Significant intercepts of gold and copper show Golden Eye emerging as a highly promising new resource prospect

Highest grade result to date of 60.8g/t AuEq over 0.4m (51.3g/t Au, 7.2%Cu & 18.0g/t Ag) with mineralisation open; Plus, assays pending from additional holes

Chibougamau Copper-Gold Project, Canada

HIGHLIGHTS:

- Gold intersected in two zones within one hole; results include:

- 7.4m @ 5.7g/t AuEq (4.6g/t Au, 0.9% Cu & 5.6g/t Ag) from 405.6m, including 3.1m @ 9.6g/t AuEq (7.4 g/t Au, 1.6% Cu & 10.0g/t Ag) (LDR-25-08)

- 2.9m @ 10.2g/t AuEq (8.3g/t Au, 1.4% Cu and 3.3g/t Ag) from 463.8m, including 0.4m @ 60.8g/t AuEq (51.3g/t Au, 7.2%Cu & 18.0g/t Ag) (visible gold) (LDR-25-08)

- First results of the drill program returned 3.3m @ 6.6g/t Au, including 2.3m @ 9.1 g/t Au (LDR-25-05) (see TSXV/ASX announcement dated 16/17 April 2025)

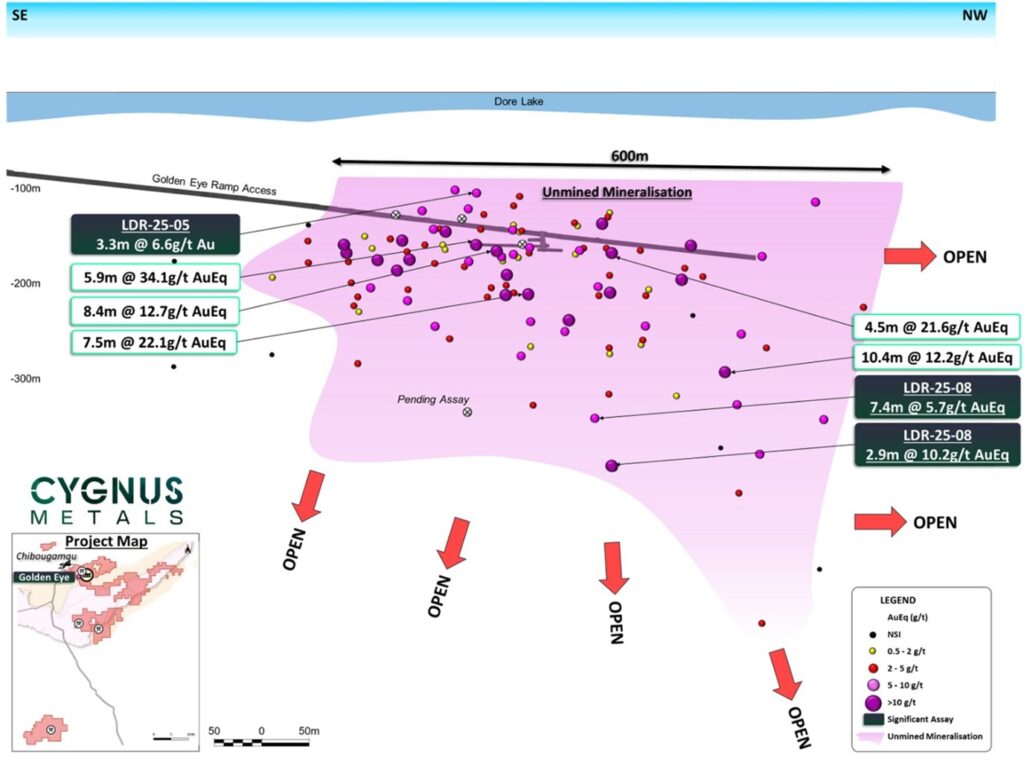

- Golden Eye has never been mined and was last drilled in the early 1990s when gold was less than US$350/oz. The entire drilling target sits outside the current Mineral Resource1

- Additional assay results from a number of drill holes at Golden Eye are expected later this month with visible gold observed in LDR-25-09* (see photo below)

* Visual estimates of mineral abundance should never be considered a proxy or substitute for laboratory analyses where concentrations or grades are the factor of principal economic interest. Visual estimates also potentially provide no information regarding impurities or deleterious physical properties relevant to valuations. The Company expects to receive the laboratory analytical results of the recent core sample (including LDR-25-09) in the current quarter.

- Significant intersections from historic drilling2 include:

- 5.9m @ 34.1g/t AuEq (32.2g/t Au, 1.2% Cu & 27.3g/t Ag) (RD-11)

- 4.5m @ 21.6g/t AuEq (14.9g/t Au, 4.7% Cu & 54g/t Ag) (RD-28)

- 8.4m @ 12.7g/t AuEq (11.0g/t Au, 1.3% Cu & 15.8g/t Ag) (RD-20)

- 7.5m @ 22.1g/t AuEq (16.0g/t Au & 4.7% Cu) (S1-87-1)

- 10.4m @ 12.2 g/t AuEq (7.3g/t Au, 3.5% Cu & 31.8g/t Ag) (S3-86-4)

- Cygnus intends to use the new results and the compiled historic drill data, totalling 77 holes for 21,371m, to complete an initial Mineral Resource for Golden Eye

- The Golden Eye prospect sits 3km from Cygnus’ central processing plant and has existing dual ramp access within 150m of the mineralisation

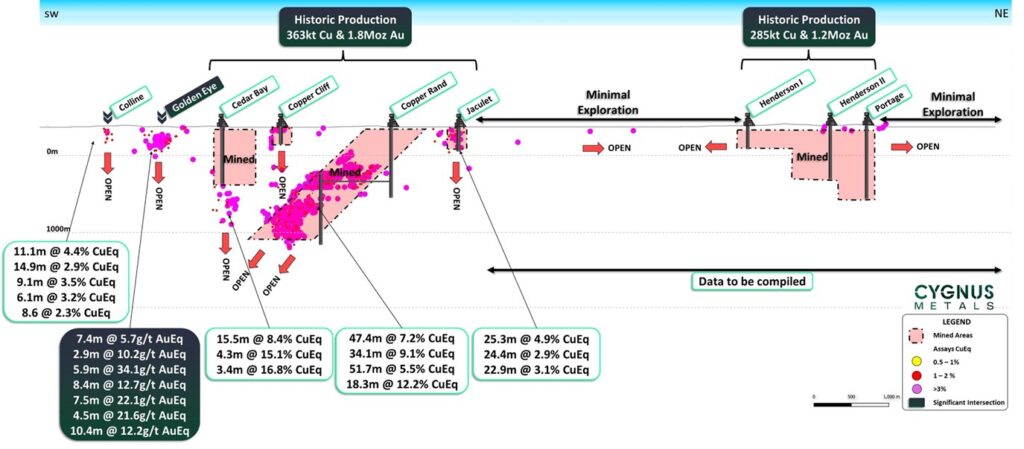

- Gold was a significant part of the historic production within the Chibougamau District, with over 3.5Moz of gold produced alongside 945,000t of copper.3

| Cygnus Executive Chairman David Southam said: “Golden Eye is clearly emerging as something special with scope to drive valuable resource growth in the near term.

“Cygnus has intersected high-grade gold mineralisation at Golden Eye, which has an existing dual ramp access that sits within 150m of the mineralisation and is located just 3km from the central processing plant. Given the results to date, which support the historical results, Golden Eye is poised to become a new and additional growth driver for Cygnus at a time of historically high gold prices. “And it is just one example of what is hiding in the historic data at the Chibougamau Project’’. |

Cygnus Metals Limited (ASX: CY5) (TSX-V: CYG) (OTCQB: CYGGF) is pleased to announce its best gold intercepts drilled to date from the Golden Eye prospect within the Chibougamau Copper-Gold Project in Quebec.

Recent results have returned two intervals from parallel mineralised zones at Golden Eye, extending gold mineralisation at depth. The results from the latest assays include:

- 7.4m @ 5.7g/t AuEq (4.6g/t Au, 0.9% Cu & 5.6g/t Ag) from 405.6m (LDR-25-08)

- Including 3.1m @ 9.6g/t AuEq (7.4 g/t Au, 1.6% Cu & 10.0g/t Ag)

- 2.9m @ 10.2g/t AuEq (8.3g/t Au, 1.4% Cu and 3.3g/t Ag) from 463.8m (LDR-25-08)

- Including 0.4m @ 60.8g/t AuEq (51.3g/t Au, 7.2%Cu & 18.0g/t Au) (visible gold)

These results are in addition to previously released results from Golden Eye (see TSXV/ASX announcement dated 16/17 April 2025) as follows:

- 3.3m @ 6.6g/t Au from just 131.7m (LDR-25-05)

- Including 2.3m @ 9.1g/t Au

The recent results highlight not only the potential to establish a high-grade mineral resource at Golden Eye but also that mineralisation remains open at depth, with the vast majority of all drilling at less than ~400m from surface. Additional results are expected this quarter from the remaining four holes of the program, with visible gold also observed in one drill hole (LDR-25-09).

Cygnus intends to use the results from the recently completed drilling alongside the newly compiled historic drill data totalling 77 holes for 21,371m to complete an initial Mineral Resource Estimate for Golden Eye. The best historic drill intercepts2 dating back to the 1990s returned:

- 5.9m @ 34.1g/t AuEq (32.2g/t Au, 1.2% Cu & 27.3g/t Ag) (RD-11);

- 4.5m @ 21.6g/t AuEq (14.9g/t Au, 4.7% Cu & 54g/t Ag) (RD-28);

- 8.4m @ 12.7g/t AuEq (11.0g/t Au, 1.3% Cu & 15.8g/t Ag) (RD-20);

- 7.5m @ 22.1g/t AuEq (16.0g/t Au & 4.7% Cu) (S1-87-1); and

- 10.4m @ 12.2 g/t AuEq (7.3g/t Au, 3.5% Cu & 31.8g/t Ag) (S3-86-4).

Golden Eye has existing double ramp access within 150m of the mineralisation and sits less than 3km from the central 900,000tpa processing facility. This makes it a potentially important part in the pathway to the development of the project.

The Chibougamau district has a strong history of gold production as well as copper, having produced 3.5Moz Au at an average grade of 2.1g/t Au.3 Gold grades vary between different deposits, although Golden Eye and Cedar Bay are the two areas with a significantly higher gold grade than other deposits within the camp.

Golden Eye is an excellent example of the value generated through ongoing compilation work which is helping to unlock this historic district while the Company continues to build upon the existing high-grade copper-gold resources with low-risk brownfield exploration.

Figure 1: Composite Long Section of Golden Eye over 600m of strike with significant gold grade of up to 34.1gt AuEq over 5.9m. Mineralisation is still open at depth with 2.9m @ 10.2g/t AuEq intersected in LDR-25-08. Refer to Appendix A of this release for newly released drill intercepts and TSXV/ASX releases dated 15 October 2024, 24/25 March 2025 and 16/17 April 2025 for previously announced drilling results.

Figure 2: Composite Long Section through the Chibougamau North Camp illustrating Golden Eye with intersections of up to 5.9m @ 34.1g/t AuEq. Refer to TSXV/ASX/ releases dated 15 October 2024 and 24/25 March 2025 for previously announced drilling results.

Ongoing Work

Cygnus is continuing to compile the data across the camp and deliver additional drill targets as the Company looks to execute its strategy of value creation through resource growth and conversion drilling. This low-cost, low-risk approach includes both surface and downhole electromagnetics to generate brownfield targets around known high quality mineralisation.

About Cygnus Metals

Cygnus Metals Limited is a diversified critical minerals exploration and development company with projects in Quebec, Canada and Western Australia. The Company is dedicated to advancing its Chibougamau Copper-Gold Project in Quebec with an aggressive exploration program to drive resource growth and develop a hub-and-spoke operation model with its centralised processing facility. In addition, Cygnus has quality lithium assets with significant exploration upside in the world-class James Bay district in Quebec, and REE and base metal projects in Western Australia. The Cygnus team has a proven track record of turning exploration success into production enterprises and creating shareholder value.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE