Rick Mills – Under the Spotlight: Greg Ferron, CEO PTX Metals

Rick Mills, Editor/ Publisher, Ahead of the Herd:

Please give us details on each of your projects, W2 in the Ring of Fire and Shining Tree in the Timmins Gold Camp.

Greg Ferron, CEO, PTX Metals:

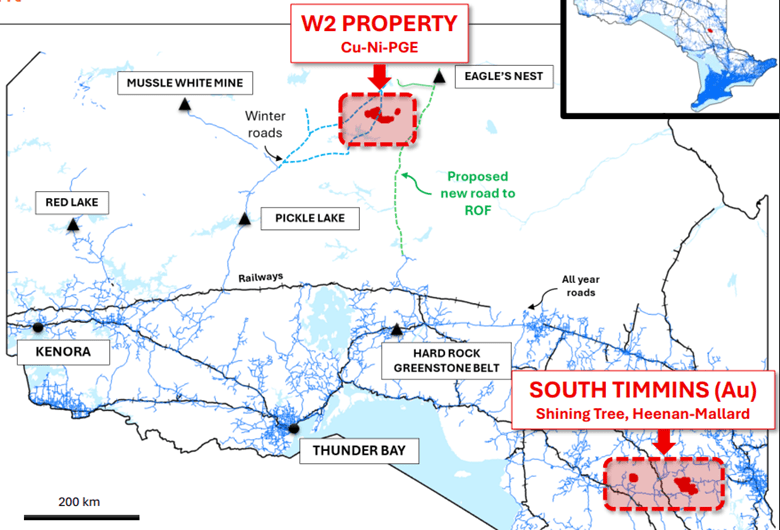

W2 is a Platinum Group Element, a PGE-nickel-copper-cobalt project and Shining Tree is gold. Both properties are quite significant in size, around 250 square kilometers each.

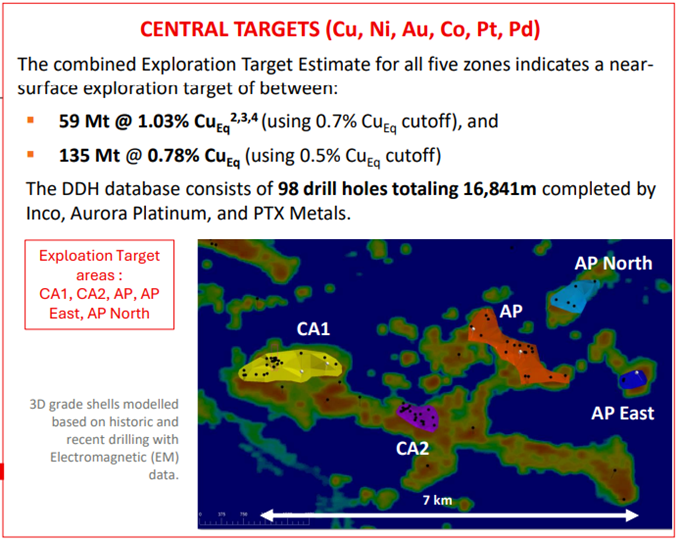

On W2’s central part there are two resource areas, the AP Zone we named after Aurora Platinum, around 2005 they did a significant amount of work drilling off that area of the property, 100 holes were drilled, and then they got bought by Quadra FNX.

The second resource area is the CA Zone which has two areas, the CA1 and CA2. The CA Zone was discovered by Inco in the late ‘70s early ‘80s, they were there for about three years.

And we’ve done an exploration target in lieu of a resource estimate. We hired a very experienced individual who does a lot of work for P&E Engineering and BAW. He’s done hundreds of resources, and I worked with him at Treasury Metals. The reason it’s not a mineral resource is because we don’t have all the drill core.

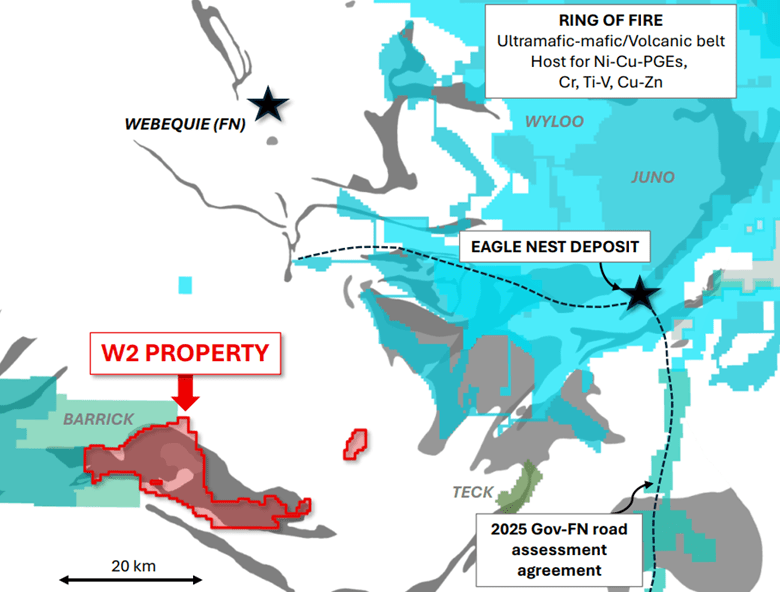

So, that’s our W2 asset, we own 100% of it, most of the mineralization is at surface and it’s in the Ring of Fire.

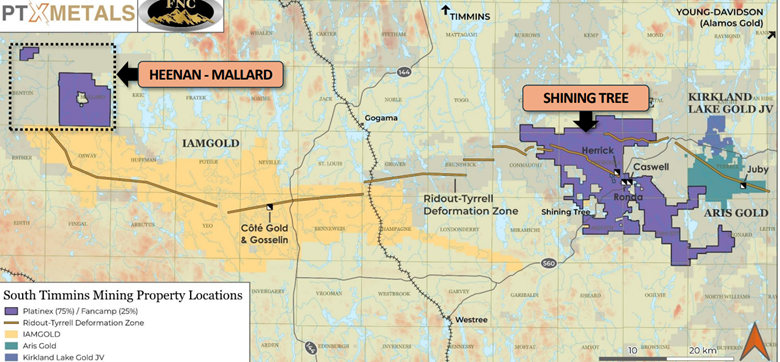

We own 75% of the Shining Tree project and it’s a gold portfolio down by Iamgold’s Cote gold mine. There are three major structures that run through the Abitibi Gold Belt and we’re on the Rideout Deformation Zone. This Zone hosts the Borden mine owned by Newmont and it also hosts the Cote deposit, which is a 20-million-ounce resource that is now in production and owned by Iamgold.

We’re further east in the Shining Tree camp and there you’ve got the Jube deposit, which is owned by Aris, and the Kirkland Lake Joint Venture north and contiguous to the Aris property.

We also own the Heenan-Mallard project which is east of Shining Tree and north of Cote, we had a discovery there this year and last year and it looks very similar to the Cote in terms of mineralization and grade.

We’ve got the much larger land position called Shining Tree. There’s a small resource and there’s some past gold production on that property and recently we closed the transaction with Alamos Gold where we bought the historical Ronda mine.

On Shining Tree we’re doing a combination of exploration work in that central area around the resource areas, around the past producing Herrick mine and another historical producer the Ronda mine where we found a high-grade structure last year and it graded 9g/t over 16 meters. And we’re also looking at doing all the regional work around that deformation zone, looking to see if we could find other projects.

That’s the two main assets in the company, W2 and Shining Tree.

RM: I’m impressed with the amount of land you own in quality camps in what are two very hot resource sectors, it seems that you have an ability to acquire quality projects in great neighborhoods.

GF: That’s the strategy of the company, be in a good jurisdiction like Ontario Canada, focus on prolific camps, we’ve got good technical advisors, and we really want to be around major mining companies.

I’ve been buying these assets on very attractive terms over the last three-four years and at the same time getting as much exploration done as we can to create shareholder value. Our goal is to, as we get into a better market, monetize our assets through possibly a spin-out or in the case of W2 a potential sale or joint venture.

RM: In the case of W2 it’s in a very underexplored camp, and it’s potentially one of the more interesting copper-nickel-PGE camps in the world, the Ring of Fire. And it’s underexplored mostly because of a lack access, but that could change very quickly. What is currently going on up there?

GF: Last year 16 First Nations received power from the grid in Ontario and we’re being told all the First Nations in the Ring of Fire will have power by the end of this year.

That’s very positive in that these communities are going to be getting off diesel power, and of course these same communities want to see roads in, because they’re going to benefit from lower costs, better access to housing, energy, schools, health care, and at the same time there’s obviously an interest in developing the mines because of the economic benefits.

RM: The mine closest to PTX’s W2 project is Fortescue Metals Eagle Nest mine. They have a base metal company called Wyloo Metals that acquired that for about $600 million, and its mineralization is very similar to your W2 mineralization.

GF: It’s important to note that it’s an ultramafic system and that’s why you get the nickel sulfides, as well as platinum, palladium, and gold and cobalt.

The closest similarity to us is obviously the Eagle’s Nest, which is about 50-60 km to the east, another comparison would be Suhanko in Finland and there’s another similar project in Western Australia called the Gonneville a PGE-nickel-copper-cobalt project owned by Chalice Mining.

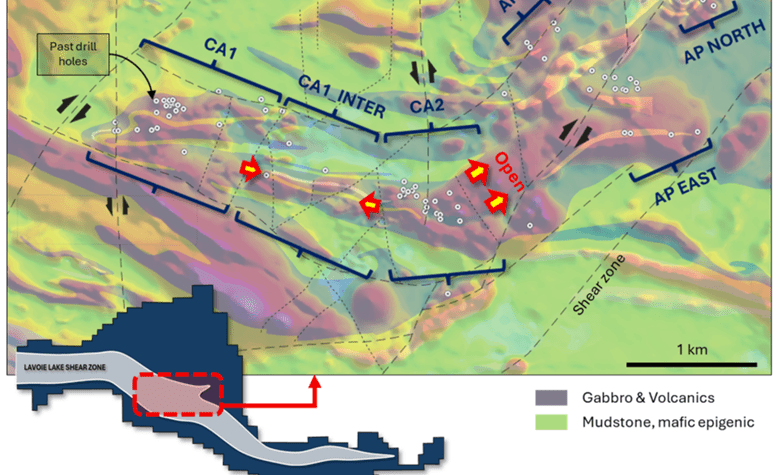

These ultramafic systems are very common projects. What we’re looking at is a gabbro-hosted system that hosts the copper, and we’re focused on that central area which is the gabbro-hosted mineralization. It’s right at surface, and it’s got two potential open pits, CA1 and the AP.

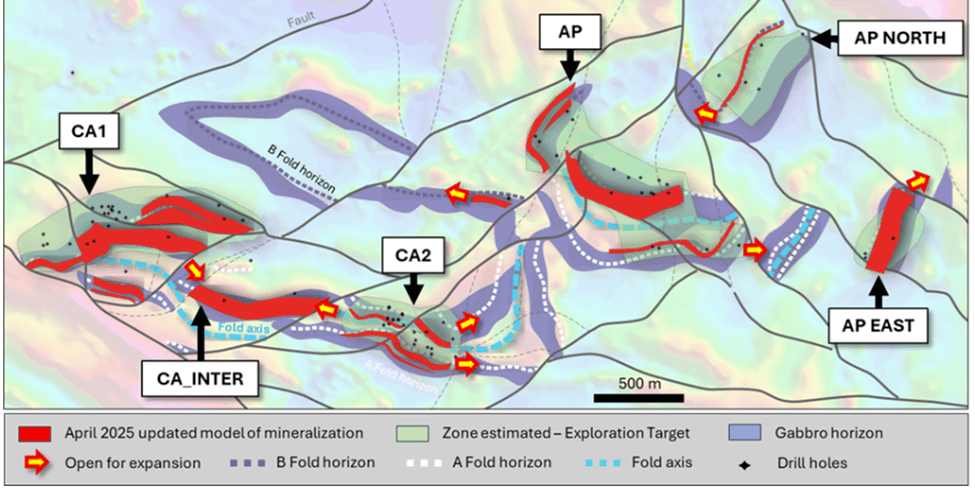

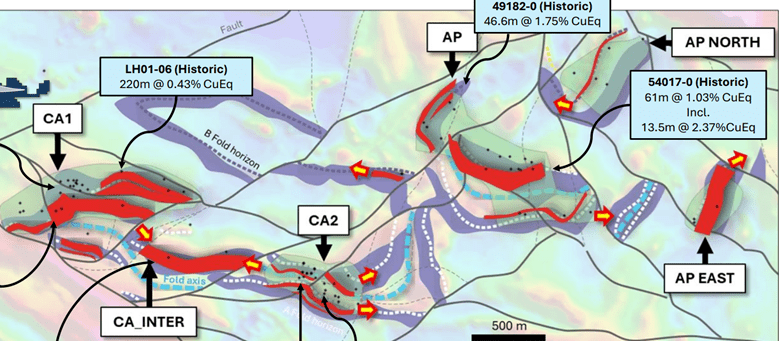

Central Area

It’s disseminated sulfides, but within that we’re also looking for massive and semi-massive sulfides as you can see in one of our recent holes we issued just a few weeks ago.

It was 235 meters of mineralization that started at 18 meters below surface, so a shallow amount of overburden, and then you get into the mineralization of disseminated sulfides, but then what happens is you also get into the semi-massive and massive within the same hole.

And that’s why you get these regions of higher-grade ore for 20 or 40 meters and then within that you get 4-5 meters of the massive/ semi-massive, but then you get out of that zone and then you get back into the higher-grade 20-40 meters and then again within that halo you get the higher-grade material as well and that seems to continue for at least 200 meters below surface and we do think that it does continue at depth.

And then in and around the central areas you can see there’s a nickel ultramafic area to the north, there’s also another gabbro system to the west called the North Limb Gabbro, and then there’s the whole Eastern Tee targets where a lot of people think there’s another Eagle’s Nest along that eastern extension.

RM: The Eagle’s Nest is quite famous, it kickstarted the whole Ring of Fire story.

GF: Correct, the difference between W2 and Eagle Nest is W2 lies flat spanning over 8 kilometers, while Eagle Nest is a pipe. They drilled through lower grade mineralization and into a higher grade second layer.

And then they got into third layer. It goes down to 1.5 km, and they hit very high-grade 3% nickel, 1% copper, a couple grams platinum-palladium.

It’s obviously a deep underground mine and they’re going to be focusing on the copper-nickel component of it, and further along strike there is a chromite deposit that they discovered.

RM: Talk about W2’s exploration estimate you commissioned.

GF: We have done an estimate based on all the historical drilling and there is quite a large resource tonnage. It’s currently at 135 million tonnes grading 0.8% copper-equivalent using a half a percent cut-off. That’s a combination of the copper, the nickel and the PGEs.

That’s equivalent to 2.3 billion pounds of copper in 10-12 billion pounds of mineralization. It’s important to point out our estimate does not take into account any losses through metallurgical processing.

The 100 drill holes are the black dots, and the red is where we’re drilling now, and the purple is where it’s undrilled but with the mag survey that we completed in January with a top firm called Hogg & Associates that does a lot of the work on the Ring of Fire, we think all these areas are mineralized.

What we’re doing now is drilling all these undrilled areas and confirming that the mineralization is similar.

RM: Inco’s drilling was 150 meters deep on average, so very shallow, and all they were looking for was the nickel sulfide.

GF: They were just looking for high-grade nickel and they were assaying for copper, but they didn’t assay for the PGEs. So, what we’re doing is extending these holes.

Hole 10 is the perfect example. We drilled through 18m of overburden and then 235 meters of mineralization and we’re seeing the pattern repeat over and over, 20-30 meters of high grade and then you come out of the zone, then another 20-30 meters.

We obviously had to cut the holes at some point just because of the budget and we wanted to stick to our program of drilling the other targets, but we do think that all the holes are ending in mineralization so we just think that if you continue to drill the pattern would continue deeper. Hole W225-10 intercepted 0.79% (Cu+Ni) and 54 g/t (Au+Pt+Pd) at 247.00-249.00m.

If you look at the sessions we’ve done based on all the historical drilling, you see a number of holes across the property that also end in high-grade mineralization, so we do think the deposit is open.

RM: So, we do have comparisons on the type of mineralogy that we’re looking at. When we have these comparisons in similar mineralogy we can look at the metallurgy. Is the metallurgy on these similar-type deposits, is it applicable to what we’re looking at? Like our mineralogy here on W2 can we say we have proven metallurgy on the W2?

GF: Good question, now we’ve got a better perception of drill core because last year we drilled the AP Zone and some step-out holes and now we’ve just completed some more drilling at our CA1, CA2, we’ve got some more assays to announce.

We’ve got more core, so we’ll get into the more detailed metallurgical work and work with Lakefield on that. We’ve got confidence in our knowledge of the mineralogy and the similarities with Eagle’s Nest and these other deposits that I mentioned. There has been some work historically done on the copper, so we’re not concerned about the copper recoveries, we think it will be consistent with other projects we’ve looked at and the same thing with the platinum, palladium and gold.

The main issue we do want to look at further is the nickel sulfide, at this grade is it going to recover at 30%, 60%? Or do we need to do a unique technique to get a higher recovery?

If you look at Eagle’s Nest, similar rocks, similar age, they have 92% copper recoveries, 83% nickel, 86% for the gold, 85% for the palladium and then from these other projects we’ve looked at, like I mentioned in Finland and Australia, you’re looking on average of somewhere between 70-80% recoveries for those key metals — the platinum-palladium as well as the copper and then again the nickel does vary depending on the deposit.

RM: You mentioned PGEs, we’ve talked in previous interviews about platinum in particular doing quite well right now as well as palladium, they’re both around 1,000 bucks an ounce. How much of a kicker would the PGEs be for a PEA?

GF: Good question, so if you look at our corporate presentation on our website, you’ll see in the back of the technical appendix there’s a resource broken down by cut-off grades and then broken down by individual commodities.

If you take an average cut-off of half a percent you get close to 1g of platinum-palladium-gold combined. Which is interesting because the platinum-palladium-gold component is about 25% of the economics, copper is going to be 50%, you get the nickel sulfides coming in around 25%.

RM: That’s significant.

GF: It is an important component of the project and what’s interesting too is the property-wide magnetic survey. If we just focus in on the central area, the C Zone is 20% of the property, you generally get higher platinum-palladium and higher nickel. That’s probably why Aurora Platinum in 2005 spent a lot of time in that northeast area because they’re a palladium company and that’s where we’ve seen some of the higher-grade platinum numbers.

Historically we’ve seen grades up to 15% copper, 2 or 3% nickel, we’ve seen gold up as high as 11 g/t, and you’ve had platinum-palladium intersections up to several grams in that area. In the most recent drill program, we’ve seen copper as high as 4% over a meter and platinum-palladium over 1g and the gold was as high as 5g per tonne. It’s definitely an important component of this project.

RM: In W2’s Copper and Precious Metals & Estimated Value chart I see +2 million ounces PGS (palladium, gold and platinum).

GF: That’s from the exploration target resource model we did, so that’s based on a half a percent cut-off, so if you lower the cut-off obviously, you’re going to have significant more Cu-Ni-PGEs. But at a reasonable cut-off you get 2 million ounces of platinum-palladium. The biggest weight of those three commodities would be palladium, is the biggest component, platinum in second and gold would be the last.

We’ve broken it all down by specific commodity, again at half a percent cut-off those 2 million ounces are 1.2 million palladium, half a million of it is the platinum and 300,000 is gold ounces.

RM: What’s the confidence level?

GF: What you’re looking at here is the actual grades. We have the assays and the assay certificates from the lab for the 100 holes, and this is based on a resource model, so these are based on the actual grades that Inco, FNX and PTX from our drilling. So, the only thing we haven’t factored in at this point is metallurgy.

RM: Expected recoveries?

GF: That’s something we’re obviously going to be doing as mentioned. We have the mineralogy done so we can understand the type of deposit it is, some peers, and traditional processes that have worked in CILs, Carbon-in-Leach, for example, that’s worked in other projects and now we’ll start doing the metallurgy work and we’re expecting recoveries of somewhere around the 80% range.

RM: You’re looking at an inferred resource when we talk about any kind of a resource?

GF: Yes, most of it’s in the inferred category, there’s a portion of it in the indicated, and then some areas would be lower than an inferred resource.

Some of those areas like the CA1, CA2, are drilled off but there’s a couple areas in the CA1 in the northeast area where you’d want to do some more infill drilling to get it in the inferred category, that’s what we’re doing right now.

RM: How long is it going to take you, and how much money do you need to raise, to get this project to where you’re going to do a PEA?

GF: We plan 20 drill holes in the central area to get a lot of this moved into a mineral resource. Three holes are going to drill high-grade areas in the AP Zone because those are the areas you want to extend deeper.

And then the balance of the holes is going to be just classic step-out holes, drilling new targets to show that the tonnage can get a lot larger. And the reason we decided on that is because we wanted to show the majors in this camp that the deposit can get larger, there’s higher-grade areas and that at the same time the guys doing the resource, the geologists and engineers want some in-fill holes to show that the deposit hangs together.

The next press release that’s coming out we’re hopefully going to show there’s continuity. That’s really the priority to get those 20 holes done, and then I hope at that point it’ll revalue the company and then we would have a larger market cap and then look at completing that whole mineral resource to an inferred-indicated category and then look at things like the PEA.

RM: That wouldn’t be this year that would be ’26?

GF: Yes, the PEA wouldn’t be until next year and really the strategy of the company at least at this point is to do two things: one is to get this exploration target into a mineral resource and show it can get a lot larger and show that it’s high grade and do a bit of the regional work, and that’s several million more dollars of drilling that we’ll need to raise to get that work done but at that point you’ll have the infrastructure in.

I think this project is better to be sold to some of these bigger groups that are building the concentrator, are going to be running operations, they’re going to want to have another deposit at surface so I think that would be our goal would be to do kind of a strategic investment next year.

I think it makes sense in this particular case. Don’t forget two good operators, Inco and FNX have already put in $25 million of drilling that’s not reflected in our share price, but I believe as the infrastructure comes in there’s going to be demand for someone to buy this this project.

RM: You said all First Nations will have power by the end of the year. There’s already a 2025 First Nations Road approval. If Doug Ford, premier of Ontario, gets his way there’s going to be an awful lot of Ring of Fire development coming over the next few years. How does that benefit W2 and your project there?

GF: It’s going benefit shareholders tremendously because one, I think the investments will come in, you already saw one significant investment by Wyloo, as mentioned they spent $650 million on Eagle’s Nest which is a feasibility stage mine. And then you saw Teck and Barrick both come into the camp.

Teck is located to the east of us and Barrick to the west, so I think as these announcements are made, I do know the First Nations have started to build the roads from their communities to the supply roads, they are starting to put in a logging road, so as this continues I think you’ll see a wave of capital coming in for exploration, and then I think you’ll see these majors want to make significant investments because I think they realize the potential of this camp is billions and billions of mineralization.

RM: And you’re sitting there with a 100%-owned project, a large resource at surface that’s only partially drilled off with a lot of potential to expand it. I think that’ll open opportunities for PTX to look at things like strategic investments, joint ventures or asset sales.

GF: We are keeping our dialogue open with all the companies in the camp as well as groups like Glencore – obviously Glencore and Vale and other groups like Lundin Mining, in the case of Glencore and Vale they’ve got existing facilities in Ontario, in Sudbury for example and Quebec, so they’ve got capacity for refineries so they’re obviously looking at the camp too.

That’s all part of it, the government wants to build a concentrator in the Ring of Fire and then have the refineries in Sudbury finish the product, so that’s the whole opportunity the government sees and that’s why they want to extend these roads and the rail lines to be able to develop these copper-nickel projects, so we have the second-most advanced project in the camp.

I think we’re well positioned.

RM: There are few juniors in there and there’s a few private companies, but ground is mostly tied up by major and mid tier producers. PTX Metals is in an excellent position with all the infrastructure certainly looking like it’s going to get done and open up the whole area, this is going to become a very hot area for the majors to be a part of.

GF: I couldn’t agree more, and there are a few other juniors that have early-stage properties, but they haven’t really been active partly because of the market.

Musselwhite, Red Lake, Timmins, Sudbury, all these camps didn’t exist at one point. It wasn’t until the infrastructure came in, we’re not that far from the rail lines here, we’re not that far from Pickle Lake, you are seeing the government, as mentioned they put in 16 power lines in and around Musselwhite, the First Nations another 10 or so this year in the Ring of Fire, so the development is happening.

I think things could really move quickly and Trump is helping us here obviously forcing the government to be more competitive, more economic and to think like the industry, right? Put in the infrastructure, work with the communities, get more of these camps builds because there is demand, as you know, for copper, PGEs and nickel.

RM: It’s like you said, all these camps had to start somewhere.

GF: It couldn’t happen at a better time with all the discussions happening and the fact that Ontario and Canada have really fallen behind in terms of the mining infrastructure. We don’t have enough concentrators, we don’t have enough refineries compared to other countries, permitting timelines are too long, we’ve lost a lot of our major mining companies, guys like FNX, Inco, Falconbridge.

The government’s finally realizing that they need to invest more capital, get more pension funds investing here, and do everything they can to improve the environment.

It’s obviously a good way to get the First Nations communities more involved because there’s such a difference for example if you’re working in Sudbury in Timmins to see how involved and how sophisticated the First Nations are in terms of the services they provide, the economic benefits they have receive, getting agreements done so quickly. The same thing will happen too in other parts of Canada as we get more sophisticated and as mining camps open.

RM: I see your April 21st, 2025 news release is an update on ‘Ontario’s Premier Announces Support To Unleash the Economic Potential for Critical Minerals and Energy in Ontario and Ring of Fire’.

GF: In Ontario they passed Bill 5 which make’s sure that mine permitting, exploration permitting stick to the intended guidelines that were in place for years. It’s a good idea to put in legislation to help make sure the industry and all the participants stick to these timelines.

RM: Let’s switch gears to your Shining Tree gold project in the mature Timmons gold camp.

GF: What we may want to try doing with the gold project, now that you’ve got a strong gold market and Cote gold mine’s been successfully put into production, we may potentially look at listing that gold division and that way we can raise capital directly and a lot easier for that property and not have to dilute shareholders with both projects.

And then of course there would be a big economic benefit to shareholders by way of PTX Gold being an equity investment in that spin-out, or dividending those shares directly to shareholders. So that’s not something I’m promising immediately, but that is something I’m trying to see where the company should go, and I think it makes a lot of sense now to potentially look at splitting up those assets.

RM: Thank you, Greg.

GF: Thanks Rick.

PTX Metals

TSX.V:PTX, OTCQB:PANXF

2025.06.11 share price: Cdn$0.11

Shares Outstanding: 118.7m

Market cap: Cdn$13m

PTX website

Subscribe to AOTH’s free newsletter

Richard does not own shares of PTX Metals (TSX.V:PTX). PTX is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of PTX.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE