Jordan Roy-Byrne – “Precious Metals Remain in Secular Bear Market”

We wrote that gold stocks are cheap and hated a few weeks ago.

You never could use those adjectives in a bull market.

Gold remains extremely close to a significant and historic breakout, but the sector as a whole is breaking down when measured against the stock market.

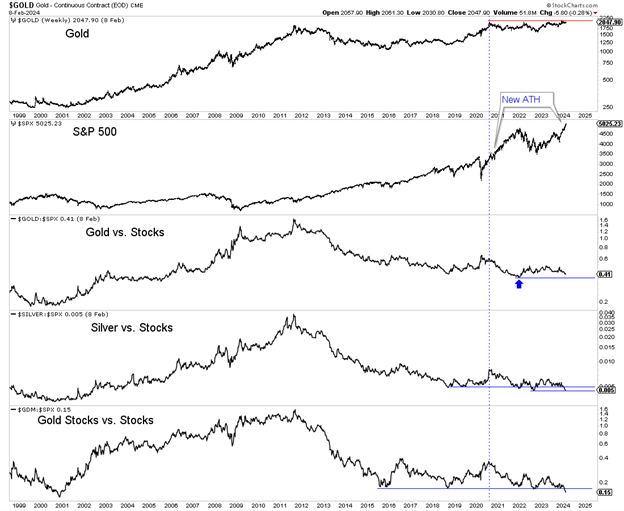

Below, we plot Gold, the S&P 500, and Gold, Silver, and the gold stocks against the S&P 500.

Since Gold’s peak in August 2020, the S&P 500 made a new all-time high following the 35% Covid crash and most recently surpassed its end of 2021 peak and 27% decline.

Meanwhile, precious metals are performing quite poorly against the stock market.

Gold against the stock market is trading at a 2-year low and is not far from testing its end-of-2021 low, which is currently an 18-year low.

Silver and gold stocks (GDX parent index) have broken down relative to the stock market and are approaching a retest of the 2000 low.

Although the performance of precious metals against the stock market looks terrible, there is an important caveat. These ratios look their absolute worst at a secular turning point.

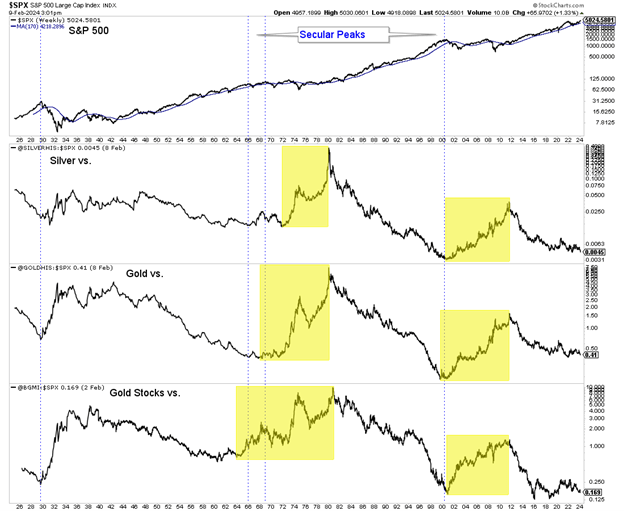

Below, we plot the S&P 500 and note its secular peaks, along with Silver, Gold, and gold stocks plotted against the S&P 500.

Note where these ratios were in the mid to late 1960s and 1999-2000.

It should be abundantly clear that the precious sector is in a secular bear market and that they will not begin a new secular bull market until the S&P 500 cracks and loses its 40-month moving average.

The stock market may have one last burst of outperformance, and precious metals could sell off again before the major secular turn.

As gold stocks are cheap and hated and may become even more so, the opportunity is finding the companies that can create value at present metals prices but are priced too cheap.

Those companies can hold up now and will enjoy accelerated performance in a Gold bull market.

I shifted my focus to finding high-quality gold and silver juniors that can perform in a static metals environment but have 500% to 1000% upside after the bull market begins. To learn the stocks we own and intend to buy, with at least 5x upside potential in the coming bull market, consider learning about our premium service.

MORE or "UNCATEGORIZED"

Delta Resources Options Delta-2 Project in Québec to Troilus Mining Corp. – $8.25M and 1% NSR to be paid over 3 years if option fully exercised

Delta Resources Limited (TSX-V:DLTA) (OTC Pink: DTARF) (FRANKFURT:6GO1) is pleased t... READ MORE

Deep Semi Massive Sulphide Zinc, Silver and Gold Intersection at Berrigan Property

Chibougamau Independent Mines Inc. (TSX-V: CBG) (Frankfurt: CLL1) (OTC: CMAUF), herein called Chibou... READ MORE

OR Royalties Acquires Additional 1.0% NSR Royalty on the Namdini Gold Mine in Ghana

OR Royalties Inc. (TSX: OR) (NYSE: OR) is pleased to announce that it has acquired an additional 1.0... READ MORE

Silver One Announces Closing of First Tranche for $31 Million

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1) is pleased to announce that... READ MORE

Gold X2 Announces Positive Reconciliation in Main Zone Grade Control Drilling with Intercepts Including 49.0m of 2.13 g/t Au

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce the fourth and f... READ MORE