Maple Gold Reports Phase I Drill Results at Eagle, Including 6.4 g/t Gold over 3.0 meters within 4.0 g/t over 7.5 metres

Maple Gold Mines Ltd. (TSX-V: MGM) (OTCQB: MGMLF) (FSE: M3G) is pleased to report assay results from the Company’s Phase I drill program at its 100%-controlled Eagle Mine Property in Quebec, Canada. The Phase I program consisted of eight diamond drill holes totaling 4,462 metres that begin to test potential extensions of mineralization along the past-producing Eagle-Telbel Mine Trend. Importantly, drilling has identified at least four additional styles of gold mineralization beyond the known Eagle-Telbel style mined historically, providing further indications for multiple gold events that may provide for broader gold distribution than previously interpreted.

Highlights:

- Drill hole EM-22-005 intersected 4.0 grams per tonne gold over 7.5 m, including 6.4 g/t Au over 3.0 m, within a semi-massive pyrite and iron carbonate horizon typical of historical Eagle-Telbel style of mineralization (see Plates 1 and 2).

- Drill hole EM-22-001 intersected 4.4 g/t Au over 0.9 m within quartz-carbonate veinlets containing visible gold (VG).

- Drill hole EM-22-002 intersected 2.4 g/t Au over 4.7 m, including 3.8 g/t Au over 2.1 m, within highly altered, graphitic and pyritic Harricana Group sediments, as well as 2.1 g/t Au over 1.8 m further up hole in altered microgabbro.

Fred Speidel, VP Exploration of Maple Gold, stated: “We are pleased with the results to date from our initial Eagle drill campaign. The data collected during Phase I is already guiding our Phase II drilling, which tests the Eagle-Telbel Mine Trend at greater depths, and we expect to reach our target of twelve (12) drill holes totaling roughly 8,200 m by the end of this quarter. In addition, we have just completed Winter 2022 drilling at Douay with assay results anticipated in the coming weeks, and initial partnership drilling at Telbel is expected to commence in Q3 2022 as part of a recently approved C$4.8 million supplemental budget for deep drilling at Douay and Joutel. This year should prove be the Company’s busiest one yet for exploration drilling, reflecting our aim of making new discoveries and achieving significant resource gains across our Quebec project portfolio.”

Interpretation and Summary of Results

Nearly all of the Phase I drill holes contained at least one interval with greater than 1 g/t Au (see Table 1 for complete assay results). In addition to the historically mined Eagle-Telbel style semi-massive pyrite with iron carbonate veinlets in mixed felsic volcanics and sediments, Phase I drill core displayed multiple additional distinct styles of gold mineralization, including:

- Quartz-carbonate-visible gold veinlets in footwall felsic volcanics and pyroclastics

- Iron carbonate-pyrite altered microgabbro

- Silica-pyrite altered feldspar porphyry

- Pyrite-rich, graphitic, hanging wall sediments

The first three holes, EM-22-001 to EM-22-003, tested shallow targets northwest of the Eagle-Telbel Mine Trend that are primarily associated with micro-gabbro hosted mineralization, as well as sulfide-rich graphitic sediments found at the top of the Harricana Group sediments. The next two holes, EM-22-004 and EM-22-005, tested moderate depth targets characterized by abundant to semi-massive sulfide and Fe-carbonate veinlets in different proportions (see Plates 1 and 2). The last three holes, EM-22-006 to EM-22-008, tested the same pyrite and iron carbonate zones at slightly greater depth; in addition to this target, the holes also intercepted gold mineralization in microgabbro and feldspar porphyry.

Plate 1: Eagle-Telbel style semi-massive pyrite with irregular and broken up iron carbonate veinlets from 346.5 m in EM-22-005, part of 1 m sample grading 1.2 g/t Au.

Plate 2: Eagle-Telbel style semi-massive pyrite with fewer iron carbonate veinlets from 352.3 m in EM-22-005, part of a 1 m sample grading 7.6 g/t Au.

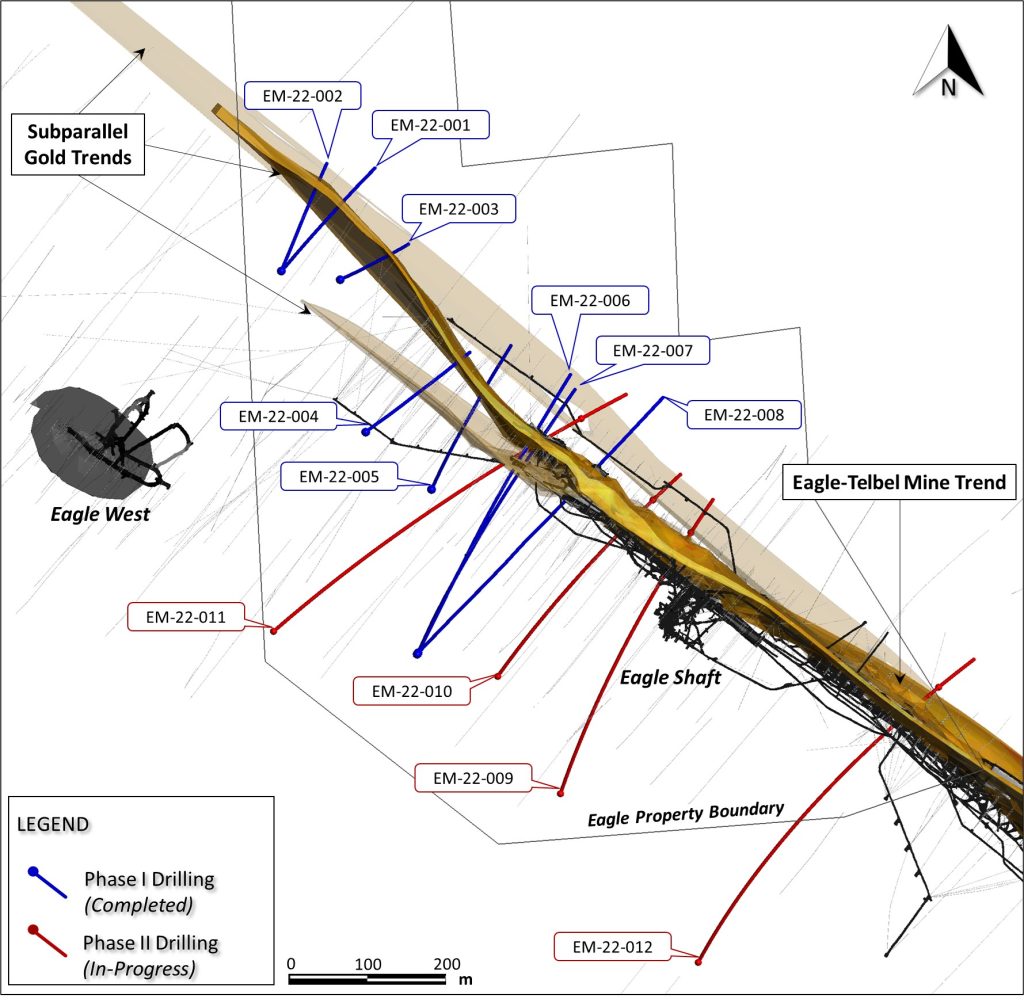

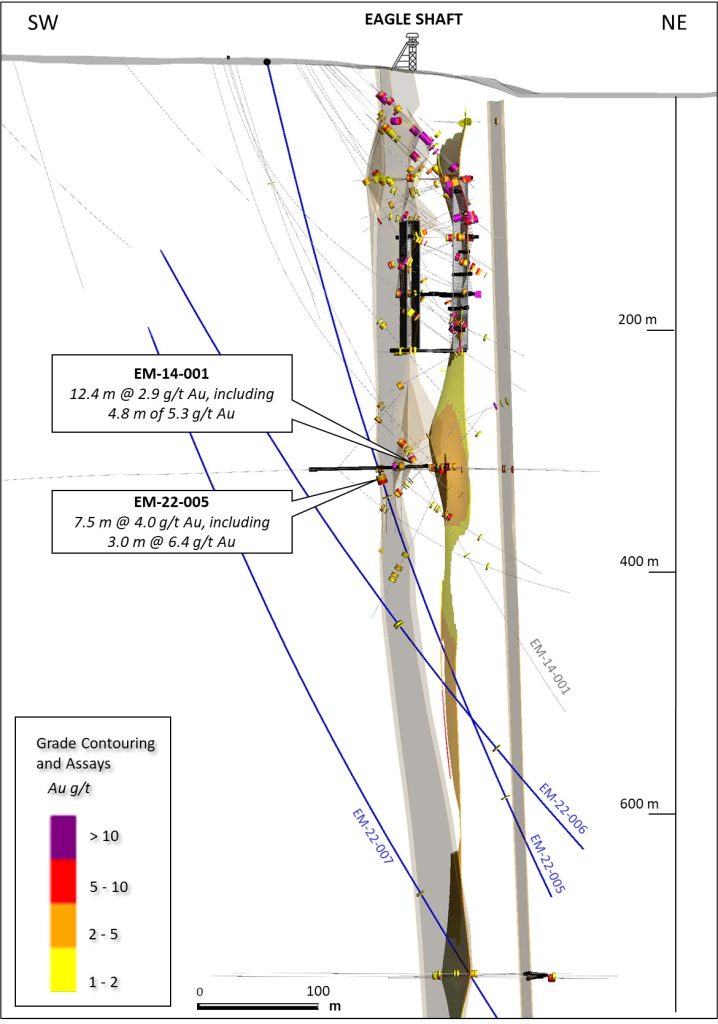

The location of the Company’s Phase I (completed) and Phase II (in-progress) drill holes is shown in Figure 1 below. A section view depicting the location of the EM-22-005 intercept relative to historical drilling (particularly EM-14-001, which returned 12.4 m of 2.9 g/t Au, including 4.8 m of 5.3 g/t Au) and the current 3D model at Eagle is shown in Figure 2 below.

Figure 1: Location of Phase I (completed) and Phase II (in-progress) drill holes at Eagle

Figure 2: NW-looking section (160 m total width) highlighting location of EM-22-005 and EM-14-001 intercepts with Eagle-Telbel style mineralization and two (2) additional subparallel gold trends based on lithologic classification and historical assay results.

Complete Phase I drill program results at Eagle are included in Table 1 below.

| Hole | UTME | UTMN | Azimuth | Plunge | Length (m) | From | To | Interval | Au (g/t) |

| EM-22-001 | 690565 | 5486334 | 40.6 | -66.8 | 356.6 | 132.0 | 134.6 | 2.6 | 1.7 |

| including | 133.7 | 134.6 | 0.9 | 4.4 | |||||

| EM-22-002 | 690565 | 5486334 | 22.0 | -52.4 | 243 | 109.4 | 110.0 | 0.7 | 2.2 |

| EM-22-002 | 183.2 | 185.0 | 1.8 | 2.1 | |||||

| EM-22-002 | 200.4 | 205.0 | 4.7 | 2.4 | |||||

| including | 200.4 | 202.4 | 2.1 | 3.8 | |||||

| EM-22-003 | 690642 | 5486322 | 59.1 | -70.5 | 288 | 146.0 | 151.0 | 5.0 | 0.4 |

| EM-22-003 | 190.0 | 195.2 | 5.2 | 0.5 | |||||

| including | 190.0 | 192.0 | 2.0 | 0.8 | |||||

| EM-22-004 | 690673 | 5486120 | 49.9 | -56.0 | 288 | 138.0 | 142.5 | 4.4 | 1.0 |

| including | 139.0 | 141.0 | 2.0 | 1.2 | |||||

| including | 149.4 | 150.0 | 0.7 | 1.1 | |||||

| EM-22-005 | 690758 | 5486043 | 22.6 | -75.7 | 714 | 346.0 | 353.5 | 7.5 | 4.0 |

| including | 350.0 | 353.0 | 3.0 | 6.4 | |||||

| EM-22-005 | 364.0 | 365.0 | 1.0 | 1.5 | |||||

| EM-22-005 | 625.0 | 626.0 | 1.0 | 1.5 | |||||

| EM-22-006 | 690737 | 5485828 | 25.9 | -63.2 | 777.7 | 539.3 | 545.6 | 6.3 | 1.0 |

| EM-22-006 | 539.3 | 543.0 | 3.7 | 1.3 | |||||

| including | 669.0 | 670.0 | 1.0 | 1.2 | |||||

| EM-22-007 | 690736 | 5485826 | 23.9 | -73.2 | 985 | 742.0 | 747.6 | 5.6 | 0.8 |

| EM-22-007 | 862.7 | 879.0 | 16.3 | 0.3 | |||||

| including | 877.0 | 878.0 | 1.0 | 2.0 | |||||

| EM-22-008 | 690737 | 5485828 | 41.9 | -66.6 | 810 | 593.0 | 596.5 | 3.5 | 0.8 |

| EM-22-008 | 600.8 | 602.8 | 2.0 | 0.8 |

Table 1: Summary of key intercepts from the Phase I Eagle drill program. All intervals are downhole core lengths. True widths are ~40-60% of downhole lengths.

Equity Incentive Plan Grant

Pursuant to its Equity Incentive Plan dated December 17, 2020 and the policies of the TSX Venture Exchange, the Company has granted stock options to an employee, officer and director of the Company. The new Options grant is a replacement award for Options that recently expired without being exercised.

Options to purchase an aggregate of 3,000,000 common shares of the Company were granted, with an exercise price of $0.23 per Common Share. Each Option grant vests one-third on the date of the grant, one-third 12 months from the date of the grant and one-third 24 months from the date of the grant. Once vested, each Option is exercisable into one Common Share for a period of five years from the date of the grant.

Further details regarding the Plan are set out in the Management Information Circular of the Company filed on May 16, 2022, which is available on SEDAR.

Qualified Person

The scientific and technical data contained in this press release was reviewed and prepared under the supervision of Fred Speidel, M. Sc., P. Geo., Vice-President Exploration of Maple Gold. Mr. Speidel is a Qualified Person under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Speidel has verified the data related to the exploration information disclosed in this press release through his direct participation in the work.

Quality Assurance and Quality Control

The Company implements strict Quality Assurance and Quality Control protocols at Eagle covering the planning and placing of drill holes in the field; drilling and retrieving the NQ-sized drill core; drillhole surveying; core transport; core logging by qualified personnel; sampling and bagging of core for analysis; transport of core from site to the Val d’Or, Quebec AGAT laboratory; sample preparation for assaying; and analysis, recording and final statistical vetting of results. For a complete description of protocols, please visit the Company’s QA/QC webpage at www.maplegoldmines.com.

About Maple Gold

Maple Gold Mines Ltd. is a Canadian advanced exploration company in a 50/50 joint venture with Agnico Eagle Mines Limited to jointly advance the district-scale Douay and Joutel gold projects located in Quebec’s prolific Abitibi Greenstone Gold Belt. The projects benefit from exceptional infrastructure access and boast ~400 km2 of highly prospective ground including an established gold resource at Douay (SLR 2022) that holds significant expansion potential as well as the past-producing Eagle, Telbel and Eagle West mines at Joutel. In addition, the Company holds an exclusive option to acquire 100% of the Eagle Mine Property.

The district-scale property package also hosts a significant number of regional exploration targets along a 55 km strike length of the Casa Berardi Deformation Zone that have yet to be tested through drilling, making the project ripe for new gold and polymetallic discoveries. The Company is well capitalized and is currently focused on carrying out exploration and drill programs to grow resources and make new discoveries to establish an exciting new gold district in the heart of the Abitibi.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE