VIZSLA SILVER EXPANDS COPALA WITH BONANZA-GRADE SILVER OUTSIDE OF THE 2023 RESOURCE BOUNDARY

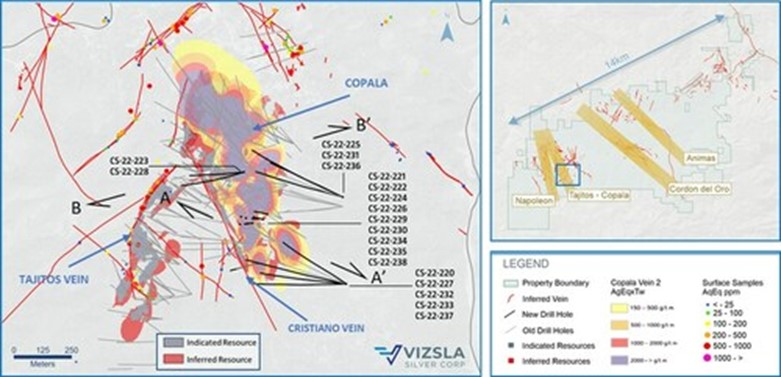

Vizsla Silver Corp. (TSX-V: VZLA) (NYSE: VZLA) (Frankfurt: 0G3) s pleased to report drill results from 19 new holes targeting the Copala structure at its 100%-owned, flagship Panuco silver-gold project located in Mexico. The reported results represent both step-out and infill drilling, effectively expanding the Copala mineralized footprint beyond the 2023 updated resource boundary as well as further demonstrating high-grade precious metal continuity within the Copala resource wireframe.

Highlights

- CS-22-225 returned 892 grams per tonne silver equivalent (AgEq) over 6.00 metres true width) (648 g/t silver and 4.29 g/t gold)

- Including 2,271 g/t AgEq over 1.21 mTW (1,680 g/t silver and 10.50 g/t gold)

- And 1,000 g/t AgEq over 1.45 mTW (756 g/t silver and 4.40 g/t gold)

- CS-22-220 returned 1,920 g/t AgEq over 2.50 mTW (1,673 g/t silver and 5.39 g/t gold)

- Including 7,505 g/t AgEq over 0.44 mTW (6,400 g/t silver and 23.00 g/t gold)

- CS-22-235 returned 1,039 g/t AgEq over 4.61 mTW (453 g/t silver and 9.16 g/t gold)

- Including 1,611 g/t AgEq over 0.90 mTW (502 g/t silver and 16.95 g/t gold)

- And 1,439 g/t AgEq over 0.90 mTW (353 g/t silver and 16.45 g/t gold)

- CS-22-229 returned 1,338 g/t AgEq over 2.90 mTW (1,010 g/t silver and 5.91 g/t gold)

- Including 1,540 g/t AgEq over 0.74 mTW (1,215 g/t silver and 6.07 g/t gold)

- And 2,282 g/t AgEq over 0.87 mTW (1,655 g/t silver and 11.00 g/t gold)

“Today’s results continue to de-risk Copala with tightly spaced infill drilling, while incremental step-outs, beyond the recently announced updated mineral resource estimate, highlight the significant expansion/discovery potential remaining in the district,” commented Michael Konnert, President & CEO. “We currently have three of our seven drill rigs targeting the Copala structure, which given its broad widths (avg 10 metres) and high silver and gold grades continues to be a primary focus for potential resource growth in the near-term. Additionally, we’re very excited about the prospectivity of an uplifted block to the east of Copala, which based on new interpretations, could host Copala type mineralization at shallow elevations, close to surface. Moving forward, as part of our fully-funded, 90,000 metre 2023 drill program, we will continue to expand the mineralized footprint at Copala and test the possibility of an uplifted block, in the coming months.”

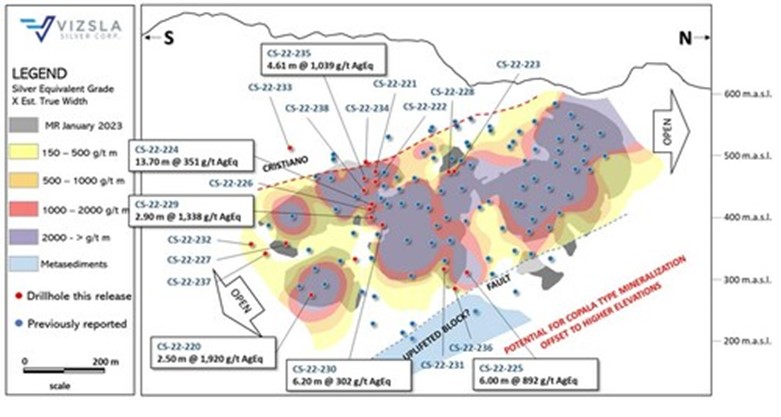

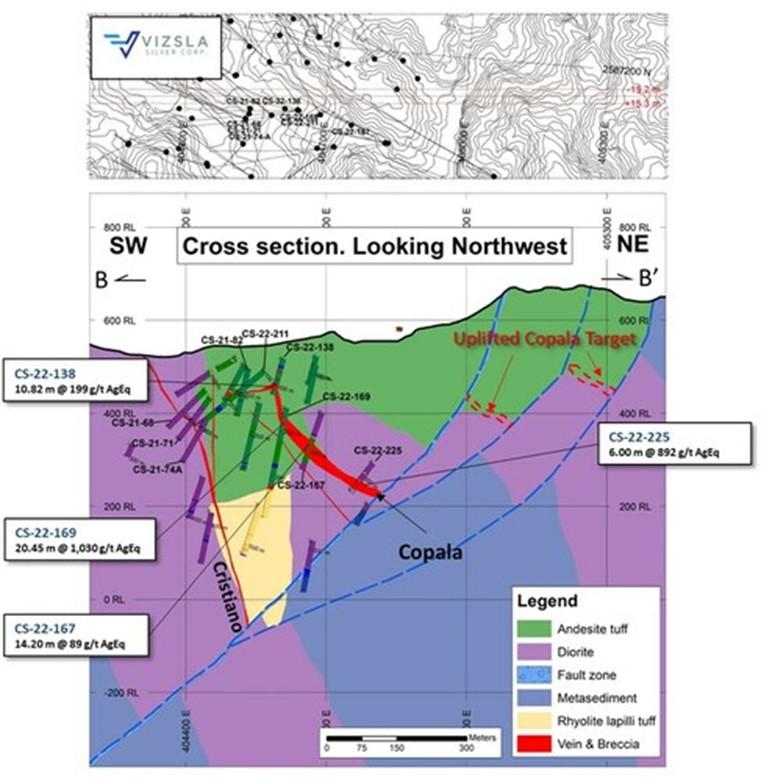

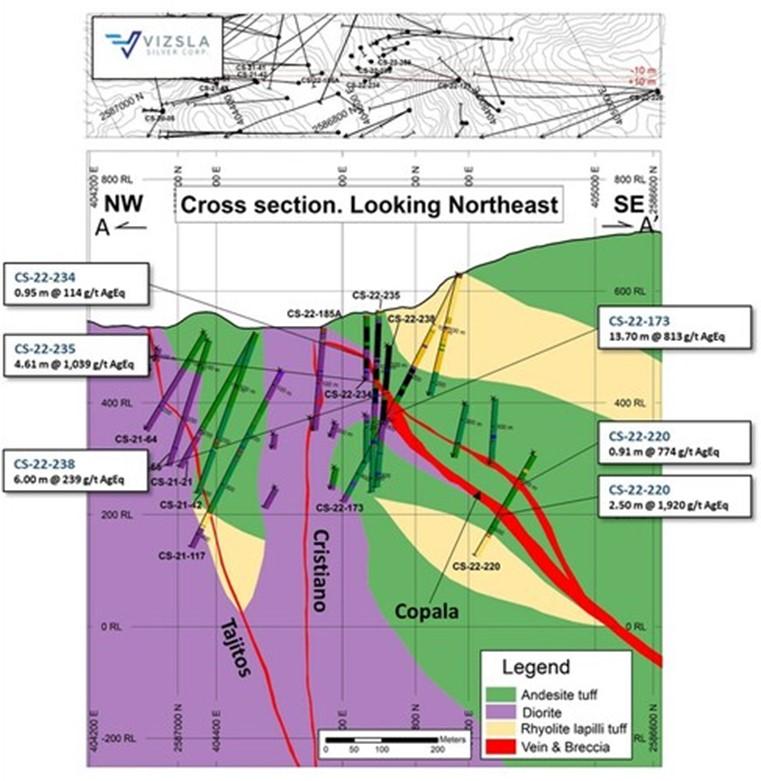

The Copala Structure is located in the western portion of the Panuco district ~800m to the east of the Napoleon structure. Copala hosts Indicated Resources of 51.1 Moz AgEq at 516 g/t AgEq and Inferred Resources of 55.4 Moz AgEq at 617 g/t AgEq within a broad envelope of vein-breccia interlayered with host rock, up to 82 metres thick. Interpretations by Vizsla geologists indicate Copala has an average dip of ~46° to the east (~35° in its northern sector and steepening to ~52° in the southern sector).

Drilling at Copala has now traced mineralization along approximately 1,100 metres of strike length and approximately 400 metres down dip. High-grade silver-gold mineralization remains open laterally to the north and southeast, as well as down dip to the east. The recently completed infill-drilling program consisted of 25 holes drilled at 25 metre centers designed to assess grade continuity and to provide sample material for future metallurgical tests. Infill-holes CS-22-221, CS-22-222, CS-22-224, CS-22-226, CS-22-229, CS-22-230 and CS-22-235, reported today, have confirmed strong continuity of structures and high-grades at tighter drill spacing. Additionally, step-out holes CS-22-220 and CS-22-225 have expanded the Copala structure’s high-grade footprint to the southeast and east, respectively.

Previously reported drillholes CS-22-202, CS-22-207 and CS-22-219, indicate an uplifted block of basement metasediments in fault-contact with andesites and diorite (see figures 2 and 4) on the east side of Copala. New interpretations suggest between ~300 to 350m of vertical displacement by the fault. This information, in conjunction with ongoing data collection, is being used to define a target elevation for Copala type mineralization on the footwall side (east) of the fault. An uplifted block to the east of the current Copala resource has the potential to host Copala type mineralization at a shallower elevation, closer to surface. Vizsla plans to test this hypothesis with drillholes collared on the footwall side of the fault during Q1 2023.

Table 1: Downhole drill intersections from the holes reported for the new splay vein at the foot wall of Copala.

| Drillhole | From | To | Downhole Length |

Estimated True width |

Ag | Au | AgEq | ||

| (m) | (m) | (m) | (m) | (g/t) | (g/t) | (g/t) | |||

| CS-22-220 | 515.10 | 516.25 | 1.15 | 0.91 | 526 | 4.22 | 774 | ||

| CS-22-220 | 560.20 | 563.35 | 3.15 | 2.50 | 1,673 | 5.39 | 1,920 | ||

| Includes | 561.85 | 562.40 | 0.55 | 0.44 | 6,400 | 23.00 | 7,505 | ||

| CS-22-221 | 106.40 | 110.80 | 4.40 | 3.35 | 428 | 3.64 | 643 | ||

| Includes | 108.00 | 109.50 | 1.50 | 1.14 | 912 | 7.96 | 1,385 | ||

| CS-22-222 | 131.90 | 135.00 | 3.10 | 2.40 | 288 | 1.73 | 385 | ||

| Includes | 132.75 | 133.75 | 1.00 | 0.77 | 697 | 4.44 | 948 | ||

| CS-22-223 | No Significant Results | ||||||||

| CS-22-224 | 190.50 | 212.60 | 22.10 | 13.70 | 270 | 1.48 | 351 | ||

| Includes | 191.65 | 193.60 | 1.95 | 1.21 | 553 | 2.94 | 713 | ||

| Includes | 205.60 | 208.10 | 2.50 | 1.55 | 846 | 3.96 | 1,054 | ||

| CS-22-225 | 517.50 | 523.70 | 6.20 | 6.00 | 648 | 4.29 | 892 | ||

| Includes | 519.25 | 520.50 | 1.25 | 1.21 | 1,680 | 10.50 | 2,271 | ||

| Includes | 520.50 | 522.00 | 1.50 | 1.45 | 756 | 4.40 | 1,000 | ||

| CS-22-226 | No Significant Results | ||||||||

| CS-22-226 | 236.20 | 244.65 | 8.45 | 7.11 | 66 | 0.44 | 92 | ||

| Includes | 236.20 | 237.05 | 0.85 | 0.71 | 123 | 0.92 | 177 | ||

| Includes | 243.55 | 244.65 | 1.10 | 0.93 | 163 | 1.01 | 219 | ||

| CS-22-227 | No Significant Results | ||||||||

| CS-22-228 | 141.40 | 143.00 | 1.60 | 1.60 | 97 | 0.44 | 120 | ||

| CS-22-228 | 203.00 | 206.00 | 3.00 | 3.00 | 247 | 2.17 | 376 | ||

| Includes | 204.50 | 206.00 | 1.50 | 1.50 | 433 | 3.83 | 661 | ||

| CS-22-229 | 242.65 | 246.00 | 3.35 | 2.90 | 1,010 | 5.91 | 1,338 | ||

| Includes | 242.65 | 244.50 | 1.85 | 1.60 | 1,453 | 8.73 | 1,941 | ||

| CS-22-230 | 276.00 | 280.85 | 4.85 | 2.92 | 176 | 1.06 | 236 | ||

| Includes | 277.00 | 278.00 | 1.00 | 0.60 | 357 | 2.30 | 487 | ||

| CS-22-230 | 288.20 | 298.50 | 10.30 | 6.20 | 242 | 1.15 | 302 | ||

| CS-22-231 | 542.00 | 544.30 | 2.30 | 2.00 | 116 | 0.40 | 135 | ||

| CS-22-232 | 475.50 | 477.00 | 1.50 | 1.45 | 175 | 1.09 | 236 | ||

| CS-22-232 | 549.90 | 550.70 | 0.80 | 0.77 | 533 | 2.40 | 657 | ||

| Includes | 550.30 | 550.70 | 0.40 | 0.39 | 926 | 4.12 | 1,139 | ||

| CS-22-233 | No Significant Results | ||||||||

| CS-22-234 | 74.35 | 75.55 | 1.20 | 0.95 | 67 | 0.76 | 114 | ||

| CS-22-235 | 126.00 | 133.65 | 7.65 | 4.61 | 453 | 9.16 | 1,039 | ||

| Includes | 126.00 | 129.00 | 3.00 | 1.81 | 428 | 16.70 | 1,525 | ||

| Includes | 130.75 | 133.25 | 2.50 | 1.51 | 764 | 7.51 | 1,217 | ||

| CS-22-236 | No Significant Results | ||||||||

| CS-22-237 | No Significant Results | ||||||||

| CS-22-237 | 571.40 | 577.60 | 6.20 | 5.56 | 161 | 0.38 | 175 | ||

| Includes | 576.55 | 577.60 | 1.05 | 0.94 | 513 | 1.20 | 558 | ||

| CS-22-238 | 152.00 | 160.50 | 8.50 | 6.00 | 176 | 1.12 | 239 | ||

| Includes | 158.60 | 159.45 | 0.85 | 0.60 | 566 | 4.40 | 823 | ||

Note: AgEq = Ag g/t x Ag rec. + (Au g/t x Au Rec x Au price/gram)/Ag price/gram. Metal price assumptions are $24.00/oz silver and $1,800/oz gold and metallurgical recoveries assumed are 93% for silver and 90% for gold. Gold and silver metallurgical recoveries used in this release are from metallurgical test results of the Napoleon vein (see press release dated February 17, 2022).

| Drillhole | Easting | Northing | Elevation | Azimuth | Dip | Depth |

| CS-22-220 | 405,084 | 2,586,574 | 700 | 305.7 | -61.1 | 659.4 |

| CS-22-221 | 404,630 | 2,586,861 | 564 | 270.3 | -89.7 | 261.3 |

| CS-22-222 | 404,656 | 2,586,860 | 570 | 270.3 | -89.7 | 267.0 |

| CS-22-223 | 404,643 | 2,587,058 | 557 | 265.0 | -64.0 | 543.0 |

| CS-22-224 | 404,686 | 2,586,857 | 580 | 270.3 | -87.7 | 252.0 |

| CS-22-225 | 405,072 | 2,586,950 | 641 | 295.8 | -48.8 | 661.5 |

| CS-22-226 | 404,705 | 2,586,856 | 591 | 270.3 | -85.7 | 340.5 |

| CS-22-227 | 405,084 | 2,586,574 | 700 | 282.9 | -49.3 | 714.0 |

| CS-22-228 | 404,643 | 2,587,058 | 557 | 252.6 | -67.1 | 668.0 |

| CS-22-229 | 404,726 | 2,586,853 | 599 | 271.7 | -84.1 | 403.5 |

| CS-22-230 | 404,744 | 2,586,876 | 615 | 281.5 | -80.8 | 376.5 |

| CS-22-231 | 405,072 | 2,586,950 | 641 | 285.8 | -52.8 | 610.5 |

| CS-22-232 | 405,083 | 2,586,570 | 697 | 270.0 | -52.1 | 667.5 |

| CS-22-233 | 404,702 | 2,586,663 | 619 | 254.6 | -58.2 | 231.0 |

| CS-22-234 | 404,630 | 2,586,835 | 556 | 270.2 | -89.7 | 262.5 |

| CS-22-235 | 404,655 | 2,586,835 | 565 | 269.6 | -87.0 | 325.5 |

| CS-22-236 | 405,072 | 2,586,950 | 641 | 296.2 | -54.2 | 591.0 |

| CS-22-237 | 405,084 | 2,586,574 | 700 | 277.3 | -52.3 | 652.5 |

| CS-22-238 | 404,680 | 2,586,834 | 570 | 256.0 | -85.2 | 322.0 |

Table 2: Drillhole details for the reported drillholes. Coordinates in WGS84, Zone 13.

About the Panuco project

The newly consolidated Panuco silver-gold project is an emerging high-grade discovery located in southern Sinaloa, Mexico, near the city of Mazatlán. The 6,761-hectare, past producing district benefits from over 86 kilometres of total vein extent, 35 kilometres of underground mines, roads, power, and permits.

The district contains intermediate to low sulfidation epithermal silver and gold deposits related to siliceous volcanism and crustal extension in the Oligocene and Miocene. Host rocks are mainly continental volcanic rocks correlated to the Tarahumara Formation.

The Panuco Project hosts an estimated in-situ indicated mineral resource of 104.8 Moz AgEq and an in-situ inferred resource of 114.1 Moz AgEq. An updated NI 43-101 technical report for the Panuco Project with the updated Mineral Resource Estimate is being prepared and expected to be filed on SEDAR within 45 days of our recent Mineral Resource Update published on January 24, 2023.

About Vizsla Silver

Vizsla Silver is a Canadian mineral exploration and development company headquartered in Vancouver, BC, focused on advancing its flagship, 100%-owned Panuco silver-gold project located in Sinaloa, Mexico. To date, Vizsla has completed over 250,000 metres of drilling at Panuco leading to the discovery of several new high-grade veins. For 2023, Vizsla has budgeted +90,000 metres of resource/discovery-based drilling designed to upgrade and expand the mineral resource, as well as test other high priority targets across the district.

Quality Assurance / Quality Control

Drill core and rock samples were shipped to ALS Limited in Zacatecas, Zacatecas, Mexico and in North Vancouver, Canada for sample preparation and for analysis at the ALS laboratory in North Vancouver. The ALS Zacatecas and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Silver and base metals were analyzed using a four-acid digestion with an ICP finish and gold was assayed by 30-gram fire assay with atomic absorption (“AA”) spectroscopy finish. Over limit analyses for silver, lead and zinc were re-assayed using an ore-grade four-acid digestion with AA finish.

Control samples comprising certified reference samples, duplicates and blank samples were systematically inserted into the sample stream and analyzed as part of the Company’s quality assurance / quality control protocol.

Qualified Person

In accordance with NI 43-101, Martin Dupuis, P.Geo., COO, is the Qualified Person for the Company and has reviewed and approved the technical and scientific content of this news release.

Figure 1: Plan map of recent drilling centered on the Copala structure. (CNW Group/Vizsla Silver Corp.)

Figure 2: Inclined longitudinal section for Copala structure with drillhole pierce points. The section is 1x along strike to 1.4x along the dip to compensate for the average 46-degree dip of Copala. (CNW Group/Vizsla Silver Corp.)

Figure 3: Cross section showing Copala and Cristiano veins and the concept of potential for Copala on uplifted block to the east. (CNW Group/Vizsla Silver Corp.)

Figure 4: Cross section showing Copala, Cristiano and Tajitos veins. (CNW Group/Vizsla Silver Corp.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE