Rupert Resources Reports Further Drilling Results From Ikkari and Provides Update on Other Activities

Rupert Resources (TSX:RUP) is pleased to report drilling from its 2022-23 exploration program at its multi-million ounce Ikkari gold discovery at the 100% owned Rupert Lapland Project in Northern Finland and provides further project updates.

In November 2022, the company published a preliminary economic assessment for the project demonstrates the potential for a 24-year life of mine at an average annual production of 200,000 troy ounce gold. After-Tax Net Present Value (5% discount) of $1.6 billion with unlevered Internal Rate of Return of 46% and payback after two years, assuming a gold price of $1,650 per oz. An expected lowest quartile all-in sustaining cost of $759/oz is outlined over LOM, and $596/oz during the open-pit operation. Low sensitivity to cut-off grade and low initial strip ratio is also detailed. (see November 28, 2022 press release and footnotes 1&2).

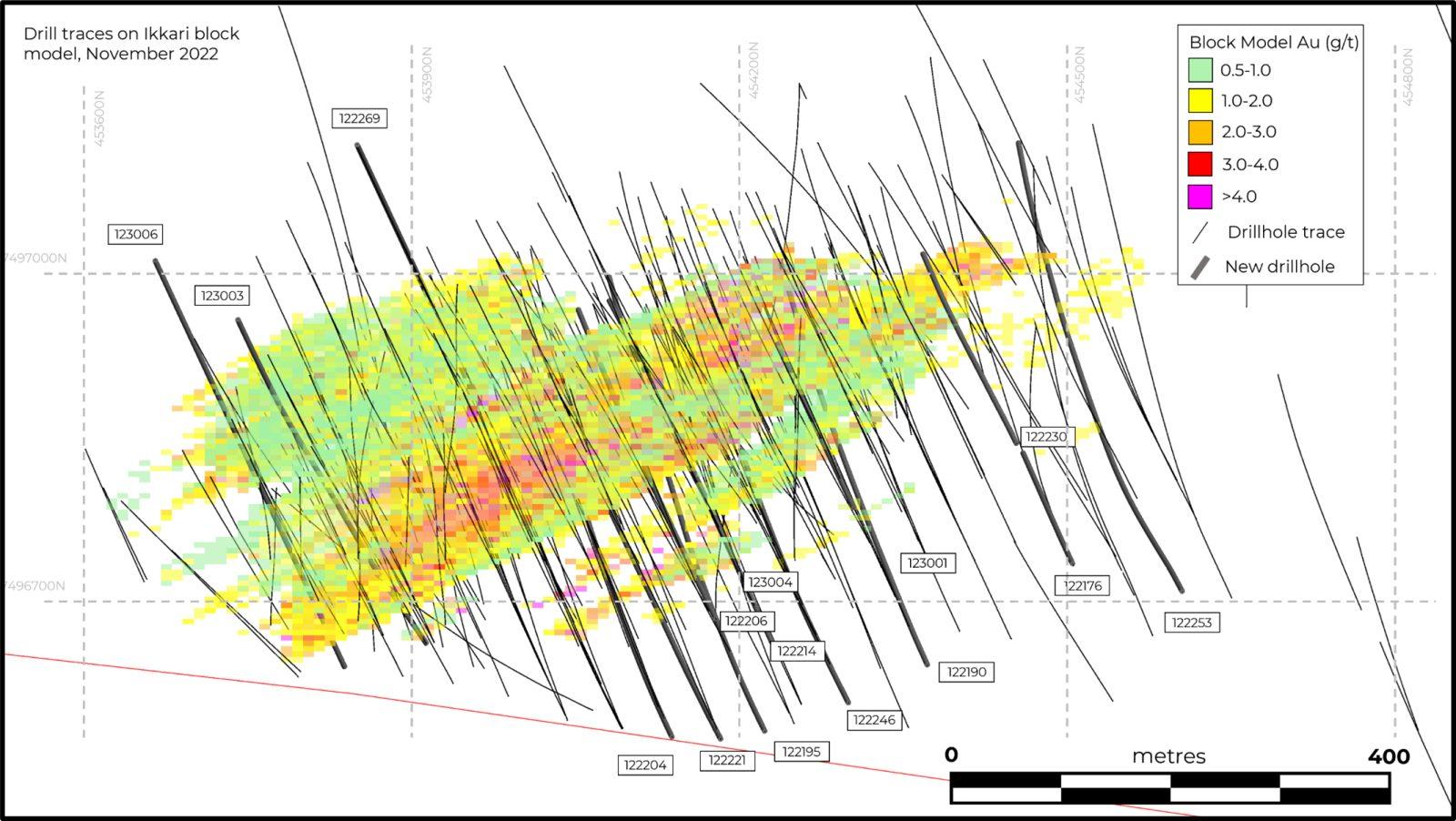

Highlights from infill drilling results (figure 1) aimed at further upgrading areas of inferred resources at Ikkari include:

- #122190 – 52.6m of 2.3g/t from 515m in the east adding confidence to the inferred resources at this depth

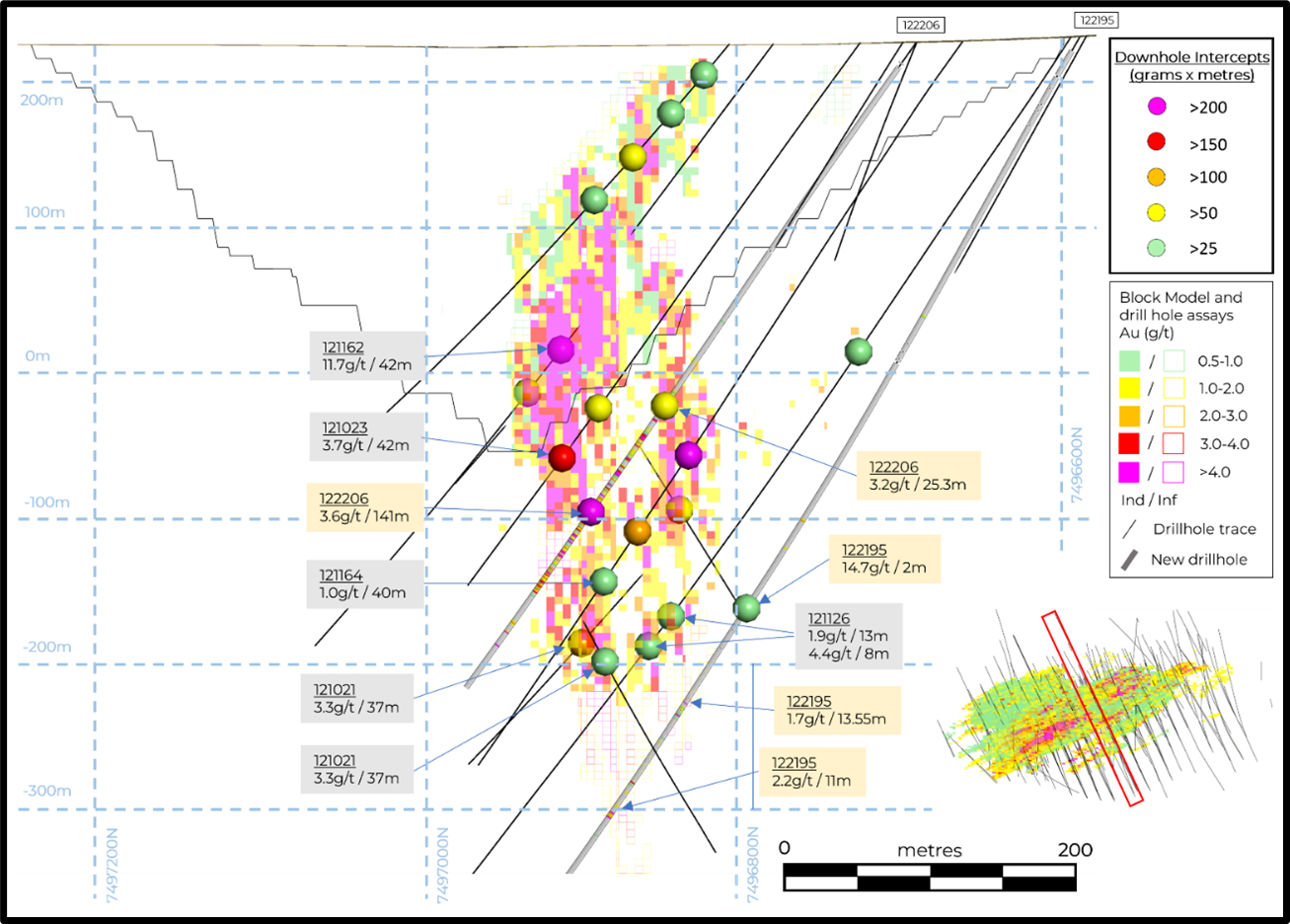

- #122206 – 25.3m of 3.2g/t Au from 291m and 141m of 3.6g/t Au from 322m (figure 2a) in the central portion of the deposit. The intercept extends to 100m below the open pit considered by the PEA, confirming the continuity of high-grade mineralisation.

- #122214 – 15.4m of 5.4g/t Au from 341m, 35m of 1.9g/t Au from 370m and 15m of 3.3g/t Au from 448m also in the centre of the deposit

- #122221 – 27m of 2.9g/t Au from 452m in the west of the deposit

- #123001 – 27m of 3.7g/t Au from 128m and 22m of 2.3g/t Au from 234m in the east of the deposit

Significant results to date, outside of the current block model include:

- #123003 – 6m of 74.1g/t from 361m including 1m of 445g/t, suggesting high-grade mineralisation potential in the west

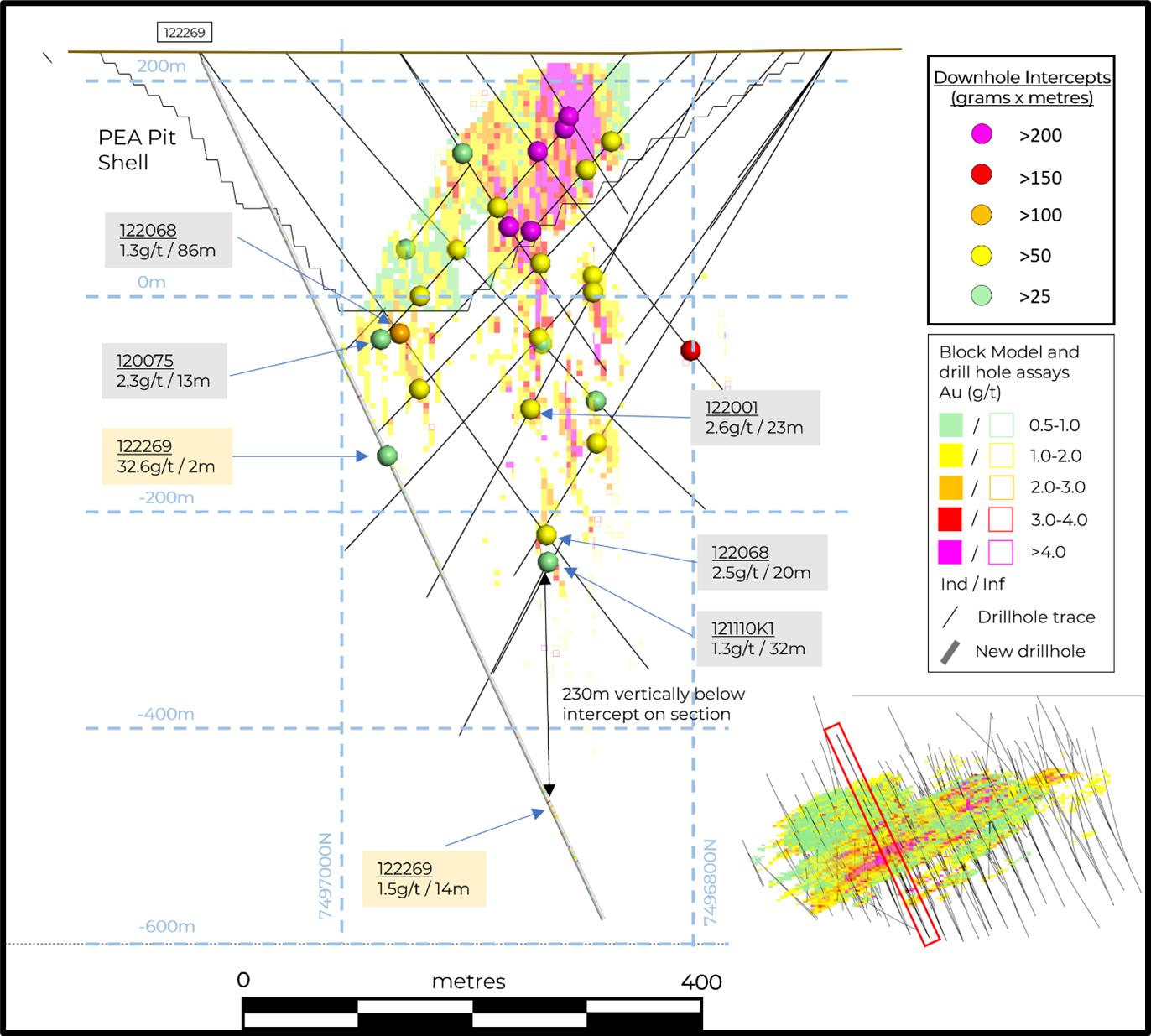

- #122269 – 14m of 1.5g/t from 816m, including 1m at 11.2g/t (figure 2b), 230m below the deepest intercept on this section and a 160m step-out west from the closest hole at a similar depth (#121036: 44m of 1.0g/t from 797m including 12m of 2.4g/t from 823m, see press release dated September 13, 2021)

James Withall, CEO of Rupert Resources commented, “We are now at the mid-point of the 2022/23 drilling campaign with winter conditions allowing drilling of Ikkari at depth. Initial results confirm the exceptional continuity of the Ikkari resource and the potential for resource expansions in the west and at depth. We have also identified further mineralisation 7km east from Ikkari along the main regional structure on our land package at Koppelo.”

2022-2023 exploration program

The 2022/2023 work program commenced in August 2022 and is planned to include up to 72,800m of drilling. Around 30,000m has been allocated to Ikkari infill and project drilling with the balance divided equally between Ikkari extension, potential satellites; and regional exploration across Rupert’s 634km2 land position, targeting additional discoveries of scale. Rupert is currently focused on near-term resource additions at Ikkari to ensure these can be included in future economic and environmental assessments and the eventual permitting application for the Project. Whilst drilling is possible year-round, winter drilling conditions are favourable for drilling deeper holes and prospective targets on softer ground.

The results reported today continue to show the consistent mineralisation over broad widths that is a unique characteristic of the Ikkari deposit. Since the initial inferred resource was defined in September 2021, closer spaced infill drilling has steadily increased confidence in the resource. The goal of the next resource update, planned in the second half of 2023, will be to further increase resources in the indicated category and grow the overall footprint of the deposit.

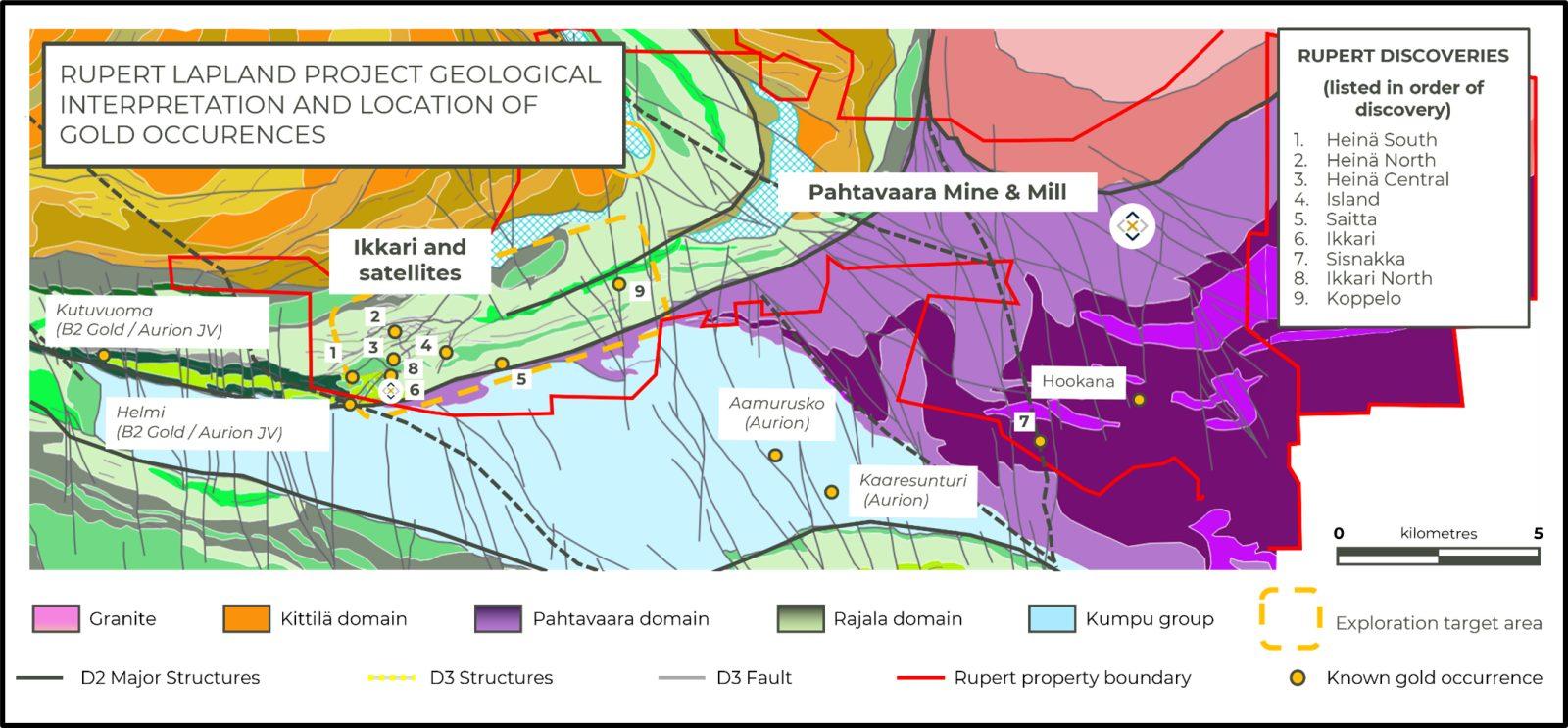

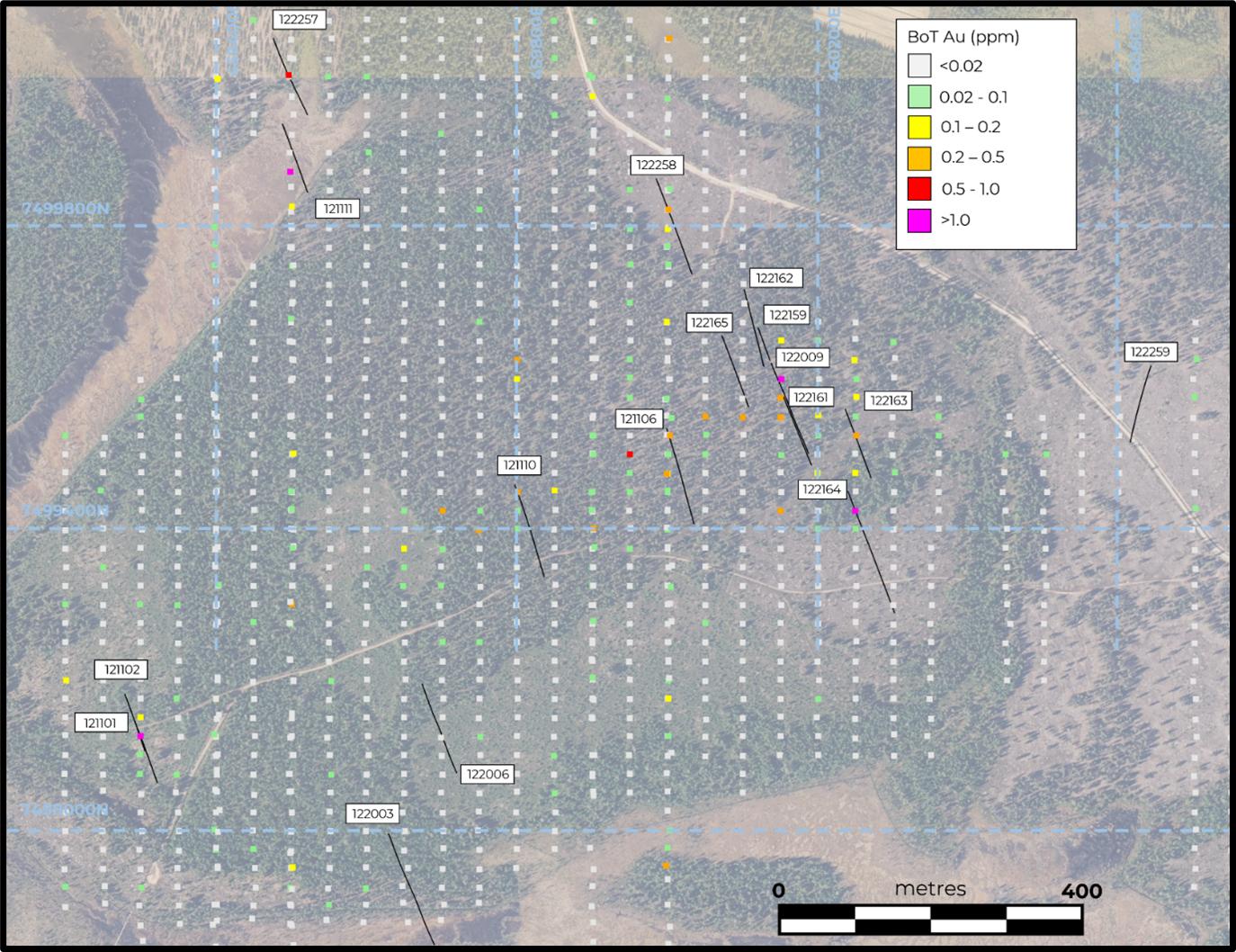

Recent regional exploration has focussed to the east of the Ikkari and Heinä discoveries along structures subparallel to the main regional ENE structural trend (figure 4) focussing on a series of base of till anomalies coincident with geophysical features of interest. Whilst drilling to date remains limited, results at Koppelo (figures 3 & 4), located 7km east northeast of Ikkari have yielded 3.1m of 5.3g/t Au from 21m in #122161 and 3m of 3.3g/t Au in #122162. Mineralisation in these holes is associated with albitised quartzites, similar in appearance to those present within the Ikkari deposit, and again provides supporting evidence of Rupert Resources ongoing methodical exploration approach.

Project updates

Appointment of Study Manager

Work is commencing on the Pre-feasibility Study for the Ikkari project and the Company has hired an experienced Study Manager, André van Wageningen to join the team. André, a Mining Engineer who also holds an MBA, brings over 20 years of experience across Canada, Sweden and Finland. He is based at our office in Sodankylä and will lead the study team. Following his appointment, the Company has issued in accordance with and subject to the terms, conditions and restrictions of the Amended and Restated Equity Incentive Plan (the “Plan”) effective November 9, 2022, 51,546 performance share units (“PSUs”) and 91,575 share options (“Options”). The PSUs will vest according to certain corporate and individual performance objectives and each PSU will convert into up to one common share of the Company, or the cash equivalent thereof, subject to the level of achievement of such performance objectives. The Options were granted on March 2, 2023 with an exercise price of $4.85 per share, being the closing price of the Company’s shares on the TSX on March 1, 2023. The Options are exercisable for a five-year period from the date of grant, with 1/3rd of the options vesting after 12 months, 1/3rd after 24 months and the remainder after 36 months.

Following the award of the Options, there are 6,092,575 share options outstanding under the Plan, representing 3.0% of the issued and outstanding shares, together with a total of 332,397 performance share units.

Pahtavaara mine environmental bond

Following submission of a revised long term closure plan for the Pahtavaara Mine in late 2019 and further updates to this in 2021, the Company has received notice from the Regional State Administrative Authority that it is seeking to increase the environmental bond for Pahtavaara beyond the amount provided for on the Company’s balance sheet of $6.2million as of November 30, 2022. The new bond provision of EUR14.2million assumes the requirement to source moraine material from outside of the current mining permit area and place this over all existing waste structures to a thickness of up to 80cm.

The Company’s proposed closure plan considered three options varying from a low CO2 emission design through to the use of 30cm of moraine cover sourced from the mine site and similar to the historic closure permit. The company is in the third year of trials to show the efficacy of direct seeding of the tailings facility, which makes up 74% of the area of total waste structures at Pahtavaara, and has a permit granted to continue these trials until the end of 2024. Results to-date have demonstrated the potential for this to be suitable low impact long-term closure solution. Furthermore, a new extensive mine waste characterisation test-work program commenced in Q3 2022. The Company is considering an appeal and will continue to liaise with the relevant authorities to arrive at the optimal long-term solution to plan for mine closure in line with industry best practice and an updated closure plan proposal will be submitted following further work.

Preliminary Economic Assessment Ikkari Project NI 43-101 amended and restated.

After the filing of the NI 43-101 on January 10th 2023, the company requested a formal review of the documents by the Ontario Securities Commission to ensure compliance in future filings. Non-material changes were requested to the list of Qualified Persons along with additional commentary for clarification within sections 12, Data Verification and 14 Mineral Resource Estimates. The changes do not affect the economic analysis, conclusions or recommendations and the revised documents have now been re-filed on SEDAR.

Geological interpretation

Ikkari was discovered using systematic regional exploration that initially focused on geochemical sampling of the bedrock/till interface through glacial till deposits of 5m to 40m thickness. No outcrop is present, and topography is dominated by low-lying swamp areas.

The Ikkari deposit occurs within rocks that have been regionally mapped as 2.05-2.15 billion years old Savukoski group greenschist-metamorphosed mafic-ultramafic volcanic rocks, part of the Central Lapland Greenstone Belt. Gold mineralisation is largely confined to the structurally modified unconformity at a significant domain boundary. Younger sedimentary lithologies are complexly interleaved, with intensely altered ultramafic rocks, and the mineralized zone is bounded to the north by a steeply N-dipping cataclastic zone. In general, alteration and structure appear to be sub-vertical, with lithologies generally dipping ~70 degrees north.

The main mineralized zone is strongly altered and characterised by intense veining and foliation that frequently overprint original textures. An early phase of finely laminated grey ankerite/dolomite veins is overprinted by stockwork-like irregular siderite ± quartz ± chlorite ± sulphide veins. These vein arrays are often deformed with shear-related boudinage and in situ brecciation. Magnetite and/or haematite are common, in association with pyrite. Hydrothermal alteration commonly comprises quartz-dolomite-chlorite-magnetite (±haematite). Gold is hosted by disseminated and vein-related pyrite. Multi-phase breccias are well developed within the mineralised zone, with early silicified cataclastic phases overprinted by late, carbonate- iron-oxide- rich, hydrothermal breccias which display a subvertical control. All breccias frequently host disseminated pyrite, and are often associated with bonanza gold grades, particularly where magnetite or haematite is prevalent. In the sedimentary lithologies, albite alteration is intense and pervasive, with pyrite-magnetite (± gold) hosted in veinlets in brittle fracture zones.

Review by Qualified Person, Quality Control and Reports

Dr Charlotte Seabrook, MAIG, RPGeo., Exploration Manager of Rupert, is the Qualified Person as defined by National Instrument 43-101 responsible for the accuracy of scientific and technical information in this news release.

Samples are prepared by ALS Finland in Sodankylä and assayed in ALS laboratories in Ireland, Romania or Sweden. All samples are under watch from the drill site to the storage facility. Samples are assayed using fire assay method with aqua regia digest and analysis by AAS for gold. Over limit analysis for >10 ppm Au is conducted using fire assay and gravimetric finish for assays over >100ppm Au. For multi-element assays, Ultra Trace Level Method by HF-HNO3-HClO4 acid digestion, HCl leach and a combination of ICP-MS and ICP-AES are used. The Company’s QA/QC program includes the regular insertion of blanks and standards into the sample shipments, as well as instructions for duplication. Standards, blanks and duplicates are inserted at appropriate intervals. Approximately five percent (5%) of the pulps and rejects are sent for check assaying at a second laboratory.

Base of till samples are prepared in ALS Sodankylä by dry-sieving method prep-41 and assayed for gold by fire assay with ICP-AES finish. Multi-elements are assayed in ALS laboratories in either of Ireland, Romania or Sweden by aqua regia with ICP-MS finish. Rupert maintains a strict chain of custody procedure to manage the handling of all samples. The Company’s QA/QC program includes the regular insertion of blanks and standards into the sample shipments, as well as instructions for duplication.

About Rupert Resources

Rupert Resources is a gold exploration and development company listed on the TSX Exchange. The Company is focused on making and advancing discoveries of scale and quality with high margin and low environmental impact potential. The Company’s principal focus is Ikkari, a new high quality gold discovery in Northern Finland. Ikkari is part of the Company’s “Rupert Lapland Project,” which also includes the Pahtavaara gold mine, mill, and exploration permits and concessions located in the Central Lapland Greenstone Belt of Northern Finland. The Company also holds a 20% carried participating interest in the Gold Centre property located adjacent to the Red Lake mine in Ontario.

Figure 1. Location of new drilling at Ikkari. Block model displayed as per November 2022 Resource update using a 0.5g/t cut-off grade in the open pit and 1.0g.t cut-off outside the open pit

Figure 2a. Cross section showing new drillholes 122206, 122195 and highlighted intercepts from the section. Section is cut as indicated on the inset plan map. Section is cut 30m wide, block model is shown only where it intersects the section line and where it is above the appropriate cut-off. Indicated resource blocks are shown with a solid colour and inferred blocks by their outline only. Intercepts above 25gram-meters are plotted as points at their mid-point and coloured by the gram-meters contained. All intercepts are calculated above a 0.4g/t cut-off and allow for a maximum of 5m internal dilution. New intercepts are highlighted by yellow boxes whilst historical intercepts are labelled with grey boxes.

Figure 2b. Cross section showing new drillhole 122269 and highlighted intercepts from the cross section. Section is cut as indicated on the inset plan map. Section is cut 30m wide, block model is shown only where it intersects the section line and where it is above the appropriate cut-off. Indicated resource blocks are shown with a solid colour and inferred blocks by their outline only. Intercepts above 25gram-meters are plotted as points at their mid-point and coloured by the gram-meters contained. All intercepts are calculated above a 0.4g/t cut-off and allow for a maximum of 5m internal dilution. New intercepts are highlighted by yellow boxes whilst historical intercepts are labelled with grey boxes.

Figure 3. New gold discoveries in Central Lapland

Figure 4 – Plan map showing the location of the Koppelo Drilling

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE