SOMA GOLD REPORTS 1ST QUARTER FINANCIAL RESULTS

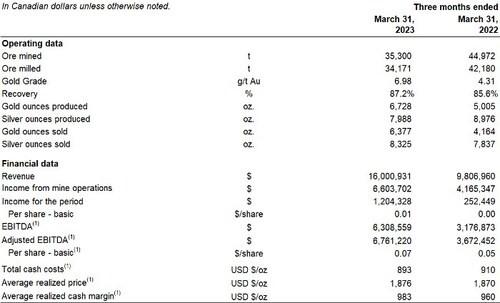

- Gold Sales of 6,448 ounces in Q1-2023 – an increase of 52% from Q1-2022

- Net Income of $1.2 million on Revenue of $16 million

- Adjusted EBITDA(1) of $6.8 million

- Total cash cost per ounce of gold sold decreases to US$893(1)

Soma Gold Corp. (TSX-V: SOMA) (WKN: A2P4DU) (OTC: SMAGF) is pleased to announce that the Company’s first quarter Financial Statements and MD&A have been filed on SEDAR and are available at the following link: https://bit.ly/Soma2023Q1Financials.

Highlights of the Quarter:

- Cordero Mine declares commercial production as of January 1, 2023 (see news release dated January 11, 2023).

- Sales of 6,448 gold equivalent ounces – the second-highest sales number in Soma’s history.

- Revenue of $16.0 million, income from mine operations of $6.6 million and Net Income of $1.2 million all show significant improvements from the comparative quarter of 2022 (63%, 59% and 377% increases, respectively).

- Adjusted EBITDA(1) of $6.8 million compared to $3.7 million in Q1-2022.

- Total cash costs per ounce of gold sold of US$893(1) compared to US$910 in Q1-2022.

Javier Cordova, Soma’s President and CEO, states, “It is gratifying to deliver the performance we anticipated in our 2023 plan and guidance. We are well on track to completing the year at or above expectations. The team has outperformed on most metrics as we see the effects of self-performing mechanized mining. We are successfully transitioning from the 2022 challenges of managing the construction of the Cordero Mine and gold production to optimizing costs and recovery. During the balance of 2023, we will continue to ramp up gold production and further reduce the costs to produce those ounces.”

ABOUT SOMA GOLD

Soma Gold Corp. is a mining company focused on gold production and exploration. The Company owns two adjacent mining properties in Antioquia, Colombia with a combined milling capacity of 675 tpd. (Permitted for 1,400 tpd). The El Bagre Mill is currently operating and producing. Internally generated funds are being used to finance a regional exploration program.

Q1-2023 and Q1-2022 Financial and Operating Highlights (CNW Group/Soma Gold Corp.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE