Critical Investor – “Banyan Gold Closes Upsized C$12.2M Non-Brokered Private Placement; Macro Review 2022”

As 2022 has come to an end, it might be appropriate to not only discuss the latest, successful raise by Banyan Gold, but also reflect on their many successes in 2022 , the potential for the price of gold in 2023, something that is material to Banyan Gold of course, and macro economics and the sector as a whole.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Banyan Gold’s resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Banyan or Banyan’s management. Banyan Gold has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

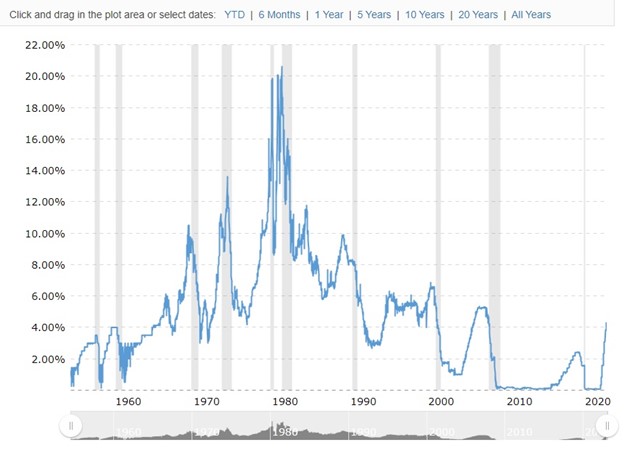

This past year, we saw the Russia invasion of the Ukraine disrupting commodity supply chains, but also the fallout from COVID-19, causing fundamental underinvestment in almost any supply chain worldwide, which in turn fueled inflation to sky high levels not seen in over 40 years. This development caused the Federal Reserve to raise interest rates to the highest levels in 15 years:

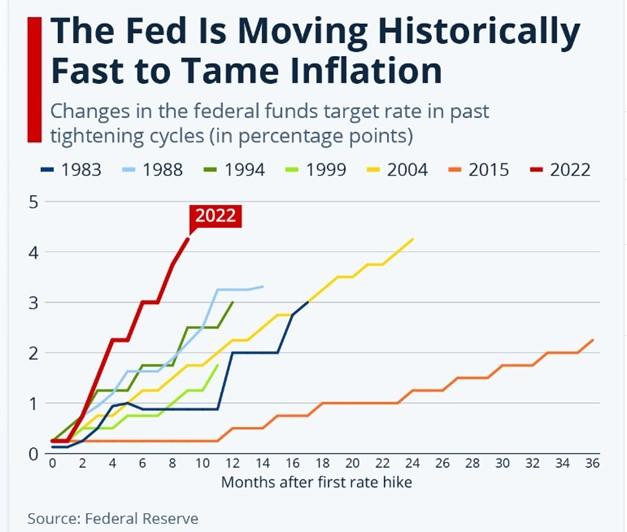

but also raising them at speeds never witnessed before:

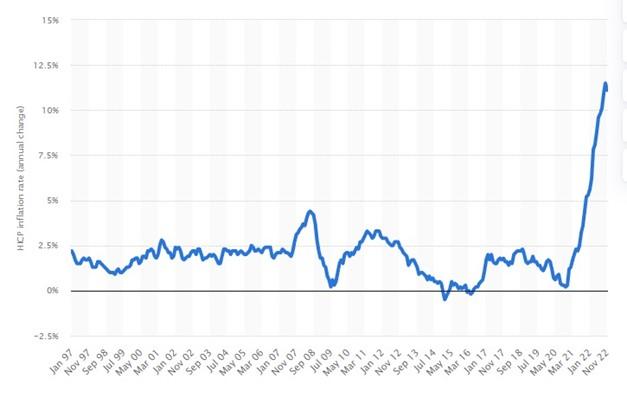

As the US inflation for goods and services seemed to have spiked in June 2022, causing the Fed to turn mildly optimistic in their interest rate policy, the Eurozone inflation surpassed the US one month later, and seems to have peaked for now as well, although the Western world has established artificial price ceilings for oil and gas in order to minimize proceeds for Russia and costs for civilians and economy. The next chart clearly shows how rare the latest spike is for the Eurozone inflation:

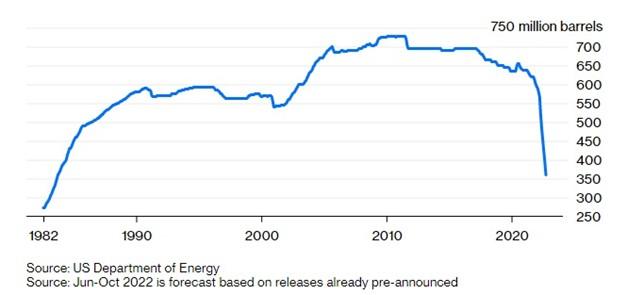

I’m not sure if these price ceilings for oil and gas structurally are a good solution by the way; as for example the Eurozone governments are paying the difference between the (much higher) market prices and ceiling prices, so in turn its citizens and companies will pay for this later on anyway via higher taxes. As a different remedy, the US has been tapping their oil reserves at alarming speeds to keep prices in check, although the oil price hasn’t gotten much cheaper along the way and has kept trading around US$80/b. Here is the chart of the Strategic Reserves:

This drop in reserves is caused predominantly by selling a type of oil that is easy to refine by high margins, most of what is left is less profitable to refine. As the refinery industry has a huge capacity problem these days since many refineries had to close shop during COVID-19, also reinforced by the focus on green energy, one can understand that something has to give in here. The short term solution for now seems to be coming from Saudi Arabia, but it doesn’t seem convenient to be dependent on such nations for the West. This energy issue could be a giant trainwreck in the making in my view, and will make the transition to green energy harder, not easier, as the world needs affordable energy now, which still is fossil fuel based, which will delay the transition.

Another interesting issue is the complete release of COVID-19 restrictions by China, causing huge numbers of deaths and infected people after a period of very stringent lockdowns, as nobody had the opportunity to achieve group immunity as has been the case in the Western world. If COVID-19 manages to cripple China completely for a while, or in a chaotic way, this could invoke a myriad of consequences, ranging from far-ranging supply disruption to demand destruction for many of commodities. Official figures showed that the latest spike of COVID-19 infections seems to have been under control now, but there exists lots of doubt about these figures, and many countries require negative tests for travelers from China nowadays.

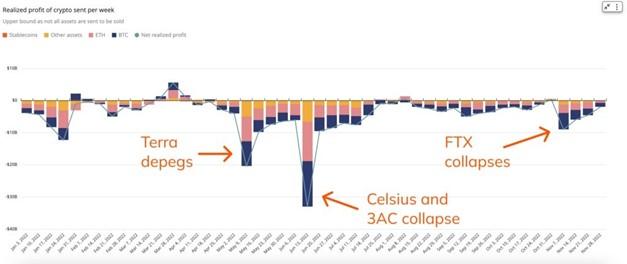

Of a less structural nature, but headline grabbing nevertheless and totally unexpected was the meltdown of FTX in November 2022, the third largest crypto exchange platform worldwide, starring CEO and founder Sam Bankman-Fried and a few close friends, causing about US$10B in damages for clients who saw their cryptos vaporize. This case showed in my view why decentralized, unregulated cryptos have no longer a seat at the table as a regular investment asset. Incoming bankruptcy liquidator and new CEO John J. Ray III stated after a week of investigating the mess he found, that despite having been involved in the bankruptcies of Enron, Residential Capital, Nortel and Overseas Shipholding: “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.” And keep in mind, this was just a US$10B loss for crypto investors, earlier this year there were the depegging of Terra USD and the collapse of Celsius and Three Arrows Capital, realizing weekly losses of US$20.5B and US$33B.

As funds and major corporates started dumping Bitcoins and other cryptos in 2021, and banks rolled up their newly created crypto related services even faster than created, investors could have lost over a trillion dollars in total from the highs, and I view these developments and the reluctancy of the regulators to accept crypto as an asset as the final nails in the coffin of crypto/Bitcoin becoming a serious investment. I really thought it had a shot at it when total crypto market cap went to US$2T, banks created trading desks, spot Bitcoin ETFs applied for approval with the SEC, large corporates and money managers like Blackrock, Vanguard, Tesla etc started buying Bitcoin as an investment, etc etc, but to no avail unfortunately. It seems the crypto saga has come to an end (as has the cannabis myth), and speculative investor funds have been freed up to invest in other asset classes now, and hopefully some of it will return again to junior mining.

On top of all this, a worldwide recession seems to be in the making, some argue we have already entered one, after two negative quarters of GDP growth in H1, 2022, but a positive Q3 followed rather mysteriously, on the back of increased exports and increased consumer spending. Everything real estate related dropped including construction, and this usually is an important measure to measure overall growth, so signals are mixed. The same is ongoing for employment, with massive amounts of staff being fired as lots of large corporates are trying to shave costs, but total non-farm payroll jobs actually increased by 263k. It is safe to say we are truly in uncharted territories now, as no expert seems to understand what direction the world economy is heading for. Will it be stagflation, will it be a depression, or will it just be a mild recession in H2, 2023, with the Fed joining forces with other central banks worldwide, enabling a soft landing, stabilizing interest rates at 4.5-4% until inflation starts dropping off below 4-5% levels, returning the world economy slowly into business as usual? The markets seem to be in a bottoming process at the moment, after having recorded huge losses (largest since 2008), as the S&P 500 chart shows for example:

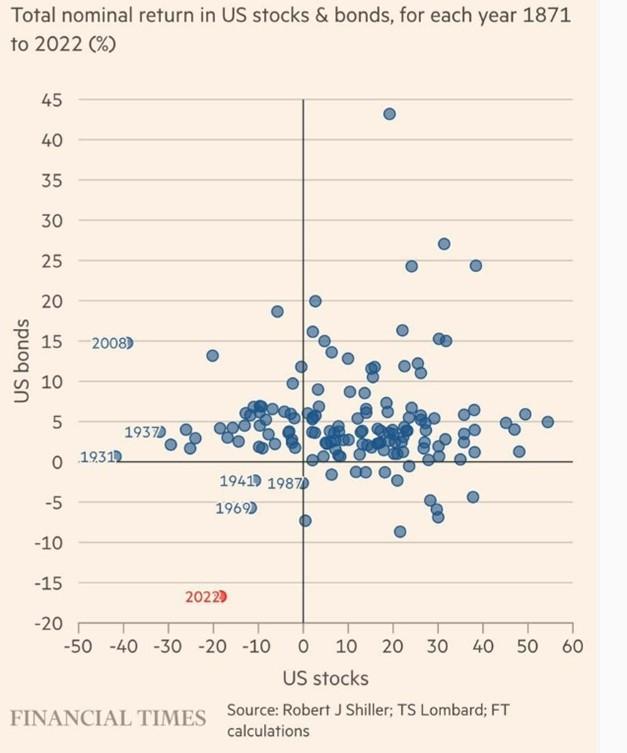

The Financial Times composed an interesting chart as well on this topic, outlining 2022 as the single worst year since 1871 for total nominal return for stocks and bonds combined:

This anomaly was of course created by the explosive rate hikes by the Fed at unprecedented speeds, causing bonds to lose value at unprecedented speeds as well, and was obviously more than the stock markets could handle. As all things rising or dropping at high speeds have to end at some point, and demand destruction is already happening because of high prices (I just love this quote of Rick Rule: the best cure for high prices is high prices), I believe IF supply chain issues could be resolved, we could have seen peak inflation, and IF a mild recession can be pulled off, this would be the best scenario for the world economy to return to normal. But as we have seen several black swans the last few years now, and lots of “unprecedents”, who knows what the future will bring. However, with interest rates topping out likely soon, it seems the US Dollar will likely lose more strength, which could be good for gold.

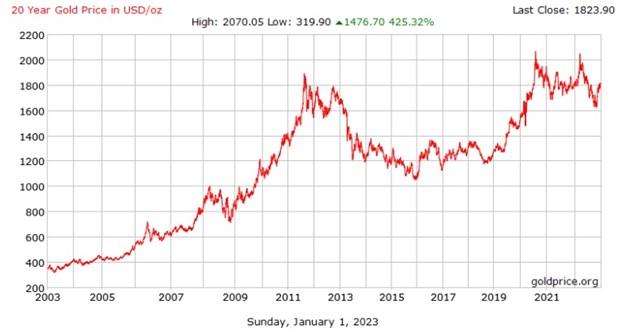

Gold is waiting patiently along the sidelines:

So-called experts see gold trading towards US$2,300-2,500/oz, and even up to US$3,000/oz before year end of 2023, but this could take a while longer. I do believe we could see all-time highs (>US$2070.05/oz) developing in 2023 on a lower US Dollar and persistent inflation, but this is all pure speculation, as gold doesn’t have fundamental drivers but just sentiment drivers and is controlled for 97-98% by futures traders and not real demand/supply mechanisms.

Banyan Gold Corp. (TSXV:BYN) (OTCQB:BYAGF) would be a primary beneficiary of a higher gold price, of course, as its flagship AurMac asset in the Yukon is entirely gold-focused. The company announced on December 7, 2022, a C$11.5M non-brokered private placement by issuing up to 11.8M Premium Flow Through (FT) shares at a price of C$0.568, and up to 12M common (non-FT) shares at a price of C$0.40, which was a 3c discount to the share price at the time. The FT premium was about 36%, which is standard. Except 2.8M FT shares, none of the issued FT and common shares were subject to the 4 month and one day hold period. It was good to see there were no warrants attached to the common shares, as dilution is already substantial with 25M new shares being issued, or an increase in outstanding shares of about 10%.

After announcing an upsizing from C$11.5M to C$12.2M on December 14, 2022, the closing was announced on December 22, 2022, which was impressive as it isn’t too easy to raise capital these days. I wondered if the European road trip had much to do with this, and Banyan President and CEO, Tara Christie, answered: “The road trip to Europe was a great opportunity to reconnect with shareholders after not being able to travel to Europe in the last couple years – In fact, one large shareholder in the last financing was a European investor.”

The current cash position stands at about C$19.M and puts Banyan in a strong position going into 2023. Current plans according to CEO Christie are completing 25,000 m of drilling, metallurgical work, a resource update by H2 2023 and ending the year with a strong treasury.

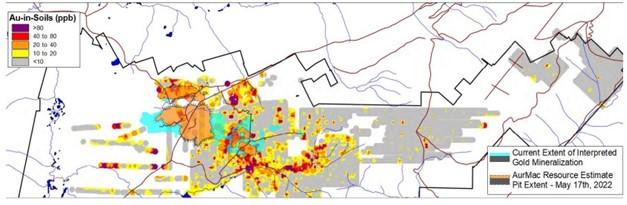

Let’s have a quick recap at the current state of affairs at AurMac.

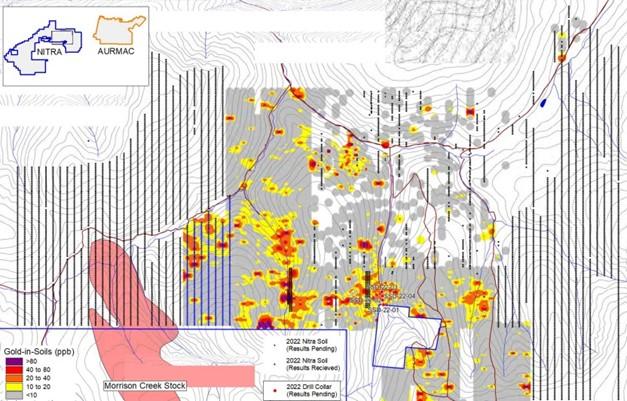

The ongoing stream of announced results have been economic for the most part, taking the hypothetical resource estimate for AurMac to 5.8Moz Au according to my earlier estimates. The results for 100 of the 211 holes drilled are still pending and should be fully received by March. After most of the assays are received, an updated resource estimate is expected somewhere by H2, 2023. A very interesting subject to me is the fact that 10% of the overall 2022 drilling was focused on high priority regional targets on the AurMac Property and Nitra Property, I’m curious what will come out of these holes as this could be a gamechanger, potentially materially expanding mineralization. Results are also pending for an extensive soil sampling program at Nitra.

As a reminder, it is very likely Banyan will proceed with targeting, and eventual follow up drilling could even commence as early as this month, but CEO Christie was happy to update me further on this subject:

“The area near Nitra and hole 320 are best drilled after late May. We could start other areas as early as January/February but winter drilling is a bit more expensive and with such a long season in 2022, we need time to do maintenance and give our crew a break. We will finalize our drill plan as we receive more assays so we can figure out the best value for our shareholder dollars. We plan to start drilling in March with 3 drills, and drill a total of 25,000 m in 2023 as mentioned. We are financed to drill more if we think we will be rewarded for it in the market. We have many options so it’s a great place to be.”

Banyan Gold seems firmly on its way to succeed in achieving their 6-7Moz Au target and according to my global estimates, the current resource could very well stand at 5.8Moz Au already. With lots of assays still coming in, I expect AurMac to grow further and at least surpass 6Moz Au, which appears to be pretty economic, as well, for average grade (0.60g/t Au which is good for heap leaching), size and infrastructure. Management is also enthusiastic about the Nitra target, of which sampling results already show indications of a mineralized zone comparable to AurMac. But, for now, most focus is on the latter of course, which represents, at least in my view, one of the most low risk investment opportunities in the gold mining sector.

Conclusion

2022 has been a turbulent year for investors, with lots of developments from various angles. Notwithstanding this, Banyan Gold kept sideranging as one of the most stable gold juniors on the Venture Exchange, which, in part, was due to the excellent maiden resource for AurMac, and the apparent expansion potential across the board. Lots of assays are expected, a new drill program will start in March and Nitra results coming in could provide a gamechanger. Banyan Gold isn’t just busy putting exploration dollars into the ground, but also seem to be pretty effective at growing the resource, and really building value here, undoubtedly giving shareholders a bang for their buck in the long run. Banyan is in an excellent position to profit from improving markets and renewed investor interest. CEO Christie is very aware of potential market gyrations, and I have no doubt she will navigate Banyan through any potential recession storm the best way possible, getting the best results for investors at the right time.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Banyan Gold is a sponsoring company. All facts are to be checked by the reader. For more information go to www.banyangold.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE