Southern Silver Announces Acquisition of El Sol Claim; Corporate Update

Southern Silver Exploration Corp. (TSX-V: SSV) has entered into an agreement with Monarca Minerals Inc. to purchase the El Sol mineral claim in Durango, Mexico.

The claim is situated contiguous with Southern Silver’s Cerro Las Minitas mineral property, operated as a joint venture between Southern Silver and Electrum Global Holdings LP.

The purchase is solely for the account of Southern Silver and the claim will not form a part of the Cerro Las Minitas joint venture. Acquisition cost is $US 300,000 payable in three equal instalments on execution of a definitive agreement, twelve months and eighteen months together with retention by the vendor of a 2% NSR on production from the claim with a right in Southern Silver to purchase the royalty at any time for US$1,000,000.

El Sol Claim

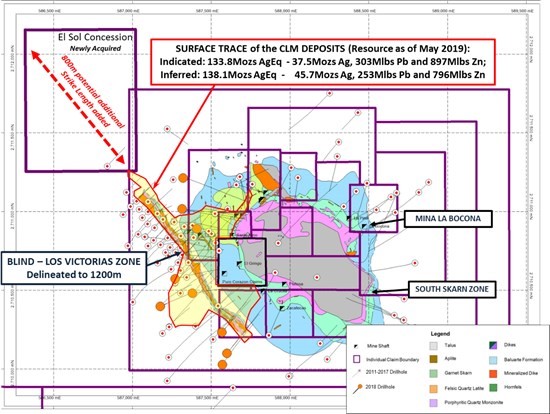

The El Sol concession is a single 63ha claim strategically located on the northwestern boundary of the Bocona block of claims and is adjacent to the Area of the Cerro which hosts the four mineral deposits currently identified within the Cerro Las Minitas claim package. It covers an important northwest projection of the Blind – El Sol deposits and potentially at least one additional mineralized structure.

The claim is largely gravel covered with previous work including: airborne magnetic geophysics; surface soil and acacia sampling; limited dump sampling of historic artisanal workings and a single core hole in the southeastern end of the property.

A drill hole, from 2013, intersected thick intervals of aplite and monzonite with associated grossular skarn and re-crystallized limestone which corresponds well to the projection of the Blind Zone deposit and returned anomalous Ag-Pb-Zn values with associated pathfinder elements. Additional exploration potential exists both down dip of the initial drill intercepts and on-strike to the northwest where the projected structure crosses two large magnetic anomalies located on the claim.

Select dump sampling of artisanal workings located to the northeast of the Blind Zone structure returned anomalous values from several strongly oxidized and silicified rocks including sample CLM-316 which returned 0.67g/t Au, 559g/t Ag, 3.3% Pb and 4.3% Zn. These workings do not appear to be related to the Blind Zone mineralization and represent a second potential high-grade target for priority follow-up.

Future exploration on the claim by Southern Silver will focus on: defining new drill targets along the projection of the Blind Zone deposit; further sampling in the area of the two large magnetic anomalies located on the claim and target definition in the area of the artisanal workings.

Figure 1: El Sol Claim Location. See full description of resource in Footnote 1

Corporate Update

In corporate matters, the Company reported on recent warrant and stock option exercises. During the current fiscal period:

- 9,944,295 share purchase warrants issued in March 2015, which expired in March 2020, with an exercise price of $0.08, have been exercised for gross proceeds receivable of $795,544;

- 1,818,000 stock options granted in March 2015, which expired in March 2020, with an exercise price of $0.08, were exercised for gross proceeds receivable of $145,440;

- 1,850,000 share purchase warrants issued in April 2016, which were due to expire in April 2021, with an exercise price of $0.08, have been exercised for gross proceeds receivable of $148,000; and

- 1,110,000 share purchase warrants issued in May 2016, which were due to expire in May 2021, with an exercise price of $0.15, have been exercised for gross proceeds receivable of $166,500.

Proceeds from such warrant and option exercises of $1,255,484, together with gross proceeds from our 2019 Unit private placement of $4,206,500, are being used for working capital and to cover the Company’s share of the costs associated with current and future exploration and development programs at Cerro Las Minitas and El Sol.

Southern Silver announces that it has granted 2,466,666 incentive stock options exercisable at a price of $0.12 per common share to directors, officers and consultants. 1,800,000 stock options have a five year term and the remaining 666,666 stock options have a three year term; all stock options are subject to the policies of the TSX Venture Exchange.

About Southern Silver Exploration Corp.

Southern Silver Exploration Corp. is a precious metal exploration and development company with a focus on the discovery of world-class mineral deposits in north-central Mexico and the southern USA. Our specific emphasis is the Cerro Las Minitas silver-lead-zinc project located in the heart of Mexico’s Faja de Plata, which hosts multiple world-class mineral deposits such as Penasquito, San Martin, Naica and Pitarrilla. We have assembled a team of highly experienced technical, operational and transactional professionals to support our exploration efforts in developing, along with our partner, Electrum Global Holdings LP, the Cerro Las Minitas project into a premier, high-grade, silver-lead-zinc mine. The Company engages in the acquisition, exploration and development either directly or through joint-venture relationships in mineral properties in major jurisdictions. Our property portfolio also includes the Oro porphyry copper-gold project located in southern New Mexico, USA.

- The 2019 Cerro Las Minitas Resource Estimate was prepared following CIM definitions for classification of Mineral Resources. Resources are constrained using mainly geological constraints and approximate 10g/t AgEq grade shells. The block models are comprised of an array of blocks measuring 10m x 2m x 10m, with grades for Au, Ag, Cu, Pb, Zn values interpolated using ID3 weighting. Silver and zinc equivalent values were subsequently calculated from the interpolated block grades. The model is identified at a 175g/t AgEq cut-off, with an indicated resource of 11,102,000 tonnes averaging 105g/t Ag, 0.10g/t Au, 1.2% Pb, 3.7% Zn and 0.16% Cu and an inferred resource of 12,844,000 tonnes averaging 111g/t Ag, 0.07g/t Au, 0.9% Pb, 2.8% Zn and 0.27% Cu. AgEq cut-off values were calculated using average long-term prices of $16.6/oz. silver, $1,275/oz. gold, $2.75/lb. copper, $1.0/lb. lead and $1.25/lb. zinc. Metal recoveries for the Blind, El Sol and Las Victorias deposits of 91% silver, 25% gold, 92% lead, 82% zinc and 80% copper and for the Skarn Front deposit of 85% silver, 18% gold, 89% lead, 92% zinc and 84% copper were used to define the cut-off grades. Base case cut-off grade assumed $75/tonne operating, smelting and sustaining costs. All prices are stated in $USD. Silver Equivalents were calculated from the interpolated block values using relative recoveries and prices between the component metals and silver to determine a final AgEq value. The same methodology was used to calculate the ZnEq value. Mineral resources are not mineral reserves until they have demonstrated economic viability. Mineral resource estimates do not account for a resource’s mineability, selectivity, mining loss, or dilution. The current Resource Estimate was prepared by Garth Kirkham, P.Geo. of Kirkham Geosciences Ltd. who is the Independent Qualified Person responsible for presentation and review of the Mineral Resource Estimate. All figures are rounded to reflect the relative accuracy of the estimate and therefore numbers may not appear to add precisely.

Robert Macdonald, MSc. P.Geo, is a Qualified Person as defined by National Instrument 43-101 and supervised directly or was part of the team that supervised the collection of the data from the El Sol Project that is reported in this disclosure and is responsible for the presentation of the technical information in this disclosure.

MORE or "UNCATEGORIZED"

Rupert Resources Reports Results From Project Drilling Including 120m at 6.2g/t Gold

Rupert Resources Ltd. (TSX:RUP) reports assay results from projec... READ MORE

West Red Lake Gold Announces Closing $33 Million Bought Deal Public Offering Including the Full Exercise of the Over-Allotment Option

West Red Lake Gold Mines Ltd. (TSX-V: WRLG) (OTCQB: WRLGF) is ple... READ MORE

Abitibi Metals Drills 13.15 Metres At 4.82% CuEq in Eastern Drilling At The B26 Deposit

Highlights: The Company has received results from drillholes 1274... READ MORE

Patriot Drills 122.5 m at 1.42% Li2O and 71.4 m at 1.57% Li2O at CV5

Highlights Continued strong lithium mineralization over wide inte... READ MORE

Argonaut Gold Announces First Quarter Financial and Operating Results

Argonaut Gold Inc. (TSX: AR) reported financial and operating res... READ MORE