Jordan Roy-Byrne – “Is the Relative Strength in Gold Miners to Gold Significant”

It has been a tough spring and summer for precious metals. Gold failed to breakout when it had the chance and it closed the second quarter in ominous and weak fashion. It was the lowest monthly close in more than a year. Silver has performed better but only because it has not declined to the degree Gold has. The one technical positive for the sector is the positive divergence in the miners. They did not make new lows in the second quarter. That is encouraging but only time will tell us how sustainable and significant that might be.

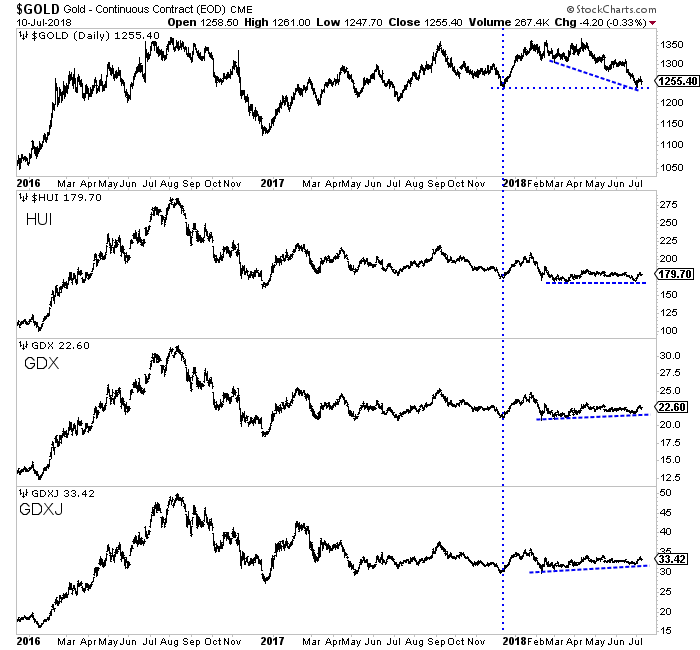

As the chart below shows, the gold stocks held up quite well as Gold broke below its spring low (around $1300/oz). Gold declined 5.5% in the second quarter yet both GDX and GDXJ gained 1.5% and 1.7% respectively (while the HUI was down marginally).

That relative strength is certainly encouraging, but does it indicate the sector is about to explode higher?

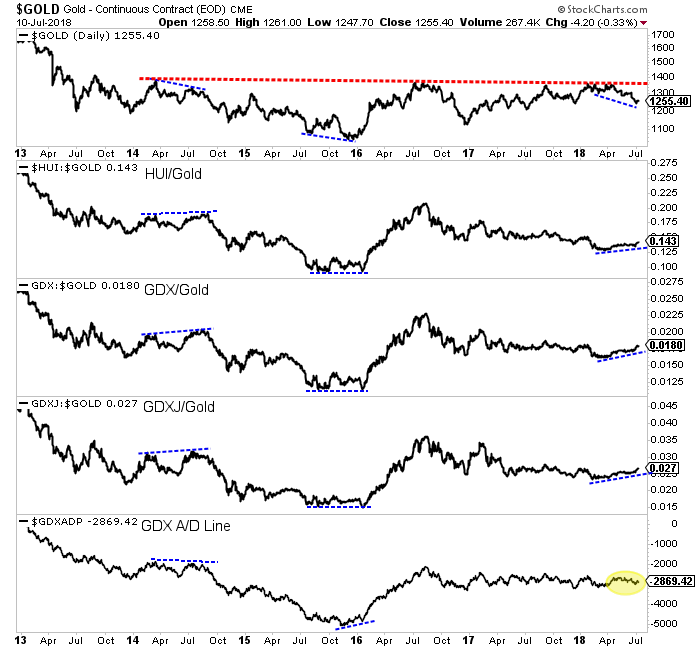

Recent history shows two other examples of a positive divergence with respect to gold stock performance against Gold. In the summer of 2014, the various gold stock indices relative to Gold made higher highs while Gold didn’t even come close to its earlier 2014 high. That resolved terribly if you were a gold bull. However, at the end of 2016, the gold stocks relative to Gold did not make a new low while Gold did. That resolved wonderfully for gold bulls.

The GDX advance decline line (plotted at the bottom of the chart) argues that the sector is unlikely on the cusp of another 2016 upside explosion. Over the past few months it has declined while the gold stocks relative to Gold have trended higher. The current relative strength in the gold stocks would be much more encouraging if it was matched by the same type of positive divergence in the advance decline line.

Ultimately, there are two ways the current setup will resolve.

Gold will either rally back to and overtake major resistance at $1300-$1310 or roll over after approaching said resistance.

In the rollover scenario (which is more likely) we will find out if the current relative strength in the gold stocks can be sustained. If it can, even as Gold moves lower, that would be significant. But at present and without a similar positive divergence in the advance decline line it is too soon to deem the relative strength as significant or bullish (beyond the short term). To follow our guidance and learn our favorite juniors for the next 6 to 12 months, consider learning about our premium service.

MORE or "UNCATEGORIZED"

First Phosphate Confirms Another High Grade Intersect of 11.85% Igneous Phosphate Across 84 Metres Starting from Surface at Its Begin-Lamarche Project in Saguenay-Lac-St-Jean, Quebec, Canada

First Phosphate Corp. (CSE: PHOS) (OTC: FRSPF) (FSE: KD0) is plea... READ MORE

MAG Silver Reports First Quarter Financial Results

MAG Silver Corp. (TSX:MAG) (NYSE American: MAG) announces the Com... READ MORE

Troilus Announces Feasibility Study Results for the Gold-Copper Troilus Project: Outlines a Large Scale, 22-Year Open Pit Project in Tier-One Jurisdiction With USD$884.5 Million NPV(5%)

Troilus Gold Corp. (TSX: TLG) (OTCQX: CHXMF) reports results from... READ MORE

Alamos Gold Intersects Higher-Grade Mineralization within a New Zone Near Existing Infrastructure at Young-Davidson

Alamos Gold Inc. (TSX:AGI) (NYSE:AGI) reported new results from i... READ MORE

Titan Reports First Quarter 2024 Results; National Safety Recognition Award

Titan Mining Corporation (TSX: TI) announces the results for the... READ MORE