Ted Butler – The Silver Advisor – “Kootenay Silver: Advancing Towards a 100 Moz Silver Resource with a Fully-Funded 50,000 Metre Drill Program”

With four site visits in the space of three weeks, it’s safe to say that “boots-on-the-ground season” is in full swing here at Silver Advisor.

From the rugged mountains of Salta to the sprawling silver belts of Chihuahua and Sonora, I’ve been in for a Latin American treat — and I’m not just talking about the asado or the tacos.

Rather, I’m talking about the masterclass in silver exploration I’ve observed first-hand — the kind that transforms geological potential into a world-class resource, without cutting corners.

Over the coming weeks, I’ll be sharing my exclusive insights from these site visits – for free – so that you, our esteemed Silver Advisor reader, can make better informed investment decisions.

Today, we delve into the first of my 4 site visits, starting with a Mexican exploration company that has been a constant in the Silver Advisor portfolio from the very beginning…

Kootenay Silver (TSX-V:KTN) (OTC:KOOYF)

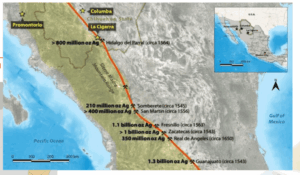

To recap, Kootenay is squarely focused on its flagship Columba Silver Project, which is located in northwestern Chihuahua State, Mexico, along the famous Sierra Madre mineral trend.

As illustrated below, Kootenay’s Columba, and La Cigarra, sit near major historic silver mines, including Hidalgo de Parral, which produced over 800 million ounces silver in the 16th century.

Avid Silver Advisor readers will recall that Kootenay published a Maiden Resource Estimate for its Columba project this summer, which came in hot at a substantial 54 million silver ounces.

Looking ahead, the company is fully financed to advance a 50,000 metre drilling program at Columba – one that could easily propel the resource toward the coveted 100 Moz mark.

In the following article, you’ll see the high-grade core that formed the 54 Moz resource, and you’ll learn where the drill rigs are being placed to grow the resource to 100 Moz and beyond.

You’ll also meet the team driving the resource expansion and you’ll get the lowdown on the financial backing that anchors Kootenay’s ability to deliver long-term value to its shareholders.

So without further ado, let’s cut to the chase, and dig into some of the high-grade silver intercepts that got investors so excited about Kootenay in the first place…

What Was The First Drill Hole That Put Kootenay On The Map?

On November 3rd 2021, Kootenay released assays for Hole CDH 21-110. In doing so, the company went from being viewed as exploration potential to a real silver mine candidate.

Yours truly standing atop the hallowed turf of Hole CDH 21-110 – one of the first that proved D-Vein’s huge potential.

Looking at the intercepts from Hole 110, it’s easy to see why: 453 g/t silver over 29.9 metres, including 650 g/t Ag over 17.8m, 932 g/t Ag over 6m, and a peak of 1,915 g/t Ag over 0.85m.

With this, Kootenay not only struck wide, high-grade silver. That’s because, at the same time, it also uncovered D-Vein’s huge potential at depth, despite values at surface returning ~100 g/t Ag.

Close-up photos of some core from Hole 110.

Namely, Hole 110 cut 150+ metres vertically below surface, and served as the gateway to a broader system of silver mineralisation that remains open at depth for Kootenay to explore.

Curiously, the old timers, who operated a historic La Fortuna mine at Columba from 1900-1910, may have known there was silver at depth, but simply lacked the technology to exploit it.

The fact that they didn’t mine it is a massive bonus for Kootenay, who’ve continued to reap the rewards from D-Vein as recently as May with high grade hits like Hole 199 (more on that later).

Still, the old timers mustered some 70k-100k tonnes of production, while building underground workings that include 4 shafts and 6 levels of drifts measuring over 1,000 meters in length.

Since then, there’s only been one brief period of historical production (1958-60), as well as a dewatering of the mine in 1982, before Kootenay purchased Columba back in 2019.

“Close, but no cigar”… Stood in front of the shaft built by the old timers. They never fully exploited La Fortuna, which hosts numerous classic epithermal high-grade veins measuring 10+ kilometres of strike over widths of 6+ meters.

Enough With The Old Timers… What About Kootenay’s Other Big Intercepts?

It’s worth noting that Hole 110 was Kootenay’s second 12,000+ gram-meter silver intercept in the space of a month, thanks to assays released on October 6th 2021 from Hole CDH-21-103.

Drilled at the JZ area of Columba, Hole 103 hit 6 metres of 2,035 g/t Ag, within 805 g/t Ag over 17 meters and 333 g/t Ag over 44 meters, including a project-high of 9,840 g/t Ag over 0.92 meters.

Nonetheless, Hole 110 was the more critical discovery, since it opened the door to the potential of D-Vein – the vein responsible for 60% of the silver in Columba’s 54 Moz Maiden Resource.

Undeterred by a warning from a not-so-friendly rattlesnake, I hiked up D-Vein with Kootenay’s Australian-born VP of Exploration, Dale Brittlife, and their Argentine-born Geologist, Luis Moya.

Perched on D-Vein with Dale and Luis. Dale (centre) has 10 years of experience managing exploration projects in northern Mexico for juniors such as Kootenay, Astral Mining, Orex Minerals, and Silver Viper Minerals. Raised in Salta, Luis (left) has 30 years’ experience in as an Exploration Geologist, including a considerable 17 years in Mexico.

One of the big hits that defined D-Vein’s massive contribution to the Columba resource was Hole 199 – a hole drilled in May of this year as part of the previous 50,000 meter drill program.

Confirming Kootenay’s thesis that high-grade silver exists at depth, Hole 199 encountered D-Vein 360 meters vertically below surface and was drilled from the footwall side of D-Vein.

A new record high value for that structure, Hole 199 intercepted 620 g/t Ag over 16.5 meters (5.78m estimated true width) from 405.5 meters downhole, including 1,775 g/t Ag over 5.5 meters (1.93m etw).

Within that, individual samples assayed 2,920 g/t Ag over 0.55m, 7,630 g/t Ag over 0.55m, and 5,620 g/t Ag over 0.5m — a rattling reminder of the bonanza potential running through D-Vein.

Close-up shot of some core from D-Vein, Hole 199 – the bonanza grade, 7630 g/t silver interval.

As if Hole 199 wasn’t enough to whet investors’ appetite, Hole 196A assays were reported in the same news release, with one interval dancing to the tune of 1525 g/t silver over 0.82 metres.

And if you think that’s high grade, wait until you see Hole 171 from D-Vein. Assayed in October 2024, a Hole 171 interval returned 2,370 g/t silver over 0.5 metres from 257.5 meters downhole.

More broadly, Hole 171 cut an impressive 87-meter zone of continuous silver mineralization, stepping out ~50 meters deeper and ~100 meters southeast of previous holes 140 and 125.

Close-up of core from Hole 171. It’s largely sulfide, packed with silver-bearing minerals like sphalerite and galena – the metallic, shiny zones you see here, which typically occur in high-temperature core of epithermal vein systems.

So, D-Vein Has to Be Kootenay’s Main Drill Target, Right?

Indeed, with wide intercepts at consistently high grades, it’s no wonder Kootenay are placing one of their 2 drill rigs on D-Vein as part of the ongoing 50,000 metre drill program at Columba.

In front of drill rig 1 of 2 at D-Vein with Luis and Kootenay’s Project Manager, Roberto feat. an impromptu photo bomb from Pancho the dog. FYI, Roberto was born in Hermosillo, Mexico and has been with Kootenay since he graduated University Estatal de Sonora in 2016. At 32 years of age, his extensive knowledge of geology is beyond his years.

As of October 31st, Kootenay’s drilling contractors, GlobeXplore, had got through about 7,800 metres of that 50,000 metre program, and were averaging ~2,500 metres drilled per month.

At that rate, drilling could last for up to 18 months. However, management told me they’d be adding 1 or 2 more drill rigs – an aggressive move that conveys their conviction for Columba.

Saddle up: Even the mules – or “burros” if you’re in Latin America – are on the payroll at Kootenay… the average man can carry 1-2 rods to the drill rig, but these plucky animals, which are more than well-looked after, can carry up to 8!

Most likely, new drill rigs will be added once Kootenay finishes building its new offices, with the idea that Kootenay’s team sleeps there, freeing up space for more drillers to stay at camp.

Nestled in the rocky terrain of Chihuahua – Camp at Columba for the Kootenay team and drilling contractors.

While at camp, I asked the team to walk me through the veins that will drive resource expansion, aside from the clear star of the show, D-Vein. Lucky for me, Roberto, and both Luis’s, obliged…

Checking out Columba’s Veins – Luis Hernández (left) is a sharp Mexican Geo who’s been with Kootenay since 2021.

How Will Kootenay Grow Columba To a 100 Moz Silver Resource?

For reference, Kootenay’s 54 million ounce silver resource – which boasts an average grade of 284 g/t silver – was reached after approximately 53,000 metres of drilling at Columba.

By that logic, a mere continuation of that form into the ongoing 50,000 metre drill program should translate to (at least) another 50 million silver ounces, bringing the total to 100 Moz Ag.

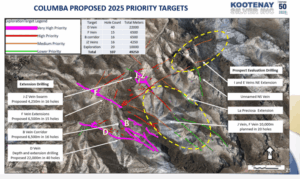

As part of the current 50,000 metre program, 22,000 metres is allocated to D-Vein and 4,250 metres is reserved for the J-Z Vein swarm, with B-Vein and F-Vein each receiving 6,500 metres.

Broken down into holes, that translates to 40 holes for D-Vein, 15 for F-Vein, 16 for the B-Vein corridor, 16 for the J-Z vein swarm, and another 20 holes for exploration/prospect evaluation.

Running almost parallel to D-Vein, B-Vein, and in particular the B2 Vein extension, has shown real promise, with Hole 174 producing a bombshell interval of 3090 g/t silver over 1.1 metres.

Close-up of Hole 174 from the B2 Vein. It returned 233 g/t silver over 41.2 meters core length (27.60 meters etw). The gun metal grey in the sample is Acanthite – a mineral composed of silver sulfide that turns to argentite above 173°C.

What’s also interesting about B2 Vein is that it’s an extension of the historically mined F Vein, which, on its own, contributed a healthy 6 Moz to the total 54 Moz silver resource at Columba.

Clearly part of the interconnected mineralised system, F-Vein was responsible for Hole 183, which cut through 32 metres of 210 g/t silver, including a cool 1,440 g/t silver over 0.79 metres.

Assayed in January of this year, Hole 183 was a wide intercept that exemplifies F-Vein’s underrated potential.

Beyond this, Dale is optimistic about the undrilled extension of J Vein south. Chiefly, he has a hunch that there’s 2km of prospective structures sitting there, with the whole thing mineralised.

Dale showing me some core from what I believe is D-Vein – the Vein that just keeps on giving at Columba.

All things considered, it’s safe to say that Kootenay is doing a stellar job of proving Columba’s geologic potential. Naturally, we’re chomping at the bit to see the imminent high grade assays.

A sign of what’s to come: Filtering through the archives of Columba’s high-grade core, with the help of Roberto.

Despite this, there’s more to a junior exploration company than sexy drill results. In other words, Kootenay must assure investors that they can advance Columba through the Lassonde Curve.

Maiden Resource In The Bag: How Will Kootenay “Bring It Home” For Shareholders?

Fortunately for us shareholders, Kootenay is fully-funded to complete its ongoing 50,000 metre drill program, thanks to a C$17.4 million bought deal financing closed over the summer.

In addition, CEO Jim McDonald told me over dinner that a further $3-4 million in warrants had also been exercised, thereby bringing Kootenay’s total cash position to C$20 million plus.

This financial stability is flanked by resolute shareholders like Eric Sprott (~4.5%) and Condire (~5%), as well as a strong base of institutional investors (35%) and European family offices.

As such, Kootenay remains an attractive takeover target for majors including Pan American Silver, Coeur Mining and Agnico Eagle – all 3 of whom held Kootenay shares in the past.

Of course, even in the absence of an acquisition, Kootenay is well-equipped to advance Columba to production, with a PEA already in the pipeline after the next resource update.

The fact that Columba’s historical silver recoveries sit comfortably in the 80% range bodes well for the PEA, too, and it also strengthens project economics while boosting future cash flows.

What’s more, Kootenay has already embarked on an expansive “PEA level” metallurgical program, including ore sorting, which could easily take silver recoveries to the 85-90% level.

Admittedly, Mexico’s permitting environment lacked clarity during President AMLO’s tenure. And even with a more pragmatic President, Claudia Sheinbaum, permits aren’t yet easy to obtain.

That said, there have been some notable permits delivered, including most recently for a large project in neighbouring Sonora State – a very positive sign for the Mexican mining industry.

Moreover, the Kootenay team is an experienced bunch that weathered the Covid storm, as well as the “survival of the fittest” bear market of the early 2020’s that many juniors died in.

Not to mention, CEO Jim Macdonald has seen it all. With 30 years’ experience, he co-founded and developed National Gold (which merged with Alamos Minerals) to form Alamos Gold.

Naturally, if Kootenay can fulfil its remit in reaching a 100 Moz resource, we at Silver Advisor see it being a lucrative investment, especially in view of a silver price that has doubled since 2024.

Our work here is done – Sun setting on a thoroughly enjoyable and illuminating trip to Kootenay’s Columba project!

As always, read our disclaimer here.

The Gold Advisor Copyright 2025

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE