VIZSLA COPPER ANNOUNCES ACQUISITION OF CONSOLIDATED WOODJAM COPPER

Vizsla Copper Corp. (TSX-V: VCU) is pleased to announce that it has entered into a definitive arrangement agreement dated September 7, 2022 with Consolidated Woodjam Copper Corp. (TSX-V: WCC) whereby Vizsla Copper will acquire all of the issued and outstanding common shares of WCC pursuant to a plan of arrangement.

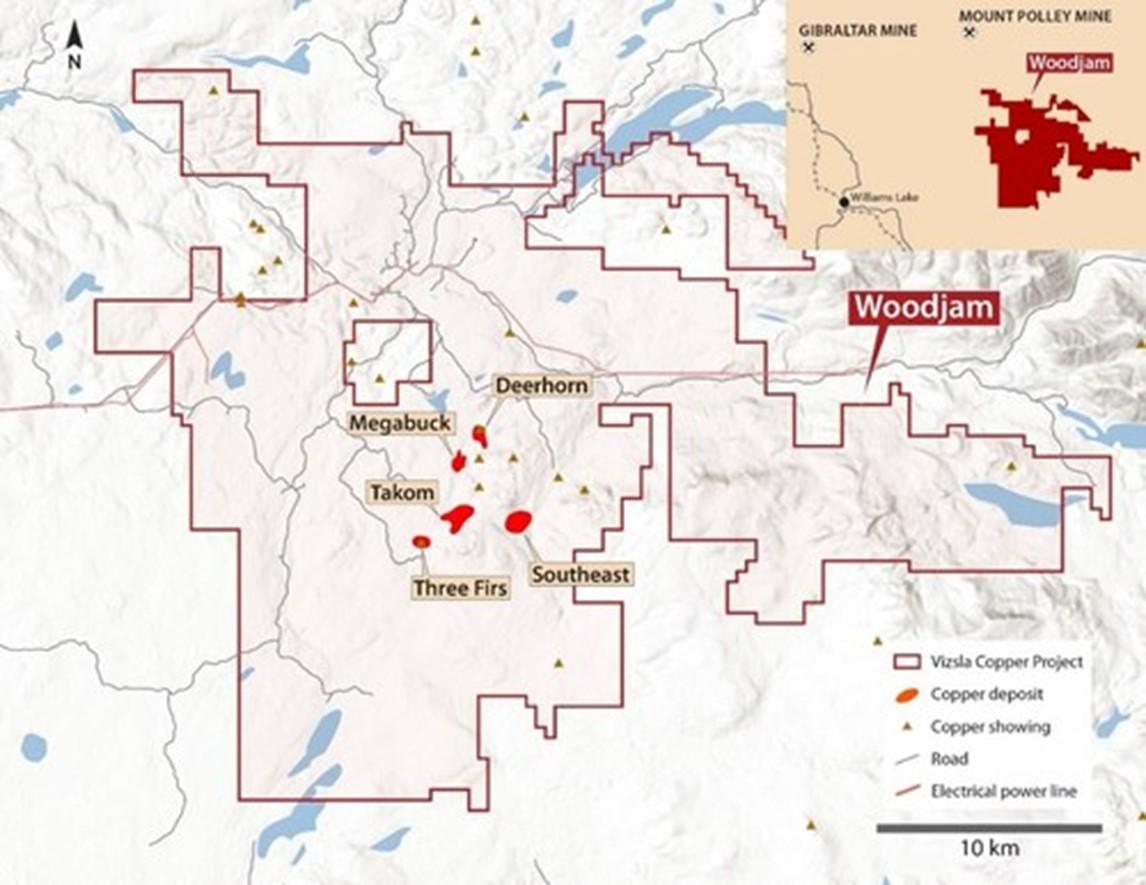

WCC is engaged in copper, gold and molybdenum exploration and development on the Woodjam project in central British Columbia. The Woodjam Project is located near the community of Horsefly, approximately 55 kilometers east of the regional center of Williams Lake, British Columbia.

TRANSACTION HIGHLIGHTS:

- Significant Resource Base. The Project contains multiple porphyry deposits with combined historical resource estimates containing approximately 1.7 billion pounds of copper and almost 1 million ounces of gold 1, 2, 3, 4.

- Large Land Position in Proven Mining District. The Project property is large and well-located, comprising more than 64,000 hectares in a very accessible region of the Quesnel Terrane.

- Strong Expansion and Discovery Potential. Combining the Woodjam Project with Vizsla Copper’s Blueberry and Carruthers Pass properties offers shareholders exposure to a pipeline of projects ranging from expansion-driven brownfield to exciting discovery-seeking greenfield.

- Experienced Management and Board. WCC shareholders will have exposure to the Inventa Capital-backed Vizsla Copper board of directors and management team. Bill Morton and Glen Garrett will become strategic advisors of Vizsla Copper, bringing a wealth of knowledge and experience, and ensuring a smooth transition for the Woodjam Project.

- Strong Treasury. Upon completion of the Arrangement, Vizsla Copper will have a total cash balance of approximately C$3.5 million, which will be used to fund ongoing exploration work at the Company’s properties.

- Board Support. The Arrangement Agreement has been unanimously approved by the board of directors of each of Vizsla Copper and WCC. The WCC board of directors has agreed to recommend that WCC shareholders vote in favour of the Arrangement.

- Low Execution Risk. No material regulatory issues are expected to arise in connection with the Arrangement that would prevent its completion, and all required regulatory approvals are expected to be obtained.

“This transaction immediately positions the Company as a potential developer in the battery metals space, given the presence of several porphyry copper and porphyry copper-gold deposits on the Woodjam Project,” stated Craig Parry, Executive Chairman of the Company. “We expect to see continued strength in the copper markets in the long term, with electrification demand and jurisdictional supply disruptions being key drivers.”

“The Woodjam exploration team discovered the Southeast deposit on the Woodjam property in 2007 and since then, they’ve delineated historical resource estimates of approximately 1.7 billion pounds of copper and almost 1 million ounces of gold within three deposits,” commented Steve Blower, Vice President, Exploration of the Company. “With an area of over 64,000 hectares in the heart of the prolific Quesnel Terrane, the potential for further exploration success on the Woodjam Project is excellent.”

WOODJAM PROJECT

The Woodjam Project is located 55 kilometers east of the community of Williams Lake in an area characterized by a low elevation, flat to gently undulating landscape that is well accessed by logging roads (Figure 1). Geologically, the Project is located within the prolific Quesnel Terrane – a large regional depositional belt commonly dominated by alkalic volcanic units and related volcaniclastic lithologies. The Quesnel terrane hosts both alkaline and calc-alkaline porphyry copper+/-gold+/-molybdenum deposits, including the Copper Mountain, New Afton, Highland Valley, Mount Polley, Mount Milligan and Kemess mines.

To date, six zones of porphyry mineralization (Megabuck, Deerhorn, Takom, Three Firs, Southeast, Megaton) have been identified at the Woodjam Project by drilling (95,092 meters in 281 holes since 2009 and a further 114 holes, 30,092 meters predominantly from 1998) (Figure 2). These six mineralized zones form a cluster approximately 5 kilometers in diameter. The Megabuck and Takom Zones were occurrences documented before 1998 but largely untested until after 2003 while the larger Southeast Zone and Deerhorn Zone were discovered in 2007 and 2008 respectively. In 2012, the Three Firs Zone was discovered and in 2012 the Megaton Zone was discovered.

A historical mineral resource estimate was completed on each of the Southeast, Deerhorn and the Takom deposits for Gold Fields Horsefly Exploration Corp. and WCC in 2013 1, 2, 3, 4. The Historical Estimates are summarized in Table 1.

Table 1 – Historical Estimates at the Woodjam Project1, 2, 3, 4

| Deposit | Category | Tonnage | Grade | Metal Content | ||

| M tonnes | % Cu | g/t Au | M lbs Cu | 000 oz Au | ||

| Southeast1 | Inferred | 221.7 | 0.31 | 0.05 | 1,507 | 383.7 |

| Deerhorn2 | Inferred | 32.8 | 0.22 | 0.49 | 158 | 516.2 |

| Takom3 | Inferred | 8.3 | 0.22 | 0.26 | 40 | 68.2 |

| Total | Inferred | 262.8 | 0.30 | 0.11 | 1,705 | 968.1 |

|

Notes: |

||||||

| 1. Source: “NI 43-101 Technical Report for 2012 Activities on the Woodjam South Property, Cariboo Mining Division, British Columbia”, prepared by Ross Sherlock, PhD., P.Geo., Gold Fields Canada Exploration BV and Alex Trueman, P.Geo., MAusIMM CP(Geo), Gold Fields Exploration, Inc., prepared for the Former JV Partner and WCC with an effective date of May 15, 2013. The Historical Estimate on the Southeast deposit (the “Southeast Historical Estimate“) was completed by Alex Trueman, P.Geo., MAusIMM CP (Geo), Chief Resource Geologist, Gold Fields Exploration Inc. with an effective date of May 15, 2013. The Southeast Historical Estimate was prepared with localized multivariate uniform conditioning, with a cutoff grade of US$8.60/t. The NSR calculation uses US$1,650/oz Au, US$3.90/lb Cu and recoveries of 69% Au and 85% Cu. The Southeast Historical Estimate was reported within a modelled open pit shell based on a price assumption of US$1,650/oz Au and US$3.90/lb Cu. | ||||||

| 2. Source: “NI 43-101 Technical Report for 2012 Activities on the Woodjam North Property, Cariboo Mining Division, British Columbia”, prepared by Ross Sherlock, PhD., P.Geo., Gold Fields Canada Exploration BV, Jacqueline Blackwell, Ph. D., P. Geo., Gold Fields Canada Exploration BV and Twila Skinner, P.Geo., Gold Fields Canada Exploration BV, prepared for the Former JV Partner and WCC with an effective date of May 15, 2013. The Historical Estimate on the Deerhorn deposit (the “Deerhorn Historical Estimate“) was completed by Brian Wolfe (MAIG), Principal Resource Geologist, Gold Fields Australasia Pty. Ltd. with an effective date of May 15, 2013. The Deerhorn Historical Estimate was prepared with localized multivariate uniform conditioning, with a cutoff grade of US$8.60/t. The NSR calculation uses US$1,650/oz Au, US$3.90/lb Cu and recoveries of 69% Au and 85% Cu. The Deerhorn Historical Estimate was reported within a modelled open pit shell based on a price assumption of US$1,650/oz Au and US$3.90/lb Cu. | ||||||

| 3. Source: “NI 43-101 Technical Report for 2012 Activities on the Woodjam North Property, Cariboo Mining Division, British Columbia”, prepared by Ross Sherlock, PhD., P.Geo., Gold Fields Canada Exploration BV, Jacqueline Blackwell, Ph. D., P. Geo., Gold Fields Canada Exploration BV and Twila Skinner, P.Geo., Gold Fields Canada Exploration BV, prepared for the Former JV Partner and WCC with an effective date of May 15, 2013. The Historical Estimate on the Takom deposit (the “Takom Historical Estimate“) was completed by Brian Wolfe (MAIG), Principal Resource Geologist, Gold Fields Australasia Pty. Ltd. with an effective date of May 15, 2013. The Takom Historical Estimate was prepared with ordinary kriging, with a cutoff grade of US$8.60/t. The NSR calculation uses US$1,650/oz Au, US$3.90/lb Cu and recoveries of 69% Au and 85% Cu. The Takom Historical Estimate were reported within a modelled open pit shell based on a price assumption of US$1,650/oz Au and US$3.90/lb Cu. | ||||||

| 4. The Historical Estimates are considered historical in nature and as such are based on prior data and reports prepared by previous property owners. The reader is cautioned not to treat them, or any part of them, as current mineral resources or reserves. The Company has determined the Historical Estimates are reliable given that they are based on data collected with modern drilling and sampling methods and were completed the Former JV Partner, and relevant to be included here in that they simply demonstrate the mineral potential of the Woodjam Project. A qualified person has not done sufficient work to classify the Historical Estimates as current resources and Vizsla Copper is not treating the Historical Estimates as current resources. Significant data compilation, re-drilling, re-sampling, data verification and a site visit may be required by a qualified person before the Historical Estimates can be classified as a current resource. There can be no assurance that any of the historical mineral resources, in whole or in part, will ever become economically viable. In addition, mineral resources are not mineral reserves and do not have demonstrated economic viability. Even if classified as a current resource, there is no certainty as to whether further exploration will result in any inferred mineral resources being upgraded to an indicated or measured mineral resource category. The Historical Estimates relating to inferred mineral resources were calculated using prior mining industry standard definitions and practices for estimating mineral resource and mineral reserves. Such prior definitions and practices were utilized prior to the implementation of the current standards of the Canadian Institute of Mining for mineral resource estimation and have a lower level of confidence. | ||||||

TRANSACTION SUMMARY

Immediately prior to the Arrangement, Vizsla Copper will complete a consolidation of the Vizsla Copper common shares on the basis of one post-consolidation Vizsla Copper Share for every 3.5 Vizsla Copper Shares issued and outstanding immediately prior to the Consolidation.

Under the terms of the Arrangement Agreement, all of the issued and outstanding WCC Shares will be exchanged for Vizsla Copper Shares on the basis of 0.307206085 Vizsla Copper Shares for each WCC Share. Pursuant to the Arrangement, Vizsla Copper expects to issue an aggregate of approximately 43,417,026 Vizsla Copper Shares to WCC shareholders. Upon completion of the Arrangement, current WCC shareholders will own approximately 65% of the 66,795,425 issued and outstanding Vizsla Copper Shares.

The Arrangement Agreement includes certain customary provisions, including non-solicitation provisions, as well as certain representations, covenants and conditions which are customary for a transaction of this nature. The Arrangement Agreement provides for a C$750,000 termination fee payable by WCC to Vizsla Copper in certain circumstances.

The Arrangement will be effected by way of a plan of arrangement under the Business Corporations Act (British Columbia), requiring the approval of: (i) at least 66 2/3% of the votes cast by the shareholders of WCC; and (ii) a simple majority of the votes cast by holders of WC shares, excluding votes attached to WCC Shares held by any person as required under Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions, at a special meeting of WCC’s shareholders called to consider, among other matters, the Arrangement. In addition to shareholder and court approvals, the Arrangement, including the Exchange Ratio, are subject to approval of the TSX Venture Exchange and the satisfaction of certain other closing conditions customary in transactions of this nature.

All outstanding stock options of WCC will be exchanged for options of Vizsla Copper and all warrants of WCC will become exercisable to acquire common shares of Vizsla Copper, in amounts and at exercise prices adjusted in accordance with the Exchange Ratio.

Full details of the Arrangement will be included in WCC’s information circular, which is expected to be mailed to shareholders in October 2022. It is anticipated that the closing of the Arrangement will take place in the fourth quarter of 2022. A copy of the Arrangement Agreement will also be filed on Vizsla Copper’s company profile on SEDAR at www.sedar.com.

FINDER’S FEE

In connection with the Arrangement, Vizsla Copper entered into a finder’s fee agreement with an arm’s-length party. As compensation for the finder’s introduction of Vizsla Copper and WCC, Vizsla Copper will pay to the finder such number of Vizsla Copper Shares as is equal to 3% of the number of Vizsla Copper Shares issued to WCC shareholders on closing of the Arrangement. The finder’s fee is subject to approval of the TSXV. Any Vizsla Copper Shares issued to the finder will be subject to escrow and released over a period of three years after completion of the Arrangement. The finder has agreed to notify Vizsla Copper of any potential disposition of Vizsla Copper Shares and allow Vizsla Copper the opportunity to designate the purchase of all or any portion of such shares.

QUALIFIED PERSON

The disclosure of technical or scientific information in this press release has been reviewed and approved by Ian Borg, P.Geo., Senior Geologist for Vizsla Copper. Mr. Borg is a Qualified Person as defined under the terms of National Instrument 43-101.

ABOUT VIZSLA COPPER

Vizsla Copper is a mineral exploration and development company focused on its interests in three British Columbia copper projects; the Blueberry project, the Carruthers Pass project, and, following closing of the Arrangement, the Woodjam Project.

Figure 1 – Woodjam Project Location Map (CNW Group/Vizsla Copper Corp.)

Figure 2 – Woodjam Project Map (CNW Group/Vizsla Copper Corp.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE