Brian Leni – “Update on FPX Nickel Corp.”

NOTE: This update article was first published for Junior Stock Review Premium readers on May 22nd, 2020. Subsequently, FPX’s share price has appreciated roughly 30% since. Become a Premium subscriber today and get my best investment ideas, market commentary and interviews first.

The attention of the market right now is rightfully focused on gold and silver, as the thesis for owning the metals has never been clearer.

Conversely, base metal prices have fallen off and are at multi-year lows. The downside risk, at least in the short term, is clearly evident.

While many base metal operations have been shut down due to the Covid-19 lockdown, it’s the demand side of the equation which I think poses the most risk to the short-term future of base metals’ prices.

In my view, much of the next 3 to 6 months is still murky, as it’s unclear to me if all the quantitative easing (QE) and low interest rates will be able to stave off the impact of the Covid-19 pandemic.

To add, even if a depression-like scenario is averted, it’s my view that this global shutdown will come at a price.

That price could come in a number of forms, but the one that I think is most likely is one of stagflation.

Stagflation is defined as,

“persistent high inflation combined with high unemployment and stagnant demand in a country’s economy.”

Although a stagflation environment paints an ugly picture for the economy and by extension base metals, I’m still very bullish on their long-term future.

I, therefore, believe any potential weakness in share prices as great buying opportunities for those who have an investment horizon of at least 1 to 2 years down the road.

Conversely, if you can handle the risk and are able to find a well-financed junior base metal explorer, discovery can pay no matter where you are in the cycle.

Today, I would like to give you an update on FPX Nickel Corp. (TSX-V:FPX).

As the name suggests, FPX is a junior nickel company that is developing their Decar Nickel District in Central British Columbia, Canada.

FPX Nickel Corp.

MCAP – $24.5M

Shares – 163.3M

FD – 178.9M

Cash – $1.9M as of May 1st, 2020

Currently, FPX is focused on an updated PEA, which I believe should be dramatically different from the one released in 2013.

What’s changed over the last 7 years? A lot.

Let me take you through what I see as the major positive differences between the old and the new.

- Lower Exchange Rate – In 2013, the CAD to USD exchange was almost at par – $0.97 – while today, the exchange rate has changed dramatically, especially in the last couple of months – $0.72

- Metallurgical Recoveries – Last year, FPX conducted extensive metallurgical work and improved their metallurgical recoveries from 82% to 85%.

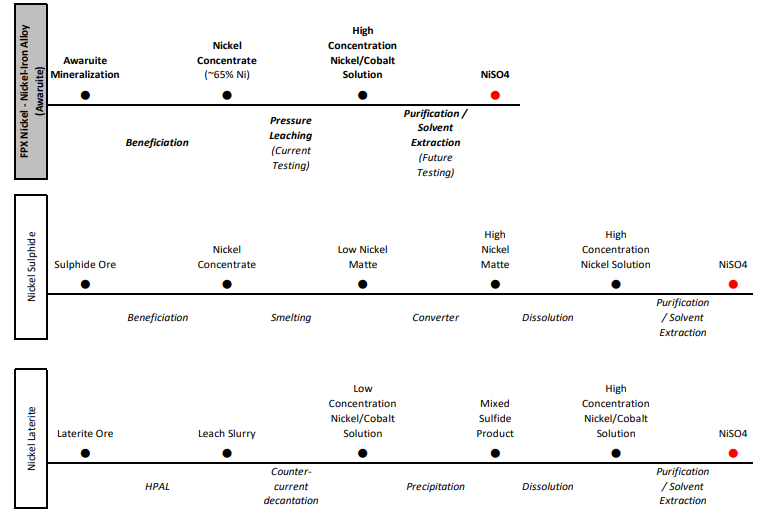

- End Product Flexibility – While it may not have a direct economic benefit, the fact that the metallurgical work completed in 2019 revealed Decar’s high grade nickel concentrate was easily converted into nickel sulphate, via leaching, was a major accomplishment. Nickel sulphate is important, as it’s the chemical which battery makers need, thus, it gives FPX the flexibility to potentially feed battery makers and/or steel producers.

- Payability – In my view, the payability of an operations end product is often overlooked by investors. The fact is, depending on the grade of the primary metal, in this case nickel, and the level of deleterious elements, the payability of a concentrate can vary greatly. Along with the improvement to metal recoveries, FPX expects to produce a high grade 63 to 65% Ni concentrate. The 2013 PEA considered a 13.5% Ni concentrate, which translates into a significant difference in payability, moving from 75% with the 13.5% Ni concentrate to 90-95% with the high grade 63-65% Ni concentrate.

- Starter Pit – In 2017, FPX completed an 8 hole step out drill program on the Baptiste deposit. The program was successful, extending the strike length by roughly 500m or roughly 25% and, given the high grade nature of the mineralization of the extension, appears to give the company a great spot for a starter pit. Mining high grade mineralization first should increase early profits and, therefore, increase the NPV of the project. Remember, that’s a discounted model, profits are discounted in the future, making profits early on that much more impactful to the overall NPV of the project.

Economic Improvements to Come

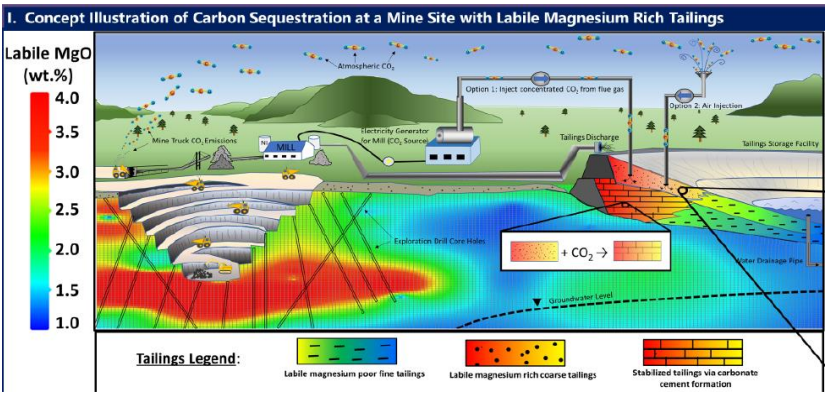

- Carbon Neutral –Currently, UBC and Trent University are collaborating on a research program which is investigating carbon capture and storage at mining sites. FPX’s Decar Nickel District is at the centre of this research as the study looks to maximize the reaction between carbon dioxide and magnesium silicate mine tailings. As FPX states in their most current Corporate Presentation, the Decar mine waste is high in Brucite, which makes it a prime candidate for carbon sequestration. It is, therefore, possible that a future mine at Decar could be carbon neutral and would benefit under the current BC carbon tax.

- Iron Ore By-Product – To note, there are little to no sulphides present in Decar’s host rock and tailings and, most advantageous, the flotation tailings appear as though they will be saleable. In FPX’s case, the tailings are actually a magnetite iron ore concentrate, which has a grade range of 60 to 62%, and may be a good candidate for sale to steel mills in the western portion of Canada and the United States. This may not be included in the updated PEA, but could prove as a great revenue source, depending on the iron ore price, for a future mining operation.

Risks to Investment

Covid-19 Crisis – While I’m citing Covid-19 as a risk, it’s really only a catalyst for supply and demand destruction and ties into the stagflation theme which I explained in the introduction. Longer term, though, FPX is at the top of my list in terms of junior nickel companies, and is currently the only one I’m invested in.

Nickel Price – It’s my guess that FPX will target a nickel price of around US$7.50/lb in their updated PEA, which means that the nickel price has to increase by almost 50% from its current price. Without an increase in price, the value of Decar is very speculative. To contrast that, take a look at the majority of undeveloped nickel projects worldwide. You will soon see that they are uneconomic at US$5.60/lbs. In fact, many require much more than US$8/lb to be economic, making FPX’s Decar very attractive.

CAPEX – There’s no getting around the fact that this will be a multi-billion dollar development project. To some, they won’t be able to see passed this, but I would point out, there aren’t many 30+ year mining projects that don’t require large upfront capital costs.

Debt – FPX does have a good chunk of debt, roughly $7.9M, however, it isn’t due for a few years and it is all held by 2 of the company’s largest shareholders. My guess, if FPX hasn’t been bought out before the loans’ maturity, FPX’s CEO Martin Turenne will find a way to eliminate it or extend the debt into the future.

Concluding Remarks

In my opinion, FPX Nickel is the best junior nickel company in the market. Putting it all together, the investment thesis is as follows:

- Good Management – CEO Martin Turenne is top notch, as good as they come in the sector.

- Access to Cash – FPX has been able to continually raise money without warrants and continually at higher prices over the last 4 years.

- Economics – As I covered, the upcoming updated PEA should show the market that Decar is an economic project at around US$7.50/lbs nickel, putting them near the top of the undeveloped nickel projects worldwide.

- While the grade isn’t world class, the size and metallurgical aspects of the deposit are and that mixed with its location make it, in my view, highly desirable to potential buyers.

Investment in FPX isn’t without risk, but at its current MCAP, it’s trading at a fraction of its value. I continue to hold my shares of FPX and will continue to add to my position moving forward.

Further reading and watching on nickel and FPX Nickel Corp.:

2019 Cambridgehouse VRIC Presentation – https://www.juniorstockreview.com/nickel-a-short-and-long-term-outlook/

2019 Cambridgehouse VRIC Panel – https://www.juniorstockreview.com/junior-stock-review-nickel-panel/

Mining Stock Education – https://www.youtube.com/watch?v=AxgbpO0vebk

Original Investment Thesis Article January 2018 – https://www.juniorstockreview.com/fpx-nickel-corp-undervalued-pure-nickel-play/

FPX Metallurgical Improvements Update – https://www.juniorstockreview.com/fpx-nickel-corp-update-on-the-baptiste-deposit-metallurgy/

Get the e-book Junior Resource Sector Investing Success: The Risks, Rules & Strategies You Need to Know today, when you become a FREE Junior Stock Review VIP .

Until next time,

Brian Leni P.Eng

Founder – Junior Stock Review Premium

Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. I have NO business relationship with FPX Nickel Corp., I do own shares in FPX Nickel Corp and am therefore bias.

MORE or "UNCATEGORIZED"

Koryx Copper Intersects 338.61 Meters At 0.38% Cu Eq Including 230.61 Meters At 0.45% Cu Eq and Multiple 2 Meters Intersections Over 1.00% Cu Eq

Significant copper and molybdenum intersections include: HM09: 13... READ MORE

Aya Gold & Silver Reports Q1-2024 Results; Maintains Guidance; Zgounder Expansion on Track

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased t... READ MORE

Silver Mountain Delivers Positive Preliminary Economic Assessment For Its Reliquias Project, Peru; Pre-Tax NPV 5% Of C$107 million, Pre-Tax IRR Of 57%, And Payback Of 1.8 Years

Key Highlights – Preliminary Economic Assessment Pre-Tax Net Pr... READ MORE

ARIS MINING REPORTS Q1 2024 RESULTS WITH SEGOVIA GENERATING $13.8 MILLION IN OPERATING CASH FLOW

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its ... READ MORE

Orla Mining Reports First Quarter 2024 Results

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) announces the results fo... READ MORE