StrikePoint (SKP.V) comments on recent gold deal in Nevada!

Equinox Gold sold the Pan Mine to Minera Alamos for US$90m in cash and shares.

At the surface it looks like a great deal for both companies. Equinox gets cash for their balance sheet and Minera Alamos gets Nevada gold production.

Pan is one of the lowest grade operations in the state of Nevada, about 0.4 g/t Au, and no silver.

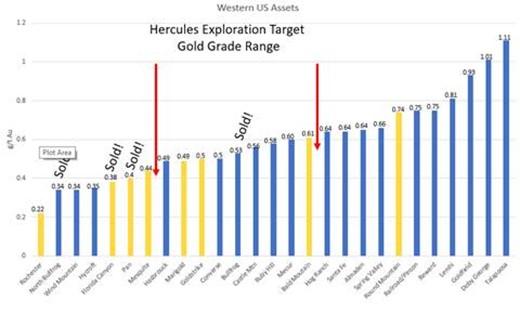

Interestingly, Pan is lower grade than StrikePoint Gold’s Hercules Gold Project which has an Exploration Target of 0.48 g/t to 0.63 g/t Au. The Hercules Exploration target is bigger too, with an estimated range of 819,000 to 1,018,000 oz Au.

Looking at the numbers. Pan midpoint guidance is 35,000 oz/year, and Midpoint AISC is $1,650/oz Au. At $3,300 gold the operation throws of about $58 million dollars/year. It shows that these low grade assets can really sing if you run them correctly!

Minera Alamos paid about 2 years of cashflow. Bought deal to support the transaction.

The window is opening.

| Read The LinkedIn Update from CEO Mike Allen

|

|

|

|

|

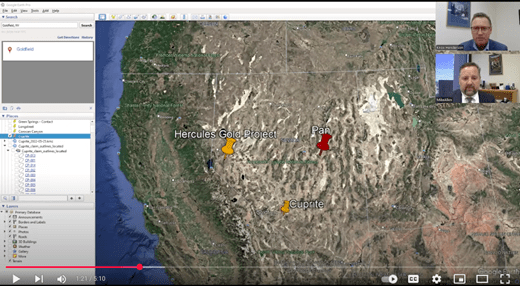

| Video: StrikePoint CEO Michael Allen comments on Pan gold mine acquisition in Nevada

|

|

|

|

MORE or "UNCATEGORIZED"

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE

Monument Reports Second Quarter Fiscal 2026 Results

Monument Mining Limited (TSX-V: MMY) (FSE: D7Q1) today announced its financial results for the three... READ MORE

Taseko announces First Cathode Harvest at Florence Copper

Taseko Mines Limited (TSX: TKO) (NYSE American: TGB) (LSE: TKO) is pleased to announce its F... READ MORE

Highland Copper Closes Sale of 34% Interest in White Pine for US$30 Million

Highland Copper Company Inc. (TSX-V: HI) (OTCQB: HDRSF) is pleased to announce, further to its press... READ MORE