Rick Mills – “Gold Miners Junior Buying Spree”

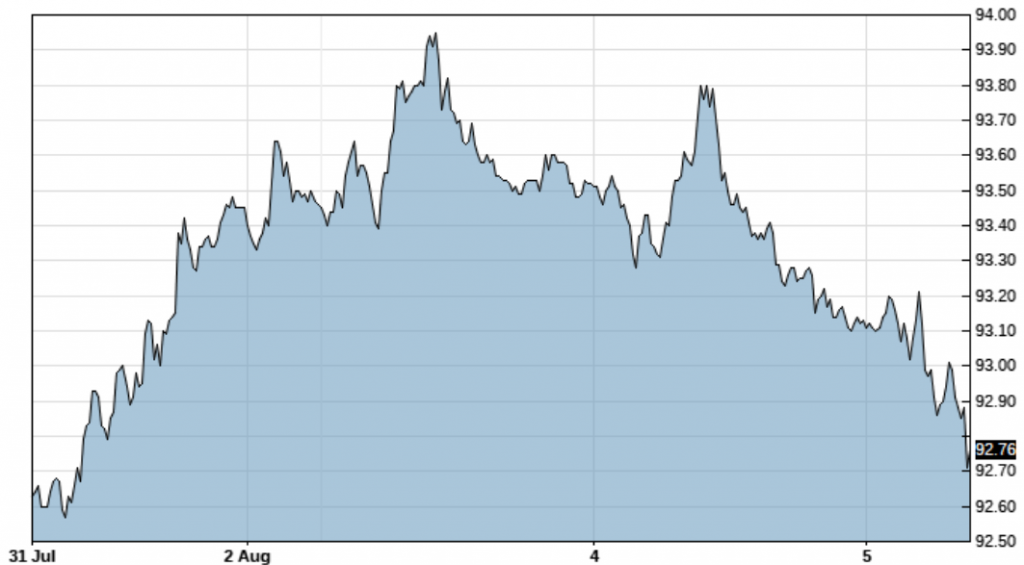

Canadians, at least those fortunate enough to enjoy a long weekend, returned to their desks Tuesday to watch gold prices crack another milestone – $2,000 per ounce – as the spectacular summer rally for the precious metal continues.

At time of writing, spot gold’s last bid was $2,019.20, marking a $42 gain since Monday’s trading session. Silver prices also experienced a major leg up, with spot silver posting a $1.68 increase to $26.01, as of 17:05 Eastern time – a 7-year high.

The usual suspects are behind the surges of both metals, ie., worrisome covid-19 infections, geopolitical concerns especially US-China tensions over trade (President Trump tried to force China-owned TikTok into selling its US operations), the South China Sea, fears of inflation on the back of unlimited monetary stimulus and low interest rates worldwide.

Bullion prices have climbed more than 30% year to date, as investors choose gold as a safe haven amid widespread economic uncertainty created by the pandemic. They believe gold will hold its value better than other assets such as stocks and bonds.

US economic carnage

Central bank stimulus in the US has pushed sovereign bond yields to record lows, making gold an attractive alternative, despite offering no interest or dividend income. On Tuesday US Treasury yields fell, as investors remained pessimistic about the U.S. economy’s health and eyed the slow pace of negotiations in Congress on another [$1 trillion] fiscal relief package to combat the coronavirus pandemic, Marketwatch reported.

Second-quarter US GDP contracted nearly 33%, its sharpest drop on record, showing the US economy is in its worst recession since the Great Depression. Any near-term recovery now seems hopelessly optimistic.

The yield on the benchmark 10-year note slipped 4.8 basis points to 0.514%, its lowest since the “flash-crash” of March 9. That puts “real yields” on the 10-year in negative territory, always a bullish signal for gold.

The US government and policymakers around the world have no choice but to unleash massive stimulus programs to help their citizenries to deal with the worst economic downturn since the 1930s.

According to Bank of America, via Zero Hedge, the amount of global fiscal and monetary stimulus in June had reached an astronomical US$18.4 trillion in 2020, consisting of $10.4 trillion in government spending and $7.9 trillion in central bank asset purchases, “for a grand total of 20.8% of global GDP.”

The IMF predicts the percentage of global public debt to rise from 69% of national income last year to 85% in 2020.

Racking up so much of its own debt means the United States has to keep interest rates low, to prevent onerous borrowing costs.

The country’s public sector deficit is set to nearly triple, while public debt will rise to 107% of GDP, according to the IMF.

“The U.S. is being the most aggressive with easing and government spending and as a result we expect to see the biggest deterioration in public finances there,” The Financial Post quotes Mathieu Savary, a strategist at BCA Research.

As an example of explosive monetary stimulus via money printing, consider: at the end of 2019, the Fed’s balance sheet as a percentage of GDP was 19%; six months into 2020, it had doubled, to 39%.

Amid the growing pile of debt, Fitch on Friday revised its US outlook to negative, “to reflect the ongoing deterioration in the U.S. public finances and the absence of a credible fiscal consolidation plan,” while affirming the country’s AAA rating.

Meanwhile the dollar has weakened considerably, making bullion cheaper for buyers holding other currencies, thus boosting investment demand.

The buck’s retreat is directly correlated to America’s failure to control the virus. Cases are still growing daily although at a slower rate than in Brazil and India. The US is approaching 5 million cases and has over 160,000 covid-19 deaths.

According to Horizons ETFs portfolio manager Nick Piquard, global debt and unlimited money printing are denting confidence in the US dollar as the reserve currency – a subject we have written on extensively.

“The U.S. dollar system has worked so far. But we’re getting to the point where there’s so much debt in the world and with this new crisis, there’s even more debt,” Piquard explained to Kitco:

“People are figuring out that maybe they will have to make some changes to how the U.S. dollar acts as a reserve system. The U.S. is probably going to have to print a lot of dollars to bail out all this debt. That’s really fuelling the gold rally.”

“Investors are seeing that this COVID crisis isn’t going to go away anytime soon. The cases keep going up globally. And the longer it takes, the more debt needs to be created,” Piquard said. “Congress is debating right now about how many trillions of dollars they’re going to have to spend for a new stimulus after having already spent trillions of dollars.”

And even once the COVID crisis is behind us, the economy is going to be weak for a while, Piquard pointed out.

“After all that money has been spent, it’s not like you’re going to be able to raise taxes to get that money back, or it’s not going to be easy to raise rates,” he said. “The market is anticipating that the Fed is going to have to do more. And all those things are just beneficial for gold.”

Gold stocks: a diamond in the rough

Considering all of the above, it’s no surprise that the only companies in North American stock markets doing well right now, the only ones making any money, are those benefiting from the pandemic, ie., Big Tech FANGS like Facebook, Google and Apple, and gold stocks.

High gold and share prices mean it’s time for the gold sector to look at another round of consolidations, which could mean serious gains for smart investors who know where to place their share buy orders. A recent report from Sprott Asset Management explains:

While most of corporate America is struggling, the gold mining sector is financially robust. Free cash flow generation is more common than not for gold producers, balance sheets are strengthening and dividends are increasing. The current world mining infrastructure could not be replicated at anything close to historical book value. Therefore, the appetite and financial capacity is low for large scale capital expenditures that would significantly increase global mining output. While most mainstream companies that populate the S&P 500 Index face a sub par earnings outlook, mining companies look forward to rising earnings and favorable year-over-year earnings comparisons.

Among the senior producers with cash positions above $1 billion at the end of the first quarter, were Agnico Eagle Mines, Kinross Gold and AngloGold Ashanti.

Preliminary Q2 results from Newmont Goldcorp, Barrick, Yamana and Agnico Eagle show profitable second quarters. NEM decided to reward its shareholders with a 79% dividend increase. The world’s number two gold miner, Barrick Gold, has already increased its dividend three times in 2019-20. Its stock is up 56% year to date. Kinross has nearly doubled in value, up 96% so far.

Acquisitions

How will the major gold miners spend their nest eggs, which at $2,000 gold, are becoming ever larger? There’s a very good chance they are going to spend a fair chunk on acquiring new mines and new development properties.

Even before the gold rally picked up steam, M&A in the gold space was well underway.

Canadian precious metals miner SSR Mining acquired Alacer Mining in all-stock, no-premium deal valued at $1.7 billion; China’s Shandong Gold bought TMAC Resources for $149 million; and Silvercorp Metals struck a deal to buy Colombia-focused Guyana Goldfields in a cash and shares transaction worth about $105 million.

In February, AngloGold Ashanti announced plans to offload its remaining portfolio of South African assets, including Mponeng – the deepest mine in the world at 4 km underground – to Harmony Gold Mining. The sale turns Harmony into the country’s largest gold producer.

March saw Vancouver-based Endeavour Mining offer CAD$1 billion for Toronto-listed SEMAFO. Combined, the two entities created a top 15 gold producer and the largest in West Africa with six operations.

Acquisitions amongst the gold producers – large, medium and small – has also trickled down to the juniors. 2020 examples include:

- Seabridge Gold, developing KSM, one of the largest copper-gold deposits in the world, completed the purchase of Golden Predator’s 3 Aces project in Canada’s Yukon territory.

- AngloGold Ashanti completed its option to purchase the Silicon project in Nevada from Renaissance Gold.

- Colombia-focused Caldas Gold acquired the Juby gold project, consisting of 14,000 patented claims within the Abitibi greenstone belt in Ontario. Under the deal, Caldas will issue private company South American Resources 20 million shares, and pay CAD$9.5 million to Lake Shore Gold, a subsidiary of Pan American Silver. Caldas is a spin-off of Gran Colombia Gold.

“There has been a noticeable uptick in behind the scenes activity and as the COVID-19 travel restrictions ease off, we will see an even greater number of transactions being announced. The increase in the gold price and company share prices has given both for buyers and sellers the confidence to transact,” a Canadian investment banker told Mining Journal.

Data from S&P Global Intelligence shows that so far this year, there has been a total of US$3.9 billion in gold transactions, in 8 deals representing about 32 million ounces of gold reserves. Buyers are paying an average of $123/oz.

What is prompting gold miners to acquire other miners and earlier stage assets?

The top gold producers are running out of reserves, it’s not surprising, much of the easy-to-mine gold has been discovered.

According to McKinsey & Company, in the 1970s, ‘80s and ‘90s, the gold industry found at least one +50Moz gold deposit and at least ten +30Moz deposits. However, since 2000, no deposits of this size have been found, and very few 15Moz deposits.

In its latest report, Wood Mackenzie says to avoid a perpetual decline in mined gold the industry will need to commission 8Moz of projects, meaning an investment of about $37 billion over the next five years.

However rather than seeing another mega-merger, the likes of the Barrick-Newmont joint venture in Nevada, the $10 billion fusing of Newmont and Goldcorp, or Kirkland Lake Gold’s $4.9 billion purchase of Detour Gold, at AOTH we think the more likely scenario is for senior producers to acquire development-stage juniors.

Peak gold

For years we’ve been predicting it. We were one of the first to say it, and now it’s coming true. But what does peak gold actually mean? AOTH did some detective work to find out.

Conventional wisdom holds that peak gold is the point when the amount of gold supply hits a ceiling, then stops increasing. By this definition, gold has been increasing, year by year, although by smaller and smaller amounts – supporting the idea of the gold supply slowly building to a top.

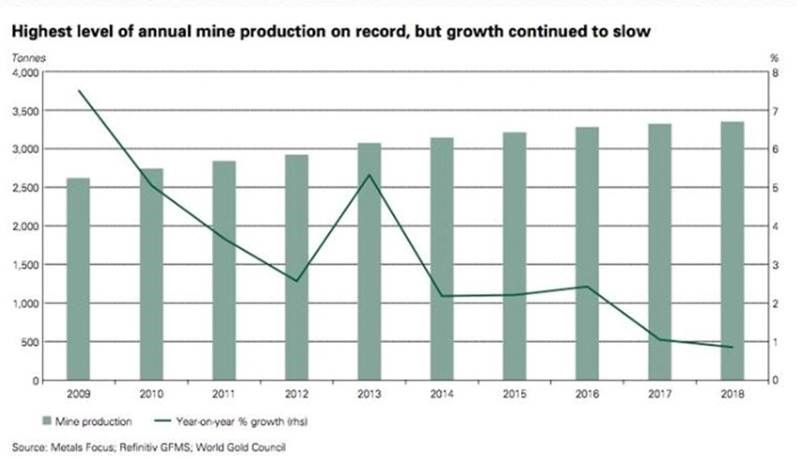

So, while gold output in 2018 was higher than 2017, it was only 1% higher – 3,347 versus 3,318 tonnes, according to the World Gold Council. Gold production of 3,318t in 2017 was 1.3% more than 2016’s output of 3,274t. This phenomenon is shown graphically below.

But if we define peak gold as the point when mined supply no longer meets gold demand, the gold market peaked a long time ago. Allow me to explain.

Last year (2019) gold demand reached 4,355.7 tonnes.

WGC reports that 2019 mine production was 3,463.7t.

Gold jewelry recycling was 1,304t, bringing total gold supply last year to 4,776.1t.

If we stop there, we show a slight gold supply surplus of 420 tonnes. Peak gold debunked!

Not so fast, let’s think about those numbers for a minute. In calculating the true picture of gold demand versus supply, we, at Ahead of the Herd don’t, and won’t, count jewelry recycling. What we want to know, and all we really care about, is whether the annual mined supply of gold meets annual demand for gold. It doesn’t! When we strip jewelry recycling from the equation, we get an entirely different result. ie. 4,355 tonnes of demand minus 3,463 tonnes of production leaves a deficit of 892 tonnes.

This is significant, because it’s saying even though major gold miners are high-grading their reserves, mining all the best gold and leaving the rest, they still didn’t manage to satisfy global demand for the precious metal, not even close. Only by recycling 1,304 tonnes of gold jewelry could gold demand be satisfied.

Now the question becomes, how do we close that predicted Wood Mackenzie 8moz mined shortfall and 900-tonne (for round numbers) jewelry supplied gap?

Through mergers and acquisitions (M&A), larger gold mining companies typically buy smaller miners to bulk up their depleting reserves base. But this doesn’t really add to the global supply of gold; it simply moves a portion of global reserves from one company to the other.

Juniors find new gold mines

A junior resource company’s place in the mining food chain is to acquire projects, make discoveries and advance them to the point when a larger mining company either buys the much de-risked project, or takes the junior over. Understand that today’s junior resource companies own most of the projects that are tomorrow’s mines.

It used to be that major gold companies had large budgets with which to conduct exploration to replace and expand their reserves. After the gold market crash in 2012, austerity programs demanded cuts to exploration budgets.

“The effect of this reduced spend and limited scope meant that mining companies were barely able to replace produced ounces while converting nearby resources to reserves,” a recent report from McKinsey & Co. states.

Moreover, the majors shifted their attention to brownfield projects (past producers) from more risky greenfields (undeveloped projects), leaving that to the gold juniors.

Junior resource companies, not majors, own the worlds future mines and juniors are the ones most adept at finding these future mines. They already own, and find more of, what the world’s larger mining companies need to replace reserves and grow their asset base.

Up to now the few buyouts that have occurred have come at low premiums, or in some cases, no premiums.

But competition for ounces in the ground is going to drastically heat up resulting in bidding wars and much higher premiums offered than we have seen to date.

Another thing that’s changed with the much higher gold price, is major gold companies can afford to pick up smaller deposits. Previously when gold was, say, US$800.00 majors needed to buy large deposits, greater than several million ounces, then scale them up to have an effect on their bottom lines. With gold prices of +$2,000/oz, they could consider a 500,000-oz deposit, as long as the grades are decent and it’s close to existing infrastructure. This opens up the field to many more take-over possibilities – every company with a +500Koz gold deposit is now a potential candidate.

For Ahead of the Herd (AOTH) investors, this is a period when remarkably easy money is made if you can identify existing assets that are likely to be rerated in this bull market.

One junior we recently delivered to AOTH’s free newsletter is – Freegold Ventures (TSX-V:FVL).

The company had 6.5 million ounces of gold in an historic resource that people had forgotten about until they released a new discovery hole; the stock rocketed from $0.20 to $1.45. It wasn’t just because they drilled a new hole, it was because the asset they already had was being rerated in this new market cycle. Freegold isn’t done yet, in fact we think they are just getting started tagging on a new discovery to an (until now) under-appreciated asset. The deposit could easily grow to 10 million ounces.

There are loads more companies like this still raising their first meaningful capital in years that will find themselves back in the spotlight as boots hit the ground and the drills start turning. And when assay results start to roll in, the market will have to blend the value of these new results with assets that were far underpriced in the previous market, ie., a significant rerating will occur.

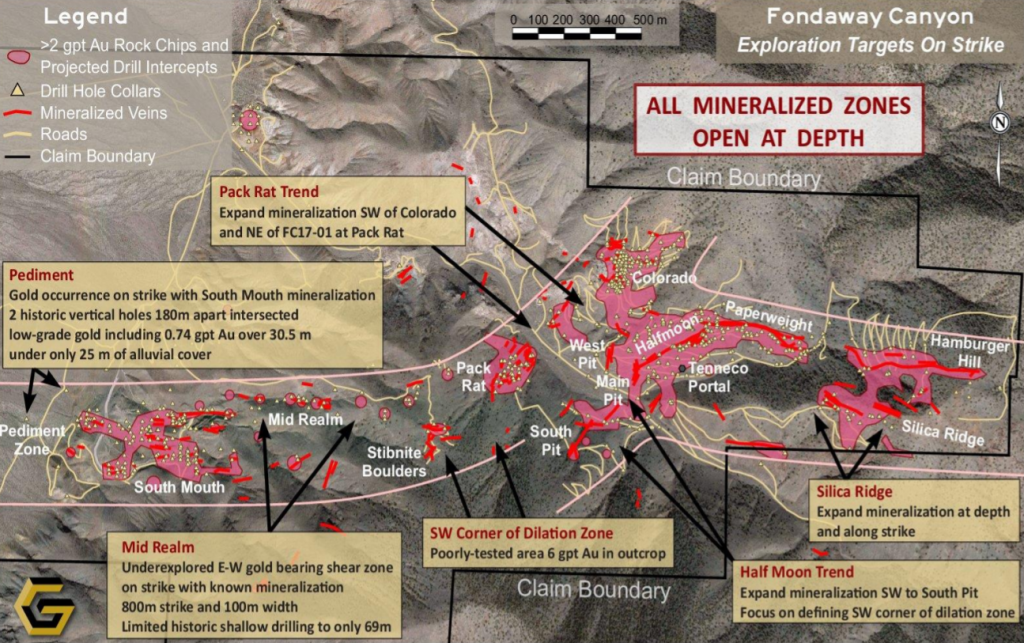

A great example is Getchell Gold (CSE:GTCH). At its Fondaway Canyon project in Nevada, the high-grade resource begins near surface, is open at depth, and along strike.

A 2017 technical report denotes 409,000 oz of indicated resources grading 6.18 grams per tonne, and 660,000 oz inferred grading 6.4 g/t, for a combined 1.1 million ounces.

That alone is impressive. But what really stands out, is the opportunity to add significantly more ounces if the structures, and ultimately, the potential source of this gold system can be identified, mapped and drilled.

The majority of the 1.1 million ounces are hosted by the Paperweight, Halfmoon and Colorado zones, with the remainder in parallel veins or splays of the major veins – which range from 5 to 20 feet.

There is a good possibility that the veins found in the mountains are just the “smoke” from a major, deep-seated gold system. Fondaway Canyon is a strong contender for building ounces – both underground and open-pit.

To me the idea is to buy as many Indicated and Inferred (I&I) ounces as you can, paired alongside massive upside exploration potential. Nevada-based Getchell Gold seems to be the perfect example. Not only does the company have ample gold resources with tremendous expansion potential, it has yet to be recognized by the market.

An unprecedented wave of acquisitions is about to wash over the junior resource sector. The first round of major mergers has occurred, treasuries are stuffed to overflowing. Now the smaller companies are going to be “BUY” targets and in particular the development-stage juniors.

Mergers and acquisitions activity at the producer level usually grab headlines, not surprising considering that take-over bids are often in the hundreds of millions, even billions of dollars.

But it is consolidation at the junior level where some serious money can be made.

What are the exploration plays we think are going to move, based on our analysis and their drill results? Anyone can make a 2 or 3-timer in a bull market that raises all boats. Put another way, if the breeze is stiff enough even turkeys can fly, but it is a rare talent who can cast a well-trained eye over a company’s drill assays, surface samples, or geophysical surveys, to understand the rocks they’re in, and the characteristics of the mineralization – Does it continue? Does the deposit “hang together? Is it scalable? Is it economic at today’s prices? And most importantly, does it have “legs”, to borrow a term from journalism, to become a long-term play? ie., the potential of being developed into an asset that major mining companies will be interested in acquiring?

The point at which these questions can be answered in the affirmative, is usually when the big institutional money comes rushing into a stock, driving its trading volume and stock price to new heights.

Using geological expertise to identify these projects and companies, the ones with staying power, can be highly rewarding.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Ahead of the Herd Facebook

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether or not you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice. AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

AOTH/Richard Mills is not a registered broker/financial advisor and does not hold any licenses. These are solely personal thoughts and opinions about finance and/or investments – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor. You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments but does suggest consulting your own registered broker/financial advisor with regards to any such transactions

Richard owns shares of Freegold Ventures (TSX.V:FVL) and Getchell Gold (CSE:GTCH). GTCH is a paid advertiser on his site aheadoftheherd.com

MORE or "UNCATEGORIZED"

NEW GOLD COMPLETES US$173 MILLION BOUGHT DEAL FINANCING

New Gold Inc. (TSX: NGD) (NYSE American: NGD) is pleased to annou... READ MORE

SILVER VIPER CLOSES LIFE OFFERING

Silver Viper Minerals Corp. (TSX-V: VIPR) (OTC: VIPRF) announces... READ MORE

MAX Power Closes $1.9 Million Private Placement

MAX Power Mining Corp. (CSE: MAXX) (OTC: MAXXF) (FRANKFURT: 89N) ... READ MORE

McEwen Copper Announces Completion of the Feasibility Drilling Program

70,000 meters completed, highlights include: 349.0 m of 0.77... READ MORE

Rupert Resources Reports Results From Project Drilling Including 120m at 6.2g/t Gold

Rupert Resources Ltd. (TSX:RUP) reports assay results from projec... READ MORE