Rick Mills – “SYH drill results anticipated as U price hits 2-year high”

The drills are turning at Skyharbour Uranium’s (TSX-V:SYH) flagship Moore project, and SYH investors are eagerly anticipating what they uncover in the basement rocks. From what its Patterson Lake neighbour, Fission Uranium, just pulled out of the ground, hopes are high.

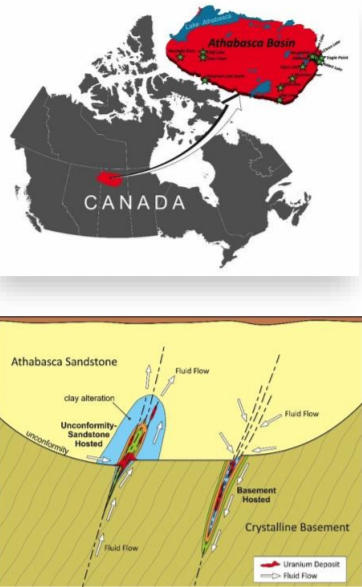

Action in the Basin

On Sept. 25 Kelowna, BC-based Fission announced assay results from nine holes drilled this summer at its Patterson Lake South (PLS) property. One of the most impressive uranium discoveries in the high-grade Athabasca Basin – with mind-blowing grades up to 23% U3O8, the deposit was later named Triple R.

Fission’s goal is to convert previously identified inferred zones to the indicated category.

Highlights included hole PLS18-588 (line 645E) which intersected 76.5m of total composite mineralization, including intervals such as 15.5m at 23.89% U3O8 in 50.5m at 8.21% U3O8. The results will be included in a new resource estimate that will part of the company’s upcoming prefeasibility study.

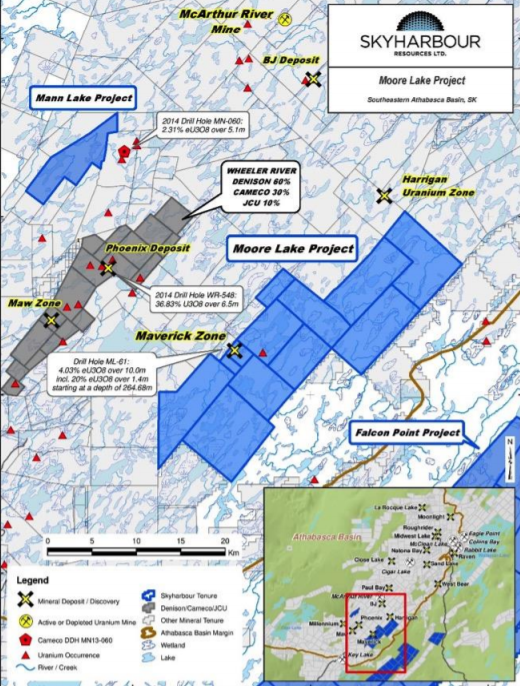

Meanwhile, closer to Skyharbour’s Moore project, Denison Mines rolled out a prefeasibility study on its flagship Wheeler River project, whose Phoenix deposit is in close proximity to Moore’s Maverick Zone.

The PFS considers the potential economic merit of co-developing the Phoenix and Gryphon deposits. The Phoenix deposit is designed as an in-situ recovery (ISR) mining operation, with processing occurring at a plant to be built at Wheeler River. The Gryphon deposit is designed as an underground mining operation.

What’s in the basement?

Recent news from other juniors in the Basin are important because Skyharbour’s top priority this drill season is to check out the basement rocks in the Maverick Zone, given other recent basement-hosted discoveries including NexGen’s Arrow, Fission’s Triple R and Denison’s Gryphon deposits.

Since mid-2000, the focus at Moore has been on the 4-kilometer Maverick structural corridor where pods of high-grade unconformity-type uranium mineralization have been intersected. During the winter and summer of 2017, just under 10,000 meters of drilling was completed. Highlights included 20.8% U3O8 over 1.5m, 9.12% U3O8 over 1.4m, and 2.23% over 9.3m U3O8, all at between 250 and 275m depth. About half of the 4-km corridor has been drill-tested.

Stepping out 100m from the Maverick Zone, Skyharbour also discovered a new high-grade mineralized lens, where 9.12% U3O8 over 1.4m and 4.17% U3O8 over 4.5m at 278m depth was found. This year a drone survey was conducted along the corridor, flown at close 20m spacings at 35m elevation. This enabled Skyharbour to better define high-priority targets. A 3,400m, 9-hole winter drill program returned high-grade mineralization and successfully expanded known zones. This summer/fall’s 3,000m program however takes a different tack, and focuses on drill-testing the Maverick corridor primarily below the unconformity in the relatively untested basement rocks.

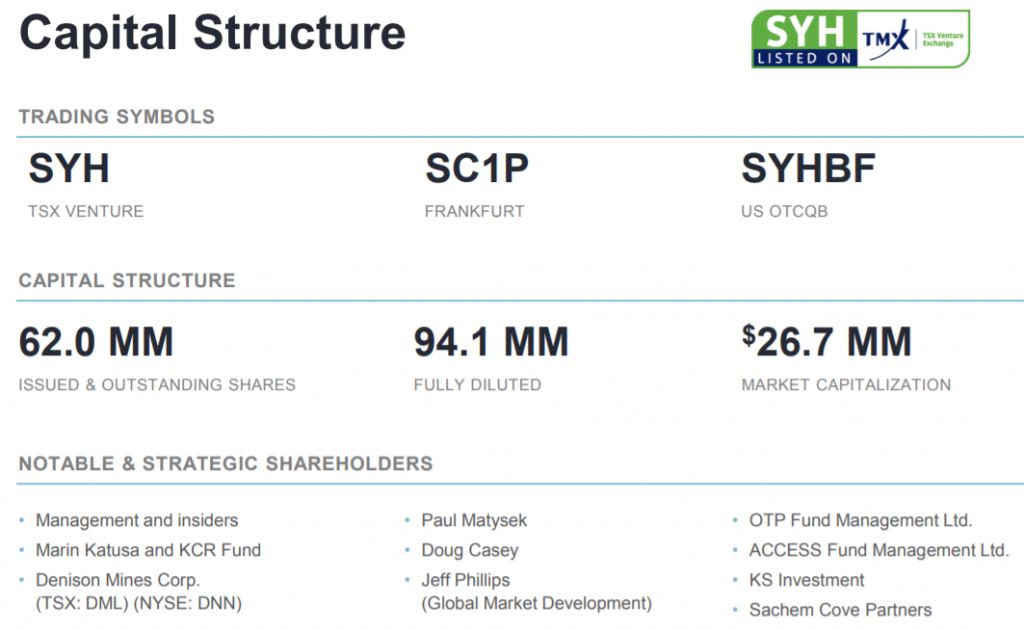

Just over a million warrants were exercised, topping up the treasury with close to $450,000. The extra funds mean that Skyharbour has completed its earn-in agreement with Denison Mines on the Moore property almost three years ahead of schedule. The option agreement required SYH to spend half a million in cash and shares within five years, and also pay $3.5 million in exploration expenditures (now complete), in order to get 100% of the project.

The company also has a 50% interest in the Preston Project – one of the largest land packages (75,965 hectares) in the Basin – located near Fission Uranium’s Triple R and NexGen Energy’s Arrow deposits, both of which contain high-grade uranium. Under a prospect generation arrangement, SYH optioned 70% of Preston to French nuclear giant Orana (formerly Areva), which can earn up to 70% of Preston by spending $8 million over six years. The other 30% would be divided between Skyharbour and Clean Commodities.

At the same time, Skyharbour agreed with Azincourt Uranium to option 70% of another portion of Preston, with Azincourt issuing 4.5 million shares and spending $3.5 million over three years, to Skyharbour and Clean Commodities. The two agreements in total mean that for $11.5 million in exploration and cash payments plus 4.5 million Azincourt shares, 70% of the Preston and East Preston projects will be optioned off.

Winter drilling at Preston

Entering into the second year of its option agreement with Skyharbour and Clean Commodities, Azincourt announced in August a 2018-19 drill program scheduled to begin mid-November. The program will involve between 2,000 and 2,500 meters of drilling at East Preston and is designed to test targets identified through a winter geophysical survey early this year.

Skyharbour’s plan is to come out with a maiden resource estimate at Moore, in the first half of 2019. Between the drilling and the resource estimate, there will be ample news flow and catalysts over the next year to position the company optimally to thrive in an improving uranium market.

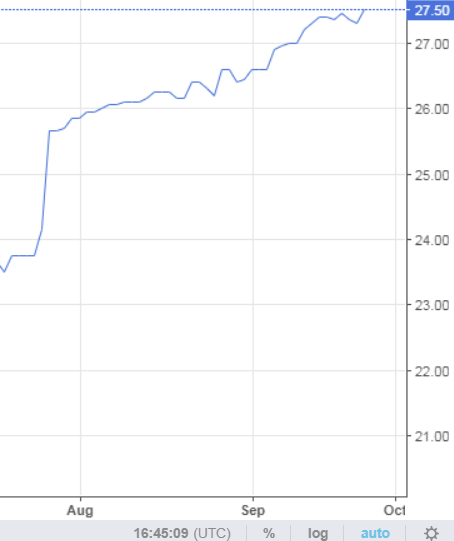

Two-year high for uranium price

And that market is indeed picking up pace. In the beginning of September the spot uranium price hit a two-year high of $26.70 a pound and the price has kept rocking – with 2.4 million pounds worth about $64 million changing hands according to TradeTech, a nuclear industry consultant. That’s a far cry from the dismal lows of $18 a pound in November 2016; since the start of 2018, uranium has gained 24%.

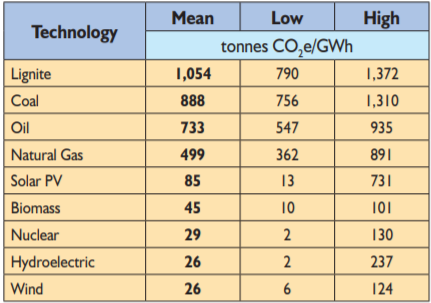

The good pricing news coincided with a study from MIT which concluded that the general public does not yet see nuclear power as necessary for a low-carbon future, despite its obvious green credentials, emitting no greenhouse gases compared to coal or natural-gas power plants.

“Our survey results show that the public does not yet see nuclear power as a way to address global warming, suggesting that further public education may be necessary,” MINING.com quoted a report from Oz Financial.

A nuclear future

At Aheadoftheherd, we’ve already researched the increased demand that electrical vehicles will put on the world’s existing electricity production capacity, and concluded that nuclear is necessary to meet that demand.

The New Policies scenario, part of the IEA’s “World Energy Outlook 2017”, projects a global stock of 130 million EVs by 2030 using 567,450GWh. So according to the energy experts we are going to need somewhere between 567,450GWh and 995,220 GWh of new electricity production per year by 2030 just for EVs.

Despite the accident at Fukushima that followed the Japanese earthquake/tsunami in 2011, and a few radiation escapes that can be counted on one hand since nuclear power plants started in the 1950s, nuclear remains our cheapest, safest, and most energy-efficient source of power generation.

Data from the World Health Organization shows that nuclear energy emits the lowest amount of carbon dioxide equivalent per unit of energy produced, when considering the whole cycle of emissions. According to the World Nuclear Association, nuclear is the second-largest form of low-carbon electricity after hydro-electric power.

The need for a reliable source of base load power is clearly at the heart of China’s nuclear program. According to the World Nuclear Association, China with its appalling air pollution is the leader with 17 new reactors under construction and 184 planned or proposed. Globally there are about 50 reactors under construction in 13 countries and another 150 planned, according to the World Nuclear Association. Most would be built in Asia, where demand for new electricity, including EVs, is highest.

There are several reasons for choosing nuclear over solar. Despite its popularity over the past few years and the cost of solar power dropping significantly, it still suffers from several drawbacks including: high installation costs ($2,000 to $3,700 per kilowatt hour compared to $1000 for natural gas and $1,200 to $1,700 for wind); the large amount of land required for industrial-scale solar farms; and the fact that plants are limited as to where they can be sited; the intermittency factor, where power can only be generated when the sun shines, limiting solar to sunny climates; and the need to build new transmission infrastructure like power lines.

The electricity needed for any country to successfully augment, if not replace fossil fuels, both for transportation and everyday use, will have to come from nuclear power generation. There is simply no other logical alternative.

For more read Nuclear power, it’s no contest

Conclusion

What does this mean for uranium demand and U explorers like Skyharbour Resources? It means that more uranium needs to be mined in order to bridge what is expected to be a yawning gap between supply and demand.

According to nuclear consultant UxC, the global capacity for nuclear power is expected to grow by 27% between 2015 and 2030. UxC estimates annual uranium demand will spike by nearly 60%, from the current 190 million pounds of U3O8 to 300 million pounds by 2030.

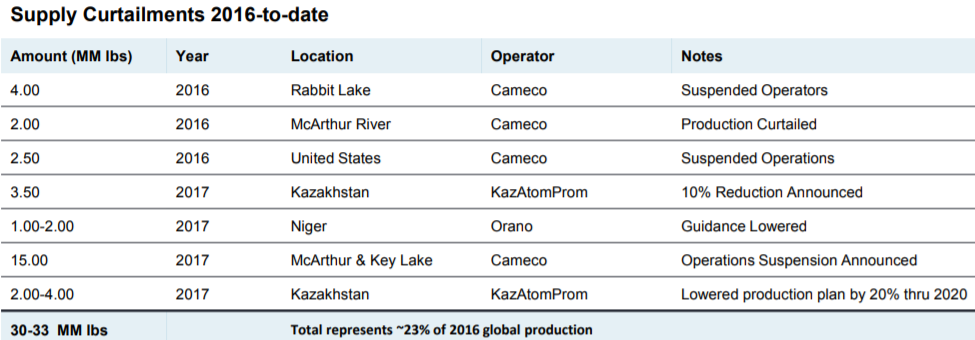

But there’s a problem. Uranium supply has been steadily dropping since 2016. That year total mined supply was around 163 million pounds, in 2017 it was 154 million, and this year it’s estimated to be under 135 million. With current U3O8 demand at 192 million pounds, that leaves a shortfall of at least 57 million pounds. It’s basic economics: When demand exceeds supply, prices go up.

For more on the uranium market, including the demand and supply picture, uncovered demand and proposed import tariffs on uranium, read our Why the uranium price must go up.

The last hot uranium market, before 2011, ran the spot price up to $138 per pound, and made investors a lot of money. I’ve got the coming bull market for uranium on my radar screen, along with Skyharbour’s assays as they explore the basement rocks at Moore. And then it’s on to drilling at Preston. Stay tuned.

Richard (Rick) Mills

Just read, or participate in if you wish, our free Investors forums.

Ahead of the Herd is now on Twitter.

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified.

Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard owns shares of Skyharbour Uranium (TSX-V:SYH).

MORE or "UNCATEGORIZED"

NEW GOLD COMPLETES US$173 MILLION BOUGHT DEAL FINANCING

New Gold Inc. (TSX: NGD) (NYSE American: NGD) is pleased to annou... READ MORE

SILVER VIPER CLOSES LIFE OFFERING

Silver Viper Minerals Corp. (TSX-V: VIPR) (OTC: VIPRF) announces... READ MORE

MAX Power Closes $1.9 Million Private Placement

MAX Power Mining Corp. (CSE: MAXX) (OTC: MAXXF) (FRANKFURT: 89N) ... READ MORE

McEwen Copper Announces Completion of the Feasibility Drilling Program

70,000 meters completed, highlights include: 349.0 m of 0.77... READ MORE

Rupert Resources Reports Results From Project Drilling Including 120m at 6.2g/t Gold

Rupert Resources Ltd. (TSX:RUP) reports assay results from projec... READ MORE