Peter Krauth – Cerro de Pasco: A Potential 400-bagger?

Our very first Silver Advisor company is a silver-rich tailings reprocessing project. It has a long and storied history, and today boasts one of the world’s largest above-ground metals resources.

Cerro de Pasco (CSE:CDRP) (OTCQB :GPPRF) (FRA :N8HP) is essentially a silver-rich tailings reprocessing and rehabilitation story, but a very large and profitable one at that. The main asset is located in Peru, about 175 km NNE of Lima.

The Team

There are simply too many to key contributors to enumerate them all. Still, Guy Goulet is the CEO with a +30 year track record of successful mining ventures (one being founding CEO of what is now Aya Gold & Silver, with $1.7B market cap). Steven Zadka is the Executive Chairman and a founding partner who initially obtained the rights to this project.

The Project

The Quiulacocha tailings project is one of the world’s largest above-ground metals resources. It has a storied history. In the early 20th century, none other than JP Morgan himself, with a cohort of investors, pumped millions of dollars into what was the world’s largest polymetallic mine. They sent the planet’s best geologists and mining engineers to work on the project. This was “the” mine to work at, where the most advanced techniques and technologies were being employed. Morgan actually listed the mine on the New York Stock Exchange. Talk about a flagship!

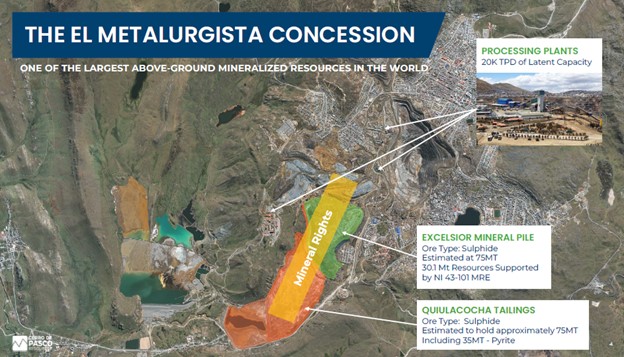

CDPR owns a 100% interest in the Metalurgista mining concession of 96 hectares, including mineral rights over 57 hectares of the Quiulacocha Tailings Storage Facility. The pit has mostly been mined out. In the following figure you can see that the orange area contains the tailings and the green area is the remaining stockpile, over which the company has the mineral rights. We can see the pit to the right, which is surrounded on three sides by the city of Cerro de Pasco.

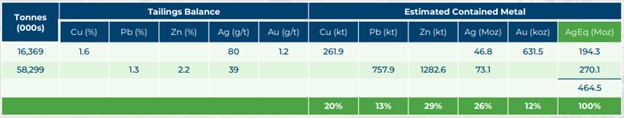

Based on historic metallurgical balances, the resource totals approximately 464.5Moz AgEq.

Note that the silver currently represents 26% of the overall contained metal, while gold represents 12%. Together that’s 38% of an estimated 464.5Moz AgEq. The silver alone is over 100Moz. Along with the gold that’s 176Moz in precious metals.

Now this is not a traditional mine. Instead, it’s a tailings processing endeavour. That means it should be much easier to mine than having to blast and move rock from an open pit or underground. This is also an environmental remediation project, which is key.

The economics are simply outstanding.

There is a total of about 75M tonnes of material in situ, worth about $164.8/tonne. The average metal recovery is conservatively assumed by CDPR at about 41.5%. So, the recoverable portion is worth about $68.41/tonne. After deducting concentrate selling fees, the value is then reduced to $49.3/tonne. From there they expect to deduct a very low $1/tonne mining cost, $5/tonne processing cost, and $4/tonne sustaining & G&A cost, leaving a profit per tonne of about $39.3.

That means an estimated $39.3/tonne x 75M tonnes, generating a life-of-mine profit of $2.9 billion. Under the 10K tpd scenario (3.6M tpa), that means EBITDA of $141 million annually. Should they scale up to a potential 25K tpd scenario (9M tpa), then EBITDA soars to $353 million annually.

More recent drilling suggests that silver grades are considerably higher than historic samples, potentially making the silver content even more valuable. There is also the potential to recover critical metals not previously considered.

Resource investor extraordinaire, Eric Sprott, is a big investor with over 16% of ownership. Sprott thinks this could turn out to be a – wait for it – 400 bagger.

Ultimately, Sprott may be right. I’ve seen what can happen when investors pile in to a phenomenal story like this.

Watch for ongoing drill results from the current drill campaign, as the team continues to compile and assess results. Keep in mind that they are now testing for the critical metal Gallium, whose export to the US was recently banned by China.

Gallium’s consistent presence is exceeding management’s expectations and I believe could add significant value to this project.

I’m long on this stock and think it’s very attractive at current levels, where I don’t expect it to stay for long.

Courtesy of the Silver Advisor

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE