StrikePoint Gold Acquires Nevada’s Past Producing Como Mining District from Newmont Mining Corporation

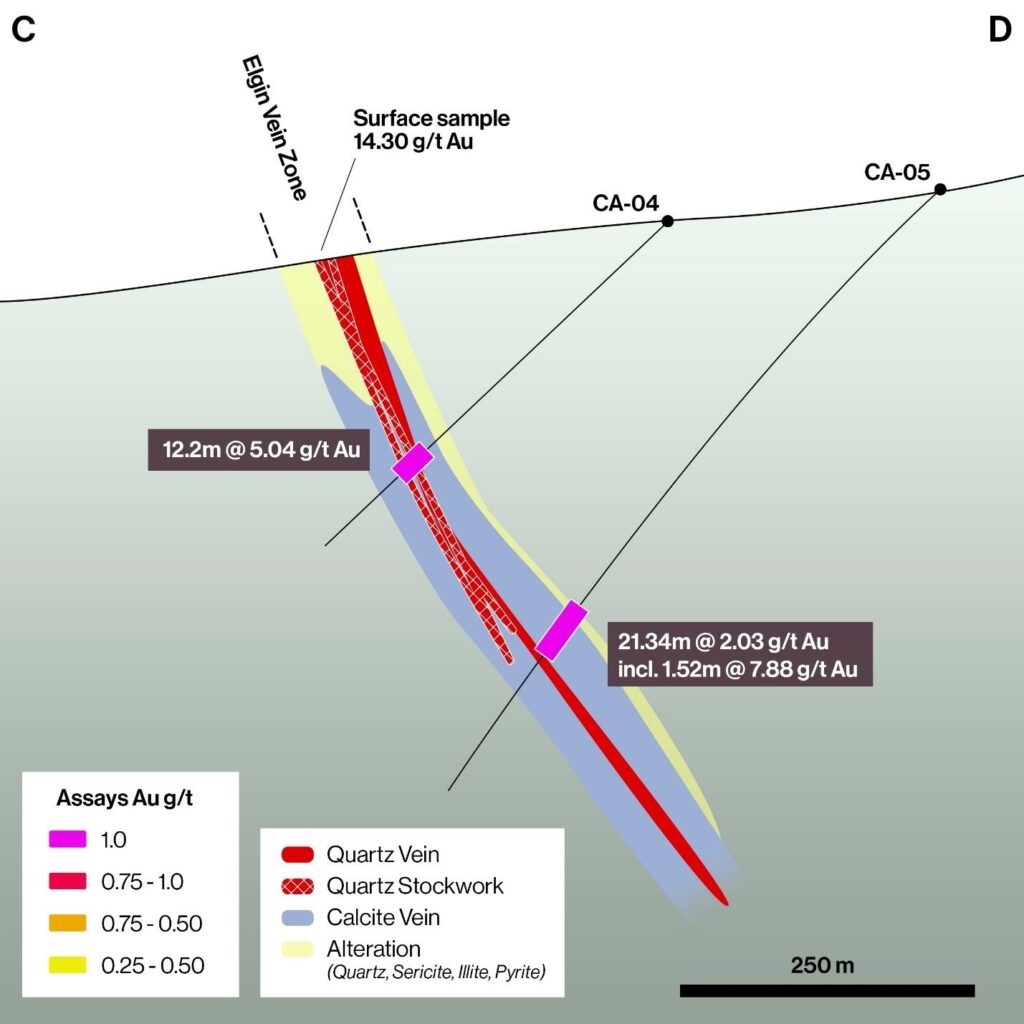

Historical drillhole intercepts include CA-04, 12.19m of 5.00 g/t Au and CA-05, 21.34m of 2.02 g/t Au

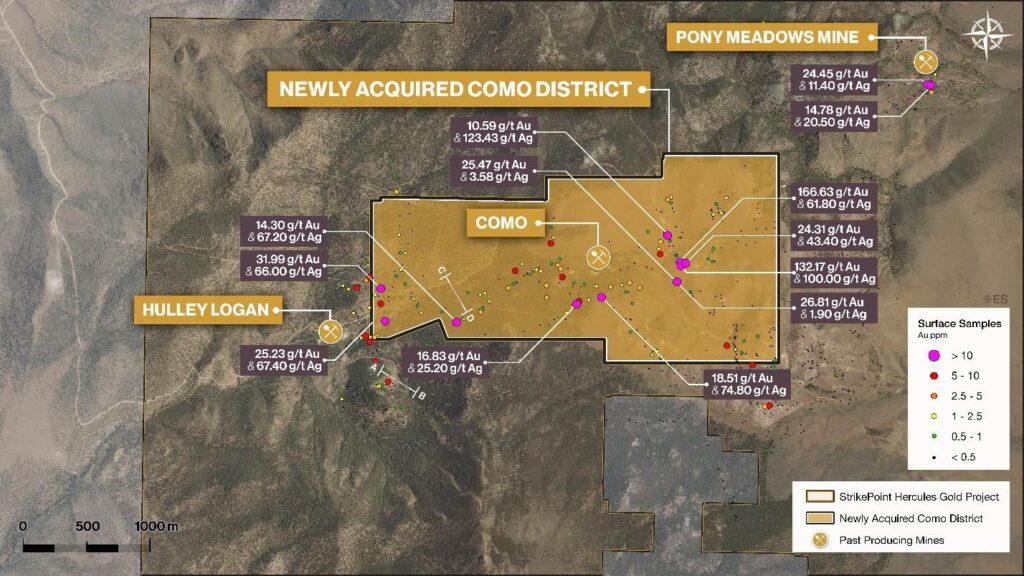

Surface samples up to 166.63 g/t Au and 61.80 g/t Ag

StrikePoint Gold Inc. (TSX-V:SKP) (OTCQB:STKXF) is pleased to announce that it has entered into a definitive agreement to acquire certain unpatented mining claims in the past producing Como Mining District from Fronteer Development (USA) LLC, a wholly owned subsidiary of Newmont Mining Corporation.

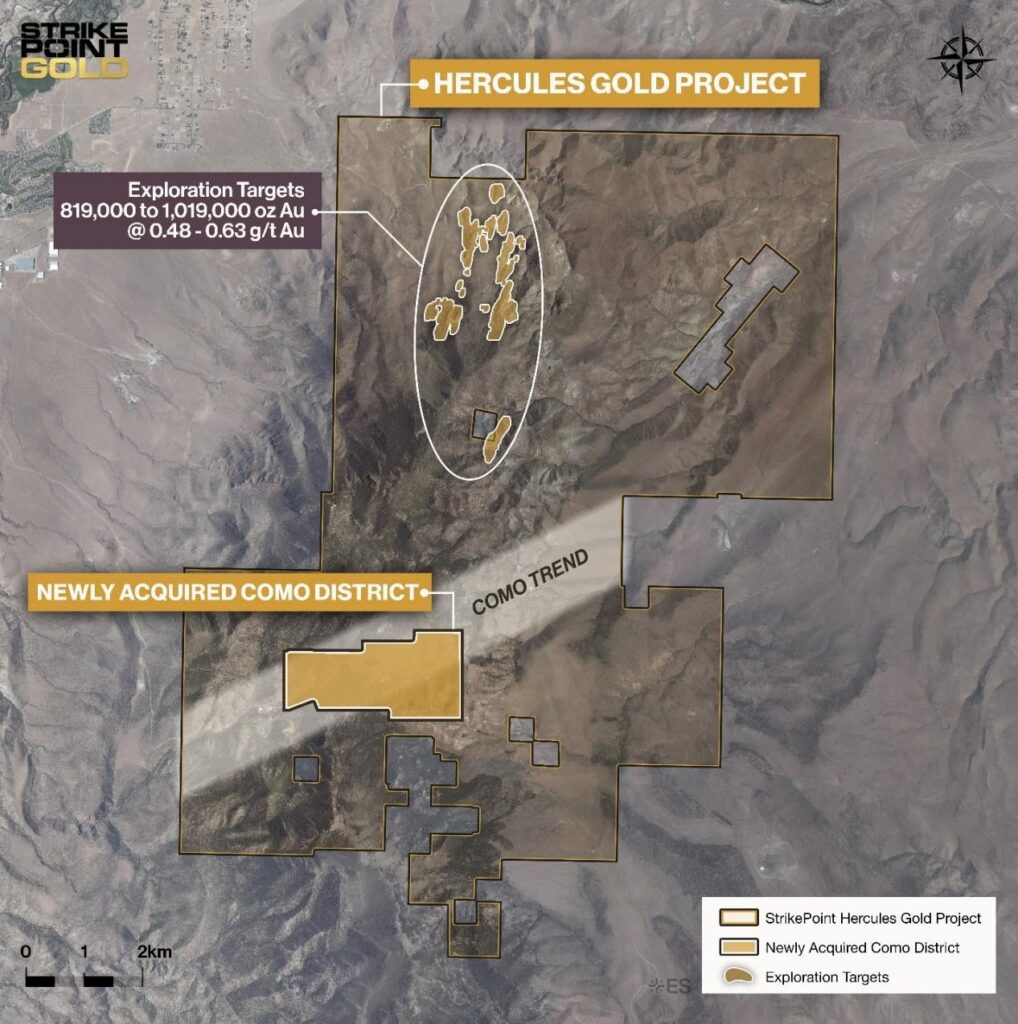

This transaction further consolidates StrikePoint’s Hercules Gold Project, located in Nevada’s Walker Lane and allows for expanded exploration of the southern portion of the property where several past producing mines have seen limited modern exploration.

Como Mining District

The acquisition consists of 51 unpatented claims located in the past producing Como District. Historic surface sampling has returned gold (“Au”) values of up to 166.62 grams per tonne (“g/t”) Au (4.86 ounces per ton), and silver (“Ag”) values of up to 109.72 g/t Ag. In a historical surface sample database acquired by the Company a total of 623 surface samples covering the Como Mining District and surrounding area currently controlled by Strikepoint, were collected. Of the 623 surface samples, 93 returned grades greater than 1.00 g/t Au.

Figure 1. Newly Acquired Como District

A limited amount of historical drilling has been completed at the Como Mining District, including the acquired unpatented claims. Highlighted intercepts include CA-4 which returned 12.19 meters of 5.00 g/t Au, including 3.05 meters grading 13.88 g/t Au and CA-05 which returned 21.34 meters of 2.02 g/t Au. These holes were targeting the Elgin Vein where a surface sample returned 14.30 g/t Au. No silver data is presented for these two holes.

Figure 2. Section C-D

The above data is historical in nature and is presented solely for reference. It is believed that the drilling was reverse circulation drilling, with the hole size unknown. No QA/QC data is available at this time. Assay laboratory, assay techniques, sample size, assay lab location and certification of the laboratory are not known, at this time, but the assay lab was independent to the Company.

Michael G. Allen, President and CEO of StrikePoint commented, “The historic data shows widespread gold and silver in surface sampling and historical drilling. This transaction consolidates the southern portion of the Hercules Gold Project and allows for effective exploration in the future, along the “Como Trend” which extends between three historical producers, the previously controlled Hulley-Logan Mine, the Como District and the previously controlled Pony Meadows Mine. The Company expects to amend its existing Como Comet drill permit to allow for drilling on these newly acquired claims shortly.”

The Como Trend:

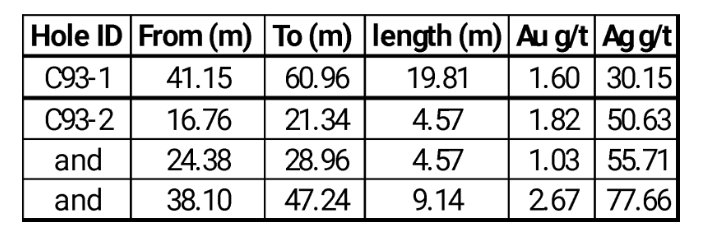

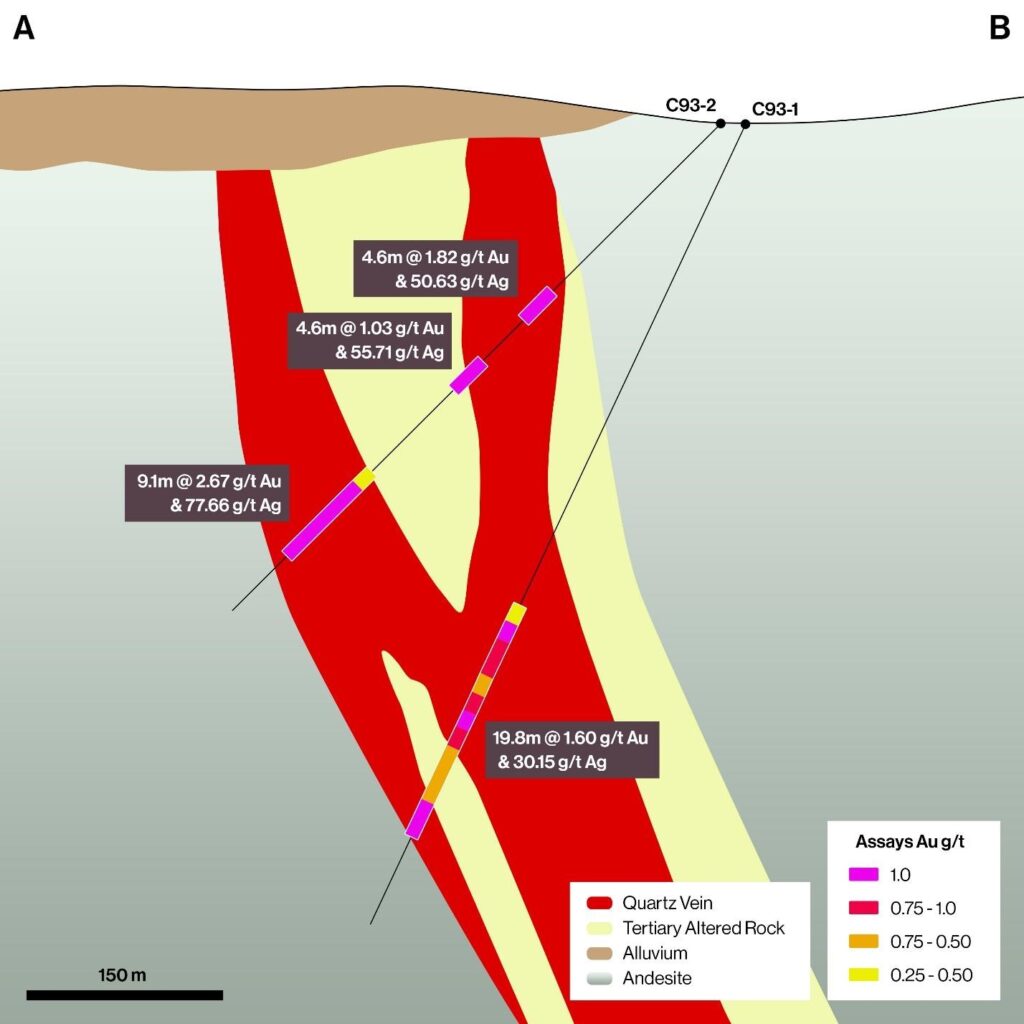

Stretching from the past producing Hulley-Logan open pit, heap leach mine, through the Como district, five kilometers to the northeast to the Pony Meadows Mine, the Como Trend has now been consolidated by StrikePoint. Various operators have drilled portions of the Como trend historically, in addition to the historic production. Additional to the drillholes discussed above, highlights include holes C93-1 and C93-2 which are summarized below.

Figure 3. Section A-B

The above data is historical in nature and is presented solely for reference. It is believed that the drilling was reverse circulation drilling, with the hole size unknown. No QA/QC data is available at this time. Assay laboratory, assay techniques, sample size, assay lab location and certification of the laboratory are not known, at this time, but the assay lab was independent to the Company.

The Company expects to be drilling on the Como, Pony Meadows and Sirens permits later in 2026, after the completion of its upcoming drill program on the 819,000 to 1,019,000 oz Au Exploration Target grading between 0.48 g/t Au and 0.63 g/t Au in 40,300,000 to 65,500,000 tonnes at the Hercules Gold Project. For further information on the Exploration Target please refer to the Company’s March 3, 2025 news release.

Figure 4. Hercules Property With Como Trend and Hercules Target

Transaction Summary

The Purchase and Sale Agreement between Fronteer Development (USA) LLC and the Company consists of the following payments, amounts below are US Dollars.

- $25,000 due on signing (paid),

- $50,000 due 12 months after the execution of the agreement,

- $75,000 due 24 months after the execution of the agreement,

- $150,000 due 36 months after the execution of the agreement.

And the following milestone payments.

- $1,500,000 due within 120 days completion of a Preliminary Economic Assessment on a 250Koz AuEq deposit contained within the acquired claims.

- $3,500,000 within 120 days of commercial production on the property.

The Company also granted Newmont a 1.5% net smelter return royalty, subject to a buydown to 1.0% for $1,000,000 and a Right of First Refusal on the remainder.

Qualified Person Statement

All technical data and scientific data, as disclosed in this press release, has been reviewed and approved by Michael G. Allen, P. Geo, President and CEO of the Company. Mr. Allen is a qualified person as defined under the terms of National Instrument 43-101.

About StrikePoint

Headed by CEO Michael G. Allen, StrikePoint is a multi-asset gold exploration company focused on building precious metals resources in the Western United States and in Canada.

StrikePoint is rapidly becoming one of its largest holders of mineral claims with approximately 145 square kilometers of prospective geology under claim, encompassing two district scale projects, the Hercules Gold Project and the Cuprite Gold Project.

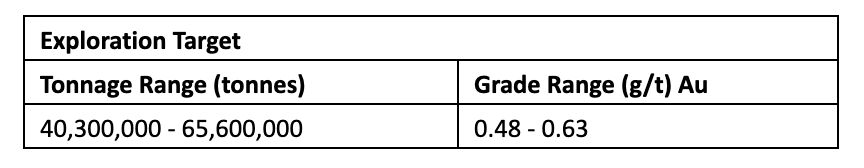

The Hercules Gold Project features an Exploration Target, as defined by NI 43-101, as follows:

Hercules Gold Project Exploration Target Model *

* The stated potential quantity and grade is conceptual in nature, and there has not been sufficient exploration to define a mineral resource, and it is uncertain if further exploration will result in the target being delineated as a mineral resource. The Exploration Target Model has not been evaluated for reasonable prospects of eventual economic extraction. The Exploration Target expressed should not be misrepresented or misconstrued as an estimate of a mineral resource or mineral reserve.

For further information on the Exploration Target, please refer to the Company’s March 3, 2025 news release. The technical report describing the Exploration Target and the Hercules Gold Project can be found on the Company’s website.

Mr. Allen has been working in the Walker Lane for the last 15 years, with multiple transactions completed in that timeframe including the acquisition of the Sterling Gold Project, located near Beatty, Nevada, and the sale of Northern Empire Resources Corp. to Coeur Mining, Inc. for approximately C$120 million. The Sterling Gold Project is now part of AngloGold Ashanti plc’s Arthur Gold project.

The Management and Board of StrikePoint has strong expertise in exploration, finance and engineering.

MORE or "SLIDER"

Prospector Podcast - Dr. Dave Lawie: Bridging the Global Mining Gap. Geopolitics, China, and Critical Metals

In this episode, Michael Fox interviews Dr. Dave Lawie, Chief Geoscienti... READ MORE

Jeff Christian – “Silver Volatility EXPLAINED: Inventories, Deliveries, and Price Risk” (Video)

In this presentation, Jeffrey Christian of CPM Group reviews current con... READ MORE

Glenn Jessome President & CEO Silver Tiger Metals Update

In this update, management explains the rationale behind choosing equity... READ MORE

Power Metallic Intercepts 20.40 Meters of 4.11% CuEqRec in Hole 25-046, and 8.60 Meters of 6.84% CuEqRec in Hole 25-045 at Lion

Power Metallic Mines Inc. (TSX-V: PNPN) (OTCBB: PNPNF) (Frankfu... READ MORE