Rick Mills – Income Tax Versus Tariffs: Who wins? Who loses?

The idea sounds great. Hike tariffs on goods coming into the United States, which will protect local industries and workers from foreign competition. The extra revenue flowing into government coffers will be enough to offset income taxes, which would be abolished.

It’s more than a theory. President-elect Donald Trump mentioned the principal of replacing income taxes with tariffs when he met with Congressional Republicans in June.

He said it again while talking to Joe Rogan in October. Rogan has one of the most-listened-to podcasts in the world.

“Did you just float out the idea of getting rid of income taxes and replacing it with tariffs?” Rogan asked the Republican presidential nominee during their three-hour interview. “We’re serious about that?”

“Yeah, sure, but why not?” Trump responded.

Here we accept the challenge of answering former and now, President elect Trump’s question.

What could happen

Trump has repeatedly proposed increased tariffs, including a 10% or 20% across-the-board tariff on all trading partners, as well as a 60% tariff on Chinese imports.

He advocates eliminating taxes on tips, overtime pay and Social Security benefits, and said he would consider tax exemptions for firefighters, police officers, military personnel and veterans.

According to the right-leaning Tax Foundation, ending taxes on tipped income, overtime and Social Security alone would cost an estimated $2 trillion over 10 years.

Remember, Trump in his first term started a trade war with China (and other countries including the EU and Canada) beginning in March 2018 with a 25% tariff on steel and a 10% tariff on aluminum imports.

According to the Quarterly Journal of Economics, import tariffs increased from 2.6% to 16.6% on 12,043 products covering $303 billion or 12.7% of US imports. Countermeasures from US trading partners increased tariffs from 7.3% to 20.4% on 8,073 products covering $127 billion of US exports.

A study published in the journal showed that US consumers bore most of the costs from the 2018-19 tariff increases:

The resulting losses to U.S. consumers and firms that buy imports was $51 billion, or 0.27% of GDP. We embed the estimated trade elasticities in a general-equilibrium model of the U.S. economy. After accounting for tariff revenue and gains to domestic producers, the aggregate real income loss was $7.2 billion, or 0.04% of GDP. Import tariffs favored sectors concentrated in politically competitive counties, and the model implies that tradeable-sector workers in heavily Republican counties were the most negatively affected due to the retaliatory tariffs.

The Biden administration kept most of Trump’s tariffs and added their own, in May of this year quadrupling the tariff on imports of Chinese-made electric vehicles from 25% to 100%.

The Guardian reports the White House also said it was imposing more stringent curbs on Chinese goods worth $18 billion. Levies would rise from 7.5% to 25% on lithium-ion batteries, from zero to 25% on critical minerals, from 25% to 50% on solar cells, and from 25% to 50% on semiconductors.

Tariffs on steel, aluminum and personal protective equipment — which range from zero to 7.5% — would climb to 25%.

In addition to higher tariffs, Trump has also called for an extension of the individual tax cuts he imposed in 2017, and further tax reductions on the corporate side.

How realistic?

First we’d like to know, is scrapping the income tax realistic? And secondly, has it ever been done before and if so, how did it work out?

The second question is easier to answer. It may surprise some to learn that the United States in its early days only had tariffs, and did not have an income tax until 1913.

Trump’s vision is therefore reminiscent of the 1890s, when under President William McKinley, high tariffs on imported goods funded federal expenses. Critics at the time argued that they placed too high a burden on working-class Americans due to the inflated prices of consumer goods, many of which were imported – very much the same complaint critics make today.

The federal income tax was introduced to create a progressive tax system that would alleviate income inequality and ensure that wealthier Americans contributed a larger share. (CEO Today Magazine, Oct. 28, 2024)

As to the first question, Econofact.org answered “no”. The reason is that tariffs don’t take in nearly enough revenue to make up for a loss in income taxes. Last year, for example, the federal government collected about $2.2 trillion in individual income taxes — about half of government revenue. US imports in 2023 totaled about $3.8 trillion. Thus, to generate enough revenue from tariffs to match revenue from income tax, the government would have to charge a tariff of 58%.

But that’s only if imports stayed at the same level. The more likely scenario is that businesses and consumers would reduce their purchases of imported goods because the tariffs make them more expensive.

History confirms this: when tariffs have increased in the past, import volumes have dropped as companies and consumers reduced their purchases of imported goods. Fewer import purchases means less tariff revenue.

A tax expert interviewed by CNBC agrees.

“It would not be possible to raise tariffs rates high enough to cover anywhere close to that amount [of income tax revenue], as imports would decline as the tariff rates increased,” said Garrett Watson, a senior policy analyst at the Tax Foundation.

Watson noted the tariffs would generate an estimated $3.8 trillion over 10 years compared with $33T that income taxes would bring in.

He says Trump’s tax plan including tariffs would expand the deficit by $3 trillion over a decade. “The math doesn’t work out,” Watson said.

Trump falsely claimed on his Truth Social media platform that tariffs are “paid for by the abusing country.” In fact, tariffs are borne by US importers; the increased costs are typically passed onto consumers as higher prices.

Erica York, senior economist and research director with the Tax Foundation, also scoffed at the notion that tariffs could replace income taxes.

“It’s an absurd idea for many reasons, the biggest being that it is mathematically impossible to replace the income tax with tariffs,” York told CNN. “Imports are a much smaller tax base than taxable income, and there’s no way to squeeze enough revenue from taxing imports to fully replace taxing income. A swap like this would hike taxes on working-class taxpayers and invite harmful retaliation against US exports.”

Tariffs currently only bring in about 2% of federal revenue.

Brian Riedl, a senior fellow at the right-leaning Manhattan Institute, estimated that replacing $2.4 trillion in income taxes would require imposing a 75% tariff on America’s $3.2T in annual imports.

Again, that presumes that imports would be purchased at the same levels, which is unlikely due to the extremely high tariff. Moreover, it doesn’t account for the retaliatory measures America’s trading partners would almost certainly implement.

Riedl noted Trump had to spend part of the revenue he raised from tariffs in his first term by bailing out farmers that were hurt by China’s countervailing duties.

As reported by CNN, China’s tariffs on commodities including soybeans, corn and wheat made American agricultural products more expensive. Private buyers nearly stopped purchasing US soybeans, leaving a record amount sitting in storage at the end of 2018. In mid-2019, the Trump administration started paying $14.5 billion to farmers, on top of $10 billion in aid they received in 2018.

China challenges US in South America with new port in Peru

According to the Committee for a Responsible Federal Budget, even without eliminating the income tax, Trump’s economic policies would increase the national debt by $7.5 trillion over a decade. The non-partisan watchdog estimates his tariffs would bring in only $2.7T over 10 years.

CEO Today Magazine says not only would extremely high tariffs fail to close the gap left by eliminating income taxes, such a shift could have “unintended and severe economic consequences”. These include increased costs to US consumers and businesses leading to inflation — a negative outcome seeing as the Federal Reserve has only just succeeded in bringing inflation close to its 2% target.

Deportations, Tariffs and Tax Cuts, Snatching Defeat From the Jaws of Victory – Richard Mills

The higher tariffs would likely prompt retaliatory measures from trade partners that could lead to a trade war that restricts the flow of goods to and from the United States.

CEO Today posits that dismantling the income tax system would face stiff political opposition. Even with a Republican-controlled Congress, the wholesale elimination of income tax revenue would be difficult to justify given the negative implications for federal spending on essential programs, such as Social Security, Medicare, and defense.

The magazine concludes the tax shift would have few supporters:

Trump’s proposed elimination of income taxes in favor of tariffs may appeal to those who favor smaller government and lower taxes. However, the feasibility of this shift is limited by economic reality. Today’s federal budget relies heavily on income and payroll taxes, and a tariff-based system would not be able to bridge this revenue gap without causing severe inflation and potentially pushing the U.S. into a damaging trade war.

Peterson Institute study

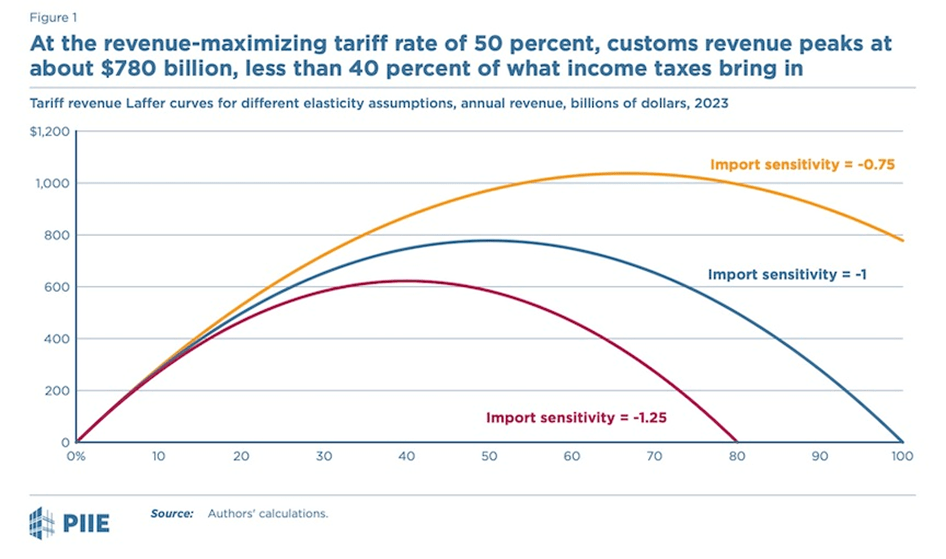

An analysis by the nonpartisan Peterson Institute for International Economics found that 50% tariffs would only raise a maximum of $780 billion, far less than the amount raised by income tax (about $2.4T).

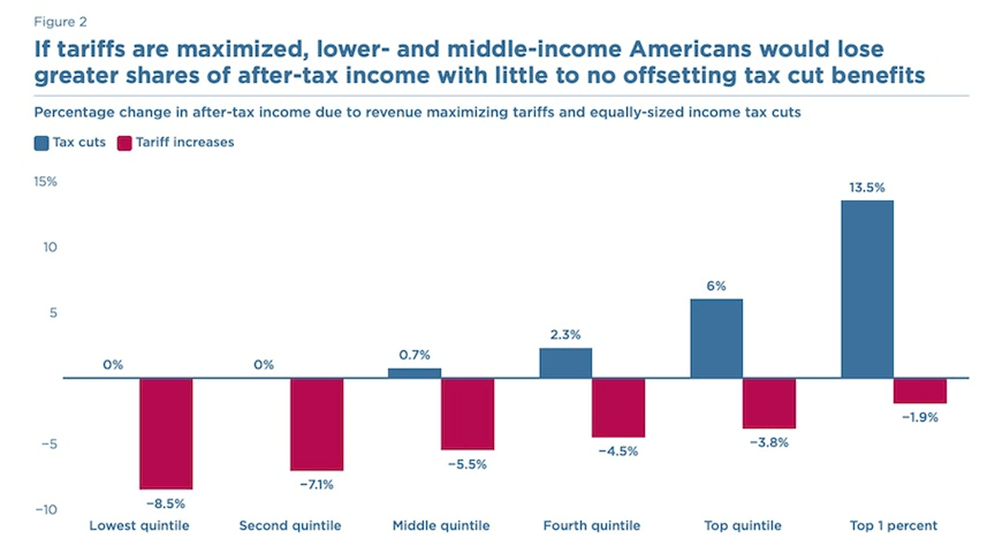

The study also found that the tariffs-for-taxes swap would cost jobs, ignite inflation, increase federal deficits, and cause a recession. It would also shift the tax burden away from the well off, substantially increasing the tax burden on the poor and middle class.

If pursued, this policy would antagonize US allies and partners, provoking worldwide trade wars, damaging global economic welfare, and undermining national security. It would also likely destabilize the global financial system.

A recent Peterson Institute policy brief calculated that revenues from Trump’s 10%/ 60% tariff proposals would only total about $225 billion per year. This figure it says is overestimated because it doesn’t include the economic shocks caused by retaliation against US exporters, and losses suffered by the import-dependent manufacturing sector.

Exporters would also be hit by a higher dollar.

While Trump has touted the idea that tariffs will reduce the US trade deficit, the study holds that a stronger dollar would add to the deficit by making US exports more expensive abroad, and make foreign production relatively cheaper.

The study then describes a sort of vicious circle, of a rising US dollar exchange continuing to hurt US exports and cause inflation:

In response to Trump’s tariffs, foreign central banks would feel compelled to cut their interest rates to offset the loss of exports to the United States, also driving dollar appreciation. Anticipating this outcome, global investors would immediately bid up the dollar’s value as they all move to add dollar assets to their portfolios. Those moves, in turn, will make US exports yet more expensive abroad, reducing the global demand for them even more…

Unlike the United States, most countries experiencing currency appreciation benefit from a lower price of imports, which are typically invoiced in major foreign currencies, predominantly the dollar. But the United States does not enjoy that advantage because almost all of its imports are invoiced in its own currency, the dollar. As a result, the US price level would not benefit from a sharp, immediate fall in import prices resulting from the dollar’s strength, so the inflationary impact of a big tariff increase would be severe, and especially severe given that the United States is currently at full employment.

Source: Peterson Institute for International Economics

Source: Peterson Institute for International Economics

Conclusion

The evidence is unequivocal. Eliminating the income tax and replacing it with tariffs is, according to experts, “economically destructive” and “mathematically impossible”. A 75%, across-the-board tariff on the current $3.2 trillion of imports would be required to replace the current $2.4 trillion brought in by income taxes.

That presumes that imports would be purchased at the same levels, which is very unlikely with such a high tariff. Moreover, it doesn’t account for the retaliatory measures America’s trading partners would undoubtedly implement, bleeding revenues from the government. We already know that China’s tariffs on US agricultural products cost the federal government about $24 billion.

Eliminating the income tax would, in the words of the Peterson Institute, mean “A DANGEROUS, BACKWARD MOVE TO THE 19TH CENTURY” when the rich (and everyone else) paid no taxes and the poor shouldered the heaviest burden of paying for consumer goods that were made more expensive due to tariffs.

Subscribe to AOTH’s free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Quimbaya Gold Closes $4 Million Financing and Expands Executive Team

Cornerstone investor brings proven regional track record; company... READ MORE

Spanish Mountain Gold Announces Larger Scale Preliminary Economic Assessment With a Base Case NPV5% After-Tax of C$1.0 Billion, 18.2 % IRR and 3.4 Year Payback at US$ 2,450/Oz Gold Price; at US$3,300/Oz Spot Gold Price NPV5% C$2.3 Billion, 32.0% IRR and 2.0 Year Payback; Including an Updated Mineral Resource Estimate for Its Spanish Mountain Gold Project

Spanish Mountain Gold Ltd. (TSX-V: SPA) (FSE: S3Y) (OTCQB: SPAUF)... READ MORE

Aura Announces Preliminary Q2 2025 Production Results

Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX: ORAAF) is plea... READ MORE

Cascadia Announces Closing of Financing

Cascadia Minerals Ltd. (TSX-V:CAM) (OTCQB:CAMNF) is pleased to an... READ MORE

Abcourt Closes US$ 8M Loan Facility to Start Sleeping Giant Mine

Abcourt Mines Inc. (TSX-V: ABI) (OTCQB: ABMBF) is pleased to anno... READ MORE