Peter Krauth – “Central Banks Love Gold”

As much as central banks would like us to believe otherwise, they know better than most the value of holding gold. And their actions of the past 13 years has been nothing short of breathtaking.

First let me say that I know this is a full-fledged silver newsletter. But please indulge me this essay on gold, the money of royalty since millennia, because gold is the beacon investors look to first.

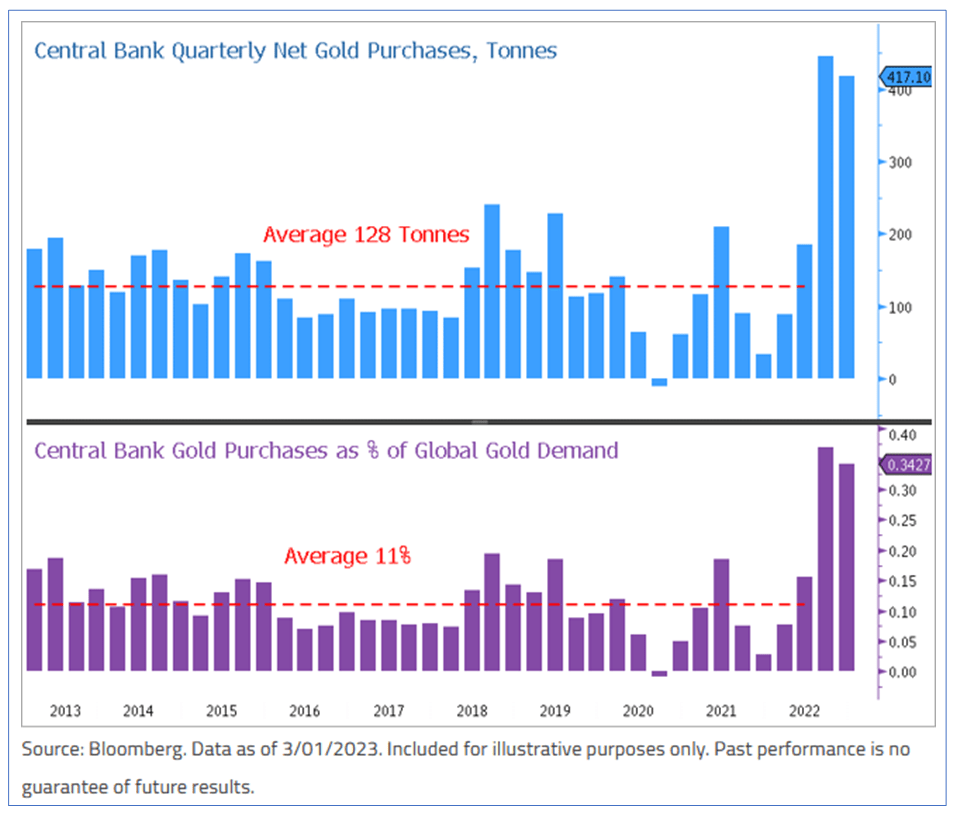

In fact, I believe that’s why central banks have been on their most aggressive gold buying spree in a decade. Have a look at the following chart from Sprott Inc. (via Sprott Precious Metals Report).

The level of purchases in recent months is practically off the charts at more than triple the long- term average. Remember, these are some of the institutions that have the best inside information and insight. They’ve been seeing how serious inflation has become, and how badly stock and bond markets performed last year. The International Monetary Fund from 2021 broke down central bank reserve assets as follows:

- Foreign Currencies (63%): typically, major currencies (USD, euros, yen, etc.) held to support exchange rate stability, facilitate international trade and provide liquidity in times of crisis.

- Government Bonds (23%): typically bonds from high credit quality issuers, held to earn income and maintain a lower risk profile.

- Gold Bullion (7%): held as a store of value, for portfolio diversification and as a source of international liquidity.

- Other Assets (7%): mostly special drawing rights (SDRs),15a form of international reserve asset created by the IMF, consisting of a basket of currencies that includes the U.S. dollar, euro, yen and British pound. Other financial instruments, though much less common, are equities, corporate bonds and/or commercial paper for income diversification.

The World Gold Council recently reported that central bank gold holdings are at a 50-year high, estimated at 36,782 tonnes. The moment America froze Russia’s U.S. Treasury holdings after its invasion of Ukraine, central banks and other large investors became acutely aware of the risks of holding assets that are another’s liability. Gold is one of the few exceptions.

One standout in this area is Singapore. Its central bank recently added a massive 44.6 tonnes of gold, growing its total from 153.8 tonnes to 198.4 tonnes. That’s an impressive 29% in one month, the tiny nation’s second largest gold purchase ever, and the second major buy in under two years.

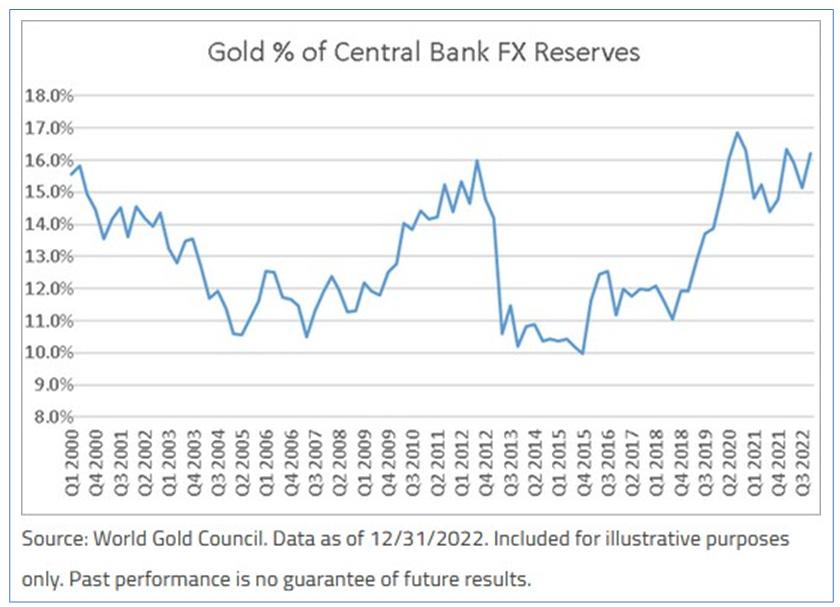

This chart demonstrates how gold has, for the last four years, clearly become a more dominant share of central bank foreign exchange reserves.

It’s worth noting too that bond king Jeff Gundlach, CEO of DoubleLine Capital, is bullish on gold at $1,800. So where does that leave silver? In a really good place, in my view.

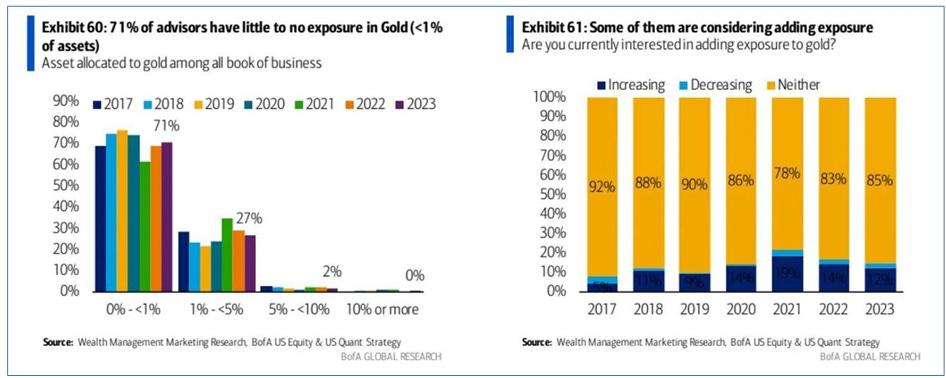

And through all of this, investors have historically low levels of exposure to gold, while we remain close to all-time high gold prices, as Bank of America research demonstrates.

The gold/silver ratio, which tells us how many ounces of silver are needed to buy one of gold, is at 83. That’s historically very high, given that the average of the last 20 years is closer to 60. I’m very favourable to both metals, but I think silver is dramatically undervalued and has considerably more upside for the balance of this secular precious metals bull market.

And I’m not alone.

Keith Neumeyer, President of First Majestic Silver, recently said automakers’ need for silver could soon cause them to purchase silver mines, sending the metal’s price up to $125 per ounce. Some research suggests a silver-zinc battery could provide considerably more energy density than the current lithium-ion battery.

And researchers from the University of New South Wales, Sydney (Australia) have determined that the current rates of reduction in silver consumption are not enough to offset the growing demand form the photovoltaic (solar panel) sector. The team sees the potential for cumulative installed capacity to rise from 1 TW at end 2022 to 15-60 TW by 2050, which would cause significant risk from outsized silver demand.

Using current technology would demand 20% of the annual silver supply by 2027, and up to 85- 98% of the current global silver reserves by 2050. And a quick transition to higher efficiency technology could accelerate silver demand even further. And as I’ve said in previous writings and presentations, next-generation high-efficiency technologies will require even more silver.

You can read more about their findings here: https://solarquarter.com/2023/01/11/the-silver- learning-curve-for-photovoltaics-and-projected-silver-demand-for-net-zero-emissions-by-2050- research/

And in a recent Kitco interview, McEwen Mining’s Executive Chairman, Rob McEwen (of Goldcorp fame), thinks gold could hit $5,000 per ounce by 2027, catapulting silver to $250 per ounce.

Like Neumeyer, McEwen sees silver much higher in the next few years. And interestingly – spoiler alert – his $250 target is close to my $300 silver target as explained in my book, The Great Silver Bull.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE