Solaris Enters into US$200 Million Financing Agreements with Royal Gold to Advance the Warintza Project

Solaris Resources Inc. (TSX: SLS) (NYSE: SLSR) is pleased to announce that it has entered into a US$200 million financing arrangement comprising a gold stream and net smelter return royalty with RGLD Gold AG, a subsidiary of Royal Gold, Inc. following a competitive and comprehensive process during which the Company received numerous compelling and credible financing proposals from third parties.

HIGHLIGHTS:

- Non-dilutive US$200 million funding package from Royal Gold, comprising a gold stream and NSR royalty, US$100 million of which is available immediately

- The package provides the funding required to repay the Senior Debt facility and is expected to provide the necessary liquidity to fund all value accretive derisking activities through to a final investment decision

- Stream expected to represent a small percentage of the gold over the life of mine which, together with the modest NSR royalty, reinforces Warintza’s position as a multi-generational tier 1 copper project following significant due diligence and financial commitment on accretive terms providing a robust reflection of the potential scale, economics and stage of development

- Stream termination provision contains no penalties under a change-of-control scenario, providing the Company flexibility to enhance shareholder value going forward

- Maintained strategic optionality around future project financing

- Funding package restricted to Warintza cluster thus retaining exposure to significant exploration upside potential with commercial optionality around high-priority targets within the Warintza district

The Financing Agreements provide the Company with long-term liquidity required to fund all value accretive, derisking activities through to a final investment decision, in addition to paying off the senior secured debt facility with Orion Mine Finance Management LP. The structure of the Financing Agreements aligns with Solaris’ strategy of maximizing shareholder value through non-dilutive means on highly accretive terms, underpinning the position of the Company’s Warintza project as a tier 1 copper asset.

Matthew Rowlinson, President and CEO of Solaris, commented: “This transaction is a clear endorsement of the potential scale, geological qualities and its near surface nature, economics and stage of development of Warintza, one of the few remaining near-term, globally significant copper development opportunities not controlled by a major. Further, it’s a reflection of the strong investor confidence in Ecuador as a mining jurisdiction, supported by the government’s commitment to the sector as a pillar of long-term economic development. The Stream is expected to represent a small percentage of the gold over the life of mine and together with the Royalty, enables the Company to maintain the project’s strategic flexibility. Through partnering with Royal Gold, a leader in the precious metals streaming and royalty space, this has not only brought very competitive cost of capital to the table, but a valued strategic relationship. We are proud of our team for executing a process that brought in a high-quality partner on accretive terms and we look forward to a long and successful partnership with Royal Gold, continuing to deliver on our commitment to unlocking value for all stakeholders.”

Richard Warke, Non-Executive Chairman of Solaris, commented: “Congratulations to the management team for successfully securing a funding package that marks a major milestone in Warintza’s development. This financing structure provides Solaris with long-term liquidity while maintaining corporate flexibility going forward, allowing the Company to fully enhance shareholder value. Their swift efforts have positioned us for growth without foreseeable share dilution — a key win for our shareholders. This progress builds on the historic work performed that laid the foundation for Warintza’s transformation into a world-class, global scale multi-generational copper asset.”

DETAILS OF THE FINANCING AGREEMENTS

Upfront Consideration

Royal Gold will pay Solaris a total cash consideration of US$200 million in three instalments as follows:

- First tranche of US$100 million upon close of the transaction (funds available immediately as signing and close are concurrent).

- Second tranche of US$50 million made available following the publication of the Pre-Feasibility Study and receipt of the Environmental Impact Assessment technical approval.

- Third tranche of US$50 million made available on the first anniversary of the closing date and completion of all filings necessary to fully perfect Royal Gold’s security.

Closing of the second and third tranches will be subject to other customary conditions.

Proceeds from the Financing Agreements will be utilised to complete technical studies, permitting activities, early infrastructure development, the repayment of the Company’s Senior Debt facility, some district exploration activities and general working capital requirements, and fully-fund the Company through to a FID.

Stream

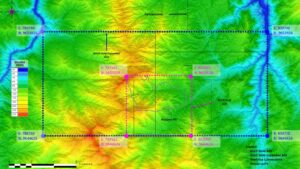

- Royal Gold will receive gold deliveries equivalent to 20 ounces per 1 million pounds of copper produced from the RGLD Gold AOI (Figure 1 – area demarked with the pink boundary), which is expected to represent only a small percentage of the gold over the life of mine.

- For each ounce of gold delivered under the Stream, Royal Gold will pay Solaris a purchase price equal to:

- 20% of spot price until 90,000 ounces have been delivered; and

- 60% of spot price thereafter.

Royalty

- Royal Gold will receive a 0.3% net smelter return royalty on all metal production from the RGLD Gold Expanded AOI (Figure 1 – area demarked with the blue boundary).

- The Royalty will increase annually by 0.0375%, up to a maximum of 0.6%, until the earlier of:

- the first delivery of gold under the Stream; or

- eight years following the closing date.

Area of Interest

Stream

The Stream AOI is limited to a small area surrounding the mineral resource (Figure 1 – area demarked with the pink boundary) resulting in Solaris retaining significant exploration upside, unencumbered by the Stream. If the Project does not enter commercial production within eight years, and the first delivery under the Stream has not occurred, the area of interest for the Stream will increase to the Expanded AOI (Figure 1 – area demarked with the blue boundary).

Royalty

The Royalty will apply to all metal production from within the Expanded AOI, demarked by the blue boundary in Figure 1. If upon a change of control transaction, Royal Gold exercises its right to terminate the Stream (further details below), the area of interest on the Royalty will be reduced to the Stream AOI, demarked by the pink boundary in Figure 1.

Figure 1

The construct of the area of interest ensures that Solaris retains exposure to the potential of significant exploration upside with commercial optionality around high-priority targets within the Expanded AOI.

Solaris retains the ability to spin out non-core properties at any time within the Expanded AOI (excluding the Stream AOI) and in such instance a royalty would immediately attach to the spin-out properties at a rate of 1.2%.

Change of Control Provision

If a CoC transaction occurs within five years of closing, or prior to the first delivery under the Stream (whichever is earlier), either party may elect to terminate the Stream and return all advance payments without penalty. Under a CoC, the Royalty would remain in place and, under certain circumstances, automatically increase to 0.6%.

Other Considerations

Royal Gold has pledged to financially support the Company’s environmental and social programmes, reflecting their commitment to sustainable development and social responsibility. This aligns with the Company’s belief that sustainable mining is not just an economic endeavour; it is a journey that must include the insights and values of every stakeholder involved, especially our indigenous populations, embracing an open dialogue and partnership rooted in trust, understanding, and mutual respect.

The transaction has been structured in a manner that contemplates the Stream and Royalty being subordinated to any future project financing, thereby retaining strategic flexibility around any future project development financing.

NEXT STEPS

As described, the Financing Agreements provide sufficient liquidity to fund the Company’s activities through to an FID. Before then, the Company expects to conclude and publish the PFS, led by Ausenco, Knight Piésold and AMC, in Q3 2025. Work will then transition into the Bankable Feasibility Study.

In parallel, the Company is advancing the technical review of the EIA in collaboration with Ecuador’s Ministries of Energy and Mines and Environment, with approval on target for mid-2025. All the project exploitation permits are expected by mid-year 2026. The recent re-election of President Daniel Noboa has provided political continuity in the country and reinforces the supportive policy environment that has enabled Solaris to maintain progress on permitting and stakeholder engagement to date.

Following the completion of over 82,000 metres of infill drilling between January 2024 and February 2025, an updated Mineral Resource Estimate is expected to be published in Q3 2025. Further, Solaris is simultaneously working to unlock value across its broader 100%-owned land package of over 260km², which contains several high-priority regional targets with step-out field exploration activities ongoing.

In addition to the above, the Company will use funds to repay its Senior Debt facility.

On behalf of the Board of Solaris Resources Inc.

“Matthew Rowlinson”

President & CEO, Director

For Further Information

Patrick Chambers, VP Investor Relations

Email: pchambers@solarisresources.com

Advisors

BMO Capital Markets is acting as financial advisor to Solaris Resources. Blake, Cassels & Graydon LLP is acting as legal advisor.

About Solaris Resources Inc.

Solaris is a copper-gold exploration and development company, committed to a sustainable future by empowering communities and stakeholders through our dedication to participatory and responsible mining. The Warintza Project, a large copper-gold porphyry deposit, is a unique, global scale and multigenerational asset located in the low capital intensity district of southeast Ecuador. The Company also owns a series of grassroot exploration projects with discovery potential in Peru and Chile and a 60% interest in the La Verde joint-venture project with a subsidiary of Teck Resources in Mexico.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE