Rick Mills – “Silver47 Drilling to Expand Their Resource”

Silver47 Exploration Corp (TSX-V:AGA) is focused on developing high-potential silver projects to meet the increasing demand for silver driven by strong industrial demand, persistent structural supply deficits and increased investment interest in the face of increasing economic uncertainty, plus a compelling mix of critical minerals including silver, copper, zinc, lead, antimony and tin.

Among its trio of projects — Red Mountain, Adams Plateau and Michelle – Red Mountain in Alaska is the flagship property.

With almost 250 million silver-equivalent ounces, Silver47 is 25% of the way to their 1 billion silver-equivalent (AgEq) target. This is what scalability — growing in the silver space — looks like.

I’ve always said the best leverage to a rising commodity price is a quality junior with experienced management, an excellent property located close to infrastructure and a workforce in a mining-friendly jurisdiction, and a resource estimate with room for expansion.

Of course, the commodity being pursued is key to success. In the case of copper, the fundamentals are bullish due to demand forecasted to outstrip supply for the foreseeable future.

Silver47 Exploration Corp.

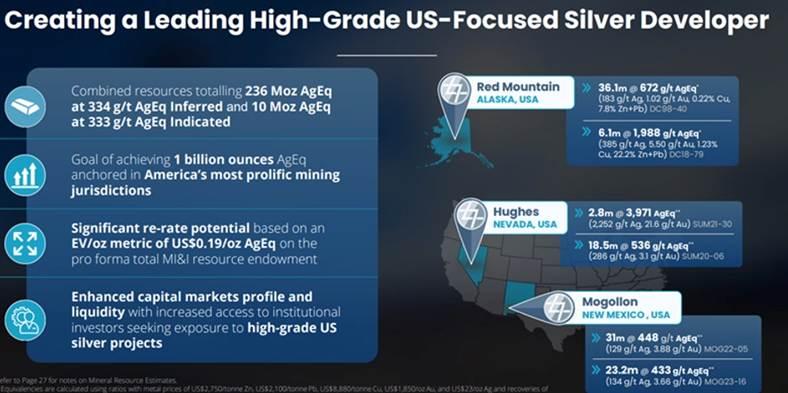

Silver47and Summa Silver (TSX-V:SSVR) in May announced an agreement to merge their respective companies by way of a court-approved plan of arrangement. The combined company is continuing under the name Silver47 Exploration Corp.

According to the news release, the combined company will become a premier high-grade silver focused explorer and developer with a portfolio of silver-rich projects in the United States (Alaska, Nevada and New Mexico). Collectively, mineral resources amount to approximately 10Moz silver-equivalent (AgEq) at 333 g/t AgEq of indicated mineral resources and 236Moz AgEq at 334 g/t AgEq inferred mineral resources, with substantial upside and a shared vision for significant additional silver discovery and consolidation.

Located 100 kilometers south of Fairbanks, Alaska, Red Mountain is situated on Alaskan state-managed lands, free from Bureau of Land Management (BLM) or indigenous claims, covering approximately 620 square kilometers of highly prospective stratigraphy with highways, railway, and power within 30-80 km.

Silver47 owns 942 mineral claims and one mining lease, providing extensive exploration opportunities over a 60-km trend in a mining-friendly region near infrastructure.

The company says there are over 5,000 permitted drill sites on multiple untested geochemical and geophysical anomalies, which should indicate to investors a high potential for new discoveries.

The area hosts several world-class deposits and mines, including Fort Knox due west, and Pogo Northern Star to the south.

In particular, Silver47’s Red Mountain project is nestled among several multi-million-ounce volcanogenic massive sulfide (VMS) and sedimentary exhalative (SEDEX) deposits, all located within the North American Cordillera, the mountain chain running along the Pacific coast of the Americas.

As seen on the map below, this includes Teck Resources’ Red Dog mine in Alaska, Barrick Gold’s former Eskay Creek mine in northwestern British Columbia now being developed by Skeena Resources, Windy Craggy, Macmillan Pass, Myra Falls, Sullivan, Trixie and Jerome.

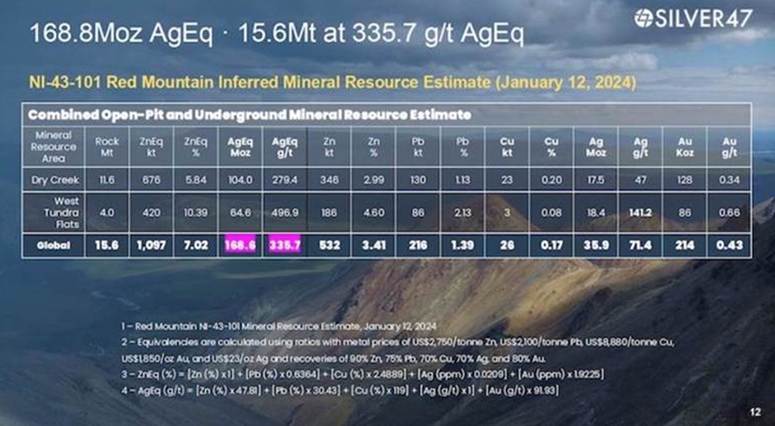

On Jan. 12, 2024, Silver47 came out with a mineral resource estimate for Red Mountain. The combined open-pit/ underground inferred resource amounts to 15.6 million tonnes at 335.7 g/t silver-equivalent (AgEq), containing 168.6Moz AgEq.

The VMS-SEDEX project is polymetallic, containing silver, gold, zinc, copper, lead, antimony and gallium.

Recent exploration has identified significant concentrations of critical minerals, including antimony (up to 0.623%) and gallium, which Silver47 says enhances the project’s strategic value amid growing demand for such elements.

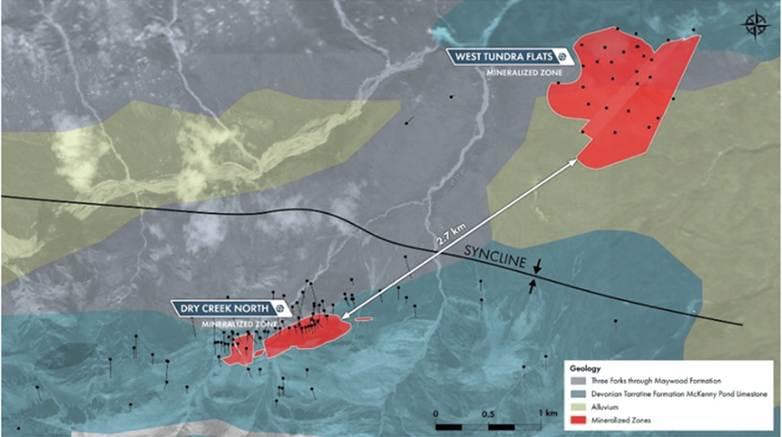

Red Mountain has, so far, nearly 40,000m of drilling on the two main deposits, Dry Creek and West Tundra Flats.

Both are open for expansion, and it is conceptually estimated that $10M in drilling may add 8-12 million tonnes of underground material, in my view a better-than-fair trade-off between further dilution and in-situ increased shareholder value.

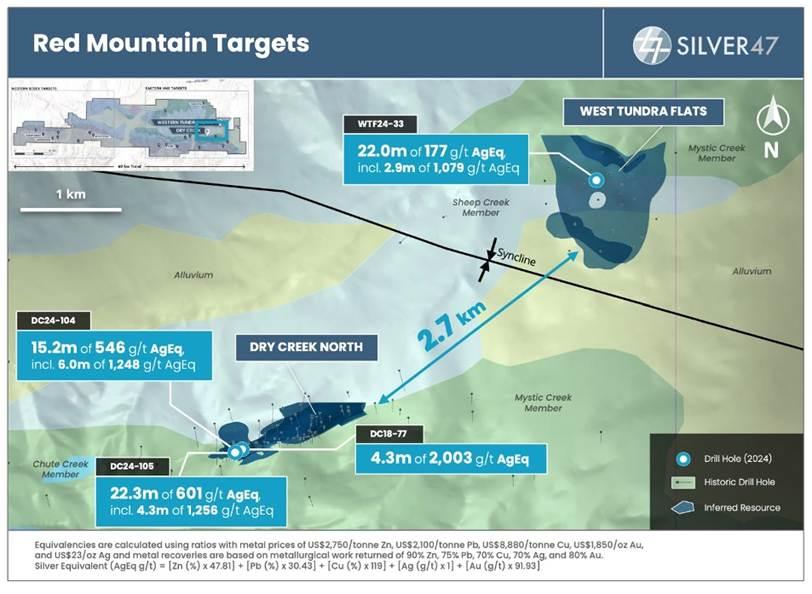

High-grade intercepts at the Dry Creek deposit area include 22.3 meters at 601 g/t AgEq (150.6 g/t Ag, 0.82 g/t Au, 5.86% Zn, 2.60% Pb, 0.13% Cu) from a depth of 18.9 meters.

On June 18, AGA commenced its fully-funded drill program at the Red Mountain VMS project.

A drill rig is now advancing the first hole of Silver47’s 2025 summer exploration program. 4,000 meters Is planned to boost Silver47’s high-grade silver and critical minerals.

The program focuses on expanding the inferred 168.6 million silver-equivalent-ounce resource (336 g/t AgEq) at Dry Creek and West Tundra Flats, where previous drilling by Silver47 and prior operators indicates significant expansion potential.

The 2025 program targets untested areas near historical high-grade intercepts, prioritizing areas richer in silver and gold to enhance Red Mountain’s resource base.

Red Mountain hosts five critical minerals scarce in the US, including zinc, copper, tin, antimony and gallium, which will be evaluated during this program to support domestic supply chain security.

Closing of Summa Silver’s oversubscribed $6.9 million subscription receipt financing was completed on June 17, paving the way for a substantial expansion of the current drilling campaign when the Silver47 and Summa Silver merger is complete.

(Silver47 previously raised $9.8 million, so with the upsized private placement of $6.9M, AGA has $15.8M in the treasury.)

Map of the Dry Creek and West Tundra Flats deposits, and drill targets.

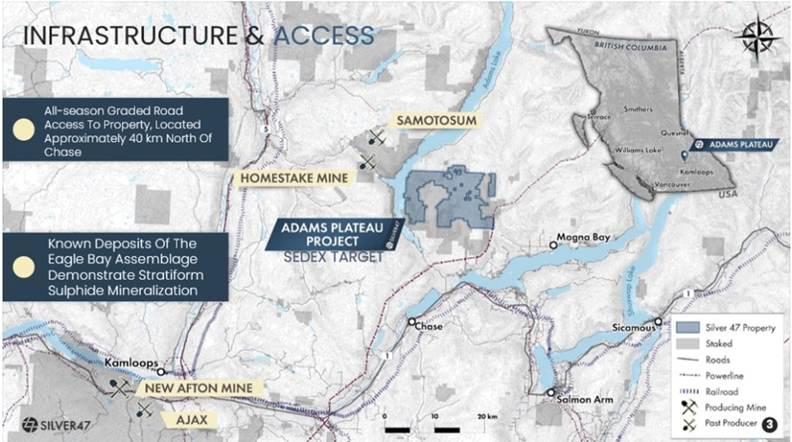

As drilling at Red Mountain ramps up, an exploration program at one of Silver47’s other properties, Adams Plateau, is nearing completion.

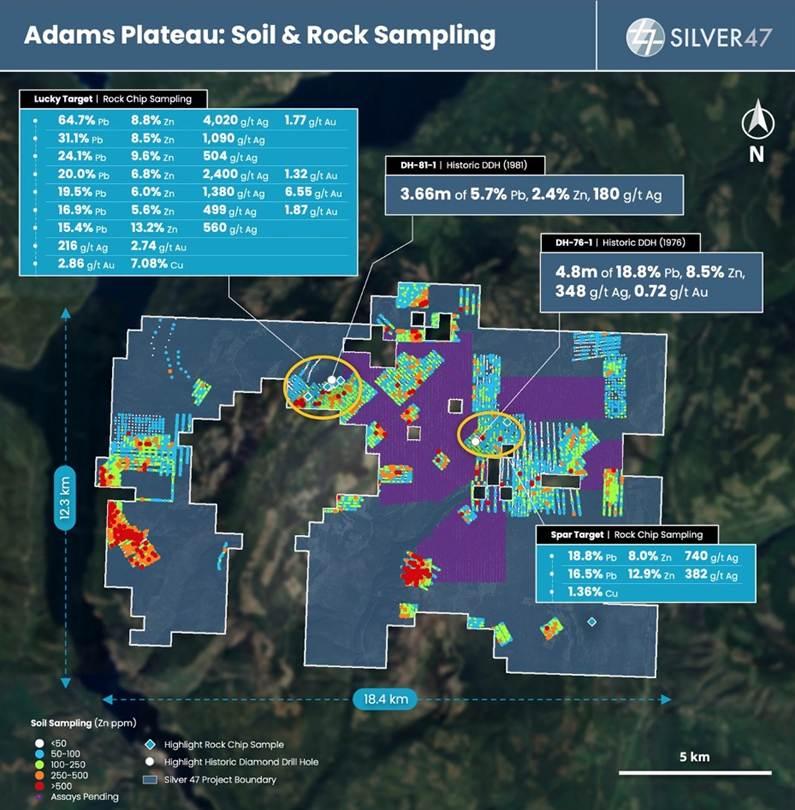

The company put out a news release July 10 saying that 5,008 soil samples were collected over an approximately 35-square-kilometer area with a focus on infilling the historical soil geochemical grid. An additional 76 rock samples have been collected with ongoing prospecting to support future drill targets.

Adams Plateau, about 100 km northeast of Kamloops in southern British Columbia, is a silver-zinc-copper-gold-lead SEDEX project.

Historical surface rock grab samples from across the property returned up to 4,000 g/t silver, 10.4 g/t gold, 7% copper, 30% zinc, and 64% lead. Recent rock samples collected by Silver47 have returned up to:

- 3,503 g/t silver, 1.0 g/t gold, 9.17% zinc, and >20% lead

- 170 g/t silver, 2.8 g/t gold, 7.1% copper, 1.05% zinc, and 0.86% lead

- 2,400 g/t silver, 1.3 g/t gold, 6.8% zinc, and 20% lead

Location map of the Adams Plateau project

Plan map of the Adams Plateau project with zinc in soil and select rock analysis.

According to Quinton Hennigh, a geologist well known to retail investors is the geologic and technical advisor for Crescat Capital, the deposit at Red Mountain is interesting because it contains both volcanic rock and sedimentary rock. This makes is almost feel like a SEDEX (sedimentary exhalative) deposit. SEDEX deposits are known for their high-grade silver, lead, zinc and copper mineralization. Hennigh says it’s helpful to think of a basin full of hot fluids that millions of years ago rose to surface — a tell-tale sign of a large district.

While Dry Creek and West Tundra Flats are the current focus, Silver47 has probably a dozen more drill targets, a lot of which will be tested this year. Noting the company has 10-12Moz of high-grade zinc-silver resources at Red Mountain, Hennigh says if they can find a few more 10s of millions of ounces, which is entirely possible, Silver47 could be looking at a resource base supportive of a large mine — possibly even analogous to Hecla’s Greens Creek.

The only problem with Red Mountain is it’s in Alaska, meaning it can’t be worked year-round. Hence the rationale for the Summa-Silver47 combination.

Most mergers and acquisitions in mining amount to a takeover, but in the case of Summa Silver and Silver47 it’s a merger of equals. Consider: shareholders of each company hold almost the same number of shares, 56% for Silver47 and 44% for Summa. Looking at the pro-forma share structure it’s about 126 million shares on a combined basis.

I like the deal for this reason and the fact that it enables Silver47 to explore year-round as opposed to a relatively brief window in the summer between break-up in the spring and the onset of winter.

This gives the company the all-important news flow that is the life blood of any junior; news will literally be coming out year-round from its southern and northern projects.

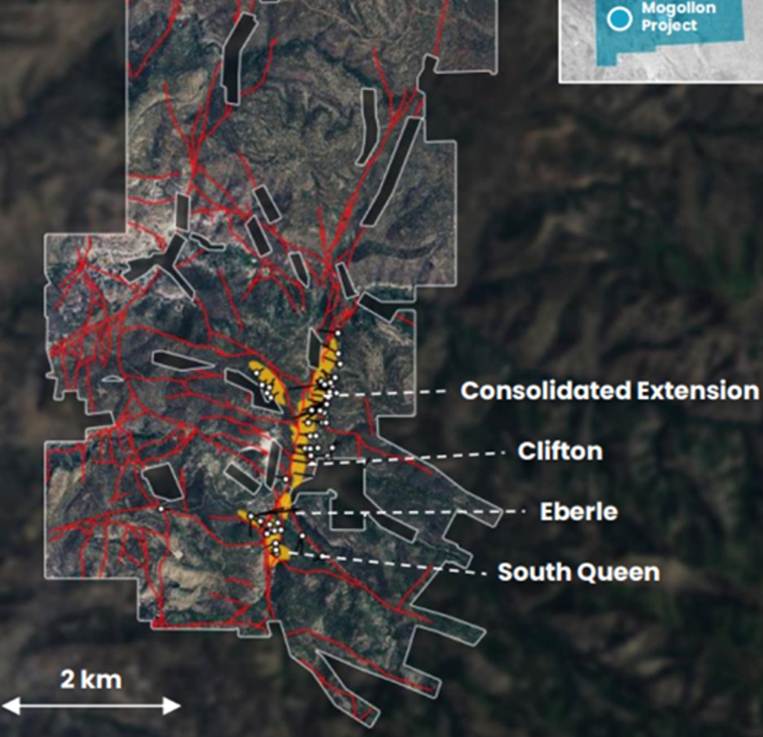

Summa’s most interesting project is called Mogollon in New Mexico.

Hennigh says the project is a continuation of the big vein systems found in Mexico and is one of the biggest epithermal vein systems he’s aware of in the western United States.

Mogollon has shown good results to date, for example 31 meters at 448 grams per tonne silver-equivalent, and 23.2m @ 433 g/t AgEq.

For an illustration of what Hennigh is talking about, look at the red-colored veins criss-crossing almost the entire project in the map above.

Mogollon has an inferred resource of 32 million oz of silver-equivalent; it grades 367 AgEq grams per tonne. The grade is good, metallurgical recoveries are 97% for silver, 98% for gold, and it’s interesting in that all of that work has been done on only 2.4 kilometers of these vein structures. There’s still 77 kilometers of vein structures of silver and gold that have not been drilled.

The idea would be Silver47 to explore Mogollon in the winter, allowing for meaningful growth to the 32Moz resource. Of course, you have the whole vein field that hasn’t even been tested yet.

There are two ways to grow a mining company: the first is through the drill bit. And the other is through mergers and acquisitions.

Why get bigger? Larger companies attract more capital, they attract institutional investors and if you look at both companies, they’re still largely a retail story and that’s great but you need to get bigger. Getting bigger is better for all because you attract more capital and as I’ve said before, mining is a capital-intensive business.

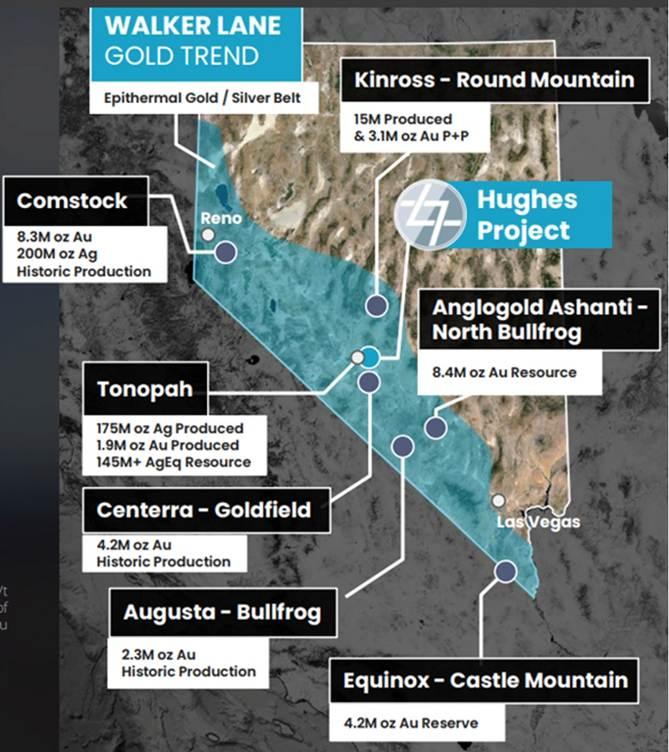

Summa’s second project is in Nevada; it’s in the historic Walker Lane District and it’s very close to Tonopah, the queen of the Silver District.

BlackRock Silver has 100 million silver-equivalent oz on the west side of the district and Summa has the east side of the district: they have a resource on the Hughes, an inferred resource at 33 million ounces of silver-equivalent and then there’s another 10 million ounces in the indicated category, so when I say it’s a merger of equals I’m not just talking about in the market, I’m talking about Summa has some impressive discovery potential, plus they’re bringing in some resources, so I think the merger deal between Summa and Silver47 was brilliant.

The third project is Kennedy, it’s new and not much work has been done. But they know there’s 22 km of gold and silver veins.

Conclusion

Red Mountain is a different beast than the veins and what they’re looking at in New Mexico and Nevada. It’s VMS and SEDEX, they’re concentrating on VMS mineralization on the east side of the property, and this property is unique because there are so many surface showings. The gossans are rusty rocks that are exposed at surface and there’s a lot of them; it’s basically weathering and oxidation of the sulfides and these are good first indicators for geologists.

The other thing about these VMS deposits is they come in a string and when you find one, you’re bound to find another; Silver 47 has two of them already, they think.

Silver47 has $16m in the kitty to drill Red Mountain, currently budgeted at 4,000 meters. The two target areas are West Tundra Flats and Dry Creek. These two are about 2.7 kilometers apart, so the question that they want to answer is do they connect? And then they’re going to drill and try to increase the resource.

Silver47’s got a 60-kilometer trend of VMS/SEDEX, they pretty much have the district all claimed up. The thing that I love about this property is that it has got so much exploration potential. I don’t think I’ve ever seen so many VMS indications right on surface; it’s literally everywhere. I love Silver47’s chances to grow their 168 million ounces of silver-equivalent in an inferred open pit/ underground resource.

Silver47

TSXV:AGA

Cdn$1.00 2025.07.30

Shares Outstanding 70.4m

Market Cap Cdn$70.4m

AGA website

Subscribe to AOTH’s free newsletter

Richard does not own shares of Silver47 (TSXV:AGA). AGA is a paid advertiser on his site aheadoftheherd.com This article is issued on behalf of AGA

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE