Rick Mills – “Silver47 Exploration Corp: Building a Silver Company”

Silver47 Exploration Corp (TSX-V:AGA) is focused on developing high-potential silver projects to meet the increasing demand for silver driven by strong industrial demand, persistent structural supply deficits and increased investment interest in the face of increasing economic uncertainty, plus a compelling mix of critical minerals including silver, copper, zinc, lead, antimony and tin.

Among its trio of projects — Red Mountain, Adams Plateau and Michelle — Red Mountain is the flagship property. But AGA also gained a handful of highly prospective new properties through a recent merger.

Summa-Silver47 merger

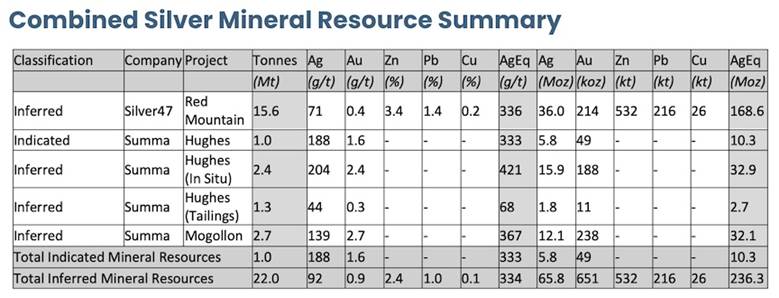

Silver47and Summa Silver (TSX-V:SSVR) in May announced an agreement to merge their respective companies by way of a court-approved plan of arrangement. The combined company is continuing under the name Silver47 Exploration Corp.

Silver47 and Summa Silver merge into high-grade US silver explorer

According to the news release, the combined company will become a premier high-grade silver focused explorer and developer with a portfolio of silver-rich projects in the United States (Alaska, Nevada and New Mexico). Collectively, mineral resources amount to approximately 10Moz silver-equivalent (AgEq) at 333 g/t AgEq of indicated mineral resources and 236Moz AgEq at 334 g/t AgEq inferred mineral resources, with substantial upside and a shared vision for significant additional silver discovery and consolidation.

The merger was completed on Aug. 1.

Existing Silver47 and Summa shareholders now own approximately 56% and 44% of the outstanding Silver47 shares, respectively.

“Silver47 now emerges as a premier United States-focused high-grade silver explorer and developer,” said Silver47’s CEO Galen McNamara. “Uniting projects in Alaska, Nevada, and New Mexico cumulatively hosting well over 200 million silver equivalent ounces with clear upside potential, we’re poised to benefit from a renewed interest in United States mineral development at a time when the importance of domestic production has returned to the national spotlight. With a talented team, strong cash position, and support from our shareholders, we plan to aggressively drive exploration, growth, and development. This combination enhances our scale and visibility in an emerging silver and critical metals market, positioning us to advance our vision and deliver ongoing value to shareholders.”

Red Mountain

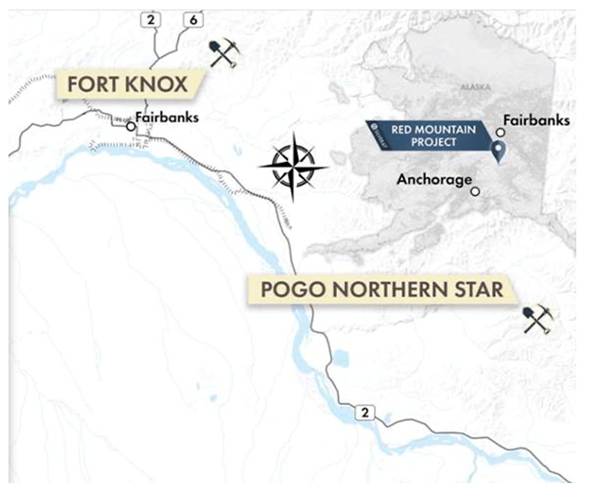

Located 100 kilometers south of Fairbanks, Alaska, Red Mountain is situated on Alaskan state-managed lands, free from Bureau of Land Management (BLM) or indigenous claims, covering approximately 620 square kilometers of highly prospective stratigraphy with highways, railway, and power within 30-80 km.

Silver47 owns 942 mineral claims and one mining lease, providing extensive exploration opportunities over a 60-km trend in a mining-friendly region near infrastructure.

The area is host to several world-class deposits and mines, including Fort Knox due west, and Pogo Northern Star to the south.

Location of Red Mountain Project

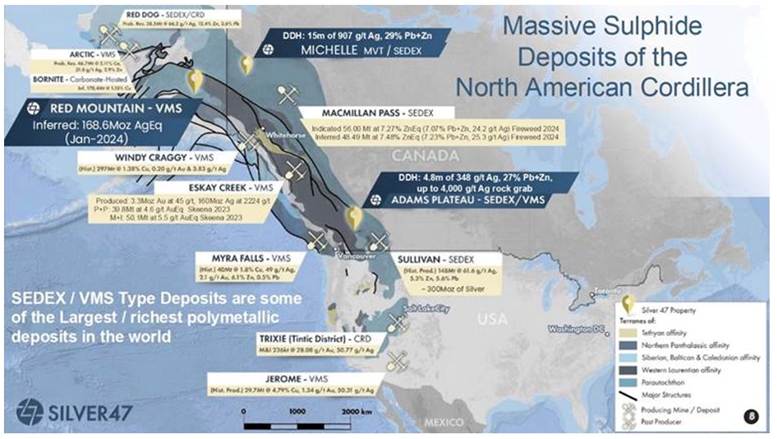

Silver47’s Red Mountain Project is nestled among several multi-million-ounce volcanogenic massive sulfide (VMS) and sedimentary exhalative (SEDEX) deposits, all located within the North American Cordillera, the mountain chain running along the Pacific coast of the Americas.

As seen on the map below, this includes Teck Resources’ Red Dog mine in Alaska, Barrick Gold’s former Eskay Creek mine in northwestern British Columbia now being developed by Skeena Resources, Windy Craggy, Macmillan Pass, Myra Falls, Sullivan, Trixie and Jerome.

VMS and SEDEX

SEDEX and VMS deposits are some of the largest and richest in the world.

Volcanogenic massive sulfides are created by volcanic-associated hydrothermal events in submarine environments. They are predominantly stratiform accumulations of sulfide minerals that precipitate from hydrothermal fluids on or below the seafloor. These deposits are one of the richest sources of zinc, copper, and lead, with gold and silver as byproducts.

VMS deposits are the primary source for many of the materials used to mold the modern world. These include zinc, lead, and copper.

At Ahead of the Herd (AOTH), we believe there are many reasons a junior that comes upon a VMS deposit will be the belle of the ball as far as attracting investors, company suitors looking for a partner, a property, or an acquisition.

Due to the usual clusters of deposits, or ore lenses, in close proximity to the initial discovery, and the polymetallic nature of the ore, VMS deposits have immense potential for scalable high grade, long-term production.

Typically, several deposits feed a central mill so VMS mine production can be scaled up to produce high metal volumes for many years. Also, the byproduct credits generated from production of different metals can help miners enhance their cash profile — one or two of the metals considered a byproduct might cover a portion, or all mining costs.

And, because of their polymetallic content, they continue to be one of the most desirable types of deposit because of the security offered against fluctuating prices of different metals.

You have rich base-metal content and often precious metals to boot. Usually when gold and silver prices are up, the economy isn’t doing so well and base metals prices are down. The reverse happens during economic booms. VMS mines are winners through all the ups and downs of economic cycles.

All of these reasons are why VMS deposits have long been recognized, by both majors and juniors, as potential “elephant” country.

Some of the largest VMS deposits in Canada include the Flin Flon mine (62Mt), the Kidd Creek mine (+100Mt) and the Bathurst No. 12 mine (+100Mt).

Sedimentary exhalative (SEDEX) deposits are geologically close cousins to VMS deposits, with the main difference being their host rocks. VMS deposits are dominantly copper-rich and associated with volcanic activity. SEDEX deposits are dominantly lead and zinc-rich and rely mainly on the heat caused by the depth and burial in deep sedimentary basins to drive the hydrothermal system. (911metallurgist)

Both deposit types share fundamental similarities in their formation processes, involving metal-rich fluids depositing minerals under specific temperature and pressure conditions.

SEDEX deposits generally occur in larger sizes and with more consistent grades compared to VMS deposits. They can range from 1 million to 100 million tonnes, with average metal grades between 10 and 12%, making them highly attractive exploration targets despite their relative scarcity. (Discovery Alert)

Red Mountain exploration

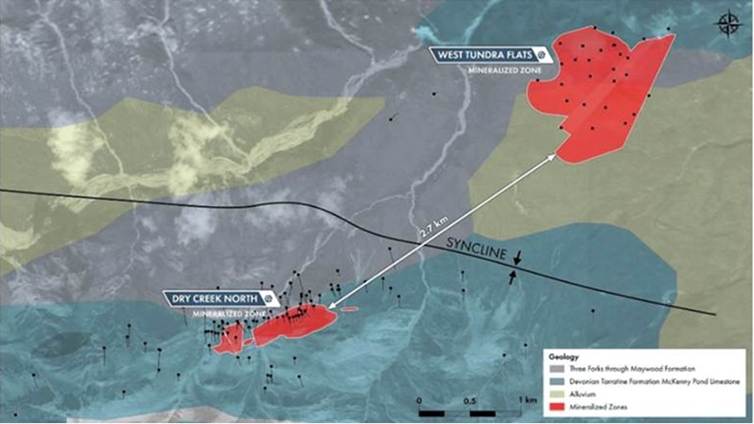

The Red Mountain project area has a rich history of mineral exploration, with the first sulfide outcrop discovered in 1975. Ongoing exploration efforts continue to reveal the potential for further resource expansion, particularly in the Dry Creek and West Tundra Flats zones.

Repeating prospective geology hosts sulfide mineralization within multiple untested geochemical and geophysical anomalies.

Total drilling to date is 39,400 meters, Dry Creek and West Tundra Flats combined. Better core recovery from 2024 drilling resulted in improved grades. Drilling highlights from the Dry Creek Zone include:

- DC24-105: 22.3m @ 150.6 g/t Ag, 0.82 g/t Au, 5.86% Zn, 2.60% Pb, 0.13% Cu from 18.9m down hole (601 g/t AgEq)

- DC18-79: 6.0m @ 409 g/t Ag, 5.38 g/t Au, 1.21% Cu, 23.3% Zn+Pb (2,155 g/t AgEq)

- DC18-77: 5.0m @ 1,213 g/t Ag, 1.87 g/t Au, 0.4% Cu, 6.0% Zn+Pb (1,719 g/t AgEq)

And from West Tundra Flats:

- Multiple high-grade drill intercepts, including 7.3m @ 334.8 g/t Ag, 0.54 g/t Au, 0.07% Cu, 5.42% Pb+Zn (619 g/t AgEq)

Resource estimate

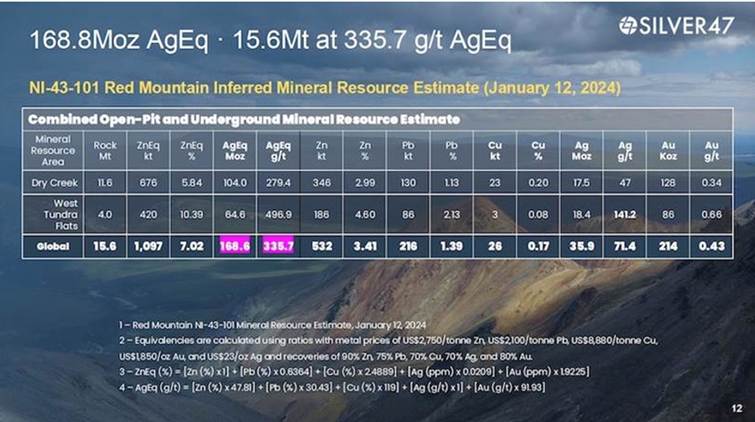

On Jan. 12, 2024, Silver47 came out with a mineral resource estimate for Red Mountain. The combined open-pit/ underground inferred resource amounts to 15.6 million tonnes at 335.7 g/t silver-equivalent (AgEq), containing 168.6Moz AgEq.

Drill program

On June 18, 2025, AGA commenced its fully funded drill program at the Red Mountain VMS project; 4,000 meters is planned to boost Silver47’s high-grade silver and critical minerals.

The program focuses on expanding the inferred 168.6 million silver-equivalent-ounce resource (336 g/t AgEq) at Dry Creek and West Tundra Flats, where previous drilling by Silver47 and prior operators indicates significant expansion potential.

West Tundra Flats and Dry Creek are about 2.7 kilometers apart, so the question Silver47 wants to answer is do they connect?

Summa Silver’s oversubscribed $6.9 million subscription receipt financing closed on June 17. Silver47 previously raised $9.8 million, so with the upsized private placement of $6.9M, AGA has $15.8M in the treasury — plenty of funds with which to conduct the current drill program.

To date, nine holes have been completed at the Dry Creek and West Tundra Flats deposits, where zones of massive, semi-massive and disseminated sulfides have been intersected in both step-out and infill holes. Assays are pending.

Mineralized core from hole WT25-38 at the West Tundra Flats deposit showing disseminated, semi-massive and massive sulfides consisting of pyrite, pyrrhotite, sphalerite, galena and chalcopyrite (172.65 to 180.5m downhole).

2026 drill targets

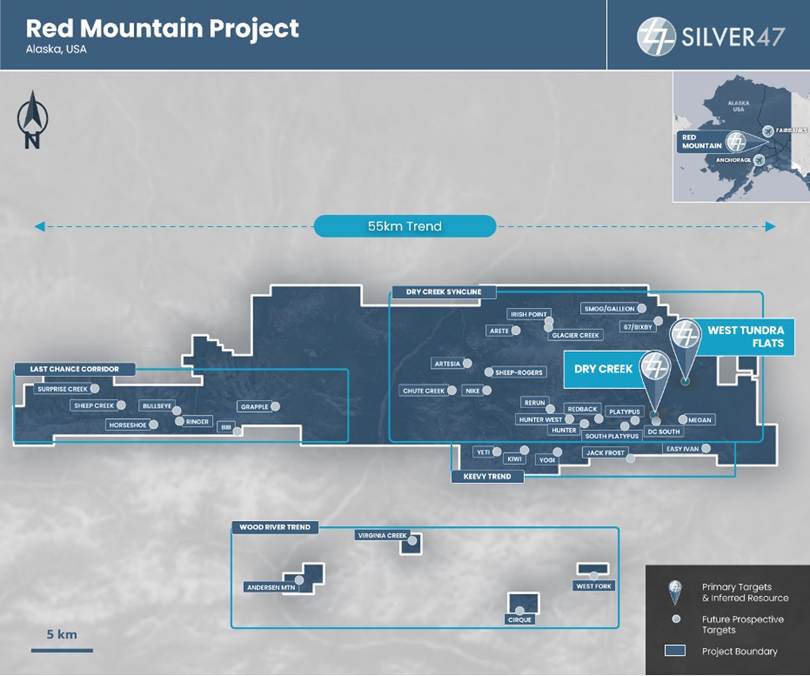

Silver47 on Aug. 13 unveiled multiple exploration targets with strong discovery potential across the Red Mountain Project. Undrilled silver-rich and polymetallic occurrences are dispersed across a 55-kilometer, highly prospective east-west corridor the company is calling the Bonnifield District. (see map below)

Building on the inferred resource estimate totaling 168.6 million silver-equivalent ounces, the drill targets leverage past work. A database of historic geochemical and geophysical data, including 2,543 rock samples, 7,948 soil samples and 15,862 XRF soil samples has revealed a series of new targets outside the current resource zones that the company is developing for drilling in 2026.

Ongoing compilation highlights at least 35 mineralized prospects, many of which are undrilled or represent preliminary drilled discoveries open to expansion.

Multiple zones of high-grade surface mineralization marked by samples collected by a previous operator representing significant polymetallic upside are highlighted by grades of:

- 1,295 g/t silver at the Galleon target

- 3.8 g/t gold at the Horseshoe target

- 16.2% copper at the Kiwi target

- 32% zinc at the Anderson Mountain target

- 20% lead at the Jack Frost target

- 4,850 g/t antimony at the Bib target

- 149 g/t gallium northeast of the West Tundra Flats deposit

- 98 g/t indium at the Jack Frost target

- 0.13% tin at the Sheep Creek target

“Our Red Mountain Project in Alaska is emerging as a premier silver and critical metals asset in the U.S.,” said Silver47’s CEO Galen McNamara.

“By leveraging extensive historic data, we’ve identified dozens of high-potential targets along broadly mineralized trends. The prospectivity of these targets was first identified by past operators, and I agree; the data suggest the likely presence of additional undiscovered and potentially giant VMS deposits on the project. I am unaware of any other domestic mineral projects with similar polymetallic discovery potential. In addition, ongoing drilling at Dry Creek and West Tundra Flats continues to intersect promising sulfide zones, with assays pending, positioning Red Mountain to deliver significant value and strengthen domestic critical mineral supply chains in the future.”

Priority volcanogenic massive sulfide (VMS) exploration targets at the Red Mountain Project are dispersed across the highly prospective Bonnifield District. The targets vary from zinc-rich to copper-rich and many have associated high-grade silver and local gold mineralization.

Four main target trends are defined and include: Dry Creek Syncline, Keevy Trend, Last Chance Corridor and Wood River Trend. Many of the targets across the Dry Creek Syncline area were known historically, however, numerous high-priority targets across the Keevy and Last Chance areas were more recently identified through regional stream sediment, ridge-spur soil and rock geochemical surveys and project-wide EM geophysical surveys completed by a past project operator. Of the 30 known targets as well as other un-explored EM targets, only 11 targets have been drill-tested, five of those with less than three holes each.

Dry Creek Syncline: The best-known targets associated with the Dry Creek Syncline are the Dry Creek and West Tundra Flats deposits.

VMS targets are located along both limbs of the project-scale, east-west trending Dry Creek Syncline, where approximately 40 km of prospective VMS stratigraphy (Mystic and Sheep Creek members of the Totatlanika schist) is well exposed. Many targets along the syncline are associated with pronounced EM anomalies and have been mostly defined by stream, soil and rock-chip geochemistry and limited ground geophysical surveys (magnetics and CSAMT). High-priority targets across the Dry Creek Syncline area include:

- Hunter: Massive sulfide mineralization at the Hunter target, 5.8 km west of Dry Creek, has been traced for over 500m within a carbonaceous phyllite that is traced for over 1 km. Rock chip sampling of the Hunter outcrop discovery returned assays up to 616 g/t Ag, 18.6% Zn, 5.4% Pb, 2.5% Cu, and 0.33 g/t Au. Six drill holes in 2018, 2019 and 2021 successfully tested the dip-extent of the massive sulfide lens highlighted by 1.4m of 17.4% Zn, 3.9% Pb, 1.6% Cu, 90 g/t Ag and 0.23 g/t Au (HR18-01)2 and 1.8m of 13.8% Zn, 3.1% Pb, 56 g/t Ag, 0.2 g/t Au and 0.9% Cu (HR18-02)2. VMS-related mineralization at Hunter is therefore open in all directions and further drilling testing of the strike- and dip-extent is warranted.

- Glacier Creek: The Glacier Creek suite of targets is approximately 12.3 km northwest of Dry Creek. The ~6 km-long target area is primarily underlain by the highly prospective Totatlanika schists and is defined by numerous EM anomalies and broad km-scale color anomalies and associated sericite alteration. Rock chip sampling is sparse, and soil-surveys have only been ridge-spur; however, numerous multi-element geochemical anomalies have been defined, together with barium enrichment in many samples. Seven holes were drilled across two programs covering a 2-km trend in 1998 and 2019. Additional geological mapping, soil and rock geochemical surveys are warranted to advance the known targets and to define drill targets.

- Galleon: The Galleon target is approximately 9.0 km north of Dry Creek. Similar to Glacier Creek, the Galleon target is primarily underlain by the Totatlanika schist where numerous showings of VMS-style, high-Pb-Zn-Cu massive sulfide mineralization have been discovered. Importantly, numerous samples from Galleon returned elevated to high-grade Ag and Au mineralization. Rock samples with up to 1,265 g/t Ag, 2.18 g/t Au, 2.4% Zn, 1.656% Pb and 1.7% Cu have been reported. Additional geological mapping, soil and rock geochemical surveys are clearly warranted to advance the known targets, followed by drill testing.

Keevy Trend: The Keevy VMS trend consists of numerous high-grade VMS targets dispersed along 25 km of favorable Keevy Peak Formation and Healy Schist stratigraphy south of the Dry Creek Syncline area. From east to west the targets comprise Lowrider, Easy Ivan, Jack Frost, Yogi, Kiwi, and Yeti with multiple unexplored EM targets west of Yeti. These targets have massive sulfide occurrences comprised of sphalerite, galena and chalcopyrite with other key VMS indicators such as chert, black barite and broad zones of sericite alteration and strongly anomalous base-metal soil anomalies. Highlights and key indicators of VMS potential from the Keevy VMS trend include:

- Kiwi: up to 316 g/t Ag, 16.2% Cu, 10.3% Zn, 1.7% Pb, and 2.8 g/t Au in rock samples

- Easy Ivan: up to 87.1 g/t Ag, 6.0% Zn, 12.3% Pb, and 0.45% Cu in rock samples

- Jack Frost: up to 285 g/t Ag, 14.0% Zn, 20.0% Pb, and 1.1% Cu in rock samples

- Yeti: black barite with elevated silver and strong base metal soil anomalism

Besides sparse ridge-spur and local grid soil surveys, prospecting and rock sampling many of the targets are under-explored and represent priority targets for follow-up. Geological mapping and infill soil geochemical surveys are planned to advance many of the targets along the highly prospective Keevy Trend.

Last Chance Corridor: The Last Chance area of prospective VMS targets is centered approximately 40 km west of the Dry Creek deposit. These targets may represent the western extent of the Keevy Trend. Seven targets have been defined covering a prospective corridor of 15 km primarily underlain by the Healy Schist and include from east to west: Copper Creek, Grapple, Bib West, Bullseye, Ringer, Sheep Creek and Horseshoe. The VMS lenses exposed in outcrop consist of pyrrhotite, pyrite and/or sphalerite, galena and chalcopyrite. Only the Sheep Creek target has been drill-tested (1979 program by US Borax1) and all targets are primarily defined based on rock, soil and stream sediment anomalism and airborne and local ground-based geophysical methods. Highlights from previous rock-chip sampling include:

- Horseshoe: up to 8.3% Zn, 4.6% Pb, 0.76% Cu, 44 g/t Ag and 3.8 g/t Au in rock samples

- Bib: up to 7.3% Zn, 5.1% Pb, 0.3% Cu, 60 g/t Ag and 0.47 g/t Au in rock samples

- Grapple: up to 5.1% Zn, 13.2% Pb, 0.79% Cu and 139 g/t Ag in rock samples

- Ringer: up to 0.72% Cu, 27 g/t Ag and 1.0 g/t Au in rocks samples

- Sheep Creek: up to 306 g/t Ag, 4.3% Zn, 3.98% Pb, and 0.18% Cu in rock samples and 24.5 m of 1.3% Zn,1.0% Pb and 0.127% Sn in historical drilling

Follow-up geological mapping, infill soil geochemical surveys and additional higher-resolution magnetic surveys are planned to further advance many of the Last Chance targets.

Wood River Trend: Four high-grade VMS targets cover a 24-km trend on the southern limb of a district-scale anticlinal fold that runs parallel to the Dry Creek syncline. The targets are hosted in prospective Healy and Wood River Assemblage schists which host VMS-related mineralization elsewhere in the Bonnifield District. From east to west the targets include West Fork, Cirque, Virginia Creek and Anderson Mountain. Select historical rock-chip sampling and select drilling highlights include:

- West Fork: up to 3.5% Zn, 2.5% Pb, 1.2% Cu and 73g/t Ag in rock samples

- Cirque: up to 487 g/t Ag, 13.2% Zn, 3.8% Pb, 12.4% Cu and 3.7 g/t Au in rock samples

- Virginia Creek: historical drilling, 14.8m at 3.3% Zn, 0.8% Pb, 78 g/t Ag, 0.2g/t Au and 0.5% Cu and rock samples up to 2.8% Zn, 0.65% Pb, 74.1 g/t Ag, 1.01 g/t Au and 1.3% Cu

- Anderson Mountain: historical drilling, 161 g/t Ag, 0.6 m at 22% Zn, 4.8% Pb and 0.6% Cu1 and up to 151 g/t Ag, 32% Zn, 8.8% Pb and 3.8% Cu in rock samples. The prospective VMS horizon is mapped for over 240m.

Follow-up geological mapping, infill soil geochemical surveys and additional higher-resolution magnetic surveys are warranted to further advance many of the Wood River trend of VMS targets.

Plan map of Red Mountain Project

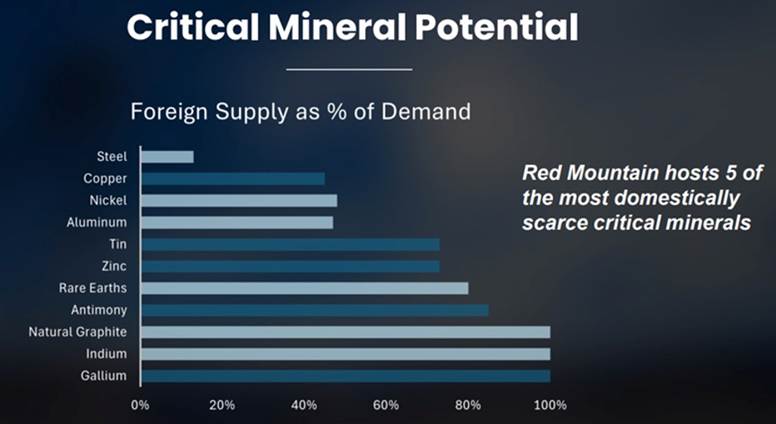

Critical minerals

Red Mountain hosts five critical minerals scarce in the US, including zinc, copper, tin, antimony and gallium, which will be evaluated during this drill program to support domestic supply chain security.

China has recently announced the halt of shipments of five critical metals to the United States. These elements include antimony, gallium, germanium, tungsten and indium. VMS deposits often carry critical metals in trace amounts. Prices, since the halt of exports, have soared, making previously uneconomic amounts potentially economic.

“The identification of gallium and antimony, among other critical minerals, within the resource zones has the potential to add significant value to our Red Mountain project,” said AGA’s Executive Chairman Gary Thompson. “While we are focused on growing the silver-gold and base metals resource at Red Mountain, further assessment of these critical minerals, which are used in a myriad of high-tech applications, is planned to better understand the potential contribution that they may have on the project.”

AOTH analysis

With almost 250 million silver-equivalent ounces (Silver47 + Summa Silver), Silver47 is 25% of the way to their 1 billion silver-equivalent (AgEq) target. This is what scalability — growing in the silver space — looks like.

I’ve always said the best leverage to a rising commodity price is a quality junior with experienced management, an excellent property located close to infrastructure and a workforce in a mining-friendly jurisdiction, and a resource estimate with room for expansion.

While Dry Creek and West Tundra Flats are the current focus, Silver47 has dozens more drill targets slated for testing next year. Noting the company has 10-12Moz of high-grade zinc-silver resources at Red Mountain, Quinton Hennigh, a highly respected geologist well known to retail investors, says if they can find a few more tens of millions of ounces, which is entirely possible, Silver47 could be looking at a resource base supportive of a large mine — possibly even analogous to Hecla’s Greens Creek.

The only problem with Red Mountain is it’s in Alaska, meaning it’s expensive to work year-round. Hence the rationale for the Summa-Silver47 combination.

But with its new southern properties Silver47 can explore year-round as opposed to a relatively brief window in the summer between break-up in the spring and the onset of winter.

Mogollon

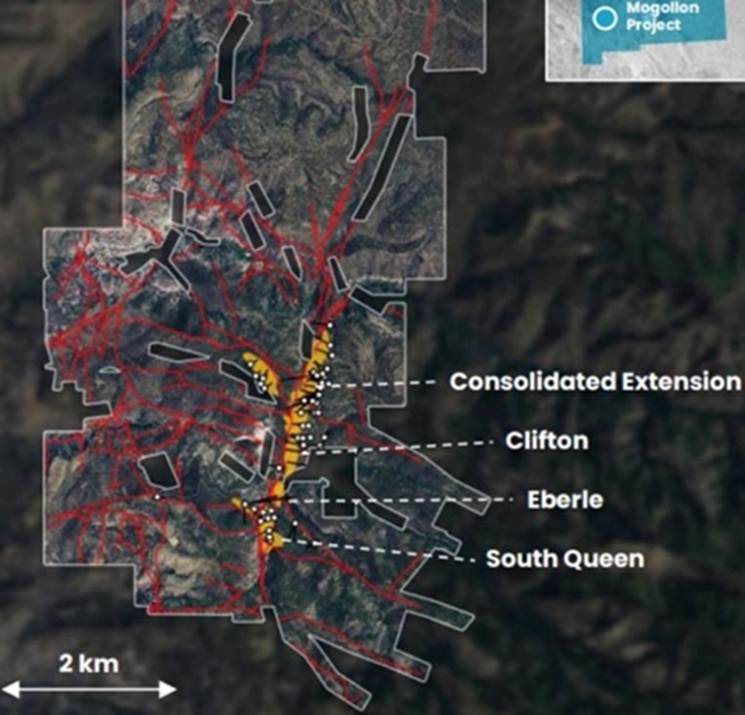

AGA’s most interesting new project is called Mogollon, it’s in New Mexico.

The project is a continuation of the big vein systems found in Mexico and is thought to be one of the biggest epithermal vein systems in the western United States.

Mogollon has shown good results to date, for example 31 meters at 448 grams per tonne silver-equivalent, and 23.2m @ 433 g/t AgEq.

For an illustration, look at the red-colored silver veins criss-crossing almost the entire project in the map above.

Mogollon has an inferred resource of 32 million oz of silver-equivalent; it grades 367 AgEq grams per tonne. The grade is good, metallurgical recoveries are 97% for silver, 98% for gold, and it’s interesting in that all of that work has been done on only 2.4 kilometers of these vein structures. There’s still 77 kilometers of vein structures of silver and gold that have not been drilled.

The idea would be Silver47 to explore Mogollon in the winter, allowing for meaningful growth to the 32Moz resource. Of course, you have the whole vein field that hasn’t even been tested yet.

Hughes

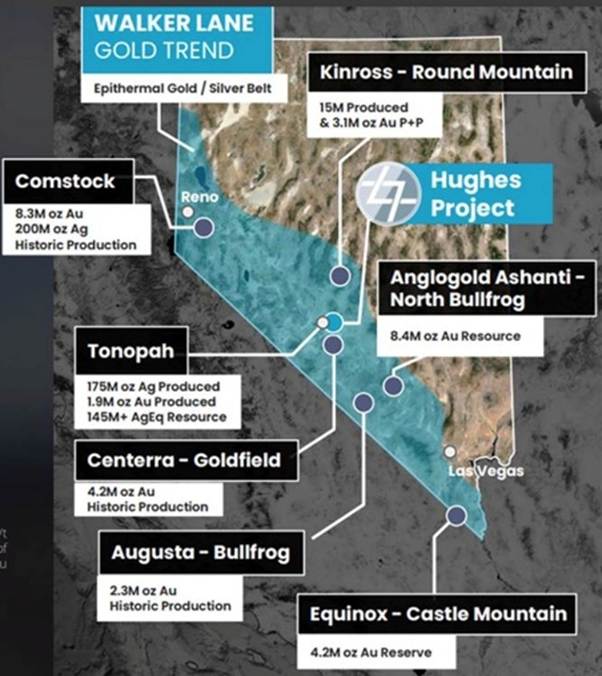

Silver47’s second new project is in Nevada; it’s in the historic Walker Lane District and it’s very close to Tonopah, the queen of the Silver District.

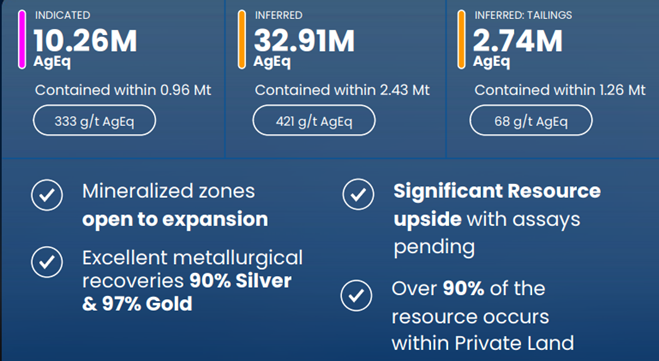

BlackRock Silver has 100 million silver-equivalent oz on the west side of the district and Silver47 has the east side of the district: they have a resource on the Hughes, an inferred resource at 33 million ounces of silver-equivalent and then there’s another 10 million ounces in the indicated category.

The third new project is Kennedy; it was new to Summa and not much work has been done. But AGA knows there’s 22 km of gold and silver veins.

This gives the company the all-important news flow that is the life blood of any junior; news will literally be coming out year-round from its southern and northern projects.

There are two ways to grow a mining company: the first is through the drill bit. And the other is through mergers and acquisitions.

Why get bigger? Larger companies attract more capital, they attract institutional investors and if you look at both companies, they’re still largely a retail story and that’s great but you need to get bigger. Getting bigger is better for all because you attract more capital and as I’ve said before, mining is a capital-intensive business.

Conclusion

Silver47 is focused on VMS and SEDEX mineralization in their current work program at Red Mountain. The property is unique because there are so many surface showings. The gossans are rusty rocks that are exposed at surface and there’s a lot of them; it’s basically weathering and oxidation of the sulfides and these are good first indicators for geologists.

The other thing about these VMS deposits is they come in a string and when you find one, you’re bound to find another; Silver47 has two of them already, they think.

Here’s 321gold’s Bob Moriarty’s take on Silver47:

I’ve owned part of a project in Alaska named Red Mountain about 100 km south of Fairbanks for a long, long time. It was owned by an Australian company named White Rock Minerals that ran it into the ground before going into bankruptcy. But it was bought by a silver-oriented company called Silver47 (AGA-V SVEXF-Pink sheets).

At the time they owned a giant silver project in the Yukon that also was buried in red tape. I suggested to them they contact the bankruptcy court for White Rock to see if they could do a deal on Red Mountain. They did and now own it. Red Mountain has a 43-101 showing 15.6 million tonnes at a grade of 335.7 g/t AgEq for a total of 168.6 million ounces of silver Eq. The company is targeting 1 billion ounces of AgEq in this massive district scale VMS deposit of silver, lead, zinc, and copper.

But company president Gary Thompson realized that similar giant VMS projects often carry what was trace elements of critical metals such as antimony and gallium, niobium and vanadium. Before China cut off the supply to the United States those minerals were more interesting than economic. With the increase in price we know is coming, all of a sudden those metals turn into the icing on an already rich cake. The Red Mountain deposit is one of the highest-value properties in terms of metal in the ground values in the world.

Currently antimony is priced at about $25 per kilo. In a press release dated the 12th of February Gary listed some of the outstanding results from assays done in the past for antimony. The most valuable grades of antimony showed up in assays from the Dry Creek zone with values up to 6.23 kilos per tonne worth $155 USD per tonne in the ground.

Gallium is quoted at $934 USD per kilo. Assays show as high as 116 ppm gallium worth $108 per tonne in the ground. Those numbers do not of course reflect average grades or how much is recoverable. Studies are being done presently by Silver47 to determine how much is recoverable. And one important factor is what would it cost in adding an antimony or a gallium circuit to a processing mill. But what should be obvious is that (1) Silver47 has a lot of critical metals now in short supply and (2) to regain footing to be able to compete in manufacturing in the world, the US must develop resources of its own and the processing plants to separate them.

Silver47 was an interesting investment before the addition of more potential valuable elements in the mix. Essentially you are buying silver Eq ounces for $0.16 CAD an ounce. I don’t think it gets any better than that. With a 43-101 resource of 15.6 million tonnes, worth about $5 billion, Silver47 is one of the cheapest silver, lead, zinc projects in the world. It will be a mine.

There are very few pure silver companies out there. Most silver is produced as a byproduct of copper or VMS deposits. Silver47’s Red Mountain is not a pure silver project, but it has 168 million ounces of silver-equivalent, so this is one of the cheapest ways to invest in silver in an environment of rising prices.

Silver is breaking out, up around 30% year to date, surpassing even gold. In January 2025, the Silver Institute forecasted another deficit in the silver market, with annual demand at 1.20 billion ounces and supply at 1.05 billion ounces. The 150-million-ounce shortfall would be the fifth consecutive year that silver demand outstrips supply.

The bullish factors for silver include the ongoing supply deficits, as silver miners fail to keep up with demand from the solar power sector and electric vehicles, specifically. Solid-state batteries and new applications like AI data center chips, advanced electrical relays, smart grid infrastructure upgrades, and every US manufacturing facility, will pile on more demand for silver. Mine supply has shrunk 7% since 2016.

The investment case for silver is also strong, and getting stronger, as market participants price in at least once rate cut in September, and possibly another in December, despite the threat of inflation posed by the Trump tariffs, as imported goods get more expensive. In the first half of 2025, silver ETFs saw significant inflows, reaching 95Moz.

Trump is actively trying to manipulate the Federal Reserve’s Board of Governors, to replace current Fed Chair Jerome Powell with personnel more on board with interest rate cuts. A rate cut in September would certainly be a tailwind for precious metals.

The bullish market conditions for silver have shaped the ideal environment for silver explorers like Silver47 Exploration.

Red Mountain has, so far, nearly 40,000m of drilling on the two main deposits, Dry Creek and West Tundra Flats. A 2024 combined open-pit/ underground inferred resource amounts to 15.6 million tonnes at 335.7 g/t silver-equivalent (AgEq), containing 168.6Moz AgEq.

Both deposits are open and there is plenty of room for expansion. High-priority targets across the Dry Creek Syncline area include Hunter, Galleon and Glacier Creek.

High antimony and gallium assay values consistently occur within previously reported intervals of high-grade silver-zinc-gold-lead-copper massive sulfides and are distributed throughout the resource. Niobium and vanadium highs occur primarily in the western portion of Dry Creek.

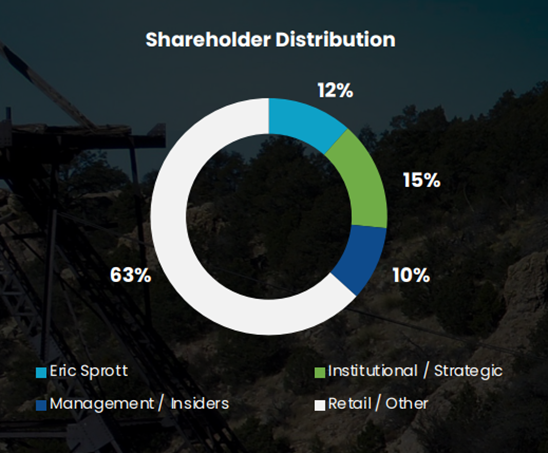

Silver47 has 138 million shares outstanding. About 37% of the shares are held by management, Eric Sprott and Crescat Capital.

Key members of the five-member management team include Executive Chairman Gary Thompson, a veteran geologist who is also chairman and CEO of Brixton Metals; CEO Galen McNamara, co-founder of Summa Silver and a geologist with 20 years of discovery and capital markets experience; and VP Operations Chris York, an economic geologist with 20 years experience focused on sediment-hosted and epithermal narrow vein deposits.

Silver47’s 2025 drill program should provide plenty of news flow for investors including catalysts for share price appreciation.

Silver47 is already looking ahead to 2026 drilling. Ongoing compilation highlights at least 35 mineralized prospects across the Red Mountain Project covering a 55-km trend, many of which are undrilled or represent preliminary drilled discoveries open to expansion.

Silver47 Exploration Corp

TSX.V:AGA

Cdn$0.81 2025.08.13

Shares Outstanding 139.6m

Market Cap Cdn$113m

AGA website

Subscribe to AOTH’s free newsletter

Richard does not own shares of Silver47 Exploration Corp (TSX.V:AGA). AGA is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of AGA

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE