TRX Gold Reports First Quarter 2026 Results

Record Production and Strong Financial Performance Continue into 2026

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) reported its results for the first quarter of 2026 for the three months ended November 30, 2025. Financial results are available on the Company’s website at www.TRXgold.com. Unless otherwise noted, all references to currency in this press release refer to US dollars.

TRX Gold’s CEO, Stephen Mullowney commented: “In Q1, we once again delivered record results, in line with guidance shared last quarter, pouring a record 6,597 ounces of gold and selling 6,492 ounces of gold at an average realized price of $3,860 per ounce, generating revenue of $25.1 million, gross profit of $14.2 million (57% margin) and EBITDA1 of $13.2 million (53% margin). The strong cash flow in a record gold price environment has enabled us to meaningfully reinvest in TRX Gold’s growth. During the quarter, we strengthened our working capital position, advanced plans to upgrade and expand our processing plant to improve our production profile, and increased investment in exploration to further delineate resources at Buckreef Gold. The Company is entering a new phase of growth, with improving production scale, stronger margins and a growing resource base. We are very encouraged by the progress and excited about the year ahead.”

Key highlights for Q1 2026 include:

- Record Production, Revenue, and EBITDA: During Q1 2026, Buckreef Gold poured a record 6,597 ounces of gold and sold 6,492 ounces of gold at a record average realized price1 of $3,860 per ounce, recognizing revenue of $25.1 million, gross profit of $14.2 million, adjusted net income1 of $7.7 million, operating cash flow of $4.0 million and EBITDA1 of $13.2 million, all of which reflect significant increases compared to the prior year comparative period, demonstrating the Company’s leverage to record gold prices during Q1 2026. The Company remains on track to achieve its fiscal 2026 production guidance of 25,000 – 30,000 ounces of gold at a total average cash cost of $1,400 – $1,600 per ounce at Buckreef Gold.

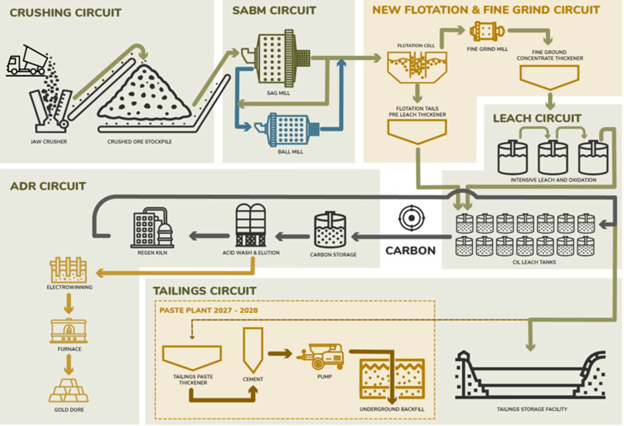

- Process Plant Expansion and Upgrades Progressing: During Q1 2026, the Company announced it has begun executing on a larger processing facility than was initially contemplated in the PEA, consisting of a 3,000+ tpd processing circuit for sulphide material as well as a 1,000 tpd processing circuit for oxide and transition material, and tailings retreatment, while also being capable of processing sulphide material. The newly designed processing plant expansion is now expected to produce average annual gold production in excess of the 62,000 ounces of gold published in the PEA and is expected to be financed from internally generated cashflow over the next 18-24 months. During Q1 2026 the Company made progress on upgrades to the 2,000 tpd plant and the expansion to a 3,000+ tpd processing plant, including finalization of procurement and accelerated manufacturing for several key components, including the pre-leach thickener, upgraded agitators & interstage screens, Aachen reactor, oxygen plant, ADR plant and new gold room, and apron feeder & belt magnet. The plant upgrades are scheduled for completion in fiscal 2026 and are expected to boost plant reliability and performance.

- Continued to Strengthen Working Capital and Expand Stockpile Inventory on ROM Pad: During Q1 2026, the Company continued to strengthen its working capital position through increased production, organically generated cashflow, improved liquidity and an increase in stockpile inventory. As a result, the Company’s current ratio has improved from approximately 1.3 at August 31, 2025 to approximately 1.7 at November 30, 2025, after adjusting for non-cash liabilities. During Q1 2026, the Company continued to invest in mine development, mill optimizations, and run of mine (ROM) stockpile inventory. The ROM stockpile has grown from approximately 15,162 ounces of contained gold at August 31, 2025, to an estimated 19,698 ounces of contained gold as at November 30, 2025. Subsequent to Q1 2026, the ROM pad stockpile has increased further to an estimated 22,891 ounces of contained gold, an increase of 3,193 ounces compared to November 30, 2025, as the Company continued to access higher grade ore blocks in the pit and processed a higher proportion of high grade mined material.

- Exploration Plans Advancing: During Q1 2026, the Company began the first phase of the fiscal 2026 exploration program by completing a detailed 810 line-kilometer ground magnetic survey in October 2025. This high-resolution geophysical survey is designed to map subsurface magnetic variations across the tenement area, helping to identify structural features, lithological contacts, and potential mineralized zones with the goal of generating new drilling targets. A final geological interpretation is expected in fiscal Q2 2026.

- Metallurgical Testwork Underway: During Q1 2026, the Company focused on metallurgical testwork programs including (i) gold deportment testing across various geo-metallurgical domains within the Buckreef Main Zone, (ii) flotation and concentrate leach optimization testwork, and (iii) SAG and Ball Mill Circuit Design, as part of its current flowsheet optimization and future expanded flowsheet development. Testwork was completed in the areas of flotation, fine-grinding and intensive leaching. Flotation testwork continued to deliver positive recoveries of 88% – 91.5% and fine grinding and intensive leaching testwork indicated that positive recoveries of flotation concentrate are achieve at a p80 of 20 microns. Final analysis of these results, along with fine grind concentrate settling rates, are expected to be received in fiscal Q2 2026.

- Strong Health, Safety, and Environmental Track Record: The Company achieved zero lost time injuries (“LTI”) and there were no reportable environmental incidents during Q1 2026.

Selected Operating and Financial Data

Select operating and financial information from the operation for the three months ended November 30, 2025, follows below:

| Unit | Three months ended November 30, 2025 |

Three months ended November 30, 2024 |

|

| Operating Data | |||

| Ore Mined | k tonnes | 227 | 103 |

| Waste Mined | k tonnes | 1,129 | 821 |

| Total Mined | k tonnes | 1,356 | 924 |

| Strip Ratio | w:o | 5.0 | 8.0 |

| Mining Rate | tpd | 14,903 | 10,154 |

| Mining Cost | US$/t | $4.76 | $4.00 |

| Plant Ore Milled | k tonnes | 140 | 155 |

| Head Grade | g/t | 1.88 | 1.29 |

| Plant Utilization | % | 90 | 88 |

| Plant Recovery Rate | % | 75 | 72 |

| Processing Cost | US$/t | $19.75 | $12.60 |

| Plant Mill Throughput | tpd | 1,540 | 1,703 |

| Gold Ounces Poured | oz | 6,597 | 4,841 |

| Gold Ounces Sold | oz | 6,492 | 4,813 |

| Financial Data | |||

| Revenue1 | $ (‘000s) | 25,117 | 12,528 |

| Gross Profit | $ (‘000s) | 14,215 | 4,834 |

| Net (loss) income | $ (‘000s) | (496) | 2,137 |

| Adjusted net income2 | $ (‘000s) | 7,732 | 1,872 |

| Adjusted EBITDA2 | $ (‘000s) | 13,211 | 4,394 |

| Operating Cash Flow | $ (‘000s) | 4,020 | 2,381 |

| Adjusted working capital | $ (‘000s) | 14,994 | 5,725 |

| Average Realized Price (gross)2 | $/oz | 3,869 | 2,603 |

| Average Realized Price (net)2,3,4 | $/oz | 3,860 | 2,653 |

| Cash Cost2 | $/oz | 1,508 | 1,410 |

| 1 Revenue includes immaterial amounts from the sale of by-product silver and copper. | |||

| 2 Refer to the “Non-IFRS Performance Measures” section. | |||

| 3 Net of revenue and ounces of gold sold related to OCIM gold prepaid purchase agreement. | |||

| 4 Net of interest related to Auramet gold prepaid purchase agreement. | |||

Figure 1: Buckreef Gold’s Open Pit Mining Operations

Figure 2: Load and Haul Operations at Buckreef Gold

Figure 3: Load and Haul with New 374 Excavator and Haul Truck

Figure 4: Revised Process Flowsheet for the Upgraded and Expanded Plant

Figure 5: 18 Meter Diameter Pre-Leach Thickener

Figure 6: Pre-Leach Thickener Foundation Civils in progress

Figure 7: Aachen ® Reactor ready for shipment and Vendor Testwork Flotation Cells

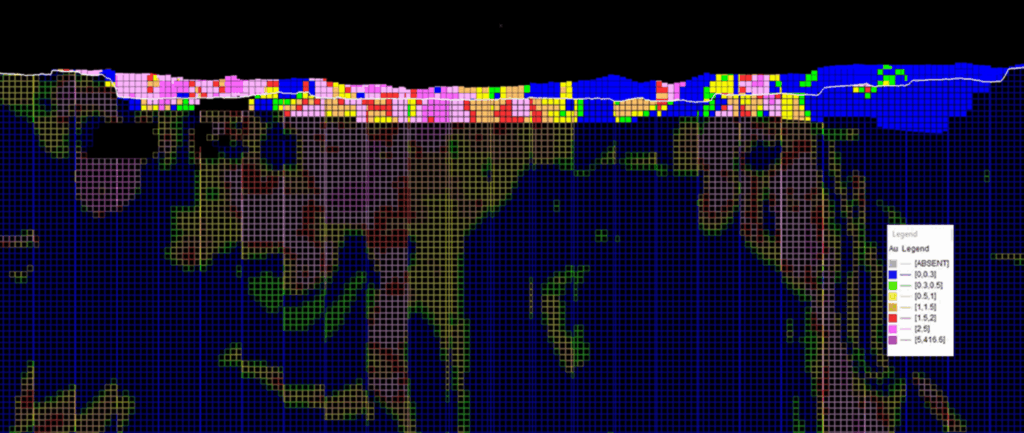

Figure 8: Buckreef Gold fiscal 2026 Mine Plan (including Ore Mined to Date above line)

About TRX Gold Corporation

TRX Gold is a high margin and growing gold company advancing the Buckreef Gold Project in Tanzania. Buckreef Gold includes an established open pit operation and 2,000 tonnes per day process plant with upside potential demonstrated in the May 2025 PEA. The PEA outlines average gold production of 62,000 oz per annum over 17.6 years at 3,000 tonnes per day of throughput capacity, and US$1.9 billion pre-tax NPV5% at average life of mine gold price of US$4,000/oz2. The Buckreef Gold Project hosts a Measured and Indicated Mineral Resource of 10.8 million tonnes (“MT”) at 2.57 grams per tonne (“g/t”) gold containing 893,000 ounces (“oz”) of gold and an Inferred Mineral Resource of 9.1 MT at 2.47 g/t gold for 726,000 oz of gold. The leadership team is focused on creating both near-term and long-term shareholder value by increasing gold production to generate positive cash flow to fund the expansion as outlined in the PEA and grow Mineral Resources through exploration. TRX Gold’s actions are informed by the highest environmental, social and corporate governance (“ESG”) standards, as evidenced by the relationships and programs that the Company has developed during its nearly two decades of presence in the Geita Region, Tanzania.

Qualified Person

Mr. Richard Boffey, BE Mining (Hons) F AusIMM, Chief Operating Officer of TRX Gold Corporation, is the Company’s in-house Qualified Person under National Instrument 43-101 “Standards of Disclosure for Mineral Projects” and has reviewed and assumes responsibility for the scientific and technical content in this press release.

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE