Critical Investor – “Kenorland Minerals Completes 2022 Summer Exploration Program; Regnault Keeps Expanding”

Ice drilling at Regnault target, Frotet project, Quebec

It was good to meet up in person again after a long time with Kenorland Minerals (TSX-V:KLD)(FSE:3WQO) CEO Zach Flood at a great conference in Frankfurt last week (Deutsche Goldmesse, organized by Kai Hoffman), and discuss the latest drill results of their flagship Regnault in Quebec, and further plans of the company. Kenorland appears to be in excellent financial shape, as they recently raised C$7.49M, a significant equity holding of theirs (in LiFT Power (LIFT.CSE), a lithium junior) is doing very well (1.75M shares @ C$12.20 are worth C$21.35M at the time of writing), bringing their total working capital at C$10.5M and equity interests at C$24M, and they have numerous ongoing JVs/option agreements as operators with majors. Of notice is also that former President Francis MacDonald isn’t just the CEO of LIFt Power these days, but also still a lead advisor to Kenorland, so Kenorland will have a front row seat regarding LiFt developments, and as such will be able to time any future divestments extremely well.

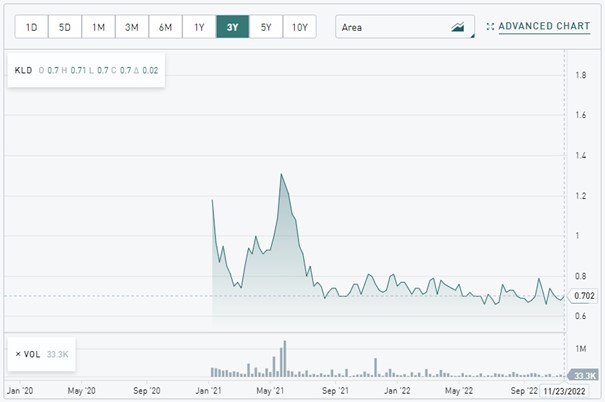

The share price remains stable around the C$0.70 levels (equal to the last pre IPO round), even during the downturn this summer, as Kenorland stock continues to be supported by many, for example the likes of Sumitomo, all the big Quebec funds, Sprott Global, Commodity Capital, Euro Pacific and last but not least Rick Rule himself.

Share price 3 year period (Source: tmxmoney.com)

It is good to see this level of ongoing support, otherwise the share price would probably have dropped to 35-40c levels in my view. As Kenorland is, at least for yours truly, the posterboy of a very high profile prospect generator play, with one of the best risk/reward ratios in my view, the amount of support is rare, but understandable. If any prospect generator could make a Tier I discovery, it is Kenorland Minerals with their agreements with majors, quality assets in quality jurisdictions, smart management, financial support and discovery concept.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Kenorland’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Kenorland or Kenorland’s management. Kenorland Minerals has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

Although a recession is coming according to a lot of experts, with inflation still running high and a Fed contemplating if they should raise 25 or 50 basis points which both represent a soft landing, a lots of stocks have come off bottom levels struck in October, on a lower US Dollar and higher gold prices. Besides this, the Russia crimes are ongoing in the Ukraine, but seems to become business as usual after 2 rockets landing in Poland were identified as not being from Russia. Something really captivating the financial world was the titanic demise of FTX evaporating billions of dollars, a crypto platform controlled by one of the biggest con men in history: Sam Bankman-Fried. In my opinion this shows that the crypto world can’t exist without solid regulation, and with regulation the speculative appeal disappears, and with it its future as a store of value. Banks, funds and large companies already figured this out earlier, and exited this ecosystem well in advance, crashing the likes of Bitcoin and Ethereum. I see this as a clear advantage for the junior mining sector, as speculative investment capital will have one less avenue to spend its hard dollars on, and hopefully Kenorland will profit from more money coming into the junior mining sector.

Let’s have a look at the recently announced drill results of flagship target Regnault now, published at November 14, 2022, and the implications for potential back-of-the-envelope resource estimates.

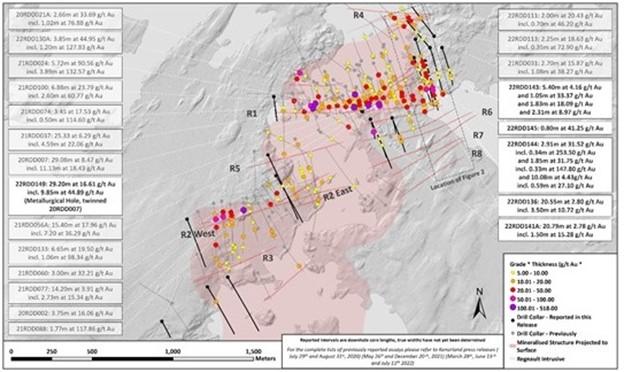

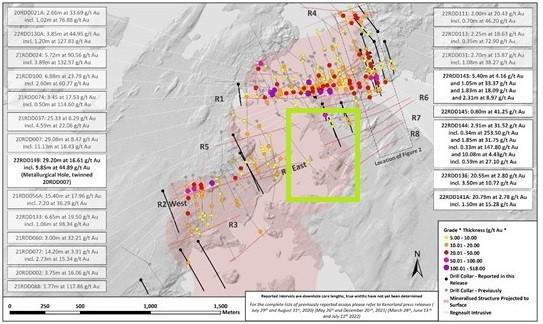

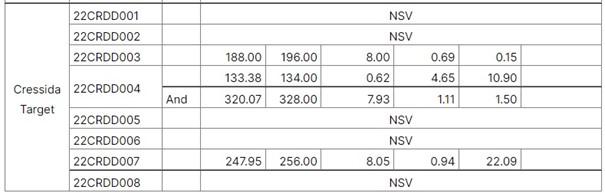

This batch represents the final drill results of the 2022 summer program at the Frotet project, and involved the assays of the remaining 5 of 25 drill holes completed, containing 11,903m drilled (23 holes) at Regnault, and 2,511m (8 holes) at Cressida (a few kilometers north west of Regnault). The highlights looked like this, further extending recent vein discoveries:

- 22RDD136: 20.55m @ 2.80 g/t Au incl. 3.50m @ 10.72 g/t Au at R6 (2022 discovery, residual grade 0.96g/t Au)

- 22RDD141A: 20.79m @ 2.78 g/t Au incl. 1.50m @ 15.28 g/t Au at R7 (2022 discovery, residual grade 1.68g/t Au)

- 22RDD144: 2.91m @ 31.52 g/t Au incl. 0.34m @ 253.50 g/t Au at R5 (2022 discovery, residual grade 1.9g/t Au)

- 22RDD144: 1.85m @ 31.75 g/t Au incl. 0.33m @ 147.80 g/t Au at R6 (2022 discovery, residual grade 5.4g/t Au)

- 22RDD149: 29.20m @ 16.61 g/t Au incl. 9.85m @ 44.89 g/t Au at R1, residual grade 1.47 g/t Au (Metallurgical drill hole, twinned 20RDD007: 29.08m @ 8.47g/t Au)

These are the highlights, and when looking at the table of results it will be clear that this batch wasn’t the best batch as 9 out of 23 didn’t return gold intercepts and there were quite a bit of low grade intercepts too, but the results that hit good grades were important, as lots of veins were extended meaningfully by this. Since at current gold prices all average grades above 3.5-4g/t Au with a vein width of at least 2-3m are economically viable, a gram x meter figure of 7-12 is sufficient, and lots of intercepts did achieve this. As low grade zones are often combined with (very) high grade intercepts, the average grade for most mineralization will likely be economic, and the cut-off grade can also be pretty low, maybe even around 2g/t Au, including most low grade zones as well. No wonder that CEO Zach Flood was pleased with these results:

“The summer drill programs at the Frotet Project were a great success. At Regnault we have extended the R1 system over 100m to the east, for a total of over one kilometer of strike, remaining open. We have also begun to prove continuity along the recently discovered parallel vein structures, including R5, R6, R7, and R8, located just to the south of the R1. At the Cressida Target, our maiden drill program discovered gold mineralisation over three kilometers away and along strike from Troilus Gold’s Southwest Zone. We anticipate the next phase of exploration in Q1 2023 to include up to 25,000m of drilling at Regnault which will be primarily focused on additional step-outs on the R1, R5, R6, R7, and R8 veins, as well as deeper drilling to test for additional parallel vein structures.”

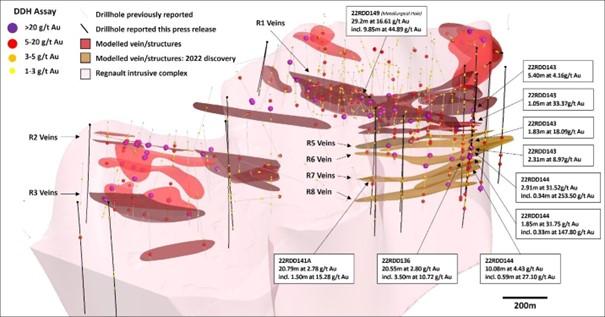

For the first time, Kenorland managed to create a wonderful 3D visualization, which increased my understanding of the vein structures, especially R5-R8:

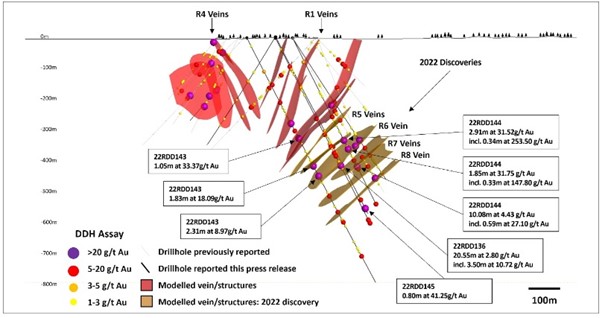

When looking at this model, it is clear that the recent results significantly extended the R5-R8 veins to the west and somewhat to the east, and even additional veins seem to be indicated between R5 and R6, and R7 and R8. Hole 145 hit 0.8m @ 41.25g/t Au about 60-70m below R8, so this might be another new vein. Here is a cross section over R1, looking under an angle towards the R5-R8 veins:

Regarding my back of the envelope estimate for the hypothetical Regnault resource, the combination of these models showed much more insight for me, and made it easier to estimate mineralization. As a reminder, the R1 zone is in fact a set of layered veins, but for guesstimating purposes this will be calculated as one zone. This results in an updated, very global back-of-the-envelope estimate on the R1 structure, and arrive for R1 at 1100 x 300 x 5 x 2.75 = 4.5Mt, at an average guesstimated grade of 6g/t Au, this would mean a hypothetical 870koz Au. The length of the mineralized envelope is actually a few hundred meters longer as the mentioned 1050m strike length in the news release, as the envelope is bent upwards towards the surface, so therefore I assume 1100m envelope length for R1.

The R2 back-of-the-envelope guesstimate stands unchanged at 900 x 200 x 2 x 2.75 = 990kt, at an average guesstimated grade of 8g/t Au this remains a hypothetical 255koz Au. For the R3 structure we have more visual information now, so the envelope could be estimated at 600 x 200 x 4 x 2.75 = 1.3Mt, at an average estimated grade of 7g/t this results in a hypothetical 294koz Au. The R4 structure to the north seems to be consisting of fairly narrow veins as well, 200m long and 225m deep, however not continuous from surface but separate vein structures, so the combined mineralized envelope is guesstimated at 200 x 100 x 2 x 2.75 = 110kt, at an average guesstimated grade of 10g/t Au this could imply a hypothetical 36koz Au. This results in a total hypothetical estimate for R1-R4 of 1.46Moz Au.

For the R5-R8 vein the data has become more complex with significant variation in average grades, even with additional structures indicated in between these veins, so I will try to estimate numbers per vein. For the R5 vein, the envelope is estimated at 700 x 75 x 5 x 2.75 = 722kt, at an average estimated grade of 10g/t this results in a hypothetical 233koz Au. For the R6 vein (including a second vein in between R5 and R6), the envelope is estimated at 800 x 75 x 6 x 2.75 = 990kt, at an average estimated grade of 8g/t this results in a hypothetical 255koz Au. For the R7 vein (including a second vein in between R7 and R8), the envelope is estimated at 650 x 50 x 7 x 2.75 = 625kt, at an average estimated grade of 8g/t this results in a hypothetical 161koz Au. For the R8 vein, the envelope is estimated at 650 x 80 x 3 x 2.75 = 429kt, at an average estimated grade of 8g/t this results in a hypothetical 111koz Au. These new veins result in a total, hypothetical number of 760koz Au. My overall estimate would come in at an hypothetical 2.22Moz Au for now, which is considerably more than my last estimate.

A hypothetical resource of 2.2Moz Au at an estimated average grade of 7-8g/t Au definitely begins to look like an economic deposit for JV partner Sumitomo. As discussed in my last update, Sumitomo will probably take a production decision as soon as a certain internal threshold is met, and will likely explore for deeper mineralization during production, when drilling at depth is much cheaper because of underground development. Since Sumitomo is large, but no major like Newmont or Barrick with huge operations, the 5Moz Au threshold probably doesn’t apply to them. I see them pursuing a construction decision at 3Moz Au, and if I’m somewhat correct in my estimates, my take is Kenorland might get there at the end of 2023.

Exploration at the Regnault target has seen 56,996m of diamond drilling so far. The fiscal 2022 exploration budget includes up to 40,000 meters of drilling carried out over two phases: the recently completed summer campaign (11,903m) from April to July of 2022, and an upcoming winter campaign (up to 25,000m) from January to April of 2023. Drill targeting will be focused on broad step-outs to extend the strike length and depth of recently discovered vein sets to the south of the R1 vein system. Priority targets will include stepping out on the R5 veins and testing the 475m gap zone between the R2-R3 shear hosted mineralized veins and the R6-R7-R8 mineralized structures. Drilling is expected to begin late January and continue through March with four drill rigs. It will be interesting to see if Kenorland can indeed connect R2-R3-R5 with R6-R7-R8:

If successful, such a connection could easily host another estimated, hypothetical 400-500koz Au. I wondered why new drilling had to wait until late January. CEO Flood replied: “The next phase of winter drilling will be focused in the center of the Regnault gold system which requires drilling from ice on the lake.”

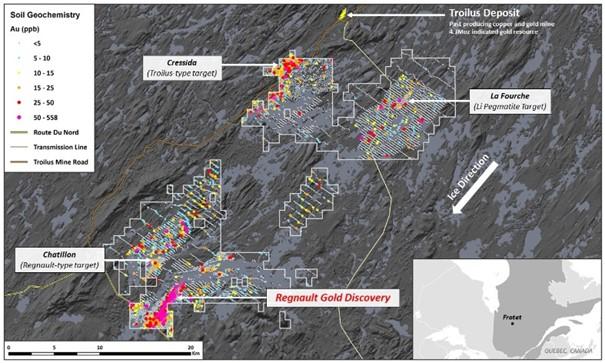

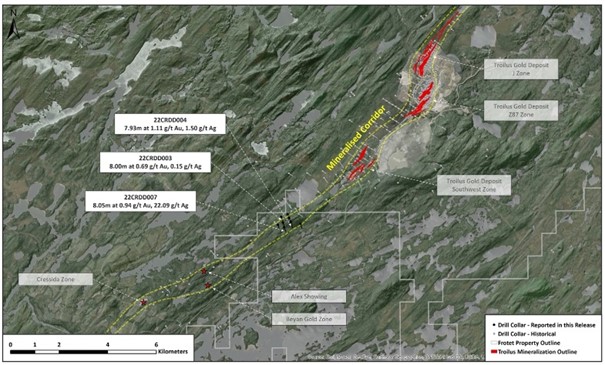

Kenorland has also completed a 2,500m drill program at their Cressida target, more to the northwest area of the Frotet project. This target can be observed below, along strike of the nearby (2.5km) Troilus deposit:

The sampling results were very promising, unfortunately the released drill results didn’t show spectacular intercepts like Regnault in this first round of drilling:

Kenorland found some gold, but unfortunately not in economic quantities yet. In order to get a better view, the results are shown in the following map:

One would think there should be something, as the target is on strike with Troilus, and had great sampling results. But apparently this could easily be the result of the ice direction of the old glaciers, depositing gold from Troilus to the south in glacial till. CEO Flood commented when asked about future plans: “We discovered new gold mineralization in bedrock at Cressida. We will likely follow up on these results with an additional drill program next summer.”

This wraps it up for the Frotet project for now. Regarding other projects in Kenorland’s portfolio, the second most important project is Healy (Alaska). After a first drill program returned not very impressive results, management still has no immediate plans to explore Healy at the moment, however they continue to look at alternative paths forward which could still advance the project.

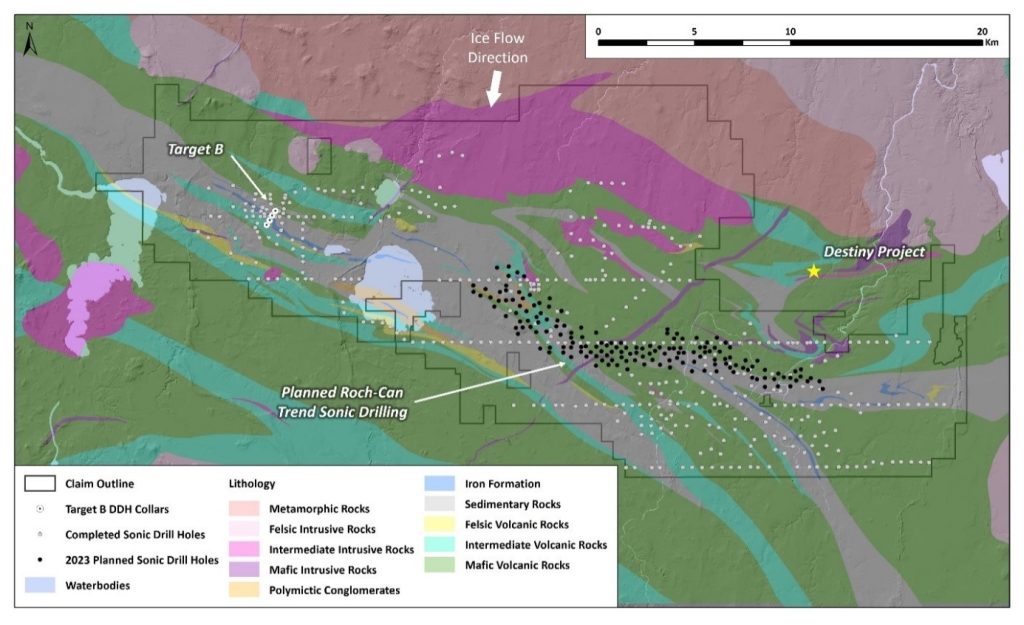

As a reminder, on October 24, 2022 Kenorland announced the formation of a 49-51% JV with Sumitomo at the Chicobi project in Quebec, which completed their earn-in obligations. For now, a C$1.5M program is funded completely by Sumitomo, and involves sonic drill holes for geochem sampling.

Although there were no significant intervals from the diamond drill holes at target B, which was very limited as can be seen in the above map, reported by Kenorland, Sumitomo obviously saw enough data of interest to form the JV. When asking CEO Flood if he had any idea what exactly triggered them to continue, he answered, “This is a very large property with multiple regional target areas. Target B was the first which we advanced to drill stage, however there were others in the pipeline, such at Roch-Can, which we had always planned to follow-up on. The Roch-Can area is slightly lower risk as historical drilling has demonstrated a large alteration system and gold mineralization in bedrock. We’re excited to continue advancing exploration at Chicobi.”

Besides Chicobi, Kenorland will also be the operator of a property wide till geochemical survey at their recently sold Wheatcroft Project in Manitoba during the fall of this year. A large 200x800m arsenic and gold geochemical anomaly has been defined, and this will be further explored with this survey. Status?

Another important project for Kenorland is the Tanacross project in Alaska. Antofagasta was granted the option to earn-in a 70% interest by paying Kenorland US$5M in total, and spending US$30M on exploration expenditures over 8 years, plus completing a NI43-101 compliant Preliminary Economic Assessment (PEA). Kenorland will be the initial operator during the period leading up to the 70% interest, and Antofagasta is required to spend at least US$1M in year one. Tanacross could provide the company with a Tier I discovery, as it certainly has the scale and the potential for it. As the results for Tanacross are expected from December onwards, I wondered what the current status on this timeline is. CEO Flood stated: “We have received most of the data from the summer exploration surveys and have begun drill targeting. We will likely know at some point in January or February if a drill program will go ahead in 2023.”

Kenorland also completed a VTEM survey at the Hunter project in Quebec (optioned to Centerra Gold), and a LiDAR survey and mapping at South Uchi (optioned to Barrick). The current status on these projects is as follows: at Hunter a property-wide sonic drill-for-till program will be carried out next month. Sonic drilling has been completed, data is still being recieved. The company is waiting on an update from Barrick on South Uchi.

At South Uchi, Barrick approved a C$1.8M budget earlier this year to complete infill glacial till geochemical sampling, within the regional As-Sb+/-Au anomaly, on a 350m by 150m spaced grid. The follow-up survey was planned to be carried out between mid-June and mid-August. CEO Flood told me Barrick was very active on South Uchi this summer and they are waiting on an update from Barrick.

Since till sampling, boulder prospecting, airborn magnetics and an IP survey have been completed at Deux Orignaux (Chebistuan), further targeting is on its way. According to CEO Flood, they proposed a program, but are still waiting still waiting on a formal approval from Newmont.

When analyzing Kenorland Minerals, it becomes obvious that this company is very well managed, is always cashed up and has no issue whatsoever to raise more when needed, is well supported by powerful players, has great projects with already one substantial discovery, has earn-ins and JVs with the best possible partners in the business, and on top of this has very little downside risk. It seems like the safest bet on a Tier I discovery, and maybe Regnault could already provide Kenorland with a significant windfall.

Conclusion

The latest batch of results further confirmed the potential of the R5-R8 veins, and most veins are still open in many directions. As other vein structures were also extended, the additional 3D model provided by the company indicated a significant increase in potential resources. My estimates pegged Regnault at a hypothetical 2.2Moz @7-8g/t Au resource at the moment, which could be closing in on Sumitomo thresholds, but this is all armwaving as you understand. I viewed a genuine Tier I discovery as a main catalyst for a long time for Kenorland, but maybe management can strike a robust deal over Regnault when Sumitomo would like to advance into construction, following in the footsteps of EMX Royalty (EMX.V) which received US$65M for their 33% interest in its Malmyzh project in Russia. Drilling continues in late January, with first results likely coming back from the labs in March. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in Kenorland Minerals and LiFT Power. Kenorland Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.kenorlandminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE