Rick Mills – “Dollar Varden expands Homestake Silver deposit with 23 holes, highlighting 93.95m of 357 g/t AgEq including 9,422 g/t Ag over 1.02m”

Dolly Varden Silver (TSX-V:DV) (OTC:DOLLF) has put out more encouraging results from drilling at the Homestake Silver deposit, part of its Kitsault Valley project in northwestern British Columbia.

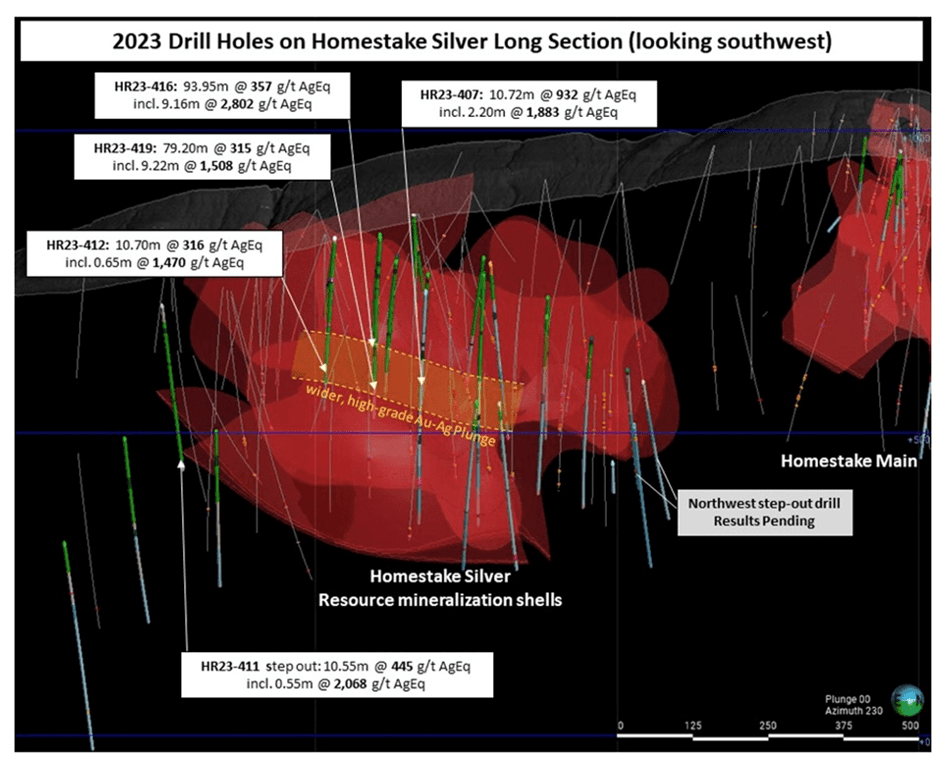

According to the Vancouver-based company, the 23 drill holes reported a total 12,150m of drilling, targeting priority zones within the deposit, and have significantly expanded the width and extent of the reinterpreted high-grade silver and gold mineralized plunge.

“The 2023 drilling at Homestake Silver has identified a substantial zone of exceptional precious metal grades, often typified by multiple phases of silver and gold mineralization, over wide, continuous intervals that are potentially amendable to bulk underground mining methods,” CEO Shawn Khunkhun stated in the Jan. 16 news release. “Results from additional step-out holes to the north of these intercepts are being finalized and are expected to be announced shortly.”

“Applying what was learned from the structural reinterpretation work at the Homestake Main gold zone to the existing wider spaced drilling at Homestake Silver Zone has led to the discovery of high-grade pathways within a continuous mineralized envelope with average precious metal grades above the average resource grades and over much wider intervals than expected”, said Rob Van Egmond, Dolly Varden’s vice president of exploration.

Core length highlights included:

- 315 g/t AgEq(2.57 g/t Au and 102 g/t Ag) over 20 meters, including internal breccia vein intervals grading 1,508 g/t AgEq (9.53 g/t Au and 718 g/t Ag) over 9.22 meters length, 7,572 g/t AgEq (36.66 g/t Au and 4,533 g/t Ag) over 1.05 meters.

- 357 g/t AgEq(1.74 g/t Au, 213 g/t Ag) over 95 meters length, including internal breccia vein intervals grading 2,802 g/t AgEq (11.80 g/t Au and 1,824 g/t Ag) over 9.16 meters length, 4,176 g/t AgEq (13.16 g/t Au and 3,085 g/t Ag) over 2.26 meters and 9,422 g/t AgEq (55.40 g/t Au and 4,830 g/t Ag) over 1.02 meters.

- 630 g/t AgEq(5.11 g/t Au and 206 g/t Ag) over 80 meters, including internal breccia vein intervals grading 1,754 g/t AgEq (14.38 g/t Au and 562 g/t Ag) over 6.80 meters length, 4,617 g/t AgEq (43.40 g/t Au and 1,020 g/t Ag) over 0.88 meters.

- 226g/t AgEq (1.40 g/t Au and 110 g/t Ag) over 00 meters, including internal breccia vein intervals grading 668 g/t AgEq (3.05 g/t Au and 415 g/t Ag) over 3.96 meters, 1,998 g/t AgEq (6.49 g/t Au and 1,460 g/t Ag) over 0.63 meters.

- 246g/t AgEq (2.32 g/t Au and 54 g/t Ag) over 90 meters length, including internal breccia vein intervals grading 932 g/t AgEq (8.94 g/t Au and 191 g/t Ag) over 10.72 meters length, 2,149 g/t AgEq (24.38 g/t Au and 129 g/t Ag) over 0.57 meters and 1,883 g/t AgEq (17.78 g/t Au and 410 g/t Ag) over 2.20 meters.

- Expansion step-out hole to the southeast; 445g/t AgEq (0.91 g/t Au and 369 g/t Ag) over 55 meters including 2,068 g/t AgEq (1.73 g/t Au and 1,925 g/t Ag) over 0.55 meters.

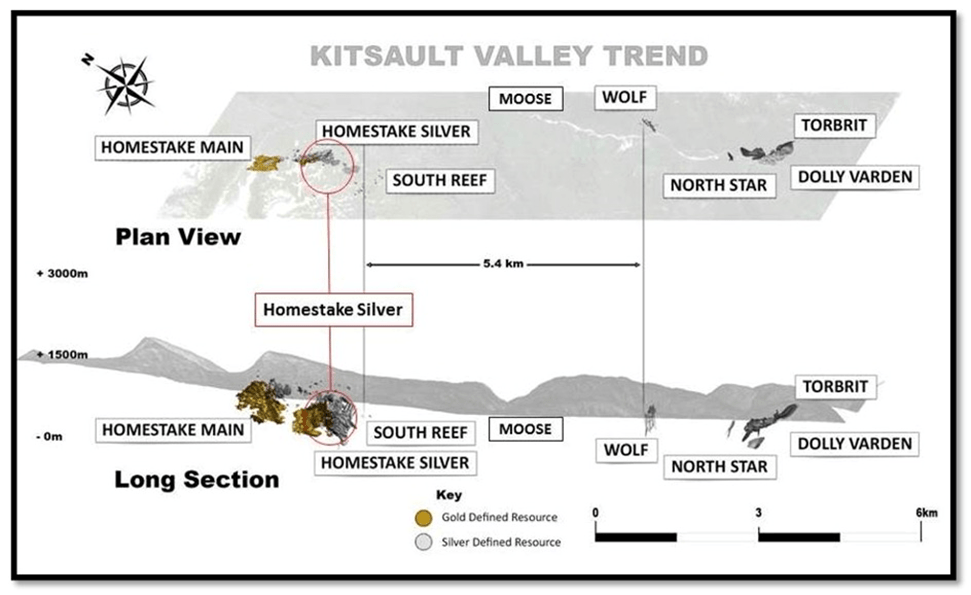

Figure 1. Location along Dolly Varden’s Kitsault Valley trend of deposits

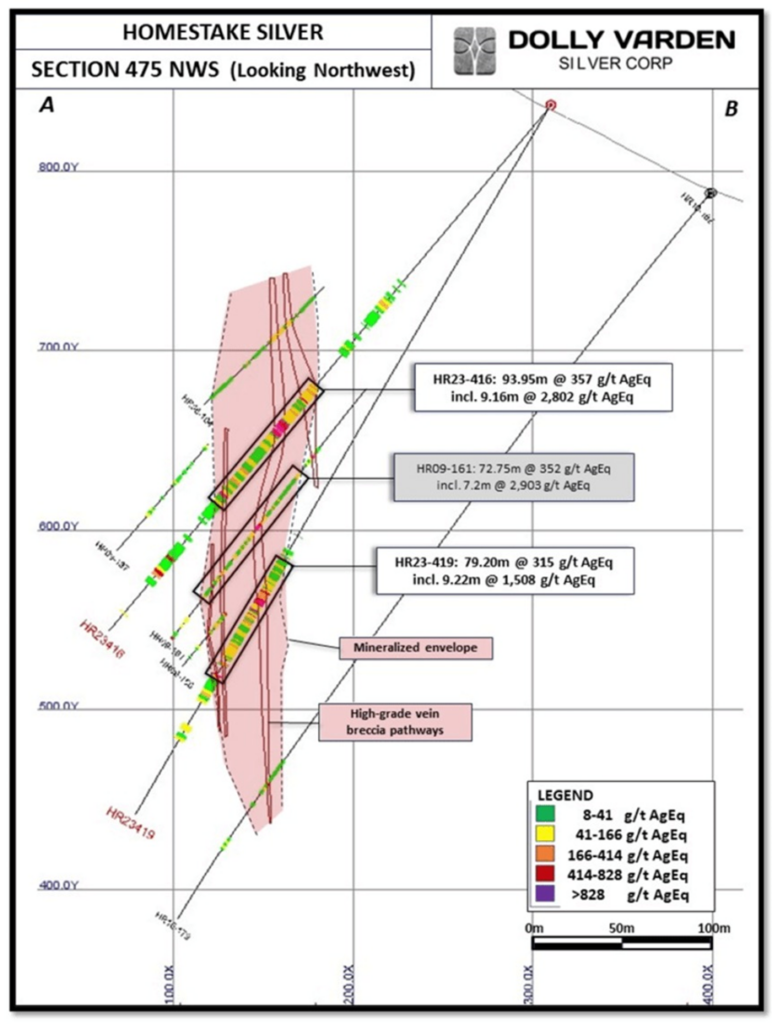

Drilling targeted the high-grade plunge within the Homestake Silver deposit. These holes focused on defining and expanding the wide gold and silver (+/- lead and zinc) mineralized zone along the low-angle, northerly plunge of the high-grade mineralization. The reinterpretation concluded that the wider mineralization zone at Homestake Silver is at a similar plunge orientation as that of the Homestake Main deposit, located 300m to the northwest. The average grades are higher, on a silver-equivalent basis, than the average grade of the silver deposits at the Dolly Varden property to the south, due to the increased gold content at the Homestake Ridge deposits.

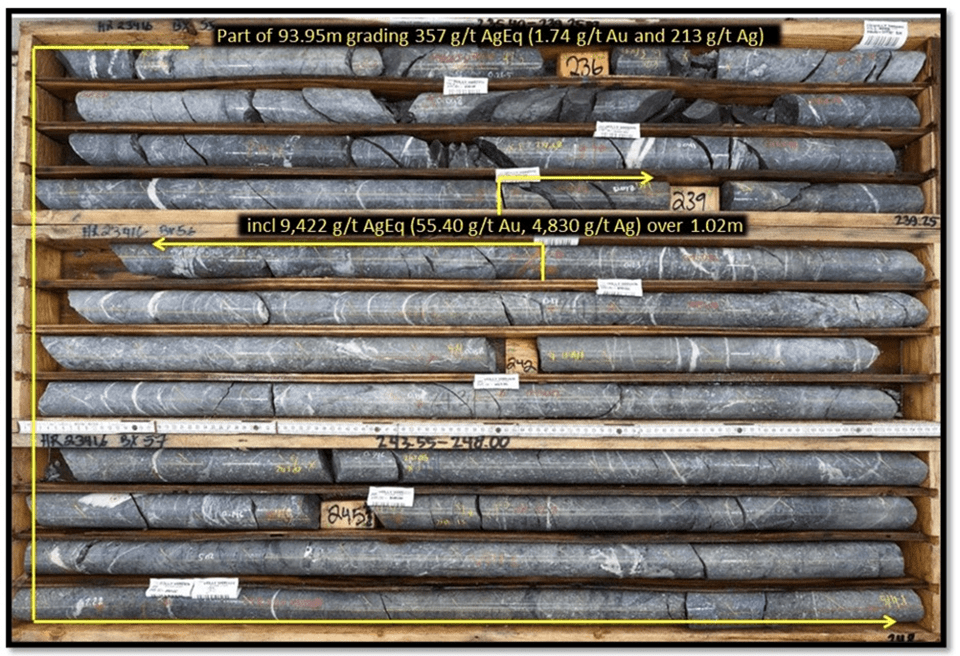

The Homestake Ridge deposits are interpreted as structurally controlled, multi-phase epithermal vein stockwork and vein breccia system hosted in Jurassic-aged Hazelton volcanic rocks. Mineralization consists of pyrite, +/-galena and sphalerite in a breccia matrix within a silica breccia vein system (see Figure 2). The northwest orientation of the main Homestake structural trend appears to have numerous subparallel internal structures that are interpreted to form the controls for higher-grade gold and silver shoots within a broader mineralized envelope at the Homestake Silver deposit. The main structural corridor dips steeply to the northeast at Homestake Main and rolls to vertical or steeply southwest at Homestake Silver (see Figure 5).

Figure 2. Drill hole HR23-416 from the Homestake Silver deposit. A 12.60-meter section from the 93.95-meter mineralized envelope highlighting the 1.02-meter high-grade multi-pulse vein breccia pathway. Strong alteration and stockwork with local multi-pulse vein and vein breccias can be seen throughout the interval.

Figure 3. Homestake Silver long section looking southwest with 2023 drill hole highlights. 100m wide window.

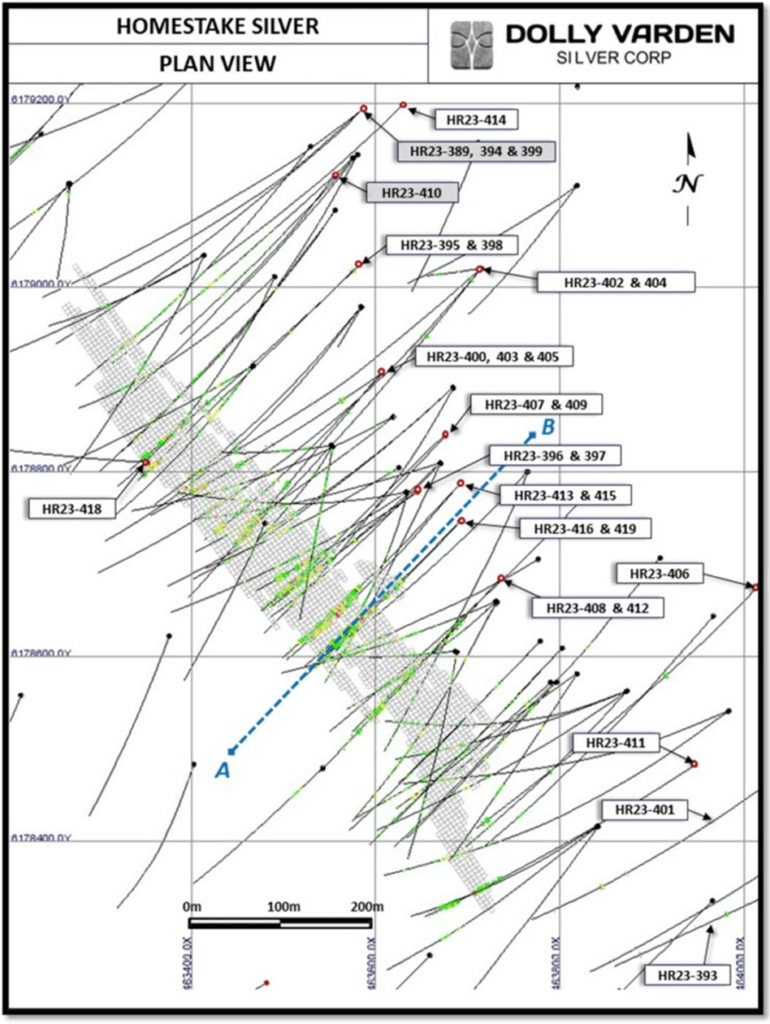

Figure 4. Homestake Silver plan view with current mineral resource block model, primarily of inferred resource classification with 2023 drill collar locations highlighted.

Figure 5. Homestake Silver cross section (A-B) with 2023 and historic drill holes.

Finalized results are still to be released for 47 of the 115-drill-hole, 51,454.90-meter 2023 Kitsault Valley project drill program. These include 25 drill holes at Homestake Main (11,054.90m), four drill holes (2,478.00m) from Homestake Silver northern extension, and six drill holes (1,627m) from Homestake Ridge, and 12 drill holes (7,400m) from the southern Dolly Varden property.

Kitsault Valley project

Located at the southern end of the Golden Triangle, the Kitsault Valley project represents the amalgamation of Dolly Varden’s original namesake silver property and its Homestake Ridge gold-silver property.

This 163-square-kilometer land package hosts one of the largest undeveloped high-grade precious metals projects in Western Canada. Its combined mineral resource is estimated at 34.7 million oz of silver and 166,000 oz of gold in the indicated category and 29.3 million oz of silver and 817,000 oz of gold in the inferred category.

The project has a rich history, which can be traced back to the early 20th century when Scandinavian prospectors first made the silver discovery in what is now the Stewart Complex.

Within the boundaries of the company’s original property are two past-producing silver mines: Dolly Varden and Torbrit, which formed a prolific silver mine camp starting in 1919 that produced more than 20 million ounces in the span of 40 years, with assays as high as 2,200 ounces per tonne.

It should be noted that Dolly Varden was among the most important silver mines in the British Empire during its heyday.

Other historically active mines in the area include North Star and Wolf, which remain underexplored to this day. Together, the four deposits comprise about 90 square kilometers within the Stewart Complex.

While these deposits were already enough to work with, DV always believed that the Kitsault Valley property is prospective for hosting further precious metal deposits, being on the same structural and stratigraphic belts that host numerous other high-grade deposits on the same trend such as Eskay Creek and Brucejack.

Towards the end of 2021, the company further consolidated its position with the acquisition of Homestake Ridge, which occupies the northern half (~75 sq km) of Kitsault Valley. This project features a high-grade gold and silver resource from three known deposits that the company believes can be converted into higher-confidence categories.

Results of the 51,454.90-meter 2023 Kitsault Valley project drill program include 19 drill holes from early-season drilling at the Wolf Vein.

In mid-September, Dolly Varden Silver put out more encouraging results from drilling at Wolf. The highlight of the bunch was hole DV23-368, a 75m step-out down plunge that intersected 1,898 g/t over 1.00m within 381 g/t Ag over 29.34m core length. The hole was drilled along plunge from the earlier hole DV22-320, which graded 321 g/t Ag over 12.85m.

Dolly Varden Silver hits 1,898 g/t Ag from step-out drilling at Wolf Vein area – Richard Mills

In November, Dolly Varden announced that Hecla Canada will purchase 15,384,616 shares at $0.65 per share for gross proceeds of $10 million. Hecla’s share percentage increases from 10.6% to 15.7%, calculated on an undiluted basis.

Hecla Mining invests $10M in Dolly Varden Silver, upping stake to 15.7% – Richard Mills

In December, Dolly Varden announced that it intends to acquire a 100% undivided interest in the southern portion of the Big Bulk Project from Libero Copper & Gold. Dolly Varden will issue Libero 275,000 common shares at a deemed value of $0.78 to close the deal.

“Big Bulk is located about 10 kilometers east of the Kitsault Valley Project,” VP Exploration Rob van Egmond told Guy Bennett, CEO of Global Stocks News. “Prior to this transaction, we controlled the northern part of it. It’s a property that we haven’t done a lot of work on because we’ve been focusing on the high-grade silver to the west.”

The southern portion of the Big Bulk property that DV is acquiring rights to earn 100% ownership in, contains seven mineral claims making up 3,025 hectares. When combined with DV’s northern portion, this doubles the size of the Big Bulk Project to approximately 6,000 hectares.

The option will give DV a new consolidated copper-gold porphyry project in the Golden Triangle region of northwestern British Columbia.

Dolly Varden Silver Corp.

TSXV:DV, OTC:DOLLF

Cdn$0.75, 2024.01.18

Shares Outstanding 254.6m

Market cap Cdn$202.5m

DV website

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Dolly Varden Silver Corp. TSXV:DV. DV is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of DV

MORE or "UNCATEGORIZED"

Quimbaya Gold Closes $4 Million Financing and Expands Executive Team

Cornerstone investor brings proven regional track record; company... READ MORE

Spanish Mountain Gold Announces Larger Scale Preliminary Economic Assessment With a Base Case NPV5% After-Tax of C$1.0 Billion, 18.2 % IRR and 3.4 Year Payback at US$ 2,450/Oz Gold Price; at US$3,300/Oz Spot Gold Price NPV5% C$2.3 Billion, 32.0% IRR and 2.0 Year Payback; Including an Updated Mineral Resource Estimate for Its Spanish Mountain Gold Project

Spanish Mountain Gold Ltd. (TSX-V: SPA) (FSE: S3Y) (OTCQB: SPAUF)... READ MORE

Aura Announces Preliminary Q2 2025 Production Results

Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX: ORAAF) is plea... READ MORE

Cascadia Announces Closing of Financing

Cascadia Minerals Ltd. (TSX-V:CAM) (OTCQB:CAMNF) is pleased to an... READ MORE

Abcourt Closes US$ 8M Loan Facility to Start Sleeping Giant Mine

Abcourt Mines Inc. (TSX-V: ABI) (OTCQB: ABMBF) is pleased to anno... READ MORE