Rick Mills – “Deciphering Max Resources’ plan to Maximize Shareholder Value”

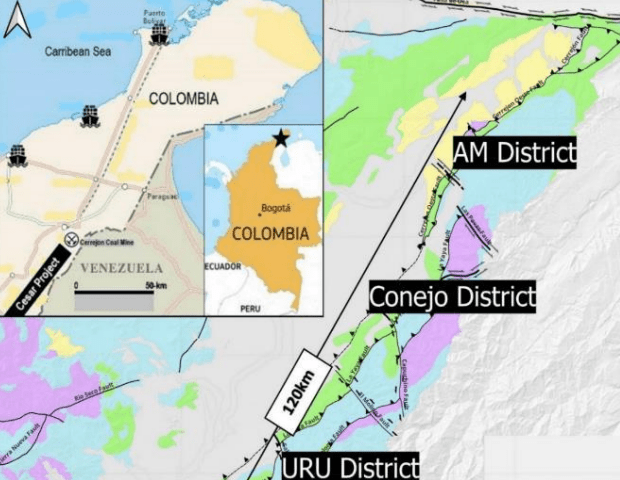

Max Resource Corp. (TSX-V:MAX) focused much of the last five years building one of the most intriguing grass roots Cu-Ag exploration plays in the world. The early work defined a previously unexploited copper silver red-bed sedimentary basin in northern Colombia.

At the time Colombia was booming with new mining opportunity as major miners and juniors alike entered the country to help unleash vast mineral wealth that had missed decades of development due to extreme political risk.

While most of the activity in the country was in the south targeting the extension of the Andean Copper Belt, Max focused on historical data citing sedimentary related copper showings in the Ceasar Basin, Northern Colombia.

After two years of regional prospecting Max proved beyond reasonable doubt the presence of a new expansive sedimentary basin while recording over a thousand copper silver mineral occurrences over which Max filed, and acquired, a remarkable land position covering over 1300sq km and including 20 Mining Concessions and dozens more Applications.

During this incredible success in the field a change of government brought in a new wave of political risk, and mining assets across the country were devasted.

After acquiring a substantial portion of the Cesar Basin in what is now called the Sierra Azul Copper Silver Project, Max was facing significant holding costs and larger ongoing exploration budgets to advance the project under challenging political conditions.

A management decision was made to bring in a joint venture partner to derisk short-term political challenges while maintaining upside exposure to this potentially prolific copper silver belt.

The strength of the discovery led to an option earn in agreement with Freeport Exploration Corp, a wholly owned affiliate of Freeport-McMoRan Inc., the world’s largest copper miner and the world’s 5th largest miner by market cap.

Under the terms of the earn-in agreement (EIA) Freeport Exploration can earn an 80% interest in MAX’s Sierra Azul Copper-Silver Project in two stages by spending an aggregate CAD$50 million and paying a total CAD$1.55 million to Max.

Although this is a very substantial deal, shareholders were disappointed with the realization that Colombia was once again a challenging operating environment and that Max’s was forced to give up a majority of the project through the earn in option. In addition, once Freeport completes it’s 80% earn in Max’s 20% is not carried. Max Resource must come up with its contribution towards all program costs from that point onwards.

Following Freeport’s initial US$4.2 million budget in 2024 Sierra Azul continued to deliver excellent field results particularly at the AM-13 discovery and the new AM-15 discovery. The approved USD$4.8 million budget for 2025 is an increase of 14% compared with 2024 and still leaves about CAD$44 million to be spent by Freeport building value for Max at Sierra Azul.

Let’s take a look at the top two districts that will be the focus of value creation in the upcoming Sierra Azul Project exploration program.

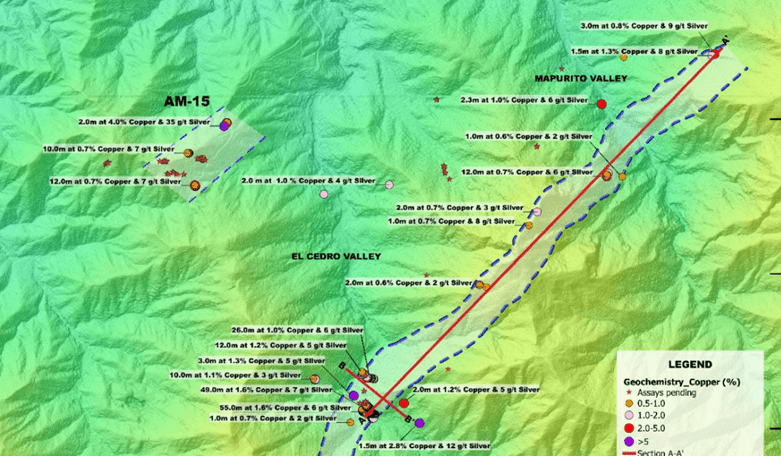

AM District

Located in the far north of the Cesar Jurassic Basin, classic stacked red bed outcrops with extensive lateral continuity have been sampled over many kilometers within the AM District, culminating in a mineralized corridor that extends over 15 km. Highlight values of 34.4% copper and 305 g/t silver from outcrop samples have been documented in the sedimentary sequences.

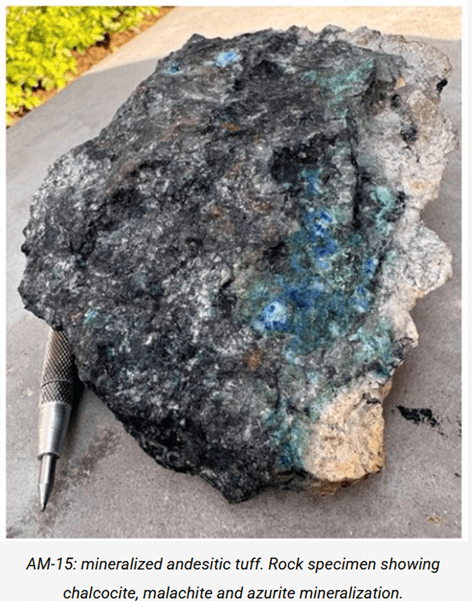

The recently discovered AM-13 and the newly discovered AM-15 zones are driving heightened interest in this area with an added geological model as mineralization is hosted as Manto-Style mineralization.

The best 2024 assay from AM-13 was 1.8% copper and 7.2 g/t silver over an impressive 48.0m (AM13_CS08, continuous saw-cut channel), including 3.4% copper and 14.0 g/t silver over 15.0m, and 3.5% copper and 15.7 g/t silver over 5.0m.

According to Max, the AM-13 Manto-style mineralization and alteration is similar to deposits in the Tocopilla-Taltal region of northern Chile, a mineralized corridor that extends well over 100 km and hosts several economic deposits including Mantos Blancos (500 million tonnes at 1.18% copper and 12 g/t silver).

This round of sampling at AM-13 expanded the Copper Silver zone to 1,500m along strike and remains open ended. New composite channel assay highlights included:

- 1.6% copper and 6 g/t silver over 55.0m (CS11)

- 1.6% copper and 7 g/t silver over 49.0m (CS08)

- 1.0% copper and 6 g/t silver over 26.0m (CS01)

The 100m-wide mineralized body rises over 300m in elevation between El Cedro and Mapurito valleys, suggesting significant depth potential.

The new AM-15 discovery is located about 1,000m northwest of AM-13. Early work suggests a large target footprint with five mineralized outcrops already identified over 100m by 300m and open in all directions.

The company says AM-15 is a high-priority target based on potential size, grade and proximity to AM-13.

“The 2025 exploration season is off to an exceptional start with the significant footprint expansion at AM-13 of over 30% coupled with the exciting new discovery of AM-15 underscore the potential of large-scale copper-silver discoveries within the Sierra Azul Project,” said Max’s CEO Brett Matich in the Feb. 25 news release.

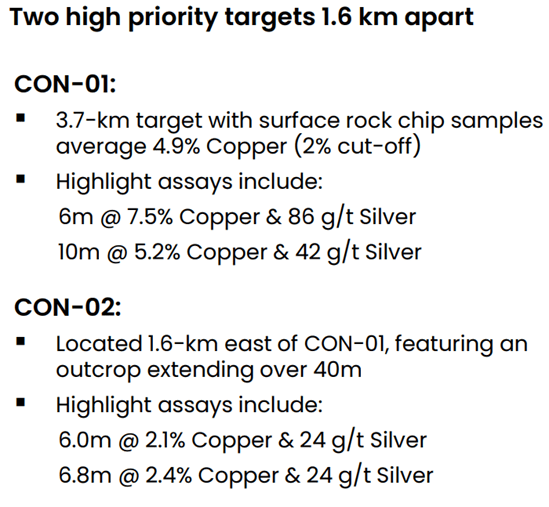

Conejo district

The Conejo district is typified by Copper Silver mineralization in Felsic to Intermediate Volcanics and appears very similar to the Manto Style mineralization at AM-13. However, work at Conejo has to date been restricted to early-stage prospecting but results have produced a high-grade zone extending over 3.7 km with average grade of 4.9% copper using 2% cutoff

To date, 13 rock samples returned values greater than 8.0% copper; 53 returned values greater than 5.0% copper; 93 returned values of 2.0% copper and above; 36 returned values greater than 20 g/t silver over widths ranging from 0.5 to 20.0m. Highlight values of 12.5 % copper and 126 g/t silver

In addition, composite results include 7.5% copper and 86 g/t silver over widths of 6.0m; 5.2% copper and 46 g/t silver over widths of 10.0m and 3.2% copper and 32 g/t silver over widths of 10.0m.

Conejo holds tremendous promise and will see a more meaningful portion of the 2025 budget spent to start to work up specific drill targets

So, the future for Sierra Azul certainly looks bright but the early-stage nature of the project has the market begging for valuation creation while Freeport continues to earn its way in.

Enter MAX’s Florália Direct Shipping Iron Ore Project

In May 2024 Max announced the acquisition of the Florália DSO Iron Ore Project in hopes to create new shareholder value. The project appears to have significant potential with a possible pathway to near-term cash flow.

But the change in direction from Sierra Azul focus to Iron Ore was not immediately appreciated by the market and Max decided not to dilute its capital structure to advance Florália DSO directly. Instead, Max has created a unique way to protect its capital structure while building significant leverage to the Florália DSO project for its shareholders.

After rapidly advancing exploration efforts at Florália and demonstrating the near-term viability of advancing to production, management put in place a plan to finance the project.

On Nov. 15, Max announced the addition of a wholly owned Australian entity, Max Iron Brazil Ltd., which will hold the Florália Brazilian assets. The company plans to list on the ASX and has completed a pre-listing financing to fund the proposed transaction and to advance drilling.

Max Brazil conducted a non-broker Pre-IPO private placement of 25,000,000 shares at a price of AUD$0.10 per share for proceeds AUD$2,500,000.

As a next step Max Brazil intends to undertake an initial public offering (IPO) and list it’s shares on the ASX. Its currently contemplated that the IPO will be for a minimum of 30,000,000 shares at a price of AUD$0.20 per share for proceeds of AUD$6,000,000 up to a maximum of 50,000,000 shares for maximum aggregate proceeds of AUD$10,000,000.

Max Resource will own approximately 55% of Max Brazil. Max Brazil is expected to start trading on the ASX in May/June of this year and will have the financial potential to bring the project to match production approvals for 1.5 Mtpa.

“If you’re a junior iron ore player this project has everything you could hope for,” CEO Brett Matich told Paydirt in a recent interview. “High-grade hematite, strong local demand, minimal infrastructure requirements, and a management team with a proven track record. It’s as simple as that.”

If Max is successful in raising the capital to list Max Brazil, and bring Florália up to production level approvals, then we believe tremendous value could be unleashed for Max shareholders.

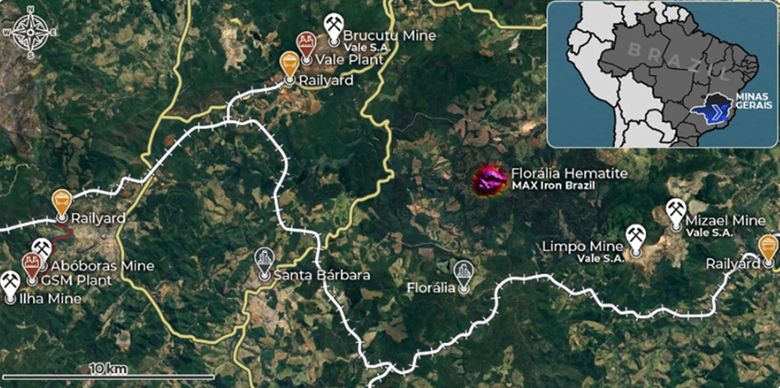

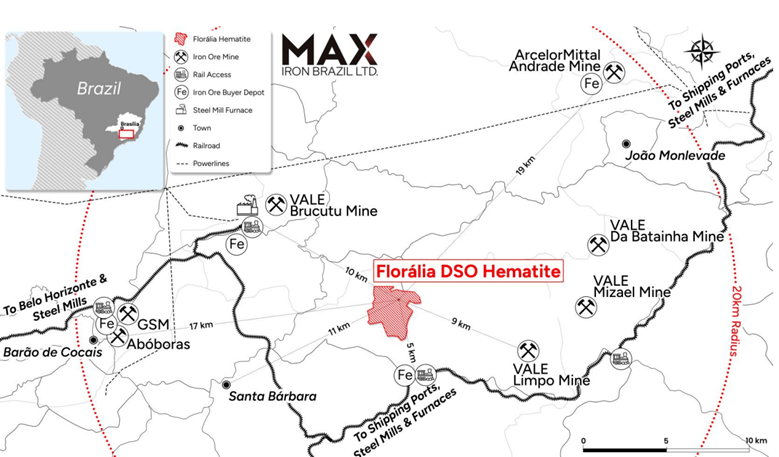

Iron ore buyers within 20-km radius of the Florália Iron Ore Project

A 55% stake in Max Brazil targeting production approvals and the largest Copper producer in the world spending another $44 million to advance Sierra Azul presents investors with a compelling case to put Max at the top of their watch list.

With that said let’s review why Florália and its’ Direct Shipping Iron Ore has management and us at AOTH so interested.

Direct Shipping Ore

The term ‘Direct Shipping Ore’ aptly captures the simplicity of the DSO mining process and the streamlined pathway this iron ore takes from mine to market. DSO stands out as a premium product, a cut above in a world demanding efficiency and environmental sensitivity.

From a geological standpoint, DSO deposits are relatively rare, often formed through the chemical alteration of banded iron formations (BIFs) under specific environmental conditions. Brazil and Australia are by far the world’s largest producers and exporters of DSO.

DSO is high-grade hematite that can be shipped directly to refineries, circumventing the need for costly processing facilities and large operations, translating to significant cost savings and a smaller carbon footprint.

The energy consumed by processing DSO hematite (Benchmark 58-62% Fe) is 50% less than magnetite. Magnetite (35% Fe) requires large-scale, high-cost beneficiation.

An even smaller footprint can be achieved if the DSO mine and crushing facilities are close to buyers and rail terminal. Often this is not the case.

Usually, after the DSO has been mined, crushed and screen classification, the mining company transports the ore by truck or rail to a port (typically 100’s of kilometers), where it is shipped to overseas steel mills.

If infrastructure doesn’t already exist, the mining company must build it. This requires significant capital for ports, roads, railways, haul truck fleet, etc., plus increased operating costs and additional permits, lengthening the time to make the mine operational.

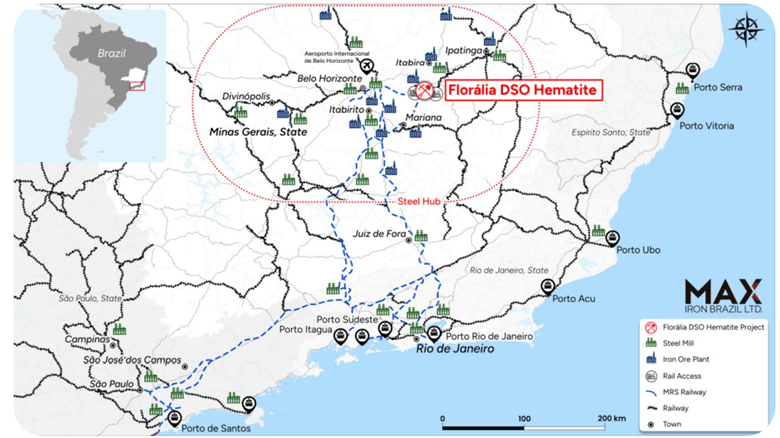

The Florália DSO Project is strategically located with an existing 20 km road SE to a railway terminal and there are existing roads to potential DSO buyers Vale (20 km NW) and Arcelor Mittal (30 km E). Local mining infrastructure includes railway networks, haul roads, mining services and personnel.

Florália is within Brazil’s Iron Quadrangle, which hosts some of the largest iron mines in the world.

Brazil’s Iron Quadrangle

Brazil is the world’s second-largest producer of iron ore, at 16% of global production. Most of the country’s iron ore mining (53%) takes places in the state of Minas Gerais, home to Florália.

Minas Gerais is Brazil’s second-highest producer of cast products in steel, iron, aluminum, bronze, and tin, with installed capacity of 2 Mtpa.

The state offers a highly skilled workforce, competitive energy prices, and a fast-tracked permitting system that makes it easier for miners to get projects off the ground.

“The government is keen to attract investment into the state, and they’ve made huge strides in streamlining the environmental licensing process,” says Mauro Lopes, international partner with Invest Minas, via Paydirt magazine. “The state is also very competitive in terms of energy costs, offering 100% renewable power at just 4c/kWh — far cheaper than in places like Australia.”

Australia is the largest iron ore producer but the Australian government taxes it at a higher rate than Brazil, taking a 7.5% royalty versus Brazil’s 3.5%. This is another advantage for Max.

Most iron-ore mining is done on surface in open pits. At the dry processing plant, the iron ore is crushed and screened, a classification process, into various size fractions to meet the required specifications.

The iron ore market is forecast to increase by USD$57.5 billion between 2023 and 2028 for a compound annual growth rate (CAGR) of 3.2%.

The World Steel Association forecasts global finished steel consumption to increase by 1.9% in 2024.

Rising demand for high-strength iron and steel, coupled with industrialization across developing nations and a booming construction sector, are driving this explosive growth.

While there has been a slowdown in China affecting iron ore demand, the Asia Pacific region is estimated to contribute 89% to the growth of the global iron ore market from 2023-28.

High-strength steel and green steel are promising new markets for iron ore mining companies.

Florália DSO Iron Ore Project Advancement

A lot of work has already been accomplished and the results from the various surveys undertaken are impressive.

Max reports high-resolution drone magnetics at Florália has identified a large anomalous zone of surficial outcropping high-grade mineralization associated with hematite/itabirite type iron formation. The size of the anomalous area has far exceeded the approximate 160m by 160m historic open cut to around 1,500m by 1,000m based on the drone magnetics, field activities and 58 channel samples.

Max’s technical team has reviewed the new drone magnetics and channel sampling data and has significantly expanded the Florália DSO geological target from 8 to 12 million tons at 58% Fe to 50 to 70 million tonnes at 55% to 61% Fe.

Analysis indicates a highly deformed structural geological environment that is fundamental to the increase in iron ore grades and tonnages, a consequence of secondary crystallization of hematite and the development of supergene enrichment.

The magnetometric geophysical survey utilized drones over the project area located in the Florália region of Santa Bárbara, Minas Gerais, Brazil, within the “Quadrilátero Ferrífero” region. The geophysical survey maps were generated with multiple filters along with a 3D inversion that provided a high-resolution block model and iso-value surfaces from the interpreted source of the anomalies.

This data has been fundamental in confirming the principal target area and the true potential of the Florália DSO project.

MAX has also completed characteristic ore tests and commenced environment studies and other components of the Feasibility Study (FS) the company plans to complete by Q1 2026. There is no native title on the property, water permits are not necessary so no tailings dam is necessary, and workers/ contractors will not need accommodation on site.

The channel sampling across road cuts is now complete with assays pending. The next step is auger and diamond drilling.

An environmental study is expected by 2025 YE.

Management is Key

The old age that cash is king in the resource sector is simply not true.

People are king, and a junior resource company’s most important asset. I’ve always believed that everything that makes a junior successful, start with its people.

Unless we’re in a full-blown bull market for commodities and precious metals there are always significant challenges involved with raising money for junior mining companies.

The Florália DSO Iron Ore Projectis well within CEO Matich’s expertise. Before joining Max, Matich was CEO of ASX-listed Aztec Resources, where he oversaw the development of the Koolan DSO hematite deposit (25 million tons at 65% Fe resource).

Also, as CEO of TSXV-listed Cap-Ex Ventures, Matich developed an un-drilled magnetite prospect into a 7.8 billion ton at 29% Fe resource.

Aztec rose from an AUD$2 million market capitalization to a $300 million merger in 2007 (Aztec share price increased 1,500%) with Aztec shareholders receiving ASX-listed Mount Gibson Iron Ore shares in the merger. Mount Gibson shares then returned a 300% share price increase within 12 months of the merger’s completion.

The Koolan Island mine is still in operation with three years of mine life left. In a presentation, Mount Gibson describes Koolan Island as “Australia’s highest grade hematite Direct Shipping Ore (DSO) with direct port access to market (1HFY24 sales of 2.5 Mwmt @ 65.4% Fe).”

“Florália looks similar, the same type of plan to Koolan Island, but the mining and capital costs are just so much less. In addition, the Florália property has the potential for fast-track development.” Matich said.

Florália DSO (benchmark 58-62% Fe) is a great fit for a junior and is an excellent project for Max because it fits so well into Matich’s wheelhouse.

Conclusion

For a host of reasons including a change in geopolitical risk, a non-optimal Joint Venture and a change of commodity focus Max Resource has found itself trading at an underwhelming $9 million market cap with a $0.05 share price. However, that has not deterred management from persevering to creating value for shareholders.

The progress at Sierra Azul using Freeport’s additional $44 million in earn in exploration funding continues to demonstrate the tremendous Copper Silver potential of this gigantic project. The discoveries at AM-13 and AM-15 identifying parallel Mantos Style mineralization over at least 100m by 1500m leaves little doubt of the potential for Sierra Azul to move the needle for Freeport let alone Max.

While Max waits for the major portion of funding to advance exploration from grass roots to development it has delivered free optionality of a near-term Iron Ore Hematite project in one of the top two Iron complexes in the world.

With excellent infrastructure, high grades, dry processing and direct shipping to local facilities the Florália project could achieve near-term production approvals by 2026 YE and ramp to 1.5 Mtpa.

With no outgoing expenses and an extremely undervalued market cap, if either exploration results from Sierra Azul or the funding and listing of Max Iron Brazil is successful, we see Max having the potential to build significant shareholder value through a dual asset approach.

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.05 2025.03.26

Shares Outstanding 180m

Market cap Cdn$9m

MAX website

Subscribe to AOTH’s free newsletter

Richard and Brad owns shares of Max Resource Corp (TSXV:MAX). MAX is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of MAX

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE