Rick Mills – “The Folly of Tariffs, Trade Wars”

This week Donald Trump said he would hit John Deere with a 200% tariff if the agricultural/ construction equipment manufacturer made good on plans to move production to Mexico.

The Republican presidential nominee has frequently said he would punish automakers with a monster tariff if they move to Mexico, but according to Reuters this is the first time he has threatened John Deere.

The company earlier this year announced it was laying off hundreds of employees in the US Midwest and increasing production capacity in Mexico. The decision has upset workers and political leaders, and pushed the issue of tariffs onto the campaign agenda.

During the recent televised debate between Vice President Kamala Harris and Trump, Harris called Trump’s plans to increase tariffs “a tax on the American people.” Remember this statement.

If re-elected president, Trump has said he would implement a 10% tariff on all imported goods and a 60% tariff on goods from China.

It’s good ol’ (actually bad) US protectionism, which despite several studies indicating the cost of Trump and Biden’s tariffs on China isn’t worth it, has a history in America dating back to the 1930s.

Trade wars: a history

In fact, countries have been fighting over access to markets ever since they began trading with one another thousands of years ago.

Investopedia reminds us that colonial powers fought over the right to trade exclusively with overseas colonies in the 17th century.

The British Empire has a long history of such trade battles. An example can be seen in the opium wars of the 19th century with China. The British had been sending India-produced opium into China for years when the Chinese emperor decreed it to be illegal. Attempts to settle the conflict failed, and the emperor eventually sent troops to confiscate the drugs. However, the might of the British navy prevailed, and China conceded additional entry of foreign trade into the nation.

In 1930, the United States enacted the Smoot-Hawley Tariff Act, raising tariffs to protect American farmers from European agricultural products.1 This act increased the already hefty import duties to almost 40%. In response, several nations retaliated against the United States by imposing their own higher tariffs, and global trade declined worldwide. As America entered the Great Depression, aided greatly by disastrous trade policies, President Roosevelt began to pass several acts to reduce trade barriers, including the Reciprocal Trade Agreements Act.

A trade war is an economic conflict between countries that results in both countries placing trade restrictions on the other. They usually start when one nation accuses the competitor nation of having unfair trading practices.

The resulting trade barriers could include tariffs, import quotas, subsidies, currency devaluation and embargoes. The goal is to lower the number of imports coming in from the country you’re targeting, or at least make that country’s products more expensive.

A tariff is a tax on a product being imported. Tariffs result in higher costs for imported goods while also raising money for the government. The idea is that domestic producers of the good being taxed will benefit from reduced competition with foreign goods. The problem is the country being tariffed may respond with its own tariff, which is a tax on the first country’s exports into the second country. This leads to a “tit-for-tat” trade war that could, and has, resulted in the imposition of tariffs on hundreds of products.

An import quota sets a limit on the amount of a product that can be imported. Like a tariff, quotas decrease the competition producers face from foreign producers. Unlike a tariff, they don’t create revenue for the government.

Domestic subsidies are a means for a government to enable local producers to lower their prices. This allows the domestic producers to export more, and compete with foreign markets on price.

Devaluing the currency is another trade war tactic. By lowering the exchange rate, a country’s exports become more competitive in other countries. The downside is that imports become more expensive.

An embargo is an extreme trade barrier that bans the trade of a certain good with the country in question. In 2010, for example, China banned the export of rare earth oxides to Japan for two months.

Trade wars are controversial. Advocates say they protect national interests and provide advantages to domestic businesses. Critics claim they hurt local companies, consumers and the economy. In the short term, trade barriers can protect industries, but in the longer term, they usually turn out to have negative outcomes. Read more here

US-China trade war

For the origins we need to go back to 2016, when Donald Trump the presidential candidate blamed US trade with China as the main cause of the loss of US manufacturing jobs, and theft of intellectual property.

The other issue he seized upon was the US trade deficit with China, i.e., the US buying more from China than it was selling.

“We can’t continue to allow China to rape our country,” he declared.

Pledging to “cut a better deal with China that helps American businesses and workers compete,” Trump laid out a four-part plan: declare China a currency manipulator; confront China on intellectual property and forced technology transfer concerns; end China’s use of export subsidies and lax labor and environmental standards; and lower America’s corporate tax rate to make US manufacturing more competitive. (The Brookings Institution, Aug. 7, 2020)

Following a meeting between Trump and China’s President Xi Jinping, China agreed to a slight opening of its economy in exchange for greater Chinese access on bilateral trade. But follow-up negotiations fizzled.

Trump then launched a trade war with China to pressure Beijing to make changes to parts of its economic system that he said facilitate unfair trade practices. Trump argued the unilateral (one-way) tariffs would shrink the US trade deficit with China and bring American manufacturing jobs that had been lost to China home.

Beginning in January 2018, the Trump administration imposed a series of tariffs including on steel, aluminum, solar panels and washing machines. The tariffs not only affected Chinese imports but goods from the European Union, Canada and Mexico. Canada retaliated by imposing duties (i.e., tariffs) on American steel, for example. The EU responded with tariffs on American agricultural products and Harley Davidson motorcycles.

Between July 2018 and August 2019, the United States announced plans to impose tariffs on more than $550 billion of Chinese products, and China retaliated with tariffs on more than $185 billion of US goods, according to Brookings.

The Biden administration has kept most of the Trump administration tariffs in place. Fast forward to May 2024, when Biden raised tariffs on $18 billion of goods from China. The tariffs targeted electric vehicles, clean energy and semiconductors — areas President Biden has been investing in to bolster domestic production:

The administration tripled tariffs on aluminum and steel to 25%, doubled them on semiconductors by 2025, quadrupled the tariff on electric vehicles to 100%, and doubled the rate on solar cells. Tariffs were also raised on ship-to-shore cranes and certain medical products. Tariffs on non-electric vehicle batteries and critical minerals like graphite will be boosted starting in 2026. The delay was aimed at helping companies transition as they rejigger supply chains, and domestic production in the U.S. gears up. (Barron’s, May 15, 2024)

Barron’s makes a couple more interesting points. First, it says the European Union is expected to impose its own tariffs on Chinese electric vehicles in coming months (it did so in July), Brazil is restoring tariffs on EV imports, and India has levied tariffs on Chinese steel.

Second, Barron’s says China shows little signs of changing its approach, given that selling higher-valued goods abroad — solar panels, batteries, electric machinery and semiconductors — is part of President Xi’s playbook.

Moreover, China’s heavy investment created competition that forced companies to innovate, meaning that China has widened its cost advantage and closed the quality gap with foreign rivals.

China is producing far more than it can absorb domestically, so it is must export goods like EVs, solar cells and lithium-ion batteries. China’s share of global exports has risen to 14% but its exports to G7 countries has fallen from 48% in 2000 to 29%. No doubt due to tariffs, China is selling less to the US and Europe and more to emerging markets.

Regarding the US election in November, Barron’s says More restrictions on technology, medical devices, and biotechs are expected in coming months from the Biden administration.

Another Trump administration would likely focus more on tariffs; outbound investment restrictions; and increased scrutiny of Chinese electric vehicles and parts, cloud computing, and biotechs on national-security grounds.

Trump could also try to revoke China’s Permanent Normal Trade Relations designation, which had normalized trade relations between the countries. Revoking it would impose more tariffs on a range of goods from China, risk a greater retaliation from China, and impose greater costs on consumers and businesses.

China could respond by pressuring the Chinese operations of US and European automakers and other industrial companies, or restrict access to critical minerals that it dominates.

The auto industry estimates almost a quarter of their profits could be at risk within a decade, while electronics manufacturers and pharmaceuticals and medical equipment-makers each estimate that more than a fifth of their profits could be at risk, according to a report from PwC Singapore cited by Barron’s.

Costs

While Trump argued China would bear the brunt of the tariffs, a study by the International Monetary Fund, via Investopedia, showed that US importers of goods have primarily shouldered the cost of the imposed tariffs on Chinese goods. These costs are eventually passed on to the American consumer in the form of higher prices, which is the exact opposite of what the trade war is intended to accomplish.

Several other studies confirm these results.

In August 2020, six months after the “phase one” trade deal with China, the Brookings Institution put out an article stating that Despite Trump’s claim that “trade wars are good, and easy to win,” the ultimate results of the phase one trade deal between China and the United States — and the trade war that preceded it — have significantly hurt the American economy without solving the underlying economic concerns that the trade war was meant to resolve.

As described by Heather Long at the Washington Post, “U.S. economic growth slowed, business investment froze, and companies didn’t hire as many people. Across the nation, a lot of farmers went bankrupt, and the manufacturing and freight transportation sectors have hit lows not seen since the last recession. Trump’s actions amounted to one of the largest tax increases in years.”

The cost to US companies from the tariffs was estimated by numerous studies at nearly $46 billion.

Research by the Wilson Center agreed that the tariffs caused great collateral damage to US businesses and consumers without generating leverage over China or reducing trade deficits as hoped:

This is because large companies are not responding to tariffs by abandoning China but by passing on the costs or circumventing tariffs. Tariffs have instead become a regressive “hidden sales tax” that places a disproportionate burden on the less affluent by contributing to rising consumer prices and on small and medium enterprises that struggle to remain competitive.

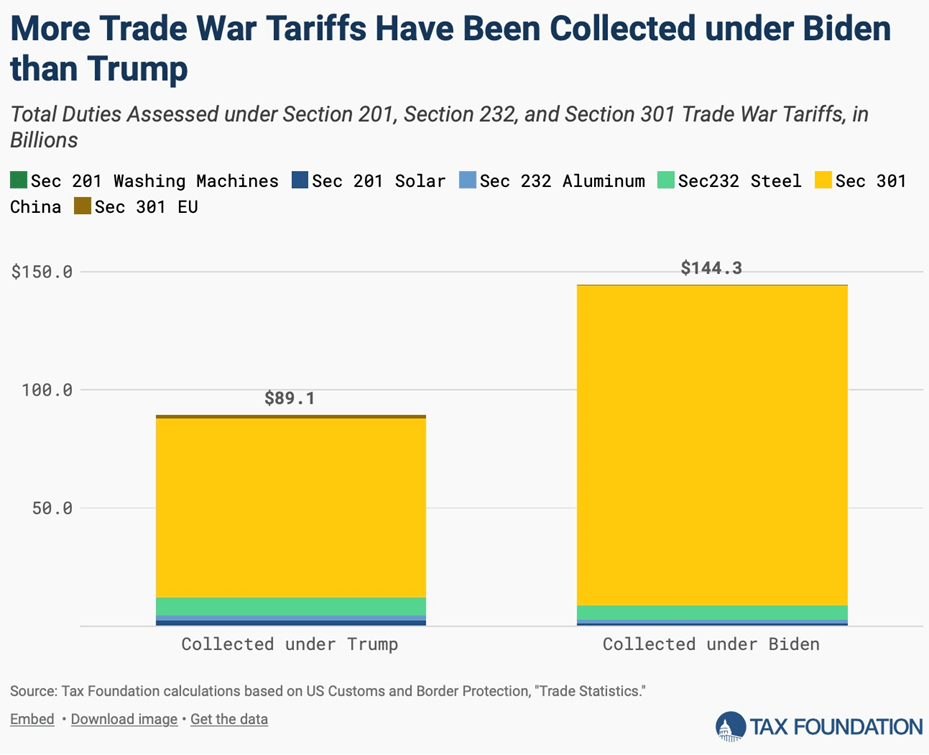

The Tax Foundation wrote that “the Trump administration imposed nearly $80 billion worth of new taxes on Americans by levying tariffs on thousands of products valued at approximately $380 billion in 2018 and 2019, amounting to one of the largest tax increases in decades.”

It noted the Biden administration kept most of the Trump tariffs in place, and announced additional tariffs in May 2024 amounting to an additional tax increase of $3.6 billion.

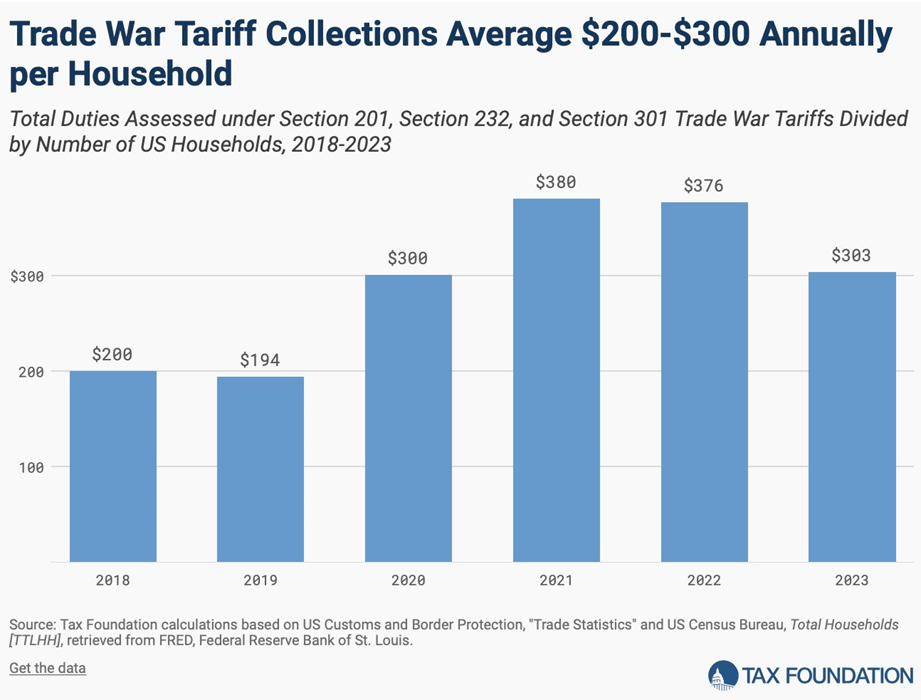

The foundation estimates the Trump-Biden tariffs will reduce long-run GDP by 0.2% and at a cost of 142,000 full-time jobs. The $79 billion in higher tariffs amounts to an average annual tax increase on US households of $625. Actual revenue collections data revealed that trade war tariffs increased tax collections by $200-300 per household.

If Trump is re-elected, the foundation estimates his proposed tariff increases would hike taxes by another $524 billion annually, shrink GDP by at least 0.8%, and shed 684,000 jobs. These estimates do not account for the effects of China’s retaliation.

Research has also been conducted on the effects of the Trump tariffs on stock prices. A 2021 Forbes article describes the work of researchers at the Federal Reserve Bank of New York and Columbia University, who used movements in stock prices to measure the response to policy announcements on tariffs and the escalation of the US-China trade war.

Researcher/ economist David Weinstein said “The results suggest that markets interpreted the impact of the tariffs as much more negative than what economists initially estimated.”

The analysis suggested that the tariffs protect the least efficient firms and reduce their incentive to innovate, while hurting the most successful US firms, reducing their ability to innovate.

Among the other key findings, the economists found:

- a long-term decline in US consumer well-being of 7.8%;

- the decline in stock market value caused by trade war announcements “amounted to a $3.3 trillion loss of firm value (equivalent to 16% of US GDP in 2019)”, worse than an earlier estimate of $1.7 trillion;

- “The data reveal that there were large and persistent movements in stock prices and inflationary expectations following these trade-war announcements. We see that the stock market fell on all of the event dates except one U.S. event date and one China event date, with a total drop of 10.4% over all of the events, and 12.9% over the three-day windows.”

Regarding Trump’s goal of reducing the US trade deficit with China, the goods deficit with China reached a record $419.2 billion in 2018. By 2019, it had shrunk to $345 billion, roughly the same level as 2016, due to reduced trade flows. Brookings notes that while the deficit with China decreased, its overall trade deficit did not. That was because the tariffs diverted trade flows from China, causing the US trade deficit with Europe, Mexico, Japan, South Korea and Taiwan to increase.

The two sides declared a truce in January 2020. The deal involved China committing to purchase an extra $200 billion in American products over two years above 2017 levels. The country also promised to protect US intellectual property, halt coercive technology transfers, and stop using currency devaluation as a trade weapon.

Six months after the agreement was signed, according to Chinese Customs Administration data, China in the first half of 2020 had purchased only 23% of its target for the year.

As of August 2020, US goods exports to China were significantly below what they were in 2017. As stated by the Brookings Institution:

In other words, Beijing essentially paid for the deal with a promise of a windfall in purchases of American goods. It appears that President Trump accepted an IOU as a declaration of victory.

In December 2021, a research paper examining the economic impacts of the US-China trade war found that by late 2019, the US had imposed tariffs on roughly $350 billion of Chinese imports, and China had retaliated on $100 billion of US exports.

The main takeaway from the research was that US consumers of imported goods bore the brunt of the tariffs through higher prices and that the trade war lowered aggregated real income in both the United States and China.

The US-China trade war makes an interesting comparison with the Smoot-Hawley tariffs of the 1930’s mentioned at the top.

During the conflict, the US imposed tariffs (including other trade partners) on 18% of its imports, equivalent to 2.6% of its GDP, while China’s retaliation impacted 11% of its imports, equivalent to 3.6% of its GDP. The tariffs increased costs for about two-thirds of dutiable products in the US.

The conflict’s magnitude and scope outstripped the 1930 Smoot-Hawley Tariff Act, the most notable protectionist move in over a century of US trade policy, which raised tariffs on 27% of dutiable products equivalent to 1.4% of GDP. (Center for Economic Policy Research, June 10, 2023)

In April 2023, the US Trade Representative initiated a four-year review of the Trump administration’s Section 301 tariffs, asking industries that supported the tariffs to weigh in on their efficacy and potential continuation.

The 1,181 comments were analyzed by the Council on Foreign Relations, which found that 917 submissions favored removing the tariffs and 260 supported continuing them. Four submissions supported tariffs on some products but not on others.

The council referenced the above-mentioned research paper on stock price movements, which showed that by the of the first year the tariffs were in place, US real income declined by $1.4 billion per month.

It also cited trade analysts from the American Action Forum, who found that US consumers bore the brunt of the tariffs, paying a total of $48 billion, with half of this figure paid by US firms that rely on intermediate inputs from China.

Many firms who submitted comments to the USTR said the tariffs led to a decrease in wages and employment, and less investment in R&D. Firms also noted the difficulty in sourcing alternative inputs, including furniture manufacturers (cane webbing) and chemicals manufacturers (sarcosine salt).

US exporters also faced higher costs, increased competition from unaffected foreign companies, and Chinese retaliatory tariffs, which all contributed to a reduced share in global markets. For example,

The American Soybean Association claimed that the trade war not only harmed U.S. soybean producers, but also made foreign competitors more appealing. For example, Brazil benefited from Chinese retaliatory tariffs on U.S. soybeans, which saw a 63 percent drop in exports from January to October 2018. Chinese retaliatory tariffs also reduced market access and raised prices for Alaskan and Pacific Northwest fisherman who found themselves in a less competitive position compared to other seafood exporters such as Russia and Vietnam.

Where it’s headed

The US-China trade war appears to show no signs of ending, in fact President Biden has continued what Trump started, and Trump is doubling down on his first-term tariffs, pledging to invoke a 10% tariff on all imports, a 60% tariff on Chinese imports, and a 200% tariff on firms that move production to Mexico and then sell into the US.

Biden has also slapped a 100% tariff on Chinese electric vehicles.

“A battle between the utility of democracies in the 21st century and autocracies,” is how Biden now characterizes the US-China conflict.

Indeed, the trade war with China has become subsumed within a bi-partisan approach to China that views Beijing as the enemy. For example the tariff on Chinese EVs is seen through the lens of protecting US national interests, while China’s imposition of export restrictions on graphite and other critical minerals is viewed as reason to reduce dependence on China and build up a domestic supply chain.

The danger of running out of minerals needed to build weapons and defend territories is a heightened risk now, during a period of intensified global conflict. With wars raging on two fronts — Eastern Europe and the Middle East — not to mention numerous smaller wars like the conflicts in Yemen and the DRC, nations are girding for war and re-arming their militaries, pushing up demand for critical and non-critical minerals including graphite, aluminum, steel, iron, rare earths, copper, silver, nickel and titanium.

Consider the following:

- According to the U.S. Department of Defense, the military is prioritizing maritime and air forces that would play central roles in the Indo-Pacific region, as the Chinese military flexes its muscles in the South China Sea and continues to hint at an invasion of independent Taiwan, a US ally.

- The US Navy, says DoD, want to grow its force to over 500 ships. In its fully-year 2024 budget request, the navy seeks to procure nine battle force ships, including one ballistic missile submarine, two destroyers and two frigates. The hulls of these ships are made of high-strength alloyed steel, containing metals like nickel, chromium, molybdenum and manganese. The Tomahawk cruise missile has an aluminum airframe and the Mark 48 torpedo has an aluminum fuel tank.

- The Air Force seeks to procure nearly 100 aircraft including 48 F-35 fighter jets, and for land forces in the Indo-Pacific, the US Army is bolstering long-range precision fires including artillery, rockets and missiles. The M30A1 rocket explodes with 82,000 tungsten ball bearings. Nearly 20% of the F-35 fighter jet’s weight is titanium, while Joint Air-to-Surface Standard Missiles have concrete-piercing casing made of tungsten steel.Last fall, President Biden signed off an an $80 million grant to Taiwan for the purchase of American military equipment.

- The defense department’s 2023 China Military Power Report estimates the Chinese have more than 500 operational nuclear warheads as of May 2023, and are developing new intercontinental ballistic missiles. These nuclear or conventionally armed missiles give the PRC the capability to strike targets in the continental United States, Hawaii and Alaska, an official said.

- Chinese leaders are seeking to modernize the People’s Liberation Army capabilities in all domains of warfare. On land, the PLA continues to modernize its equipment and focus on combined arms and joint training. At sea, the world’s largest navy has a battle force of more than 370 ships and submarines. In the past two years, China’s third aircraft carrier was launched, along with its third amphibious assault ship. The PLA Air Force “is rapidly catching up to western air forces,” the official said. The air force continues to build up manned and unmanned aircraft and the Chinese announced the fielding of the H-6N — its first nuclear-capable, air-to-air refueled bomber. (U.S. Department of Defense)

Questions are being asked whether now is a good time to be squeezing China economically, as it experiences a property crisis and a recession that could last several years. (America Magazine, Aug. 19, 2024).

While a comparison can be made between China’s troubles and Japan’s “Lost Decade’, America Magazine points out the difference is that China has been much more innovative:

The overall result of the U.S. ban on telecommunication products made by the Chinese company Huawei Technologies, for example, has been to pressure the company to make better products and develop a customer base at home and in countries besides the United States.

The gist of the article is that the world would be better off right now without a trade war. One advantage of freer US-China trade is that China’s low-cost electric cars and solar panels could be sold to American households, resulting in lower carbon emissions.

And does America really want to provoke China economically at a time of internal weakness, that could lead into something more serious? Arguably, the last thing the world needs is another armed conflict.

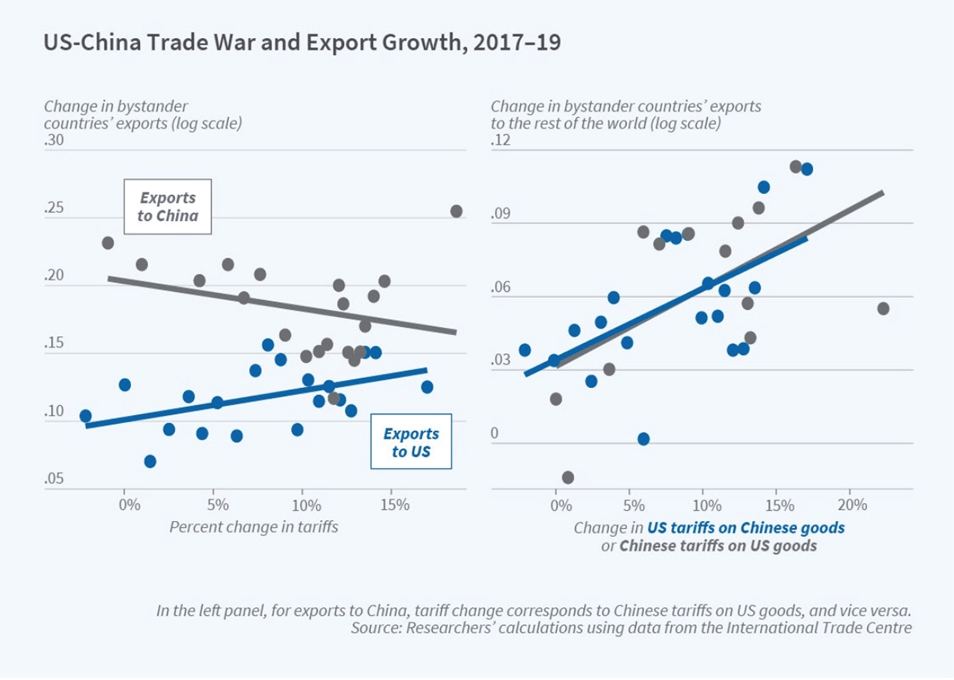

Another argument against the trade war is the fact that, while trade between the United States and China has decreased, it has gone to other countries, evening out the impact on global trade.

The Center For Economic Policy Research notes the “bystander effect” of the US-China trade war, referring to the enhanced trade opportunities for most countries.

According to the National Bureau of Economic Research,

The US and China reduced exports of products subject to increased tariffs. US exports to China fell by 26.3 percent while exports to the rest of the world increased modestly, by 2.2 percent. China’s exports to the US declined by 8.5 percent and its exports to the rest of the world rose by a statistically insignificant 5.5 percent. The researchers further find that trade in the products targeted by the tariffs increased among bystander countries. These nations did more than reallocate global trade flows across destinations; their overall exports to the world increased. Because of this response from the rest of the world, on net, they calculate that the trade war raised global trade by 3 percent.

The countries that benefited the most were those with a high degree of international integration, as proxied by their participation in trade agreements and foreign direct investment. France, for example, increased its exports both to the US and to the rest of the world in response to the tariffs…

Statistically significant increases in bystander countries’ exports in response to the tariffs occurred in 19 of the 48 countries in the data sample.

Source: National Bureau of Economic Research

Furthermore, the Carnegie Endowment for International Peace points out that some of the reasons for the United States waging trade war with China in the first place, either no longer apply, or haven’t worked.

Consider Trump’s fixation on the trade deficit. In 2021, three years after tariffs were initiated, bilateral trade had rebounded to all-time highs, China’s trade surplus had increased, and the US trade deficit had gotten worse. Carnegie notes that US trade deficits are largely driven by soaring budget deficits that have little to do with China.

As for Trump’s feeling that US firms had been over-investing in China, resulting in a loss of competitiveness, from 2001 to 2021 only 1-2% of annual US foreign investment had gone to China. By contrast, the EU had invested roughly twice as much as the United States had.

China is often accused of stealing intellectual property, but according to Carnegie, after accounting for the size of China’s foreign transactions and research, “such events may not occur unusually often or are possibly exaggerated.” Moreover, foreign plaintiffs are now more likely to win their cases in Chinese courts.

A 2020 survey by the American Chamber of Commerce in China found that nearly 70% of firms felt that China’s enforcement of intellectual property rights had improved compared to 47% in 2015.

As for the much-complained-about forced technology transfer, Chinese requirements have gotten less stringent, says Carnegie, giving BASF, Tesla and BlackRock as examples of companies that have been allowed to enter sectors without a Chinese partner.

Conclusion

By now it should be apparent that tariffs, trade wars and protectionism may seem like good solutions in theory to perceived trade unfairness, but in practice, they aren’t worth the costs.

Said differently, acting tough against an economic adversary makes for good politics and sound bites, but in the end, tariffs are a tax on the consumer and end up hurting US businesses, especially exporters who are subject to countervailing duties.

Sometimes tariffs have unintended consequences. Consider Trump’s threatened 200% tariff on automakers who make/ assemble their cars in Mexico and then sell them into the United States.

Prima facie, this seems like a good way to protect American jobs — unionized labor making cars in US plants — but at whose cost? Volkswagen and other big automakers whose economic model is based on building autos and auto parts in Europe and shipping them worldwide — including to Mexico for assembly.

Maybe Volkswagen is so irked by the tariff that it shuts down its automobile assembly plant in Tennessee.

Maybe other companies, other sectors get pissed off at the federal government for its over-the-top protectionism. Suddenly it’s like the pandemic all over again — empty shelves, a lack of fertilizer, a lack of equipment, etc.

The United States is vulnerable because its manufacturing sector has become hollowed out. In an era when everyone is focused on AI, semiconductors, cloud computing, etc., the country seems to have forgotten its “Made in America” roots. What’s the point in making a computer chip when there are no white goods, no machinery, to put it in? Because they’re no longer made domestically but overseas?

It’s one thing to slap tariffs on products that you already manufacture — you have leverage. It’s quite another to put duties on industries that you do not have, are in their infancy, electric vehicles being the obvious example. Except for Tesla, Rivian, Ford and Lucid, there is little US electric-vehicle manufacturing and even less mining of critical mineral inputs. There is no ”mine to battery” supply chain. Most of the electric-vehicle car parts assembled in the United States come from overseas.

Now the US government wants to crank up the trade war with China and is focusing on electric vehicles, solar panels and semiconductors — all areas that China has a huge advantage, and major leverage should it decide to counter-attack with tariffs, restrictions or outright bans.

The US manufacturing sector has been hallowed out, Americans no longer mine, they have next to zero smelters and refineries (and it can take up to 28 years, the second longest time in the world to go from mine discovery to production in the US). And the west is sorely in lack of the technological know how to build even basic stuff like battery anodes and rare earth magnets. It’s one thing to start trade wars, tariffs and travel down the protectionist road to protect an industry you have, where is the sense in tariffs when you have no existing industry to protect and all you are doing is hurting your own citizens?

The next president of the United States would be advised to think twice before cutting their own throat with an escalated trade war with China.

Subscribe to AOTH’s free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE