Under the Spotlight – David D’Onofrio, CEO, White Gold Corp.

Rick Mills, Editor/ Publisher, Ahead of the Herd:

David, you had some news out this morning regarding the White Gold Project’s updated mineral resource estimate but one project, admittedly a very large high-grade gold project, is far from the reality of the White Gold story.

David D’Onofrio, CEO, White Gold Corp. (TSX.V:WGO, OTCQX:WHGOF, FRA:29W):

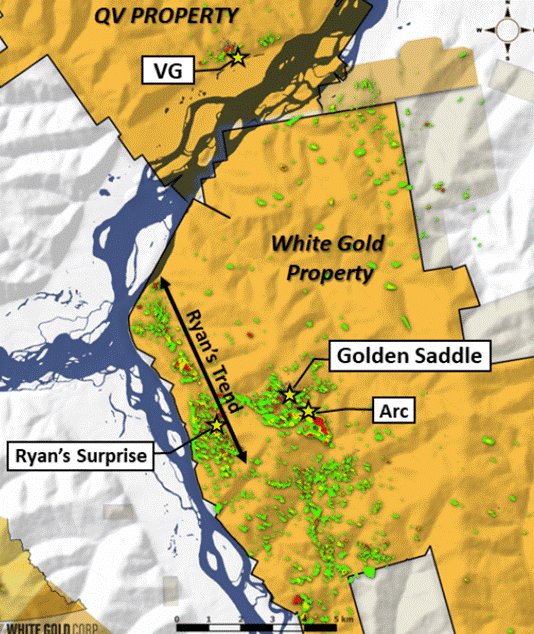

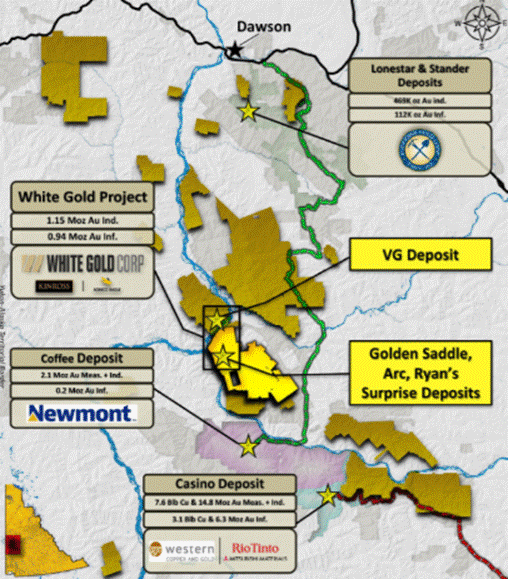

Yes, we did. Some very exciting news indeed. But you are correct. The White Gold Project is the center, or the foundation of the White Gold story. However, what this company really offers is the opportunity to not only to be investing in a potential mine, but an entire potential district, a massive land package in which we have cherry picked and locked up 80% of the targets.

RM: White Gold has been building a story base for quite a while and it’s a great time to be working in the Yukon, and elsewhere, looking for gold and critical metals.

Let’s get into the company’s flagship White Gold Project.

DD: Now that we’ve put out the update, we are getting more recognition as many people were not aware that White Gold had a very substantial resource. And now at 3 million ounces in an open pit, its definitely caught the attention of many people.

But in addition to its substantial size, what differentiates this resource from others in the Yukon and within Canada is really, and this is the really exciting part of the story in the short term, is the grade of the deposit. This is the highest-grade deposit in the Yukon at just under 1.4 grams per tonne. It’s made up of four satellite deposits all open for expansion; and three of which have seen very little work.

“The White Gold Project now comprises 1,732,300 ounces of gold in the Indicated category (35.2 million tonnes averaging 1.53 g/t Au) and 1,265,900 ounces in the Inferred category (32.3 million tonnes averaging 1.22 g/t Au), based on open pit and underground resource estimates – Rick.”

Based on what we have learned from our VP of Exploration Dylan Langille we think there’s tremendous upside.

The Golden Saddle Zone has a core that’s over 1.1 million ounces at almost 3 grams per tonne, all in an open pit, which is an exceptional grade to be mining from an open pit. And within that core, if you raise the cut-off grade to 3 grams per tonne, you still have over 700,000 ounces at almost 5 grams per tonne. And that is very special.

So, this is really like nothing else in the Yukon, and why I think now that people are understanding more about the company, are starting to appreciate that it’s a very, very unique and prospective opportunity right now.

And what Dylan’s done is opened our eyes to how much bigger this thing could be than we originally thought and really brought to light the fact of this unique characteristic of this deposit.

RM: That core of Golden Saddle, there’s really nothing like it in the Yukon. Or across Canada in an open pit.

DD: Exactly. And it remains open. And that’s the really exciting part, which will be a big focus of our exploration program now to continue to grow the high-grade core

RM: It’s important to remember that the info in the just released and updated MRE does not include any of the 2025 program that is ongoing right now.

Please explain what the 2025 program entails as it pertains to your White Gold Project and possibly growing it’s gold ounces.

DD: So, this year there were two main focuses of our diamond drilling. The first one is the high-grade footwall zone that runs sub-parallel to the core high-grade zone in the Golden Saddle.

Dylan observed that historic drilling had encountered two pierce points in that zone, but the pierce points were 300 meters apart. So, none of that material was able to be pulled into our existing resource. He’s of the view that if we can stitch that together, and he’s pretty optimistic on the probability of doing that, that zone will then be able to get pulled into our resource going forward, which is then going to constitute part of a preliminary economic assessment (PEA) that is underway and we’re looking to deliver in the first half of next year.

So, that’s potentially more 4-gram-plus type material in a pit. I think those are very exciting targets to be going after. And hopefully with those two pierce points that we’ve seen in the past, that’ll be high-probability-type exploration work.

RM: What else is Dylan doing, the second part of growing the resource?

DD: Dylan’s drilling using oriented core. This is the first time that the deposit will actually be drilled with oriented core.

That’ll let him and the other members on our technical team really get a better understanding of the structural orientation of these zones. I think that will help drive the planning for our next program. That’s important to understand all the opportunities to grow our resources, which we’re pretty optimistic can happen.

RM: In my talk with Dylan, linked to above, it became clear pretty quick he’s a very good geological detective looking for every opportunity to increase the ounce count.

DD: Yes, it’s very exciting talking to him, he’s looking for where is the plumbing coming from, does all this connect at depth? And from what he explains to me is that’s typical for these orogenic-type deposits. That’s another conversation for another day with you and him. My wheelhouse is on the corporate side, but that’s a super-exciting blue sky-type opportunity.

So that was part of it. But with these core holes, he’s able to actually test three targets with each hole. So, he’ll be testing the footwall, the oriented core going through the Main Zone, and then above the Main Zone is another parallel zone.

This is sitting on top of it, which is this hanging wall zone, which has been identified in the past, but it was very sparsely included in our historic resource. In this updated MRE and part of the remodeling exercise in doing that, we were able to capture more of this hanging wall within our resource.

RM: There was something that I talked over with Dylan when I interviewed him and that was a lot of unassayed drilling into the hanging wall.

DD: Yes. It didn’t sit well with him that with all the drilling that’s been done, the hanging wall is still so patchy.

In his review of trying to understand why, what he uncovered was that about 7,000 meters of historic drilling through the hanging wall never ended up being assayed. That’s a crazy find and we are really excited to be able to get that data as we still have all the core. If you ask why it wasn’t tested, There’s actually a good reason for that. After making the discovery, it was acquired so quickly that the original geologist never had a chance probably to go back.

And it was a different rock unit and maybe it was a different time and different gold prices, so it never got assayed. Now, fortunately, we have all that core. So, we’re going to be able to pull that core and start to assay it.

That’s an incredible bonus, to be able to have all that core in an area where we, again, we think will be high probability-type work because there’s been other instances of this hanging wall nearby that have been mineralized with gold. So those are the four aspects of new information we’ll be looking to garner from our current diamond drill program on the Golden Saddle. And then we’re also doing a little bit of drilling over on the Arc deposit to support the PEA.

So, those are the four aspects of new information we’ll be looking to garner from our current exploration program on the Golden Saddle. And then we’ve also done a little bit of drilling over on the Arc deposit to support the PEA.

That is primarily for metallurgical testing, but that Arc deposit itself, like everything else, remains wide open. It’s a huge footprint, over a kilometer long, but it’s only been drilled down to about 100 meters. So, a tremendous amount of upside there.

And I think this metallurgical information we’ll get from that will really continue to drive more value at the deposit itself.

RM: It’s not a matter of if the White Gold deposit is going to continue to grow. Really, it’s a matter of by how much, I think.

DD: I share those views, and you can say that more directly than I can, being part of the company, but I certainly believe it. Again, it’s not just arm-waving. That’s what I love about Dylan’s program. He shows you where the historic holes are, he shows you the path, he brings it up in Leapfrog 3D software, and you can really see each hole that we’re doing this year has a specific objective, and then all the holes that we’re planning for the future, which is going to be a much, much larger program, will have been planned in a similar manner.

Very specific deliverables, and hopefully, because we’re working off of so much good data, a higher-type probability of success.

RM: With the new and improved share price, you’re going to avoid an awful lot of dilution and be able to raise a significant amount of capital from everybody you’ve got covering you. I don’t think I’ve seen a junior with quite so much coverage from the financial institutions and the mining analysts. It’s been great to read a lot of this stuff and see what they’re talking about.

DD: That’s an interesting point, and I think that’s part of the reason why we have started to get so much recognition recently – it’s not a new story, White Gold. We’ve been around. And although we’ve continued to build value every year, the investor community was not aware of our accomplishment because we actually haven’t had any formal institutional coverage. Hopefully that will change now that we’re spending more time try to get the word out there.

RM: You have previously stated to me that the 2025 Precious Metals Summit at Beaver Creek was a great eye-opener.

DD: Yes, my two biggest takeaways from Beaver Creek was the fact that the world is starting to care about the commodities and precious metals which translates into an opportunity with the junior mining sector, which really hasn’t re-rated yet, and secondly that the Yukon is now really being widely viewed as one of the last great frontiers in Canada. It’s still underexplored, and we’re in such a great position having such a large land package, but not just land that was acquired through a land grab.

This was all systematically evaluated by Shawn Ryan’s novel approach and selected and cherry-picked amongst the best of the best to put into White Gold.

But our White Gold story was almost completely unknown by the institutional community. And this is why you’re starting to see these notes from even some of the largest institutions in Canada say, hey, wow, here’s an idea that really caught our eye from Beaver Creek. And that type of conversation has continued, and we’re getting more and more interest every day as the word continues to reach a broader audience.

So hopefully it’ll be that type of institutional coverage that will allow us to really get the story out to an even broader network and to the institutional community itself.

RM: There’s an awful lot of attention and capital flowing into the Yukon, and White Gold in particular for perhaps another reason. You’re not up to speed, let’s say, with your comparables, you’re trading at a discount to your peers.

And none of you are trading up to the fact that we are in Canada, everyone talks US dollars. But expenses are in Canadian dollars, and right now gold is priced at Cdn$5,580.00 an ounce. People need to wrap their head around that.

DD: Yeah, good points, you’re absolutely right on both, Canadian miners are reaping that benefit.

And even with the recent price appreciation in White Gold we still continue to be at a fairly significant discount to almost all our peers in the Yukon, and that’s notwithstanding the fact that we’re the highest grade and have arguably the most exploration upside.

So yes, I think there’s a lot of re-rating potential to be had here.

RM: That’s just on the gold side; nobody seems to be taking into account any of the three critical metals properties that you’re working on in your 2025 program.

DD: That’s actually a really good point. The Yukon has just so much geological potential. It’s the same mineral belt that runs from Alaska to the Yukon to BC. Now, Alaska and BC have had much more ounces delineated over the years. But the reason, in my view, and this has been corroborated by analysts, is simply due to the relative amount of exploration investment.

The Yukon just hasn’t seen the work get done yet. And it’s not just gold. There’s enormous critical mineral deposits.

Our neighbor to the south, a company called Western Copper and Gold. They have this Casino deposit. It’s one of the largest undeveloped copper porphyries in Canada.

It’s 20 million ounces of gold and 14 billion pounds of copper. And two of our properties sit in the shadows of that. And as you well know, these porphyries happen in clusters.

So, we’ve identified two very large targets close by, which have a lot of similarities. These are not small targets either. I think both of them are over 3 km by 3km.

And we spent the last couple of years doing the work. And so, with the soil geochemistry and now geophysics, which we did last year, and continue as part of our program this year, these are going to be getting to drill-ready status. And in addition to the Casino, the Minto mine is not too far away.

The prospectivity for copper is very high. In other parts of our package, we’ve identified other critical minerals signatures and targets for tungsten, bismuth, antimony. These are all particularly interesting.

RM: We’re in an environment now, that critical minerals have become not only politicized, but weaponized as well, there’s a tremendous amount of interest in those kinds of projects and WGO has plenty of them.

DD: Yes, so what we’ve decided to do corporately, and we’re in the process of doing now, is actually isolate those properties into a new vehicle, which we’ll spin out to our shareholders over the coming months.

And that will allow us to build a focused team with the expertise on these critical minerals to advance them and also give it the proper attention and focus that it needs. Like you said, we’re trading at a discount to our peers just based on the gold ounces in the ground. That would mean this stuff is getting no value.

If those projects were their own in juniors today, I’m sure they’d be getting pretty significant market attention. So that’s going to be a bit of a bonus that shareholders can look forward to as shareholders of White Gold will receive shares of the new critical mineral company.

RM: I’ve got one more thing I want to talk to you about. This was the sale of Newmont’s (NYSE:NEM) Coffee project to Fuerte Metals (TSXV:FMT).

Now, the price was $50 million and some shares and a small NSR where 50% of it can be bought back. To me, that is an easy deal for Fuerte to take on, considering that Kaminak Gold was originally bought out for $500 million pretty much for this deposit. And I’m looking at this and I’m going, oh, that’s so cheap.

I see that Agnico Eagle Mines (TSX:AEM) has a stake in both Fuerte and in White Gold. So now you’ve got a major, who I think is the world’s best miner and have thought so for more than a decade, sitting in the White Gold District, Agnico Eagle. You’ve got the Casino deposit sitting there with a huge amount of resource. They’ve got measured, indicated and inferred resources.

I’m wondering, who’s the financial backers behind Fuerte? There’s some shadow dancing going on here and I think you have the answer to what I’m trying to figure out.

DD: You weren’t the only person scratching their head after that deal got announced. I think it was pretty widely viewed by a lot of interested parties and the consensus on the street was that that deposit was going to sell for a much, much higher price.

But after talking to some people and getting a little more insight, it wasn’t so much that Newmont, the owner of the Coffee project, which as you know is contiguous to our land package, and we’ve actually made another high-grade discovery right along trend with it. It’s amazing actually, with so much going on, sometimes I forget to talk about this property called the Betty, where we have been hitting grades of 5g per tonne over 25m and 3g over 50m at surface and similar-type oxides to the Coffee.

But back to the transaction. What Newmont actually ended up doing is they’re going to retain a 27% interest in Fuerte Metals going forward, and they’re bringing into Fuerte to participate in the financing Agnico, Pierre Lassonde and Trinity Capital.

So, these are some of the best mine builders in the world. They’re involved with other projects like Orla Mining (TSX:OLA). It is absolutely fabulous for us to have some of the best mine builders in the world moving in next door.

RM: It clearly demonstrates that they think this is an area of the world where mines can get built.

DD: Yes, and it also unlocks a lot of infrastructure upgrades to our area that are required as part of that mine build. And so, the Coffee, it’s advanced, it’s permitted, and the best part of that transaction for us is a road which goes from the Coffee project, which is at the southern end of our portfolio, up to Dawson City.

$468 million dollars of infrastructure upgrades for up to 650 kilometres of existing roads in areas with high mineral potential and active mining in the Yukon. Proposed upgrades will cover the Company’s district-scale land package in the White Gold district, south of Dawson City

Remember White Gold, we view it as a district scale opportunity, investing in a whole district. Not just one mine. We now see that this is a critical catalyst to the evolution of the camp, because now you don’t need to be finding 2 or 3 million ounces to make an economical-type deposit. Basically, anything you can find within the area, you can truck to one of the possible future facilities.

The Coffee is a heap leach, so they’ll have that type of facility on their project. Our deposits, potentially, will be a traditional crush and grind mill. So basically, anything you find can perhaps go to one of those two facilities.

This really unlocks the leverage to the opportunity that we saw within White Gold when we originally got involved with Shawn Ryan and Agnico many years ago. Obviously, I think a lot of people are starting to connect the dots and speculate and say, hey, you have one of the best mining companies in the world owning a big chunk of two companies that are less than 20 miles apart, could there be something that can happen down the road with those?

RM: The other thing to remember here is when you look at this as a district-size play, which it seems to be coming, White Gold owns 40% of that district.

DD: Correct. We own 40% of the district, but in reality, it’s actually over 80% of the targets. Because recall, and maybe we’ve touched on this in the past, Shawn Ryan used his exploration protocol that led to the success of the Coffee, led to the success of our deposits, led to the success of other deposits in the district, to evaluate pretty much the entire district.

It was a land mass of about 110 kilometers north-south by 50, 60 kilometers east-west. And from collecting over 600,000 soil samples, which I believe is the largest soil geochemical database in the world, from that work, he then cherry-picked the most prospective targets and put those into White Gold when we created the company.

RM: Cherry-picked is right because it was his company when he, in the White Gold rush in 2010, 2011, when he optioned off all those properties to other juniors, Shawn Ryan’s exploration company had to do the work on it. That was part of the deal.

So, when gold prices collapsed and the play collapsed after Underworld and Atac and those had made their moves, Shawn was prescient enough, smart enough to actually buy back or take back a lot of that land.

He had all the database for that. And as you said, he went through, he cherry-picked, he kept the best and threw out the rest. White Gold might own 40% of the land mass, but damn near 100% of the worthwhile targets because they’ve been proven to be quality targets that need money spent on them.

I really think that that’s something important to say here. If there’s going to be a district play, there’s one company, White Gold, that has to be in play because they own most of the targets.

DD: Exactly. The fact that he was able to do this in Canada, in this area with its prolific history and so much success, it’s almost too good to be true. I’m literally pinching myself sometimes.

But you know what, things were hard, right? This has been going on for a long time, but we stuck with it. We had a view and now the pieces of the puzzle are coming together, and I really think we have the absolute right opportunity in the right place at the right time and with the right backers.

That’s what the market is starting to figure out, and I believe as they continue to, we should hopefully see more interest in the trajectory for the company going forward.

RM: There’s more here right now than a 3-million-ounce gold deposit. As good as the gold deposit is, the Golden Saddle with the high grade, there’s a lot more to this story than that. And that’s amazing because 3 million ounces of gold is what, US$11.5 billion, Cdn$16B, at today’s prices? And yet there’s so much more to this story than just the gold. There’s the critical metals, there’s Agnico Eagle owning stakes at both companies, there’s Newmont keeping 27% in the Coffee.

There’s the backers of Fuerte, some of the best mine builders in the world. There’s the fact that you own 40% of the White Gold District, but 80% of the targets. It’s a very compelling story on top of 3 million ounces with probably the highest-grade open pit in Canada.

DD: Well, that’s the way we view it. And now we’re very fortunate to have arranged to have the capital in place to continue to prove that thesis.

RM: Okay. Is there anything else that you want to go over here, David?

DD: No, I really think that we touched on a lot. The big thing that’s changed since we’ve spoke last is obviously the resource update details and now this additional capital coming into our backyard and with the infrastructure we will be the major benefactor of all that. So, it’s all starting to happen.

I think it’s early days, but the market is more and more looking for these types of opportunities. I think my phone’s rang more times in the last two months than it’s rang in the last two years. So, it’s great to see, we’re fortunate to be in a great area with great partners and a great team and really appreciate your interest and support and it’s been great getting to know you and chat with you.

RM: Thank you. We certainly have the right market for all of this, don’t we? With the gold and copper and critical metals getting all the attention right now. You couldn’t ask for a better market.

DD: I think it’s amazing to see that the world is waking up to the importance of these commodities. I saw a report from Accenture over the weekend, and it highlights something that we’ve all known in the business. There’s been such a deficient in the amount of true exploration and discovery in the last decade.

I think that’s going to lead to a pinch point in the market where the demand is not going down, it’s going up, but the supply is definitely going to go down because the new discoveries haven’t been made, and they take longer to get made and they’re more expensive to get made. And I don’t think the market is really aware of that yet.

This is what I love so much about White Gold. We already have the goods. I think that the stats in the article are that one in a thousand exploration projects actually make it all the way through.

And we have that already; we’ve already beaten those odds. That’s the hardest part of the business. And our discovery has got these exceptional high grades and it’s so unique and we’re in this great place and the ability hopefully to make many more is really what makes this opportunity for White Gold and much of the Yukon so cool.

RM: I think people better realize that this market is not going to go away. And two, White Gold is a lot more than just the White Gold deposit. It has 80% of the targets in the White Gold District. It’s got major attention coming into it.

It was great talking with you this morning. And we’ll talk again soon.

DD: Likewise. It’s always great. Stay tuned here. It should be a very busy and exciting next several months ahead.

Subscribe to AOTH’s free newsletter

Richard does not own shares of White Gold (TSX-V:WGO). WGO is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of WGO.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE