Ted J Butler – ABRASILVER SITE VISIT REPORT

ADVANCING ONE OF THE WORLD’S TOP 10 UNDEVELOPED SILVER DEPOSITS WITH PORPHYRY POTENTIAL

With silver at record highs above $60, the appetite for quality silver stocks is fast becoming insatiable.

At the same time, there’s only so much one can glean from company press releases, which is why I’m on a mission to bring you boots-on-the-ground insights from the world’s best-in-class silver companies.

To that point, few silver names are more deserving of “best-in-class” status than AbraSilver (TSX:ABRA) (OTCQX:ABBR) – a claim I can vouch for, having just visited its Diablillos project in Salta, Argentina.

By reading my photo-packed report, you’ll see why Abra landed firmly on my “nice list” this Christmas. So grab a festive drink, get yourself comfortable, and let’s unpack what my Diablillos site visit revealed.

Yours truly at the entrance to Abra’s flagship Diablillos project.

A Brief History of Diablillos: From Humble Beginnings to 350 Moz AgEq

Without a doubt, Diablillos should be credited as the primary driver behind Abra’s 362% year-to-date share price performance — a relentless rise that has lifted the company’s market cap to C$1.6 billion.

Despite this, Abra is by no means an overnight success: as recently as 2019, it struggled to break past a ~C$10 million market cap, plagued by a stagnant silver price and a backdrop of chronic underinvestment.

In fact, it was even earlier in 2016 when Abra — then operating as AbraPlata — first acquired control over core Diablillos concessions through an agreement with SSR Mining and Pacific Rim Argentina.

Since then, Abra has grown the resource at its now 100%-owned Diablillos to a substantial 350 Moz silver equivalent, containing 199 Moz of silver and 1.7 Moz of gold, as per its July 2025 resource update.

Naturally, I was keen to take a closer look at the high-grade core comprising this sizable resource. Lucky for me, Abra’s technical team – headed up by Chief Geologist, Dave O’Connor – were happy to oblige.

Abra’s Chief Geologist Dave O’Connor in front of the Diablillos Core Shack. Born in England and raised in Rhodesia, Dave studied at the Royal School of Mines in London, before building a 40 year career as an exploration geologist. This involved exploring for uranium in pre-revolutionary Iran, 13 years in Bolivia developing projects alongside Ross Beaty, and more recently advancing the El Espino discovery in Chile to a successful buyout by PuCobre in 2009.

Which Holes Put Diablillos On The Map?

Every project worth its salt begins with a “company-making” hole – one that sets a benchmark for grade expectations, while simultaneously attracting serious investors. For Abra, this hole was DDH 19-002…

Drilled in 2019 and reported in January 2020, it was one of the first two holes completed by the current management team at Oculto – an area that remains a top contributor to Abra’s resource to this day.

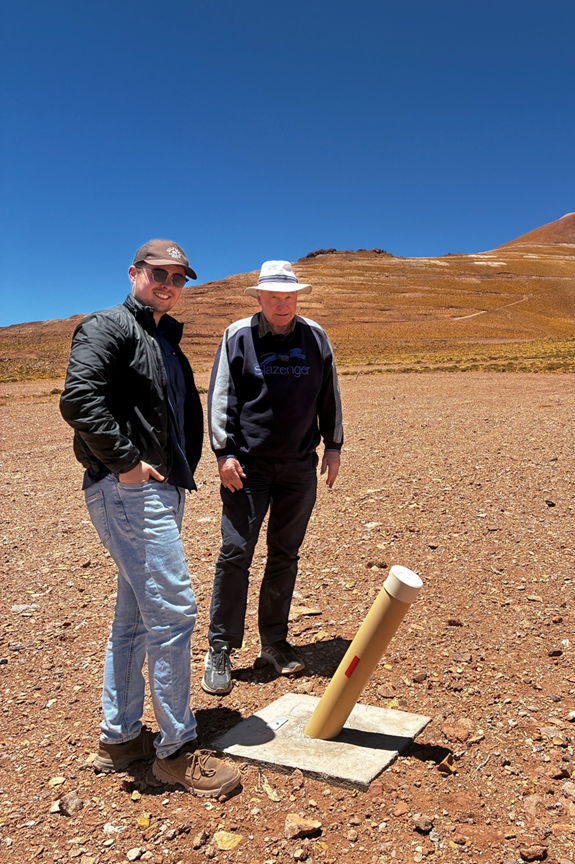

To Dave’s right is Abra’s talented Senior Geo, Nestor Ezequiel Arias. Known endearingly as “Coco” by his colleagues, he’s a geology graduate from the National University of Salta and has worked at Diablillos for 6 years. The mountains to his right transition into the Oculto deposit in question.

Most importantly, Hole DDH 19-002 at Oculto enticed renowned mining investor, Eric Sprott, who participated with the lead order in Abra’s C$4 million private placement that closed on June 23rd 2020.

Soon after that, Mr Sprott doubled down on his conviction for Diablillos with an upsized C$9.9 million investment, as part of a broader $18.0 Million Private Placement closed by Abra on September 1st 2020.

Given the calibre of the results, it’s easy to see why Mr Sprott came back for seconds, with Hole DDH 19-002 cutting through a hefty 17.5 metres of 604 g/t silver AND a bonanza-grade 7 metres of 20.6 g/t gold.

Hole DDH 19-002 (pictured) was designed to test for continuation of high grade gold mineralization in a hydrothermal breccia beneath historical holes DDH 97-007A and RC-97-053. Both were high-grade, with DDH-97-007A intersecting 27.6 metres grading 8.24 g/t gold from 204.05 metres and RC-97-053 hitting 6 metres grading 7.81 g/t gold from 286m.

More recently, a step-out hole drilled at Oculto affirmed it as the gift that keeps on giving at Diablillos. Namely, Hole DDH 25-024 hit 31 metres grading 10 g/t gold, including a monster 6 metres at 41.9 g/t gold.

Reported in May 2025, hole DDH 25-024 remains Abra’s best-ever gold intercept to date on a grade-thickness basis and was drilled at the earlier defined eastern margin of the conceptual Oculto open pit.

Not to mention, Hole DDH 25-024 was home to some outrageously high-grade gold intervals, such as 1 metre of 134 g/t gold from 325 meters downhole, and 1 metre of 64 g/t gold from 327 metres downhole.

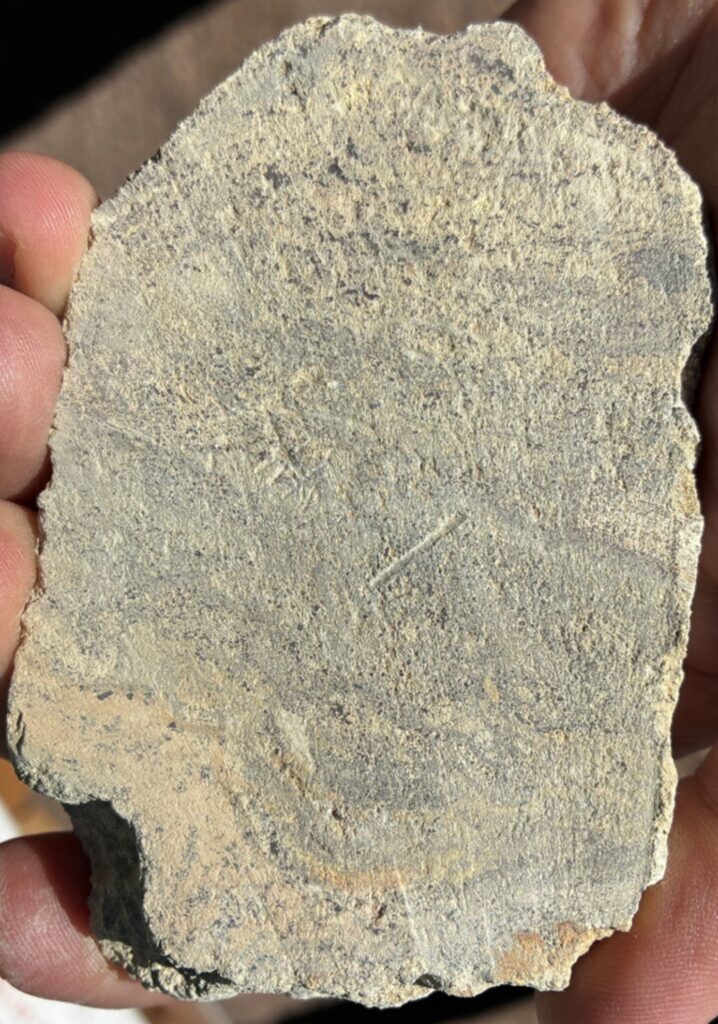

Laced with the Swiss-cheese–style vuggy silica alteration that often indicates high-grade gold, the sample in my hand comes from THAT 1 metre interval in Hole DDH-25-024, grading an astonishing 134 g/t gold at 325 metres downhole.

In summary, it’s fair to say that Diablillos is a dual-threat silver AND gold deposit, rather than silver only. So now you’ve seen a glimpse of Abra’s high-grade gold, we best take a look at some high-grade silver too.

Introducing JAC: Abra’s High-Grade Silver Treasure Trove

Staying at the core shack, the Abra team were keen to show me bonanza-grade silver samples from an area adjacent to Oculto called JAC, which was named after a former Diablillos worker, José Antonio Cires.

Hanging outside the Core Shack with the Abra team. Nico Fierro (right) is Abra’s very bright Junior Geo who’s been at Diablillos for 4 years now. He graduated from the National University of Salta and specialises in geological mapping.

Indeed, while Oculto has contributed 123.3 Moz of silver (M&I) to the tank-leachable portion of the Diablillos resource, JAC has added 58.5 Moz (M&I) and has frequently delivered higher silver grades.

A prime example of this is Hole DDH-23-004, which intersected a broad zone of exceptionally high-grade silver in early 2023: 4.0 metres at 3,025 g/t silver from a down-hole depth of 136 metres.

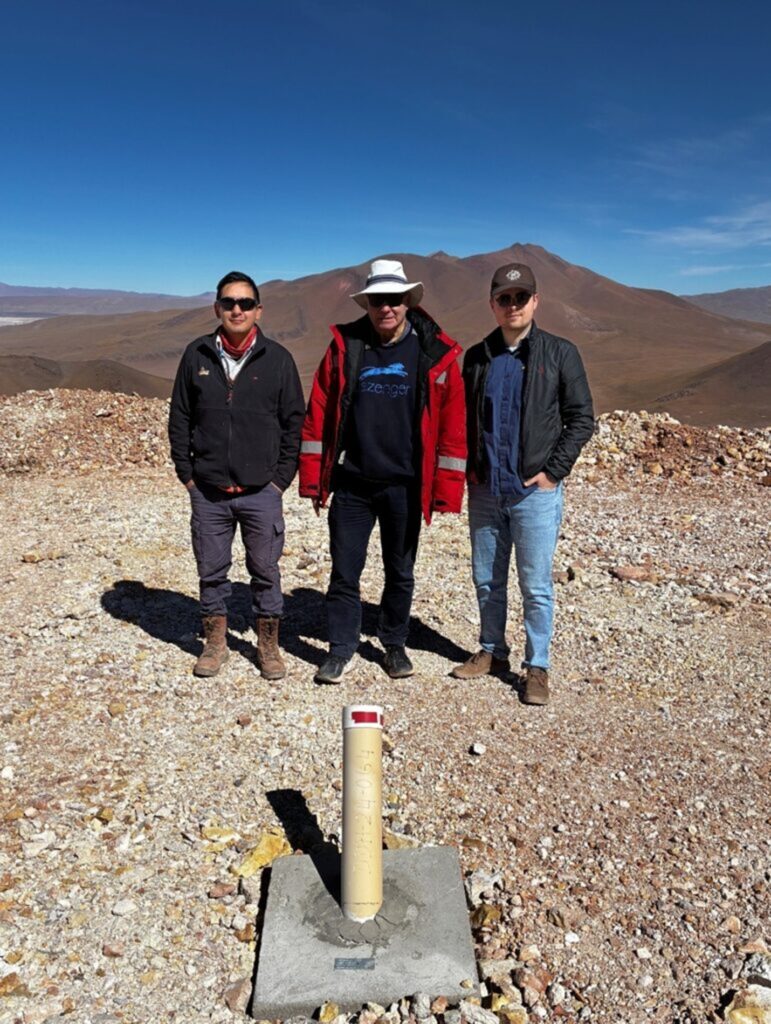

With Dave on the hallowed turf where Hole DDH-23-004 was drilled. Some 100 holes have been drilled at JAC to date.

Amazingly, a bit further downhole at 138 metres, Hole DDH-23-004 encountered the highest grade silver interval ever recorded at Diablillos – an almost unfathomable 1 metre interval grading 32,481 g/t silver.

A sample from the mega 32,481 g/t Silver interval. An untrained eye would see nothing in it. But shiny is not always high-grade in geology. And that speckly black stuff is silver oxide, which is highly leachable with cyanide solution.

With intercepts like these, it’s no wonder that Abra was continuing to drill JAC at the time of my visit last month, as part of the final stages of a 60-hole, Phase V drill program, which was fruitful to say the least.

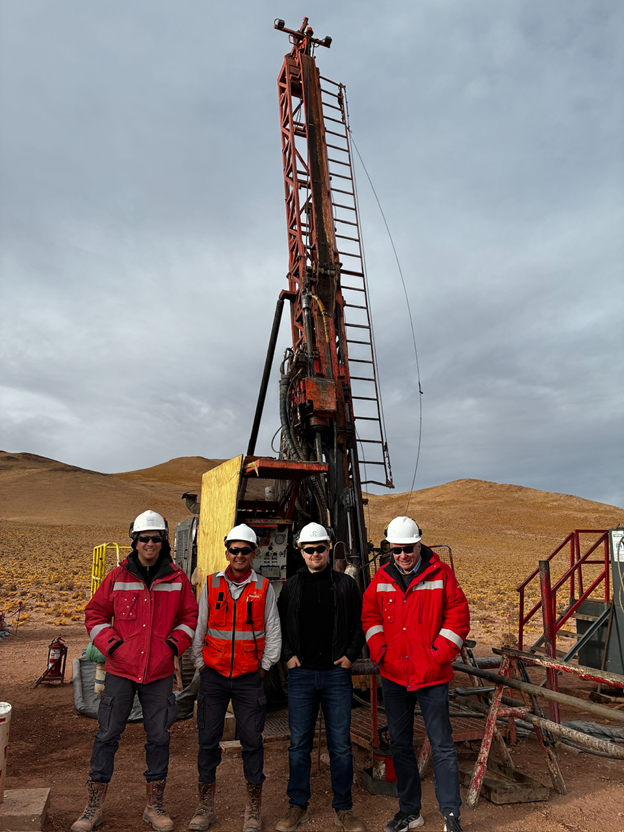

In front of the drill rig at JAC, where hole depth has ranged from 50 metres to 200 meters on average.

Speaking of fruitful, JAC’s near-surface nature makes it the lowest hanging fruit when it comes to mining Diablillos. Being high-grade, open-pit, and easily accessible, it’s the real “no brainer” for early cash flow.

From this 4,500-metre vantage point at Cerro Bayo, Dave notes that a greater number of shallow holes have been drilled at JAC compared to Oculto. That’s despite Oculto contributing over twice the ounces to the Diablillos resource.

Ultimately, JAC has been instrumental in building a high-grade silver component at Diablillos and still retains the potential to contribute to further resource growth.

That said, as Abra prepares for its 15,000-metre Phase VI drill program next year, exploration efforts are expected to increasingly focus on other areas with larger-scale upside.

Beneath the Oxides: Why Abra Might be On The Cusp Of a Major Porphyry Discovery

Abra’s expansion of its 350 Moz AgEq oxide resource at Diablillos is by no means over. In fact, I could see it crossing 400 Moz AgEq in next year’s resource update solely from the holes drilled at Oculto East.

Better yet, if the 10 holes planned for the oxides of Abra’s highest altitude target, Cerro Bayo, is anything like recent drilling there such as Hole 24-064, Diablillos may even surpass the 450 Moz AgEq threshold.

4500 meters altitude with Dave & Coco at Cerro Bayo, where Hole 24-064 returned 22.0 metres grading 2.78 g/t gold, including a breath-taking run of 9.0 metres grading 5.35 g/t gold in oxides.

In the meantime, recent discoveries from deeper holes drilled at Diablillos continue to indicate that a potentially significant underlying porphyry system sits beneath the already substantial oxide resource.

Incidentally, I saw this potential first-hand, as Abra drilled a deep hole on a porphyry target at Cerro Viejo.

With Dave at Cerro Viejo, where one of Abra’s two active rigs was drilling deep in search of a porphyry. The hole, which will be published as 25-084a, sits approximately four kilometres northeast of Oculto, with assays expected shortly.

With assays yet to be released for Hole 25-084a, I can’t be too specific about what I saw in person. What I can speak to, however, is the assays released earlier this month for another porphyry target, Hole 25-085.

Chiefly, Hole 25-085 was drilled down to 1,000 metres – Abra’s deepest reported hole yet – hitting copper, molybdenum, and other rock alterations typically found in upper levels of developed porphyry systems.

In layman’s terms, that means the rocks at depth were cooked and fractured by a powerful mineralising engine — the kind commonly associated with major copper-gold systems, of which Salta has many.

That’s right: Salta is a pro-mining jurisdiction filled with major porphyry systems, from First Quantum’s Taca Taca to porphyry-related gold systems like the nearby Lindero mine, owned by Fortuna Mining.

Pro-mining Salta: en route to Diablillos, we stopped for a coffee in San Antonio de los Cobres, where some 90% of voters backed pro-mining President Milei — the highest vote share across all of Argentina.

Meanwhile, across the Andes, Chile is also rich in porphyry systems, with Kinross’ La Coipa illustrating how oxide resources can sit within porphyry-fertile districts, later shifting exploration focus to depth.

Funnily enough, Kinross is a major investor in Abra owning 4% of total shares. As a result, it’s no surprise that the strategy unfolding at Diablillos is starting to mirror the path Kinross once followed at La Coipa.

And yet, this is not some ill-informed stab in the dark, or game of “monkey see, monkey do”. Rather, it’s a strategic exploration direction, which has been decided upon after the consideration of expert opinion.

One of those experts is the “Lionel Messi” of porphyry experts, Dr Richard Sillitoe. Following a June site visit, he expressed the view that, based on current geological interpretations, the centre of a potential porphyry system could lie approximately 1,500 metres below Oculto East.

Smile if you think you’ve found a porphyry!

The Bottom Line

Finding a porphyry at Diablillos will be costly given the need to drill 1km+ holes. But you’d be a fool to bet against Abra, as it gathers porphyry indicators likely to pique the interest of copper-gold–hungry majors.

At the same time, discovering a porphyry is not a prerequisite for the near-term advancement of Diablillos, whose oxide resource is rapidly progressing towards a construction decision by mid-2026.

Therefore, before we start salivating over a decadent porphyry dessert, let’s focus on the main course that Abra is serving up: A 350 Moz AgEq oxide resource likely to be mined at ~$4000 gold and ~$60 silver.

With Dave, Coco, and Nico at Cerro Bayo, which offers a spectacular view of the ~35,000 hectare land package at Diablillos. Notably, the recoveries across Diablillos comfortably average mid-80% with no deleterious elements.

Near-term Catalyst Summary: Charting Diablillos’ Road to Production

In December 2024, Abra published an updated Pre-Feasibility Study for Diablillos, which highlighted truly outstanding project economics: $747 million after-tax NPV5%, 27.6% IRR, and a 2.0-year payback.

And yet, these numbers were calculated using a base case of $2,050 gold and $25.50 silver — prices that now look conservative, with gold trading around $4,300 and silver near $65 at the time of writing.

At these prices, Abra’s implied profit margins would exceed 80%, based on its estimated average AISC of $12.67/oz AgEq over the life of mine and $11.23/oz AgEq for the first 5 years of full production.

Therefore, as Abra targets the completion of its Definitive Feasibility Study by April or May — which will incorporate materially higher metals price assumptions — a significant re-rating could be on the horizon.

Beyond that, Diablillos’ shovel-ready infrastructure — including tens of kilometres of access roads — provides a strong head start on the project’s estimated $544 million pre-production capex requirement.

Diablillos is blessed with a 60-person capacity camp & multiple access roads, particularly at Oculto East (pictured).

Of course, Abra isn’t the only company in Salta boasting robust infrastructure. That’s because Salta hosts many multinational mining conglomerates, from Rio Tinto to France’s Eramet and South Korea’s POSCO.

POSCO’s lithium plant (pictured) is “Sal de Oro”, which literally translates to golden salt. Located a mere 45 minute drive from Diablillos, POSCO are now producing, setting a great precedent for Abra as Diablillos nears production.

The fact that so many established mining companies are operating on Abra’s doorstep bodes incredibly well for its Environmental Impact Assessment, which is expected to be approved by Q1 next year.

More Salta Mining Activity: Santa Rita Minerals’ borax mine, Patito. Rio Tinto previously operated borax assets nearby.

More broadly, one of the main catalysts for this somewhat nascent Argentine mining boom comes down to the recent election of Argentina’s pro-business President, Javier Milei.

Armed with a robust mandate after winning the 2025 midterm elections, Milei’s flagship mining policy is the RIGI Act — a regime that offers generous tax breaks for foreign investments over US$200 million.

Mining’s top players have already flocked to RIGI, with Rio Tinto recently receiving approval for its $2.7 billion, Salta-based, Rincón de Litio project, amidst $13+ billion of total investments approved to date.

Keen to benefit from this sweeping 30-year stability package that locks in predictable tax, customs, and FX conditions, Abra applied to RIGI in November, and expects to receive approval around April.

After being granted approval, Abra will have 12 months to deploy US$40 million and must also invest a further US$40 million over the subsequent 12 months.

During that time, Abra’s cash flows will benefit tremendously from VAT relief via “tax credit certificates”, which allow the full tax on bank credits and debits to be used against income tax.

What’s more, RIGI’s inherent FX flexibility allows exporters to progressively retain dollars offshore and ultimately achieve full autonomy over foreign assets, capital inflows, and profit repatriation.

Magnificent views en-route to Diablillos.

Final Thoughts

RIGI brings a level of regulatory certainty that makes Argentina one of the top mining jurisdictions globally, as it cuts fiscal friction and bureaucracy, paving the way for projects like Diablillos to be unlocked.

Conveniently, Abra is also fully-funded through next year’s mine construction decision, after October’s C$43.4 Million raise. Now, with RIGI and EIA approvals expected next year, the jigsaw is near completion.

Combine this with next year’s 15,000 metre drill program – which aims to find porphyry potential and grow the 350 Moz AgEq oxides resource – and you’d do well to find a more catalyst-rich story than AbraSilver.

Naturally, all that’s left to do as an Abra shareholder is enjoy a medialuna or two, as Abra’s management team, led by accomplished CEO John Miniotis, advances Diablillos to production.

Maté and medialunas at Pastos Grandes (population ~250), where Abra financed the town’s bakery, laundrette, and water trucks. A fitting end to my Argentine adventure!

This report was originally published by Silver Advisor, of which AbraSilver is a sponsor/advertiser.

Courtesy of the Silver Advisor

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE