will increase Hecla’s ownership in Dolly Varden, leveraging the experience of Dolly Varden’s technical team to explore two separate, 30-kilometer-long trends of Hazelton Group rocks.

“We will be using our structural and lithological framework model developed at the Kitsault Valley Trend that has led our team to significant discoveries such as the Wolf Vein and applying them to exploration of the Illiance Trend. Hecla was successful in identifying a subparallel trend of silver-rich mineralization, located to the east of our significant silver and gold deposits,” states Rob van Egmond, VP Exploration for Dolly Varden.

Dolly Varden’s increased mineral tenure holdings will triple the total strike length of favorable Jurassic age Hazelton-group volcanic rocks and associated “Red Line” by adding the Illiance trend to the Kitsault Valley trend. Both the Kitsault Valley and the Illiance trends are interpreted to be part of a district scale, sub-basin of the Eskay Rift period. The Illiance trend has seen little modern exploration work, limited to localized diamond drilling by Hecla on the three kilometer long, north-south trending Illy epithermal system.

Also included within the acquisition area is the past producing Esperanza Mine (1910), interpreted as quartz-carbonate veins with similar silver grades to the historic Dolly Varden Mine (1920) hosted in Upper Hazelton sedimentary rocks. The Esperanza Mine is located along the Kitsault Valley access road, two kilometers north of Dolly Varden’s camp in Alice Arm, BC.

The southwestern portion of the acquired claims covers Hazelton Group rocks that trend to within seven kilometers of Goliath Resources’ recently discovered Surebet Zone gold mineralization.

The area south of Big Bulk has the potential to host additional gold-copper porphyry systems along the south trend towards the Kitsault molybdenum porphyry deposit, which is being actively advanced by Newmoly llc.

The Kinskuch property is covered by a recently renewed five-year Exploration Permit on both Nisga’a and Gitanyow Traditional Lands.

Hecla is considered a “related party” of the Company pursuant to Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions on account of Hecla owning 10,606,374 Common Shares of Dolly Varden, representing approximately 13.3% of the outstanding Common Shares. As such, the Transaction is considered a “related party transaction” pursuant to MI 61-101. The Transaction is exempt from the formal valuation requirements and minority shareholder approval requirements of MI 61-101 pursuant to Section 5.5(a) and Section 5.7(1)(a), respectively, as the value of the Common Shares issuable pursuant to the Transaction will not exceed 25% of the Company’s market capitalization.

The Transaction was negotiated by disinterested members of management of Dolly Varden and Hecla. The Transaction was unanimously approved by the disinterested members of the Dolly Varden Board of Directors.

The Common Shares issuable to Hecla will be subject to a four-month statutory hold period in accordance with applicable securities laws. No finder’s fees or commissions are payable by the Company in connection with the Transaction.

Qualified Person

Rob van Egmond, P.Geo., Vice-President Exploration for Dolly Varden Silver, the “Qualified Person” as defined by NI43-101 has reviewed, validated and approved the scientific and technical information contained in this news release and supervises the ongoing exploration program at the Dolly Varden Project. Rob van Egmond, P.Geo. is not independent of the Company in accordance with NI 43-101.

About Dolly Varden Silver Corporation

Dolly Varden Silver Corporation is a mineral exploration company focused on advancing its 100% held Kitsault Valley Project (which combines the Dolly Varden Project and the Homestake Ridge Project) located in the Golden Triangle of British Columbia, Canada, 25kms by road to tide water. The 163 sq. km. project hosts the high-grade silver and gold resources of Dolly Varden and Homestake Ridge along with the past producing Dolly Varden and Torbrit silver mines. It is considered to be prospective for hosting further precious metal deposits, being on the same structural and stratigraphic belts that host numerous other, on-trend, high-grade deposits, such as Eskay Creek and Brucejack. The Kitsault Valley Project also contains the Big Bulk property which is prospective for porphyry and skarn style copper and gold mineralization, similar to other such deposits in the region (Red Mountain, KSM, Red Chris).

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE