Rick Mills – “Update – SQM’s quest for lithium dominance”

Chile’s Sociedad Quimica y Minera (SQM) is the second largest lithium producer in the world, just behind US-based Albemarle, which takes top spot with lithium mines in Chile (La Negra and Salar de Atacama), Australia (49% stake in Talison Lithium’s Greenbushes hard rock mine), the shuttered Kings Mountain Mine in North Carolina, and the Silver Peak Mine in Nevada, the only operating lithium mine in the United States, currently.

Lately SQM has been making noises about ramping up production and overtaking Albemarle to become the top dog in the lithium space, predicting lower prices, and claiming that not enough investment is going into lithium production – crucial for making electric batteries for electric vehicles and energy storage.

It’s all a ploy to unseat its main competitor, Albemarle, and to discourage others from entering the industry, but it could backfire, big time. That’s because picking a fight with Albemarle is one that it is likely to lose. Why? Because unlike Albemarle, which has its fingers in three “pies” around the world, SQM really has only one pie: Chile. The company produces lithium carbonate and lithium hydroxide from its Salar del Carmen plant (48,000 tonnes capacity Li2CO3, 6,000 tonnes LiOH).

Recently it sold its 50% stake in the Cauchari-Olaroz project in Argentina to Ganfeng Lithium of China, leaving just one project outside of Chile, the Early Grey Lithium Project (Mt. Holland) in Australia, in which it splits ownership with Kidman Resources. The mine has a resource but is not expected to start production until 2021. It has an offtake agreement with Tesla.

Chile is a great jurisdiction for mining lithium (Read our Lithium Chile, a perfect storm to find out more) but being so dependent on Chile puts SQM in a precarious position as it “goes to war” with Albemarle. The issue of water rights is key (see below). The best way for Albemarle to stay on top is to start looking around the Clayton Valley where it has an excellent opportunity to partner with one or more lithium explorers who are looking for lithium around the Silver Peak Mine, which is depleting. Clayton Valley is producing at around 200 milligrams per liter lithium whereas lithium brines in Chile are upwards of 1,000 mg/l and Argentina averages 600 mg/l.

The Nevada project with the best chance of becoming a mine, in our opinion, is the Clayton Valley Lithium Project by Cypress Development Corp (TSX-V:CYP). The company in May put out a monstrous resource of 1.3 billion tonnes lithium containing 6.4 million tonnes lithium carbonate equivalent (LCE) in the indicated and inferred categories. The potential mine is so large, it could influence the world price of lithium. The deposit is on par with some of the biggest lithium mines in the world (around the same as Orocobre’s Salar de Oroz in Argentina) with exceptional grades of 889 parts per million lithium.

What better way for Albemarle to stay on top than to partner with Cypress to significantly up the grades at its processing plant from CYP’s high-grade clay lithium deposit, or to buy them out? The company is working on a preliminary economic assessment as we speak, including economics, metallurgy and a pilot plant. We think it’s likely to surprise the market and awaken the lithium bears out of their slumber. We don’t know what’s in the PEA, but what we can say is that some big changes are underway in the lithium market, and they all point to blue sky ahead for both Albemarle and Cypress – neighbours in the Clayton Valley of Nevada.

The doubters: Falling prices and an onslaught of supply

Before we take a look at the blue sky, let’s examine the negative scenarios for the lithium market that have been floated by the big banks, some analysts and ironically, SQM, which has all but declared the lithium boom dead.

In February investment bank Morgan Stanley was first out of the gate with a damning report on lithium; its research team concluded that an avalanche of lithium was in the works and would put the roughly 200,000 tonnes per year lithium market into surplus. The glut would mean a fall to around US$13,000 a ton in 2018, before halving to $7,000 by 2021. The bank put out a base-case supply-demand and price forecast leading up to 2025, indicating that lithium prices in China and Chile would trend below the market-equilibrium price for the next seven years. Curiously though, the report skewed heavily towards supply with little to no mention of demand.

The next lithium bear to roar was commodities researcher Wood Mackenzie, which forecast a rout in lithium and cobalt – both key ingredients in EV batteries. While Woodmac at least didn’t lowball demand growth – expecting it to grow from 233 kilo-tonnes lithium carbonate equivalent (LCE) in 2017 to 330,000t in 2020 and 405,000t in 2022 – it too forecast an imminent tsunami of lithium supply.

What the bears seem to have in common is the belief that a rush of new lithium supply will soon hit the market, but what the analysts don’t realize, or maybe for their own reasons neglect to mention, is that a lot of these mines will fail to deliver.

Many junior exploration companies chasing lithium projects are not cognizant of the economic and technical challenges – no brine mining projects and even fewer hard rock projects have been put into production for the last two decades and when done so it’s been by the major lithium producers in just four countries – Chile, Argentina, China and Australia.

As noted by Bloomberg recently, lithium also has a funding problem, with a lot of banks unwilling to touch it. While this is frustrating for mine developers, it’s good for prices, since a financing obstacle puts a lid on new supply. Here’s Bloomberg:

Banks are wary, citing everything from the industry’s poor track record on delivering earlier projects to a lack of insight into a small, opaque market. Without more investment, supplies of the commodity could remain tight, sustaining a boom that already has seen prices triple since 2015.

SQM joins the bears

SQM must know this, plus the technical challenges in bringing on new lithium mines, which typically take two years to build and five years to repay the loan.

But that didn’t stop SQM from piling on with the lithium bears. In an Aug. 22 article, MINING.com reported that SQM expects prices to be lower in the second half of 2018 due to new supply from Australia and its own increase in sales – even though global lithium demand is forecast to grow by over 20% this year.

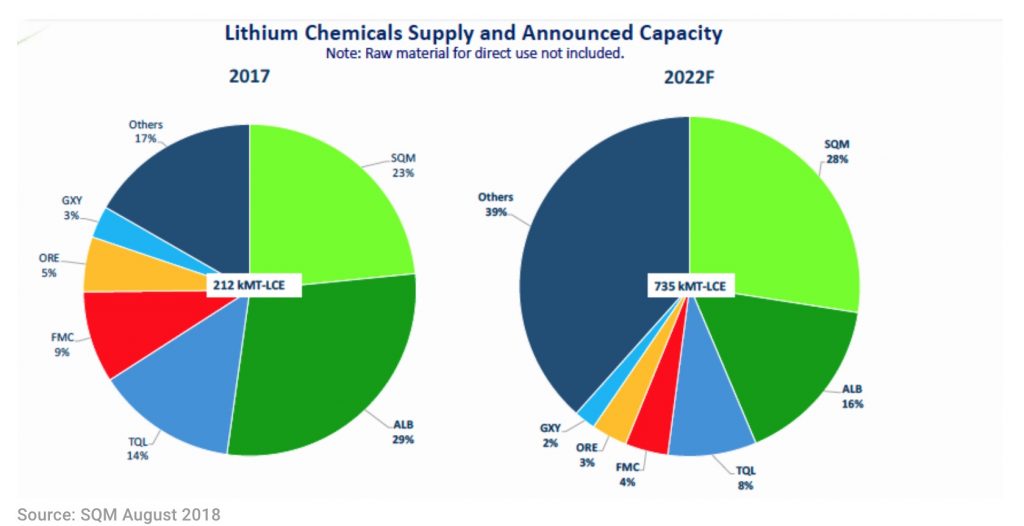

SQM has been ramping up production from its Salar del Carmen and expects to reach 120,000 tonnes a year by the end of 2019, and 180,000t by 2021, from the current 48,000t. SQM is so confident in its production increase it is boldly predicting that by 2022, it will overtake Albemarle as the world’s top lithium miner, boosting its production capacity to 28% of the world’s total versus Albemarle’s 16%.

Earlier this year SQM complained that the industry isn’t attracting enough investment, saying that lithium miners needs $10-12 billion over the next decade to meet the surging demand for electric vehicle batteries, expected to grow by 600,000 to 800,000 tonnes of LCE – three to four times the current lithium market.

However SQM underplayed that range, forecasting the demand for lithium growing at a compound rate of between just 13 and 17% over the next 10 years – putting it firmly in the bear camp. It also predicts the market will be oversupplied by 2022, with a whopping 735,000t of LCE being produced, against demand of just 475,000t.

Chile’s water problem

While SQM is dissing the lithium industry by predicting lower prices and oversupply, a pall hangs over its expansion plans: access to water. For decades the Chilean government granted water rights to lithium companies like SQM and Albemarle in the Salar de Atacama – the driest desert in the world – without considering the long-term consequences. Many of the aquifers have been over-exploited.

The government has finally got smart, and is preparing to put new restrictions on water use in the salar. Albemarle, SQM, Antofagasta and BHP are among the companies that will be affected by a ban on new permits to extract water from the southern portion of the salar’s watershed, which supplies BHP’s Escondida, the world’s largest copper mine, and Antofagasta’s Zaldivar Mine. Indigenous populations are also vying for access to water in the parched region.

Reuters reports the problem is compounded by the fact that the government doesn’t know how much water lies beneath the cracked soil.

Then these two amazing statements:

SQM and Albemarle say they have all the water rights they need and do not expect new restrictions to impact their current or future production of lithium.

SQM and Albemarle both recently signed deals with the government to sharply increase their quotas for extracting lithium from the Salar, although they say they will not use any more water than they have already been granted.

So, SQM says it plans to raise lithium production in the next three years from 48,000 tonnes a year to 180,000 tonnes, a 3.75X increase, but is not planning on using any more water? That is rather hard to believe. Will the government dig in its heels and say no to more water extraction, in spite of the huge windfall it would expect to receive from much higher lithium exports? Or will it cave in to the mining companies? This is a question that must be considered when mining lithium in Chile.

China and falling prices

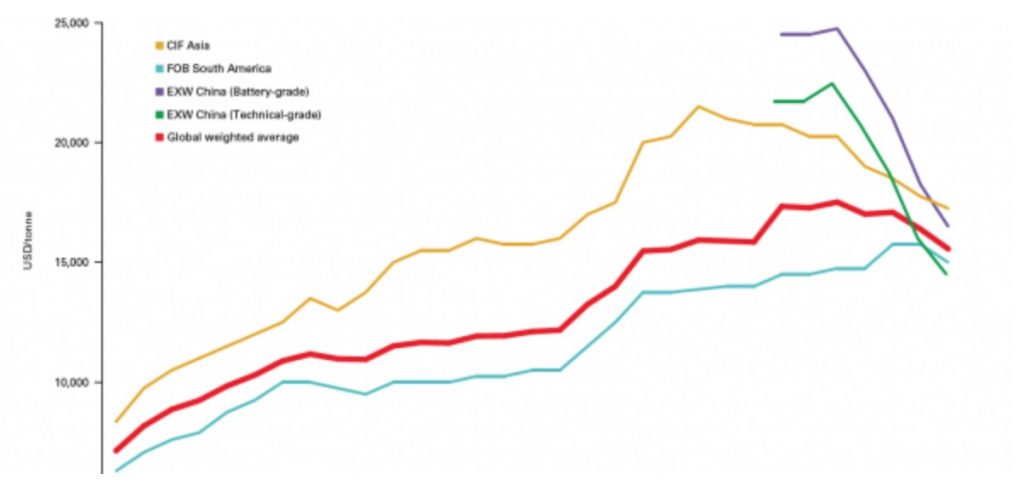

Battery-grade lithium prices have risen steadily since 2015 and reached a peak in the first quarter of 2018 at $24,750 a tonne. Since then, a reduction of subsidies to electrical vehicles in China, the world’s largest market for EVs, has seen prices slump, due to less vehicles being manufactured.

The price of battery-grade lithium carbonate in China slipped 9% in July to $16,500 per tonne.

However according to Benchmark Mineral Intelligence, a trusted source of data for the industry, the fall in lithium prices is misunderstood. While Chinese prices for Li2CO3 have fallen, this is not the case for the rest of the world (ROW) or lithium hydroxide. (see graph below, where the red line, the global weighted average price, and the South American price, show much gentler declines than Chinese prices).

The contract nature of ROW lithium prices “will protect them from falling to China levels in 2018,” Benchmark explains, adding that the lithium market outside China remains relatively tight.

The research firm also notes that despite a downturn in Chinese NEV production in the first half, it was still up 94% compared to H1 2017, and the second half of this year is also expected to break a record.

Battery demand continues to soar

Indeed the demand side of the lithium market is still booming, despite the price decline for lithium carbonate over the past few months.

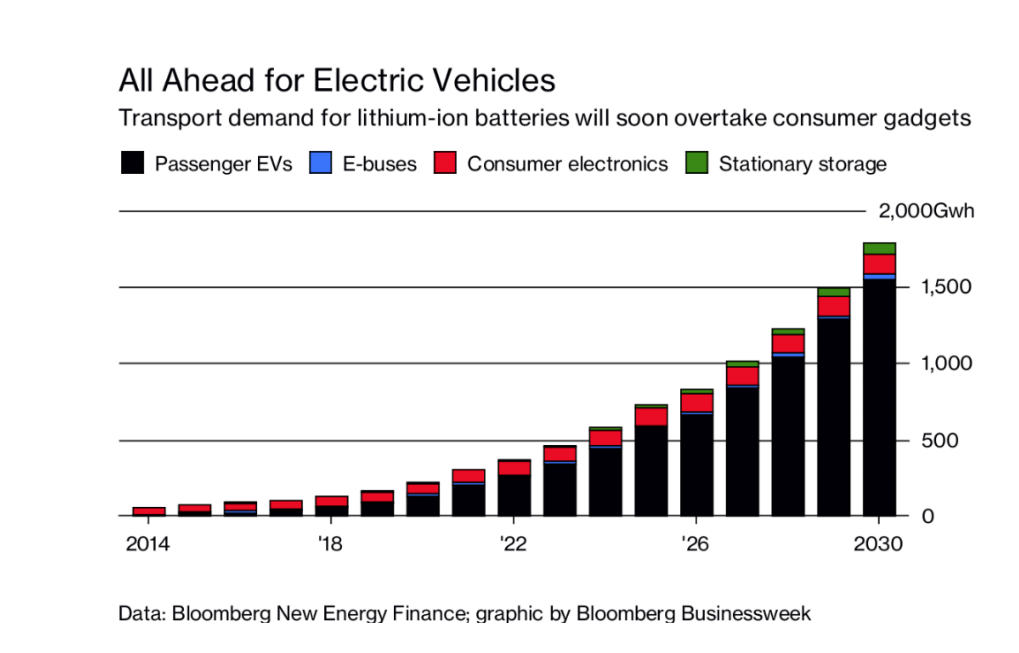

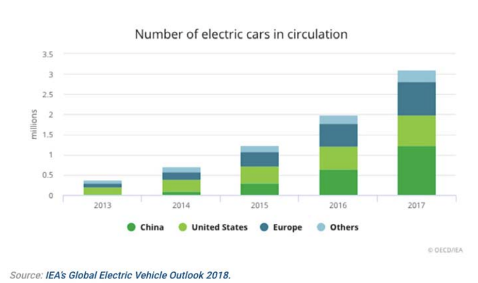

China and India are both going to 100% electric vehicles. Every major car manufacturer has electric models. Volvo has even promised to phase out internal combustion engines (ICEs) from 2019. France has vowed to end the sale of gasoline and diesel vehicles by 2040; the UK quickly followed suit. Almost a third of cars sold in Norway in 2016 were electric and Germany could outpace its neighbors as Volkswagen aims to become a leader in both EVs and automated vehicles. EVs surpassed 2 million units in 2016 and Bloomberg New Energy Finance predicts they will make up an astounding 54% of new car sales by 2040. In 2016, Chinese carmakers sold 28.03 million cars. If China follows through on its promise to go 100% electric that’s a minimum 28.03 million lithium-ion battery packs for EVs per year. Last year China sold 777,000 units of battery-powered, plug-in hybrids, and fuel-cell vehicles, and could surpass a million this year according to estimates from the China Association of Automobile Manufacturers.

Add in the UK’s 2.7 million car sales in 2016 and France’s 2 million car sales in 2016. That’s 32.73 million electric vehicles all requiring lithium-ion battery packs, without counting electric buses (a big deal in China, and going to be in India as well) or annual growth rates in auto sales. One Tesla car battery uses 45 kg or 100 pounds of lithium carbonate. The IEA expects the number of EVs to more than triple by the end of the decade, from 3.7 million last year to 13 million in 2020. According to the organization the biggest adopters will be Europe and China, due to credits and subsidies provided by the Chinese government, and tighter fuel emissions standards plus higher fuel taxes in Europe.

An Aug. 21 report from Bloomberg states that a new record for EVs sold globally, was cracked in the second quarter, zooming past 400,000 a year earlier to 411,000. At 225,000 units, China outsold the rest of the world combined.

One of the most telling signs of the tectonic shift from gas-powered vehicles to EVs was the $40-billion-euro deal that Volkswagen inked with major EV battery suppliers.

Japan’s SoftBank invested $100 million into Nemaska Lithium’s mine in Quebec. Nemaska also has an offtake agreement with Northvolt, which is aiming to have Europe’s largest battery factory.

The most recent deal was announced on Monday. POSCO will acquire lithium mining rights in Argentina from Australia’s Galaxy Resources, for $280 million. The South Korean steelmaker plans to secure lithium for its battery-making arm, POSCO ES Materials, and build a processing plant in Argentina.

These multi-million and multi-billion-dollar deals show that the world’s largest car and battery companies – and big business, governments and consumers get it, that they are all serious about combating pollution and climate change; the electrification of our transportation system is underway. And it all comes down to security of lithium supply because it is all about the batteries. As automakers cut deals for large-scale battery production they also see massive potential in the residential/commercial energy storage business through the lithium battery packs they’re already building. But without batteries, ie. lithium, they’re dead in the water because without battery materials, their production lines grind to a halt.

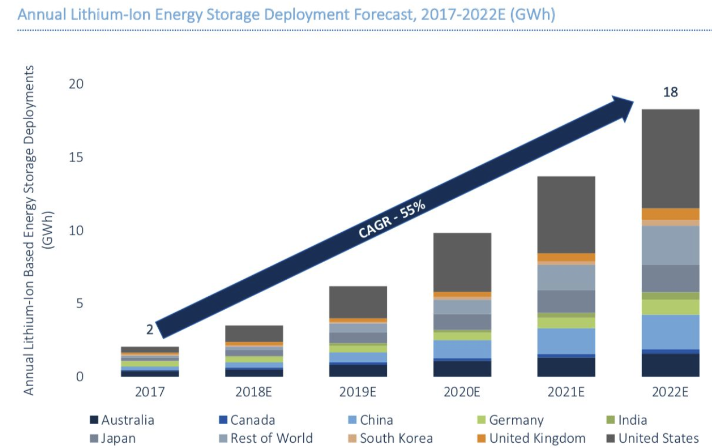

On lithium-ion battery storage, a new report from GTM Research states that global Li battery deployments will grow by 55% annually. That’s quite a CAGR, although it’s easy to get big growth numbers with so small a market: just 2 gigawatt hours of storage in 2017 compared to 112 GWh of batteries demanded by EVs the same year.

The demand for EV batteries has incentivized a massive build-out in production capacity, which reduces the cost of batteries for grid applications.

Once electric cars have had a few more years on the road, their used batteries will become cheap, secondhand stationary storage devices.

All told, authors Mitalee Gupta and Ravi Manghani expect battery pack prices to fall from $219/kilowatt-hour in 2017 to $39/kilowatt-hour in 2040, an 82 percent reduction.

Already we are seeing this technology in use. In November 2017 the world’s largest lithium-ion battery, a 100-megawatt monster made by Tesla, was installed next to a windfarm in South Australia.

Cypress’ PEA

Vancouver-based Cypress has so far flown under the radar of investors, trading at just 0.39 cents a share as of Wednesday’s close. The stock price is nowhere near reflective of what Cypress has in the ground, providing junior mining investors with a spectacular entry point. (Read Cypress has world class Clayton Valley Nevada lithium resource).

According to Roskill’s 15th edition market outlook report, demand from companies that produce batteries to power electric cars, laptops, cell phones etc is expected to increase 650% by 2027, with overall lithium demand forecast to rise more than threefold over that period. Electric vehicle lithium-ion battery pack manufacturers’ share of the overall market for lithium-ion batteries will grow from 46% in 2017 to 83% by 2027.

It is in this context that a new US lithium mine is being proposed next to Albemarle’s Clayton Valley Nevada, Silver Peak Mine.

CYPRESS DEVELOPMENT ANNOUNCES POSITIVE PRELIMINARY ECONOMIC ASSESSMENT (PEA) FOR CLAYTON VALLEY LITHIUM PROJECT, NEVADA

Cypress Development Corp. has released positive results from a preliminary economic assessment (PEA) of the company’s Clayton Valley lithium project in Nevada. The PEA was prepared by Global Resource Engineering (GRE) of Denver, Colorado, an independent engineering services firm with extensive experience in mining and mineral processing. All dollar values are in US dollars.

Highlights:

- Net present value of $1.45 billion at 8% discount rate and 32.7% internal rate of return on after-tax cash flow.

• Lithium carbonate price of $13,000 per tonne based on Benchmark Research market study.

• Average annual production rate of 24,042 tonnes of lithium carbonate over 40-year life.

• Capital cost estimate of $482 million, pre-production and operating cost estimate averaging $3,983 per tonne of lithium carbonate.

• Updated Resources from May 1, 2018 estimate:

Indicated Resource of 831 million tonnes at 867 ppm Li, or 3.835 million tonnes lithium carbonate equivalent (LCE).

Inferred Resource of 1.12 billion tonnes at 860 ppm Li, or 5.126 million tonnes LCE.

Cypress CEO Dr. Bill Willoughby commented “This is another important milestone for the project and Cypress. The PEA outlines the steps necessary for a mine and mill at Clayton Valley, including a sulfuric acid plant which is the main driver in the costs. GRE uses a conventional approach in processing and developed a production schedule that utilizes only a small fraction of the total resources on the property. The end result is a project that has strong economics and the potential to generate significant cash flow.”

The timing is excellent. Silver Peak failed to increase production between 2012 and 2016 and its lithium grades are rumored to be dropping.

Cypress Development Corp has discovered a different type of deposit than the usual brine or hard rock lithium deposits, which must either be mined using drill and blast methods, or pumped into shallow ponds and allowed to evaporate, after which the concentrated lithium carbonate is extracted.

The estimate is based on drill results from 23 holes completed by Cypress in 2017 and 2018. The deposit remains open at depth, with 21 of 23 holes ending in lithium mineralization, meaning the drills have plenty of room to run in expanding and growing the resource.

Of course, the size of a lithium deposit is of limited value if the metallurgy doesn’t work. In an earlier article we discussed the difficulties of processing lithium, but in Cypress’ case the metallurgy looks relatively simple. The company has shown that lithium can be extracted from the clay using a flow sheet whereby recoveries of +80% can be achieved in short leach times (4 to 8 hours) using conventional dilute sulfuric acid and leaching. The amount of sulfuric acid and reagents needed is relatively low, and being able to leach the lithium with acid avoids costly calcine and regrind of material during processing, which would be the case if the deposit was hectorite clay.

Cypress’ lithium-rich clays aren’t as high-grade as some hard rock lithium mines, but the mining and processing is simpler and less expensive.

The clay itself is volcanic-derived ash that fell into a lake bed and metamorphosed into clay. One theory about the brine that Albemarle has been pumping over the years is that it’s derived from volcanic ash, which is the source of the lithium brine. Cypress believes that lithium-bearing brine aquifers could be located below the clay. The company has identified rare “mudstones” found at the eastern flank of the Clayton Valley; nothing similar has been found at other properties in the valley.

The lithium would be processed from a pregnant leach solution, similar to processing copper oxide ore. Iron, silica, calcium and magnesium are precipitated out, leaving a solution containing lithium, potassium and sodium. The latter two minerals can be sold as by-products. The process is different from a lithium brine operation one might find in Chile or Argentina, because it involves a conventional mill, versus evaporation ponds found for example in the Salar de Atacama, Chile. That also saves time. Lithium brines can take up to take up to two years to evaporate and concentrate the lithium.

Cypress’ cost of production is $4,000 a tonne of lithium carbonate equivalent. Set against an average global 2017 price of $13,900/t for lithium carbonate, the economics are already looking great.

Cypress has identified about 200 million tonnes of ore, estimated to contain a million tonnes of LCE, it would use for its initial open pit mine. The company is targeting 20,000 tonnes of lithium carbonate (LCE) production a year (1,000,000/20,000 = 50 years of mining), which is bang on 10% of the current global 200,000 tonnes per year LCE production. Ten percent of world production is considered to be enough to affect the lithium price, so if Cypress goes mining and starts producing at the numbers it hopes to, the mine will be a price setter and will influence the entire lithium market.

Conclusion

There currently exists no mine to battery supply chain in North America – not in the United States nor Canada. At Albemarle’s Silver Peak Mine, the lithium, produced at around 3,500 tonnes LCE a year, is shipped to Kings Mountain in North Carolina, which produces lithium hydroxide needed for lithium-ion batteries. This material is then loaded on ships and sent to Asian battery manufacturers, which sell the batteries to auto-makers. The irony is that Tesla’s Gigafactory in Nevada is located just a short distance away from Cypress’ Nevada deposit.

“As global demand for lithium hits overdrive, Albemarle Corp is investing millions of dollars to engineer specialized types of the light metal for electric car batteries, part of a strategy to remain the niche market’s top producer.

The pivot comes as battery makers such as Panasonic Corp , the sole battery supplier to Tesla Inc, increasingly demand more purified versions of lithium that can help boost electricity storage and increase a battery’s charge, shaping Albemarle’s strategy, according to sources and documents reviewed by Reuters and confirmed by the company.

Roughly 500,000 electric vehicles were sold globally in 2016, a figure that is expected to jump sevenfold by 2022, according to estimates from the U.S. Energy Information Administration.

Albemarle’s strategy, which includes developing a battery research center near its North Carolina headquarters, is aimed at setting it apart from its major competitors, including Chile’s SQM and China’s Tianqi Lithium Corp.”

No longer can we rely on the good graces of other countries, namely Australia, China, Chile and Argentina, where 90% of the lithium is produced. We need to develop an energy metals industry in North America – from mine to battery.

The US has promised 25% tariffs on about $50 billion worth of Chinese products, including semiconductors and lithium batteries. In the midst of this trade instability, imagine a North American mine that can supply lithium to American car companies, making electric vehicles, in the US, free of tariffs, with good access to water (unlike Chile) and infrastructure?

And with no foreign off-take agreements in place – the only North American lithium miner that can say that.

We see the upcoming PEA as a catalyst that could convince Albemarle that one way to stop SQM knocking it off its pedestal is to lock up North American lithium supply by partnering with Cypress or purchasing the lithium deposit outright. Especially with a whopper of a project right next to its Silver Peak Mine with the capability to produce at 20,000 to 60,000 tonnes a year.

All the shenanigans with Elon Musk and taking Tesla private for a price completely unsupported by the loss-making company has us believing that we need a serious player to come in and build a North American EV battery industry. Albemarle is in the driver’s seat to do that, with Cypress’ help. Will it make them an offer? At aheadoftheherd.com we believe Albemarle will certainly be looking at the Cypress PEA closely and will no doubt do their own due diligence before making a move.

Richard (Rick) Mills

Just read, or participate in if you wish, our free Investors forums.

Ahead of the Herd is now on Twitter.

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard owns shares of Cypress Development Corp. (TSX-V:CYP).

MORE or "UNCATEGORIZED"

Red Pine Provides Further Update On Assay Results for Wawa Gold Project

Red Pine Exploration Inc. (TSX-V: RPX) (OTCQB: RDEXF) further to... READ MORE

Getty Copper Intersects High-grade Copper Mineralization in the First Drill Holes, Glossie Occurrence, Highland Valley Area, Southern B.C.

Getty Copper Inc. is pleased to report drill results from the fir... READ MORE

Guanajuato Silver Announces Closing of C$11.35 Million Brokered Financing

Guanajuato Silver Company Ltd. (TSX-V:GSVR) is pleased to announc... READ MORE

Hot Chili Closes A$24.9 Million Private Placement and Announces Full Underwriting of A$5 Million Share Purchase Plan

Positioning for Near-Term, Meaningful, Copper Production H... READ MORE

Barksdale Announces San Javier Preliminary Economic Assessment

Barksdale Resources Corp. (TSX-V: BRO) (OTCQX: BRKCF) is pleased ... READ MORE