North Bay Resources Acquires Mt. Vernon Gold Mine, Sierra County, California, with Assays up to 4.8 oz. Au per Ton

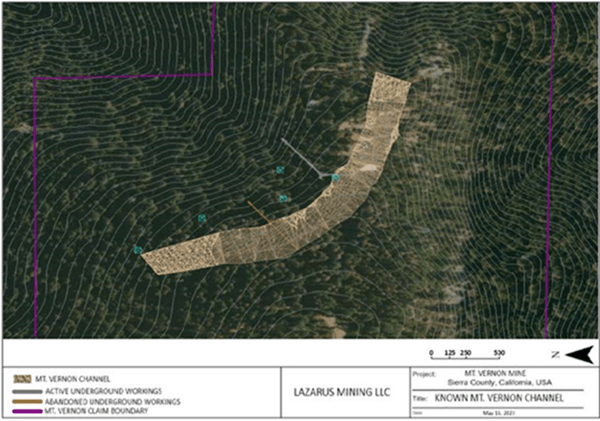

North Bay Resources Inc. (OTC: NBRI) is pleased to announce it has entered into an agreement with a private arms-length Company to acquire a 100% interest in the Mt. Vernon Mine located in Sierra County, California. The Mt. Vernon Mine is a largely undeveloped deposit, proximate to some of the richest past producing gold mines in North America. Mt. Vernon is a permitted underground mine with modern portal, tunnel, ventilation. power, and equipment (see Picture 1). The Company plans to commence test mining immediately and initial production of 100 tons per day shortly, pending minor infrastructure and permitting updates. The ore will be shipped to the Company’s Bishop, California Gold Mill for processing. The Company is targeting initial net mine production of 3 truckloads per day utilizing 30 ton triaxle dump trucks for delivery of feedstock to the Bishop Gold Mill with an average target grade of one ounce gold per ton. Production targets are based on prior exploration and currently developed underground access to the gold bearing ore body. The ore body is estimated at 954,000 tons based on the known channel (see Figure 1 – B. Hanford 2023.

Picture 1. Mt. Vernon Main Portal

Figure 1. Mt. Vernon Known Channel

Gold Mineralization

The Property is 120 acres, composed of six 20-acre claims. Two types of gold mineralization occur on the Property, a) paleo-placer deposits buried under mudflows and volcanic rocks and b) auriferous quartz veins. The Tertiary placer channels are large cobble conglomerates cemented with a ferruginous sand matrix containing free gold. Gold is recovered as fine flakes and large nuggets (see Picture 2). The channels vary in thickness from 4 feet to as much as 20 feet thick. Typically, the lower 4 feet of the gravels contain the higher grades. A 90-ounce nugget was found on the Property in 1926. The Property is located directly adjacent and upstream from the neighboring Ruby Mine. The Ruby produced what is considered to be the best collection of gold nuggets in the world. The Property is located upstream between the rich lode deposit, the source of the placer gold, and the Ruby Mine and on the same channel as the Ruby Mine.

The erosion of the gold-quartz veins during the Cretaceous-Eocene period concentrated river gravels in the ancient streams. The eruption and deposition of the lava and mud flows covered rocks during the Pliocene period and sealed the gravels in place.

Picture 2. Gold Mineralization at the Bedrock Contact

Recent Exploration

In 2023, channel sampling was completed throughout the underground at the bedrock contact. Assays were completed using acid-digestion and fire assay at Enviro-Chem Analytical Laboratory. Results are as follows:

| Mt. Vernon – Main Tunnel North Face | ||

| Sample ID | Channel Sample Location 10′ Intervals | Au Oz./Ton |

| MV23-8 | 3+90-4+00 L | 2.11 |

| MV23-7 | 4+00-4+10 L | 2.02 |

| MV23-6 | 4+10-4+20 L | 1.35 |

| MV23-25 | 4+20-4+30 L | 2.10 |

| MV23-18 | 4+30-4+40 L | 3.22 |

| MV23-12 | 4+40-4+50 L | 4.80 |

| MV23-14 | 4+50-4+60 L | 2.48 |

| MV23-23 | 4+60-4+70 L | 1.82 |

| MV23-13 | 4+70-4+80 L | 2.83 |

| MV23-26 | 4+80-4+90 L | 1.52 |

| MV23-2 | 4+90-5+00 L | 2.57 |

| MV23-24 | 5+00-5+10 L | 1.06 |

| MV23-9 | 5+10-5+20 L | 0.67 |

| MV23-3 | 5+20-5+30 L | 0.94 |

| MV23-29 | 5+30-5+40 L | 0.93 |

| Mt. Vernon – Main Tunnel South Face | ||

| Sample ID | Channel Sample Location 10′ Intervals | Au Oz./Ton |

| MV23-17 | 3+90-4+00 R | 2.01 |

| MV23-10 | 4+10-4+20R | 2.4 |

| MV23-19 | 4+20-4+30 R | 2.21 |

| MV23-28 | 4+30-4+40 R | 1.32 |

| MV23-16 | 4+40-4+50 R | 1.58 |

| MV23-21 | 4+50-4+60 R | 1.27 |

| MV23-20 | 4+60-4+70 R | 1.85 |

| MV23-11 | 4+70-4+80 R | 0.74 |

| MV23-27 | 4+80-4+90 R | 1.19 |

| MV23-1 | 4+90-5+00 R | 0.85 |

| MV23-4 | 5+00-5+10 R | 1.70 |

| MV23-15 | 5+10-5+20 R | 1.21 |

| MV23-5 | 5+20-5+30 R | 0.40 |

| MV23-22 | 5+30-5+40 R | 0.38 |

Terms of the Agreement

The terms of the Mt. Vernon acquisition agreement are as follows:

$25,000 on signing (the “Due Diligence Payment”);

$25,000 within 45 days of signing (the “MET Analyses Payment”)

$500,000 within 90 days of signing (the “Down Payment”);

$1,000,000 within 180 days of signing (the “First Annual Payment”);

$1,000,000 within 1 year of the First Annual Payment (the “Second Annual Payment”);

$1,000,000 within 2 years of the First Annual Payment (the “Third Annual Payment”);

$1,000,000 within 3 years of the First Annual Payment (the “Fourth Annual Payment”);

$1,000,000 within 4 years of the First Annual Payment (the “Fifth Annual Payment”);

$4,450,000 within 5 years of the First Annual Payment (the “Final Payment”).

Subsequent to the completion of the Option, the Property will be subject to a 2% Net Smelter Return. North Bay will have the right to acquire 100% of the NSR for a payment of $10,000,000 in whole or in part on a pro-rata basis to either or both of the NSR owners at any time for a period of up to 20 years from the date of this agreement.

Corporate Update

The Company has entered into an agreement with Tomek Jablowski for digital marketing and media services. Mr. Jablowski to receive $7,500 per month and the right to acquire $100,000 of North Bay Common Stock at a price of $0.0004 in the form of 250,000,000 incentive stock options with an exercise price of $0.0004 and a term of 3 years. The options will vest at the rate of 20% quarterly.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE