Collective Mining Discovers High-Grade Subzones in Apollo and Drills the Best Hole Ever, Intersecting 150.55 Metres at 6.16 g/t AuEq Within 534.40 Metres at 2.70 g/t AuEq

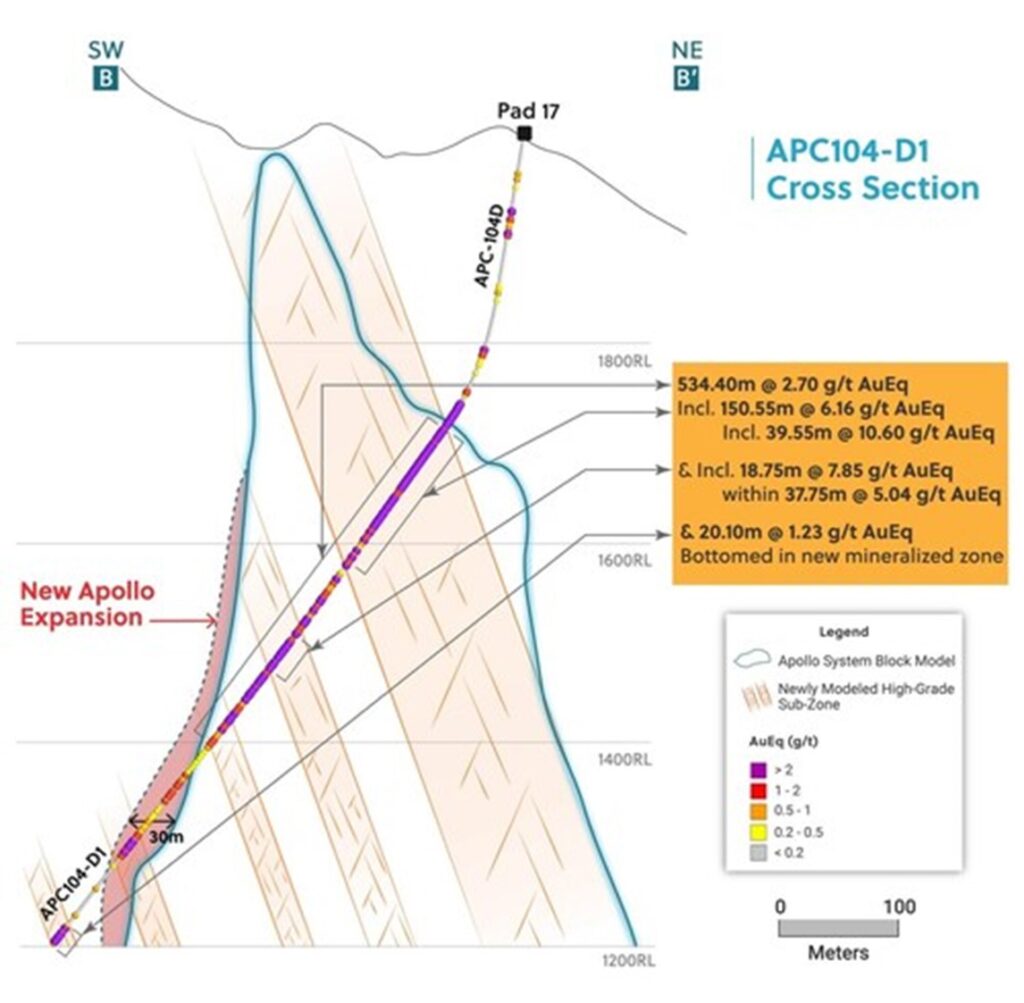

- The hole was successfully drilled orthogonally across the Apollo system to test, for the first time, the potential of newly modelled broad high-grade subzones within the system.

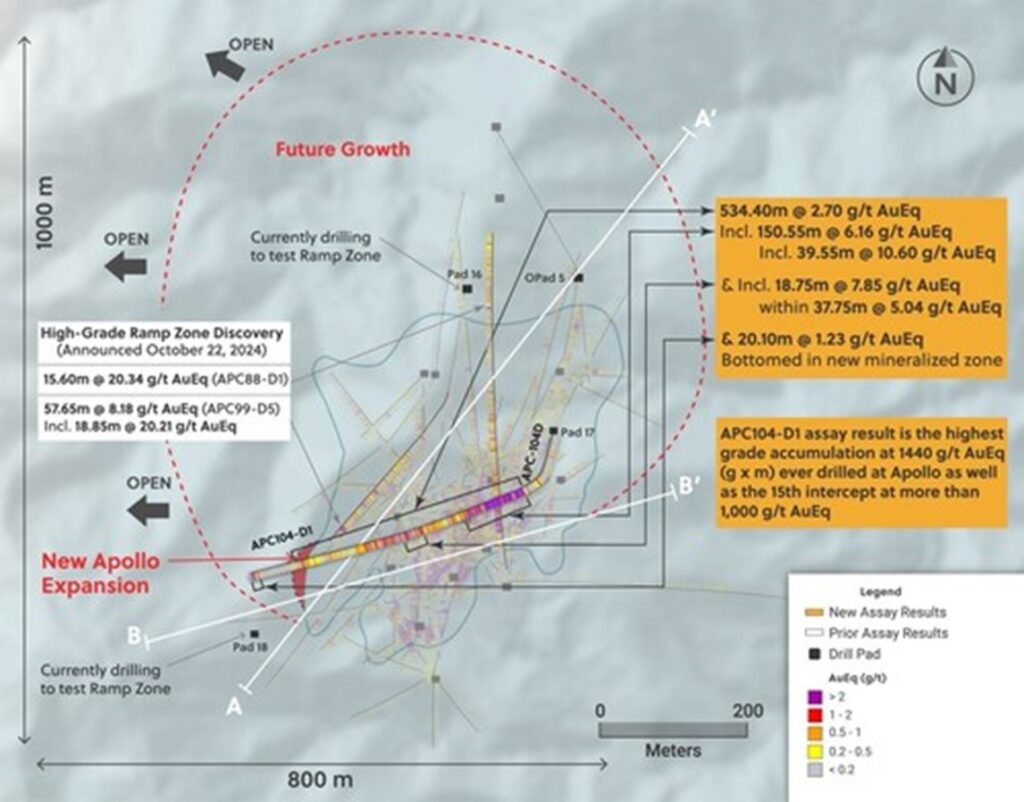

- Two additional holes to test the newly modelled high-grade subzones have been completed. Both holes intersected the projection of the newly modelled subzones and cut significant sulphide mineralization over broad intervals with assay results expected in early Q1, 2025.

- Drilling in 2025 will systematically test the vertical extent of the new modelled high-grade subzones, which cover more than 1,000 vertical metres, as they have the potential to significantly increase the overall grade profile of the Apollo system.

Collective Mining Ltd. (NYSE: CNL) (TSX: CNL) is pleased to announce initial assay results for the first of a planned series of orthogonally drilled holes designed to test the potential of newly modeled broad and high-grade subzones within the Apollo system (“Apollo”), located within the Company’s multi-target Guayabales Project in Caldas, Colombia. The Company currently has four drill rigs operating as part of its fully funded and on-schedule 40,000-metre drilling program for 2024. A fully funded 60,000-metre drill program is planned for 2025, which will be the largest drilling campaign in the history of the Company.

Ari Sussman, Executive Chairman commented: “This is a remarkable result for which our Colombian technical team deserves much credit. Internal deposit modelling led to the realization that most of the prior drilling from the south was not directly orthogonally across the system and that we should start drilling from the northern side of Apollo in a southerly pattern. As a result, drill Pad17 was constructed, and the hypothesis was tested with hole APC104-D1. 2025 is going to be an exciting year for the Company as we focus drilling on chasing laterally and vertically both the high-grade subzones and Ramp Zone as part of our fully funded, 60,000-metre drill program.”

To watch a video of David Reading, Special Advisor to the Company and QP under NI43-101 explain today’s results please click on the link here.

Details (see Table 1-2 and Figures 1-5)

- APC104-D1 was drilled southwest from mother hole APC-104D (collared from new Pad17) to intercept, orthogonally, multiple newly modeled high-grade subzones within the Apollo system with assay results as follows:

- 534.40 metres @ 2.70 g/t gold equivalent from 107.10 metres including:

-

- 150.55 metres @ 6.16 g/t gold equivalent from 107.10 metres which includes,

- 39.55 metres @ 10.60 g/t gold equivalent and,

- 37.75 metres @ 5.04 g/t gold equivalent from 358.20 metres which includes,

- 18.75 metres @ 7.85 g/t gold equivalent

- 150.55 metres @ 6.16 g/t gold equivalent from 107.10 metres which includes,

-

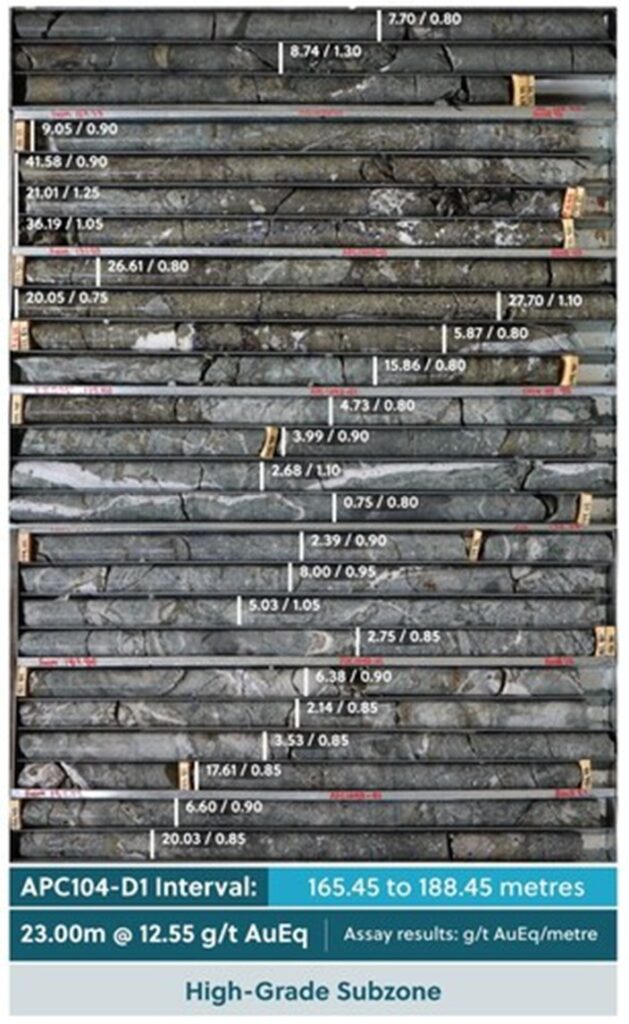

- APC104-D1 is the largest grade accumulation intercepted to date at Apollo at 1,440 g/t gold equivalent on a gram x metre basis. For context, the grade accumulation in APC104-D1 at 1,440 g/t gold equivalent is 38% higher than the average of 1,055 g/t gold equivalent for the prior fourteenth grade accumulation intercepts at over 1,000 g/t gold equivalent drilled by the Company. APC104-D1 is the first hole within a newly designed large drilling program aimed at delineating and extending the high-grade subzones to depth at Apollo. Visual logging of recently completed additional drill holes, APC104-D2 and APC104-D3, indicate that both holes have intersected the same styles of mineralization and sulphide levels as reported in APC104-D1.

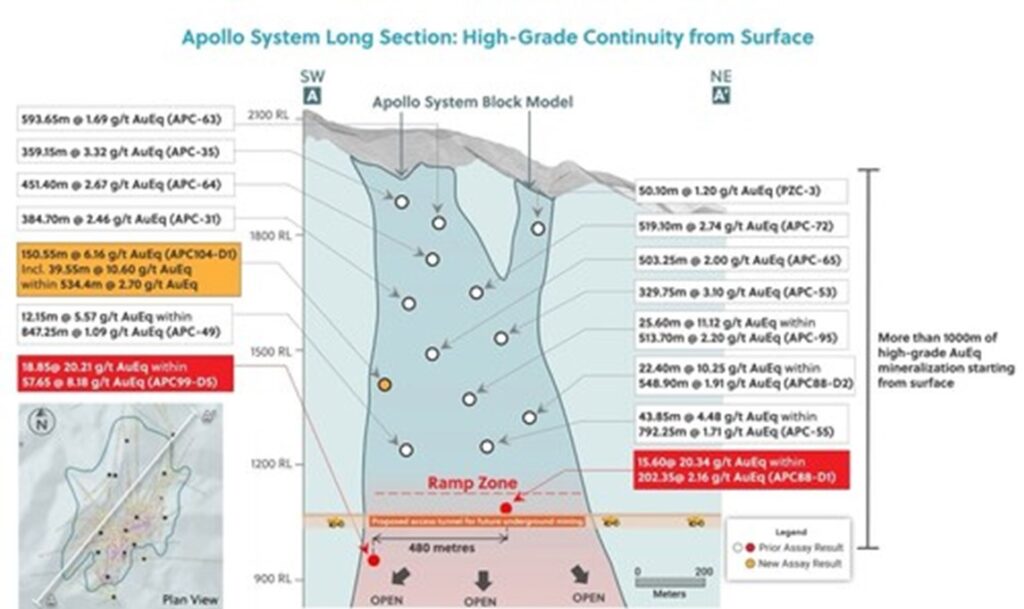

- High-grade intercepts within Apollo have now been sparsely drilled from surface down to 1,150 metres below surface with the deepest intercept being the recent discovery of the Ramp Zone which returned an intercept of 57.65 metres @ 8.18 g/t gold equivalent (see press release dated October 22, 2024). The Ramp Zone is located close in elevation to the conceptual underground haulage tunnel for a future mine at the Guayabales Project and shares some geological characteristics with Aris Mining’s multi-million-ounce Marmato Deeps deposit located only 1.75 kilometres southeast of Apollo. Drilling at the Ramp Zone is ongoing with assay results anticipated in early Q1, 2025.

- The broad mineralized interval of APC104-D1 has also expanded the Apollo system southwestwards by an additional 30 metres. Additionally, a new zone of mineralization located outside of the breccia body in country rock returned 20.10 metres @ 1.23 g/t gold equivalent and bottomed in mineralization at the end of the hole.

- The discovery of the new high-grade subzones and the recently discovered Ramp Zone highlight that the grade profile of Apollo is poorly understood and that there is potentially significant upside to the grade (and size) of the system. The Company’s 2025 drilling program will involve up to five rigs at Apollo and focus on extending and defining both the high-grade subzones and the Ramp Zone, as well as to continue expanding the Apollo system northwards and to depth. Mineralization at Apollo begins directly from surface, remains open in all directions and has current dimensions of 600 metres strike, 400 metres width and extends more than 1,150 metres below surface.

Table 1: Assays Results for Drill Hole APC104-D1 (Also see Table 2 below for a complete breakdown of individual assay results that make up the broad subzone of 150.55m @ 6.16 g/t AuEq)

| Hole # | From (m) |

To (m) |

Length (m) |

Au g/t |

Ag g/t |

Cu % |

Zn % |

AuEq g/t* |

| APC104-D1 | 50.30 | 57.10 | 6.80 | 1.32 | 10 | 0.01 | 0.13 | 1.48 |

| and | 107.10 | 641.50 | 534.40 | 2.16 | 32 | 0.09 | 0.21 | 2.70 |

| Incl | 165.45 | 205.00 | 39.55 | 7.94 | 156 | 0.28 | 1.43 | 10.60 |

| Within | 107.10 | 257.65 | 150.55 | 4.71 | 87 | 0.22 | 0.50 | 6.16 |

| & incl. | 358.20 | 376.95 | 18.75 | 7.80 | 17 | 0.03 | 0.11 | 7.85 |

| Within | 358.20 | 395.95 | 37.75 | 4.88 | 15 | 0.03 | 0.20 | 5.04 |

| and | 730.10 | 750.20 | 20.10 | 1.13 | 4 | 0.03 | 0.11 | 1.23 |

| *AuEq (g/t) is calculated as follows: (Au (g/t) x 0.97) + (Ag (g/t) x 0.015 x 0.85) + (Cu (%) x 1.44 x 0.95) + (Zn (%) x 0.43 x 0.85) utilizing metal prices of Ag – US$30/oz, Zn – US$1.25/lb, Cu – US$4.2/lb and Au – US$2,000/oz and recovery rates of 97% for Au, 85% for Ag, 95% for Cu and 85% for Zn. Recovery rate assumptions for metals are based on metallurgical results announced on October 17, 2023, April 11, 2024, and October 3, 2024. The recovery rate assumption for zinc is speculative as limited metallurgical work has been completed to date. True widths are unknown, and grades are uncut. |

Table 2: Assays Results for the High-Grade Gold Subzone Within APC104-D1 Running 150.55 Metres @ 6.16 g/t AuEq

| From

(m) |

To (m) |

Length (m) |

Au g/t |

Ag g/t |

Cu % |

Zn % |

| 107.10 | 108.25 | 1.15 | 5.44 | 22 | 0.04 | 0.14 |

| 108.25 | 109.85 | 1.60 | 4.66 | 37 | 0.04 | 0.93 |

| 109.85 | 110.80 | 0.95 | 10.90 | 54 | 0.11 | 0.53 |

| 110.80 | 111.65 | 0.85 | 0.96 | 7 | 0.02 | 0.05 |

| 111.65 | 112.65 | 1.00 | 2.52 | 31 | 0.03 | 0.54 |

| 112.65 | 113.65 | 1.00 | 3.90 | 93 | 0.14 | 2.94 |

| 113.65 | 114.50 | 0.85 | 3.10 | 16 | 0.02 | 0.19 |

| 114.50 | 115.85 | 1.35 | 0.82 | 22 | 0.04 | 0.31 |

| 115.85 | 117.00 | 1.15 | 2.44 | 47 | 0.08 | 0.81 |

| 117.00 | 117.90 | 0.90 | 0.10 | 9 | 0.04 | 0.01 |

| 117.90 | 118.80 | 0.90 | 9.75 | 98 | 0.23 | 0.31 |

| 118.80 | 119.80 | 1.00 | 4.97 | 33 | 0.07 | 0.27 |

| 119.80 | 121.40 | 1.60 | 6.02 | 26 | 0.04 | 0.23 |

| 121.40 | 123.00 | 1.60 | 20.00 | 17 | 0.03 | 0.11 |

| 123.00 | 124.65 | 1.65 | 8.85 | 13 | 0.03 | 0.08 |

| 124.65 | 126.50 | 1.85 | 2.43 | 28 | 0.06 | 0.19 |

| 126.50 | 128.25 | 1.75 | 9.64 | 45 | 0.05 | 0.70 |

| 128.25 | 129.70 | 1.45 | 3.92 | 37 | 0.03 | 0.09 |

| 129.70 | 131.20 | 1.50 | 0.28 | 13 | 0.06 | 0.01 |

| 131.20 | 132.55 | 1.35 | 2.63 | 15 | 0.08 | 0.01 |

| 132.55 | 134.25 | 1.70 | 0.99 | 10 | 0.05 | 0.01 |

| 134.25 | 135.15 | 0.90 | 0.04 | 3 | 0.01 | 0.01 |

| 135.15 | 136.70 | 1.55 | 0.09 | 8 | 0.08 | 0.02 |

| 136.70 | 137.75 | 1.05 | 1.45 | 175 | 0.61 | 0.05 |

| 137.75 | 138.60 | 0.85 | 0.17 | 210 | 0.88 | 0.05 |

| 138.60 | 139.25 | 0.65 | 0.25 | 407 | 1.70 | 0.09 |

| 139.25 | 140.10 | 0.85 | 0.42 | 499 | 2.28 | 0.12 |

| 140.10 | 141.00 | 0.90 | 0.89 | 175 | 0.59 | 0.05 |

| 141.00 | 141.80 | 0.80 | 2.60 | 551 | 1.72 | 0.18 |

| 141.80 | 142.75 | 0.95 | 3.61 | 216 | 0.67 | 0.08 |

| 142.75 | 143.55 | 0.80 | 0.62 | 162 | 0.58 | 0.08 |

| 143.55 | 144.40 | 0.85 | 0.29 | 349 | 1.42 | 0.10 |

| 144.40 | 145.50 | 1.10 | 0.96 | 336 | 1.43 | 0.14 |

| 145.50 | 146.80 | 1.30 | 0.53 | 139 | 0.61 | 0.06 |

| 146.80 | 147.90 | 1.10 | 0.82 | 323 | 1.25 | 0.09 |

| 147.90 | 149.15 | 1.25 | 1.49 | 161 | 0.63 | 0.06 |

| 149.15 | 150.45 | 1.30 | 0.17 | 44 | 0.19 | 0.02 |

| 150.45 | 151.30 | 0.85 | 0.42 | 78 | 0.26 | 0.03 |

| 151.30 | 152.45 | 1.15 | 0.71 | 55 | 0.15 | 0.25 |

| 152.45 | 153.40 | 0.95 | 1.64 | 71 | 0.23 | 0.10 |

| 153.40 | 154.20 | 0.80 | 7.08 | 89 | 0.27 | 0.11 |

| 154.20 | 155.65 | 1.45 | 6.55 | 61 | 0.19 | 0.09 |

| 155.65 | 156.45 | 0.80 | 4.32 | 110 | 0.34 | 0.71 |

| 156.45 | 157.25 | 0.80 | 6.21 | 35 | 0.09 | 0.24 |

| 157.25 | 158.05 | 0.80 | 6.52 | 142 | 0.44 | 0.06 |

| 158.05 | 158.85 | 0.80 | 1.11 | 35 | 0.12 | 0.20 |

| 158.85 | 159.70 | 0.85 | 3.76 | 152 | 0.58 | 0.23 |

| 159.70 | 160.65 | 0.95 | 0.98 | 72 | 0.26 | 0.06 |

| 160.65 | 161.40 | 0.75 | 6.10 | 64 | 0.12 | 0.33 |

| 161.40 | 162.20 | 0.80 | 0.73 | 26 | 0.09 | 0.05 |

| 162.20 | 163.05 | 0.85 | 0.39 | 23 | 0.06 | 0.07 |

| 163.05 | 163.85 | 0.80 | 4.70 | 17 | 0.05 | 0.22 |

| 163.85 | 164.65 | 0.80 | 0.40 | 20 | 0.05 | 0.31 |

| 164.65 | 165.45 | 0.80 | 0.92 | 46 | 0.14 | 0.08 |

| 165.45 | 166.25 | 0.80 | 3.91 | 224 | 0.65 | 0.47 |

| 166.25 | 167.55 | 1.30 | 5.68 | 186 | 0.61 | 0.08 |

| 167.55 | 168.45 | 0.90 | 5.41 | 152 | 0.34 | 3.86 |

| 168.45 | 169.35 | 0.90 | 29.30 | 687 | 1.34 | 7.04 |

| 169.35 | 170.60 | 1.25 | 12.20 | 414 | 0.68 | 8.16 |

| 170.60 | 171.65 | 1.05 | 17.75 | 1235 | 1.24 | 4.21 |

| 171.65 | 172.45 | 0.80 | 16.95 | 552 | 0.84 | 5.46 |

| 172.45 | 173.20 | 0.75 | 12.60 | 435 | 0.28 | 6.42 |

| 173.20 | 174.30 | 1.10 | 17.15 | 599 | 0.97 | 5.78 |

| 174.30 | 175.10 | 0.80 | 2.93 | 129 | 0.10 | 3.41 |

| 175.10 | 175.90 | 0.80 | 8.10 | 388 | 0.67 | 5.86 |

| 175.90 | 176.70 | 0.80 | 3.83 | 58 | 0.15 | 0.18 |

| 176.70 | 177.60 | 0.90 | 3.04 | 61 | 0.17 | 0.12 |

| 177.60 | 178.70 | 1.10 | 1.88 | 39 | 0.14 | 0.46 |

| 178.70 | 179.50 | 0.80 | 0.28 | 25 | 0.09 | 0.08 |

| 179.50 | 180.40 | 0.90 | 1.81 | 36 | 0.11 | 0.08 |

| 180.40 | 181.35 | 0.95 | 5.50 | 153 | 0.45 | 0.30 |

| 181.35 | 182.40 | 1.05 | 2.92 | 123 | 0.45 | 0.04 |

| 182.40 | 183.25 | 0.85 | 1.90 | 47 | 0.14 | 0.32 |

| 183.25 | 184.15 | 0.90 | 4.51 | 81 | 0.19 | 1.96 |

| 184.15 | 185.00 | 0.85 | 1.51 | 31 | 0.08 | 0.47 |

| 185.00 | 185.85 | 0.85 | 2.46 | 59 | 0.12 | 0.62 |

| 185.85 | 186.70 | 0.85 | 16.90 | 62 | 0.14 | 0.64 |

| 186.70 | 187.60 | 0.90 | 6.04 | 43 | 0.14 | 0.03 |

| 187.60 | 188.45 | 0.85 | 19.90 | 46 | 0.08 | 0.08 |

| 188.45 | 189.30 | 0.85 | 4.56 | 24 | 0.05 | 0.04 |

| 189.30 | 190.05 | 0.75 | 2.43 | 23 | 0.05 | 0.07 |

| 190.05 | 190.65 | 0.60 | 0.42 | 9 | 0.03 | 0.07 |

| 190.65 | 191.55 | 0.90 | 1.57 | 23 | 0.04 | 0.04 |

| 191.55 | 192.35 | 0.80 | 7.72 | 43 | 0.06 | 0.54 |

| 192.35 | 193.35 | 1.00 | 26.60 | 57 | 0.09 | 0.62 |

| 193.35 | 194.15 | 0.80 | 3.24 | 25 | 0.06 | 0.14 |

| 194.15 | 195.15 | 1.00 | 9.12 | 28 | 0.07 | 0.34 |

| 195.15 | 196.15 | 1.00 | 5.82 | 30 | 0.07 | 0.18 |

| 196.15 | 197.05 | 0.90 | 4.34 | 57 | 0.09 | 0.37 |

| 197.05 | 198.00 | 0.95 | 12.35 | 70 | 0.09 | 0.33 |

| 198.00 | 198.80 | 0.80 | 6.67 | 44 | 0.07 | 0.99 |

| 198.80 | 199.80 | 1.00 | 6.33 | 50 | 0.07 | 0.16 |

| 199.80 | 200.60 | 0.80 | 8.41 | 25 | 0.07 | 0.21 |

| 200.60 | 201.40 | 0.80 | 2.81 | 23 | 0.06 | 0.08 |

| 201.40 | 202.20 | 0.80 | 21.30 | 33 | 0.07 | 0.35 |

| 202.20 | 203.00 | 0.80 | 3.12 | 27 | 0.09 | 0.07 |

| 203.00 | 204.00 | 1.00 | 2.38 | 14 | 0.05 | 0.03 |

| 204.00 | 205.00 | 1.00 | 8.00 | 28 | 0.09 | 0.02 |

| 205.00 | 205.95 | 0.95 | 2.46 | 21 | 0.07 | 0.02 |

| 205.95 | 206.80 | 0.85 | 1.99 | 14 | 0.05 | 0.02 |

| 206.80 | 207.80 | 1.00 | 0.17 | 9 | 0.04 | 0.01 |

| 207.80 | 208.60 | 0.80 | 0.71 | 23 | 0.06 | 0.24 |

| 208.60 | 209.55 | 0.95 | 0.56 | 12 | 0.04 | 0.04 |

| 209.55 | 210.60 | 1.05 | 1.11 | 13 | 0.03 | 0.15 |

| 210.60 | 211.40 | 0.80 | 0.34 | 10 | 0.03 | 0.02 |

| 211.40 | 212.25 | 0.85 | 0.47 | 8 | 0.02 | 0.03 |

| 212.25 | 213.25 | 1.00 | 1.32 | 13 | 0.04 | 0.05 |

| 213.25 | 214.25 | 1.00 | 0.02 | 1 | 0.01 | 0.01 |

| 214.25 | 215.25 | 1.00 | 0.47 | 30 | 0.09 | 0.05 |

| 215.25 | 216.05 | 0.80 | 6.47 | 50 | 0.13 | 0.14 |

| 216.05 | 217.10 | 1.05 | 9.74 | 94 | 0.26 | 0.11 |

| 217.10 | 218.20 | 1.10 | 5.98 | 29 | 0.08 | 0.03 |

| 218.20 | 219.15 | 0.95 | 8.82 | 26 | 0.09 | 0.02 |

| 219.15 | 220.15 | 1.00 | 23.70 | 23 | 0.07 | 0.03 |

| 220.15 | 221.15 | 1.00 | 0.86 | 12 | 0.04 | 0.04 |

| 221.15 | 222.05 | 0.90 | 0.60 | 22 | 0.06 | 0.10 |

| 222.05 | 223.05 | 1.00 | 1.96 | 25 | 0.08 | 0.05 |

| 223.05 | 223.90 | 0.85 | 7.00 | 21 | 0.08 | 0.02 |

| 223.90 | 224.85 | 0.95 | 1.57 | 24 | 0.07 | 0.02 |

| 224.85 | 225.80 | 0.95 | 0.48 | 20 | 0.07 | 0.01 |

| 225.80 | 226.80 | 1.00 | 1.31 | 30 | 0.08 | 0.05 |

| 226.80 | 227.80 | 1.00 | 3.51 | 33 | 0.10 | 0.14 |

| 227.80 | 228.60 | 0.80 | 8.77 | 61 | 0.18 | 0.04 |

| 228.60 | 229.55 | 0.95 | 26.20 | 41 | 0.09 | 0.03 |

| 229.55 | 230.55 | 1.00 | 2.76 | 21 | 0.07 | 0.02 |

| 230.55 | 231.50 | 0.95 | 0.78 | 14 | 0.04 | 0.03 |

| 231.50 | 232.30 | 0.80 | 0.05 | 5 | 0.02 | 0.02 |

| 232.30 | 233.40 | 1.10 | 0.31 | 29 | 0.09 | 0.11 |

| 233.40 | 234.30 | 0.90 | 2.45 | 18 | 0.06 | 0.02 |

| 234.30 | 235.10 | 0.80 | 9.47 | 49 | 0.13 | 0.08 |

| 235.10 | 236.00 | 0.90 | 5.37 | 58 | 0.16 | 0.06 |

| 236.00 | 236.90 | 0.90 | 14.65 | 60 | 0.16 | 0.15 |

| 236.90 | 238.00 | 1.10 | 0.17 | 8 | 0.03 | 0.03 |

| 238.00 | 238.95 | 0.95 | 1.10 | 22 | 0.05 | 0.13 |

| 238.95 | 239.95 | 1.00 | 10.00 | 100 | 0.24 | 0.18 |

| 239.95 | 241.10 | 1.15 | 1.08 | 21 | 0.06 | 0.07 |

| 241.10 | 242.10 | 1.00 | 8.58 | 24 | 0.07 | 0.09 |

| 242.10 | 242.90 | 0.80 | 6.45 | 74 | 0.25 | 0.04 |

| 242.90 | 243.70 | 0.80 | 1.33 | 18 | 0.04 | 0.05 |

| 243.70 | 244.65 | 0.95 | 0.44 | 17 | 0.05 | 0.06 |

| 244.65 | 245.40 | 0.75 | 6.78 | 73 | 0.18 | 0.59 |

| 245.40 | 246.20 | 0.80 | 1.41 | 35 | 0.10 | 0.41 |

| 246.20 | 247.10 | 0.90 | 1.80 | 118 | 0.43 | 0.10 |

| 247.10 | 248.10 | 1.00 | 0.84 | 32 | 0.09 | 0.07 |

| 248.10 | 249.15 | 1.05 | 1.55 | 22 | 0.07 | 0.02 |

| 249.15 | 250.15 | 1.00 | 1.56 | 24 | 0.05 | 0.38 |

| 250.15 | 251.00 | 0.85 | 3.83 | 27 | 0.08 | 0.14 |

| 251.00 | 252.00 | 1.00 | 0.14 | 18 | 0.07 | 0.02 |

| 252.00 | 253.00 | 1.00 | 0.07 | 10 | 0.03 | 0.01 |

| 253.00 | 253.85 | 0.85 | 0.78 | 32 | 0.11 | 0.03 |

| 253.85 | 254.75 | 0.90 | 1.20 | 26 | 0.09 | 0.02 |

| 254.75 | 255.65 | 0.90 | 0.72 | 33 | 0.09 | 0.02 |

| 255.65 | 256.65 | 1.00 | 1.02 | 32 | 0.11 | 0.12 |

| 256.65 | 257.65 | 1.00 | 4.91 | 37 | 0.10 | 0.03 |

| Weighted Average | 150.55 | 4.71 | 87 | 0.22 | 0.50 |

About Collective Mining Ltd.

To see our latest corporate presentation and related information, please visit www.collectivemining.com

Founded by the team that developed and sold Continental Gold Inc. to Zijin Mining for approximately $2 billion in enterprise value, Collective is a gold, silver, copper and tungsten exploration company with projects in Caldas, Colombia. The Company has options to acquire 100% interests in two projects located directly within an established mining camp with ten fully permitted and operating mines.

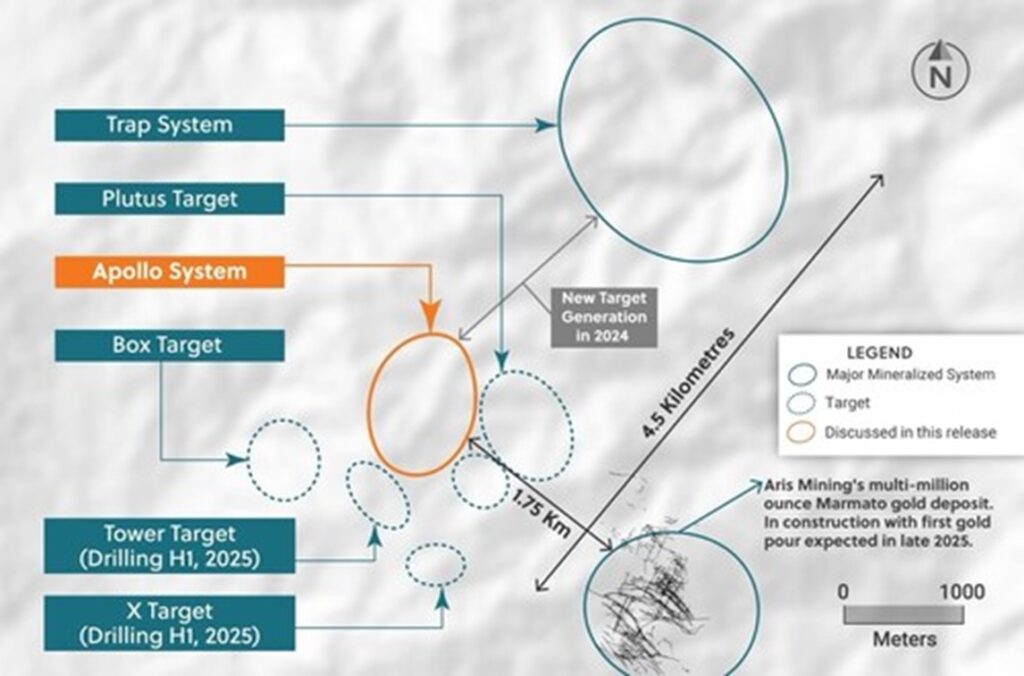

The Company’s flagship project, Guayabales, is anchored by the Apollo system, which hosts the large-scale, bulk-tonnage and high-grade gold-silver-copper-tungsten Apollo system. The Company’s objectives are to expand the Apollo system by stepping out along strike and testing the newly discovered high-grade Apollo Ramp Zone, expand the Trap system and drill a series of newly generated targets including Tower and X.

Management, insiders, a strategic investor and close family and friends own 44.5% of the outstanding shares of the Company and as a result, are fully aligned with shareholders. The Company is listed on the NYSE under the trading symbol “CNL”, on the TSX under the trading symbol “CNL”, on the FSE under the trading symbol “GG1”.

Qualified Person and NI43-101 Disclosure

David J Reading is the designated Qualified Person for this news release within the meaning of National Instrument 43-101 and has reviewed and verified that the technical information contained herein is accurate and approves of the written disclosure of same. Mr. Reading has an MSc in Economic Geology and is a Fellow of the Institute of Materials, Minerals and Mining and of the Society of Economic Geology (SEG).

Technical Information

Rock, soils and core samples have been prepared and analyzed at ALS laboratory facilities in Medellin, Colombia and Lima, Peru. Blanks, duplicates, and certified reference standards are inserted into the sample stream to monitor laboratory performance. Crush rejects and pulps are kept and stored in a secured storage facility for future assay verification. No capping has been applied to sample composites. The Company utilizes a rigorous, industry-standard QA/QC program.

Figure 1: Apollo System Long Section A – A’: High-Grade Continuity from Surface (CNW Group/Collective Mining Ltd.)

Figure 2: Cross Section B – B’ Outlining the Apollo Southwesterly Expansion from Drill Hole APC104-D1 (CNW Group/Collective Mining Ltd.)

Figure 3: Plan View of the Apollo System Highlighting the High-Grade Zone and the Southwesterly Expansion From Drill Hole APC104-D1 (CNW Group/Collective Mining Ltd.)

Figure 4: Drill Core Tray Photo Highlighting APC104-D1 (CNW Group/Collective Mining Ltd.)

Figure 5: Plan View of the Guayabales Project Highlighting the Apollo Target Area (CNW Group/Collective Mining Ltd.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE