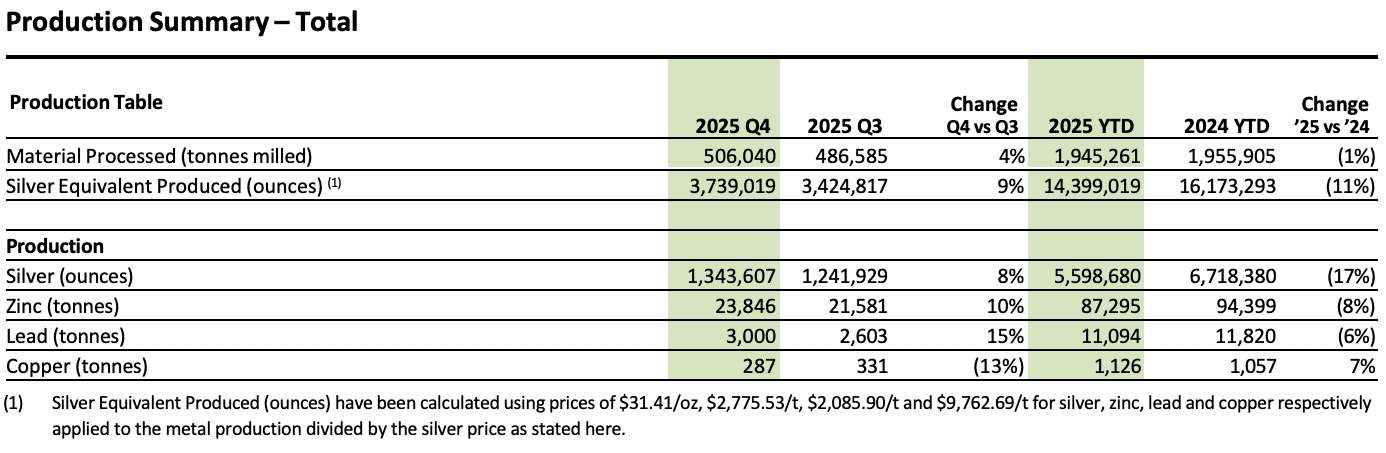

Santacruz Silver Produces 3,739,019 Silver Equivalent Ounces in Q4 2025, Comprised of 1,343,607 Ounces of Silver, 23,846 Tonnes of Zinc, 3,000 Tonnes of Lead, and 287 Tonnes of Copper

Santacruz Silver Mining Ltd. (NASDAQ:SCZM) (TSX-V:SCZ) reports its Q4 2025 production results from its Bolívar mine, Porco mine, Caballo Blanco Group of mines and the San Lucas Group which includes the Reserva Mina and the San Lucas feed sourcing business, all located in Bolivia, and the Zimapán mine located in Mexico.

Q4 2025 Production Highlights:

Silver Equivalent Production: 3,739,019 silver equivalent ounces

Silver Production: 1,343,607 ounces

Zinc Production: 23,846 tonnes

Lead Production: 3,000 tonnes

Copper Production: 287 tonnes

Underground Development: 11,558 meters

Arturo Préstamo, Executive Chairman and CEO of Santacruz, commented, “During Q4 2025, Santacruz delivered a solid quarter-over-quarter improvement in consolidated production, led by a meaningful recovery at the Bolívar mine, and supported by strong performance at Caballo Blanco, Zimapán, and San Lucas, reflecting the strength and diversification of our multi-asset operating portfolio. At Bolívar, we are beginning to see the benefits of the recovery efforts at the high silver-grade Pomabamba and Nané veins following the May 2025 flooding event, which resulted in higher production throughput, improved operating conditions, and a 34% increase in silver equivalent production compared to Q3 2025.”

Mr. Préstamo continued, “In Q4 2025, the recovery plan at Bolívar remained focused on restoring access to the affected mining areas, and continued to progress on schedule. Improvements achieved this quarter contributed to enhanced operational stability and stronger production performance. However, access to the highest-grade areas remained partially constrained, and recovery activities continued throughout Q4 2025. Our team at Bolívar is making steady progress each day, and we expect their efforts to drive a sustained quarter-over-quarter increase in silver production from these two veins this year. We continue to expect a full recovery from both areas by Q4 2026.”

Year-over-year production (2025 vs 2024) was impacted by Bolívar’s May 2025 flooding event, which temporarily restricted access to certain mining areas and limited throughput from Q2 2025 to Q4 2025. Remediation measures have been implemented since the event in May 2025 and continued to advance as planned throughout Q4 2025, placing the Bolívar’s operation on a clear path toward resolution. As access has steadily improved, silver production has begun to recover. In addition, Santacruz experienced consistent quarter-over-quarter improvements in 2025, a trend the Company expects to continue as conditions normalize.

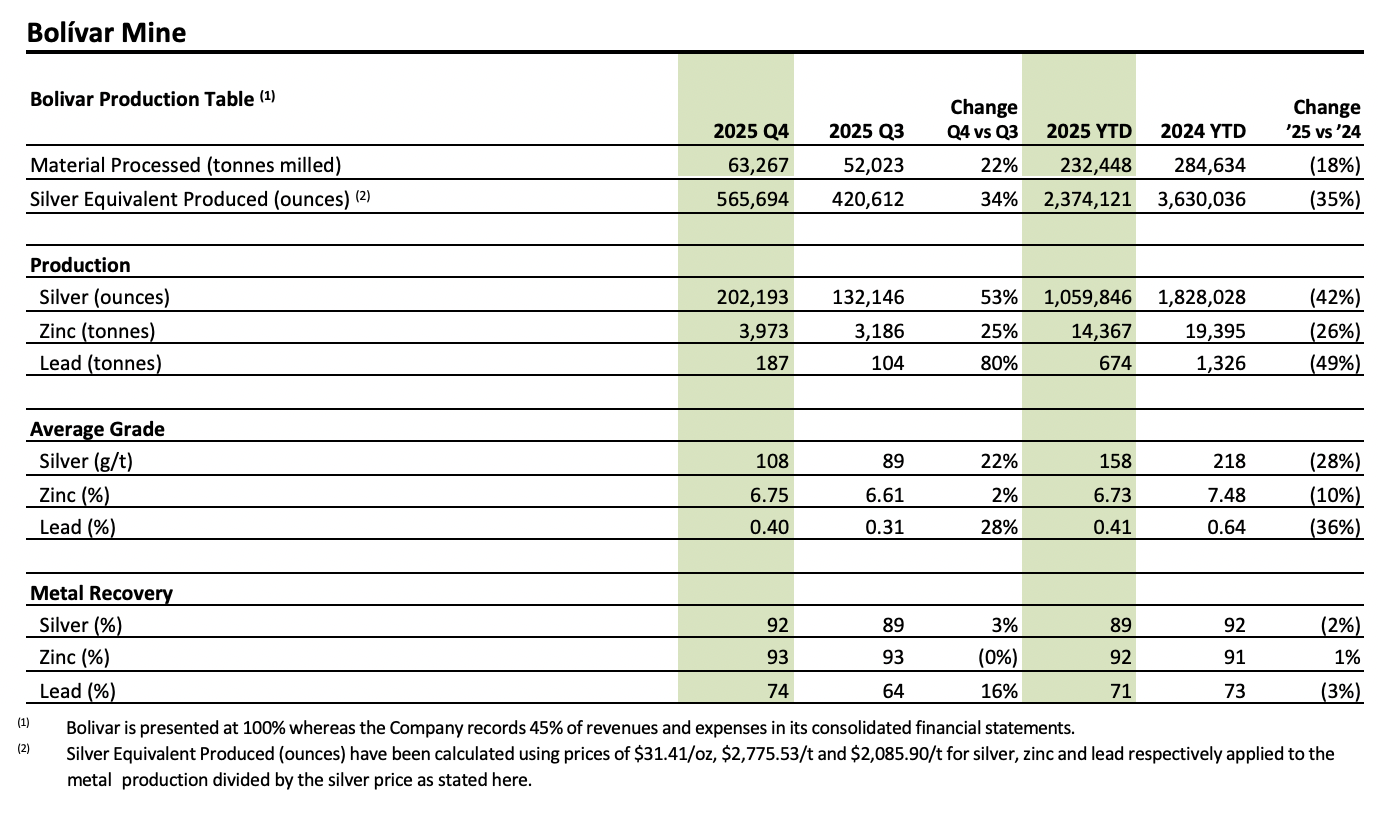

Q4 2025 vs Q3 2025

In Q4 2025, ore processed at Bolívar increased by 22% compared to Q3 2025, reflecting improved access and operating conditions as recovery activities advanced at the Pomabamba and Nané areas. Silver equivalent production increased by 34%, driven by higher throughput, a 22% increase in silver head grades and a 3% improvement in silver recoveries. Silver production increased by 53% quarter over quarter, while zinc and lead production rose by 25% and 80%, respectively, consistent with improved stope availability and the mining sequence.

Recovery efforts at the affected mining areas continued throughout Q4 2025 and advanced in line with the established recovery plan. While operating conditions improved materially compared to Q3 2025, access to the highest-grade portions of the Pomabamba and Nané veins remained partially restricted during Q4 2025. Notwithstanding these constraints, production from the Pomabamba and Nané veins increased month-over- month during Q4 2025, reflecting improved grades and silver recoveries, as a growing proportion of ore was sourced from these higher-silver-grade structures.

Q4 2025 vs Q4 2024

The high-grade areas at Pomabamba and Nane veins began to show solid progress toward the end of Q3 2025; however, their contribution to silver recoveries became more meaningful only during Q4 2025, which also affected the year-over-year comparison.

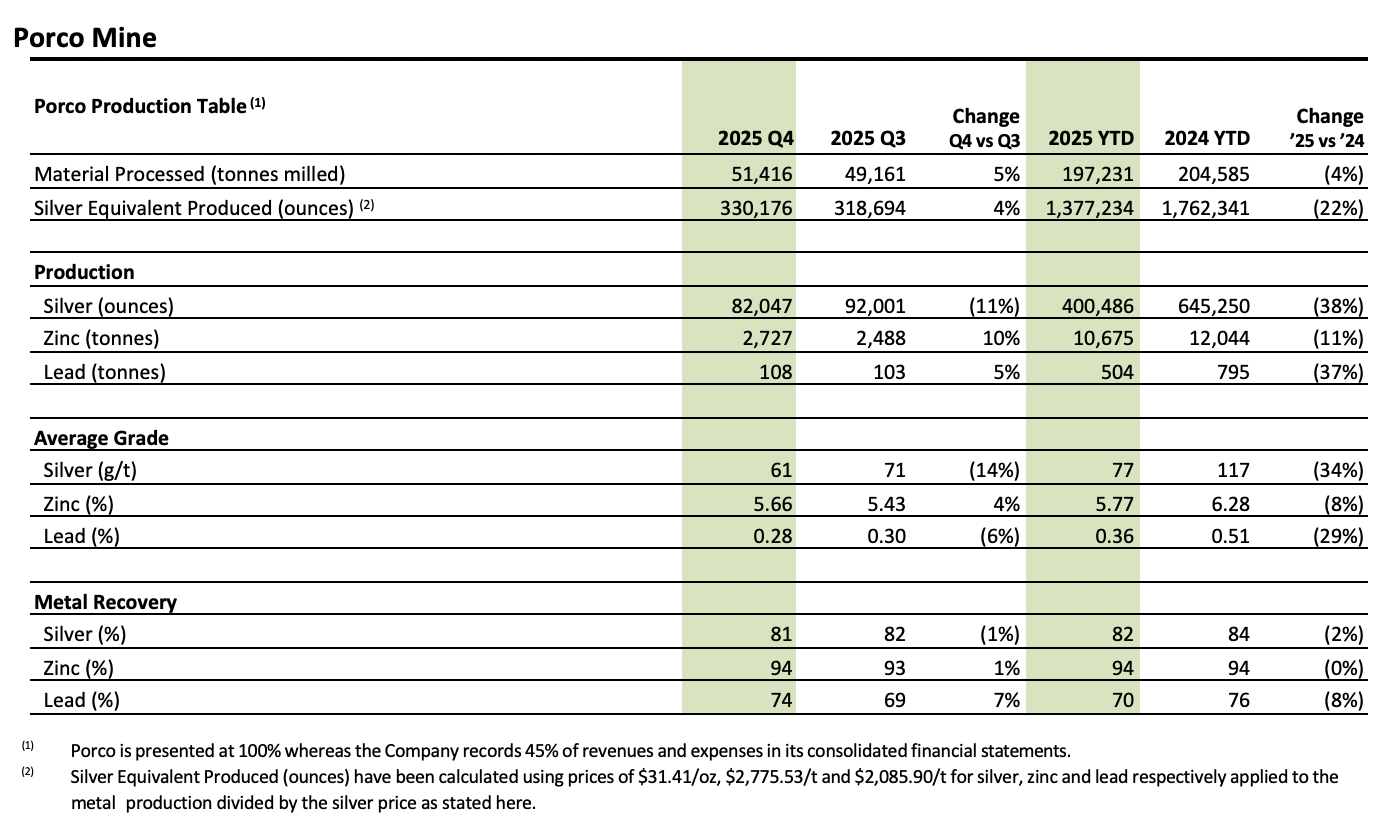

Q4 2025 vs Q3 2025

Porco reported a 10% increase in zinc production compared to the previous quarter, driven by higher head grades and stable throughput. Zinc recoveries remained strong at 94%, reflecting consistent metallurgical performance. Silver production declined as mining continued to focus on zinc-rich zones, consistent with the mine plan and Porco’s role as a predominantly zinc-producing underground operation.

Q4 2025 vs Q4 2024

On a year-over-year basis, Porco recorded a modest decrease in zinc production, reflecting slightly lower zinc grades while maintaining stable throughput and strong recoveries. The mine plan during 2025 prioritized zinc-dominant zones with lower silver content, resulting in lower silver output compared to the prior year. Porco continues to operate as a reliable zinc-producing asset with consistent operating performance.

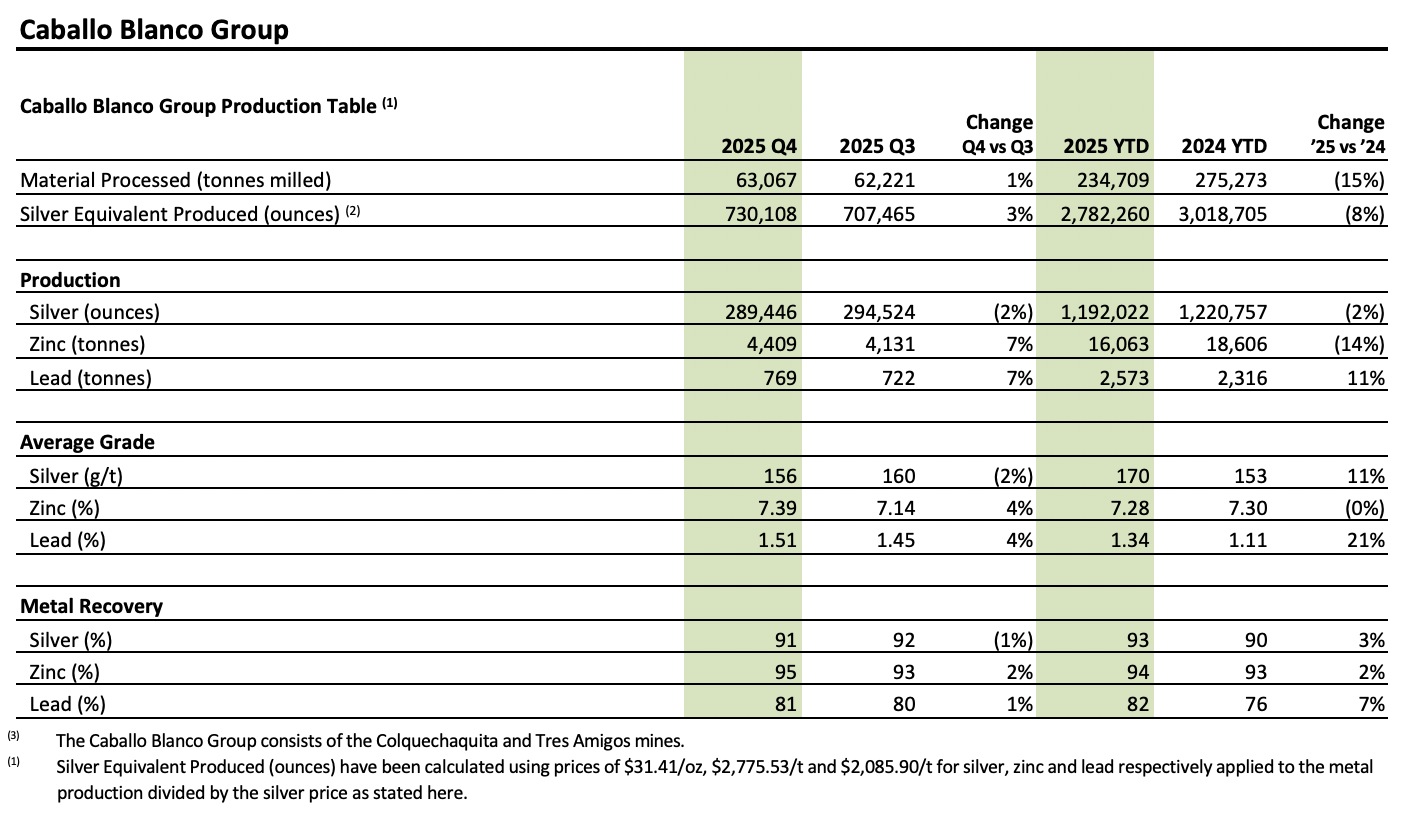

Q4 2025 vs Q3 2025

Caballo Blanco increased ore processed compared to Q3 2025, resulting in a 3% increase in silver equivalent production. Silver production remained stable, while zinc and lead output increased by 7% each, supported by higher head grades and strong recoveries. Results reflect solid operational performance and continued adherence to the mine plan.

Q4 2025 vs Q4 2024

Compared with Q4 2024, Caballo Blanco’s silver equivalent production increased, supported by higher head grades and improved recoveries. These results reflect ongoing operational optimization and continued focus on mining higher-quality zones within the mine plan.

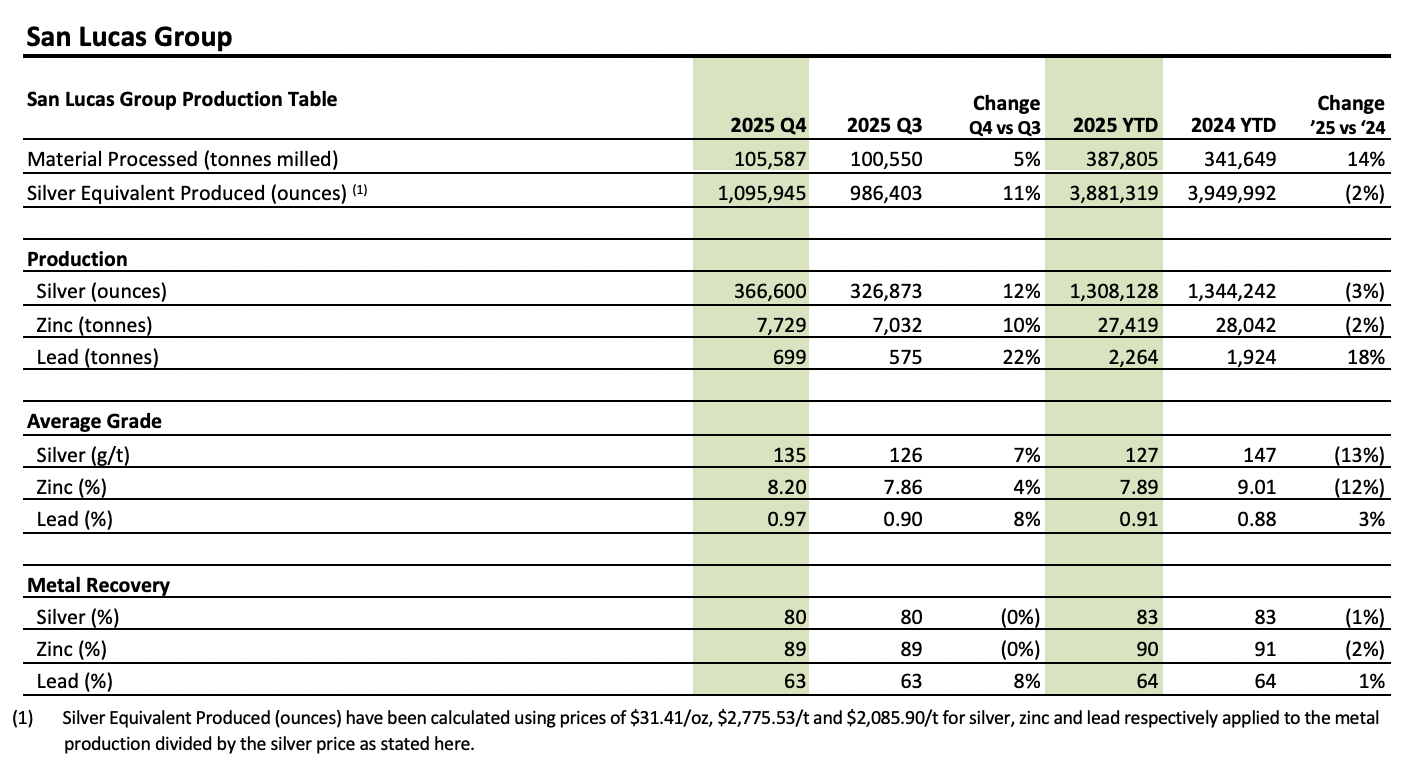

Q4 2025 vs Q3 2025

San Lucas continued to play a strategic role in Q4 2025, with ore processed up 5% from the prior quarter. Silver equivalent production increased by 11%, driven by higher throughput and improved head grades, while recoveries remained stable. The operation’s flexible, margin-based sourcing model continued to support group-level mill utilization.

Q4 2025 vs Q4 2024

On a year-over-year basis, San Lucas processed higher volumes, while silver equivalent production declined modestly due to lower head grades. Operational flexibility remained a key factor in supporting overall performance across the Bolivian operations.

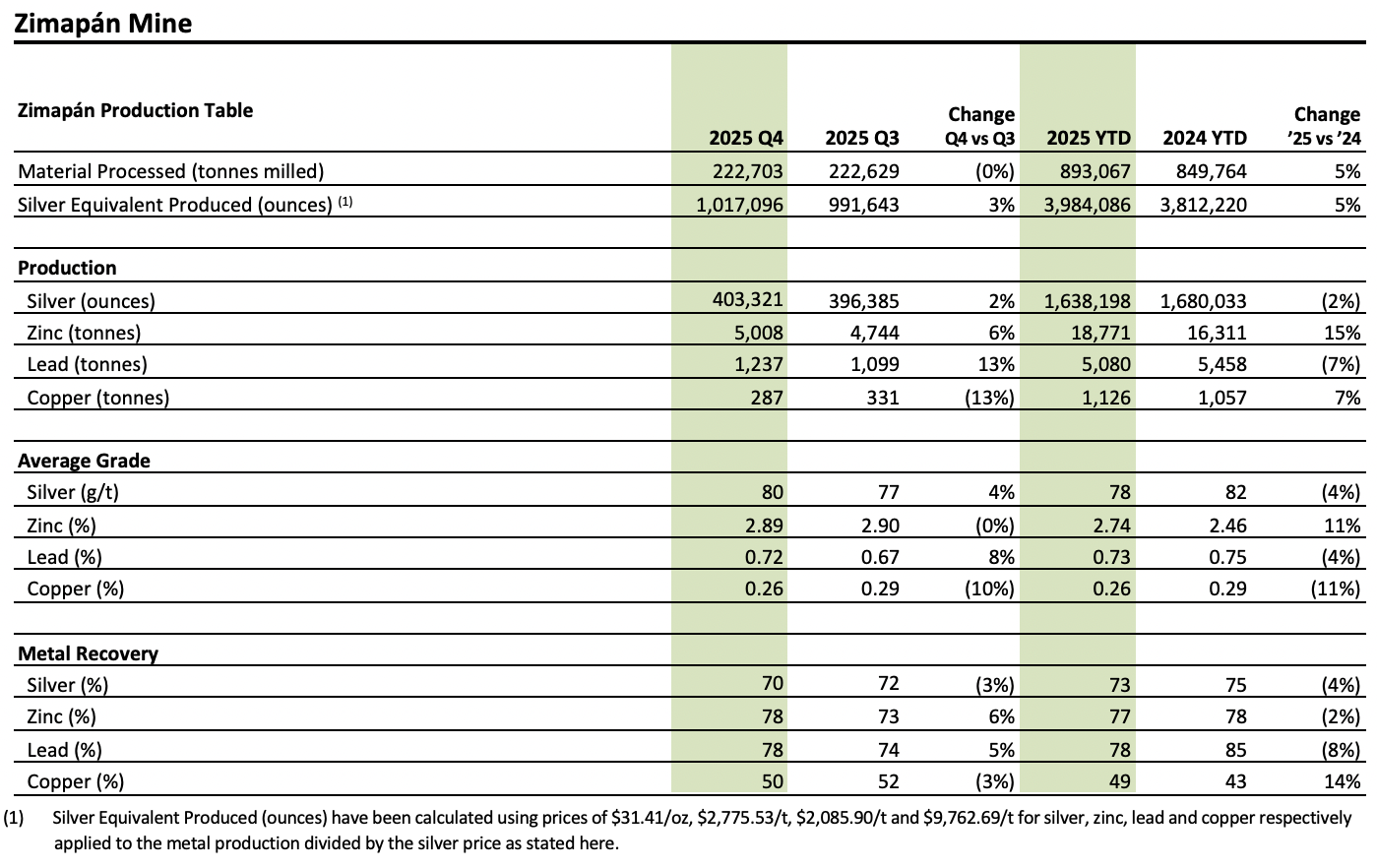

Q4 2025 vs Q3 2025

Zimapán delivered strong results throughput in Q4 2025, with silver equivalent production increasing by 3% from Q3 2025. Zinc production increased by 6%, supported by higher head grades and improved recoveries. Silver production remained stable, reflecting consistent plant performance.

Q4 2025 vs Q4 2024

Year-over-year, Zimapán’s silver equivalent production declined slightly, primarily due to lower silver head grades and recoveries. This was partially offset by higher zinc production, reflecting the execution of the mine plan and improved feed quality from zinc-dominant stopes.

Qualified Person

Garth Kirkham, P.Geo., an independent consultant to the Company, is a qualified person under NI 43-101 and has approved the scientific and technical information contained within this news release.

About Santacruz Silver Mining Ltd.

Santacruz Silver is engaged in the operation, acquisition, exploration, and development of mineral properties across Latin America. In Bolivia, the Company operates the Bolivar, Porco, and Caballo Blanco mining complexes, with Caballo Blanco comprising the Tres Amigos and Colquechaquita mines. The Reserva mine, whose production is provided to the San Lucas ore sourcing and trading business, is also located in Bolivia. Additionally, the Company oversees the Soracaya exploration project. In Mexico, Santacruz operates the Zimapán mine.

‘signed’

Arturo Préstamo Elizondo,

Executive Chairman and CEO

For further information please contact:

Arturo Préstamo

Santacruz Silver Mining Ltd.

Email: info@santacruzsilver.com

Telephone: +52 81 83 785707

Andrés Bedregal

Santacruz Silver Mining Ltd.

Email: info@santacruzsilver.com

Telephone: +591 22444849

Eduardo Torrecillas

Santacruz Silver Mining Ltd.

Email: info@santacruzsilver.com

Telephone: +591 22444849

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE