SILVER MOUNTAIN RESOURCES INTERSECTS 2.25 m @ 793.56g/t AgEq WITHIN BROADER INTERVAL OF 10.40M @ 446.23g/t AgEq IN FIRST DRILL HOLE FROM UG DRILLING AT ITS RELIQUIAS MINE IN PERU

Silver Mountain Resources Inc. (TSX-V:AGMR) is very pleased to announce the results for drill holes SMR-001-22-MTC and SMR-002-22-SCS, the first drill holes of the 12000 m underground drilling campaign at the Company’s Reliquias underground silver mine in Huancavelica, central Peru. The Huancavelica region, and especially the Castrovirreyna mining district, is known to host significant precious metal and polymetallic deposits, such as Julcani (101 Moz Ag past production) and San Genaro (>60 Moz Ag past production).[1] Silver Mountain, through its subsidiary Sociedad Minera Reliquias S.A.C., controls over of 27,000 hectares in this belt, mostly within the prospective Reliquias and Dorita property blocks. Within the Reliquias concession block, epithermal intermediate-sulphidation style mineralization was previously mined at the Reliquias and Caudalosa Grande deposits from multiple veins, however, both vein systems remain highly underexplored.

Highlights from drill hole SMR-001-22-MTC:

- 10.40 metres with 446.23 g/t AgEq (51.85 g/t Ag, 2.95% Pb, 4.82% Zn, 0.24% Cu, and 0.17 g/t Au), including

- 2.60 metres with 406.44 g/t AgEq (54.46 g/t Ag, 2.95% Pb, 4.03% Zn, 0.30% Cu, and 0.08 g/t Au); and

- 2.25 metres with 793.56 g/t AgEq (84.49 g/t Ag, 4.24% Pb, 9.45% Zn, 0.49% Cu, and 0.10 g/t Au); and

- 0.65 metres with 1523.70 g/t AgEq (152.00 g/t Ag, 13.90% Pb, 16.70% Zn, 0.33% Cu, and 0.16 g/t Au)

Highlights from drill hole SMR-002-22-SCS:

- 1.00 metre with 718.86 g/t AgEq (235.00 g/t Ag, 4.20% Pb, 5.10% Zn, 0.56% Cu, and 0.09 g/t Au); and

- 5.70 metres with 208.64 g/t AgEq (32.63 g/t Ag, 1.00% Pb, 2.14% Zn, 0.16% Cu, and 0.11 g/t Au), including

- 1.75 metres with 396.01 g/t AgEq (60.00 g/t Ag, 2.01 % Pb, 3.85% Zn, 0.39% Cu, and 0.19 g/t Au)

Alfredo Bazo, President & CEO commented: “The assay results from our first two drill holes have confirmed high-grade Ag-Pb-Zn mineralization where modelled close to existing mine workings at the Reliquias deposit. Regarding the vein width, both drill intersections have surpassed our expectations to some extent. The drill program is advancing well with two rigs turning, with 18 holes finished to date. Our shareholders can look forward to a several news-rich months with a steady flow of drill results.”

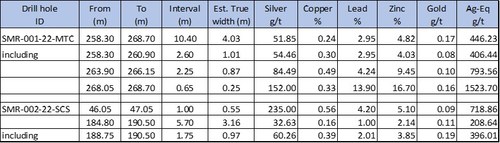

The accompanying table provides more detail regarding the mineralized intercepts encountered in drill holes SMR-001-22-MTC and SMR-002-22-SCS.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Jose Vizquerra, a Director of the Company and a Qualified Person within the meaning of National Instrument 43-101.

About Silver Mountain

Silver Mountain Resources Inc. is a silver explorer and mine developer planning to restart production at the Reliquias underground mine and undertake exploration activities at its prospective silver camps at the Castrovirreyna Project in Huancavelica, Peru.

Silver Mountain’s subsidiary Sociedad Minera Reliquias S.A.C. owns 100% of its concessions and holds more than 27,000 hectares in the district of Castrovirreyna, Huancavelica, Peru.

Sampling and Analytical Procedures

Silver Mountain Resources follows systematic and rigorous sampling and analytical protocols which meet industry standards. These protocols are summarized below.

All drill holes are diamond core holes with HQ or NQ core diameters. Drill core is collected at the underground drill site where recovery measurements are taken before the core is transported by truck to the core logging facility at the Caudalosa Grande mine camp, where it is photographed and geologically logged. The core is then cut in half with a diamond saw blade with half the sample retained in the core box for future reference and the other half placed into a pre-labelled plastic bag, sealed with a plastic zip tie, and identified with a unique sample number. The core is typically sampled over a 1-2 metre sample interval unless the geologist determines the presence of an important geological contact. The bagged samples are then stored in a secure area pending shipment to a certified laboratory sample preparation facility. Samples are sent by batch to the ALS laboratory in Lima for assay. Silver Mountain Resources independently inserts certified control standards, fine and coarse blanks, and duplicates into the sample stream to monitor data quality. These standards are inserted “blindly” to the laboratory in the sample sequence prior to departure from the core storage facilities. At the laboratory samples are dried, crushed, and pulverized and then analyzed using a fire assay-AA finish analysis for gold and a full multi-acid digestion with ICP-AES analysis for other elements. Samples with results that exceed maximum detection values for the main elements of interest (Ag, Zn, Pb, Cu) are re-analyzed using precise ore-grade ICP analytical techniques, while high gold values are re-analyzed by fire assay with a gravimetric finish.

Table 1: Results of drill holes SMR-001-22-MTC and SMR-002-22-SCS. AgEq values were calculated using silver, lead, zinc, copper, and gold. Metal prices utilized for the calculations are current prices as of June 9, 2022: Ag – 21.92US$/oz, Pb – 2,150US$/t, Zn – 3,754US$/t, Cu – 4.38US$/lb, and Au – 1,846US$/oz. No adjustments were made for recovery as sufficient metallurgical data to allow for estimation of recoveries is not yet available. (CNW Group/Silver Mountain Resources Inc.)

Table 1: Results of drill holes SMR-001-22-MTC and SMR-002-22-SCS. AgEq values were calculated using silver, lead, zinc, copper, and gold. Metal prices utilized for the calculations are current prices as of June 9, 2022: Ag – 21.92US$/oz, Pb – 2,150US$/t, Zn – 3,754US$/t, Cu – 4.38US$/lb, and Au – 1,846US$/oz. No adjustments were made for recovery as sufficient metallurgical data to allow for estimation of recoveries is not yet available. (CNW Group/Silver Mountain Resources Inc.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE