Royal Fox Reports Additional 2021 Drill Results Including 5.88 g/t over 8.0 Metres, 2.57 g/t over 10.58 Metres and 2.76 g/t over 9.4 Metres

Royal Fox Gold Inc. (TSX-V: FOXG) is pleased to report assay results from the 2021 diamond drilling campaign and results from historically drilled core not previously sampled on the Philibert gold deposit, Chibougamau, Quebec. A first set of results was published on October 19, 2021.

Highlights (Grades uncut; lengths measured along hole, Table 1):

- DDH PB-21-317 returned 5.88 g/t Au over 8.0 metres, including 22.35 g/t over 2.0 metres, from 66.0 metres to 74.0 metres

- DDH PB-21-321 returned 2.76 g/t Au over 9.4 metres from 124.6 metres to 134.0 metres in Obatogamau Fault

- DDH PB-21-318 returned 2.27 g/t Au over 10.6 metres from 503.0 metres to 513.6 metres, including 5.77 g/t Au over 3.0 metres

Simon Marcotte, President and CEO of Royal Fox, commented: “From the 1,147-metre drill program, the results returned to date continue to illustrate the high quality and potential of the Philibert gold deposit. As we aim to deliver a maiden NI 43-101 resource estimate in 2022, we couldn’t be more excited with the untapped potential of the project, including the large historical record of unsampled and sampled drill core, and the immense exploration potential to expend gold mineralization along the Guercheville Deformation Zone.”

The Philibert deposit, located 60 kilometres southwest of Chibougamau, Quebec, is defined by 60,000 metres of historic diamond drilling, including approximately 25,000 metres of unsampled drill core from campaigns completed between 1952 and 2014. At the time, gold prices favoured the development of the Philibert deposit as an underground resource. However, at today’s gold prices the district and Philibert are also amenable to open pit resources, especially when considering the recent discovery of the Nelligan gold deposit located 9 kilometres to the southwest.

2021 DIAMOND DRILLING CAMPAIGN

As part of the due diligence process, and to expand its knowledge of the deposit, Royal Fox drilled five diamond drill holes, totalling 1,147 metres during the property acquisition process in March and April 2021. The campaign focused on four key areas – N1, N7, S1_S2, and S3_S4 associated with 15 northwest-trending mineralized domains related to the Opawica-Guercheville Deformation Zone, a large system of anastomosing shear and fault zones, and host to numerous mines including the former Joe Mann Mine, which has an historical cumulative production of 4,754,377t grading 8.26 g/t Au (Faure, 2012).

Adree DeLazzer, Vice-President Exploration of Royal Fox, commented: “We are extremely pleased with the results released today which continue to demonstrate consistent grade and width from five key areas of the deposit, especially the near surface mineralization intersected within the Obatogamau Fault, again supporting our belief that the east and west sections of the deposit are continuous.”

To date, 395 assays from the 921 samples sent for analysis in June have been received from the labs, representing partial results from all five holes. Table 1 sets out the highlights from the results reported today. The results from the 526 outstanding samples will be released as they are received.

Table 1: Highlights from the assays received to date.

Note: drill results are presented uncapped; lengths represent core lengths.

| Drill Hole | From (m) | To (m) | Interval (m) | Au (g/t) | Domain |

| PB-21-317 | 66.0 | 74.0 | 8.0 | 5.66 | J |

| including | 69.0 | 71.0 | 2.0 | 22.35 | J |

| PB-21-321 | 124.6 | 134.0 | 9.4 | 2.76 | J and 37_1 |

| including | 130.0 | 133.0 | 3.0 | 5.05 | J and 37_1 |

| PB-21-318 | 503.0 | 513.6 | 10.6 | 2.27 | 106 |

| including | 509.0 | 512.0 | 3.0 | 5.77 | 106 |

| 981-14-310 | 110.5 | 112.0 | 1.5 | 3.39 | |

| 981-88-094 | 31.5 | 33.0 | 1.5 | 0.55 | |

| and | 57.0 | 58.0 | 1.0 | 0.55 | |

| 981-88-129 | 267 | 268.5 | 1.5 | 0.93 | 37_3 |

Philibert South Sections L09040W to L10640W

Mineralization along the southern trend of Philibert is modelled as four stacked tabular zones (Ai, J, JSUD and 179) that are sub-parallel to stratigraphy, ranging from 1 to 15 metres in width, moderately dipping to the northeast, and are traced up to 1.5 kilometres along strike, with mineralization open along strike and dip. Some of the best intersections to date are located on the southeastern drilled limit of the Philibert deposit, including PB-21-316 (reported on Press Release dated October 19, 2021) with 1.23 g/t Au over 55.5 metres.

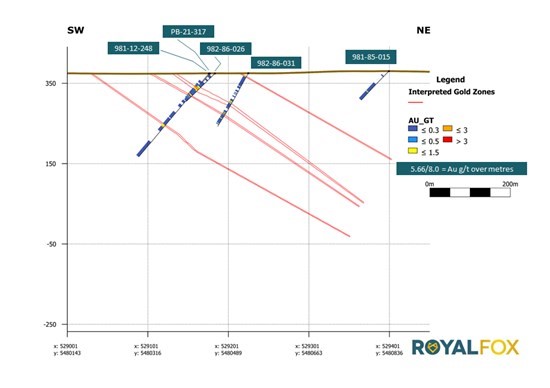

Results reported today include hole PB-21-317 returning 5.66 g/t Au over 8.0 metres from 66.0 metres to 74.0 metres, including 22.35 g/t Au over 2.0 metres from domain J part of the S1_S2 area and over 600 metres to the northwest of hole PB-21-316. The hole was designed to verify grade in 981-12-248 which returned 4.57 g/t Au over 10.5 metres from 67.5 to 78 metres. This is a key area in linking domains from S1_S2 with the S3_S4 areas (Fig. 2). We also believe domain J and JSUD can be expanded northwest linking the east and west sections of the deposit.

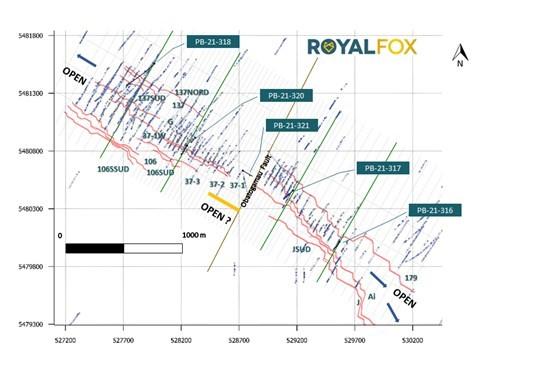

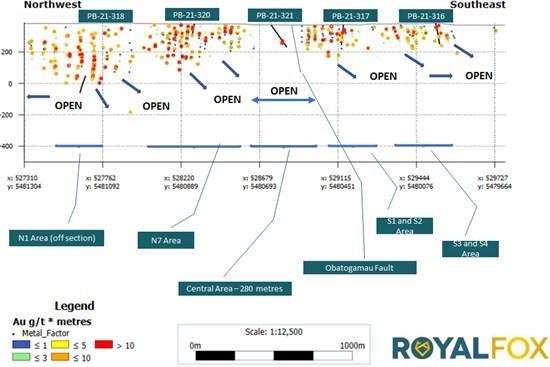

See Figure 1: plan view of the Philibert trend with drilling, Figure 2: long section of the Philibert trend looking northeast, Figure 3: section 10320, and Figure 4: core photos of the mineralized zone in hole PB-21-317.

Figure 1: Philibert trend plan view showing drill hole assay results for gold

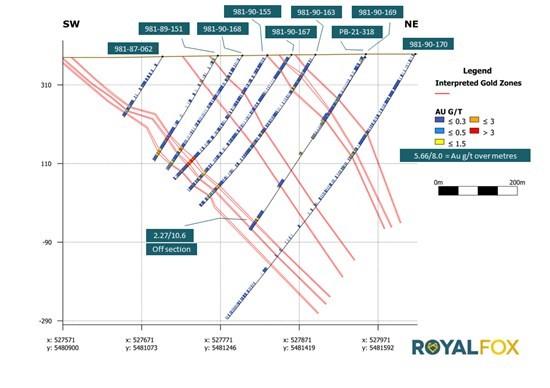

Figure 2: Looking Northeast across the Philibert trend (50 metre cut width). Excludes N1 area intercepts.

Figure 3: Section 10320W looking northwest (40 metre section width)

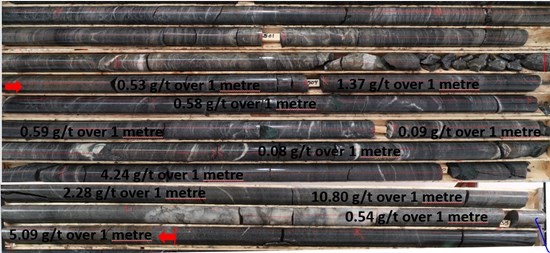

Figure 4: Drill core photos of PB-21-317 from 69.0 to 71.0 metres returning 22.35 g/t Au over 2 metres. Note the strong pyritization associated with the mineralization.

Philibert Central Sections L10640W to L10880W

Drill hole PB-21-321 tested the Obatogamau Fault, which was drilled at a 120-degree azimuth (ESE) to get a perpendicular transect across the fault and to test for potential mineralization and intersected 2.76 g/t Au over 9.4 metres from 124.6 to 134.0 metres, including 5.05 g/t Au over 3.0 metres. The new intersection is interpreted to be the continuation of domain J. Mineralization is associated with intense alteration and brittle/ductile deformation. See Figure 5: core photo of the mineralized zone in PB-21-321 and Figure 1: plan view of the Philibert trend with drilling.

Figure 5: Drill core photos of PB-21-321 from 124.6 metres to 134.0 metres returning 2.76 g/t Au over 9.4 metres. Note the intense silicification and alteration in the top core box.

Philibert Northwest Sections L10880W to L12320W

The most northwestern drill hole, PB-21-318, was drilled from section L11920W to test 8 stacked domains, including 137, 137SUD, 137NORD, G, 37-1W, 106, 106SUD, and 106SSUD. Results reported today include 2.27 g/t Au over 10.6 metres from 503 metres to 513.6 metres, including 5.77 g/t Au over 3.0 metres. The intersection correlates to domains 106 and 106SUD and part of the N1 area. Mineralization is associated with strong shearing, pyrite mineralization and silicification. See Figure 6: for drill core photo of PB-21-318 and Figure 7: for section 11920W.

Figure 6: Drill core photos of PB-21-318 from 503 metres to 513.6 metres returning 2.27 g/t Au over 10.6 metres.

Figure 7: Section 11920W, looking northwest (40 metre section width)

Historical Drill Core Sampling

Today’s results included 111 assays reported from unsampled historical core, with another 282 samples still pending. Results reported today include hole 981-14-310 which returned 3.39 g/t Au over 1.5 metres from 110.5 metres to 112.0 metres. Hole 981-88-129 returned 0.93 g/t over 1.5 metres from 267.0 metres to 268.5 metres and is at the edge of domain 37_3 which will be re-interpreted. Sampling of unsampled historic drill core is planned to commence again in December 2021 and be ongoing into 2022.

Sampling and Laboratory

True widths of the intercepts reported in this press release have yet to be determined but are estimated to be 60 to 70% of reported core lengths (except for hole PB-21-321). All NQ-size split core assays reported for 2021 were obtained by fire assay with atomic absorption finish and samples returning values over 5 ppm Au are re-analyzed, utilizing standard Fire Assay-Gravimetric methods. Samples were shipped to AGAT Laboratories with sample preparation done in Val d’Or, QC and sample analysis in Mississauga, ON. The quality assurance and quality control protocol include insertion of blank or standard every 10 samples on average, in addition to the regular insertion of blank, duplicate, and standard samples inserted by AGAT Laboratories during the analytical process.

The technical content of this release has been reviewed and approved by Adree DeLazzer, P. Geo., a Qualified Person as defined by the National Instrument 43-101.

About Royal Fox Gold Inc.

Royal Fox Gold Inc. is a mineral exploration company focused on the development of the Philibert Project near Chibougamau, Québec. The Philibert Project comprises 110 mineral titles having a total approximate area of 5,393 hectares of highly prospective ground, 9km from IAMGOLD’s Nelligan Gold project which was awarded the “Discovery of the Year” by the Quebec Mineral Exploration Association (AEMQ) in 2019.

To date, more than $10M (historical value) have been spent on the Philibert Project, with more than 60,000 metres of drilling completed. The Company is focused on de-risking the asset and releasing a maiden NI 43-101 resource estimate which will incorporate results from both brownfield and greenfield exploration, combined with extensive historical data. The Philibert Project is owned by SOQUEM. Royal Fox is currently undergoing an ownership option process, details of which can be found in the corporate presentation available on the Company’s website.

About SOQUEM

SOQUEM, a subsidiary of Investissement Québec, is dedicated to promoting the exploration, discovery, and development of mining properties in Quebec. SOQUEM also contributes to maintaining strong local economies. Proud partner and ambassador for the development of Quebec’s mineral wealth, SOQUEM relies on innovation, research, and strategic minerals to be well-positioned for the future.

MORE or "UNCATEGORIZED"

SONORO GOLD ANNOUNCES CLOSING OF OVERSUBSCRIBED $4.9M PRIVATE PLACEMENT

Sonoro Gold Corp. (TSX-V: SGO) (OTCQB: SMOFF) (FRA: 23SP) is plea... READ MORE

Northern Shield Completes Non-Brokered Private Placement of Subscription Receipts

Northern Shield Resources Inc. (TSX-V: NRN) is pleased to announ... READ MORE

PAN GLOBAL ANNOUNCES MAIDEN MINERAL RESOURCE ESTIMATES FOR THE ESCACENA PROJECT IN THE IBERIAN PYRITE BELT, SPAIN

Pan Global Resources Inc. (TSX-V: PGZ) (OTCQB: PGZFF) (FRA: 2EU) ... READ MORE

Opus One Gold Corporation Announces Closing of a Private Placement of Flow-Through Shares and Units

Opus One Gold Corporation (TSX-V:OOR), is pleased to announce the... READ MORE

Collective Mining Intersects 467.35 Metres at 1.63 g/t AuEq from 170.10 Metres at Apollo and Expands the System to the Southeast

Five diamond drill holes targeting various undrilled segments of ... READ MORE