ORENINC INDEX leaps as big deals announced

ORENINC INDEX – Monday, September 24th 2018

North America’s leading junior mining finance data provider

Free sign-up at www.oreninc.com

ORENINC MINING DEAL CLUB

Access to high-quality, pre-vetted financing opportunities

www.miningdealclub.com

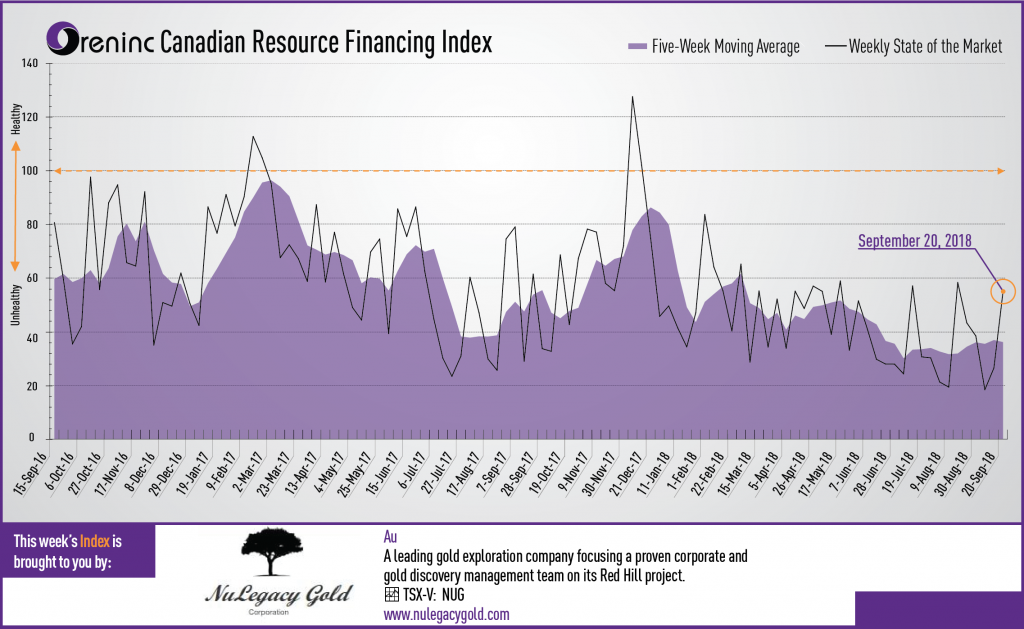

Last week index score: 26.49

This week: 54.58

Prospero Silver (TSXV:PSL) completed a private placement financing with Fortuna Silver Mines, raising gross proceeds of C$356,000.

NuLegacy Gold (TSXV:NUG) said director Ed Cope will join its management to oversee exploration and be responsible for property evaluation and acquisition.

The Oreninc Index doubled in the week ending September 14th, 2018 to 54.58 from 26.49 a week ago, as a couple of big deals were announced.

As the junior end of the precious metals world was in Beaver Creek for the Precious Metals Summit, the US announced a 10% tariff on over 5,000 products from China representing some US$200 billion, with those set to rise to 25% in January 2019. The White House also indicated that more would follow if China retaliated. Instead of retaliation, China said it would reduce tariffs on a number of goods from other non-US countries.

In Europe, the UK experienced increasing pushback form the European Union at a meeting in Salzberg, Austria concerning its proposals about how it will leave the international block in March 2019. If the deadlock in negotiations persists, the UK faces the prospect of leaving the UK with no new arrangements in place threatening to send the country into a prolonged recession.

Meanwhile investment fund Vanguard is due to complete an overhaul to its US$2.3 billion precious metals and mining fund, which will be renamed the Vanguard Global Capital Cycles Fund. It will focus on telecommunications and utilities, with only about 25% exposure to precious metals and mining.

At Beaver Creek, Joseph Foster of the VanEck said that gold needs a catalyst to break out, but events such as the war in Syria, the financial events in Turkey or the US trade war with China are too isolated to fill that role because they do not pose a major systemic threat to the financial system. He suggested that catalysts could come in the shape of the US mid-term elections in November if the Democrats win either house, or increasing interest rate rises by the US Federal Reserve that will eventually push the US into a recession.

Also in Beaver Creek, Oreninc recorded a new podcast with Brent Cook and Joe Mazumdar of Exploration Insights, Tim Oliver and Paul Harris of the Oreninc Mining Deal Club.

On to the money: total fund raises announced surged to C$198.8 million, an 40-week high, which included two brokered financings for C$38.5 million, a five-week high, and two bought-deal financings for C$38.5 million, also a five-week high. The average offer size multiplied several times to C$9.9 million, an 88-week high, whilst the number of financings remained at 20.

Another volatile week for gold as it showed some fight as it oscillated around the US$1,200/oz level, and closed up at US$1,200/oz from US$1,194/oz a week ago, with a mid-week high of US$1,207/oz. It is now down 7.89% this year. The US dollar index continued to fall as it ended the week at 94.22 from 94.92 last week. The van Eck managed GDXJ saw some life as it closed up at US$28.08 from US$26.81 a week ago. The index is down 17.73% so far in 2018. The US Global Go Gold ETF closed up again at US$10.90 from US$10.45 a week ago. It is now down 16.20% so far in 2018. The HUI Arca Gold BUGS Index also closed up again at 142.87 from 137.48 last week. The sell-off in the SPDR GLD ETF came to a halt with its inventory remaining at 742.53 tonnes, the same as a week ago.

In other commodities, silver’s fall ended as it closed up at US$14.30/oz from US$14.06/oz a week ago. Copper saw strong growth to close up at US$2.85/lb from US$2.64/lb last week. Oil also continued to grow as WTI closed up at US$70.78 a barrel from US$68.99 a barrel a week ago.

The Dow Jones Industrial Average continued to grow and established another record as it closed up at 26,743 from 26,154 last week. However, Canada’s S&P/TSX Composite Index also returned to growth as it closed up at 16,224 from 16,013 the previous week. The S&P/TSX Venture Composite Index continued to grow as it closed up at 719.95 from 715.16 last week.

Summary

- Number of financings remained at 20.

- Two brokered financings were announced this week for C$38.5m, a five-week high.

- Two bought-deal financing was announced this week for C$38.5m, a five-week high.

- Total dollars surged to C$198.8m, a 40-week high.

- Average offer size multiplied to C$9.9m, an 88-week high.

Financing Highlights

Equinox Gold (TSXV:EQX) announced a fully underwritten brokered private placement and a fully subscribed non-brokered private placement for aggregate gross proceeds of US$75 million.

- Equinox entered into an agreement with a syndicate of underwriters led by Scotiabank and BMO Capital Markets for a brokered bought deal private placement of 34.2 million subscription receipts @ C$0.95 for gross proceeds of US$25 million (C$32.5 million) and US$50 million (C$65.0 million) in a non-brokered private placement financing consisting of 68.4 million subscription receipts @ C$0.95. The non-brokered private placement is fully subscribed by Ross Beaty, the company’s chairman and largest shareholder, certain existing shareholders and new institutional shareholders.

- Equinox entered into a purchase agreement to acquire the Mesquite gold mine in California from New Gold (TSX:NGD) US$$158 million cash. Mesquite is on track to produce 140,000-150,000oz Au in 2018.

- Equinox also obtained a US$100 million acquisition credit facility from Scotiabank and a US$20 million credit facility from Sprott Private Resource Lending.

TMAC Resources (TSX:TMR) opened a C$90 million raise via a C$66.5 million private placement that its largest shareholders have committed to and C$23.5 million via a concurrent marketed overnight public offering and flow-through common shares.

- A syndicate of underwriters led by BMO Capital Markets and CIBC Capital Markets acting as joint bookrunners.

- The net proceeds will be used for debt repayment, exploration and capital expenditures.

Major Financing Openings

- Equinox Gold (TSXV:EQX) opened a C$5 million offering on a best efforts basis. The deal is expected to close on or about October 3rd.

- TMAC Resources (TSX:TMR) opened a C$4 million offering on a best efforts basis. The deal is expected to close on or about October 11th.

- Blackbird Energy (TSXV:BBI) opened a C$4 million offering on a best efforts basis.

- UEX (TSXV:UEX) opened a C$6 million offering underwritten by a syndicate led by Cormark Securities on a bought deal The deal is expected to close on or about October 10th.

Major Financing Closings

- Osisko Mining (TSX:OSK) closed a C$43 million offering underwritten by a syndicate led by Canaccord Genuity on a bought deal basis.

- Front Range Resources (TSXV:FRK) closed a C$05 million offering on a best efforts basis. Each unit included a warrant that expires in two years.

- Fura Gems (TSXV:FURA) closed a C$05 million offering on a best efforts basis.

- Wallbridge Mining (TSX:WM) closed a C$9 million offering on a strategic deal basis.

Company News

Prospero Silver (TSXV:PSL) completed a private placement financing with Fortuna Silver Mines, raising gross proceeds of C$356,000.

- The offering consisted of 4.7 million shares.

- The proceeds will be used to drill its Bermudez project in Chihuahua, Mexico.

NuLegacy Gold (TSXV:NUG) said director Ed Cope will join its management to oversee exploration and be responsible for property evaluation and acquisition.

MORE or "UNCATEGORIZED"

First Phosphate Confirms Another High Grade Intersect of 11.85% Igneous Phosphate Across 84 Metres Starting from Surface at Its Begin-Lamarche Project in Saguenay-Lac-St-Jean, Quebec, Canada

First Phosphate Corp. (CSE: PHOS) (OTC: FRSPF) (FSE: KD0) is plea... READ MORE

MAG Silver Reports First Quarter Financial Results

MAG Silver Corp. (TSX:MAG) (NYSE American: MAG) announces the Com... READ MORE

Troilus Announces Feasibility Study Results for the Gold-Copper Troilus Project: Outlines a Large Scale, 22-Year Open Pit Project in Tier-One Jurisdiction With USD$884.5 Million NPV(5%)

Troilus Gold Corp. (TSX: TLG) (OTCQX: CHXMF) reports results from... READ MORE

Alamos Gold Intersects Higher-Grade Mineralization within a New Zone Near Existing Infrastructure at Young-Davidson

Alamos Gold Inc. (TSX:AGI) (NYSE:AGI) reported new results from i... READ MORE

Titan Reports First Quarter 2024 Results; National Safety Recognition Award

Titan Mining Corporation (TSX: TI) announces the results for the... READ MORE