Under the Spotlight – Malcolm Dorsey CEO Torr Metals

Introduction

The mining industry is on the hunt for large copper and gold deposits that have favorable grades and are in locations amenable to mine developments.

Over 80% of the world’s copper production comes from large-scale open-pit porphyry copper mines.

In Canada, British Columbia enjoys the lion’s share of porphyry copper/ gold mineralization. These deposits contain the largest resources of copper, significant molybdenum and 50% of the gold in the province.

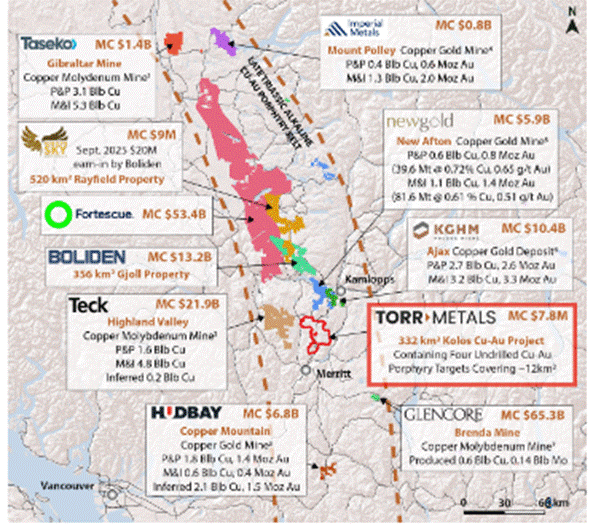

British Columbia’s Quesnel Trough is a Triassic‐Jurassic aged arc of volcano sedimentary rocks that hosts several alkalic copper-gold porphyry deposits. Extending from Washington State to the Yukon border the QT is a key player in Canada’s mining sector, particularly for copper and gold deposits. Operating mines include Mount Milligan, Mount Polley, New Afton, Highland Valley and Copper Mountain.

The Highland Valley copper mine is Canada’s largest copper mine, of the 39 copper mines in Canada 4 of the top 5 are in BC. The following are the four largest copper mines by production in Canada in 2023, according to GlobalData’s mining database

#1 Highland Valley BC

#2 Gibraltar Mine BC

#3 Copper Mountain Mine BC

#4 Mount Milligan BC

Today AOTH is putting Torr Metals (TSX-V:TMET) Under the Spotlight.

We’re talking to Torr’s CEO Malcolm Dorsey about the company’s flagship project, Kolos. The Kolos has 4 copper/ gold targets, all we at AOTH believe have off the shelf discovery potential.

Kolos is in the bastion of copper production in BC (46% of total Canadian copper production in 2023, Ontario was second at 43%), the southern end of the QT and home to the largest concentration of major miners in BC.

Rick Mills, Editor/ Publisher, Ahead of the Herd:

Malcolm, I want people on the ground trying to make a discovery, or advance one, and building value. What percentage of the money you’ve raised has gone to actual boots-on-the-ground exploration?

Malcolm Dorsey, President and CEO, Torr Metals:

That’s a good question. So, in terms of percentages of what’s going into the ground, I think that is part of what the company is about, with the fact that we positioned ourselves in a prolific mining jurisdiction, basically to leverage the fact that this is somewhere where we can easily operate, where we can easily put more money into the exploration, rather than money into remote exploration camps or into just building our own infrastructure to access some remote location.

So, the money that’s given, I try and keep it to about 20 to 30% towards marketing and monthly operating costs, and then the rest of it going into the ground for exploration.

RM: So basically 70 to 80% or $700,000 to $800,000 from a million dollars you’d be directing that into boots-on-the ground-type operation, looking for a discovery, keeping the company going, and building value for shareholders.

MD: Yes, we try and put more money into the ground for exploration and try and run things as tight as we can. We keep management costs at a minimum as well, so that we can really leverage putting more money into the ground.

RM: Have you bought shares in the market in your own company, or do you rely on, and I’m talking about financings, and I’m talking about buying shares in the market, or do you rely on options and special share units to reward you?

MD: We’ve kept the number of options to a minimum as well. We haven’t done RSUs. I’ve bought some shares on the open market to provide some market support. I’ve accumulated just over 50,000 shares, I believe, on the open market, but that’s in addition to about 2 million shares that I own that are at a price of $0.30 from the original RTO transaction.

With that, really, my payday is going to come at the end, so when we potentially push this project towards a point of a significant shareholder, I want to see value derived out of the shares that I own, and with that, I’m going to try and drive the project and the company in a direction that I think will end in a way that has that potential for a major new discovery, as I see that being the payday for myself as well as the shareholders.

RM: If you make a discovery and you advance it to a certain point, do you want to go mining, or would you prefer to sell it?

MD: The preference would be towards the greatest value to the shareholders, and my personal thought is that that is towards a potential takeover offer acquisition from a major/ mid-tier mining company.

So, the goal here is to really take it from an early stage, advance it to a level at which we are an attractive target for a takeover acquisition bid, and that would be the goal of where we direct the company rather than taking it towards mining.

Of course, there are people on the board with experience of taking projects from early stage to mining, but mining is not the goal.

RM: Well, I think you need those kind of people because they do have a say in how you explore and how you develop it to the right stage because they obviously know what a miner is going to be exactly looking for and how they want to see it developed, and maybe more important, how they want to see the surveys and the on-the-ground work done.

MD: Certainly, that’s something that I always try and push, the fact that when you’re developing an early-stage exploration project, it needs to be done in a methodology that the next set of hands are going to recognize.

I got my start working for majors, then mid-tiers, and then juniors, so I know, and I did quite a bit of years consulting for major and mid-tier explorers as well as producers, but we also have people on the board who, yeah, they’ve done that, they’ve taken early-stage to a mining project or they’ve worked for multiple major mining companies.

We’ve got the management in place that we’re ensuring that how we develop these projects is going to be in a manner that is going to be very easily recognized by a major or mid-tier, and they do highly appreciate that as well when they can recognize the methodology. They can see it and say, okay, that’s how we would have developed that project as well, which means that we like how you did it.

So, it’s good if you can start off with that, with the fact that they appreciate how you approached it, how you did it, makes it that much easier to move it to the next level.

RM: You’ve got several projects, but the one that’s your flagship, it’s called Kolos. That’s the one I want to talk about today. You’ve got four targets on that.

Why don’t you explain to us what the Kolos is and what’s so attractive about it?

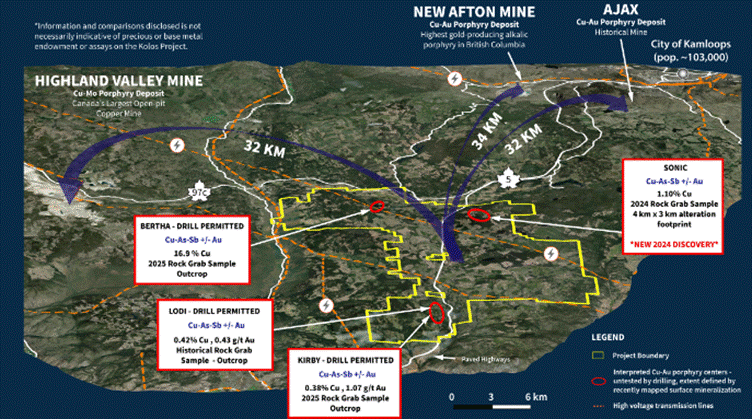

MD: The Kolos project, perhaps first of all where it’s located. What we’re targeting are these four copper-gold porphyries, early-stage targets. They’ve never been drilled before, and they’re located right off of Highways 5 and 97C in southern British Columbia.

Where they’re located is really within the copper-producing belt of Canada and British Columbia. That’s known as the southern Quesnel Trough. If you follow it, there’s eight major miners, some with producing assets or holding major deposits, as well as one mid-tier producer, New Gold (TSX:NGD) at New Afton, which is just 30 kilometers to the north of us.

We’re very well situated with some very good neighbors, but we’ve got that infrastructure accessibility as well. So, it’s not just highways, but we have power lines, we have railroads, we’re only a two-and-a-half-hour drive from Vancouver, which is Canada’s largest port on the west coast.

All that combines to say that we hit the top of the list when you’re looking for infrastructure access.

RM: There is a large concentration of major mining companies in the area for good reason. The Highland Valley copper mine is Canada’s largest copper mine, of the 39 copper mines in Canada 4 of the top 5 are in BC.

MD: Yes, we’re where the majors are most active in British Columbia, where there’s the largest concentration of them. And that is for a reason, because this area is where they are looking for additional assets, as well as those assets being there for potential feed, as some of them have producing mines such as Highland Valley, which is Canada’s largest open-pit copper mine, 30 kilometers to our west. But mines such as New Afton, just 30 kilometers to our north, has actually got a mine life that comes to an end in six years in 2031.

We’re leveraging that, that any significant new discovery would be a large potential discovery staying on its own but could also act as additional mill feed for these mines. So, what we’re looking at are these four targets. Altogether they cover about 12 square kilometers of geochemical surface anomalism.

That includes soils up to about 4,510 ppm copper, gold up to 725 ppb gold in soil. All those soil anomalies also correlate with outcrop mineralization at all four of our targets.

RM: Let’s talk Bertha first.

MD: We have some very high-grade supergene-style mineralization over in our Bertha target in the northwest portion of the project.

We’ve got about 17% copper and rock grab sampling from around an old historical exploration pit that produced 30 tonnes at 2.14% copper. This supergene-style mineralization is very analogous in terms of host rock style of alteration and mineralization to the New Afton deposit; New Afton being one of the highest-grade copper-cold porphyries in British Columbia. Really, the only other comparable is the deeper sections of the Red Chris mine now owned by Newmont (NYSE:NEM) up in northern British Columbia. That being said the presence of similar geological features does not necessarily indicate that the same endowment or mineralization will be identified at Kolos.

Our other three targets are the Sonic, Kirby, and Lodi. Kirby and Lodi are permitted.

Kirby and Lodi were where we first started. So, surface mineralization of just over 0.5% copper, over 4 grams per tonne gold in outcrop. We defined 6.6 square kilometers of surface soil anomalism.

Then we did a ZTEM survey, so a geophysical survey that shows hydrothermal alteration and mineralization extending into the subsurface. This is where we got really excited with this one, we saw the development of a serious subsurface target.

We can see that it continues over a kilometer of depth. We can see that this potential hydrothermal alteration and mineralization associated with the intrusive, just at the Kirby target alone, measures about 1,300 by 800 meters in dimension. So, there’s potential in the south at Kirby and Lodi for a cluster porphyry system.

Then if we go to the Sonic target, it’s just to the east of Highway 5 in the northeast portion of our project. There we’ve seen the development of a very large porphyry system. Sonic certainly has some strong potential, 1.1% copper at surface in outcrop with some very strong soil anomalism.

RM: And plans for drilling?

MD: Our first phase drill target that we’re looking at here to start in the fall of 2025 is over at Bertha. I’m starting at a target that had historical exploration at 30 tonnes at 2.14% copper, we’ve also defined surface mineralization along a strike length of 450 meters to the southwest, indicating a significant untested strike extent.

None of it has been drilled. We’re the first to do IP geophysics as well. That IP geophysics shows us a chargeability anomaly that’s at least 900 meters in strike length.

We can see it continues for over 600 meters vertical depth, and its dimensions are very similar to the structural controls of what you would see up at the New Afton system.

This is one where we see very high potential for a high-impact, high-grade drill interval to be made. If it is something comparable to New Afton, and I would have to add a caveat there, that info and comparisons disclosed are not necessarily indicative of the precious or base metal endowment or assays that might be possible on the Kolos project.

But if mineralization is correlatable to the chargeability anomaly and keeping in mind that historical trenching on the margins of the anomaly returned 12 meters of 1% copper there could be the possibility of some decent intervals of 75 to 100 meters of over 0.5% copper.

This is forward-looking in nature and actual results may differ materially but we’re very excited about our phase one drill target. Of course, we cannot guarantee that exploration will result in those estimates, but I do see a very strong potential to make a new high-grade discovery there.

And we have alternatives as well. We have three other targets that we can pivot into. So, plenty of flexibility, plenty of shots on goal to be made for our four different porphyry targets.

RM: Do you have the money to do this, or do you need to raise more?

MD: We do have the ability to get started with about nine hundred thousand in the bank in hard dollars however the company may consider future financing options, including potential flow-through structures, subject to market conditions and regulatory approval

RM: A lot of these porphyries they’re not just one single deposit. They’re mining from multiple open pits at the same time. What do you envision in your head for Kolos?

MD: I think even at the earliest stages, like we had previously discussed, if you’re developing a project with a methodology, a thought process towards what is the end product going to look like, because that’s how it should always be started, is you should know, does this even have the legs to make it that far? And what’s it going to look like?

What I’m going to say next is forward-looking in nature and actual results may differ as comparisons made are not necessarily indicative of the style of mineralization or extent of metal endowment on the Kolos Project.

At Bertha what I see is something with the scale potential to be along the lines of a New Afton. In that case, you’re looking at something that is more mid-tonnage. New Afton is just about 83 million tonnes in size but still packs a punch with about 2 billion pounds of copper and 2 million ounces of gold.

So mid-tonnage and higher grade and it’s largely all concentrated in a single ore body. There was surface mineralization mined out in the 1970s at New Afton that produced 23 million tonnes at about 1% copper and 0.6 grams per tonne gold.

If you look over towards the Sonic target, we have already identified significant surface geochemical anomalism covering 4.5 square kilometers, however the plan would be to do an IP geophysical survey to see also verify the potential extent of the subsurface as well.

Based on the size of geochemical anomalism and surface extent of alteration there could be a geological comparison made to the nearby Ajax deposit, which is over 500 million tonnes.

And then if you look over towards the Kirby and Lodi targets in the south, what the Z-TEM geophysics has shown us there is that they seem to be taking the form of a large-scale cluster porphyry system.

More pits, but they’ll be quite closely spaced. Something similar perhaps to what you see at Copper Mountain, which is about 100 kilometers to the south, which was also used as a comparison for developing our exploration model around Lodi and Kirby. There, what you see is a series of pits that are all closely concentrated, that all feed into the overall resource of Copper Mountain.

RM: You own or will own all the projects 100%. Do you have any royalties on any of the projects?

MD: Three of those targets, so 275 square kilometers of the 332-square-kilometer Kolos project are 100% owned by us. The one part that we strategically optioned back in this past spring was the Bertha property, which is adjacent, and it hosts the Bertha target.

That one is 57 square kilometers. We optioned it. There is the potential there for full ownership down the line. The option agreement is quite low, so very easily manageable for companies such as Torr. That one would have a royalty on it of 2% with a 1% buyback for $1 million.

RM: Very reasonable. You’re not going to be loaded down with stacked NSRs when you potentially sell the project down the road. That’s works for a better deal for shareholders, excellent.

Another thing I wanted to know was, how do you think the Teck-Anglo deal would have affected southern BC copper explorers and developers and producers? Do you think it was a big deal?

MD: I think seeing the fact that the head office was moving to Vancouver, there perhaps could be a renewed interest in not just Highland Valley, but also the periphery of it. You also see increased activity in the region.

Fortescue and Boliden in the past two years moved in and staked a large amount of ground just to our north. Boliden also just entered into an earn-in JV with Golden Sky Minerals (TSXV:AUEN) for $20 million on that.

Golden Sky Minerals is another junior explorer with my brother, Cameron Dorsey, who’s VP of Exploration that developed the conceptual idea and staking of their Rayfield project just to our north. Good conceptual plays with a strong exploration model are highly attractive to majors in this region.

And with something like the Teck-Anglo deal, I think you’re going to see that they are very aware of Fortescue and Boliden and others who are sniffing around in the region for new assets, new plays. And I think perhaps you might see a step up in Teck’s activity in the region.

RM: What kind of relationship do you have with the First Nations in the area?

MD: With the First Nations we were very proactive. So even prior to submitting any permit applications, we actually launched early engagement with the local First Nations, wanting to make sure that they knew that we wanted to talk with them even before we submitted a permit.

There was great appreciation for that approach. With that, we’ve developed some strong relationships with the First Nations in the area.

The principal First Nations being the Lower Nicola, Upper Nicola and the NNTC. Those represent additional First Nations within the region. So very good relationships with open communications. And as we move forward here, we’re looking for further collaboration and working together.

RM: The price of copper is at $4.60 right now, if you look at a long-term chart back in 2016 it was US$2 a pound, moving forward to today you see the highs are higher and so are the lows, I think it’s a chart that shows structural supply deficits building.

I know the long-term copper trend is up and copper is a critical metal. We need it for AI, we need it for power centers, we need it for electrification and decarbonization and power transmission.

Trading Economics

The other thing I see at when I look at these porphyries, and one of the big reasons I like them is because they’re so massive and scalable, they can severely impact a major miner’s bottom line to the upside.

I’ll tell you a secret, the real reason I like copper-gold porphyries is because the gold gives a copper explorer/ miner a chance to get in on a couple million ounces of gold and a gold explorer/ miner a chance to get in on a couple of billion pounds of copper.

Trading Economics

In yester years if it wasn’t a 5-million-ounce gold deposit, a major gold miner didn’t even want to look at it. But times certainly have changed with an overall scarcity of those size deposits being found.

The fact that your average size of a gold deposit has gone from well over 7 million ounces down to just a little over 4 now, combined with the scarcity of them is causing an awful lot of interest in these porphyries because of the gold content.

And that was starting well before gold sitting at $3,700 an ounce. And now the pitch is starting to get feverish in a lot of these gold players looking for their next big gold project. They would consider some of these porphyries as a gold play with a copper by-product.

You know, when you start looking at $120 a tonne, just from the gold, it really opens pops your eyes wide open, doesn’t it?

MD: Oh, certainly. I’ve always liked to say that that BC alkalic copper-gold porphyries are as much a gold deposit as they are a copper deposit. You look towards something like New Afton, it’s 2 billion pounds of copper, 2 million ounces of gold, something like Ajax, it’s 3 billion pounds of copper, 3 million ounces of gold.

So, if you were to find a 3-4Moz gold deposit these days, you’re going to get plenty of market excitement and major miner interest, but to be able to add in a couple billion pounds of copper? I think that really turns the tables on the prospectivity and the attractiveness of these types of systems.

And you see it with a lot of the major miners, companies like Barrick doing name changes, showing a shift as well towards going for these copper-gold systems and not just gold.

RM: You’ve explained your work program for the year and your goals. What about 2026? What do you expect to accomplish in 2026?

MD: As we move towards phase one drilling at the Bertha target, we’re also collecting up to 1,500 soil samples, as well as a systematic surface mapping and rock sampling program in the Sonic Zone to move that one towards being drill-ready in preparation as well for an expected drill permit to be received by about spring of 2026.

As we go through the rest of the year, I’m expecting that we’ll have additional geochemical results from that surface sampling program at Sonic that have the potential to expand, possibly double the geochemical footprint from 4.5 square kilometers to maybe even something around 9 square kilometers based on surface mineralization that we’ve sampled outside of the historical soil sampling.

We know that there’s potential that we do more soils and there should be some anomalism coming back, so we’ll do that. We’ve got a planned IP that we’re going to do at the Sonic Zone.

And then we’ll also start to get assay results from the drills that were done at the Bertha target. With all that combined as we lead into 2026, I think we’re going to see the potential emergence of some very exciting targets that could establish the Kolos project as a really key player in early-stage copper-gold porphyry exploration in this region. And then we can look towards what are the next steps.

I would like to target the Sonic Zone — we’ll see after vindication of IP geophysics — but there is some strong potential there for a very large copper-gold porphyry system that will also require drill testing to prove up the mineralization potential. Coupled together with drilling at Bertha we have some exciting and strong targets that have the potential to result in a brand-new discovery, but we also have plenty of room as well as we go into 2026 with the Lodi and Kirby targets.

RM: From our talks I know you have a key focus moving forward.

MD: There’s lots to look forward to but the key to our success will be to keep to our established exploration model, maintaining a methodical exploration approach and not get ahead of ourselves. We don’t want to spread ourselves too thin by going after too many targets at once.

We need to really constrain the targeting to create value for the shareholders, right now I see very good potential by starting at Bertha. And then in the spring, I see some good potential by drill targeting Sonic as well.

RM: Excellent. I want to bring in here, I live in northern BC. I know what winters are like here, and I know what winters are like up in the Yukon, Northwest Territories and Nunavut. There is such a thing called a Canadian winter stock. They don’t do much work if any in the winter, their news flow collapses and sometimes the share price suffers. That’s just a fact, happens pretty much every year.

You have Canadian northern stocks, winter stocks where you could do work, but it’s minus 30 with a wind chill. It gets down to minus 40, sometimes colder. And I’ve been out in those temperatures working.

And I’ve got to say straight out, you don’t do anything outside unless you absolutely have to.

Now I live on a farm, I see cold weather coming and I run out and feed the horses and the cows eight bales of hay if I have to, just so I’m not running around trying to start equipment at minus 45 wind chill and stuff like that. You just don’t do it if you don’t have to, if you do the cost is enormous.

You’re not a northern stock. I would consider you in southern BC to have relatively easy winters. You can work all-year-round down there.

MD: The key to where we are is that we don’t need to maintain an exploration camp. So that’s another logistical thing. In the wintertime, I’ve worked in camps up in the north where you can operate through, usually not through the mid-winter, through the deepest, coldest months, but perhaps through the shoulder seasons of the wintertime.

Maintaining an exploration camp in the wintertime becomes astronomical in cost. But we don’t have that, we operate out of nearby towns and cities. With that, we have highway access. We have road access to all of our drill targets right off the highway. And this area as well tends to get milder winters, not as much snowpack.

Even previous years, we’ve collected soils into mid-November with no issues. Last year was a mild enough winter that I did hear of other companies that were collecting soil samples in the middle of the wintertime. We’re certainly in an area that you can operate year-round and have quite a bit of flexibility in what you can do.

RM: Did I miss anything you wanted to cover, Malcolm? Do you have anything to add here?

MD: I think you covered it very well, but I’d like to add where Torr is right now. We’re in that pre-discovery phase, we’ve done the leg work for the last two years, we’ve staked most of the ground, 80% of that ground is 100%-owned by us. We staked it, did the leg work and established some very high-quality, high-impact targets, really constrained the targeting as well to these four porphyry targets.

Now it’s time to move forward to the next level, and that’s the planned drill program with a phase one starting at Bertha, and then we’ll move into our other targets as we move into successive seasons.

RM: Okay, I just want to sum it up with if you’re going to participate in a financing, if you are thinking about buying in the market, you’re looking at an outstanding share count of 62 million, a market cap of $8 million, which I think is very cheap and, most important, you’re going drilling.

A little bit of success in this market. I’m not going to make predictions, but $8 million market cap seems ridiculously low to me.

Thank you very much, Malcolm, great talking to you.

MD: Thanks for having me, Rick.

Subscribe to AOTH’s free newsletter

Richard does not own shares of Torr Metals (TSX-V:TORR). TORR is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of TORR.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE