Wallbridge Phase 2 Exploration Drilling Returns Multiple High Grade Gold Intercepts from Satellite Targets Along Bug Lake Zone at Martiniere

Wallbridge Mining Company Limited (TSX:WM) (OTCQB:WLBMF) today announced the results of the Phase 2 exploration drilling program at its 100% owned Martiniere gold project which returned multiple high grade gold intercepts from three exploration targets along the Bug Lake deformation zone located within 500 metres of the currently delineated mineral resource.

Highlights

Significant high grade gold intercepts returned from the Phase 2 drilling program at Martiniere include:

| BL North | 5.78 g/t Au over 3.9 m including 21.56 g/t Au over 0.9 m in hole MR-24-099

|

| Horsefly | 15.63 g/t Au over 11.0 m including 15.18 g/t over 2.3 m, 37.13 g/t Au over 1.8 m, 41.68 g/t Au over 1.2 m & 23.18 g/t Au over 0.8 m, and 7.24 g/t Au over 6.9 m including 17.56 g/t Au over 1.9 m & 6.88 g/t Au over 1.3 m in hole MR-24-100 |

| Dragonfly | 4.22 g/t Au over 4.5 m including 7.99 g/t Au over 1.1 m & 8.97 /t over 1.1 m in hole MR-24-089

3.93 g/t Au over 6.0 m including 12.15 g/t Au over 0.9 m & 5.02 g/t Au over 2.2 m in hole MR-24-092 27.60 g/t Au over 2.3 m including 9.99 g/t Au over 0.6 m & 86.30 g/t Au over 0.7 m in hole MR-24-110 |

“We are very pleased with the positive results from the Martiniere Phase 2 drilling program, as this marks another significant milestone in advancing the project,” commented Brian W. Penny, Wallbridge CEO. “The phase 2 program was targeted at zones of high grade gold mineralization along the Bug Lake deformation zone that were identified as an outcome of a detailed re-interpretation of deposit geology completed as part of the Phase 1 program earlier this year (see Wallbridge news release dated July 31, 2024).

“Various high grade gold intercepts returned from the three targets (Horsefly, Bug Lake North and Dragonfly) clearly demonstrate that the limits of the Martiniere deposit remain to be fully delineated, offering a substantial resource growth opportunity through continued exploration.

“Wallbridge’s 2024 exploration results underscore the significant potential of the Martiniere project for future growth. The results of the 2024 drilling program will be incorporated into an updated mineral resource estimate, which the company plans to complete in Q1 2025. The Wallbridge team is eagerly anticipating following up on the positive results from this year’s program as we look forward into 2025,” concluded Mr. Penny.

Webinar

For additional context to this news release, join Brian W. Penny, CEO, and Mark Peterson, Senior Geological Consultant Thursday, November 7th, 2024 at 2:00 PM ET for a live webinar here.

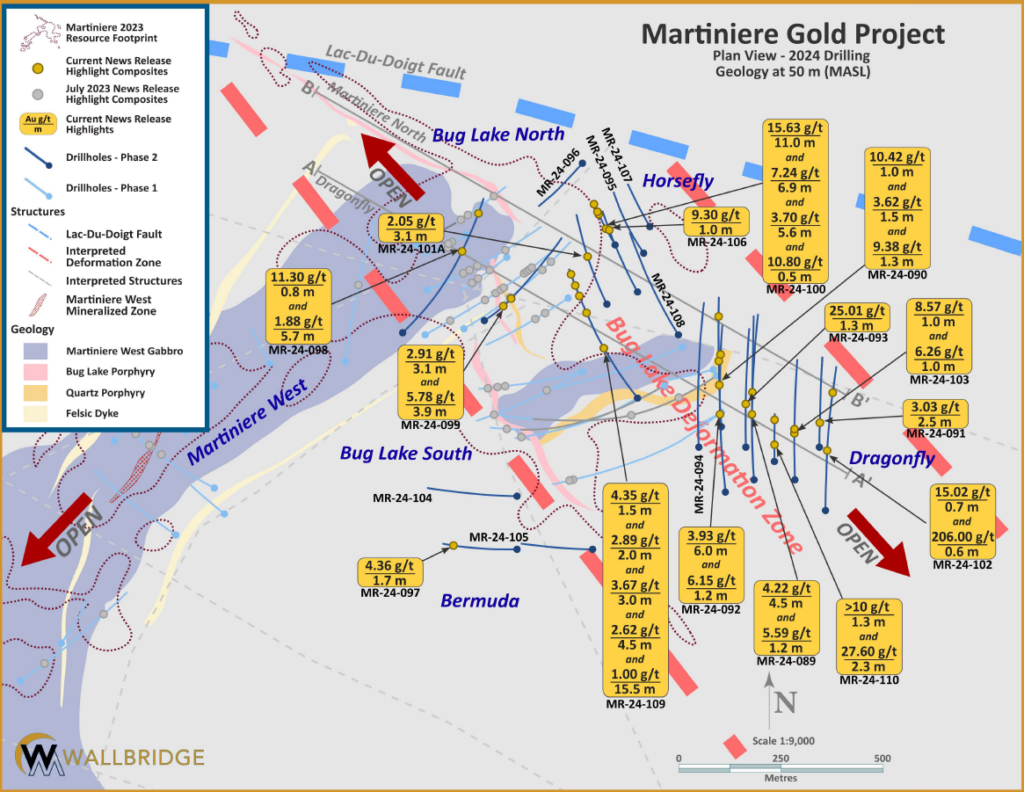

Martiniere Phase 2 Exploration Analysis

The Martiniere Phase 2 drilling program completed in September 2024, was comprised of 22 diamond drill holes totaling 8,141 m. Together with the Phase 1 program, the company has drilled 17,140 m in 51 exploration holes at Martiniere during 2024.

Building on findings from the Phase 1 program, the strategy for the Phase 2 program was to target potential lateral and vertical extensions of gold mineralization beyond the limits of the currently defined mineral resource. Gold mineralization occurs within a northwest-southeast trending corridor of sub-parallel structures and intrusive dikes and sills that host pyritic silicification and quartz-carbonate veining. To date exploration drilling along the Bug Lake zone has delineated gold mineralization over an approximate 1,500 m by 700 m area, and to an average vertical depth of approximately 350 to 400 m below surface. The Bug Lake zone remains open to further expansion along strike to the northwest and southeast and at depth.

At the Bug Lake North target, two of three drill holes intercepted significant gold grades along the down plunge projection of a strongly mineralized shoot as it extends beyond the currently defined gold resource. At the Horsefly target, roughly 300 m to the northeast of the Bug Lake North target, drilling has likewise returned multiple high grade gold intercepts along structures related to the Martiniere North zone, with three of seven drill holes intersecting significant gold grades beginning within 40 m of surface and outboard of the currently defined mineral resource. Exploration drilling in the Dragonfly area, a satellite target located approximately 600 m southeast of Horsefly and beyond the current resource limits, returned multiple high grade gold intercepts along a zone covering an area measuring approximately 500 m long, 150 m wide, and drill-tested over a vertical depth profile of 75 to 200 m from surface. The Dragonfly zone remains open to further expansion in both directions along strike and at depth below 200 m.

Martiniere Plan View

For more information including representative cross-sections, long-sections and assay summaries of complete drill holes please refer to the links below.

Martiniere Gold Project: 2024 Phase 2 Cross-Sections

Martiniere Gold Project: 2024 Phase 2 Long-Sections

Martiniere Gold Project: Q3 2024 Drill Assay Summary and Drill Hole Location Information

| Martiniere Project 2024 Phase 2 Drill Assay Highlights1 | ||||||

| From | To | Length3 | Au4 | |||

| Drill Hole | VG* 2 | (m) | (m) | (m) | (g/t) | |

| BUG LAKE NORTH | ||||||

| MR-24-096 | No Intercepts with Metal Factor > 5 g/t Au * m | |||||

| MR-24-098 | 389.4 | 390.2 | 0.8 | 11.30 | ||

| 532.1 | 537.8 | 5.7 | 1.88 | |||

| Including | 532.1 | 533.4 | 1.3 | 2.39 | ||

| 533.4 | 534.4 | 1.0 | 1.05 | |||

| 534.4 | 535.5 | 1.1 | 3.29 | |||

| 535.5 | 536.8 | 1.3 | 0.65 | |||

| 536.8 | 537.8 | 1.0 | 2.06 | |||

| MR-24-099 | 94.0 | 97.1 | 3.1 | 2.91 | ||

| Including | 94.0 | 95.1 | 1.1 | 3.97 | ||

| 95.1 | 96.0 | 0.9 | 0.71 | |||

| 96.0 | 97.1 | 1.1 | 3.81 | |||

| 136.5 | 140.4 | 3.9 | 5.78 | |||

| Including | 136.5 | 137.1 | 0.6 | 0.71 | ||

| 137.1 | 138.0 | 0.9 | 21.56 | |||

| 138.0 | 140.4 | 2.4 | 1.14 | |||

| HORSEFLY | ||||||

| MR-24-095 | No Intercepts with Metal Factor > 5 g/t Au * m | |||||

| MR-24-100 | * | 57.8 | 68.8 | 11.0 | 15.63 | |

| Including * | 57.8 | 60.1 | 2.3 | 15.18 | ||

| 60.1 | 62.3 | 2.2 | 0.58 | |||

| 62.3 | 64.1 | 1.8 | 37.13 | |||

| 64.1 | 65.9 | 1.8 | 0.42 | |||

| 65.9 | 67.1 | 1.2 | 41.68 | |||

| 67.1 | 68.0 | 0.9 | 0.34 | |||

| 68.0 | 68.8 | 0.8 | 23.18 | |||

| * | 114.4 | 121.3 | 6.9 | 7.24 | ||

| Including | 114.4 | 115.4 | 1.0 | 2.05 | ||

| * | 115.4 | 117.3 | 1.9 | 17.56 | ||

| 117.3 | 119.0 | 1.7 | 2.08 | |||

| * | 119.0 | 120.3 | 1.3 | 6.88 | ||

| 120.3 | 121.3 | 1.0 | 1.76 | |||

| MR-24-100 (cont’d) | 124.4 | 130.0 | 5.6 | 3.70 | ||

| Including | 124.4 | 124.9 | 0.5 | 3.18 | ||

| 124.9 | 125.5 | 0.6 | 20.10 | |||

| 125.5 | 127.7 | 2.2 | 0.28 | |||

| 127.7 | 130.0 | 2.3 | 2.45 | |||

| 155.0 | 155.5 | 0.5 | 10.80 | |||

| MR-24-101A | 167.4 | 170.5 | 3.1 | 2.05 | ||

| Including | 167.4 | 167.9 | 0.5 | 2.35 | ||

| 167.9 | 168.4 | 0.5 | 0.03 | |||

| 168.4 | 169.0 | 0.6 | 4.92 | |||

| 169.0 | 170.0 | 1.0 | 0.32 | |||

| 170.0 | 170.5 | 0.5 | 3.99 | |||

| MR-24-106 | 233.0 | 234.0 | 1.0 | 9.30 | ||

| MR-24-107 | No Intercepts with Metal Factor > 5 g/t Au * m | |||||

| MR-24-108 | No Intercepts with Metal Factor > 5 g/t Au * m | |||||

| MR-24-109 | 124.0 | 125.5 | 1.5 | 4.35 | ||

| Including | 124.0 | 125.0 | 1.0 | 1.52 | ||

| 125.0 | 125.5 | 0.5 | >10 | |||

| 402.0 | 404.0 | 2.0 | 2.89 | |||

| Including | 402.0 | 403.0 | 1.0 | 0.48 | ||

| 403.0 | 404.0 | 1.0 | 5.31 | |||

| 473.5 | 476.5 | 3.0 | 3.67 | |||

| Including | 473.5 | 475.0 | 1.5 | 6.88 | ||

| 475.0 | 476.5 | 1.5 | 0.47 | |||

| 517.0 | 521.5 | 4.5 | 2.62 | |||

| Including | 517.0 | 518.5 | 1.5 | 0.46 | ||

| 518.5 | 521.5 | 3.0 | 3.69 | |||

| 558.0 | 573.5 | 15.5 | 1.00 | |||

| Including | 558.0 | 559.0 | 1.0 | 2.60 | ||

| 559.0 | 559.7 | 0.7 | 0.72 | |||

| 559.7 | 560.5 | 0.8 | 2.85 | |||

| 560.5 | 561.3 | 0.8 | 0.33 | |||

| 561.3 | 562.0 | 0.7 | 1.95 | |||

| 562.0 | 568.0 | 6.0 | 0.54 | |||

| 568.0 | 569.0 | 1.0 | 2.34 | |||

| 569.0 | 572.0 | 3.0 | 0.36 | |||

| 572.0 | 573.5 | 1.5 | 1.22 | |||

| DRAGONFLY | ||||||

| MR-24-089 | 220.5 | 225.0 | 4.5 | 4.22 | ||

| Including | 220.5 | 221.6 | 1.1 | 7.99 | ||

| 221.6 | 223.9 | 2.3 | 0.15 | |||

| 223.9 | 225.0 | 1.1 | 8.97 | |||

| 294.6 | 295.8 | 1.2 | 5.59 | |||

| MR-24-090 | 143.5 | 144.5 | 1.0 | 10.42 | ||

| 224.8 | 226.3 | 1.5 | 3.62 | |||

| 374.6 | 375.9 | 1.3 | 9.38 | |||

| MR-24-091 | 85.5 | 88.0 | 2.5 | 3.03 | ||

| Including | 85.5 | 87.0 | 1.5 | 0.59 | ||

| 87.0 | 88.0 | 1.0 | 6.70 | |||

| MR-24-092 | 273.0 | 279.0 | 6.0 | 3.93 | ||

| Including | 273.0 | 273.9 | 0.9 | 12.15 | ||

| 273.9 | 275.3 | 1.4 | 1.11 | |||

| 275.3 | 276.8 | 1.5 | 0.04 | |||

| 276.8 | 279.0 | 2.2 | 5.02 | |||

| 475.8 | 477.0 | 1.2 | 6.15 | |||

| MR-24-093 | 148.1 | 149.4 | 1.3 | 25.01 | ||

| MR-24-094 | 210.2 | 213.2 | 3.0 | 1.61 | ||

| Including | 210.2 | 210.7 | 0.5 | 5.34 | ||

| 210.7 | 212.2 | 1.5 | 0.02 | |||

| 212.2 | 213.2 | 1.0 | 2.12 | |||

| MR-24-102 | * | 220.8 | 221.5 | 0.7 | 15.02 | |

| * | 422.8 | 423.4 | 0.6 | 206.00 | ||

| MR-24-103 | 82.5 | 83.2 | 0.7 | 6.67 | ||

| 156.0 | 157.0 | 1.0 | 8.57 | |||

| 170.0 | 171.0 | 1.0 | 6.26 | |||

| MR-24-110 | 79.3 | 80.6 | 1.3 | >10.00 | ||

| * | 143.0 | 145.3 | 2.3 | 27.60 | ||

| Including | 143.0 | 143.6 | 0.6 | 9.99 | ||

| * | 143.6 | 144.3 | 0.7 | 86.30 | ||

| 144.3 | 145.3 | 1.0 | 2.16 | |||

| BERMUDA | ||||||

| MR-24-097 | 223.0 | 224.7 | 1.7 | 4.36 | ||

| MR-24-104 | No Intercepts with Metal Factor > 5 g/t Au * m | |||||

| MR-24-105 | No Intercepts with Metal Factor > 5 g/t Au * m | |||||

| Notes | ||||||

| 1 | Highlighted assay composites have been selected based on a Metal Factor >5 gm*m and/or includes a result >5 g/t (MF = Au g/t * Interval length). | |||||

| 2 | Asterisk * denotes visible gold (VG) observed in drill core. | |||||

| 3 | True widths are estimated to be 60-90% of the reported core length intervals. | |||||

| 4 | Gold results >10g/t Au are pending follow-up overlimit assay analysis. Affected composite Au grades are calculated using 10 g/t Au for the overlimit sample value. | |||||

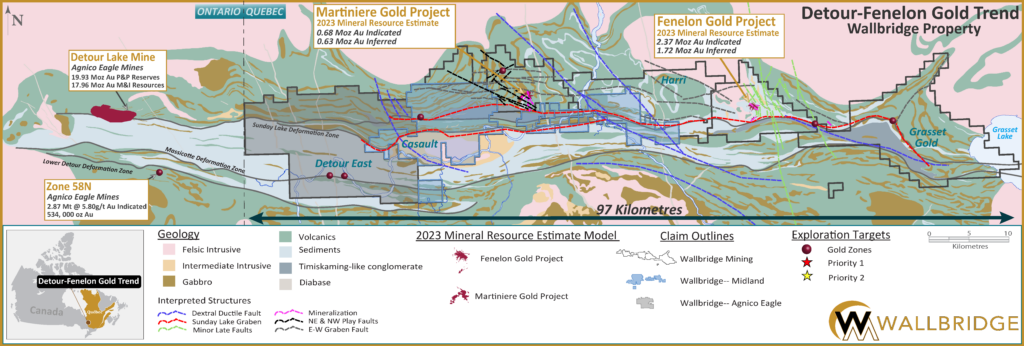

The Martiniere project is a key component of the Company’s 830 square km Detour-Fenelon Trend property package located in Northern Abitibi, Quebec, 30 km west of the Company’s flagship Fenelon gold project and 50 km east of Canada’s largest gold mine, Agnico Eagle’s Detour Lake gold mine. Exploration and resource delineation drilling completed at Martiniere has so far intercepted multiple zones of vein-hosted gold mineralization over an approximate 1.5 km by 700 m area along the northwest-southeast trending Bug Lake Zone, and over an approximate 1.5 km by 250 m area along the northeast-southwest trending Martiniere West and Central corridor.

Wallbridge Mining Detour – Fenelon Gold Trend Properties

About Wallbridge Mining

Wallbridge is focused on creating value through the exploration and sustainable development of gold projects along the Detour-Fenelon Gold Trend in Québec’s Northern Abitibi region while respecting the environment and communities where it operates.

Wallbridge’s most advanced projects, Fenelon Gold and Martiniere Gold incorporate a combined 3.05 million ounces of indicated gold resources and 2.35 million ounces of inferred gold resources. Fenelon and Martiniere are located within an 830 square km exploration land package in the Northern Abitibi region of Quebec.

Wallbridge has reported a positive Preliminary Economic Assessment at Fenelon that estimates average annual gold production of 212,000 ounces over 12 years.

Wallbridge also holds a 15.8% interest in the common shares of NorthX Nickel Corp. (formerly “Archer Exploration Corp”) subsequent to the sale of the Company’s portfolio of nickel assets in Ontario and Québec.

For further information please visit the Company’s website at https://wallbridgemining.com/ or contact:

MORE or "UNCATEGORIZED"

Surge Copper Announces Closing of First Tranche of $20 Million Private Placement

Surge Copper Corp. (TSX-V: SURG) (OTCQB: SRGXF) (Frankfurt: G6D2) is pleased to announce that it has... READ MORE

Spanish Mountain Gold Drilling Intersects 205.87 Metres Grading 0.58 G/T Gold, 142.00 Metres of 0.77 G/T Gold, and 69.40 Metres of 0.99 G/T Gold in Three Separate Drill Holes Containing Numberous Higher-Grade Sub-Intervals

Spanish Mountain Gold Ltd. (TSX-V: SPA) (FSE: S3Y) (OTCQB: SPAUF) is pleased to report additi... READ MORE

Aura Signed the Agreement to Relocate Road at Borborema Mine, Unlocking an additional 670 Koz of gold in Mineral Reserves, totaling 1.5 Moz

Aura Minerals Inc. (Nasdaq: AUGO) (B3: AURA33) is pleased to announce that it has signed the agreem... READ MORE

Aura Announces Q4 2025 and FY 2025 Financial and Operational Results

Aura Minerals Inc. (NASDAQ: AUGO) (B3: AURA33) announces that it has filed its audited consolidated ... READ MORE

Endeavour Silver Announces Q4 2025 Financial Results; Earnings Call at 10AM PST (1PM EST) Today

Endeavour Silver Corp. (NYSE: EXK) (TSX: EDR) announces its financial and operating results ... READ MORE