Aura Announces Third Quarter 2022 Financial and Operational Results, 2022 Guidance and 2025 Management Production Targets Updates

Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX: ORAAF) announces that it has filed unaudited consolidated financial statements and management discussion and analysis for the period ended September 30, 2022, which also contains the Annual Guidance Update and a new long term production target. The full version of the Financial and Operational Results can be viewed on the Company’s website at www.auraminerals.com or on SEDAR at www.sedar.com. All amounts are in U.S. dollars unless stated otherwise.

Q3 2022 Highlights (Compared to Q3 2021):

- Consolidated quarterly production of 58,175 gold equivalent ounces (“GEO1”) in Q3 2022, an increase of 8% vs. Q2 2022 at constant metal prices; consolidated production for the first nine months of 2022 was 174,861 GEO

- Aranzazu reached 313k tons milled in the quarter, a record high for a single quarter

- EPP produced 48% in Q3 2022 more than in the previous quarter; production is expected to continue to increase from EPP in Q4 2022

- San Andres production was below the Company’s expectations in Q3 2022 as a result of lower productivity generated by the ramp up of a new mine contractor and heavy rains, about 70% above the historical average for this time of the year

- Despite higher production in tons, lower copper prices in the quarter impacted total GEO calculation for copper concentrate production, while effective copper content increased 12% in comparison to same quarter of 2021

- Aura’s revenues in Q3 2022 were US$81.1 million, a decrease of 16% compared to the same period of 2021 due to lower metal prices and non-recurring Q3 price adjustments on Aranzazu’s offtake agreement of – US$ 10 million (“Aranzazu Q3 Offtake Price Adjustments”)

- Adjusted EBITDA in Q3 2022 was US$16.7 million, negatively impacted by lower metal prices and Aranzazu Q3 Offtake Price Adjustments

- During Q3 2022, Aura invested US$ 81 million in the Company’s growth initiatives, including the Big River acquisition, Almas development and exploration, increasing its Net Debt in the quarter as already expected

- Aura has also been able to reasonably off set inflation pressures and annual cash costs are now expected to be within the range of US$875 to US$899 per oz for 2022 full year, compared to the previous guidance of US$803 to US$853 per oz; the primary reasons for the increase in the expected cash cost are lower than expected production from San Andres and lower copper prices, which negatively affected GEO conversion from copper produced at the Aranzazu mine

- As expected, production continues to ramp-up and management expects a stronger Q4 2022 with 70,000 to 75,000 GEO; consolidated production was approximately 22.6k GEO in September 2022 and approximately 23k GEO in October 2022

- Full year 2022 production guidance has been revised to between 245,000 and 250,000 GEO, compared to 260,000 and 275,000 oz as expected previously. The primary reasons for the decrease in the production guidance are lower production than expected from San Andres and lower copper prices, which had a negative impact of about 8k GEO relative to the first projection issued by the Company to 2022.

- Construction at the Almas project is proceeding on budget and on schedule; at the end of October 2022, about 79% of the project was completed and over 92% of the budget on services and equipment had been negotiated. Production is expected to begin by April 2023

- In October, Aura announced the completion of a Feasibility Study of the Matupa Project on its X1 deposit, which included a leveraged IRR of 50%2 and a payback period of 2.3 years2, not including potential upsides with Serrinhas and other deposits

- In September, the Company closed the acquisition of 80% of Big River (owner of the Borborema project) which has about 1.9M Oz of M&I Resources and 0.57 Oz in Inferred Resources.

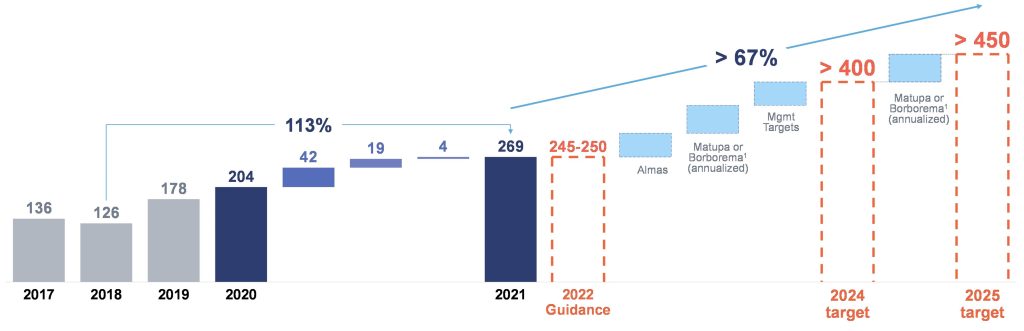

- Aura is announcing new long-term guidance to 2025, when it expects to produce more than 450,0003 annualized GEO, representing an increase of more than 67% vs. its 2021 production. This increase will come from optimizing production from assets currently in operations and bringing three new mines online in the coming years (Almas, Matupá and Borborema3).

- During the first nine months of 2022, the Company returned approximately US$19 million in cash to its shareholders through dividends and share and BDR buybacks; during the last 12 months the yield is 7.8%4

- On September 15, the Company announced that, for the second year in a row, it was ranked number one on the TSX30™ 2022 on the Toronto Stock Exchange

- On October 20, the Company qualified to trade on the OTC Markets Group (ticker: ORAAF), providing U.S. investors with greater accessibility to trading Aura’s common shares

Rodrigo Barbosa, President and CEO of Aura, commented: “We continued to increase production at our mines in Q3 and expect to continue on this path in Q4. Lower copper prices and weaker-than-expected production at San Andres pushed our 2022 production guidance to a lower range. Despite the short-term challenges in San Andres, we are moving forward with our growth pipeline: construction of Almas is on time and on budget, we recently released the Feasibility Study of the Matupá project and closed the acquisition of 80% of Big River Gold Limited. Now, we not only aim to produce over 400,000 GEO annualized by 2024 but to reach over 450,000 GEO annualized by 2025, all of it while paying dividends and under the highest ESG standards which we call Aura 360.”

Operational And Financial Overview (US$ thousand)

| For the three months ended September 30, 2022 |

For the three months ended September 30, 2021 |

For the nine months ended September 30, 2022 |

For the nine months ended September 30, 2021 |

|||||

| Total Production1 (GEO) | 58,175 | 61,588 | 174,861 | 191,389 | ||||

| Sales2 (GEO) | 57,963 | 63,669 | 179,138 | 201,786 | ||||

| Net Revenue | 81,189 | 97,060 | 286,849 | 310,158 | ||||

| Adjusted EBITDA | 16,661 | 39,144 | 97,195 | 134,096 | ||||

| Cash costs per GEO sold | 971 | 825 | 924 | 799 | ||||

| Ending Cash balance | 120,916 | 165,059 | 120,916 | 165,059 | ||||

| Net Debt | 80,723 | (7,695 | ) | 80,723 | (7,695 | ) | ||

| Recurring Capex | (12,060 | ) | (17,262 | ) | (21,567 | ) | (37,321 | ) |

| 1 Considers capitalized production | ||||||||

| 2 Does not consider capitalized production | ||||||||

Guidance Update

2022 Guidance:

The Company’s updated gold equivalent production, cash operating cost per gold equivalent ounce produced and Capex guidance for 2022 is detailed below.

Production

The table below details the Company’s updated GEO production guidance for 2022 by business unit:

| Production (‘000 GEO) 2022 |

||||

| Updated | Previous | |||

| Aranzazu | 109 – 110 | 115 – 120 | ||

| EPP Mines | 69 – 71 | 70 – 75 | ||

| San Andrés | 67 – 69 | 75 – 80 | ||

| Total | 245 – 250 | 260 – 275 | ||

Factors that contributed to the change in the Company’s guidance include:

- Assumption for average Copper market prices for the year decreased, which negatively affects the Gold Equivalent Ounces calculation. The new price assumption is based on the market consensus, with a forecast of US$ 3.60 per pound for Q4 2022, and actual prices for first nine months of the year.

- If we consider previous price assumptions for Copper and Gold prices, Aranzazu, and Aura as a whole, would be expected to produce an additional ~ 8,000 GEO during 2022

- A reduction on production guidance from San Andres Mines due to lower-than-expected results from Q2 and Q3 2022, as a result of lower recovery metallurgical rates from a greater amount of sulfide material fed to the plant, from a oxide-sulfide transition area in the mine. Reduction was also affected by lower-than-expected production on Q3 2022, due to high rainfall levels in the quarter (about 70% above the historical rains in the last 20 years for the period) which, combined with a period of contractor transition, reduced ore moving capacity in the mine and reduced ore fed to the plant.

In addition to production guidance for 2022, management’s targets for production for 2024-2025 across its business units are presented below.

Management maintains the previous annualized production target of more than 400,000 GEO by the year ending December 31, 2024, and has added a production target of more than 450,000 annualized GEO for the year ending December 31, 2025:

A chart accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/77fb9a3a-8145-481d-a608-5f3efb91cfd7

1) Considering 80% of the ounces to be produced by the Borborema project

Notes: 2022 figures are based on current technical reports for the Company’ s projects, except as otherwise noted. Please refer to the heading “Technical Information”. Figures for 2024 and 2025 are based on management’s expectations based on a variety of factors, including preliminary, high-level studies for each of the assets. These targets are management’ s objectives only and are subject to certain risks and assumptions. See “Forward-Looking Information”. Includes ounces capitalized from EPP projects and Gold Road in 2020 and 2021.

Cash costs

The table below shows the Company’s updated cash operating costs per GEO sold guidance for 2022 by Business Unit:

| Cash Cost per GEO (US$ thousand) 2022 |

||||

| Updated | Previous | |||

| Aranzazu | 672 – 696 | 645 – 690 | ||

| EPP Mines | 963 – 987 | 955 – 992 | ||

| San Andrés | 1,115 – 1,139 | 910 – 980 | ||

| Total | 875 – 899 | 803 – 853 | ||

- In Aranzazu, despite lower copper market prices, the Company has been able to manage lower costs levels to partially offset price reductions. If we consider previous Copper and Gold prices assumptions for GEO calculation, the updated cash cost guidance range would be between $629 and $653 per GEO, below previous guidance.

- EPP is keeping the previous guidance despite stronger FX (BRL / USD) than previously projected

- At San Andres, the increase in cash cost per GEO was directly related to production decreases in Q2 and Q3 2022. The hiring of a new mine contractor, which started in July 2022, is expected to reduce nominal unit costs per ton moved compared to previous quarters and is expected to increase productivity at the mine.

Capex:

The table below shows the breakdown of estimated capital expenditures by type of investment, and a comparison to the previous guidance:

| Capex (US$ million) 2022 |

||||

| Updated | Previous | |||

| New projects + Expansion | 66 – 68 | 55 – 61 | ||

| Exploration | 8 – 9 | 12 – 14 | ||

| Sustaining | 32 – 33 | 33 – 36 | ||

| 106 – 110 | 100 – 111 | |||

- New projects + Expansion is expected to increase mainly due to an acquisition of Mineral Rights for US$ 6.6 million by Mineração Apoena, which was completed during Q3 2022. The Company expects such acquisition will contribute to the increase in EPP’s LOM in the near future.

- Sustaining Capex was reduced to partially compensate for higher Expansion Capex

- Aura believes its properties have strong geological potential and management’ s objective is to expand LOM across its business units. Total expenditures in exploration in 2022 are now estimated to be between US$ 23 million and US$ 25 million, within the range of the previous (US$ 23 million to US$ 27 million); of which:

- US$8 MM to US$9 MM in capital expenditures (included in the table above) in areas where the Company has proven and probable mineral reserves; and,

- US$15 MM to US$16 MM in exploration expenses, not capitalized, in areas where the Company does not yet have proven or probable mineral reserves (not included in the table above).

Key Factors

The Company’s future profitability, operating cash flows, and financial position will be closely related to the prevailing prices of gold and copper. Key factors influencing the price of gold and copper include, but are not limited to, the supply of and demand for gold and copper, the relative strength of currencies (particularly the United States dollar), and macroeconomic factors such as current and future expectations for inflation and interest rates. Management believes that the short-to-medium term economic environment is likely to remain relatively supportive for commodity prices but with continued volatility.

To decrease risks associated with commodity prices and currency volatility, the Company will continue to evaluate and implement available protection programs. For additional information on this, please refer to the AIF.

Other key factors influencing profitability and operating cash flows are production levels (impacted by grades, ore quantities, process recoveries, labor, country stability, plant, and equipment availabilities), production and processing costs (impacted by production levels, prices, and usage of key consumables, labor, inflation, and exchange rates), among other factors.

Non-GAAP Measures

In this press release, the Company has included Adjusted EBITDA, cash operating costs per gold equivalent ounce sold and net debt which are non-GAAP measures. These non-GAAP measures do not have any standardized meaning within IFRS and therefore may not be comparable to similar measures presented by other companies. The Company believes that these measures provide investors with additional information which is useful in evaluating the Company’s performance and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. The below tables provide a reconciliation of the non-GAAP measures presented:

Reconciliation from Income for the Quarter for EBITDA and Adjusted EBITDA:

| For the three months ended September 30, 2022 |

For the three months ended September 30, 2021 |

For the nine months ended September 30, 2022 |

For the nine months ended September 30, 2021 |

||||

| Profit (loss) from continued operation | 70 | 11,190 | 43,934 | 61,882 | |||

| Income tax (expense) recovery | 2,099 | 8,240 | 23,084 | 25,369 | |||

| Deferred income tax (expense) recovery | 2,822 | 6,117 | (262 | ) | 16,147 | ||

| Finance costs | 5,912 | 5,065 | 5,626 | 6,447 | |||

| Other gains (losses) | (3,330 | ) | 33 | (2,255 | ) | (1,098 | ) |

| Depreciation | 9,088 | 8,499 | 27,068 | 25,349 | |||

| EBITDA | 16,661 | 39,144 | 97,195 | 134,096 | |||

| Impairment | – | – | – | – | |||

| ARO Change | – | – | – | – | |||

| Adjusted EBITDA | 16,661 | 39,144 | 97,195 | 134,096 | |||

Reconciliation from the consolidated financial statements to cash operating costs per gold equivalent ounce sold:

| For the three months ended September 30, 2022 |

For the three months ended September 30, 2021 |

For the nine months ended September 30, 2022 |

For the nine months ended September 30, 2021 |

|||||

| Cost of goods sold | (65,361 | ) | (59,421 | ) | (192,335 | ) | (178,588 | ) |

| Depreciation | 9,061 | 8,337 | 26,753 | 24,820 | ||||

| COGS w/o Depreciation | (56,300 | ) | (51,084 | ) | (165,582 | ) | (153,768 | ) |

| Gold Equivalent Ounces sold(2) | 57,963 | 61,715 | 179,138 | 191,794 | ||||

| Cash costs per gold equivalent ounce sold | 971 | 825 | 924 | 799 | ||||

| (1) Considers exclusively finished product | ||||||||

| (2) Do not considers pre-commercial production and sale, capitalized | ||||||||

| (3) Do not consider Gold Road, due to reclassification | ||||||||

Reconciliation Net Debt:

| September 30, 2022 |

December 31, 2021 |

|||||

| Short Term Loans | 84,045 | 58,169 | ||||

| Long-Term Loans | 123,731 | 99,862 | ||||

| Plus / (Less): Derivative Financial Instrument | (5,537 | ) | 2,779 | |||

| Less: Cash and Cash Equivalents | (120,916 | ) | (161,490 | ) | ||

| Less: Restricted Cash | (600 | ) | (944 | ) | ||

| Net Debt | 80,723 | (1,624 | ) | |||

Qualified Person

Farshid Ghazanfari, P.Geo., Geology and Mineral Resources Director for Aura Minerals Inc. has reviewed and confirmed the scientific and technical information contained within this news release and serves as the Qualified Person as defined in National Instrument 43-101.

About Aura 360° Mining

Aura is focused on mining in complete terms – thinking holistically about how its business impacts and benefits every one of our stakeholders: our company, our shareholders, our employees, and the countries and communities we serve. We call this 360° Mining.

Aura is a mid-tier gold and copper production company focused on the development and operation of gold and base metal projects in the Americas. The Company’s producing assets include the San Andres gold mine in Honduras, the Ernesto/Pau-a -Pique gold mine in Brazil and the Aranzazu copper-gold-silver mine in Mexico. In addition, the Company has four additional gold projects in Brazil: Almas, under construction; Borborema and Matupá, in development, and São Francisco, in care & maintenance, and one gold project in Colombia, Tolda Fria.

MORE or "UNCATEGORIZED"

Spanish Mountain Gold Announces Larger Scale Preliminary Economic Assessment With a Base Case NPV5% After-Tax of C$1.0 Billion, 18.2 % IRR and 3.4 Year Payback at US$ 2,450/Oz Gold Price; at US$3,300/Oz Spot Gold Price NPV5% C$2.3 Billion, 32.0% IRR and 2.0 Year Payback; Including an Updated Mineral Resource Estimate for Its Spanish Mountain Gold Project

Spanish Mountain Gold Ltd. (TSX-V: SPA) (FSE: S3Y) (OTCQB: SPAUF)... READ MORE

Aura Announces Preliminary Q2 2025 Production Results

Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX: ORAAF) is plea... READ MORE

Cascadia Announces Closing of Financing

Cascadia Minerals Ltd. (TSX-V:CAM) (OTCQB:CAMNF) is pleased to an... READ MORE

Abcourt Closes US$ 8M Loan Facility to Start Sleeping Giant Mine

Abcourt Mines Inc. (TSX-V: ABI) (OTCQB: ABMBF) is pleased to anno... READ MORE

Mishkeegogamang First Nation and First Mining Sign Long Term Relationship Agreement for the Development of the Springpole Gold Project

Agreement setting out the significant participation of Mishkeegog... READ MORE