Gwen Preston – “Beaver Creek Thoughts”

The first question about a conference is always “How was the sentiment?”

The answer: terrible.

Companies were disappointed that not much money showed up. By ‘money’, I mean funds with cash to invest.

Funds run the gamut from small family offices to big resource-oriented private equity groups…and the list of funds at Beaver Creek was clearly down this year. The funds that did come were almost all fully allocated, which means all their mining-focused money is already invested.

Why would funds without capital to invest come to a mining conference? Two reasons:

- To find new, better investments

- To decide what holdings to sell should they manage (1)

The second point means companies were anxious going into meetings with funds that owned their stock because they knew they needed to convince each fund to hold. That’s the goal every time a pubco meets with an investor but the pressure this time was particularly amped up.

Left and right I heard companies bemoaning how the market used any news – good or bad – as an opportunity to sell. The junior metals space is notoriously illiquid (many stocks trade very low volumes) so when news sparks trading, investors who have been waiting for an opportunity to exit do so. The result: even reasonably good results often lead to share price declines.

It’s fair to bemoan that.

But complaining doesn’t solve anything. Instead, I like to think about the underlying problem and whether I see a solution to that.

The underlying problem is a lack of investors interested in mining. That’s why liquidities and valuations are so low. Is that going to change?

That is the million-dollar question.

Answers at the conference fell into one of two categories.

Category One: yes, it will change. Metals markets move in cycles and upcycles always start when sentiment is at its worst, like it is today. It may take some time but we’ve gotta be near the bottom. Real rates have peaked so gold will improve from here; the green transition will power undersupplied base metals higher.

Category Two: what’s going to spark a change? Everything that’s happened in the markets in the last 15 years means investors don’t care about gold or base metals. And neither of the paths ahead change that. If we get a soft landing, investor attention will stay with tech and market indexes. If we get a recession, base metals will tank; gold will benefit out the other side but then investors will turn back to the speculative investments that have worked for the last decade (tech, biotech, energy), leaving explore-co’s on the sidelines once again. Nothing changes if nothing changes!

The biggest differentiator between people in each category was the lack or presence of pressure.

Lack of pressure: companies with good cash in the bank or access to cash (there are some!), wealthy investors that have played metals cycles with success before and so are patient

Under pressure: junior companies that need to finance to make progress, investors who believe in the metals thesis but haven’t had big success/the opportunity to participate in a proper metals bull market and so are feeling the need for some market wins sooner rather than later

Frank Guistra has been largely out of mining for the last decade. He’s back and very excited about the gold and metals bull market he thinks will unfold over the next few years. Of course, his bank account and the fact that he hasn’t been slogging away in this sector mean he has patience – he doesn’t know whether the upleg will start in a few months or two years.

Other wealthy investors with whom I spoke held similar positions. And companies with cash in the bank or reliable access to cash (because of deep pocketed backers and/or very exciting stories) are similarly unworried – the market will happen.

But those under pressure – to finance or to make returns/make up lost ground on mining-heavy portfolios – were much more stressed.

I vacillate. Don’t get me wrong – I am in the second group! – but I spend enough time thinking about mining and talking to people who have successfully navigated mining cycles before that I find the enthusiasm contagious.

I also simply want the setup to change, for our portfolios and because the world needs mining. Development, and especially green development, cannot happen without base metals. Gold backs the power setup in the world (there’s an arm-wavey statement if ever I made one!) and that setup is shifting, with the BRICS nations banding together to challenge the dominance of the west and the dollar. This shift has central banks buying gold hand over fist.

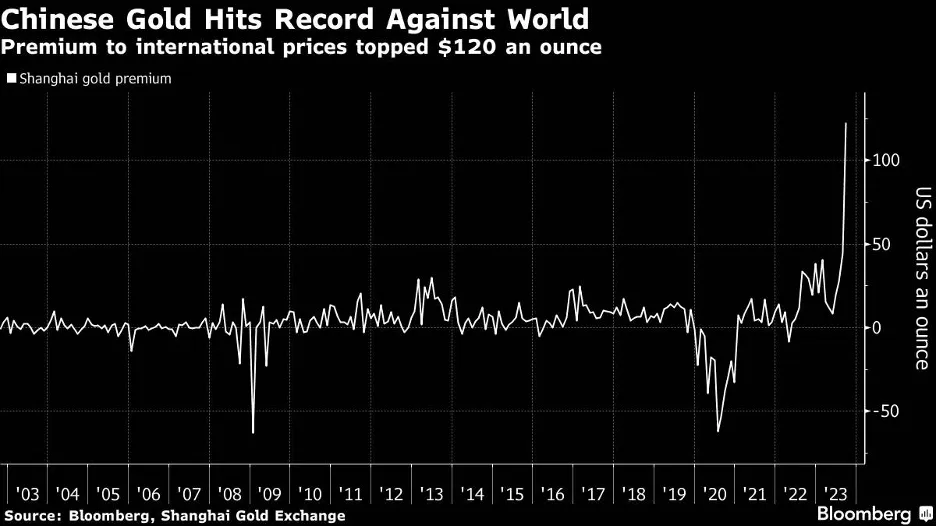

Gold also hedges economic uncertainty, which is why people are paying record $100per-oz.-plus premiums to buy gold in China right now.

Wanting something to happen and seeing reason for it to happen in the near term are different things. And so for now, I remain focused on discoveries because they work in just about any market.

The more advanced projects in my portfolio are things that should – will – be worth more if/when gold moves higher or investors get interested in metals. But I don’t know when that will happen.

What I do know is that companies awaiting results from promising targets that just saw first-pass drilling stand a chance of making big gains on their own schedule.

That’s why my favorite stocks right now are discovery opportunities. Blackwolf, Cascadia, Aston Bay, Founders, Ridgeline, and Headwater (the first three are testing for new discoveries, the latter three offer the potential to greatly expand the scale of discovery).

It’s also the reason two other stocks stood out to me at Beaver Creek. I’ll get to those next week.

I wish I could also be excited about undervalued developers right now, because there are so many. But I just can’t pinpoint a reason to believe they will re-rate in the next few months. Re-ratings happen when the price of the underlying metal jumps and/or a flood of new investors become interested in the mining space. I don’t see either of those happening in the waning months of 2023 unless we go into a recession, after which gold would go higher…but developer stocks would get slammed lower first.

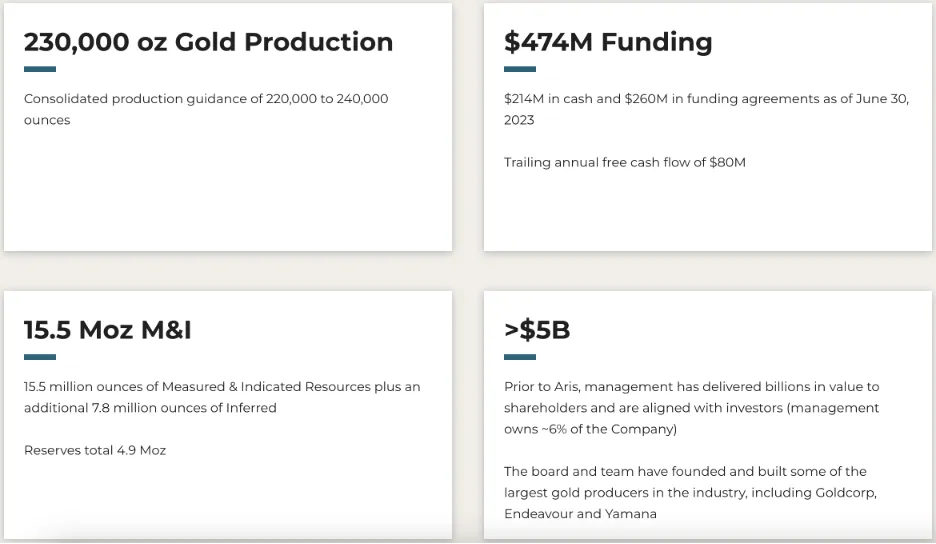

Heck, even producers are cheap. Take Aris Mining (TSX: ARIS) (NYSE: ARMN). This is a screen grab from Aris’ homepage.

This company is producing $80 million in free cash flow annually. It has $214 million cash and another $260 million available to it. It will produce some 230,000 oz. gold this year and has a path to 400,000 oz. annual production. It has 15.5 million ounces in resource, of which almost 5 million is in reserves.

And it’s trading at a $470-million market cap.

I could give lots of examples but, since I don’t think there’s a near-term opportunity here, I won’t. Sure, you could trade gold’s usual September-October run as long as you get out again before November and/or before recession signs strengthen. You could probably repeat that trade in the first months of 2024: buy late this year, when mining stocks reliably slide, and sell again before the end of February. That period usually sees gold stocks gain 10 to 20%.

I do a bit of that kind of trading on the side but it’s not the reason I’m in this game. I’m here for (1) discoveries that creates massive new value and (2) the value that gets unlocked when a project successfully becomes a mine. I will happily take a rising tide re-rating all metals explorers, developers, and miners higher…but I don’t know when that will happen.

So it’s discoveries for me.

But only the very best.

I look for the best all the time, but when markets are weak it’s extra important to be highly selective. I can think of a list of companies with good exploration projects, targets that deserve testing, and good management teams…that I will not be buying in this market. Why? Because they are not the best. The modest amounts of exploration funding available in these weak markets is going to only the best targets and management teams. And both – targets and management – must be tops. Great targets without management who can explain the setup (sell the idea) won’t attract money. And great execs whose targets lack strong potential for significant discovery splash soon won’t attract money.

And guess what makes the world, and drills, go round?

Still To Come…

I also left Beaver Creek with some new uranium insights. I will delve into those next week. For now: the spot uranium price is up 10% in a few weeks and uranium stocks are leveraging that gain.

And there are two other stocks that I found very interesting. Stayed tuned…

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE