Rick Mills – “Graphite One Positioned to Play Leading Role in Providing US Graphite Security of Supply”

Automakers and defense companies have been raising alarm bells over the fact that the United States hasn’t mined any graphite since the 1950s, and even if it had, it would need to be shipped to China for processing. Graphite One (TSX-V:GPH) (OTCQX:GPHOF) could take a leading role in loosening China’s tight grip on the US graphite market

Graphite market

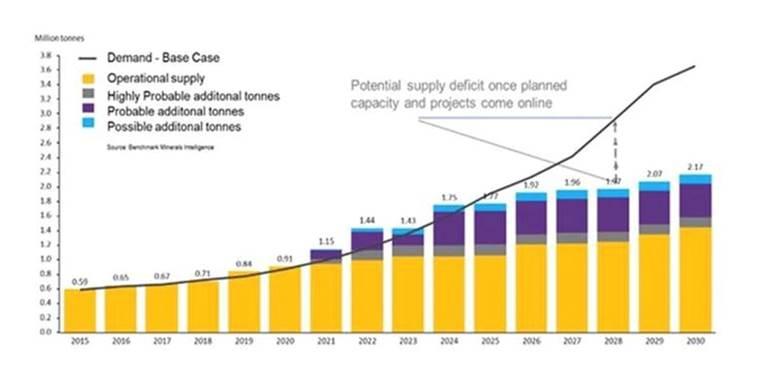

BloombergNEF expects graphite demand to quadruple by 2030.

The International Energy Agency (IEA) goes 10 years further out, predicting that growth in graphite demand could see an 8- to 25-fold increase between 2020 and 2040.

Given that demand for graphite is accelerating at a rate never seen before, the impending supply crunch could get serious.

Source: Benchmark Mineral Intelligence

Analysis by Benchmark Mineral Intelligence projects that natural graphite will have the largest supply shortfalls of all battery materials by 2030 — even more than that of lithium — with demand outstripping expected supplies by about 1.2 million tonnes.

And this is just counting EV battery use only; the mining industry still needs to supply other end-users. The automotive and steel industries remain the largest consumers of graphite today, with demand across both rising at 5% per annum.

BMI previously stated that flake graphite feedstock required to supply the world’s lithium-ion battery anode market is projected to reach 1.25 million tonnes per annum by 2025. For reference, the amount of mined graphite for all uses in 2023 was 1.6 million tonnes.

BMI has also said up to 97 average-sized graphite mines need to come online by 2035 to meet global demand.

Source: Benchmark Mineral Intelligence

US dependence

China is by far the biggest graphite producer at about 80% of global production. It also controls almost all graphite processing, establishing itself as a dominant player in every stage of the supply chain.

China also accounts for 98% of announced anode manufacturing capacity expansions through 2030, according to the International Energy Agency.

China’s metal dominance — Richard Mills

As previously stated the United States currently produces no graphite and therefore must rely solely on imports to satisfy domestic demand.

Graphite is:

- One of 14 listed minerals for which the US is 100% import dependent.

- One of nine listed minerals meeting all six of the industrial/defense sector indicators identified by the US government report.

- One of four listed minerals for which the US is 100% import-dependent while meeting all six industrial/defense sector indicators.

- One of three listed minerals which meet all industrial/defense sector indicators — and for which China is the leading global producer and leading US supplier.

The US has no security of supply for graphite. They have clearly reached a point where much more graphite needs to be discovered and mined IN THE US.

Fighting back

President Donald Trump, in his first term, authorized the Pentagon to utilize funding available under Title III of the Defense Production Act (DPA) — a tool established during the Cold War to ensure the US could secure goods needed for national security — to support the re-establishment of a US rare earths supply chain.

In 2022, a bipartisan group of senators led by Alaska’s Lisa Murkowski and West Virginia’s Joe Manchin wrote to President Joe Biden urging him to authorize the Pentagon to tap into DPA funds to bolster domestic supplies of other critical minerals. The request resonated with Biden, who used the DPA authority to designate battery minerals and metals – graphite, lithium, nickel, manganese and cobalt – as “essential to the national defense.”

For all the partisanship pulling Washington apart, an emerging consensus on critical minerals — and the dangers of Chinese dependency — began to take shape.

The result was bipartisan legislation that keeps Chinese goods behind high tariff walls and other restrictive measures.

In fact the US government, under President Biden, has committed (by way of the Inflation Reduction Act) billions worth of loans and grants to support a domestic critical mineral supply chain — as the country seeks to become more resource-independent and less beholden to China and other countries for minerals critical to a clean-energy future, and to the tech-intensive defense systems that safeguard national security.

Trump’s support of critical minerals

Now back in the White House Trump continues his long attack on Biden’s Inflation Reduction Act and other clean-energy initiatives that are the darlings of progressives. However, one area that is likely to see a continuance is critical minerals.

Trump has announced that his administration will “pursue a path towards US energy dominance” that will require substantial amounts of minerals, from tungsten in exploration drill bits to copper in electrical transmission lines.

On Jan. 20, President Trump issued Executive Orders (“EOs”) on energy, critical minerals and the importance of Alaska to US critical minerals development and American energy independence.

Three EOs impact Graphite One’s critical minerals project:

The Energy Emergency EO aims to facilitate “the energy and critical minerals (“energy”) identification, leasing, development, production, transportation, refining, and generation capacity of the United States,” to support development of the “…energy supply needed for manufacturing, transportation, agriculture, and defense industries, and to sustain the basics of modern life and military preparedness.”

This EO addresses a range of federal policies with a focus on streamlining permitting processes to bolster US energy dominance, eliminating or reducing current burdens in developing domestic energy resources, specifically on critical minerals.

UNLEASHING ALASKA’S EXTRAORDINARY RESOURCE POTENTIAL

This new EO recognizes the essential importance of Alaska — home to G1’s Graphite Creek project, recognized by the USGS as the nation’s largest graphite deposit and “among the largest in the world” — to US. critical minerals development and energy independence.

“These Presidential actions confirm our 100% U.S.-based supply chain strategy. So much depends on the U.S. having a robust, reliable source of advanced graphite materials, and Graphite One intends to meet that need,” said Graphite One’s CEO Anthony Huston.

DoD grants

Two Department of Defense grants have been awarded to Graphite One, one for $37.5 million, the other for $4.7 million — the latter to develop an alternative to the current firefighting foam used by the US military and civilian firefighting agencies, using graphite sourced from Graphite Creek.

G1’s Feasibility Study, due first quarter 2025, is 75% funded by the DoD.

Graphite Creek in 2021 was given High-Priority Infrastructure Project (HPIP) status by the Federal Permitting Improvement Steering Committee (FPISC). The HPIP designation allows Graphite One to list on the US government’s Federal Permitting Dashboard, which ensures that the various federal permitting agencies coordinate their reviews of projects as a means of streamlining the approval process.

The mine

On Jan. 30, 2025 Alaska Governor Mike Dunleavy identified Graphite Creek (Graphite One’s Project – Rick) as one of two Alaska projects during his State of the State address, which highlighted the economic and security implications of critical minerals development.

“The Graphite One deposit, the largest in North America, north of Nome, continues to move ahead with support from a Defense Department grant,” Governor Dunleavy told the Alaska legislators. ”Construction could begin in that project by 2027 and the mine could be producing as early as 2029.”

Ohio AAM plant

Graphite One is more than a mining company.

It plans to invest $435 million to build a graphite anode manufacturing plant in Trumbull County, Ohio, between Cleveland and Pittsburgh.

The plant will use synthetic graphite until natural graphite anode active material becomes available from Graphite Creek, according to the March 20 news release.

Anode deal with Chenyu

In October 2024, G1 signed a technology license and a consulting agreement with Hunan Chenyu Fuji New Energy Technology Co. Ltd. (Chenyu).

Founded in 2019, Chenyu is a high-tech company specializing in R&D, production, sales and professional services of lithium-ion battery materials including artificial graphite anode, natural graphite anode, silicon carbon anode materials and waste battery recycling. The company currently has five production facilities and an R&D center.

Chenyu would grant G1 an exclusive license to certain AAM technologies in return for the payment of royalties; offer advice and guidance in designing, constructing, commissioning and operating the Ohio AAM plant in return for the payment by G1 of milestone fees; agree to offer G1 advanced AAM technology prior to offering it to other AAM manufacturers in North America; and agree to offer G1 the right to license Chenyu’s AAM technology in Europe, the United Kingdom and, surprise, the Kingdom of Saudi Arabia before offering it to other AAM manufacturers.

EXIM financing

In October of 2024 G1 received a Letter of Interest (LI) for up to $325 million in debt financing from the Export-Import Bank of the United States (EXIM), to go towards construction of its AAM manufacturing facility in Ohio. The funds would come from EXIM’s “Make More in America” and “China and Transformational Exports Program” (CTEP) initiatives.

EXIM’s funding commitment is conditional upon completing the application, due diligence and underwriting process and receiving all required approvals.

G1 expects to submit a formal application to EXIM in 2025.

AAM market

The anode, also known as the negative electrode, is typically made up of graphite powder baked onto copper foil.

Active anode materials (AAM) is a term referring to materials that are being developed for use in various energy storage and convergence technologies; the primary focus is on improving battery performance.

AAMs are typically carbon-based materials, such as graphite powder or silicon oxide. Graphite is the most common AAM because it’s inexpensive, has a stable structure, and is highly conductive. Silicon anodes have a higher energy density, but they have a shorter cycle life and can expand in volume.

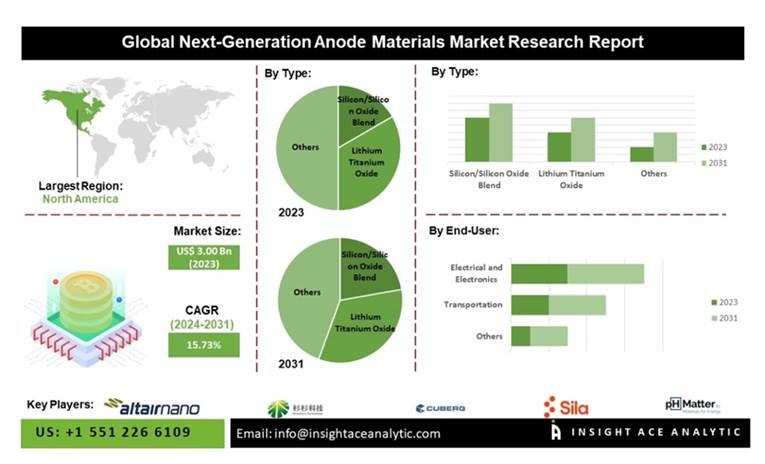

According to Insight Ace Analytic Pvt. Ltd., the AAM market was valued at USD$3 billion in 2023 and is predicted to triple by 2031 to $9.57B.

A report by Polaris Research valued the global anode market at $11.5 billion in 2023. By 2032, revenues should reach $123.7B, with the industry growing at a CAGR of 30.9%.

The main reason for such a high growth rate is increasing EV adoption.

“The lithium-ion battery anode market is experiencing notable growth due to electric vehicle acquisition. The growing approval of plug-in hybrids and EVs instantly translates into growing demand for lithium-ion batteries,” states Polaris Market Research via PR Newswire.

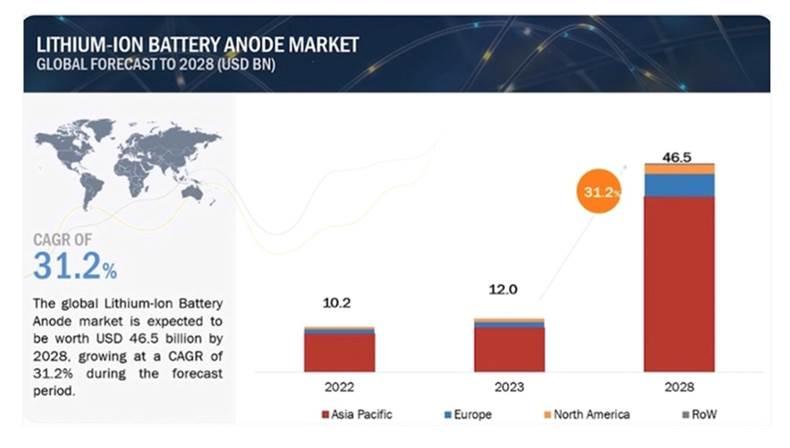

Another report by Markets&Markets projects anodes will grow from a $12 billion industry in 2023 to $46.5 billion in 2028.

Source: Markets&Markets

The report concurs with Polaris Research’s observation that electric vehicles are the key demand driver, but adds that industrial applications are increasingly adopting lithium-ion batteries for their efficiency and clean-energy benefits.

China dominates the AAM market with an estimated 95% share. But the United States is pushing back. According to Solar Power World,

In Dec. 2024, the American Active Anode Material Producers (AAAMP) filed petitions with the Dept. of Commerce and U.S. International Trade Commission seeking AD/CVD on imports of battery anode materials from China. AAAMP says that China’s dominance on active anode material (AAM) production has prohibited the domestic market from establishing competitive operations.

Lithium-ion battery uses

It’s important to note that Graphite One, through its agreement with Chenyu, will give G1 the technology to produce anodes for all lithium-ion batteries, not just the batteries for EV’s.

According to the Environmental Protection Agency, Lithium-ion (Li-ion) batteries are used in many products such as electronics, toys, wireless headphones, handheld power tools, small and large appliances, electric vehicles and electrical energy storage systems.

Eco Lithium Tree goes deeper into this topic, naming the 14 most popular uses of lithium-ion batteries: pacemakers; digital cameras; personal digital assistants, smart phones and laptops; watches; portable power packs; personal mobility devices like scooters; electric vehicles; golf carts and trolleys; solar energy storage; and emergency power backup.

A recent Bloomberg article is headlined ‘Giant Batteries Are Transforming the World’s Electrical Grids’. According to the piece,

A battery farm can be set up almost anywhere, and homeowners rarely object to living near one. They’re getting cheaper: Global prices for large-scale energy storage systems have plunged 73% since 2017, according to BNEF. Their ability to switch on and off instantly lets them recharge when electricity is cheap and sell power when prices rise. And they’re relatively fast to deploy, with the installation at the Hummingbird facility taking less than a year. “Just the speed of that coming on has been amazing,” says John Zahurancik, senior vice president for the Americas at Fluence Energy Inc., one of the biggest battery developers in the US.

Li-ion batteries are also used in a multitude of military applications including communications equipment, weapons, drones, submarines, and powering space systems, GPS systems, and hybrid electric tactical vehicles. The US Navy is reportedly working to extend the environments in which lithium-ion batteries can be used safely. (Google AI Overview)

Graphite One will also be able to make silicon anodes, which are a component of lithium-ion batteries that use silicon to store lithium ions. According to Benchmark Mineral Intelligence, Silicon materials can be used directly as an active anode material (AAM) or mixed with graphite to form a blended material to improve anode performance.

IRA funding freeze scare

Of course, Graphite One and its Graphite Creek project in Alaska isn’t the only company involved in the AAM market. As outlined by S&P Global in a March 2024 article:

- On Feb. 5, Westwater Resources signed its first graphite offtake agreement with South Korean battery manufacturer SK On for a 34,000 metric ton natural graphite supply from its under-construction Kellyton, Alabama, plant.

- On Feb. 9, Panasonic Energy signed a binding offtake agreement with Australia’s Novonix to procure synthetic graphite from its Tennessee plant.

- On the same day, another Australia-based natural graphite supplier Syrah Resources commenced operations at its 11.25 kiloton per annum (ktpa) natural graphite production facility in Vidalia, Louisiana.

- This was followed by two big announcements by the Canadian mining company Nouveau Monde Graphite on Feb. 15. It signed offtake agreements with General Motors (GM) and Panasonic Energy to supply 18,000 metric tons of anode active materials (AAM) per annum to each as well as raising new equity investments from both companies.

According to Fast Markets, Nouveau Monde Graphite, Novonix and Westwater have all announced offtake agreements to comply with the United States’ subsidy scheme under the Inflation Reduction Act and to ease the current dependence on China for material.

Syrah Resources announced earlier this month that its subsidiary, Syrah Technologies, received a tax credit worth about USD$165 million from the IRS. The amount was granted under the Inflation Reduction Act’s ‘Qualifying Advanced Energy Project Tax Credit Program’.

On Jan. 21, the day after Donald Trump was inaugurated as the 47th president, the White House issued a memo stating that there will be a freeze on the disbursement of funds from the Inflation Reduction Act and the Infrastructure Investment and Jobs Act, also known as the bipartisan infrastructure law.

(CNN reported on Tuesday that a federal judge has temporarily blocked part of the Trump administration’s plan to freeze all federal aid, a decision that could impact trillions in government spending and halt public programs affecting millions of Americans.)

As noted by Waste Dive, The two laws were hallmarks of former President Joe Biden’s domestic policy agenda, rolling out billions of dollars in federal funding for clean energy construction and manufacturing projects…

Graphite One is unaffected by Trump’s executive orders to freeze all federal aid, or to put it in another way – Graphite One has a tremendous funding advantage over competitors due to its prescient decision not to apply for IRA or bipartisan infrastructure law funds – the reason being that, should Trump be re-elected president, these programs might be canceled.

Also, there is no indication from recent news about Trump’s executive orders that EXIM’s potential financing of up to $325 million of Graphite One’s project’s costs will be canceled.

“In December 2019, President Donald Trump signed the Export-Import Bank Extension into law as part of the Further Consolidated Appropriations Act, 2020 (P.L. 116–94) which authorized the bank until December 31, 2026.

Export-Import Bank is an effort to assist American exporters in competing with Chinese companies and to maintain American advantages in specified industries.” Wikipedia

Conclusion

Increased usage of natural graphite is expected from non-Chinese sources, who are seeking to establish ex-China supply chains.

Graphite One is a “first mover” at the forefront of this trend. The company has significant financial backing from the Department of Defense, and political support from the highest levels of government, including Alaska senators, Alaska’s governor, and the Bering Straits Native Corporation.

Graphite, whether synthetic or natural, plays a vital, irreplaceable part in the functioning of a modern economy.

Paramount is “security of supply.” With the upcoming release of a Feasibility Study on G1’s Graphite Creek project, a technology licensing agreement, and a consulting agreement with Hunan Chenyu Fuji New Energy Technology Co., a Letter of Interest (LI) for up to $325 million in debt financing from the Export-Import Bank of the United States, and plans for an AAM manufacturing plant in Ohio’s Voltage Valley, it would seem G1 has positioned itself to play a leading role in providing the United States with graphite security of supply.

“The United States has zero commercialization of synthetic anode battery materials. Supplying proven products to the North American battery material supply chain will give G1 a competitive edge by allowing rapid entry into a market where technology is developing quickly.” Graphite One’s CEO Anthony Huston

Richard (Rick) Mills

aheadoftheherd.com

Subscribe to AOTH’s free newsletter

Richard owns shares of Graphite One Inc. (TSXV:GPH). GPH is a paid advertiser on his site aheadoftheherd.com. This article is issued on behalf of GPH

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE