Vox Royalty Announces Agreement to Acquire Transformational Global Gold Portfolio, Overnight Marketed Offering of Common Shares and Expanded Revolving Credit Facility

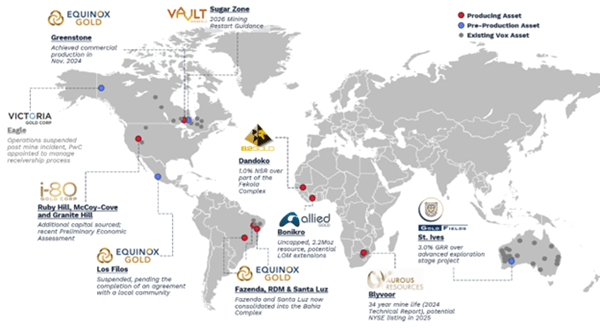

Vox Royalty Corp. (NASDAQ: VOXR) (TSX: VOXR) a returns focused mining royalty and streaming company, is pleased to announce that it has entered into definitive agreements to acquire a global gold portfolio of ten gold offtake and royalty assets, covering twelve mines and projects across eight jurisdictions, including Australia, Brazil, Canada, Côte d’Ivoire, Mali, Mexico, South Africa and the United States, from certain subsidiaries of Deterra Royalties Limited for total upfront cash consideration of $57.5 million and $2.5 million in deferred milestones. The Transaction will be funded with a concurrent overnight marketed offering of common shares and an upsized revolving credit facility with Bank of Montreal.

Kyle Floyd, Chief Executive Officer stated: “We are excited to announce this highly accretive gold portfolio transaction that is expected to grow revenue per share by over 100%, expand our producing asset count to 14, and expand our large-cap operator exposure. The Portfolio revenue is entirely gold-related and based on Q2-2025 actuals, pro-forma revenue related to gold exceeded 80%, which is expected to accelerate our potential inclusion on the GDXJ index in 2026. This Transaction is consistent with our disciplined strategy of buying highly accretive legacy assets with exceptional long-term optionality. Over the trailing four quarters ending June 2025, this global gold portfolio generated over $16 million of gold cash flow, and based on Q2-2025 gold cash flow of $5.6 million, this portfolio is currently generating over $20 million of annualised run-rate gold cash flow. We look forward to sharing more on the completion of the offering and deal completion with Deterra.”

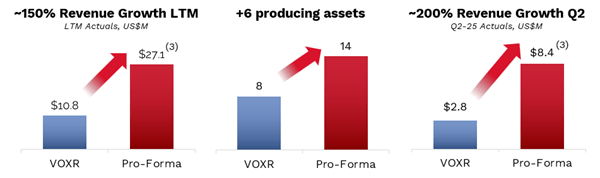

Pro Forma Growth from Global Gold Portfolio

Notes:

1. Based on Q2 -25 Vox revenues of $2.8M and $5.6M for the acquired portfolio.

2. Based on LTM Vox revenues of $10.8M and $16.3M for the acquired portfolio, assumes an illustrative 10M common shares issued.

3. Pro-Forma represents actuals reported by Vox Royalty Corp and as disclosed by Deterra June 2025 quarter portfolio update dated July 31, 2025 – https://www.deterraroyalties.com/wp-content/uploads/2025/07/2922636.pdf

Past results of the acquired portfolio may not be representative of future results.

Transaction Rationale

- This Transaction is expected to have an immediately accretive financial impact, including: i) revenue per share, ii) cash flow per share, and iii) net asset value.

- The acquired portfolio generated approximately $5.6 million of revenue in the three months ended June 20251 and the portfolio generated approximately $16.3 million1 of revenue in the trailing four quarters ending June 30, 2025, representing an expected revenue growth of approximately 200% and 150%, respectively2.

- Pro-forma, the Transaction represents an increase in revenue per share of approximately 115%3.

- The margins realized by this portfolio have significantly outperformed the underlying price of gold. Comparing the first half of 2022 to the first half of 2025, the average margin per ounce realized on the acquired assets has increased from $23.10/oz to $63.10/oz, representing a relative growth of approximately 170%4, while the underlying realized gold price has increased from $1,807/oz to $3,099/oz, or approximately 70%4. Similarly, the ounces delivered by the portfolio within the same comparison period increased by approximately 30%, from 111koz to 144koz, while delivering a total of 976koz since January 20224.

- Adds immediate cash flow from seven operating mines, with potential embedded growth and upside optionality from exploration success, life of mine extensions, throughput expansions and mine re-starts within the diversified portfolio.

- Provides exposure to assets operated by medium to large-cap operators such as Equinox Gold Corp., Allied Gold Corporation, Gold Fields Limited, B2Gold Corp., and Vault Minerals Limited.

- Weights the portfolio and revenue mix towards precious metals, with a larger proportion of revenue derived from gold, potentially unlocking eligibility to precious metal-based indexes such as the GDXJ.

- The portfolio is expected to provide access to over 300,000 ounces of physical gold per annum, based on FY2025 (to June 30, 2025) actuals of 338,000 delivered ounces 4, as well as CY2024 actuals of 306,000 delivered ounces5.

- The funding package ensures Vox maintains a strong balance sheet to execute on its acquisition pipeline after the closing of the Transaction.

Portfolio Summary

The portfolio includes eight separate gold offtake contracts and two gold royalties, as described below:

| Asset | Key Terms of Interest | Total oz Delivered

(to Dec 2024) |

Commodity | Jurisdiction | Stage | Operator |

| Fazenda |

35% of gold production, up to a cap of 658 koz(i) |

364 koz |

Gold |

Brazil |

Producing |

Equinox Gold Corp. |

| RDM(i) | ||||||

| Santa Luz(i) | ||||||

| Greenstone | 100% of gold production, up to a cap of 58.5 koz per annum (until March 2027) | 58.5 koz | Gold | Canada | Producing | Equinox Gold Corp. |

| i-80 Assets; Ruby Hill, Cove & Granite Creek | 100% of gold production(i), up to a cap of 40 koz per annum (until December 2028) | 44 koz | Gold | United States | Producing | i-80 Gold Corp. |

| Bonikro | 50% of gold production (uncapped) | 177 koz | Gold | Ivory Coast | Producing(ii) | Allied Gold Corporation |

| Blyvoor | 100% of gold production, up to a cap of 2.7 Moz | 64 koz | Gold | South Africa | Producing | Aurous Resources(iii) |

| Sugar Zone | 80% of gold doré production, up to a cap of 961 koz | 93 koz | Gold doré | Canada | Development (iv) | Vault Minerals Limited |

| Los Filos | 50% of gold production, up to a cap of 1.1 Moz | 512 koz | Gold | Mexico | Suspended(v) | Equinox Gold Corp. |

| Eagle | 25% of gold production, up to a cap of 1.1 Moz | 163 koz | Gold | Canada | Suspended(vi) | Victoria Gold Corp. |

| St. Ives | 3.0% GRR (effective 1.04% GRR)(vii) | — | Gold | Australia | Exploration | Gold Fields Limited |

| Dandoko | 1.0% NSR(viii) | — | Gold | Mali | Development | B2Gold Corp. |

Notes:

- This represents a multi-asset offtake.

- The current mine plan extends to 2029. Allied Gold Corporation is targeting a mine life extension.

- Aurous Resources has announced that it is considering a potential listing of its securities on the NYSE with the goal of securing expansion capital.

- The operator is guiding towards a restart of operations at Sugar Zone in 2026, following the receipt of remaining permits and estimated pre-production restart capital expenditures of C$55 million.

- On April 1, 2025, Equinox Gold Corp. announced an indefinite suspension of operations at the Los Filos mine in Mexico, following the expiry of its land access agreement with one of three local communities.

- On June 24, 2024, Victoria Gold Corp. announced the suspension of mine operations following a heap leach containment incident. PricewaterhouseCoopers has been appointed to manage the receivership process.

- The St Ives royalty is a 3.0% GRR, but the Transaction will also include an obligation for Vox Australia Pty Ltd. to pay a 1.96% GRR royalty to a third party.

- Includes deferred contingent consideration of $1.25 million upon first royalty receipts, and $1.25 million on receipt of payment on 500koz from the royalty area.

Concurrent Overnight Marketed Underwritten Offering of Common Shares

The Company is pleased to announce that it has commenced an overnight marketed public offering, subject to market conditions, of common shares of Vox in the United States and each of the provinces of Canada, other than Québec. The Offering is expected to be up to $55 million, at a price of $3.70 per share, with the final terms of the Offering including pricing, to be determined in the context of the market and finalized pursuant to the terms of an underwriting agreement to be entered into by and among Vox, BMO Capital Markets, Cantor Fitzgerald Canada Corporation, and National Bank Financial Inc. as lead underwriters.

The Underwriters may elect to purchase up to an additional 15% of the Common Shares offered pursuant to the Offering on the same terms and conditions for a period of 30 days following and including the closing date of the Offering.

Vox intends to use the net proceeds from the Offering to fund the purchase price of the Transaction, subject to certain conditions precedent being satisfied or waived by the parties. If Vox uses less than the full amount of the net proceeds from the Offering to purchase the Portfolio, the Company will reallocate those funds to the acquisition of additional royalties over the next 12-24 months.

The Offering is expected to close on or about September 26, 2025, subject to the satisfaction of customary closing conditions and the receipt of regulatory approvals, including the approval of the Toronto Stock Exchange and The Nasdaq Capital Markets. There can be no assurance as to whether or when the Offering may be completed, or as to the actual size or specific terms of the Offering.

The Offering will only be made by means of prospectus supplements that form part of Vox’s existing short form base shelf prospectus dated February 13, 2025, filed pursuant to the shelf prospectus procedures established by National Instrument 44-102 – Shelf Distributions and National Instrument 44-101 – Short Form Prospectus Distributions, and Vox’s U.S. registration statement on Form F-10, as amended (File No. 333-284746), filed with the United States Securities and Exchange Commission. Preliminary prospectus supplements together with the accompanying base shelf prospectus or registration statement, as applicable, have been filed with the securities regulatory authorities in all provinces of Canada other than Québec, pursuant to the Multijurisdictional Disclosure System, and with the SEC in the United States, respectively. Copies of these documents will be available on Vox’s profiles on the System for Electric Document Analysis and Retrieval website maintained by the Canadian Securities Administrators at www.sedarplus.ca and the SEC’s website at www.sec.gov, as applicable. Alternatively, copies of the preliminary prospectus supplements and the accompanying base shelf prospectus or registration statement, as applicable, may also be obtained from BMO Capital Markets, at Brampton Distribution Centre c/o The Data Group of Companies, 9195 Torbram Road, Brampton, Ontario, L6S 6H2, by telephone at (905) 791-3151 Ext. 4312 or by email at torbramwarehouse@datagroup.ca, and in the United States by contacting BMO Capital Markets Corp., Attn: Equity Syndicate Department, 3 Times Square, 25th Floor, New York, NY 10036 (Attn: Equity Syndicate), Cantor by telephone at (212) 938-5000 or by email at prospectus@cantor.com, or National at 130 King Street West, 4th Floor Podium, Toronto, Ontario M5X 1J9, by telephone at (416) 869-8414 or by email at NBF-Syndication@bnc.ca.

Upsized Revolving Credit Facility

On September 23, 2025, the Company executed a credit agreement with BMO providing for an upsized $40 million secured revolving credit facility. The upsized Facility includes an accordion feature for an additional $35 million of availability subject to certain conditions, resulting in total funding capacity under the Facility of $75 million. The Company executed a second amendment subject to satisfaction of conditions precedent for the effectiveness thereof for the increase of the Facility and the accordion feature. The previous credit facility was a $15 million secured revolving credit facility that included an accordion feature for an additional $10 million.

The key terms of the upsized Facility are:

- The purpose of the credit agreement is to assist in funding offtake purchases from the portfolio or offtake contracts to be acquired under the Transaction and for general corporate purposes;

- Secured against substantially all the assets of the Company, including the ten gold offtake contracts and royalty assets to be acquired in the Transaction;

- Interest rate of Secured Overnight Financing Rate plus 2.50% to 3.50% (as defined in the Facility), contingent upon the Company’s leverage ratio;

- Facility has flexibility to be drawn and repaid, with the undrawn portion subject to a standby fee of 0.5625% to 0.7875% per annum based on the undrawn amount;

- Upfront fee of 0.25% per annum on the total Facility amount; and

- Matures on September 23, 2028, with annual one-year extension options.

Additional Portfolio Information

Fazenda, RDM and Santa Luz – Brazil | Operating | Equinox Gold

Equinox Gold’s Brazilian operations comprise three producing mines: Fazenda and Santa Luz (together the Bahia Complex) are in the State of Bahia, and RDM (Riacho dos Machados) in Minas Gerais. Fazenda has operated for nearly 40 years as both an open pit and underground mine, while Santa Luz achieved commercial production in late 2022 as a conventional open pit. RDM is an open-pit mine with a conventional plant that commenced production in 2014. Equinox provided 2025 production guidance for the Bahia Complex of 125-145koz at cash costs of $1,360-1,460/oz, and 50-60Koz for RDM, at cash costs of $1,615-1,715/oz.

https://www.equinoxgold.com/our-mines/fazenda-gold-mine/

https://www.equinoxgold.com/our-mines/santa-luz-gold-mine/

https://www.equinoxgold.com/our-mines/rdm-gold-mine/

Figure 1: Fazenda Mine, Brazil. Source: Equinox Gold

Figure 2: RDM Mine, Brazil. Source: Equinox Gold

Figure 3: Santa Luz Mine, Brazil.Source: Equinox Gold NI 43-101 Technical Report.

Greenstone – Ontario, Canada | Operating | Equinox Gold

Greenstone is a large open-pit mine near Geraldton, Ontario, which achieved commercial production in November 2024. Equinox consolidated 100% ownership of the asset in May 2024 and has been ramping up throughput and recoveries towards its 27ktpd nameplate processing capacity. Equinox provided a production guidance range of between 220,000 to 260,000 ounces at cash costs of $1,275-$1,375/oz for 20257.

https://www.equinoxgold.com/our-mines/greenstone-gold-mine/

Figure 4: Greenstone Mine, Ontario, Canada. Source: Equinox Gold – Greenstone Mine Site Tour.

Ruby Hill, Cove and Granite Creek – Nevada, USA | Operating | i-80 Gold Corp.

i-80 Gold’s Nevada portfolio is anchored by three cornerstone assets: Ruby Hill, a brownfields complex with existing processing infrastructure, now advancing the Archimedes Underground; Cove, a high-grade underground development on the Battle Mountain Trend; and Granite Creek, a permitted underground mine with additional open-pit oxide potential. In September 2025, i-80 announced that they had started underground development at Archimedes (Ruby Hill), following the receipt of the relevant construction permits8. The Company also delivered a positive Preliminary Economic Assessment for the Granite Creek Open Pit9, and an updated PEA for Cove10. https://www.i80gold.com/

Figure 5: Ruby Hill Mill Source: i-80 Gold.

Figure 6: Portal and Decline at Cove. Source: i-80 Gold.

Figure 7: Underground Portal at Granite Creek. Source: i-80 Gold.

Bonikro – Côte D’Ivoire | Operating | Allied Gold Corporation

Bonikro is Allied Gold’s open-pit operation within the Côte d’Ivoire Complex, operated alongside Agbaou in the Birimian belt with the two mills located 20 km apart. The assets are being managed to lift near-term output while extending a 10+ year strategic mine life. For 2025, Bonikro is guided at 98–105 Koz with cash costs of $1,230-1,300/oz11. Allied expects to spend $60M in 2025, driven by elevated production stripping to expose higher-grade ore and lower AISC from 2026, resulting in negligible waste stripping in 2026 and 202711. https://alliedgold.com/our-portfolio/c-te-d-ivoire-complex/default.aspx

Figure 8: Bonikro Gold Mine, Côte d’Ivoire.

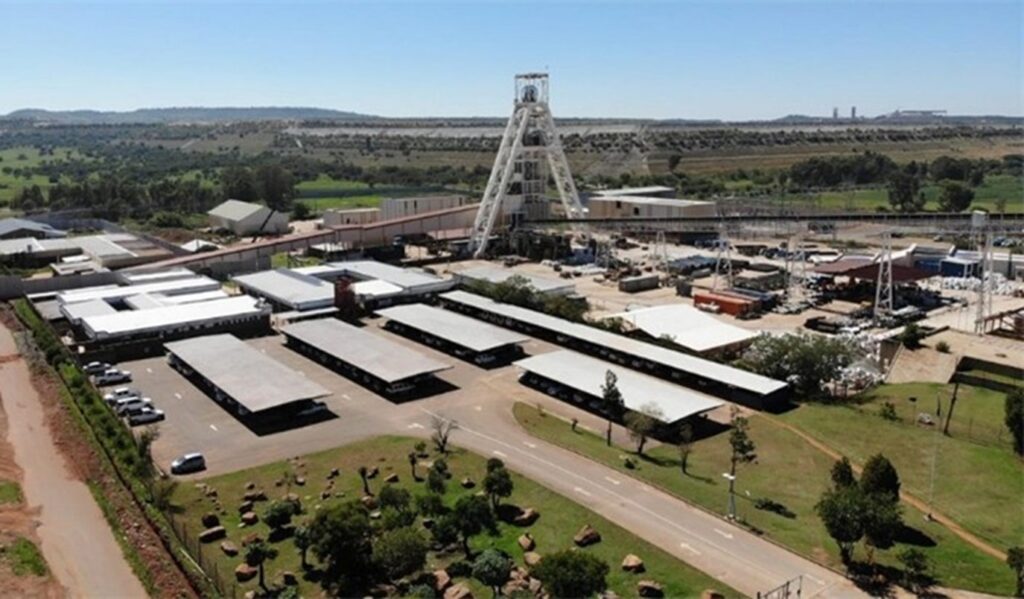

Blyvoor – South Africa | Operating | Aurous Resources

Blyvoor is an underground gold mine located on Johannesburg’s West Rand in South Africa, with operations dating back to 1942. Historically one of South Africa’s most prolific producers, the mine has yielded more than 38 Moz of gold to date. Aurous acquired the asset in 2020, and has since then re-started the operation, supported by a February 2024 technical report that outlines a 34-year life of mine producing approximately 150 koz per annum at an AISC of approximately $905/oz12. The orebody lies within the Witwatersrand Basin’s Carletonville Goldfield, hosted by the Main Reef Conglomerate Formation, and is mined from two economic horizons: the high-grade, carbon-rich Carbon Leader Reef (typically <40 cm thick, averaging 7–8 g/t) and the overlying Middelvlei Reef, approximately 50–75 m above, with lower but payable grades. Blyvoor benefits from substantial legacy infrastructure developed over decades of previous operations, including established underground haulage systems, developed crosscut networks, existing on-reef raises across multiple mining levels and comprehensive surface infrastructure. This existing infrastructure portfolio significantly reduces capital development requirements compared to greenfield mining projects, providing enhanced project economics and accelerated production ramp-up capabilities. Aurous is advancing a special purpose acquisition company (SPAC) based go-public transaction with Rigel Acquisition Corp., which is backed by Orion Resource Partners13, 14 https://blyvoorgold.com/

Figure 9: Blyvoor Gold Mine, Main Shaft, South Africa

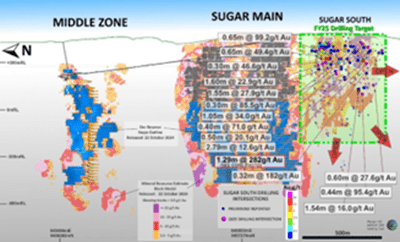

Sugar Zone – Ontario, Canada | Development | Vault Minerals Ltd.

Sugar Zone is Vault Minerals’ high-grade underground gold project in Ontario. The mine was acquired by Silver Lake Resources in 2022 and became part of Vault Minerals following the 2024 merger between Red 5 and Silver Lake. Operations at Sugar Zone were paused in 2023, while the new owners upgraded infrastructure and re-scoped the operating plan. Recently, Vault has indicated plans for a restart in 2026, following an investment of C$55M in development activities and concurrent receipt of a tailings permit15. https://vaultminerals.com/operations/sugar-zone

Figure 10: Sugar Zone Long Section – Ontario, Canada.

Source: Vault Minerals.

Dandoko – Mali | Development | B2Gold Corp.

Dandoko is a gold deposit within B2Gold’s Fekola Complex, acquired in 2022. The operator has been integrating it into its broader Fekola regional strategy. Dandoko is located approximately 25km from the Fekola mill. B2Gold has outlined plans to begin exploiting regional targets around Fekola in 2026, pending the receipt of exploitation permits16.

The acquired royalty is a 1.0% NSR, with the royalty holder assuming a $1.25M payment triggered upon the receipt of first royalty revenue, and a $1.25M payment triggered upon receipt of payment on 500,000 oz from the royalty area.

https://www.b2gold.com/operations-projects/producing/fekola-mine-mali/

Figure 11: Fekola Project Area incl. Dandoko, Mali.

Source: B2Gold.

Los Filos – Mexico | Care & Maintenance | Equinox Gold

Los Filos is a large heap-leach complex in the State of Guerrero comprising three open pits (Los Filos, Bermejal, Guadalupe) plus two underground areas (Los Filos, Bermejal). Operations are indefinitely suspended as of April 1, 2025, after a land-access agreement expired; Los Filos has been excluded from Equinox’s 2025 guidance pending a new agreement and restart plan17.

https://www.equinoxgold.com/growth-projects/los-filos-expansion/

Eagle – Yukon, Canada | Suspended | Formerly Victoria Gold, PricewaterhouseCoopers Inc. Appointed as Receiver

Eagle is an open-pit, heap-leach gold mine near Mayo, Yukon. Following a heap-leach facility failure on June 24, 2024, the Yukon government and an Independent Review Board oversaw investigations and remediation. PwC acts as court-appointed receiver of the project and project assets, issuing ongoing site and remediation updates and hosting the IRB’s final report18. The site remains in remediation, and a sale process is being managed through the receivership. https://www.pwc.com/ca/victoriagold

St Ives – Western Australia | Exploration | Gold Fields Limited

The acquired royalty is a 3.0% Gross Revenue Royalty (effective 1.04% GRR) on an exploration stage project in proximity to the St Ives Gold Mine. The rights and obligations to be acquired include the payment of existing royalties to previous holders of the tenements, resulting in the effective rate of 1.04% GRR.

Qualified Person

Timothy J. Strong, MIMMM, of Kangari Consulting LLC and a “Qualified Person” under NI 43-101, has reviewed and approved the scientific and technical disclosure contained in this press release.

About Vox

Vox is a returns focused mining royalty and streaming company with a portfolio of over 60 royalties spanning six jurisdictions. The Company was established in 2014 and has since built unique intellectual property, a technically focused transactional team and a global sourcing network which has allowed Vox to target the highest returns on royalty acquisitions in the mining royalty sector. Since the beginning of 2020, Vox has announced over 30 separate transactions to acquire over 60 royalties.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE