Cordoba Announces Positive Preliminary Economic Assessment for the San Matias Copper-Gold-Silver Project

Cordoba Minerals Corp. (TSX-V: CDB) (OTCQB: CDBMF) today reported results from an independent Preliminary Economic Assessment for its San Matias Copper-Gold-Silver Project in Colombia. The PEA was prepared by Nordmin Engineering Ltd. of Thunder Bay, Ontario, and includes revisions to the June 2019 San Matias Mineral Resource estimate that was completed by Nordmin (refer to Cordoba’s news release dated July 3, 2019). All amounts are in United States dollars, unless otherwise stated. Summary results of the PEA are shown below in Table 1.

San Matias PEA Highlights:

- Conceptual 8,000 tonnes per day conventional open pit mining operation, increasing to 16,000 tpd after the processing plant expansion is completed in Year 6 – underpinned by 119.1 million tonnes of modeled mill feed grading 0.45% copper, 0.26 g/t gold and 2.41 g/t silver, supporting a 23-year life of mine. During the first five years, the PEA includes copper, gold and silver grades averaging 0.67%, 0.30 g/t and 3.74 g/t respectively with a low strip ratio of 0.82:1.

- PEA life of mine production of 417,300 tonnes of copper, 724,500 ounces of gold and 5,930,000 ounces of silver contained in a clean copper concentrate and precious metals doré. The copper concentrate is expected to contain very low contents of deleterious elements, such as arsenic and lead.

- Estimated annual copper production of 15,400 tonnes in concentrate in Years 1 to 5; increasing to 20,700 tonnes in Years 6 to 16; and averaging 18,100 tonnes per year over the total 23-year PEA life of mine.

- Average LOM C1 cash costs of $1.32 per pound of copper, net of precious metals by-product credits.

- Initial capital expenditures of $161.4 million, expansion capital expenditures of $120.6 million and total PEA life of mine capital expenditures, including sustaining capital, Tailings Management Facility (“TMF”) and reclamation costs, of $527.5 million.

- Pre-tax net present value (“NPV”) of $347.0 million at an 8% discount rate and a pre-tax internal rate of return (“IRR”) of 26.8%, using metals price assumptions of $3.25 per pound copper, $1,400 per ounce gold and $17.75 per ounce silver. A USD/COP foreign exchange rate of 3,125:1 has been applied. Pre-tax values include Colombian mining royalties of 4% of total precious metals revenue and 5% of total copper revenue.

- After-tax NPV8% of $210.7 million and an after-tax IRR of 20.3%, representing a 5.3-year payback using the same metals price assumptions.

- Over the PEA life of mine, the San Matias Project is expected to generate $180.7 million in royalty revenue plus $331.2 million in income tax revenue to the government.

- Cordoba has identified additional opportunities to enhance the overall project economics, including delineation of the high-grade gold veins contained within the El Alacrán deposit (“Alacran”) and optimization of mineral processing and metals recovery. Potential also exists for the discovery of the porphyry sources for the Alacran and Montiel West deposits and for other deposits within the San Matias Project area.

The San Matias 2019 PEA is preliminary in nature and includes an economic analysis that is based, in part, on Inferred Mineral Resources. Inferred Mineral Resources are considered too speculative geologically for the application of economic considerations that would enable them to be categorized as Mineral Reserves – and there is no certainty that the results will be realized. Mineral Resources do not have demonstrated economic viability and are not Mineral Reserves.

“We believe we have demonstrated a very robust project at San Matias through the PEA work completed by Nordmin.” stated Eric Finlayson, President and CEO of Cordoba. “The Alacran deposit, with its significant copper, gold and silver grades and low strip ratio, remains the cornerstone of the Project, supplemented by the later addition of mill feed from the Montiel East, Montiel West and Costa Azul pits. This is only the beginning for San Matias, and we will continue to explore our highly prospective copper and gold targets within the region.”

San Matias Copper-Gold-Silver Project Overview

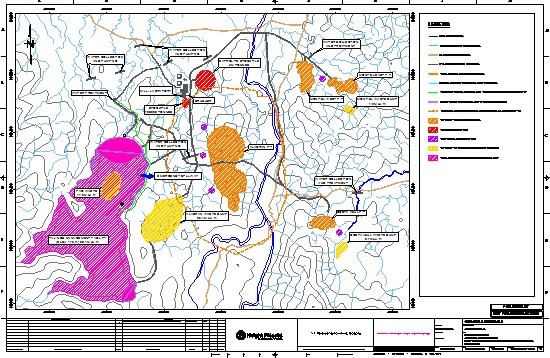

The San Matias Copper-Gold-Silver Project is located in the municipality of Puerto Libertador, Department of Córdoba, Colombia, and is approximately 200 kilometres north of Medellín. The site is road accessible from the town of Puerto Libertador, approximately 20 kilometres away. The PEA outlines a conventional open pit mining operation consisting of a main open pit mine at the Alacran deposit and three smaller open pit mines at the Montiel East, Montiel West and Costa Azul satellite deposits. The PEA includes a centralized processing plant and TMF located directly adjacent to the Alacran pit. The site layout is shown below in Figure 1.

The PEA includes employment for 290 personnel during the first 5 years of expected production and increasing to 355 personnel for the remaining 18 years.

Permitting

Cordoba holds exploration licences covering 149 square kilometres and has an additional 2,491 square kilometres of exploration licenses under application. Cordoba is working to complete the Mining Technical Work Plan (Programa de Trabajo y Obras or “PTO”) and the Environmental Impact Assessment (“EIA”) for the Alacran deposit, required prior to receiving approvals to begin construction.

Table 1: San Matias July 2019 PEA highlights completed by Nordmin Engineering Ltd.

| Preliminary Economic Assessment Highlights – July 2019 | |

| Production Metrics | |

| PEA mine life (years) | 23 |

| Total copper production (t) | 417,300 |

| Total gold production (oz) | 724,500 |

| Total silver production (oz) | 5,930,000 |

| Average annual copper production (Years 1 to 5; tpa) | 15,400 |

| Average annual copper production (Years 6 to 16; tpa) | 20,700 |

| Average annual copper production (LOM average; tpa) | 18,100 |

| Total conceptual open pit resources (kt) | 119,100 |

| Total waste (kt) | 96,200 |

| Total material (kt) | 215,300 |

| Strip ratio (waste: conceptual open pit resources) | 0.81:1 |

| Years 1 to 5 / average LOM copper grade (%) | 0.67% / 0.45% |

| Years 1 to 5 / average LOM gold grade (g/t) | 0.30 / 0.26 |

| Years 1 to 5 / average LOM silver grade (g/t) | 3.74 / 2.41 |

| Nameplate mill throughput (Years 1 to 5; tpd) | 8,000 |

| Nameplate mill throughput (Years 6+; tpd) | 16,000 |

| Operating Costs | |

| Total operating cost ($/t processed; incl. royalties) | $15.78 |

| C1 cash cost ($/lb copper; net of by-product credits) | $1.32 |

| Capital Costs ($M) | |

| Initial capital expenditures | $161.4 |

| Expansion capital expenditures | $120.6 |

| Total LOM capital expenditures (incl. TMF expansion, sustaining & closure) | $527.5 |

| Economic Analysis | |

| Pre-tax undiscounted free cash flow ($M) | $1,076.5 |

| Pre-tax NPV8% ($M) | $347.0 |

| Pre-Tax IRR | 26.8% |

| After-tax undiscounted free cash flow ($M) | $745.3 |

| After-tax NPV8% ($M) | $210.7 |

| After-tax IRR | 20.3% |

| Copper price ($/lb) | $3.25 |

| Gold price ($/oz) | $1,400 |

| Silver price ($/oz) | $17.75 |

| Exchange rate (USD/COP) | 3,125 |

Pre-tax values include Colombian mining royalties of 4% of total precious metals revenue and 5% of total copper revenue.

PEA Mining Plan

The PEA envisions that the Alacran and satellite pits will be mined using conventional drill, blast and shovel/truck open pit mining methods. The PEA assumes mining activities will be performed by a contractor-owned mining fleet for Years 1 to 5 of operation and switching to an owner-operated fleet in Year 6 and onward.

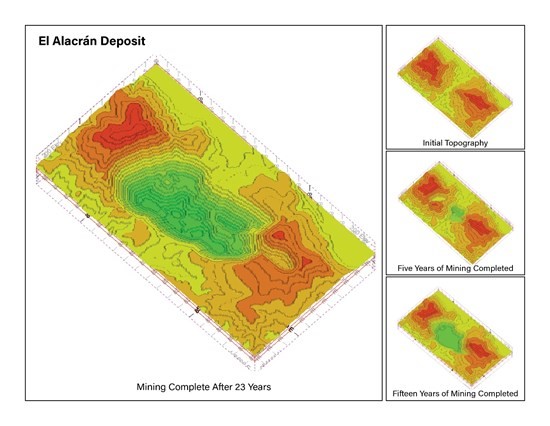

Mining at the Alacran pit is planned to initially target the high-grade, low-waste strip blocks located in the centre of the deposit. Three small pushbacks are planned within the first five years of the operation to ensure consistent high-grade resources are being fed to the mill and maximizing NPV. During the first five years, copper, gold and silver grades are expected to average 0.67%, 0.30 g/t and 3.74 g/t respectively with a low strip ratio of 0.82:1 including pushbacks. An additional three pushbacks are planned in the remaining life of mine for the Alacran pit. The deposit is situated along a ridgeline, which reduces the overall strip ratio and allows for minimal re-ramping in the pushbacks. Alacran pit outlines are shown below in Figure 2.

In the PEA, mining activity at the Alacran pit is projected to be reduced in Year 17, at which point part of the mining fleet is planned to start mining the satellite deposits at the Montiel East, Montiel West and Costa Azul pits. The PEA assumes that these smaller, satellite open pits will be mined simultaneously in order to provide a sustainable supply of mill feed and increase operational flexibility. During Years 17 to 23, 8,000 tpd of mill feed is expected from the Alacran pit complemented by 8,000 tpd from the satellite pits.

The PEA calls for saprolite rock to be mined and a portion of this material to be stockpiled in order to maintain a set rate of blending with fresh rock prior to being processed through the mill.

Figure 1: San Matias site layout showing the Alacran pit, the Montiel East, Montiel West and Costa Azul satellite pits, the mill location and the TMF.

Figure 2: Progressive PEA pit outlines at the Alacran mine

Mineral Processing, Metallurgy and Infrastructure

The process plant has been designed as a conventional milling operation with an initial nameplate capacity of 8,000 tpd, increasing to 16,000 tpd following a planned processing plant expansion completed at the beginning of Year 6. The conceptual plant design includes a gravity separation circuit for initial precious metals recovery prior to a conventional froth flotation circuit. The PEA assumes that the plant will produce gold-silver doré bars on site and a copper concentrate containing the remaining precious metals by-products. The copper concentrate is expected to contain very low levels of deleterious elements, such as arsenic and lead.

The Project process flowsheet includes:

- Primary crushing with stockpile;

- A Semi Autogenous Ball Mill Comminution (“SABC”) circuit, utilizing one Semi Autogenous Grinding (“SAG”) Mill and one Ball Mill for initial plant throughput, adding a second Ball Mill during the planned expansion to achieve the higher processing rate;

- Potential for gravity separation of precious metals with Intensive Leach Reactor (“ILR”) chemical separation to produce doré;

- Froth flotation with rougher, scavenger and cleaning stages;

- Thickening and dewatering of final concentrate prior to transport for refining.

Based on preliminary metallurgical test work completed on fresh rock and recent test work to predict recovery performance of upper (oxidized) zones, the overall copper recovery is expected to average 78.6%. Gold and silver recoveries for the overall process are expected to average 74.4% and 65.5% respectively. Further metallurgical test work is recommended to optimize recoveries and confirm the validity of a doré producing circuit from the Ball Mill cyclone underflow. Copper concentrate output is expected to be approximately 280 to 300 tpd for the first five years of operation, increasing to approximately 560 to 600 tpd thereafter.

Power to the Project is expected to be supplied via a 15-kilometre, 230 KV powerline connecting to the Sator SAS 300 MW thermal power plant. The Sator SAS plant is part of a permitted regional electric grid expansion that includes the currently operating ISA and Gecelca 300 MW thermal power plants. The Sator SAS plant is expected to be operational within the next three to five years.

The PEA envisions that the road access to the San Matias site will be improved to the town of Puerto Libertador to allow for increased movement of equipment and materials to and from site. Any doré produced is expected to be flown out through the Puerto Libertador airport located approximately 20 kilometres away, and copper concentrate is planned to be loaded on-site and transported by 60-tonne trucks to port facilities at Tolu (approximately 250 kilometres away) or Cartagena (approximately 400 kilometres away) for export to international smelters. Both ports currently support the export of ferronickel from South 32’s Cerro Matoso nickel mine.

Tailings Management Facility

The PEA envisions that the TMF will be located in Concepción Creek valley, approximately 1.5 kilometres west of the Alacran open pit and will be designed to contain a maximum of 156 million tonnes of tailings and waste rock material. The initial TMF is designed to contain 43 million tonnes of tailings material and waste rock. Dam raises are planned for Years 9, 14 and 18 of operations. The foundation materials in the valley generally consist of low permeability saprolite lying over low permeability bedrock. The Final Dam is planned to be constructed using non-potentially acid generating waste rock from open pit mining operations to develop the expanded valley type impoundment.

The PEA calls for the upstream face of the Final Dam to be lined with a geosynthetic lining system to minimize seepage from the TMF. The PEA envisions that a foundation drain will be installed in the base of the Final Dam to collect any potential seepage. The Final Dam in the conceptual TMF will be raised in several stages using the downstream construction method and conventional tailings slurry will be conveyed from the plant via a pipeline. Waste rock will be hauled and placed in the TMF basin by the mine haul trucks and a dozer. In the conceptual TMF, the tailings slurry will be sub-aqueously discharged from multiple locations along the dam crests and around the perimeter of the TMF basin to evenly fill the impoundment. The potentially acid generating (“PAG”) waste rock is expected to be strategically placed within the TMF basin such that the tailings and supernatant pond will cover and maintain the PAG waste rock in a saturated state within 6 months of the waste rock being placed in the TMF.

The PEA envisions that the TMF will have a permanent water cover over the tailings and waste rock to keep the waste submerged. A floating pump barge is to be installed at start-up to reclaim process water from the TMF to the plant for reuse in the process. The TMF concept includes freeboard to temporarily store runoff resulting from the Environmental Design Storm and a spillway to safely pass the peak flows resulting from the Inflow Design Flood.

It is expected that the TMF will operate in a water surplus during the wet season and that supernatant water will need to be treated, as required, and discharged over a portion of the year.

Operating Costs

Copper C1 cash costs are expected to average $2.51/lb including royalties but before precious metals credits and $1.32/lb net of credits. Total onsite operating costs including royalties are expected to average $15.78 per tonne processed. Mining costs are expected to average $1.85 per tonne of material mined at the Alacran and satellite pits based on a total of 215.3 million tonnes of total material moved. Cost contingencies of up to 25% have been applied as additional buffer in the cost estimates. A breakdown of the unit costs is shown in Table 2 below.

Table 2: San Matias operating cost breakdown.

| Operating Cost | $/t mined | $/t processed | $/lb copper payable | LOM $M |

| Mining | $1.85 | $3.34 | $0.45 | $398.1 |

| Processing | $8.89 | $1.20 | $1,058.4 | |

| G&A | $1.47 | $0.20 | $175.5 | |

| Royalties | $0.56 | $0.08 | $66.3 | |

| Government royalties | $1.52 | $0.21 | $180.7 | |

| Total onsite | $15.78 | $2.14 | $1,879.0 | |

| TC/RC & other offsite | $2.77 | $0.38 | $330.5 | |

| Total before by-product credits | $18.55 | $2.51 | $2,209.5 | |

| By-product credits | ($8.80) | ($1.19) | ($1,048.2) | |

| Total net of by-product credits | $9.75 | $1.32 | $1,161.2 |

Capital Expenditures

The initial capital expenditures for the Project total $161.4 million, which include site preparation, construction of the processing plant and TMF, road upgrades and other infrastructure. It is expected that site construction will occur over a 3-year pre-production period. The PEA assumes that mobile mining equipment will be supplied by the mining contractor and operated for the first 5 years of operations, after which the equipment will be bought out and converted to an owner-operated mining fleet beginning in Year 6.

An expansion of the mine, mill and processing facilities is planned to be completed in Year 6 and is expected to cost $120.6 million, including $46.6 million for the purchase of the owner-operated mine fleet (including contingency). The Year 6 expansion is expected to increase the nameplate capacity of the San Matias plant from 8,000 tpd to 16,000 tpd. A breakdown of the PEA life of mine capital expenditures is shown in Table 3 below.

Table 3: San Matias capital expenditures breakdown.

| Capital Expenditures | $M |

| Mining | $5.8 |

| Process plant | $65.0 |

| Tailings management facility | $18.4 |

| Infrastructure and other | $38.7 |

| Contingency (20% mine, 25% mill, 35% TMF, 25% other) | $33.5 |

| Total initial capital | $161.4 |

| Expansion capital | $120.6 |

| TMF and other LOM expansion capital | $49.5 |

| Sustaining capital | $176.0 |

| Reclamation and closure costs | $20.0 |

| Total LOM capital expenditures | $527.5 |

Taxes and Royalties

The San Matias Project will be subject to Colombian corporate taxes and mining royalties on metals production. The corporate income tax rate in Colombia is 30% from 2022 onwards. Colombian mining royalties are 4% of all revenues received from gold and silver sales and 5% of all revenue from copper sales. The mining royalties are deductible for income tax purposes. Over the life of mine, the San Matias Project is expected to generate $180.7 million in royalty revenue plus $331.2 million in income tax revenue to government.

A 2% royalty on the Net Income for Production is payable to Sociedad Ordinaria de Minas Omni.

Economic Analysis and Sensitivities

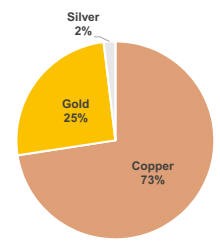

The San Matias PEA prepared by Nordmin estimates LOM revenue totalling $3.8 billion using metals price assumptions of $3.25 per pound copper, $1,400 per ounce gold and $17.75 per ounce silver. A USD/COP foreign exchange rate of 3,125:1 has been applied. A breakdown of revenue by metals is shown in Table 4.

Table 4: San Matias LOM revenue by metal.

| Total Revenue | LOM $M |

|

||||||||||

| Copper | $2,776.3 | |||||||||||

| Gold | $975.3 | |||||||||||

| Silver | $72.9 | |||||||||||

| Total Revenue | $3,824.5 | |||||||||||

The San Matias PEA estimates a pre-tax NPV of $347.0 million applying an 8% discount rate and a pre-tax IRR 26.8%. On an after-tax basis, the Project generates an NPV 8% of $210.7 million and an IRR of 20.3%, representing a 5.3-year payback.

The Project’s economics are sensitive to input metals prices, discount rate and cost assumptions as shown in Table 5, 6 and 7 below.

Table 5: San Matias pre-tax and after-tax NPV8% and IRR sensitivity to copper price.

| Copper price | Pre-tax NPV8% ($M) |

Pre-tax IRR (%) |

After-tax NPV8% ($M) |

After-tax IRR (%) |

| $2.75/lb | $191.2 | 19.7% | $100.6 | 14.6% |

| $3.00/lb | $269.1 | 23.4% | $156.0 | 17.6% |

| $3.25/lb | $347.0 | 26.8% | $210.7 | 20.3% |

| $3.50/lb | $424.9 | 30.0% | $265.0 | 22.8% |

| $4.00/lb | $580.7 | 35.9% | $373.3 | 27.5% |

Table 6: San Matias pre-tax and after-tax NPV sensitivity to discount rate.

| Discount Rate | Pre-tax NPV ($M) |

After-tax NPV ($M) |

| 0% | $1,076.5 | $745.3 |

| 5% | $525.0 | $340.2 |

| 8% | $347.0 | $210.7 |

| 10% | $263.6 | $150.5 |

| 15% | $129.1 | $54.4 |

Table 7: San Matias Copper-Gold-Silver Project pre-tax NPV8% sensitivity.

| Sensitivity ($M) | -10% | -5% | Base Case | 5% | 10% |

| Copper price | $245.8 | $296.4 | $347.0 | $397.6 | $448.3 |

| Copper recovery | $260.8 | $303.9 | $347.0 | $390.1 | $433.2 |

| Initial capital costs | $361.6 | $354.3 | $347.0 | $339.7 | $332.4 |

| Operating costs | $412.9 | $380.0 | $347.0 | $314.1 | $281.1 |

Table 8: San Matias Copper-Gold-Silver Project after-tax NPV8% sensitivity.

| Sensitivity ($M) | -10% | -5% | Base Case | 5% | 10% |

| Copper price | $139.4 | $175.3 | $210.7 | $246.0 | $281.2 |

| Copper recovery | $150.1 | $180.6 | $210.7 | $240.8 | $270.8 |

| Initial capital costs | $223.6 | $217.2 | $210.7 | $204.3 | $197.8 |

| Operating costs | $256.8 | $233.8 | $210.7 | $187.5 | $163.9 |

Mineral Resources

The San Matias Copper-Gold-Silver Project as described in the PEA is based on 119.1 million tonnes of modeled mill feed grading 0.45% copper, 0.26 g/t gold and 2.41 g/t silver. Nordmin has prepared an updated Mineral Resource estimate for the pit-constrained resources following a more detailed study of the cost parameters and inputs used when completing the PEA study.

The July 2019 Mineral Resource estimate, shown in Table 8 below, updates and replaces the June 2019 Mineral Resource Estimate also prepared by Nordmin (refer to Cordoba’s news release dated July 3, 2019). The July 2019 Mineral Resource estimate includes a more refined pit shell and the conversion of certain lower-grade waste blocks into resources with more accurate cost estimates.

Sections through the Alacran block model and plan view are shown in Figure 3 and 4.

Table 9: San Matias Mineral Resource estimate as at July 24, 2019, Nordmin Engineering Ltd.

| Classification | Tonnage (Mt) |

CuEq Grade (%) |

Copper Grade (%) |

Gold Grade (g/t) |

Silver Grade (g/t) |

Contained Copper (tonnes) |

Contained Copper (Mlb) |

Contained Gold (oz) |

Contained Silver (oz) |

| Indicated Resources | |||||||||

| Alacran – Phase 1 | 16.7 | 0.85 | 0.64 | 0.30 | 3.59 | 106,700 | 235.2 | 158,800 | 1,935,200 |

| Alacran – Phase 2 | 81.2 | 0.61 | 0.44 | 0.24 | 2.45 | 360,200 | 794.2 | 613,500 | 6,389,200 |

| Montiel East | 4.3 | 0.70 | 0.46 | 0.35 | 1.53 | 19,800 | 43.7 | 48,800 | 211,200 |

| Montiel West | 4.6 | 0.52 | 0.24 | 0.49 | 1.32 | 11,200 | 24.8 | 72,600 | 195,800 |

| Costa Azul | 7.4 | 0.40 | 0.27 | 0.21 | 0.65 | 20,300 | 44.8 | 49,200 | 155,800 |

| Total | 114.3 | 0.64 | 0.45 | 0.26 | 2.42 | 518,300 | 1,142.70 | 942,900 | 8,887,200 |

| Inferred Resources | |||||||||

| Alacran – Phase 1 | 0.6 | 0.42 | 0.33 | 0.14 | 1.65 | 1,900 | 4.2 | 2,600 | 30,500 |

| Alacran – Phase 2 | 1.6 | 0.40 | 0.32 | 0.13 | 1.57 | 5,200 | 11.5 | 7,000 | 83,100 |

| Montiel East | 1.8 | 0.34 | 0.25 | 0.15 | 0.88 | 4,400 | 9.6 | 8,500 | 50,300 |

| Montiel West | 0.6 | 0.39 | 0.07 | 0.54 | 0.93 | 400 | 1.0 | 11,100 | 19,000 |

| Costa Azul | 0.1 | 0.39 | 0.29 | 0.16 | 0.6 | 400 | 0.8 | 600 | 2,400 |

| Total | 4.8 | 0.39 | 0.26 | 0.20 | 1.21 | 12,300 | 27.2 | 29,900 | 185,300 |

Notes on Mineral Resources

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability; the estimate of Mineral Resources in the updated Mineral Resource statement may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. There is no certainty that the Indicated Mineral Resources will be converted to the Probable Mineral Reserve category, and there is no certainty that the updated Mineral Resource statement will be realized. It is reasonable to expect that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- The Mineral Resources in this estimate were independently prepared by Glen Kuntz, P.Geo. of Nordmin Engineering Ltd., following the Definition Standards for Mineral Resources and Mineral Reserves Prepared by the CIM Standing Committee on Reserve Definitions, adopted by CIM Council on May 10, 2014. Verification included a site visit to inspect drilling, logging, density measurement procedures and sampling procedures, and a review of the control sample results used to assess laboratory assay quality. In addition, a random selection of the drill hole database results was compared with original records.

- The Mineral Resources in this estimate used Datamine Studio 3 Software to create the block models and used Datamine NPV Scheduler to constrain the resources and create conceptual open pit shells for the deposits. Assumptions used to prepare the conceptual pits include:

- Metal prices of $3.25/lb copper, $1,400/oz gold and $17.75/oz silver;

- Operating cost inputs include:

- Mining cost of $2.43/t mined for the first 5 years and $1.69/t thereafter,

- Processing cost of $8.63/t milled for the first 5 years and $7.50/t thereafter,

- G&A costs of $2.56/t milled for the first 5 years and $1.32/t thereafter;

- 97.0% mining recovery, 4.0% dilution and 45° pit slope in fresh and transitional rock and 32.5°in weathered saprolite;

- Variable process recoveries of 50.0% to 90.0% for copper, 72.0% to 77.5% for gold and 40.0% to 70.0% for silver depending on the domain (saprolite, transition or fresh sulphide) and copper grade.

- Freight costs of $100.00/t concentrate, and treatment costs of $90.00/t dry concentrate, payable metal factors of 95.5% for copper and 96.5% for gold and 90.0% for silver. Refining charges of $0.090/lb copper, $5.00/oz gold and $0.30/oz silver.

- Copper equivalent has been calculated using: CuEq % = Cu % + (Au Factor x Au Grade g/t + Ag Factor x Ag Grade g/t) x 100.

- Au Factor = (Au Recovery % x Au Price $/oz / 31.1035 g/oz) / (Cu Recovery % x Cu Price $/lb x 2204.62 lb/t).

- Ag Factor = (Ag Recovery % x Ag Price $/oz / 31.1035 g/oz) / (Cu Recovery % x Cu Price $/lb x 2204.62 lb/t).

- Variable process recoveries of 50.0% to 90.0% for copper, 72.0% to 77.5% for gold and 40.0% to 70.0% for silver depending on the domain (saprolite, transition or fresh sulphide) and copper grade.

- A NSR cut-off of $13.75/t has been applied.

- The cut-off date of the drill hole information was November 24, 2017.

- All references to the 2018 Mineral Resource estimate are reported in the Technical Report titled “NI 43-101 Technical Report on the El Alacran Project Department of Córdoba, Colombia”. The Technical Report has an effective date of April 10, 2018. The 2018 estimate is no longer considered to be current and is not to be relied upon.

- Due to rounding, totals may not sum.

Opportunities for Additional Upside

Cordoba has identified additional opportunities to enhance the overall project economics, including:

- Delineation of the high-grade gold veins contained within the Alacran deposit to improve gold grades within the resource model;

- Utilization of contractor mining near the end of the mine life to reduce capital expenditures;

- Improved taxation efficiencies with a more refined tax and depreciation model.

Potential also exists for the discovery of the porphyry sources for the Alacran and Montiel West deposits and for other deposits within the San Matias Project area.

Cautionary Statement

The PEA is preliminary in nature and includes Inferred Mineral Resources that are too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. There is no certainty that the results of the PEA will be realized.

Technical Information & Qualified Person

The PEA was independently prepared by Mr. Glen Kuntz, P.Geo. and Ms. Agnes Krawczyk, P.Eng., both of Nordmin, who are considered “Qualified Persons” under National Instrument 43-101 Standards of Disclosure for Mineral Projects. The technical disclosure in this news release is based upon the information in the PEA prepared by or under the supervision of Mr. Kuntz and Ms. Krawczyk.

The technical information in this release has been reviewed and verified by Mr. Glen Kuntz, P.Geo., a “Qualified Person” for the purpose of National Instrument 43-101.

After-tax results were calculated by Cordoba’s management team and are not considered independent.

The Company will file a technical report prepared in accordance with National Instrument 43-101 on www.sedar.com within 45 days of this news release.

About Cordoba

Cordoba Minerals Corp. is a mineral exploration company focused on the exploration and acquisition of copper and gold projects. Cordoba is exploring the San Matias Copper-Gold-Silver Project, which includes El Alacrán deposit and satellite deposits at Montiel East, Montiel West and Costa Azul, located in the Department of Cordoba, Colombia. Cordoba also holds a 25% interest in the Perseverance porphyry copper project in Arizona, USA, which it is exploring through a Joint Venture and Earn-In Agreement.

MORE or "UNCATEGORIZED"

Rupert Resources Reports Results From Project Drilling Including 120m at 6.2g/t Gold

Rupert Resources Ltd. (TSX:RUP) reports assay results from projec... READ MORE

West Red Lake Gold Announces Closing $33 Million Bought Deal Public Offering Including the Full Exercise of the Over-Allotment Option

West Red Lake Gold Mines Ltd. (TSX-V: WRLG) (OTCQB: WRLGF) is ple... READ MORE

Abitibi Metals Drills 13.15 Metres At 4.82% CuEq in Eastern Drilling At The B26 Deposit

Highlights: The Company has received results from drillholes 1274... READ MORE

Patriot Drills 122.5 m at 1.42% Li2O and 71.4 m at 1.57% Li2O at CV5

Highlights Continued strong lithium mineralization over wide inte... READ MORE

Argonaut Gold Announces First Quarter Financial and Operating Results

Argonaut Gold Inc. (TSX: AR) reported financial and operating res... READ MORE