Wallbridge Continues to Expand Fenelon Gold System in Multiple Directions

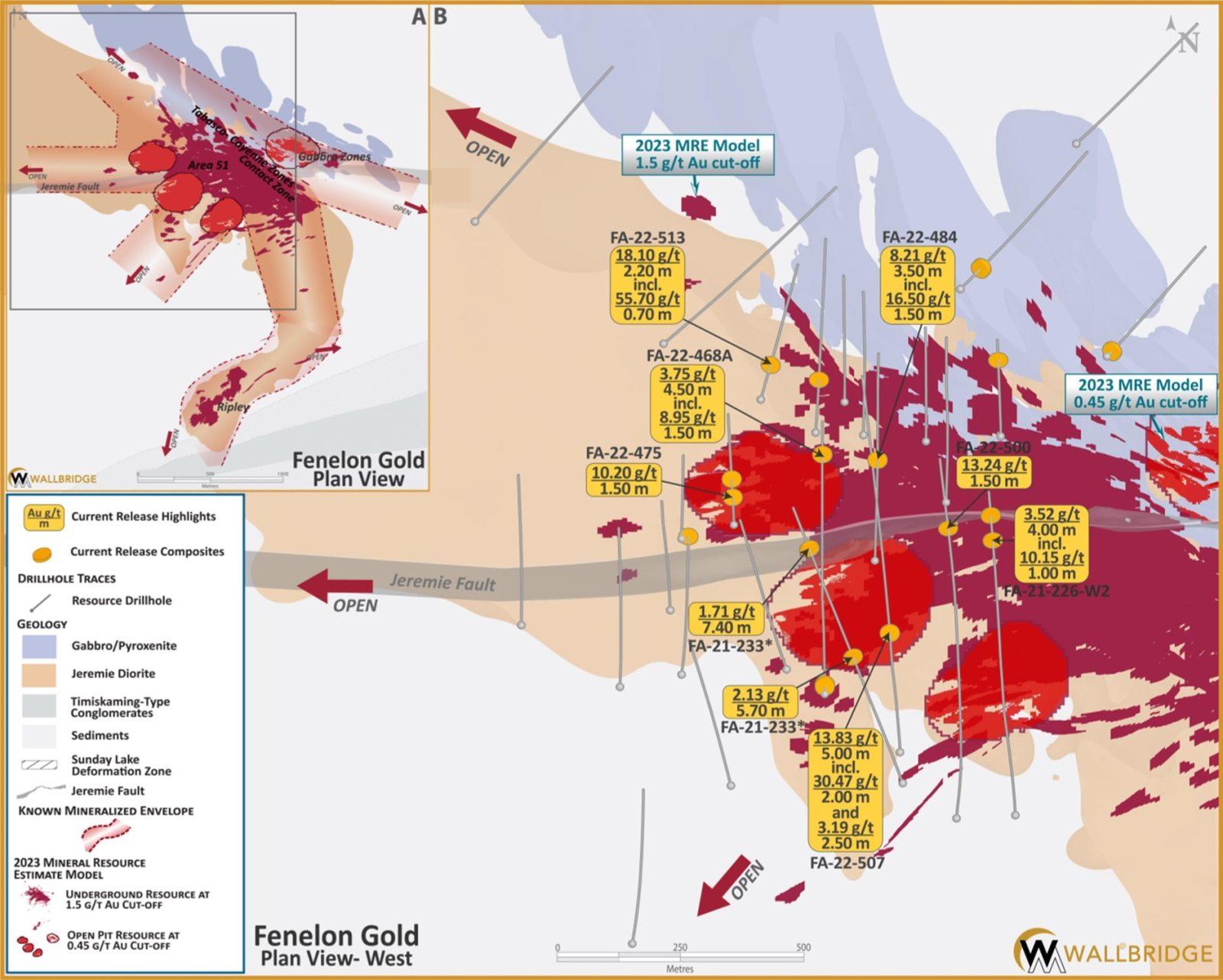

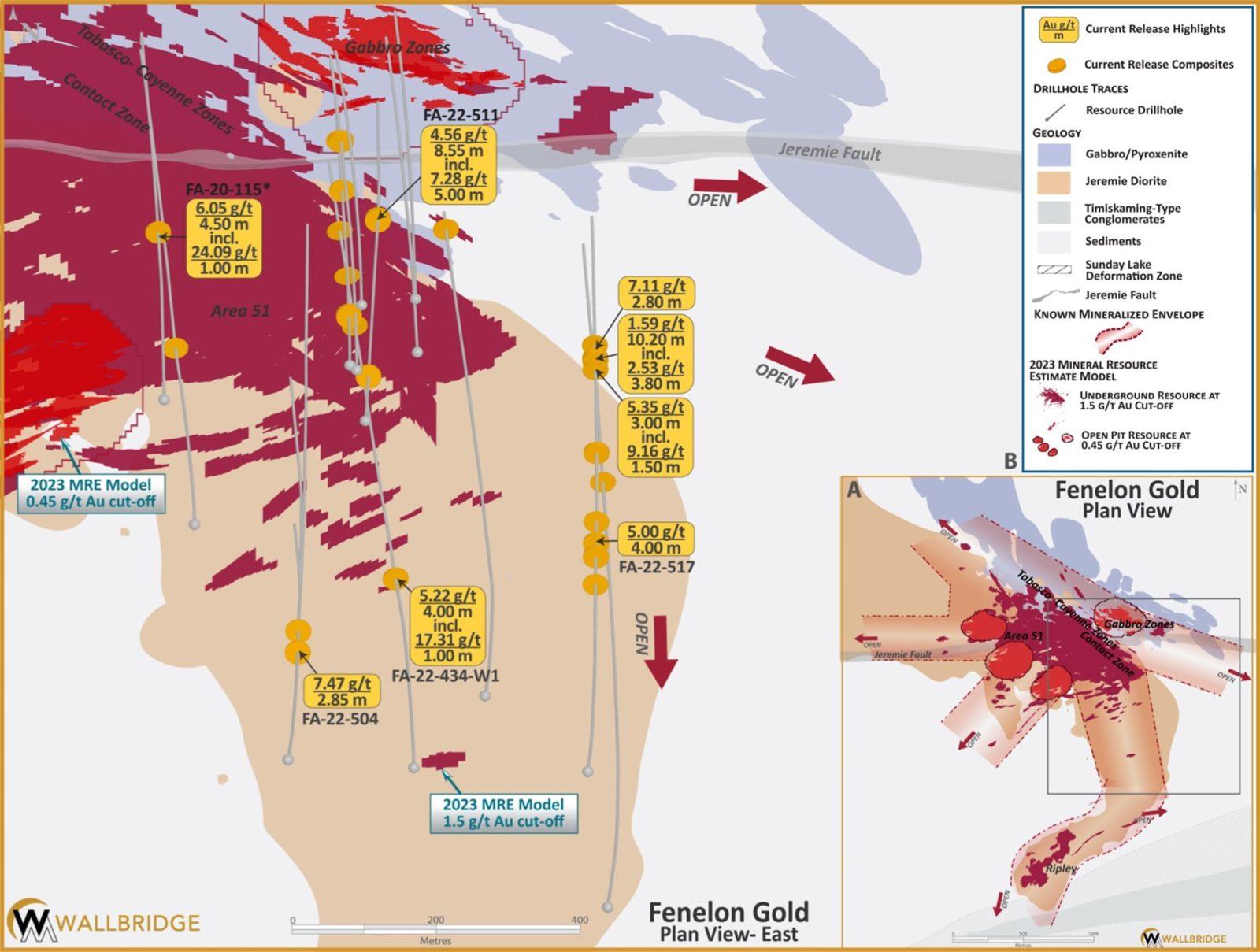

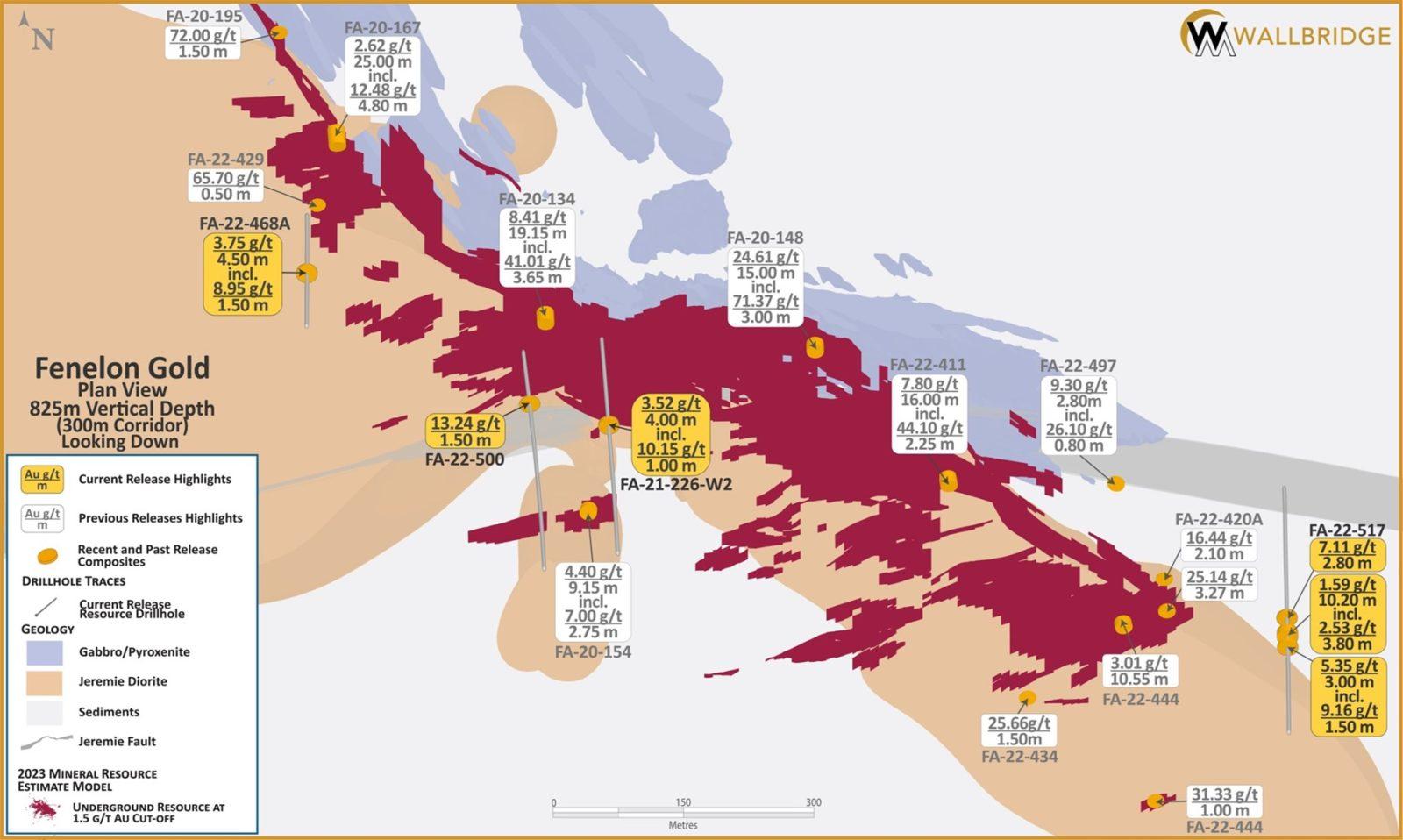

Wallbridge Mining Company Limited (TSX:WM) (OTCQX:WLBMF) is pleased to report that new assay results from the 2022 exploration program at the Company’s 100%-owned Fenelon Gold project have expanded the Area 51, Tabasco and Contact zones beyond the western and eastern limits of the 2023 Mineral Resource Estimate footprint. These results underscore the potential to further increase the size of the deposit, which remains open in multiple directions.

Attila Péntek, Wallbridge’s Vice President, Exploration, commented:

“Wallbridge continues to grow the footprint of the Fenelon deposit beyond the boundaries of the MRE (see Wallbridge press release dated January 17, 2023), supporting our 2023 strategy of drilling larger step-outs on known mineralized zones. Recent results, including those reported today, have continued to expand gold mineralization, particularly in the southeast, where our updated MRE already demonstrated significant resource growth. Most of the 2022 assay results have now been received and reported, with only a few isolated samples pending.”

“Our 2023 drill program is also testing various targets on a regional scale with the objective of identifying new zones of mineralization and areas of promising geology such as favorable host rocks and structures. We now have three drill rigs in target areas surrounding the Fenelon deposit until April, when two of the drills will be mobilized to Martiniere to commence exploration drilling with larger step-outs on known mineralized zones.”

Recent Highlight Assay Results

| Western Extensions | ||

| Area 51 | ||

| FA-22-507 | 13.83 g/t Au over 5.00 metres, including | |

| 30.47 g/t Au over 2.00, and 3.19 g/t Au over 2.50 metres |

||

| FA-22-500 | 13.24 g/t Au over 1.50 metres; | |

| FA-22-468A | 3.75 g/t Au over 4.50 metres, including | |

| 8.95 g/t Au over 1.50 metres; | ||

| FA-22-475 | 10.20 g/t Au over 1.50 metres; | |

| FA-21-226-W2 | 3.52 g/t Au over 4.00 metres, including | |

| 10.15 g/t Au over 1.00 metres; | ||

| FA-21-233 | 2.13 g/t Au over 5.70 metres; | |

| FA-21-233 | 1.71 g/t Au over 7.40 metres; | |

| Tabasco-Cayenne Corridor | ||

| FA-22-513 | 18.10 g/t Au over 2.20 metres, including | |

| 55.70 g/t Au over 0.70 metres; | ||

| FA-22-484 | 8.21 g/t Au over 3.50 metres, including | |

| 16.50 g/t Au over 1.50 metres; | ||

|

Eastern Extensions |

||

| Area 51 | ||

| FA-22-504 | 7.47 g/t Au over 2.85 metres; | |

| FA-22-434-W1 | 5.22 g/t Au over 4.00 metres, including | |

| 17.31 g/t Au over 1.00 metres; | ||

| FA-20-115 | 6.05 g/t Au over 4.50 metres, including | |

| 24.09 g/t Au over 1.00 metre from the 2022 historic drill core infill sampling program; | ||

| Tabasco-Cayenne-Contact Zone Corridor | ||

| FA-22-511 | 4.56 g/t Au over 8.55 metres, including | |

| 7.28 g/t Au over 5.00 metres; | ||

| FA-22-517 | 5.00 g/t Au over 4.00 metres; | |

| FA-22-517 | 5.35 g/t Au over 3.00 metres, including | |

| 9.16 g/t Au over 1.50 metres; | ||

| FA-22-517 | 1.59 g/t Au over 10.20 metres, including | |

| 2.53 g/t Au over 3.80 metres; | ||

| FA-22-517 | 7.11 g/t Au over 2.80 metres; | |

The results reported in today’s press release are from 41 holes of the 2022 resource drill program and two assay results (FA-20-115 & FA-20-155) from the 2022 infill sampling program. Two drill holes from the 2021 program were extended during the 2022 program: FA-21-233 beyond 360 metres and FA-21-300 beyond 322 metres. Three drill holes from the 2022 program have partial results pending.

All figures and a table with drill hole information of recently completed holes are posted on the Company’s website under “Current Program” at https://wallbridgemining.com/our-projects/fenelon-gold/.

2023 Exploration Drill Program

At Fenelon, the updated MRE totals 2.37 million ounces of gold in the Indicated category and 1.72 million ounces of gold in the Inferred category, representing a significant increase in gold grade and an increase in contained ounces compared to the 2021 MRE. Details of the 2023 MRE results can be found in the Wallbridge press release dated January 17, 2023 and the National Instrument 43-101 Technical Report filed on SEDAR on March 3, 2023.

This updated MRE will form the basis of Wallbridge’s PEA, scheduled for completion during the second quarter of 2023. This economic study will guide the next steps Wallbridge will take toward developing its most advanced gold project.

The 15,000 metres of drilling planned for Fenelon, which remains open laterally and at depth in multiple directions, will, in part, follow up on recent exploration results (see Wallbridge press releases dated November 8 and December 8, 2022 and February 28, 2023) that continue to expand the known gold zones.

In February, Wallbridge mobilized three drills at Fenelon to complete more aggressive step outs on the known system, and to test grassroots targets on a more regional scale. One of the drills has been testing a target area to the Northwest of the Fenelon deposit in search for extensions of the Jeremie Diorite, one of the main host rocks at Fenelon. A second drill is undercutting the main Area 51 system at depth and will be completing large step outs (200-300 metres) towards the west to continue expanding the system in a completely open area at moderate depths. The third drill is testing the Ripley system, as described in Wallbridge press release dated February 28, 2023.

In addition, the Company will continue de-risking the project with further technical studies and environmental and permitting activities.

Figure 1. Fenelon Gold. A) Fenelon Plan View and B) Plan View-West

Figure 2. Fenelon Gold. A) Fenelon- Plan View and B) Fenelon- Plan View- East

Figure 3. Fenelon Gold, Plan View, 825 metres Vertical Depth

| Table 1. Wallbridge Fenelon Gold Property, Recent Drill Assay Highlights- West (1,4) | |||||||

| Drill Hole | From | To | Length | Au | Au Cut(2) | VG(3) | Zone/Corridor |

| (m) | (m) | (m) | (g/t) | (g/t) | |||

| FA-21-226-W2 | 1019.50 | 1023.50 | 4.00 | 3.52 | 3.52 | Area 51 | |

| Including… | 1022.50 | 1023.50 | 1.00 | 10.15 | 10.15 | Area 51 | |

| FA-21-226-W2 | 1093.50 | 1099.00 | 5.50 | 1.47 | 1.47 | Contact Zone | |

| FA-21-233* | 412.80 | 418.50 | 5.70 | 2.13 | 2.13 | VG | Area 51 |

| FA-21-233* | 739.40 | 746.80 | 7.40 | 1.71 | 1.71 | Area 51 | |

| FA-22-462 | No Significant Mineralization | ||||||

| FA-22-468A | 29.00 | 41.05 | 12.05 | 0.45 | 0.45 | Area 51 | |

| FA-22-468A | 901.00 | 905.50 | 4.50 | 3.75 | 3.75 | Area 51 | |

| Including… | 904.00 | 905.50 | 1.50 | 8.95 | 8.95 | Area 51 | |

| FA-22-475 | 107.00 | 108.50 | 1.50 | 10.20 | 10.20 | Area 51 | |

| FA-22-475 | 178.25 | 179.90 | 1.65 | 5.23 | 5.23 | Area 51 | |

| FA-22-476 | 530.50 | 532.00 | 1.50 | 4.08 | 4.08 | Area 51 | |

| FA-22-478 | No Significant Mineralization | ||||||

| FA-22-484 | 395.00 | 398.50 | 3.50 | 8.21 | 8.21 | Contact Zone | |

| Including… | 397.00 | 398.50 | 1.50 | 16.50 | 16.50 | Contact Zone | |

| FA-22-486 | No Significant Mineralization | ||||||

| FA-22-489A | No Significant Mineralization | ||||||

| FA-22-493 | No Significant Mineralization | ||||||

| FA-22-500 | 1085.50 | 1087.00 | 1.50 | 13.24 | 13.24 | Area 51 | |

| FA-22-502A | No Significant Mineralization (4) | ||||||

| FA-22-507 | 480.00 | 485.00 | 5.00 | 13.83 | 13.83 | VG | Area 51 |

| Including… | 480.00 | 482.00 | 2.00 | 30.47 | 30.47 | VG | Area 51 |

| And**… | 482.50 | 485.00 | 2.50 | 3.19 | 3.19 | Area 51 | |

| FA-22-510 | No Significant Mineralization | ||||||

| FA-22-513 | 130.50 | 132.70 | 2.20 | 18.10 | 18.10 | Tabasco | |

| Including… | 130.50 | 131.20 | 0.70 | 55.70 | 55.70 | Tabasco | |

| FA-22-518 | 255.50 | 256.45 | 0.95 | 6.84 | 6.84 | Cayenne | |

| FA-22-521 | No Significant Mineralization | ||||||

| FA-22-523 | No Significant Mineralization | ||||||

| FA-22-524 | 188.50 | 189.00 | 0.50 | 17.51 | 17.51 | VG | Tabasco |

| FA-22-526 | No Significant Mineralization | ||||||

| FA-22-531 | No Significant Mineralization | ||||||

| FA-22-532 | No Significant Mineralization | ||||||

| FA-22-535 | No Significant Mineralization | ||||||

| FA-22-536 | 18.30 | 27.50 | 9.20 | 0.75 | 0.75 | Cayenne | |

| FA-22-539 | 82.00 | 94.70 | 12.70 | 0.70 | 0.70 | VG | Cayenne |

| Including… | 82.00 | 88.00 | 6.00 | 1.18 | 1.18 | Cayenne | |

| FA-22-541 | No Significant Mineralization | ||||||

| (1) Table includes only assay results received since the latest press release dated March 6, 2023. | |||||||

| (2) Au cut at: 110 g/t Au for the Tabasco/Contact /Cayenne zones; 75 g/t Au for the Area 51 zones. | |||||||

| (3) Intervals containing visible gold (“VG”). | |||||||

| (4) Metal factor of at least 5 g/t*m and minimum weighted average composite grade of 0.45 g/t Au within the 2022 MRE open pit shell and 1.5 g/t Au for outside open pit shell. | |||||||

| * Original drill hole extended after 360m for FA-21-233. | |||||||

| ** Results reported here contain previously announced intervals that were extended with new assay results. | |||||||

| Note: True widths are estimated to be 50-80% of the reported core length intervals. | |||||||

|

Table 2. Wallbridge Fenelon Gold Property, Recent Drill Assay Highlights- East and 2022 Infill Sampling (1,4) |

|||||||

|

Drill Hole |

From | To | Length | Au | Au Cut(2) | VG(3) | Zone/Corridor |

| (m) | (m) | (m) | (g/t) | (g/t) | |||

| FA-20-115* | 399.50 | 404.00 | 4.50 | 6.05 | 6.05 | Area 51 | |

| Including… | 402.00 | 403.00 | 1.00 | 24.09 | 24.09 | Area 51 | |

| FA-20-155* | 431.00 | 432.00 | 1.00 | 12.51 | 12.51 | Area 51 | |

| FA-21-300** | 129.90 | 137.50 | 7.60 | 0.66 | 0.66 | Contact Zone | |

| FA-21-300** | 449.50 | 452.50 | 3.00 | 2.76 | 2.76 | Tabasco | |

| FA-21-300** | 569.00 | 570.30 | 1.30 | 8.70 | 8.70 | Tabasco | |

| FA-22-434-W1 | 511.00 | 515.00 | 4.00 | 5.22 | 5.22 | Area 51 | |

| Including… | 514.00 | 515.00 | 1.00 | 17.31 | 17.31 | Area 51 | |

| FA-22-434-W1 | 1037.00 | 1040.50 | 3.50 | 1.98 | 1.98 | Area 51 | |

| FA-22-434-W1 | 1133.45 | 1134.50 | 1.05 | 4.69 | 4.69 | Area 51 | |

| FA-22-434-W1 | 1217.50 | 1220.75 | 3.25 | 2.91 | 2.91 | Cayenne | |

| FA-22-473 | No Significant Mineralization | ||||||

| FA-22-473-W1 | 1166.50 | 1169.50 | 3.00 | 4.71 | 4.71 | Cayenne | |

| Including… | 1167.00 | 1168.50 | 1.50 | 7.27 | 7.27 | Cayenne | |

| FA-22-504 | 345.00 | 347.85 | 2.85 | 7.47 | 7.47 | Area 51 | |

| FA-22-504 | 411.30 | 413.30 | 2.00 | 3.72 | 3.72 | Area 51 | |

| FA-22-504-W1 | No Significant Mineralization | ||||||

| FA-22-504-W2 | No Significant Mineralization | ||||||

| FA-22-506 | No Significant Mineralization | ||||||

| FA-22-509 | 516.75 | 523.10 | 6.35 | 1.66 | 1.66 | Tabasco | |

| FA-22-511 | 137.50 | 142.00 | 4.50 | 2.83 | 2.83 | Contact Zone | |

| Including… | 140.00 | 140.75 | 0.75 | 14.50 | 14.50 | Contact Zone | |

| FA-22-511 | 596.45 | 605.00 | 8.55 | 4.56 | 4.56 | Tabasco | |

| Including… | 598.60 | 603.60 | 5.00 | 7.28 | 7.28 | Tabasco | |

| FA-22-515 | No Significant Mineralization | ||||||

| FA-22-517 | 486.60 | 487.10 | 0.50 | 26.50 | 26.50 | Contact Zone | |

| FA-22-517 | 551.50 | 556.50 | 5.00 | 1.67 | 1.67 | Contact Zone | |

| FA-22-517 | 584.00 | 588.00 | 4.00 | 5.00 | 5.00 | Contact Zone | |

| FA-22-517 | 636.00 | 637.00 | 1.00 | 7.20 | 7.20 | Contact Zone | |

| FA-22-517 | 789.25 | 794.20 | 4.95 | 2.09 | 2.09 | Contact Zone | |

| FA-22-517 | 970.20 | 973.20 | 3.00 | 5.35 | 5.35 | Tabasco | |

| Including… | 971.15 | 972.65 | 1.50 | 9.16 | 9.16 | Tabasco | |

| FA-22-517 | 987.80 | 998.00 | 10.20 | 1.59 | 1.59 | Tabasco | |

| Including… | 994.20 | 998.00 | 3.80 | 2.53 | 2.53 | Tabasco | |

| FA-22-517 | 1020.20 | 1023.00 | 2.80 | 7.11 | 7.11 | Cayenne | |

| FA-22-520 | No Significant Mineralization | ||||||

| FA-22-530 | 1073.30 | 1073.90 | 0.60 | 12.00 | 12.00 | Contact Zone | |

| (1) Table includes only assay results received since the latest press release dated February 28, 2023. | |||||||

| (2) Au cut at: 110 g/t Au for the Tabasco/Contact /Cayenne zones; 75 g/t Au for the Area 51 zones. | |||||||

| (3) Intervals containing visible gold (“VG”). | |||||||

| (4) Metal factor of at least 5 g/t*m and minimum weighted average composite grade of 0.45 g/t Au within the 2022 MRE open pit shell and 1.5 g/t Au for outside open pit shell. | |||||||

| * New highlight from the 2022 in-fill sampling program. | |||||||

| ** Original drill hole extended after 322m for FA-21-300. | |||||||

| Note: True widths are estimated to be 50-80% of the reported core length intervals. | |||||||

Assay QA/QC and Qualified Persons

Drill core samples from the ongoing drill program at Fenelon are cut and bagged either on-site or by contractors and transported to SGS Canada Inc. or Bureau Veritas Commodities Canada Ltd. for analysis. Samples, standards and blanks are included for quality assurance and quality control, were prepared and analyzed at the laboratories. Samples are crushed to 90% less than 2mm. A 1kg riffle split is pulverized to 85% passing 75 microns. 50g samples are analyzed by fire assay and AAS or ICP. At SGS and Bureau Veritas, samples >10g/t Au are automatically analyzed by fire assay with gravimetric finish or screen metallic analysis. To test for coarse free gold and additional quality assurance and quality control, Wallbridge requests screen metallic analysis for samples containing visible gold. These and future assay results may vary from time to time due to re-analysis for quality assurance and quality control.

The Qualified Person responsible for the technical content of this press release is Christopher Kelly, M.Sc., P.Geo., Senior Geologist of Wallbridge.

About Wallbridge Mining

Wallbridge is focused on creating value through the exploration and sustainable development of gold projects along the Detour-Fenelon Gold Trend while respecting the environment and communities where it operates. Wallbridge’s flagship project, Fenelon Gold, is located on the highly prospective Detour-Fenelon Gold Trend Property in Québec’s Northern Abitibi region. An updated mineral resource estimate completed in January 2023 yielded significantly improved grades and additional ounces at the 100%-owned Fenelon and Martiniere properties, incorporating a combined 3.05 million ounces of Indicated gold resources and 2.35 million ounces of Inferred gold resources. Fenelon and Martiniere are located within an approximate 830 km2 exploration land package controlled by Wallbridge. The Company believes that these two deposits have good potential for economic development, especially given their proximity to existing hydro-electric power and transportation infrastructure. In addition, Wallbridge believes that the extensive land package is extremely prospective for the discovery of additional gold deposits.

Wallbridge also holds a 19.9% interest in the common shares of Archer Exploration Corp. as a result of the sale of the Company’s portfolio of nickel assets in Ontario and Québec in November of 2022.

Wallbridge will continue to focus on its core Detour-Fenelon Gold Trend Property while enabling shareholders to participate in the potential economic upside in Archer.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE