Under the Spotlight – CEO David Hottman, Orestone Mining

Rick Mills, Editor/ Publisher, Ahead of the Herd:

David, I’d like you to tell us a little bit about yourself and your qualifications, your history as a CEO and then get into telling us about the team that you’re working with here. You’ve been together with these guys a long time.

David Hottman, CEO, Orestone Mining (TSX-V:ORS)

I started in the capital markets, in the brokerage industry, in 1985 with a cycle low on gold at $289.

In ‘88, I started working for a group called Bema Gold Corporation. In ‘89, Bema put its first mine into production, a small 20,000-ounce-a-year heap leach mine. And we acquired, actually through someone that is currently on the Orestone advisory board, a project in Chile, where we ended up drilling off 6 million ounces.

It was going to be quite a long time for the development cycle, and a group of us split off from Bema and formed Eldorado Gold (TSX:ELD). Eldorado, that was Rick Barclay, Mike Beley, Gary Nordin and me as four of the six founders. And we were pouring gold bars there before we came public.

My role has primarily been that of corporate finance, the market and management of companies. I stayed the first five years with El Dorado, and we took it to a billion-dollar market cap.

We had three mines in production, another three or four development projects, and quite a large discovery in the process. My reason for leaving was just tired out. If you’re traveling three, three-and-a-half weeks a month, even your plants die.

So, it was the time when Bre-X blew up, January 1997. I left El Dorado, and then in in the first quarter of 1997 I started a company called Nevada Pacific Gold. And we came public in ‘99, and that company was eventually taken over by what is now McEwen Mining (NYSE:MUX) in a hostile takeover 2007.

It was a couple hundred-million-dollar deal and everybody made money. So, a few years passed, and I convinced my partner Gary Nordin let’s build just one more company, and that is Orestone Mining (TSX.V:ORS).

So that’s a bit of my history. I’ve raised $300 or $400 million for mining projects, exploration and development production assets. So that’s the depth of my background.

RM: And Gary Nordin?

Gary Nordin has been a geologist for over 40 years and a co-founder of Bema Gold and Eldorado Gold. He’s also been involved in several other companies that were successful and taken over during that time. He is the geological brains behind the operation. I’ll give you an example.

When I mentioned that Bema acquired a project in Chile, that was the Refugio project. Gary went to the project, looked at the data, and basically, it’s close to 3,500, 3,600 meters of elevation.

Anglo American Corp (LSE:AAL) had drilled the project using the wrong style of drilling and the wrong drill bits. Basically, they were using open hole percussion at that elevation with a standard compressor on it. Gary went up there and said, “Well, based on what I see, we’ve got a multi-million-ounce gold deposit here. What we’ll do is we’ll drill it with reverse circulation, which contains the sample a lot better, and we’ll double the compressors because at that elevation you need more force to be able to lift that gold up to the top of a drill hole to sample it.”

So, voila, first drill program, our results didn’t decrease with the depth of the hole, and we were drilling a couple hundred-meter holes consistently, and eventually we drilled off, I think altogether it was about 8 million ounces of gold. Gary has recognized other projects along the way.

We were involved early in Arizona Star’s Aldebaran project, which is now owned by Barrick (TSX:ABX) and Newmont (NYSE:NEM). It’s called Cerro Casale now, but it’s close to 30 million ounces, and we were involved in the early modeling and early exploration on that one. Then in Eldorado Gold, we acquired some concessions of raw land and Gary was quite excited about it, and the drilling was done just after I had left Eldorado. But a 12-million-ounce gold deposit was discovered and put into production.

It’s been in production for well over a decade now.

RM: You and Gary, you’re responsible for at least 20 million ounces of gold being found, that is world class exploration David, I’ve met few that can claim that many ounces or deposits.

DH: Being involved with a project, it’s never one person, it’s always a team, no matter what anybody says.

One person can make a decision to do something, but it’s an entire team that contributes to a discovery, so it’s pretty hard to list names and then slide total success of a discovery onto one person. But we’ve been involved in some pretty big discoveries. As I say, the Cerro Casale thing is now about 30 million ounces, so do you take credit for the early discovery? So yes, at least 20 million ounces.

RM: You’ve been involved in discovering several deposits, a few of which have turned out to be not just economic, but extremely economic with large amounts of precious metal. And you’ve turned them into mining companies that have been sold in the merger and acquisition route, M&A.

That speaks to an awful lot of experience and knowledge in the resource sector.

DH: That’s right, and with a few scars here and there. You have some big wins, and everybody makes money. So yeah, we’ve been involved with some big ones, we’ve put some mines into production, purchased other mines and operated them.

RM: The mines you’ve built have all been open-pit heap leach operations. Was that particular focus on purpose?

DH: Yes, we have been involved in underground, but the ones that we’ve built have been open-pit, heap-leach mines. That’s where discovery of ounces is the cheapest, is open pit, obviously.

And your development costs are relatively inexpensive compared to trying to develop an underground mine, just with the amount of engineering and equipment and what-not. And the team combined, Bruce Winfield came out of some major mining companies and then was working in the junior sector and was involved with three or four mines in Central America. And for Gary and me, it was a total of three mines, either built or operated in Mexico and then a large mine in Brazil.

And so combined, the team has been involved in quite a number of development and operations, an awful lot of them starting from grassroots discovery.

RM: That’s an important point. Grassroots discovery all the way through to developing an economic deposit, putting a mine into production, running the company or selling it.

So, through all these experiences, being the leader of a lot of it as a CEO, what have you taken away from all this? What’s the most important thing that you’ve learned about being a CEO and working in the resource sector?

DH: Well, I would have to say that probably the most important is efficient deployment of capital. And that’s not just financial capital. It’s the human capital.

Where is the person best fitted in? In what role? Who plugs this gap and that set of tasks within a company? And then intellectual capital. Gary is an extremely well-respected geologist. And it’s about, I guess on my side, it would be about financial stewardship and being able to raise capital when it’s necessary or advantageous.

And so basically being a CEO is monitoring your capital. As I say, that’s human, financial, intellectual. And also listening to others, not being too arrogant, but being focused and determined.

Sometimes people misinterpret that for arrogance, but you have to be focused, and you have to drive because nobody else is going to do it for you. That’s the way I see the role.

RM: When it comes down to the quality of the work that you do, you think about where you want to be in this space and say it’s precious metals. So, you think about where you want to go, where your forte is, your expertise. And you focus on finding a deposit, what you need to do to get it to what you want it to become.

And you have to do the work to a very high quality. You can’t skimp or cut any corners because you want to turn this into a real company or you want to move it along to, in the next stage of development to a mid-tier or a major, which you’ve done before. So, the quality of your work has to be of foremost importance as well because you want the next hands to own it to recognize, “Hey, we don’t have to go back and redo half this stuff. This work is legit, and we can take it into our data room and use a substantial amount of it.”

DH: That’s right. And with a little bit of forethought, you can save yourself a lot of time and money.

Most of them, well, all the projects that we’ve been involved with that are open pit, heap leach, the first question is not, is it open pit and how big is it? The first question is, can we get the gold out of the rock? And so, we’ve seen some deposits over the years where it’s just too hard, too silicious and you’re not going to be able to get the gold out of the rock.

So, it might be a million or more ounces, but it’s not worth the time and energy on metallurgy, or the cost profile of grinding it into powder is too much. So, metallurgy, doing early-stage bottle rolls to test that.

Basically, before you start exploration, take a look at the geometry of a deposit. Can you develop it? As far as quality of work, that gets more into what we’re looking at in Argentina as an open-pit resource. We’re already looking at the type of drill bit to use to get the best sample that will give us the most accurate results.

Also, along those lines is drill hole placement. We’re at the end of our first early-stage program. If successful, we’ll be able to come up with a drill-indicated resource and then you build from that. But it’s about looking into the future, not just doing the work today.

RM: I like open-pit mining because really when you break it down to its basic, it’s an earth-moving operation. It’s a little more complicated than just going in and digging a hole. But it is an earth-moving operation.

And that goes back to the, not the cheapness, but the least expensive method of mining usually. You’re looking at this open pit and it’s easier to scale up if you discover something of size. It’s easier to scale up and potentially make it more attractive to a mid-tier miner or a major because they can actually see that they can get enough production out of it to affect their bottom line, their margin.

Which is something a lot of people, I think, don’t consider when they’re looking at a project. Is it scalable to a major? Is it scalable in size? And the open pit to me just represents that as an easier path. Would you agree to that?

DH: Yes. The open pits we’ve been involved with in the past have all grown. You want initial cash flow. And back in the old days, in the mid ‘90s, we could put a mine into production for five, seven million dollars.

And a small open pit, the one that we did in Mexico, I think I mentioned we were pouring gold bars before we came public. We started out with test production or kind of a big metallurgical test, and then you expand it. It makes the permitting easier as well.

First year production, 20,000 ounces. Within a couple of years, we were around 50,000 ounces. That mine is still operating today.

It’s went through several different owners over the last 20, 25 years. But I think well over a million ounces have been mined. The deposit is going to tell you how you can expand it.

But open pit, most definitely, they are much easier to expand. Not necessarily on a moment’s notice, but within a very reasonable timeframe. Within a year, you could double or triple production at an open pit at a heap leach mine versus an underground, it would take a huge amount of lead time because each working face is only going to give you a certain amount of ore.

RM: Tell us how you could double your production.

DH: Well, in open pit mining, as long as you’ve got the pad space, you put on another set of equipment. As an example, like a 988 loader, if you’ve got less than a kilometer of haul, it matches up working with four 777 70-ton trucks.

So, as a cell or compartment, you could easily double your production if you have enough pad space. And pad space is not necessarily easy to build, but it’s relatively quick to build and inexpensive.

So yes, this type of mine is definitely expandable and attractive to majors.

RM: That’s a great segue into the Salta province in Argentina where the Francisca project is located. Why don’t you get right into what we have at Francisca, and then we’ll move up to the Captain Property copper-gold porphyry here in central British Columbia.

So, tell us about the Francisca, what your plans are for it this year and next year.

DH: Francisca is a project that we acquired in February. We have a deal that is for $4.2 million US. We can earn an 85% interest in the project. And then the partners fund on a proportional basis.

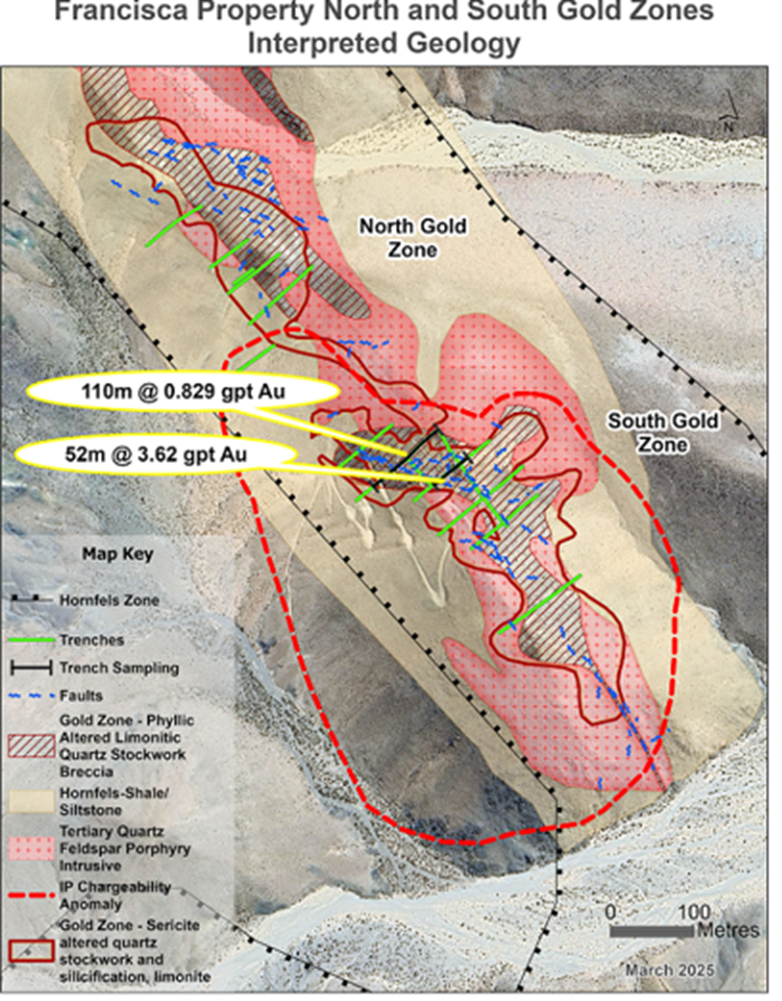

The project was discovered in 1996. A series of sampling programs between ‘96 and ‘99 led to a nice zone being outlined. There were 300 samples on the south zone averaging about a gram of gold per ton.

It’s located on the top of a mild or low-relief hill. It’s not jagged country. It’s more of a rolling hill, which makes it great for mining.

What we’re seeing at our Francisca project down in Argentina is that it does have high-grade structures going through it. Some of them are porphyry dikes. And the mineralogy of that indicates that there’s potentially a big porphyry underneath driving the entire system.

And in between the higher-grade structures, you have alteration that is lower in grade in terms of gold, but certainly above the minimum mining grade, especially in today’s market.

RM: So far grade seems exceptional for open-pit heap leach gold. How did this not get picked up again?

DH: Yes, you might hear, “Okay why, if it’s a good project, why did somebody drop a project like this back in 1999 if it’s so attractive?” And that’s because in ‘98 and ‘99, central banks were selling gold. Gold hit a bottom of around $250, $255 an ounce in, I think it was the 1st to the 5th of July ‘99, because I just brought Nevada Pacific public a couple of months earlier. You bring a company public in a bear market, and then it just gets hammered. It wasn’t fun. I remember it precisely. So, looking at this project, it’s no wonder that they would drop it.

Also, Teck Corporation was funding the junior that discovered it. Teck wanted bigger projects. Actually, to be fair, to the west of this project, they went on to discover three multi-million-ounce gold porphyry deposits.

So, Francisca got left behind. It wasn’t big enough. They found a bunch of a lot larger projects.

RM: This is right in your wheelhouse.

DH: Not much work had been done for quite a number of years. And so, we come along, we see a project that, as I say, the 300 samples were averaging a gram a ton. We see some high-grade structures.

The geometry of the hill is right. It’s very oxidized. So, it’s ideal for the discovery and development of an open-pit heap leach mine.

We have been kicking tires on this type of project for a long time, and this is a rarity. So, we’re very excited about it. Some of the trenches, which we’re going to be resampling here starting in the next month, 110 meters of just about a gram in a trench. Another trench, and this is all in our PowerPoint presentation, that’s 50 meters of 3.5 grams.

So, these are pretty exciting numbers when the average grade in the industry for an open-pit heap-leach mine now would be in the half a gram range. And those mines are producing probably at about $1,000 an ounce, maybe $1,200 an ounce. And with gold here pushing $4,000, that could be a lot of profit margin.

RM: You have got something potentially much bigger than a surface oxide gold project though?

DH: So, this project, we have been compiling data. We’ve recently found some IP data from historic IP data, which shows that there is a very strong IP conductor, that stands for induced polarization, it’s looking for the chargeability of metal in the ground. That would be the signature of more of a porphyry-type deposit.

And so, under the southern end of this zone, we have a whopper of an IP anomaly, and we’ve got these porphyry-textured mineralogy, porphyry dikes coming up to the surface. So, what we’re seeing on surface is just the afterthought, so to speak. And we’re very hopeful and confident.

We believe that we can drill off a half million, million ounces in this open-pit scenario with the porphyry underneath. And if that’s the case, it would still be an open pit, but it might not be a heap leach type of mine. We’ll have to wait and see what the porphyry, how deep the oxidation level goes and what-not.

But it’s an exciting project to go out and easily explore, inexpensive to explore. This is the cheapest type of ounces to be able to develop. Where your discovery cost, you might be at $10 an ounce, whereas an underground mine might be at $300 an ounce.

RM: You staked some more ground around there.

DH: Yes. The data that we received in the IP survey indicates that part of the anomaly trended off to the east. We spent numerous months here over the summer acquiring that block of land, and that just gives us additional coverage.

Not necessarily development land, where we have what we believe we need to develop, but additional coverage on the deposit. You always want that before you drill, because once you make a discovery, it gets a little bit more expensive.

RM: Well, it gets some people running around staking everything around you, and that can be a hassle. We do have mines and development projects in the neighborhood.

DH: Yes, there’s a very large silver deposit to the north operated by SSR, Silver Standard. To the west of us, a couple hundred kilometers, there is the Taca Taca, which is a multi-billion-ton copper deposit that they’re talking about developing.

In the same region, there are some big lithium deposits. RTZ is investing I think it’s $4 billion on that development. In that area as well, there’s an open-pit gold deposit that is being developed.

There are three of them over there so yes, there are big developments ongoing.

The Filo copper project is not too far south of us. Lundin Mining (TSX:LUN) and RTZ own that, and they’re approaching the government on future plans. I think that’s as well a $3 or $4 billion development.

So, there are big mineral discoveries that are being brought to fruition in the region.

RM: The IP indicating a porphyry is very interesting, because you look at these intrusives, and as a huge heat source, you get the copper closer to the center, and then as you start moving out, gold falls out, and then distal would be the silver. Interestingly we have gold and silver both at Francisca.

DH: That’s right, yes. I guess I should talk about it more. For us, it’s primarily the gold, but the silver can obviously be a big benefit to you. In fact, one of our directors has built a silver company in Mexico, and he’s producing almost 4 million ounces of silver a year now.

So yes, silver is a very important commodity. We just don’t have enough data on the silver to really quantify it, but in some of our test sampling that we did earlier this year we had up to 150 grams in some of these higher-grade structures. So, there is a lot of silver.

I don’t really know how to quantify it yet. Some of the mines I’ve been involved with in the past, like in El Dorado, we had an ounce a ton of silver and one gram of gold. Economically, if you recover 50% of the silver, you’re lucky.

RM: Silver can plug a heap leach.

DH: If you’re using a carbon recovery system, yes, it can plug the system up and increase your cost of production.

If you’ve got a lot of silver you use the Merrill Crowe system, which more efficiently takes out the metals that are recovered in the process. So, yes, there’s silver. It’s fantastic.

Silver is almost $50 an ounce, an all-time high. So, it might be a real economic benefit to a project like this.

Trading Economics

Trading Economics

RM: Let’s switch over to your Captain Project. It’s an interesting gold/ copper porphyry.

When you look at these copper-gold porphyries in British Columbia, it used to be you got a little bit of a gold byproduct, it can help pay for the cost of mining. and with the copper, the price going is up so much in the past year, in 2016 it was $2 a pound. Now it’s approaching $5.

The S curve meeting the J curve makes Copper the new oil

The copper market is explosive with all the problems the world’s largest copper mines having, it’s important to know these mines were predicted a couple of years ago to supply 80% of the world’s new copper supply.

And so, you’ve got the copper factor. But now with gold approaching $4,000, in my opinion gold is no longer a semi-economic byproduct of these deposits. I call it a coproduct.

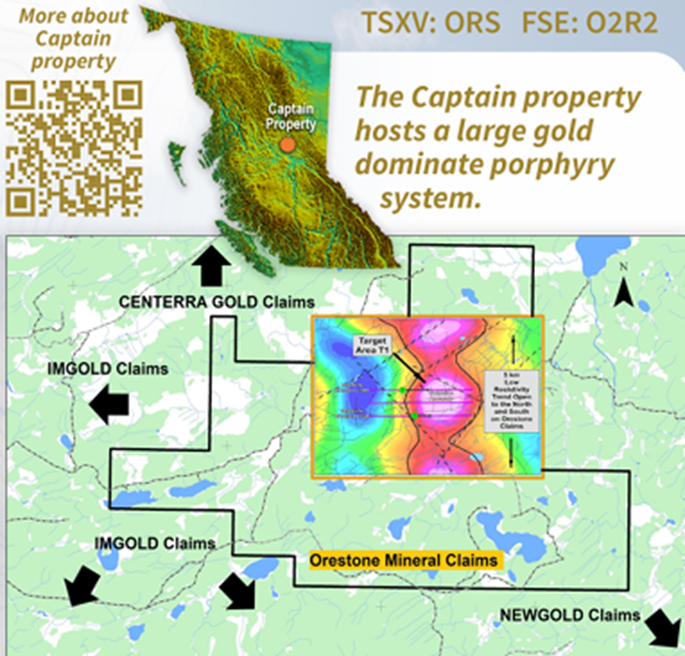

DH: Yeah, what we’re looking at Captain is a gold-rich porphyry.

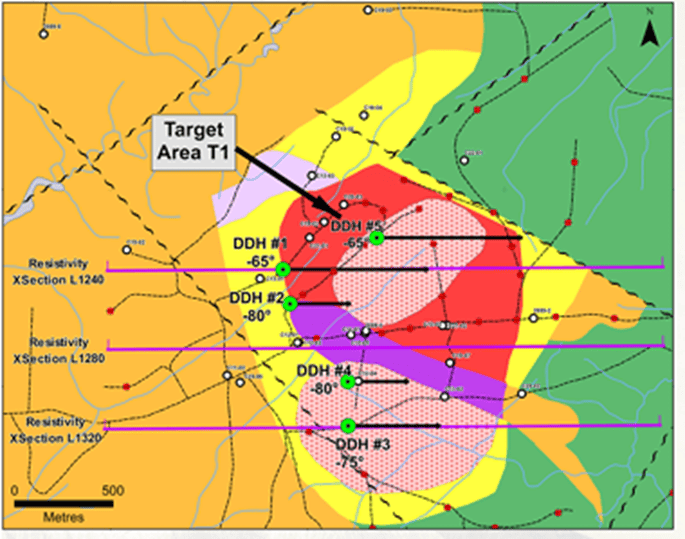

The exploration to date, we’ve outlined a north-south trend of 7 kilometers where we’ve got several geophysical anomalies. We’ve done most of our work on the central one. The other ones just came to light with a study a couple of years back.

But basically, the core target that we’re looking at, all of the drill intercepts where we have mineralization are showing us that it is dramatically higher in gold than it is in copper.

Copper would be very much the byproduct. The dikes or fingers that come off of the main core geophysical anomaly that we’ve drilled through, porphyry dikes, the mineralization there we’ve gotten, as I mentioned it’s higher in gold than it is in copper.

Trading Economics

But also in those dikes, they’re very much the porphyry mineralogy with the types of alteration that they have. So, the Captain Project is really to be considered a gold porphyry target. Just the sheer size of it, I would say that it has a 5 or 10-million-ounce potential.

And we’ve yet to drill into the core of the main body of the porphyry. We’ve hit dikes coming off of it. And this year we hope to drill and it’s easier for us to drill it in winter so that’s good for timing.

Probably January or February 2026 we’d like to drill a couple of holes right down the center of one of the targets that we’ve isolated, it could be really exciting stuff.

Parts of the deposit area are covered with 20 meters of glacial till, which is sand and gravel, maybe a few boulders. Other areas, it’s up to 100 meters deep, and that’s caused by the softness of the ground.

The last ice age, as the glaciers were moving, they carved it out and just left sand and gravel in their wake. So, yes, it would most likely be open pit. Here again, a lot of the previous drilling, we’ve got some really good gold grades, some early indications.

RM: I know that country very well. My wife and I have fished for monster trout and lake trout all over it, and we’ve hunted moose up there for 30-some years before we bought the farm and kind of backed off from a lot of the hunting and fishing.

But we know that country well, we know members of the First Nations there. Fort St. James at one time there were the most millionaires per capita anywhere in the world, and it was all based on resource extraction — forestry — but the forestry’s settling down a little bit because Pine Beatles killed the main component of our forest, which was the pine.

We’re really excited about mining; people are very receptive to mining because they understand resource extraction. Prince George and the North Line, we call it, all the way out to Prince Rupert, we’re very familiar with resource extraction, and we’re 100% behind it.

We realize the economic benefits, obviously, of resource extraction. It’s great that guys are looking up here now, and they’re spending money and spending time, and looking at a lot of exploration and development. And there are several mines up here that are in production, and people have really high-quality, good-paying jobs.

DH: That’s right. The economic benefit to a region can be phenomenal in resource extraction if you’ve got a big open pit mine. I mean, it’s still beneficial if you’ve got a small, underground mine.

There’s still tremendous economic benefit, but a big open pit, the amount of suppliers or employment, suppliers, contractors, everything in the closest towns to the operation, extending out to the major supply centers. There’s economic and social benefit all the way along the development chain.

RM: Yeah, and copper-gold projects, it used to be that gold miners were gold miners and copper miners were copper miners, the gold guys kind of looked at them like, “Meh, it’s just a little bit of gold to us, we need 5m ozs.”

But then the copper miners, well, they were after copper, and it was kind of the same thing, “Oh, gold’s a byproduct.”

But nowadays, you look at this, and you see the demand-supply equation for copper, but more importantly, you look at the gold miners, and you know Barrick Gold changed its name to Barrick Mining (TSX:ABX) in May 2025, to better reflect its broader focus on growing their copper business alongside its gold operations.

And they are very interested in porphyry gold because we know that the average discovery size of a gold deposit use to be 7.7 million ounces, and today it’s just barely over 4Moz and the number of discoveries per year has fallen through the floor, 28 in ’98, to 6 major gold deposits discovered since 2020.

So, they look at these things, and they say, “Huh, 3 million ounces of gold, a couple billion pounds of copper, we’re going to take that, we like it.” It’s just the new paradigm in the copper-gold major mining space that these gold miners want, need the exposure to copper, and the copper miners love the gold because you’re looking at right now $120 a gram for gold.

So, you’ve got increased competition in the M&A space for all these things as they get developed and prove themselves to be of size and scalable to change any major’s bottom line. And it really wakes them up.

DH: That’s right. They’re the biggest deposit type in the world. I can remember back in the mid-’90s sitting with a Newmont corporate development individual that was telling me that they’re not really interested in porphyries. They had Nevada.

Fast forward, porphyries being the biggest deposit type in the world, if you find 3-4-5 million ounces and you have to deal with some pesky copper or whatever that pays for the operation, well, so be it. But all of the majors, the only way that companies can grow is to find and or acquire through M&A and develop these larger deposits. And the only answer is the porphyry type deposits.

That’s why we’ve focused on this. We’ve looked at a lot of vein situations and different commodities and what-not. But the true wealth is created at the end of the drill bit.

So, do you want to try and create a little wealth, or do you want to try and create a lot of wealth? And it’s the target size that makes the difference.

RM: It is, isn’t it? It really does come down to size matters.

DH: Yes, it does. And also, the value. If you found a million-ounce deposit, like when we were in Eldorado, what turned out to be a million ounces, we developed starting out at 20,000 ounces a year. You know, a million-ounce deposit back then, gross value was $390 million. So, if you extracted that gold over a 10-year period, maybe you would make $90 million, $60 million over a 10-year period and be happy about it.

Granted, it was in the early mid-’90s. But today that million-ounce deposit is worth almost $4 billion. Yes, there has been inflation, but the margins, it’s just astounding the amount of money that is being thrown off by the open pit mines these days.

RM: Well, that’s true, all you have to do is look at how high the price of gold and copper has gone up, that outweighs the cost of CAPEX and OPEX going up.

DH: That’s right. I mean, even in CAPEX, down in Argentina, to put in a 50,000-ounce-a-year operation, you might spend $30-$40-$50 million, it just depends on new fleet or contractor-operated fleet, that kind of thing. But it truly is the cheapest development format.

We’re looking for open-pit, good-grade gold deposits that will be highly sought after if they are of size. If they’re smaller in size, they’re something that we could develop, we’ll be pushing them forward.

RM: Let’s check the Treasury. We know you’ve got two projects with some excellent potential. We know that you want to get to work on them tomorrow. One can be easily worked all year. The other one in BC can also be drilled in the winter.

There’s a need to raise some money, I’m thinking.

DH: Yes. We’re looking at, within the next month we’ll be down on the ground in Argentina. We think that’s going to be a share price revaluation catalyst. We’d like to raise a couple million dollars probably before the end of the year, but certainly at higher prices. And so far, the market is very robust.

The exploration, I think, is going to drive our share price and make it a lot easier to raise capital at a decent price.

RM: Yeah, fourth quarter and first of the new year are excellent for raising money, don’t want to miss that period.

I did help finance ORS earlier in the year, and we’ve come up a little bit. The thing is now we’re all cleaned up, we’re ready to go, and you need to raise some money to, of course, hit these projects hard and really talk about where we’re going and what we’re doing and some results.

And with the market cap where we’re starting, I think there’s some room to grow that market cap, just from the fact we’ve got boots on the ground and, second, we’re going to be putting out, hopefully, some good news from two different projects.

So, the news flow, which is the lifeblood of any junior, there’s going to be a lot of it coming.

DH: That’s right. Earlier in the year, the financing that you participated in, we brought on a new strategic shareholder by the name of Crescat Capital out of Denver in the United States.

And our market cap today is only about CAD$5-6 million, and with two very attractive projects in the pipeline that are just, well, Captain’s drill-ready, the other one will be drill-ready by the end of the year. I could see a million-ounce discovery really driving the market cap to many multiples of where we’re currently sitting.

And so, yes, everything has its time. Over the summer wasn’t necessarily a time to finance, but we’re getting into that window now. And I appreciate you taking the time to highlight the company and showcase our efforts.

RM: Very informative David, thank you.

DH: Thank you, Rick, and I appreciate your efforts here. Have a great day.

Subscribe to AOTH’s free newsletter

Richard owns shares of Orestone Mining (TSX-V:ORS). ORS is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of ORS.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE