Vizsla Expands Napoleon Resource Area and Outlines High-Grade Footprint

Vizsla Silver Corp. (TSX-V: VZLA) (OTCQB: VIZSF) (Frankfurt: 0G3) is pleased to provide additional results from twenty one new drill holes targeting the Napoleon Vein resource area at its flagship Panuco silver-gold project located in Mexico.

Highlights

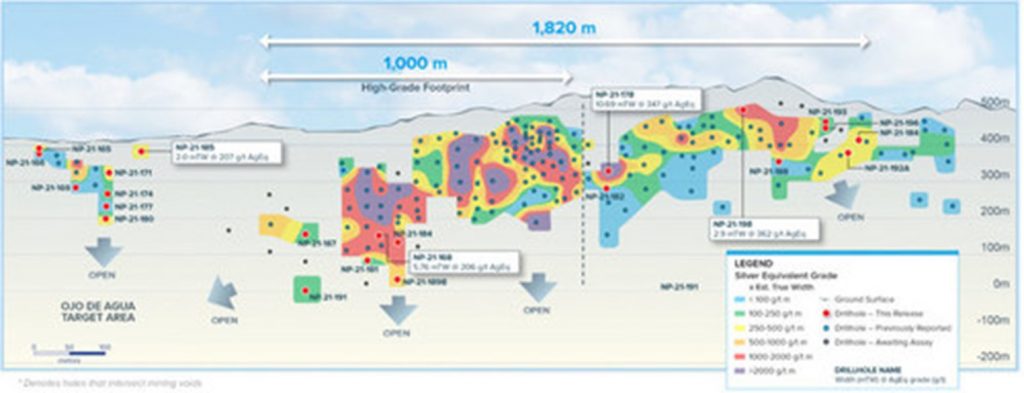

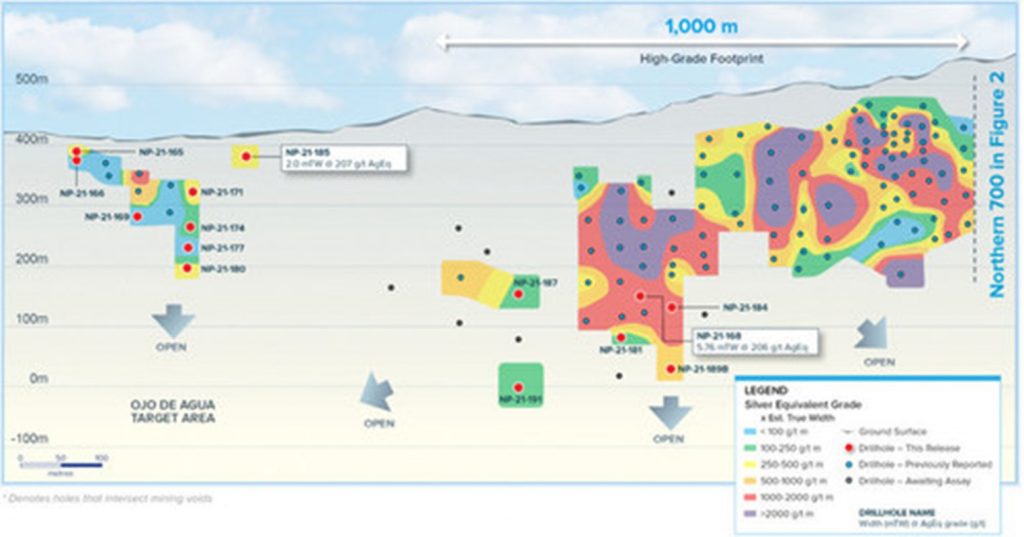

- Drilling has now defined a higher-grade precious metals rich footprint at Napoleon measuring approximately 1,000 metres long by an average 400 metres deep with an average true width of 3.86 metres. Based on 106 holes completed to date, the higher-grade footprint hosts an uncut, undiluted weighted average grade of 453 g/t AgEq (148 g/t silver, 2.90 g/t gold, 0.46% lead and 1.44% zinc)

- The greater Napoleon Vein resource area, including the higher-grade footprint, now measures approximately 1,820 metres long by approximatly 300 metres average depth with an average true width of 3.36 metres. Based on a total of 159 holes, the greater Napoleon resource area has an uncut, undiluted weighted average grade of 421 g/t AgEq (142 g/t silver, 2.62 g/t gold, 0.46% lead and 1.39% zinc)

| Note: All numbers are rounded. Silver equivalent is calculated using the following formula: Silver-equivalent = ((Au_g/t x 52.48) + (Ag_g/t x 0.5289) + (Pb_ppm x 0.0013) + (Zn_ppm x 0.0013)) / 0.5627. Metal price assumptions are $17.50 oz silver, $1,700 oz gold, $0.75 pound lead and $0.85 pound zinc, recoveries assumptions are 96% gold, 94% silver, 78% lead and 70% zinc based on similar deposit types. |

Vizsla President and CEO Michael Konnert commented: “As we rapidly approach the deadline for drilling to be incorporated into the maiden Panuco resource estimate, anticipated in Q1 2022, new results from the Napoleon Vein continue to demonstrate the exceptional size and grade of the underlying system. Large step-outs have now expanded the zone’s greater mineralized footprint to over 1,800 metres along strike with a notable higher-grade precious metals rich subzone developing over 1,000 metres to the south and below the discovery hole. This near-surface high-grade subzone hosts multiple intercepts over 1,000 g/t AgEq and reamains open to the south and at depth “

Napoleon Drilling Detail

Napoleon drilling continues to highlight one long continuous panel of mineralization, now traced over 1,820 metres of total strike length. A higher-grade footprint, developing to the south of discovery hole NP-20-07, is marked by multiple intercepts grading over 1,000 g/t AgEq. Newly reported holes within this area further emphasise a shallowly plunging panel of higher-grade mineralization dipping ~20o to the south.

The higher-grade footprint is a relatively wide, precious metals rich, subzone extending from the original discovery area to the south (Figure 2). This near-surface higher-grade footprint has an average vein width of 3.9 metres with an uncut, undiliuted weighted average grade of 453 g/t AgEq (148 g/t silver, 2.90 g/t gold, 0.46% lead and 1.4% zinc). The high-grade footprint currently spans ~1,000 metres along strike to an average depth of 400 metres. However, locally, mineralization has been traced down to 450 metres below surface marked by previously reported hole NP-21-189B. Mineralization remains open to depth and to the south.

To the north of the original discovery area, towards Papayo, medium grade mineralization is observed to be relatively narrow compared to the higher-grade footprint (1.8 mTw vs 3.9 mTw), extending to the far north of Napoleon (Figure 1). In total, the greater Napoleon Vein resource area, including the higher-grade footprint, now covers an area ~1,820 metres long by 300 meters deep with an average vein width of 3.36 metres and an uncut, undiltuted weighted average grade of 421 g/t AgEq (142 g/t silver, 2.62 g/t gold, 0.46% lead and 1.39% zinc). The greater Napoleon Vein ore density is estimated at 2.72 tonnes/cubic metre based from results of 49 samples analysed.

Complete table of Napoleon Resource Area Intersections

| Drillhole | From | To | Estimated true width |

Gold | Silver | Lead | Zinc | Silver Equivalent |

Zone |

| (m) | (m) | (m) | (g/t) | (g/t) | (%) | (%) | (g/t) | ||

| NP-21-165 | 25.50 | 26.55 | 0.82 | 4.00 | 9 | 0.02 | 0.04 | 383 | OdA |

| NP-21-166 | No Significant value | OdA | |||||||

| NP-21-168 | 292.25 | 306.25 | 5.76 | 0.81 | 56 | 0.84 | 2.55 | 206 | |

| NP-21-169 | No Significant value | ||||||||

| NP-21-171 | 123.55 | 125.05 | 1.21 | 2.25 | 26 | 0.00 | 0.00 | 234 | OdA |

| NP-21-174 | 162.50 | 163.50 | 0.72 | 0.19 | 156 | 0.06 | 0.32 | 173 | OdA |

| NP-21-177 | No Significant value | OdA | |||||||

| NP-21-178 | 228.15 | 241.25 | 10.69 | 1.21 | 220 | 0.41 | 0.77 | 347 | |

| Incl. | 237.00 | 241.25 | 3.47 | 2.81 | 469 | 0.66 | 1.17 | 746 | |

| NP-21-180 | 240.65 | 242.45 | 1.74 | 0.29 | 206 | 0.01 | 0.04 | 222 | OdA |

| NP-21-181 | 462.00 | 463.10 | 0.74 | 1.72 | 9 | 0.21 | 0.26 | 179 | |

| NP-21-182 | No Significant value | ||||||||

| NP-21-184 | 358.85 | 363.25 | 1.63 | 2.69 | 33.6 | 0.19 | 2.16 | 337 | |

| NP-21-185 | 50.00 | 52.85 | 2.52 | 0.54 | 156 | 0.16 | 0.29 | 207 | OdA |

| NP-21-187 | 394.40 | 397.20 | 1.80 | 0.37 | 15 | 0.09 | 3.15 | 124 | |

| NP-21-188 | No Significant value | ||||||||

| NP-21-189B | 591.00 | 597.00 | 3.21 | 0.40 | 20 | 0.45 | 2.74 | 129 | Papayo |

| NP-21-191 | 545.20 | 547.90 | 0.80 | 0.29 | 148 | 0.25 | 3.44 | 251 | |

| NP-21-192A | 143.60 | 145.50 | 1.14 | 4.75 | 128 | 1.20 | 2.53 | 650 | Papayo |

| NP-21-193 | 71.45 | 73.60 | 1.06 | 0.44 | 60 | 0.08 | 0.15 | 103 | |

| NP-21-194 | 113.65 | 114.30 | 0.39 | 7.76 | 286 | 1.68 | 3.42 | 1,110 | Papayo |

| NP-21-198 | 85.25 | 88.50 | 2.90 | 0.76 | 210 | 2.22 | 1.84 | 362 | Papayo |

| Table 1: Drillhole intersections from the Napoleon Vein Resource area not previously reported | |||||||||

| Note: All numbers are rounded. Silver equivalent is calculated using the following formula: Silver-equivalent = ((Au_g/t x 52.48) + (Ag_g/t x 0.5289) + (Pb_ppm x 0.0013) + (Zn_ppm x 0.0013)) / 0.5627. Metal price assumptions are $17.50 oz silver, $1,700 oz gold, $0.75 pound lead and $0.85 pound zinc, recoveries assumptions are 96% gold, 94% silver, 78% lead and 70% zinc based on similar deposit types. | |||||||||

Drill Collar Information

| Prospect | Drillhole | Easting | Northing | Elevation | Dip | Azimuth | Hole Depth |

| Napoleon | NP-21-165 | 403,634 | 2,586,038 | 407 | -42.0 | 268.0 | 121.0 |

| NP-21-166 | 403,634 | 2,586,038 | 407 | -62.0 | 268.0 | 160.5 | |

| NP-21-168 | 403,502 | 2,586,975 | 426 | -66.5 | 260.5 | 351.9 | |

| NP-21-169 | 403,648 | 2,586,135 | 397 | -65.0 | 270.0 | 223.5 | |

| NP-21-171 | 403,630 | 2,586,198 | 403 | -40.0 | 290.0 | 176.6 | |

| NP-21-174 | 403,630 | 2,586,199 | 402 | -55.5 | 283.0 | 215.0 | |

| NP-21-177 | 403,630 | 2,586,199 | 403 | -65.0 | 283.0 | 260.0 | |

| NP-21-178 | 403,497 | 2,587,577 | 486 | -40.4 | 272.7 | 294.0 | |

| NP-21-180 | 403,698 | 2,586,196 | 410 | -62.0 | 283.0 | 360.0 | |

| NP-21-181 | 403,636 | 2,586,957 | 478 | -59.0 | 261.5 | 516.0 | |

| NP-21-182 | 403,497 | 2,587,577 | 486 | -49.9 | 272.0 | 300.9 | |

| NP-21-184 | 403,572 | 2,587,015 | 449 | -61.0 | 267.0 | 420.0 | |

| NP-21-185 | 403,556 | 2,586,310 | 416 | -41.0 | 270.0 | 111.0 | |

| NP-21-187 | 403,711 | 2,586,773 | 445 | -49.0 | 255.0 | 498.0 | |

| NP-21-188 | 403,421 | 2,588,099 | 575 | -47.5 | 266.0 | 294.8 | |

| NP-21-189B | 403,763 | 2,587,027 | 488 | -51.0 | 267.0 | 642.0 | |

| NP-21-191 | 403,711 | 2,586,773 | 445 | -55.0 | 266.0 | 595.5 | |

| NP-21-192A | 403,246 | 2,588,229 | 515 | -68.5 | 274.0 | 300.0 | |

| NP-21-193 | 403,224 | 2,588,171 | 524 | -56.0 | 268.4 | 298.5 | |

| NP-21-194 | 403,246 | 2,588,229 | 515 | -60.0 | 312.0 | 201.0 | |

| NP-21-198 | 403,327 | 2,587,986 | 548 | -37.0 | 244.0 | 168.0 |

Table 2: Drill hole details. Coordinates in WGS84, Zone 13

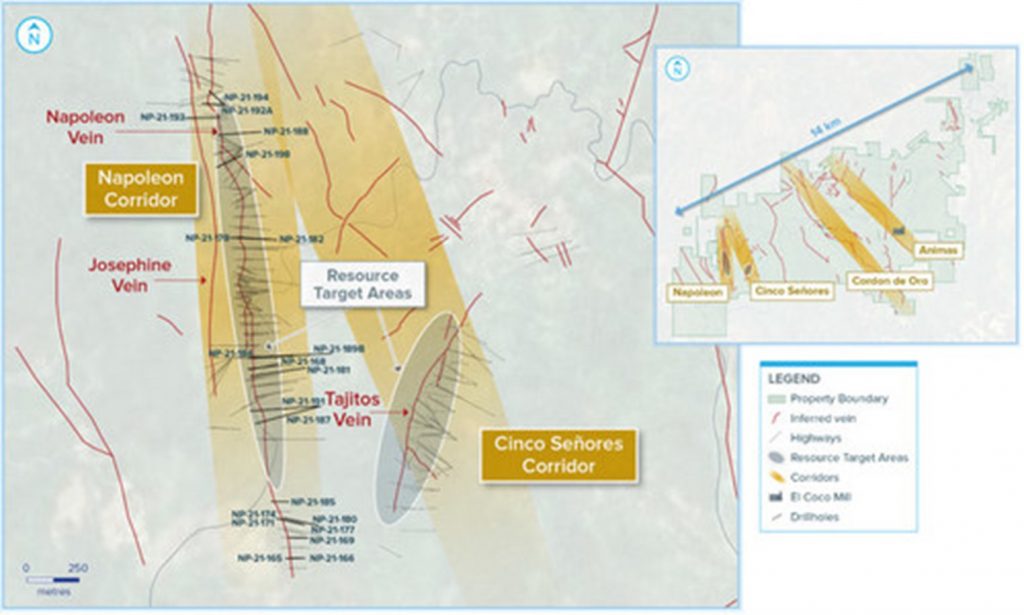

About the Panuco project

The newly consolidated Panuco silver-gold project is an emerging high-grade discovery located in southern Sinaloa, Mexico, near the city of Mazatlán. The 6,754.1-hectare, past producing district benefits from over 75 kilometres of total vein extent, a 500 ton per day mill, 35 kilometres of underground mines, tailings facilities, roads, power and permits.

The district contains intermediate to low sulfidation epithermal silver and gold deposits related to siliceous volcanism and crustal extension in the Oligocene and Miocene. Host rocks are mainly continental volcanic rocks correlated to the Tarahumara Formation.

Note: Two new claims have been acquired adding 149.9 hectares of new area. 4,103.5 hectares previously reported as part of the Panuco project have been removed from the total hectares due to 4 claims being located at a significant distance from the project. These hectares remain as 100% owned by Vizsla Silver.

Quality Assurance / Quality Control

Drill core and rock samples were shipped to ALS Limited in Zacatecas, Zacatecas, Mexico and in North Vancouver, Canada for sample preparation and for analysis at the ALS laboratory in North Vancouver. The ALS Zacatecas and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Silver and base metals were analyzed using a four-acid digestion with an ICP finish and gold was assayed by 30-gram fire assay with atomic absorption (“AA”) spectroscopy finish. Over limit analyses for silver, lead and zinc were re-assayed using an ore-grade four-acid digestion with AA finish.

Control samples comprising certified reference samples, duplicates and blank samples were systematically inserted into the sample stream and analyzed as part of the Company’s quality assurance / quality control protocol.

Qualified Person

The Company’s disclosure of technical or scientific information in this press release has been reviewed and approved by Martin Dupuis, P.Geo., Vice President of Technical Services for Vizsla Silver. Mr. Dupuis is a Qualified Person as defined under the terms of National Instrument 43-101.

Longitudinal section of the entire main Napoleon prospect with all holes labelled and selected intersections shown. (CNW Group/Vizsla Silver Corp.)

Longitudinal section from the southern half of the Napoleon prospect with all holes labelled and selected intersections shown. Scale bar identifies extent of the higher-grade panel of mineralization. (CNW Group/Vizsla Silver Corp.)

Plan map of the main Napoleon Corridor resource area highlighting recent drilling. (CNW Group/Vizsla Silver Corp.)

MORE or "UNCATEGORIZED"

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 Kilometres West of Eureka; Follow-Up Drill Program Underway

Delta Reports New Gold Intercept at Nova Target in Wedge Area, 4 ... READ MORE

Silver One Announces Closing Of Final Tranche Of $32 Million Financing

Silver One Resources Inc. (TSX-V: SVE) (OTCQX: SLVRF) (FSE: BRK1)... READ MORE

SAGA Metals Achieves 100% Drilling Success in 2025—Reports Final Assays from Trapper South at Radar Critical Minerals Project in Labrador

Exceptional grades of Titanium, Vanadium and Iron in all 15 drill... READ MORE

Near Surface Intersection Yields 6.58 g/t gold over 10.35 metres

Intersection is within 33 metres from surface and contained in a ... READ MORE

Alamos Gold Provides Three-Year Operating Guidance Outlining 46% Production Growth by 2028 at Significantly Lower Costs

Further production growth to one million ounces annually expected... READ MORE